Petroleum Refining Hydrogen Market Revenue and Forecast by 2033

Petroleum Refining Hydrogen Market Revenue and Trends 2025 to 2033

The global petroleum refining hydrogen market trends highlight the integration of green hydrogen technologies, aiming to reduce carbon emissions and promote sustainable refining processes. This market is expanding because refiners are under regulatory pressure to lower sulfur emissions and produce cleaner fuels, and hydrogen is indispensable for many of these decarbonization and upgrading processes.

What are the Major Trends in the Petroleum Refining Hydrogen Market?

Several overlapping trends are fueling the market's growth. Firstly, stricter environmental regulations, particularly concerning global pollutants like sulfur and nitrogen oxides, are prompting refiners and chemical manufacturers to adopt hydrogen-centered processes such as hydrocracking and desulfurization to meet ultra-low sulfur fuel standards. Secondly, the expansion of refining complexes in developing nations, especially in the Asian countries, is boosting overall hydrogen demand due to increased refining capacity and subsequent hydrogen consumption. Finally, technological advancements in hydrogen production, including integrating carbon capture with steam methane reforming and pilot-scale hydrogen electrolysis, are making hydrogen more economically feasible for regular refining operations.

Segment Insights:

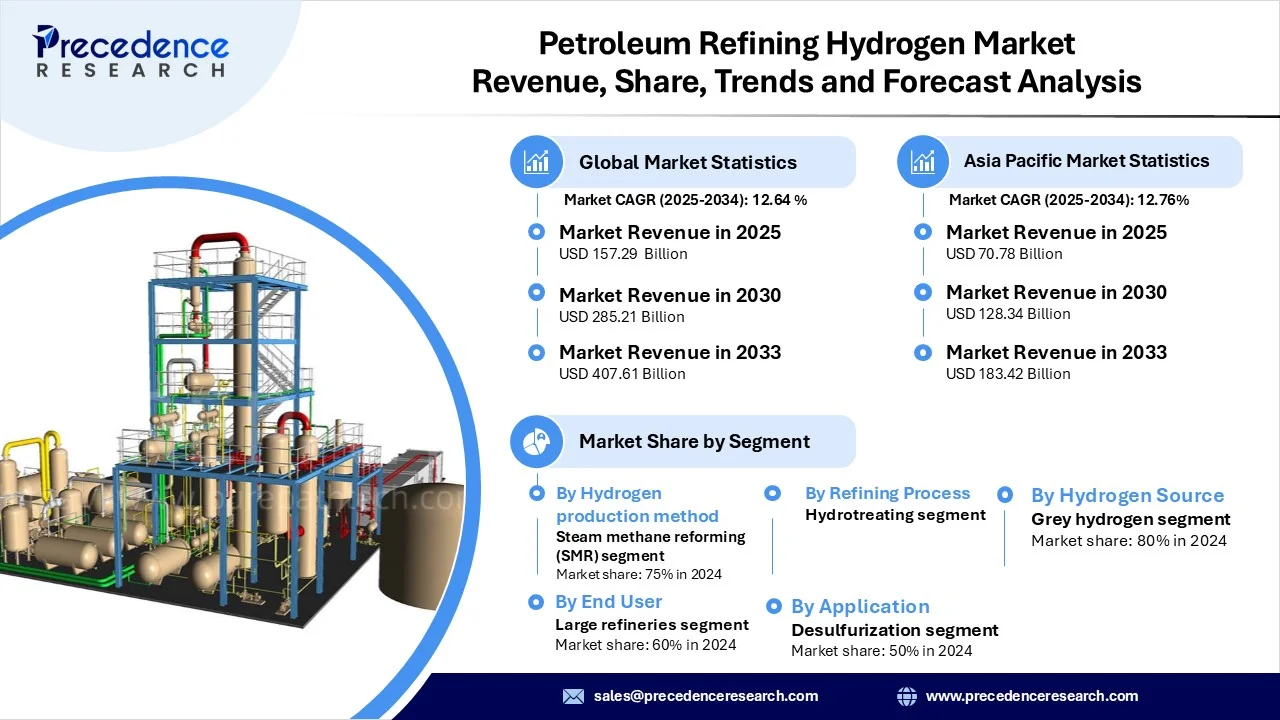

- By hydrogen production method, the steam methane reforming (SMR) segment dominated the market in 2024 due to its established technology, existing infrastructure, and lower cost associated with fossil-based hydrogen.

- By refining process, the hydrocracking segment dominated the market in 2024. This is because of its ability to efficiently convert heavy fractions into lighter fuels using hydrogen.

- By application in petroleum refining, the desulfurization segment led the market with the largest share in 2024. This is primarily due to ultra-low sulfur fuel mandates that require hydrogen in hydrotreating units.

- By end-user, the large refineries segment dominated the market in 2024, leveraging their high throughput, access to capital, as well as economies of scale in hydrogen facilities.

- By hydrogen source, the grey hydrogen segment registered dominance in the market in 2024 due to its long-standing dominance as the most established and cost-effective hydrogen production method within the refining industry.

Regional Insights:

Asia Pacific dominated the petroleum refining hydrogen market in 2024. The region's dominance stems from substantial refinery capacity expansions in countries like China and India, which have significantly increased the demand for hydrogen. The implementation of stricter emissions regulations across Southeast Asia necessitates the use of hydrogen-based processes to meet environmental standards. Furthermore, major domestic refiners in the region possess captive hydrogen production capabilities, ensuring a steady supply for critical refining operations.

North America is expected to grow at the fastest rate in the upcoming period due to stringent decarbonization regulations and substantial hydrogen subsidies, particularly in the U.S. The existing refining infrastructure in the region is undergoing upgrades to comply with increasingly strict operating emissions norms. Moreover, both public and private investments are being directed toward low-emission hydrogen projects within the refining sector, further fueling growth.

Petroleum Refining Hydrogen Market Report Coverage

| Report Attribute | Key Statistics |

| Market Revenue in 2025 | USD 157.29 Billion |

| Market Revenue by 2033 | USD 407.61 Billion |

| CAGR from 2025 to 2033 | 12.64% |

| Quantitative Units | Revenue in USD million/billion, Volume in units |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa |

Petroleum Refining Hydrogen Market Companies

- Shell Hydrogen

- BP

- ExxonMobil

- Chevron

- TotalEnergies

- Mitsubishi Heavy Industries

- Siemens

- Haldor Topsoe

- McDermott International

- Jacobs Engineering

- JGC Corporation

- WorleyParsons

- Doosan Heavy Industries & Construction

Recent Development:

- In June 2025, Indian Oil Corporation (IOCL) is setting up India’s largest green hydrogen plant at its Panipat refinery, aiming to produce 10,000 tonnes annually. This project is a key step in IOCL’s decarbonization strategy, replacing fossil-based hydrogen with renewable-powered green hydrogen to significantly cut emissions. (Source: https://www.eqmagpro.com)

Get this report to explore global market size, share, CAGR, and trends, featuring detailed segmental analysis and an insightful competitive landscape overview @ https://www.precedenceresearch.com/sample/6924

You can place an order or ask any questions, please feel free to contact us at sales@precedenceresearch.com |+1 804 441 9344