What is the Petroleum Refining Hydrogen Market Size?

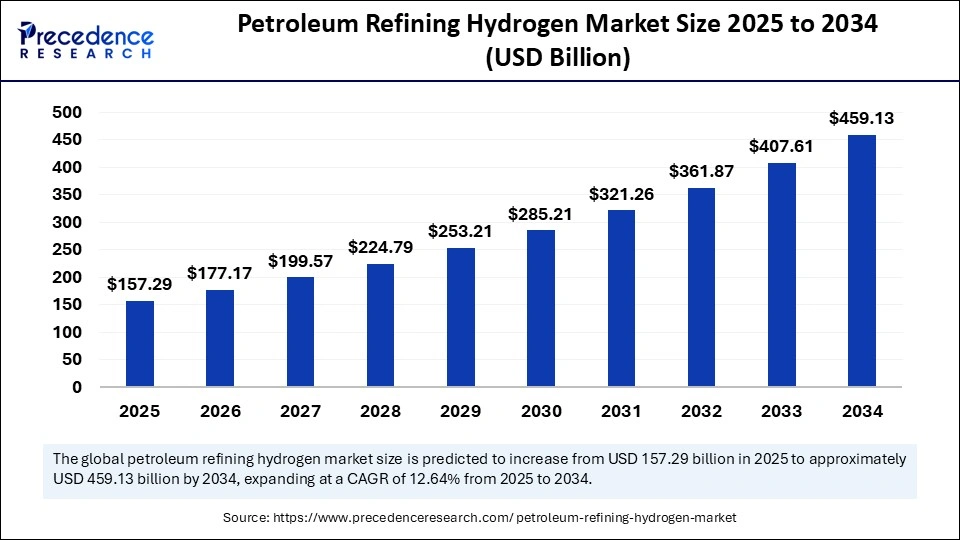

The global petroleum refining hydrogen market size accounted for USD 139.64 billion in 2024 and is predicted to increase from USD 157.29 billion in 2025 to approximately USD 459.13 billion by 2034, expanding at a CAGR of 12.64% from 2025 to 2034. The growth of the petroleum refining hydrogen market is driven by cleaner fuel regulations, rising refinery modernization, and increasing emphasis on sustainable refining practices worldwide.

Market Highlights

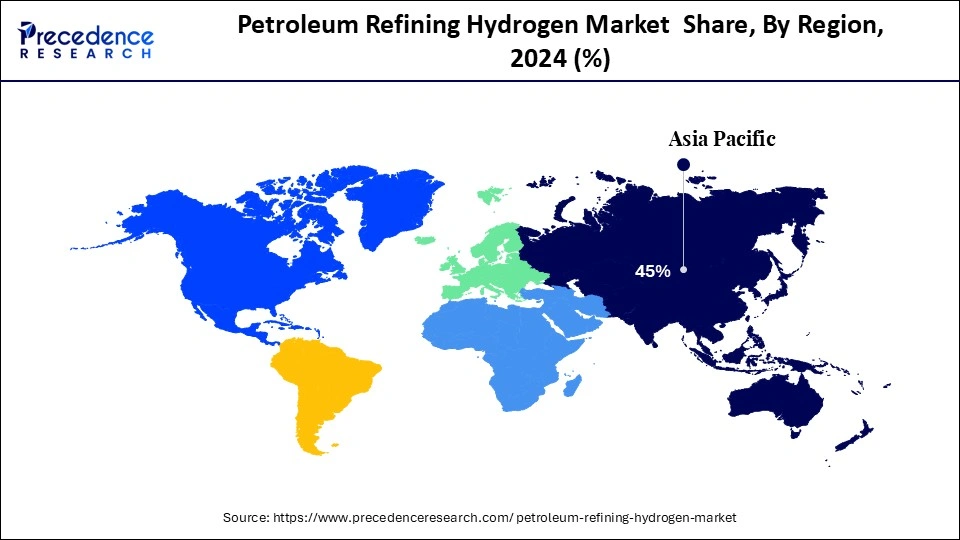

- Asia Pacific dominated the petroleum refining hydrogen market with the largest market share of 45% in 2024.

- North America is expected to expand at the fastest CAGR between 2025 and 2034.

- By hydrogen production method, the steam methane reforming (SMR) segment held the biggest market share of 75% in 2024.

- By hydrogen production method, the electrolysis segment is expected to grow at the fastest CAGR during the forecast period.

- By refining process, the hydrocracking segment captured the highest market share of 35% in 2024.

- By refining process, the hydrotreating segment is expected to expand at a notable CAGR over the projected period.

- By application in petroleum refining, the desulfurization segment contributed the maximum market share of 50% in 2024.

- By application in petroleum refining, the hydrogenation of heavy oils segment is expected to expand at a notable CAGR over the projected period.

- By end user, the large refineries segment accounted for the significant market share of 60% in 2024.

- By end user, the small and medium refineries segment is expected to expand at the notable CAGR over the projected period.

- By hydrogen source, the grey hydrogen segment generated the major market share of 80% in 2024.

- By hydrogen source, the green hydrogen segment is expected to expand at a notable CAGR over the forecast period.

Market Size and Forecast

- Market Size in 2024: USD 139.64 Billion

- Market Size in 2025: USD 157.29 Billion

- Forecasted Market Size by 2034: USD 459.13 Billion

- CAGR (2025-2034): 12.64%

- Largest Market in 2024: Asia Pacific

- Fastest Growing Market: North America

Why Is Hydrogen Essential in Modern Petroleum Refining?

The petroleum refining hydrogen market is experiencing significant growth, driven by stricter regulations for fuel quality and an increasing need for ultra-low sulfur fuels. The market is associated with hydrogen production and use in refining processes, such as hydrocracking and desulfurization, primarily for the purpose of meeting fuel quality and environmental needs. However, since hydrogen is produced from fossil fuels, concerns have arisen about the sustainability of hydrogen sources, driving greater research and investment in lower-carbon alternatives. Overall, the market is influenced by regulatory compliance and technological developments.

How AI is Advancing Hydrogen Refining?

Artificial Intelligence is not new to the petroleum refining hydrogen operations space. The development of predictive maintenance, advanced process control, and the optimization of hydrogen production economically are all valuable applications of AI in hydrogen operations. Honeywell's suite of technology, Protonium, launched in 2025, utilizes AI/ML to enhance the efficiency of electrolyzer and plant design, and is already being implemented at the U.S. Mid-Atlantic Clean Hydrogen Hub.

Moreover, TotalEnergies in Europe is utilizing AI in digital twins of its operations, further demonstrating the value of deploying green hydrogen in petrochemical workflows. More broadly, research frameworks such as AceWGS demonstrate how AI accelerates innovation with catalysts, enabling hydrogen to play a more significant role in cleaner, more efficient refining.

Petroleum Refining HydrogenMarket Outlook

- Market Growth Overview: Between 2025 and 2034, the petroleum refining hydrogen market is expected to experience rapid growth due to increasing demand for hydrogen in various industrial applications. Global hydrogen demand reached approximately 97 million tons (Mt) in 2023 and 100 Mt in 2024, with oil refineries remaining the dominant consumers. U.S. data confirms that refiners represent the largest share of industrial hydrogen demand, supporting steady growth in the merchant-supply market. This trend is driven by the need for increased hydrogen use to process heavier crude oils and comply with stricter fuel specification standards.

- Sustainability Trends: Policy and tax incentives now expressly include low-emission hydrogen, with the U.S. 45V Clean Hydrogen Production Tax Credit (up to $3/kg for eligible hydrogen) and Department of Energy (DOE) programs directing some investment to electrolytic and CCUS-enabled hydrogen production, with most hydrogen consumed by U.S. refineries being fossil-based led to the landscape for hydrogen abatement measures being in their infancy.

- Global Expansion: As per IEA tracking, hydrogen demand is spanning geographies new merchant suppliers, regional hubs and export corridors, and predominantly project pipelines but focused in Asia, Europe, and North America; however, new hydrogen deployment of supply refiners, for the most part continues to rely on existing routes that are natural gas based and has not reached a point of wide-scale electrolysis.

- Start-up Ecosystem: There is a growing number of emerging industry players, with aims on scaling electrolysers, hydrogen purification, and merchant distribution, as well as carbon capture for refinery hydrogen; however, commercialization pathways and opportunities will need to overcome several challenges, reducing costs, matching supply, and permitting to become a reliable feedstock alternative for refiners.

Market Scope

| Report Coverage | Details |

| Market Size in 2024 | USD 139.64 Billion |

| Market Size in 2025 | USD 157.29 Billion |

| Market Size by 2034 | USD 459.13 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 12.64% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Hydrogen Production Method, Refining Process, Application in Petroleum Refining, End-User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Restraining Factor

What is Preventing Global Petroleum Refineries from Increasing the Usage of Hydrogen?

A primary barrier is the comparative expense and financial risk associated with transitioning from low-emission hydrogen (green and/or blue) to conventional hydrogen (gray), which is derived from fossil fuels. The Shift from conventional gray hydrogen to low-emission alternatives, such as green or blue hydrogen, involves significantly higher production costs and infrastructure investments, creating financial risk for refiners. These economic challenges act as a major restraint on the petroleum refining hydrogen market's transition to cleaner hydrogen sources, slowing adoption despite regulatory and environmental pressures. As a result, European refiners such as Neste have made the decision to suspend green-hydrogen projects planned to use electrolyzers and related infrastructure purchases, as regulatory or subsidy support has weakened.

The IEA's Global Hydrogen Review 2025 indicates that, while low-emission hydrogen grew by approximately 10% in 2024, its consumption remains less than 1% of total global hydrogen production due to cost pressures and some policy uncertainty.(Source: https://www.iea.org)

Opportunity

Could Refinery Decarbonization Mandates Be the Driving Force Behind Hydrogen's Rise in Petroleum Refining?

Yes, refinery decarbonization mandates could significantly accelerate the adoption of hydrogen in petroleum refining, as they prompt operators to reduce carbon emissions and meet increasingly stringent environmental standards. This regulatory pressure is prompting increased interest in low-carbon hydrogen solutions, positioning hydrogen as a key enabler of cleaner refining processes. Global hydrogen demand reached 97 Mt in 2023 and increased to almost 100 Mt in 2024, with refining still the largest user; approximately 1 Mt of low-emission hydrogen was produced. Thus, the areas for growth are substantial. (Source: https://www.iea.org)

In June 2024, TotalEnergies signed a 15-year contract to purchase 70,000 tons of green hydrogen (Hâ‚‚) per year for its European refineries, which will reduce COâ‚‚ emissions by approximately 700,000 tons annually. Similarly, in December 2024, Ecopetrol of Colombia is developing a green hydrogen facility for use at its Cartagena refinery (800 t/yr). These actions indicate that new regulations demanding emissions cuts and the imperative to decarbonize refining, as an important industry, could expand the use of hydrogen as a shift in the total refining market.(Source: https://www.americaeconomia.com)

Segments Insights

Hydrogen Production Method Insights

Why Did the SMR Segment Contributed the Largest Market Share in 2024?

The steam methane reforming (SMR) segment held around 75% share of the petroleum refining hydrogen market in 2024. This is mainly due to the proven effectiveness of SMR method, as well as its relatively low cost, established technology, and widespread utilization at large refineries. Furthermore, hydrocracking and desulfurization are associated with the demand for refining and application, which continues to elevate SMR's role in petroleum hydrogen.

The electrolysis segment is expected to grow at the fastest rate during the forecast period. The growth of the segment is driven by decarbonization efforts and global emphasis on clean hydrogen. Also, green hydrogen and hydrotreating are rapidly being adopted, particularly by small- and medium-sized refineries focused on sustainability. In addition, the regulatory push and investment in hydrogen technologies that reduce hydrogen production from renewable resources are contributing to increased adoption of the electrolysis method in refining applications.

Refining Process Insights

What Made Hydrocracking the Dominant Segment in the Market in 2024?

The hydrocracking segment dominated the petroleum refining hydrogen market with a 35% share in 2024. This is because hydrocracking is an important process in converting heavier fractions of crude oil into high value products (i.e. diesel, jet-fuel, and gasoline). This process has a higher degree of efficiency, provides greater production of clean fuels, and, importantly, is incorporated into the configuration of large, modern refineries.

The hydrotreating segment is expected to expand at the fastest CAGR over the forecast period. This is mainly due to the increasing hydrogen use in hydrotreating, driven by stringent fuel quality standards and the resultant environmental regulations. Hydrotreating is a widely used processing technique to remove sulfur, nitrogen, and other impurities from petroleum products. Increasing requirements from ultra-low sulfur fuels and further downstream clean operations will drive further hydrogen use at modern refineries.

Application in Petroleum Refining Insights

Why Did the Desulfurization Segment Lead the Petroleum Refining Hydrogen Market?

The desulfurization segment led the market, accounting for a 50% share in 2024. The segment's dominance is attributed to an increasing global emphasis on ultra-low sulfur fuels as a mechanism to cut emissions and improve air quality. Refineries have increasingly relied on hydrogen desulfurization units to comply with regulations. Consequently, desulfurization is and will remain the primary driver for hydrogen demand in refining applications.

The hydrogenation of heavy oils is the fastest-growing segment, as refiners look for opportunities to upgrade a heavier crude fraction into lighter more desirable fuels. Upgrading heavy crude portions to lighter hydrocarbons will help refiners increase their yield, improve fuel quality, and enhance the overall operational efficiency of their facilities. The Hydrogenation of heavy oils is being driven forward by the increasing production of heavier crude oil and significant demand for clean fuels.

End-User Insights

Which End-User Consumes the Most Hydrogen for Refining?

The large refineries segment dominated the petroleum refining hydrogen market with a 60% share in 2024. This is mainly due to their higher processing capacities and greater need for hydrogen in complex refining operations like hydrocracking and desulfurization. These facilities are also more likely to invest in advanced hydrogen production and integration technologies to meet stringent fuel quality and emission standards efficiently.

The small and medium refineries segment is likely to grow at a significant rate in the upcoming period. This is due to their increasing adoption of outsourced or merchant hydrogen supply to meet evolving fuel standards without the high capital investment of on-site production. Their flexibility and growing need to upgrade operations to process heavier crudes and comply with environmental regulations have also driven demand for hydrogen. Government-policies that support cleaner fuels also push these refineries to adopt hydrogen schemes for cleaner fuels. The ongoing adoption of hydrotreating and hydrogenation in small-medium refineries further supports segmental growth.

Hydrogen Source Insights

What is the Most Common Source of Hydrogen Used in Petroleum Refining?

The grey hydrogen segment dominated the petroleum refining hydrogen market in 2024 with a 80% share in 2024, representing the most used source of hydrogen in petroleum refining. This is mainly due to the fact that the natural gas-based production methods are both economical and scalable. It is the most cost-effective and widely available option, produced from natural gas using established technologies like steam methane reforming.

The green hydrogen segment is expected to expand at the fastest CAGR in the coming years, as refineries are moving toward decarbonization and integrating renewable technologies. The production of green hydrogen involves the electrolysis of renewable energy to resolve emissions problems while advancing sustainability objectives. Global investments, pilot programs, and stricter carbon regulations are advancing green hydrogen into the supply line of refinery operations and higher potential to contribute as a future technology alternative.

Regional Insights

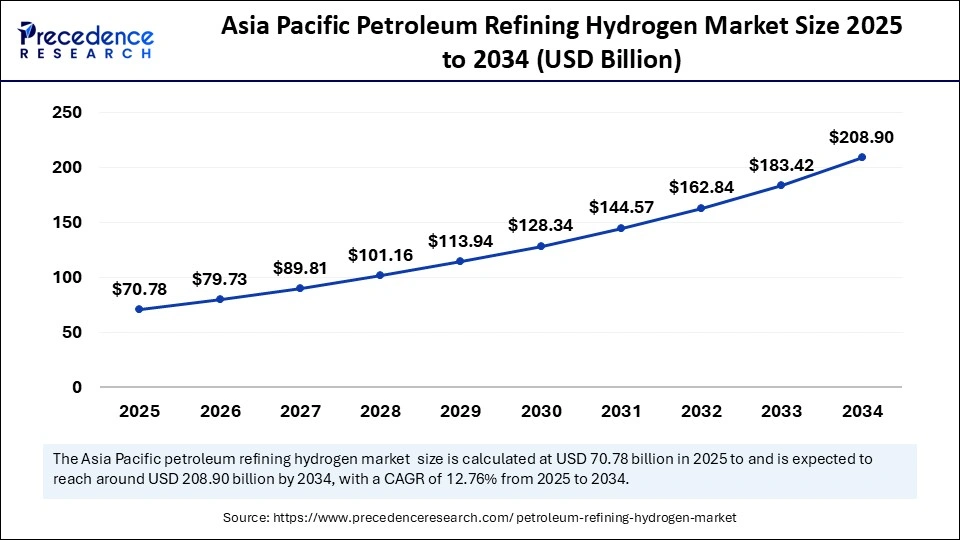

Asia Pacific Petroleum Refining Hydrogen Market Size and Growth 2025 to 2034

The Asia Pacific petroleum refining hydrogen market size was exhibited at USD 62.84 billion in 2024 and is projected to be worth around USD 208.90 billion by 2034, growing at a CAGR of 12.76% from 2025 to 2034.

What Made Asia Pacific the Dominant Region in the Market in 2024?

Asia Pacific dominated the petroleum refining hydrogen market by holding a 45% share in 2024, as refiners expanded throughput to meet demand for fuels in the local region, improve product quality, and shift to export markets, while governments are also backing hydrogen production and electrification of industry. Increasing throughput at refineries in South and East Asia and plans to develop production and low-emissions hydrogen projects is leading to incremental hydrogen demand for hydro processing.

Modernization of China's refineries increases in petrochemical integration within their refineries, and strategic hydrogen projects makes China the de-facto growth engine large refineries will simply require more hydrogen to meet stricter fuel specifications and to upgrade heavier crudes. National industrial and energy plans, alongside local low-emissions hydrogen projects announced, support capacity expansion in the sector, combined with nearby export-based refining means China's shift is expected to have a notable impact on regional hydrogen demand for refining.

What Makes North America the Fastest-Growing Area for Petroleum Refining Hydrogen?

North America's refining complex is hydrogen-heavy due to its expanding refinery capacity, stringent fuel emission regulations, and increasing demand for cleaner transportation fuels. Additionally, strong government support for low-carbon hydrogen initiatives and investments in hydrogen infrastructure are accelerating growth in the region. Aggressive policy push and R&D (funding and planning of the DOE hydrogen program) with extensive existing hydrogen infrastructure allows the use of captive hydrogen at scale. North America's advanced hydrogen infrastructure, merchant hydrogen supply and retrofit projects maintain this high hydrogen demand and resiliency in refining steadiness.

The U.S. is a major contributor to the market because it has the largest hydrogen production capacity in place, it has integrated hydrogen with the most complexrefineries, and the United States federal government has established targeted programs that enable low-emissions hydrogen development through funding and pilot programs. Recent U.S. planning documents and inventories document extensive capacity already online and planned, enabling refineries access to captive hydrogen and merchant hydrogen and, at the same time, planning for hydrogen demand decarbonization pathways.

- In January 2025, the Port of Houston Authority received a US $25 million federal grant to build a hydrogen refueling station in Bayport, Texas.

(Source: https://porthouston.com)

Value Chain Analysis

- Sourcing of Raw Materials

Natural gas, naphtha, and other hydrocarbons are primary feedstocks for hydrogen production in refineries. Reliable sourcing of these feedstocks promotes costefficiency, ensures predictable operations, and facilitates compliance with new carbon emissions regulations.

Key Players: ExxonMobil, Shell, Chevron, BP

- Production of Hydrogen

Hydrogen is primarily produced via steam methane reforming (SMR) and the partial oxidation process. Advanced technologies and carbon capture integration areincreasingly used to minimize emissions and maximize operational efficiency.

Key Players: Air Liquide, Linde plc, Air Products & Chemicals, Cummins Inc.

- Storage & Distribution

Hydrogen produced is then stored in high-pressure vessels or pipelines and distributed. Efficient distribution systems within refineries facilitate the continuous supply

of hydrogen for desulfurization and other refining processes, thereby minimizing bottlenecks and downtime.

Key Players: Praxair (Linde), Chart Industries, Hexagon Purus, Plug Power

- Applications for Refining

Hydrogen is essential to the hydrocracking, desulfurization, and upgrading processes. Using hydrogen enables the production of cleaner fuels that meet stringent environmental regulations, thereby enhancing the quality of the refined products and the sustainability of the refining process.

Key Players: Sinopec, Indian Oil Corporation, TotalEnergies, Saudi Aramco

- Delivery of End-Use

The refined products sent to downstream companies include low-sulfur diesel, gasoline, and jet fuel. The integration of hydrogen ensures compliance with global emissions standards and progressing towards sustainability.

Key Players: Valero Energy, Marathon Petroleum, Phillips 66, Reliance Industries

Top Key Players in the Petroleum Refining Hydrogen Market and Their Offering

- Air Products and Chemicals: The company is the global supplier of hydrogen to the petroleum refining industry. Refineries utilize hydrogen for hydroprocessing, a crucial step in producing cleaner-burning transportation fuels that comply with environmental regulations.

- Linde Group: It offers comprehensive solutions that cover hydrogen production, processing, storage, and distribution.

- Air Liquide: It provides hydrogen for essential processes, such as sulfur removal, by supplying the necessary technology and services to produce, store, and distribute this critical gas.

- Hydrogenics Corporation: The company is engaged in supplying electrolyzers for on-site hydrogen generation in industrial applications, including petroleum refining

- Praxair (Linde): It caters to large-scale hydrogen production plants, recovery systems, and pipeline networks worldwide

Petroleum Refining Hydrogen Market Companies

- Shell Hydrogen

- BP

- ExxonMobil

- Chevron

- TotalEnergies

- Mitsubishi Heavy Industries

- Siemens

- Haldor Topsoe

- McDermott International

- Jacobs Engineering

- JGC Corporation

- WorleyParsons

- Doosan Heavy Industries & Construction

Recent Developments

- In March 2025, Bharat Petroleum Corporation Limited (BPCL) collaborated with KPIT Technologies during the Global Hydrogen and Renewable Energy Summit in Kochi to endorse hydrogen-based mobility initiatives in Kerala.(Source: https://fuelcellsworks.com)

- In March 2023, Mitsubishi Power began providing ENEOS Corporation with an energy balance optimization service to support the optimization of hydrogen volume regulation and utilization in the petroleum refining process during the desulfurization stage at the ENEOS Corporation Sakai Refinery.

(Source: https://www.mhi.com)

Segments Covered in the Report

By Hydrogen Production Method

- Steam Methane Reforming (SMR)

- Partial Oxidation (POX)

- Autothermal Reforming (ATR)

- Coal Gasification

- Electrolysis

- Other (Biomass, Water Splitting)

By Refining Process

- Hydrocracking

- Hydrotreating

- Reforming

- Alkylation

- Desulfurization

- Isomerization

By Application in Petroleum Refining

- Desulfurization

- Hydrocracking

- Hydrogenation of Heavy Oils

- Upgrading of Bitumen

By End-User

- Large Refineries

- Small and Medium Refineries

- Petrochemical Industry

- Hydrogen Source

- Grey Hydrogen

- Blue Hydrogen

- Green Hydrogen

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting