What is the Blue Hydrogen Production Market Size?

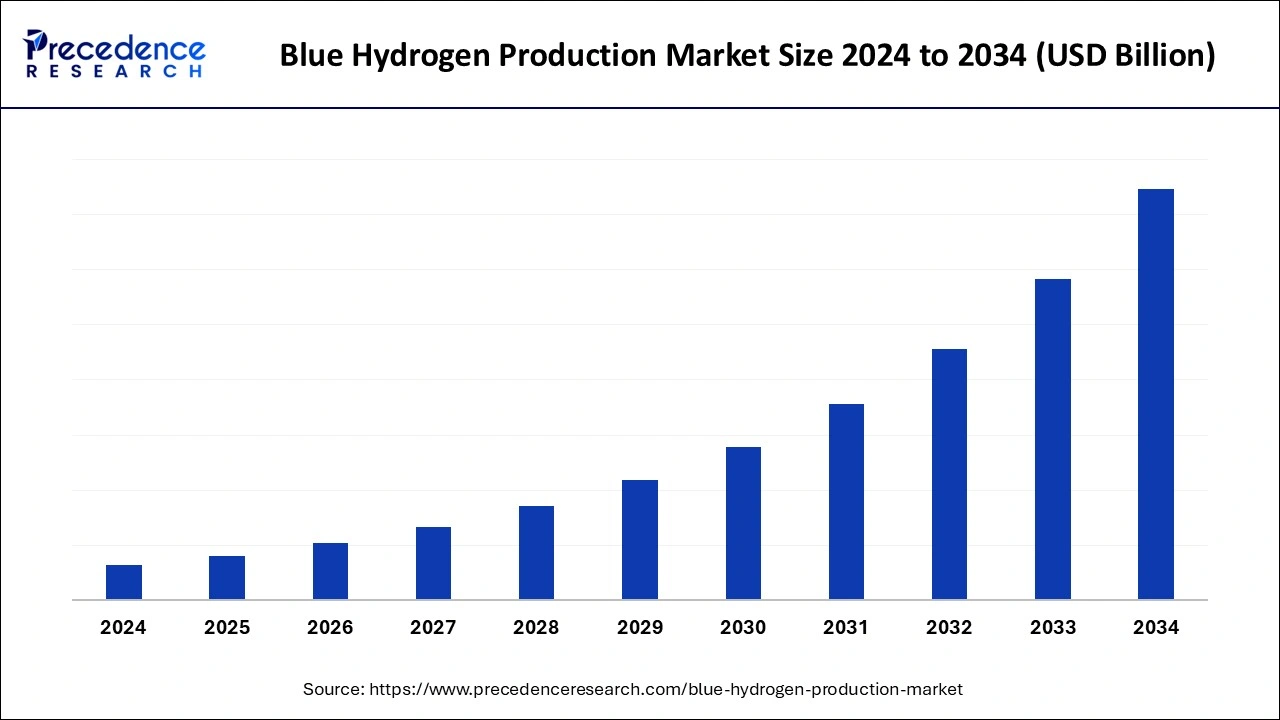

The global blue hydrogen production market will expect to see extraordinary compound annual growth rate (CAGR) over the next decade. The blue hydrogen production market is driven by increasing government incentives, rising demand for clean energy, and technological advancements in carbon capture and storage.

Blue Hydrogen Production Market Key Takeaways

- North America accounted for the largest share of the blue hydrogen production market in 2024.

- Asia Pacific is anticipated to witness the fastest growth in the market during the forecasted years.

Artificial Intelligence (AI) Integration in the Blue Hydrogen Production Market

The development of the blue hydrogen production market relies gradually on the implementation of artificial intelligence. Artificial intelligence optimizes the power grid integration of renewable energy resources like solar and wind systems, and advanced algorithms function to forecast renewable power output while managing real-time grid consumption. AI provides essential tools to manage demand alongside consumption prediction capabilities that support the balance between energy supply and demand and grid stabilization.

AI allows the implementation of predictive maintenance through machine learning algorithms that detect equipment failure before it happens, thus decreasing operational time and cutting repair expenses. The smart grid technology allows AI to synchronize energy generator operations with consumer requirements and store energy installations.

- In December 2024, SGH2 Energy unveiled the expansion of a Memorandum of Understanding (MoU) with ABB, a global automation and electrification leader for developing artificial intelligence (AI) and digital solutions to enhance sustainable and resource-efficient operations.

Market Overview

Blue hydrogen production from fossil fuels by capturing and storing carbon emissions has become a leading solution for clean energy generation. The production of blue hydrogen through steam methane reforming (SMR) enables natural gas to react with hot steam to create hydrogen alongside carbon monoxide. The carbon monoxide product from this process becomes hydrogen, while storage of captured carbon dioxide emissions results in blue hydrogen classification. The demand for the blue hydrogen production market keeps rising because it enables heavy industries' decarbonization while supporting net-zero missions and supplying clean fuels for transportation power and industrial operations.

The blue hydrogen production market segment expands because of increased hydrogen clean energy adoption rates alongside growing environmental concerns and supportive governmental tax benefits and carbon-emission policies. Several governments aim to reach their carbon emission reduction objectives, thus increasing market demand for blue hydrogen. Market expansion for blue hydrogen will be supported by well-production technologies along with rising investor support. The effective adoption of blue hydrogen requires finding solutions to blend it with the current natural gas pipeline systems. The trends in the blue hydrogen market are increasing adoption of carbon capture utilization and storage (CCUS) technology.

What is fuelling the fast expansion of the Blue Hydrogen production market across the world?

The blue hydrogen production market is experiencing tremendous momentum, as companies shift towards cleaner energy. Blue hydrogen, or hydrogen produced from natural gas with carbon capture and storage (CCS), is one of several important options identified across decarbonization strategies. With both government support and demand for hydrogen increasing across power generation, transportation, and industrial sectors, combined with investment into carbon-neutral infrastructure, the blue hydrogen market is projected to undergo tremendous growth in the coming years, notably throughout Europe and the Americas.

Blue Hydrogen Production Market Growth Factors

- Government policies and incentives: Blue hydrogen serves as a crucial component of energy transition strategies through government policies that combine carbon emission reduction with technology-based cleaner energy development.

- Rising demand for clean energy: The arrangement of natural gas and carbon emission capturing through blue hydrogen serves as an intermediate pathway to future sustainable energy production systems.

- Technological advancements: Better carbon capture systems lower the cost of capturing CO2 pollution, which enhances the affordability of blue hydrogen production.

- Private sector investments: The blue hydrogen production market expansion benefits from new projects and scale-up developments that arise from strategic partnerships between energy companies, technology suppliers, and governmental entities.

- Energy security and diversification: Blue hydrogen production increases energy security by replacing fossil fuels through the existing natural gas infrastructure.

- Regulatory support for carbon reduction: Blue hydrogen has become more relevant due to growing regulations that demand reductions in greenhouse gas emissions, thus creating market demand for carbon-neutral energy sources.

- Global supply chain development: The development of efficient infrastructure systems enables large-scale hydrogen production while securing its delivery to industrial sectors, which in turn decreases costs and expands access to the global marketplace.

Market Outlook:

There is a bright outlook for the global blue hydrogen market, supported by government decarbonization policies and growth in corporate commitments to carbon neutrality. The blue hydrogen production market is poised for rapid deployment through 2035, in part due to investments in scaling advanced CCUS technologies, as well as emerging collaboration among multiple sectors as it moves toward alignment with conventional hydrogen production and fully green hydrogen production.

- Industry Growth Overview: The blue hydrogen market is projected to experience double-digit CAGR growth to accomplish the objectives of achieving clean energy while utilizing existing natural gas. The largest energy players are ramping up pilot projects at an accelerated pace to establish early commercialization efforts.

- Sustainability Trends: Key sustainability trends include innovation in carbon capture and use, pathways to incorporate renewable-powered hydrogen, and the development of hydrogen circular ecosystems. Blue hydrogen is being positioned as a transition fuel in helping nations responsibly improve energy usage to meet net-zero targets.

- Global Expansion: Global expansion is occurring globally through partnerships between energy companies, technology, and governmental collaborations. North America, Europe, and the Middle East are investing significant amounts of capital in coordinating or establishing hydrogen corridors and cross-border export projects driven by significant growth in energy demand.

Market Scope

| Report Coverage | Details |

| Dominated Region | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

The growing role of hydrogen in fuel-cell electric vehicles and global transportation

Transportation scientists have identified hydrogen as a promising low-carbon fuel for vehicles, although implementing it alongside other fuels remains challenging. Hydrogen stands superior to fossil fuels because they continue to decline while their costs rise. The aerospace industry, together with fuel-cell electric vehicle manufacturing, operates through significant hydrogen fuel consumption. The production of hydrogen fuel cell automobiles requires affordable fuel supply since both technology costs and refueling station infrastructure significantly affect market competitiveness. Naval shipping and air transportation lack sufficient low-carbon fuel options, thus presenting an opening for the development of a hydrogen fuel system.

-

- The International Energy Agency has indicated that 97 Mt of Hydrogen production occurred in 2023, with less than 1% classified as low-emissions. Experts predict that announced low-emissions hydrogen projects will achieve production of 49 Mtpa by 2030.

Restraint

Energy losses in hydrogen production

The energy carrier known as hydrogen exists as a synthetic product. Electrical energy is converted to hydrogen by water electrolysis. The process of hydrogen production consumes high-grade electrical energy for both its creation and compression, liquefaction operations, and medium transportation, transfer, and storage mechanisms. The transformation of energy occurs throughout the hydrogen production cycle and using electrolysis or reforming methods. The conversion of electrical power together with hydrocarbon chemical energy leads to the creation of hydrogen's chemical energy. All hydrogen production methods presently suffer from energy losses.

Opportunity

Supportive government policies and regulations

The expansion of the blue hydrogen production market depends heavily on government policies and regulations for clean energy transition and reducing greenhouse gas levels. The adoption of blue hydrogen received support from several states through target creation along with financial incentives. Government entities actively promote blue hydrogen as a clean energy option. The use of renewable energy systems during blue hydrogen production methods helps minimize emissions while reducing the environmental impact of this resource.

National governments are implementing policies that promote hydrogen utilization with other renewable low-carbon fuels to address climate change and air pollution effects. The demand for blue hydrogen continues to rise because it produces fewer carbon emissions than conventional fossil fuels. The establishment of these programs serves as the vital component for establishing cleaner energy technology infrastructure and diminishing atmospheric carbon content.

- The European Union's goal is to generate 10 million tons of renewable and low-carbon hydrogen products by 2030 with blue hydrogen. The direction of industrial activities receives assurance from these factors while investor confidence increases simultaneously.

The Rise of Blue Hydrogen: Driving the Future of Clean Energy in North America

The blue hydrogen production market was dominated by North America in 2024. The increasing need for blue hydrogen drives its production forward. Multiple organizations operate to develop and distribute alternative clean energy solutions through blue hydrogen programs. The market will experience growth through technological advancements and substantial government investments. The product demand will strengthen because of several climate-related hydrogen promotion initiatives coupled with low-carbon hydrogen production tax incentives.

Increasing investments in blue hydrogen transportation infrastructure through pipeline systems and storage facilities together with hydrogen hub development combines manufacturing with storage and deployment infrastructure at single sites. Blue hydrogen projects currently receive investment from leading energy corporations, including Shell, ExxonMobil, and Chevron, that utilize their natural gas and CCS expertise.

- In January 2023, the U.S. government established the Grannus Blue Ammonia and Hydrogen Project in Northern California. The project seeks to annually generate 150,000 metric tons of blue ammonia and blue hydrogen.

Government Investments and Partnerships Fuel Blue Hydrogen Growth in Asia Pacific

Asia Pacific is anticipated to witness the fastest growth in the blue hydrogen production market during the forecasted years. The rising clean energy solutions in power generation and transportation sectors are coupled with government investments and initiatives to reduce emissions and expand infrastructure capabilities for blue hydrogen storage, along with growing partnerships for clean energy economy development. The region shows increased energy requirements combined with official programs that seek clean energy adoption.

- In January 2023, the Government introduced the National Green Hydrogen Mission to transform India into a worldwide leader in producing and exporting green hydrogen alongside its derivatives. For 2030, the country aims to produce at least 5 MMT yearly of green hydrogen, and future export growth will increase to 10 MMT annually.

Regional Insights

Asia Pacific: China Blue Hydrogen Production Market Trends

China's blue hydrogen production market is gaining significant traction as the country pursues low carbon hydrogen while leveraging its vast fossil fuel resources. Industrial clusters, especially in steel, ammonia, and refining, are being retrofitted with steam methane reforming (SMR) plants coupled with carbon capture and storage (CCS), making blue hydrogen more viable. Shared COâ‚‚ transport and storage infrastructure across provinces is driving down carbon-capture costs, accelerating project development.

Why Is Europe Leading the Transition to the Global Blue Hydrogen Market?

Europe has remained dominant within the blue hydrogen market due to its ambitions to decarbonize and establish hydrogen infrastructure development. Countries including the UK, Germany, and the Netherlands are scaling carbon capture rates and hydrogen pipeline construction. The EU Hydrogen Strategy envisions hydrogen being a part of energy systems by 2030. Europe's commitment to sustainable industrial decarbonization has made it a global leader in improving the value chain for blue hydrogen.

The UK Blue Hydrogen Production Market Trends

The UK blue hydrogen production market is gaining strong momentum as part of the country's broader low carbon hydrogen strategy, backed by government support and revenue mechanisms. The “Hydrogen Production Delivery Roadmap” targets 4 GW of CCUS enabled hydrogen capacity by 2030, underlining blue hydrogen's role as a transition technology. Major industrial clusters in Teesside, Humber, and Northwest England are being developed to link hydrogen production with carbon capture and storage infrastructure. Key players like BP, Equinor, INEOS, and SSE are investing inblue hydrogen projects, signaling growing private-sector confidence.

How is Blue Hydrogen Development Influencing the Energy Transition in Latin America?

Countries including Brazil, Chile, and Argentina are pursuing blue hydrogen projects to lower carbon emissions while meeting energy needs for industry. Blue hydrogen projects are expanding because of synergies with international energy companies, pro-hydrogen government policies, and the availability of natural gas. The National Green Hydrogen Strategy in Chile, along with the prospect of cross-border trade, is helping establish Latin America as a prominent and future hub for low-carbon hydrogen development for production and export within the next decade.

What Are the Main Stages in the Market Value Chain for Blue Hydrogen Production?

The blue hydrogen value chain consists of several key stages driving efficiency, cost, and sustainability. Feedstock sourcing through carbon capture to end-use qualifications, each stage plays an important role in ensuring overall commercial viability and environmental accountability.

- Feedstock Sourcing and Reforming: Natural gas is the primary feedstock used, which is then reformed to hydrogen via steam methane reformation (SMR). New technologies to improve reformation efficiency and lower emissions will assist in improving hydrogen yields from the feedstock.

- Carbon Capture, Utilization and Storage (CCUS): CCUS technology captures Carbon emissions experienced during the production of hydrogen, which stands out as another distinctive feature of blue hydrogen. The carbon that is captured is disposed of by storage underground or utilized in industry to provide pathways for industries to reach their net-zero emissions targets.

- Distribution and End Use: Hydrogen is then distributed, either through dedicated pipelines or available cryogenic storage or blended into feedstock for end-use applications. Industries like transportation, steel manufacturing, and energy generation can use blue hydrogen as a cleaner substitute for fossil fuels.

Regional Insights

Asia Pacific: China Blue Hydrogen Production Market Trends

China's blue hydrogen production market is gaining significant traction as the country pursues low carbon hydrogen while leveraging its vast fossil fuel resources. Industrial clusters, especially in steel, ammonia, and refining, are being retrofitted with steam methane reforming (SMR) plants coupled with carbon capture and storage (CCS), making blue hydrogen more viable. Shared COâ‚‚ transport and storage infrastructure across provinces is driving down carbon-capture costs, accelerating project development.

Why Is Europe Leading the Transition to the Global Blue Hydrogen Market?

Europe has remained dominant within the blue hydrogen market due to its ambitions to decarbonize and establish hydrogen infrastructure development. Countries including the UK, Germany, and the Netherlands are scaling carbon capture rates and hydrogen pipeline construction. The EU Hydrogen Strategy envisions hydrogen being a part of energy systems by 2030. Europe's commitment to sustainable industrial decarbonization has made it a global leader in improving the value chain for blue hydrogen.

The UK Blue Hydrogen Production Market Trends

The UK blue hydrogen production market is gaining strong momentum as part of the country's broader low carbon hydrogen strategy, backed by government support and revenue mechanisms. The “Hydrogen Production Delivery Roadmap” targets 4 GW of CCUS enabled hydrogen capacity by 2030, underlining blue hydrogen's role as a transition technology. Major industrial clusters in Teesside, Humber, and Northwest England are being developed to link hydrogen production with carbon capture and storage infrastructure. Key players like BP, Equinor, INEOS, and SSE are investing in blue hydrogen projects, signaling growing private-sector confidence.

How is Blue Hydrogen Development Influencing the Energy Transition in Latin America?

Countries including Brazil, Chile, and Argentina are pursuing blue hydrogen projects to lower carbon emissions while meeting energy needs for industry. Blue hydrogen projects are expanding because of synergies with international energy companies, pro-hydrogen government policies, and the availability of natural gas. The National Green Hydrogen Strategy in Chile, along with the prospect of cross-border trade, is helping establish Latin America as a prominent and future hub for low-carbon hydrogen development for production and export within the next decade.

What Are the Main Stages in the Market Value Chain for Blue Hydrogen Production?

The blue hydrogen value chain consists of several key stages driving efficiency, cost, and sustainability. Feedstock sourcing through carbon capture to end-use qualifications, each stage plays an important role in ensuring overall commercial viability and environmental accountability.

- Feedstock Sourcing and Reforming: Natural gas is the primary feedstock used, which is then reformed to hydrogen via steam methane reformation (SMR). New technologies to improve reformation efficiency and lower emissions will assist in improving hydrogen yields from the feedstock.

- Carbon Capture, Utilization and Storage (CCUS): CCUS technology captures Carbon emissions experienced during the production of hydrogen, which stands out as another distinctive feature of blue hydrogen. The carbon that is captured is disposed of by storage underground or utilized in industry to provide pathways for industries to reach their net-zero emissions targets.

- Distribution and End Use: Hydrogen is then distributed, either through dedicated pipelines or available cryogenic storage or blended into feedstock for end-use applications. Industries like transportation, steel manufacturing, and energy generation can use blue hydrogen as a cleaner substitute for fossil fuels.

Blue Hydrogen Production Market Companies

- Linde Plc

- Shell Group of Companies

- Air Liquide

- Air Products and Chemicals, Inc.

- Engine

- Equinor ASA

- SOL Group

- Iwatani Corp.

- INOX Air Products Ltd.

- Exxon Mobil Corp.

Recent Developments

- In October 2024, Double Zero Holdings and SJ Environmental announced a ground-breaking partnership aimed at converting stranded natural gas into blue hydrogen. With their partnership, these companies achieved a major advancement in the energy transition by offering a clean alternative energy system with reduced emissions of pollutants.

- In October 2024, Cadent gas distribution company revealed plans for a blue hydrogen pipeline across the north of England, sparking a wave of environmentalist pushback.

- In October 2024, ExxonMobil intends to construct its inaugural worldwide hydrogen manufacturing plant for low-carbon hydrogen at the Baytown, Texas, site.

- In November 2023, Air Products and Chemicals, Inc. declared their plan to construct a modern carbon capture and CO2 treatment facility at its Dutch hydrogen manufacturing site in Rotterdam. The plant operations are expected to begin in 2026, with blue hydrogen production to be delivered to ExxonMobil's Rotterdam refinery and customers through its pipeline network system.

Regions Covered in the Report

By Regions

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting