Pharmaceutical Excipients Market to Exceed USD 8.37 Bn By 2030

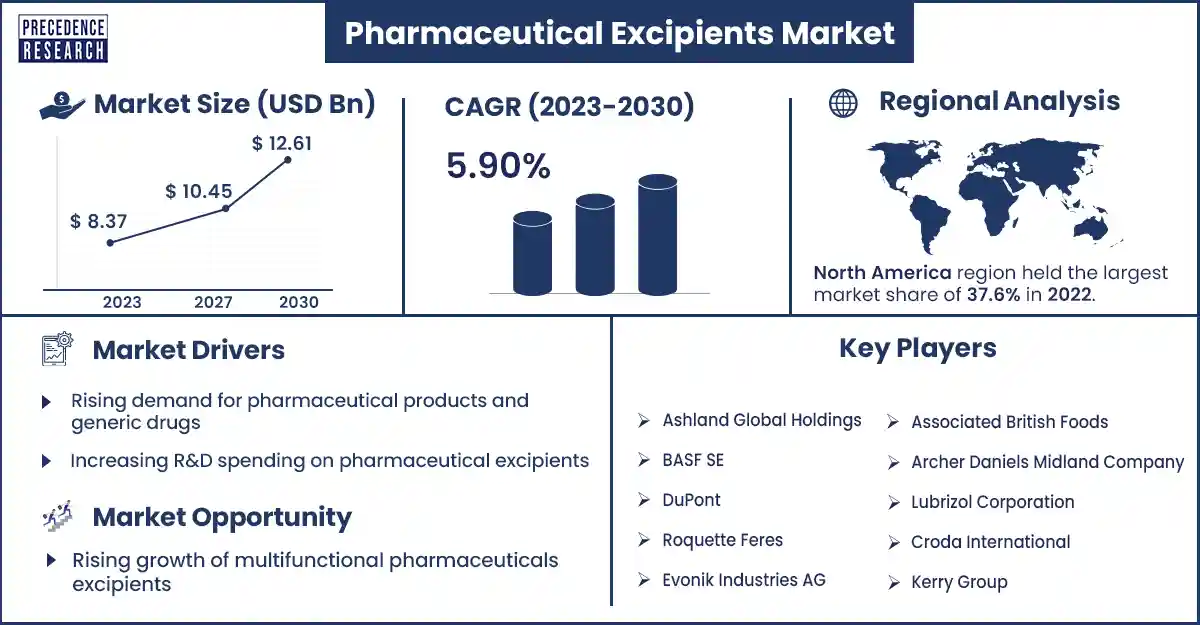

The global pharmaceutical excipients market size was evaluated at USD 8.37 billion in 2023 and is expected to attain around USD 12.61 billion by 2030, growing at a CAGR of 5.9% from 2023 to 2030.

Market Overview

The pharmaceutical excipients market is divided into different segments, including formulations, functionality, and products. Pharmaceutical excipients are components other than the active pharmaceutical components that exist in finished pharmaceutical drug formulation. These pharmaceutical excipients are consistently used as coatings, flavorings, binders, lubricants, and coloring agents for formulation. Pharmaceutical excipients are essential for drug delivery within our body. Its measurable motive is to eventually accelerate the physiological absorption of the drug and simplify the manufacture of the drug products.

A carefully selected excipient may improve patient experience by offering taste-covering properties or may decrease manufacturing costs by being multifunctional. The pharmaceutical industry is ever desiccated to patients' therapeutical requirements and apart from active components. Ideal excipients play an important role in formulation development. Pharmaceutical excipients are ingredients other than the pharmacological prodrug or active drug involved in the production process or contained in a completed pharmaceutical product dosage form.

Regional Snapshots

North America dominated the pharmaceutical excipients market in 2023. It has the maximum share in the market. Pharmaceutical excipients play an important role in drug formulation and its development in North America. The U.S. has the International Pharmaceutical Excipients Council (IPEC). This council is responsible for developing, implementing, and promoting the global use of safe and good-quality pharmaceutical excipient delivery systems. In Canada, they have a rich and long history of innovative research in drug delivery within the biotechnology community, pharmaceutical industry, and academic institutions. Health Canada evaluates the excipients present in pharmaceutical products in various ways, such as in inhalation products. The efficacy and properties of pharmaceutical excipients are very important, and in modified-released products, various kinds of excipients are thoroughly examined.

Europe region is estimated to grow fastest in the forecast period. In the coming years, many European countries will focus on the generics market owing to the medicines license. European countries such as France, the UK, and Germany are expected to witness significant growth rates during the forecast period, which is likely to boost the requirements for the pharmaceutical excipients market. In these countries, the rising government initiatives to decrease the prices of drugs in the market are expected to enhance the market for generic drugs.

- For instance, in Europe, the European Medicines Agency announced a regulatory perspective on nitrosamine mitigation policies. The announcement highlighted that while nitrite concentration in pharmaceutical excipients is a major risk factor in nitrosamine drug ingredient-related impurities formulation, there is an opportunity for preventive actions and corrective implementation.

Pharmaceutical Excipients Market Report Scope

| Report Coverage | Details |

| Market Revenue in 2023 | USD 8.37 Billion |

| Projected Forecast Revenue by 2030 | USD 12.61 Billion |

| Growth Rate from 2022 to 2030 | CAGR of 5.9% |

| Largest Market | North America |

| Base Year | 2022 |

| Forecast Period | 2022 to 2030 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Rising demand for pharmaceutical products and generic drugs

The pharmaceutical excipients market is anticipated to take advantage of the rising requirement for generic drugs. Generic drug's presence in the market is expected to increase the volume of drugs sold. They are cheaper than branded drugs. Due to the patent cliff, there is an increase in the number of generic drug approvals. Generic drug producers are frequently looking for ways to decrease costs, and excipients can be outstanding cost-saving measures. Because of this, there is increasing demand for affordable excipients, good quality, which maintain the pharmaceutical excipient market. This is expected to be a positive sign of the growth of the market.

Increasing R&D spending on pharmaceutical excipients

The pharmaceutical industry develops a variety of innovative drugs and medicines that supply valuable medical advantages every year. Many of those drug's medicines are costly and contribute to increasing health care costs for the federal government and private sector. Strategists have considered strategies that would lower drug costs and reduce federal drug spending. Such strategies would likely reduce the industry’s incentive to make new drugs. These factors of increasing research and development in the pharmaceutical industry may drive the growth of the pharmaceutical excipients market.

- For instance, the Congressional Budget Office (CBO) announced the trends in expenditure for drug research and development (R&D) and the launch of new drugs. CBO also studied factors that regulate how much drug industries spend on R&D, such as expected revenues from a new drug, government federal policies, and price to develop a new drug that impacted the requirement for drug therapies and the supply of new drugs.

Restraint

Higher development costs related to novel excipients

The acceptance process for new excipients can be complex, expensive, and long. It needs high-cost speculations and can further delay the time to market for new excipients, which can make it harder for pharmaceutical industries to defend the investments in innovating new products. Before they can be used in drug products, new excipients must be approved by regulatory agencies such as FDA.

Moreover, these excipients must be produced in large quantities to fulfill the requirements of the pharmaceutical industry. This procedure can be costly and lengthy. That is why higher development costs are predicted to challenge the pharmaceutical excipients market.

Opportunity

Rising growth of multifunctional pharmaceuticals excipients

Multifunctional excipients are a type of pharmaceutical excipients produced by mixing two or more excipients together using a physical method, such as granulation, blending, and mixing. This method alters the physical properties of the separate excipients, resulting in a new excipient with escalated functionality. These excipients provide various benefits over existing single-function excipients, such as decreased number of excipients in a formation, thus streamlining the manufacturing procedure, developed performance of the formulation due to binding and compressibility compared to separate excipients and decreased variability in formulation properties by ensuring continuous performance of pharmaceutical formulations there this opportunity may drive the growth of the pharmaceutical excipients market in the coming years.

Recent Developments

- In August 2023, Union Health Minister Mansukh Mandaviya announced that India has started producing 38 active pharmaceutical ingredients in the last one and a half years. It was import-dependent, under the manufacturing of linked incentive scheme for the sector.

- In September 2023, the pharmaceutical company Coloron launched the New Titanium dioxide-free moisture protection. It is coated for the pharmaceutical tables. Colorcon product provides Opadry with complete film coating systems to the customers. It has helped to decrease the complexity of ingredients and high-quality products.

- In November 2023, the company Roquette launched a new project based on moisture-sensitive pharmaceutical and nutraceutical ingredients. Roquette has added three excipients for moisture–sensitive and neutraceutical ingredients such as Microcel 113 SD, Microcel 103 SD, and Lycatab CT-LM.

- In October 2023, at CPHI in Barcelona, IFF launched the latest biopolymer, Methanova. It is a well-characterized biopolymer. Before the event started next week, OSP was lucky enough to catch up with them. At this event, IFF will show its portfolio of nitrate solutions for the pharmaceutical industry.

- In March 2024, in the United States, the CEO of generic drugmaker RK Baheti focused on launching five to six products every quarter. He has expected a growth of 7-10% in the active pharmaceutical ingredients business.

Market Key Players

- Ashland Global Holdings

- BASF SE

- DuPont

- Roquette Feres

- Evonik Industries AG

- Associated British Foods

- Archer Daniels Midland Company

- Lubrizol Corporation

- Croda International

- Kerry Group

Market Segmentation:

By Product

- Organic Chemicals

- Inorganic Chemicals

- Others

By Functionality

- Fillers and Diluents

- Suspending and Viscosity Agents

- Coating Agents

- Binders

- Disintegrants

- Colorants

- Lubricants and Glidants

- Preservatives

- Emulsifying Agents

- Flavoring Agents and Sweeteners

- Other Functionalities

By Formulations

- Topical Formulations

- Oral Formulations

- Parenteral Formulations

- Other Formulations

By End-Users

- Pharmaceuticals Companies

- Research Organization

- Academics

- Others

By Distribution Channel

- Online Pharmacy

- Retail

- Mail-Order

By Excipient Type

- Lactose-based Excipients

- α-lactose monohydrate

- Anhydrous α-lactose

- Anhydrous β-lactose‹

- Amorphous Lactose

- Cellulose-based

- Microcrystalline Cellulose (MCC)

- Cellulose Ethers

- Others

- Starches

- Carboxymethylcellulose Sodium (CCS)

- Sodium Starch Glycolate (SSG)

- Fine Chemicals

- Mannitol

- Biopharma Excipients

- Others

Buy this Research Report@ https://www.precedenceresearch.com/checkout/1761

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 650 460 3308