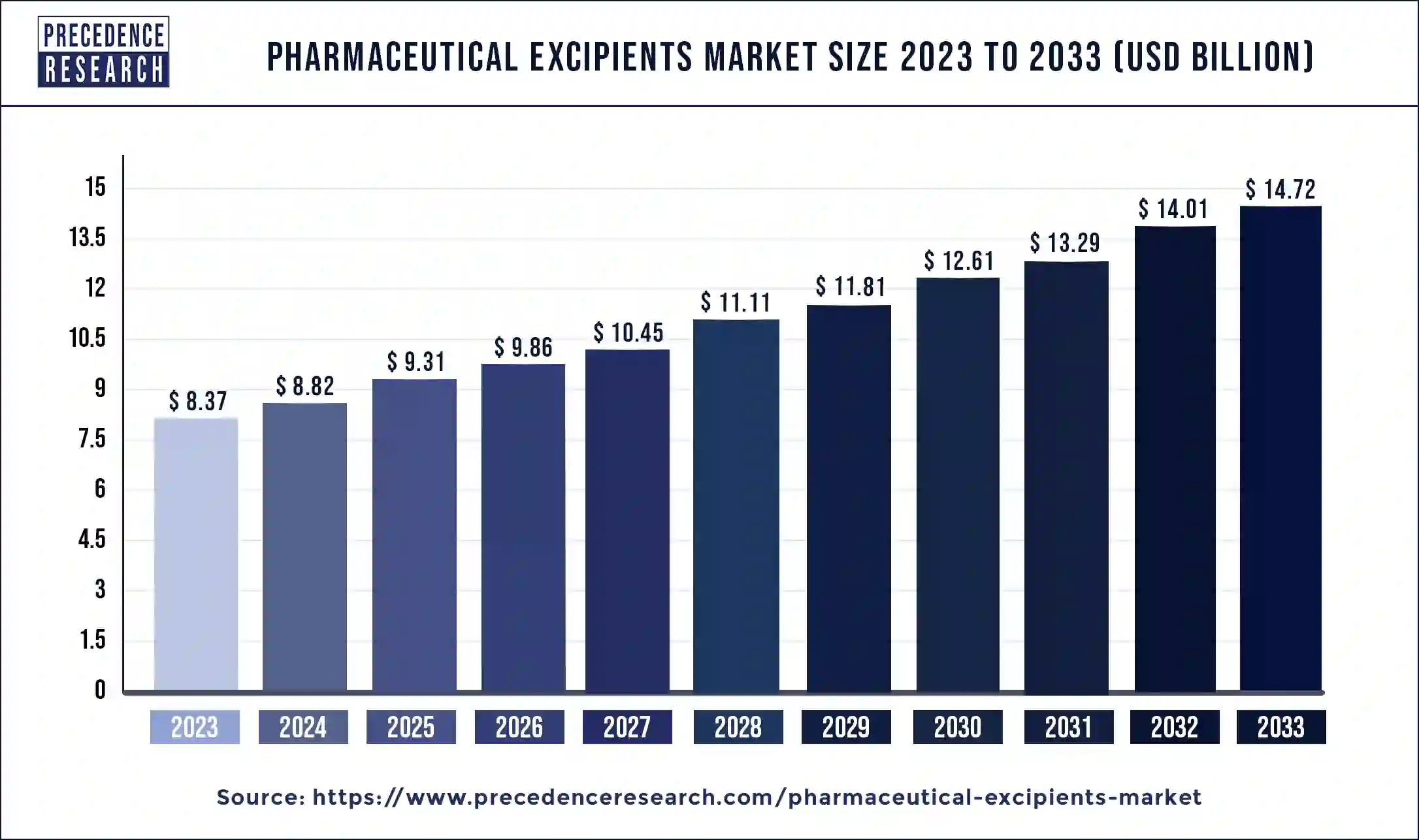

What is the Pharmaceutical Excipients Market Size?

The global pharmaceutical excipients market size is valued at USD 9.31 billion in 2025, and it is expected to surpass around USD 16.14 billion by 2035, registering a CAGR of 5.66% from 2026 to 2035.

Market Highlights

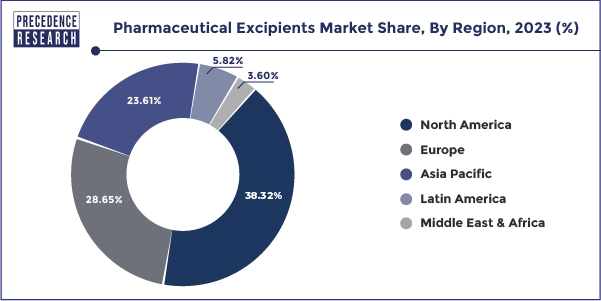

- North America dominated the market, holding the largest market share of 38.32% in 2025.

- By excipient type, lactose-based excipients held the highest revenue share of around 41.26% in 2025.

- By functionality, the fillers and diluents segment held a significant share in 2025.

- By functionality, the coating agents segment is anticipated to show considerable growth in the market over the forecast period.

- By excipient type, the lactose-based excipients segment held a substantial share in 2025.

- By excipient type, the cellulose-based segment is expected to show considerable growth in the market over the forecast period.

Market Overview

What are Pharmaceutical Excipients?

Pharmaceutical excipients, which are pharmacologically inactive, are crucial in the preparation, stability, and efficacy of drugs. They are added together with active pharmaceutical ingredients (APIs) to facilitate the manufacturing process as well as to assure that the end product is safe, effective, and user-friendly. Excipients are used in a variety of ways, such as: as binders to bind a tablet, as fillers to give mass to the tablet, as lubricants to facilitate easy compression of the tablet, as preservatives to extend shelf life, and as flavoring agents to enhance pleasantness.

The pharmaceutical excipients market is showing protracted development, and it is composed of an increase in the management of high-quality and patient-friendly drugs, and innovative delivery platforms. There has been an upsurge in chronic and lifestyle-related diseases like diabetes, cardiovascular diseases, and cancer, and this has propelled the need to have more complex and treatment-specific drugs. Moreover, with the blistering growth of biologics, biosimilars, and personalized medicines, there is an increase in custom excipient solutions required to offer the stability of the products and bioavailability.

AI Integration in the Pharmaceutical Excipients Market

The pharmaceutical excipients market is adopting artificial intelligence, which makes it more promising in formulation and process design as well as predictive analytics. With AI-powered modeling tools, scientists can be able to process large amounts of data to model how a given excipient may react to active pharmaceutical ingredients to enhance drug stability, bioavailability, and shelf-life. Quality control is an area where AI is transforming the industry by allowing the shifting of quality control strategies on manufacturing excipient characteristics and maintaining batch-to-batch consistency, as well as regulatory compliance.

Pharmaceutical Excipients MarketGrowth Factors

Pharmaceutical excipients are inert substances, other than pharmacologically active medicines that are included in the production process or are present in pharmaceutical product dosage format. Excipients are extensively used in the formulation of drugin order to add bulkiness to solid formulations, provide long-term stability, and facilitate drugs absorption. Additionally, it also improves the overall safety or functional attributes of the product during usage or storage.

The global pharmaceutical excipients market is propelled by the growing demand for oral pharmaceutical medicines and the augment of novel therapeutics owing to the proliferation in the number of pharmaceutical industries across the globe. Additionally, the amalgamation of medicine formulation as well as nanotechnology in excipients has led to the formulation of nano-derived liposomes, nano-coated tablets, and vaccines. Moreover, many key players are targeting the developing economies for the growth of their manufacturing plants for pharmaceutical excipients, glycerin, preservatives, and Fatty Acids owing to low cost labor availability. However, high production cost and stringent government regulations are expected to restrain the overall market growth in terms of value sales.

Applications such as topical formulation, parenteral formulation, and oral formulation are driving in huge investments in the market. Moreover, the target consumers such as drug manufacturers, consulting firms, and pharmaceutical excipients manufacturers, research & development companies and others are likely to offer immense opportunities for the growth of market during the forecast period in terms of value sales. Furthermore, the market growth is majorly driven by the growing demand from the pharmaceutical sectors due to the outbreak of Covid19 pandemic. Additionally, the rising use of generic drugs coupled with the development in the field of biopharmaceuticals is other factors which are supporting the market growth in terms of value sales.

However, the rising pressure owing tothe strict guidelines set by the regulatory authorities about the approval of drugs and excipients is likely to hamper the market growth. The easy availability of low-quality excipients has adversely affected the effectiveness of the medicines that creates a requirement for quality control.

Moreover, according to the key market players in the industry, over the last three years there has been a continuous rise in the demand for cheaper quality excipients from the developing economies such as Asia Pacific and East Africa regions. This is attributable to the rise in the requirement in the local drug manufacturing industry. However, the trend is the opposite of the situation currently in developed countries with sophisticated manufacturing practices, where demand for superior quality excipients is increasing, but at a lower rate than that in emerging economies.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 9.31 Billion |

| Market Size in 2026 | USD 9.86 Billion |

| Market Size by 2035 | USD 16.14Billion |

| Growth Rate from 2026 to 2035 | CAGR of 5.66% |

| Largest Market | North America |

| Fastest Growing Market | Europe |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Functionality, Excipient Type, and region |

Market Dynamics

Drivers

Growing Pharmaceutical Sector

The ongoing growth of the global pharmaceutical industry is one of the biggest growth factors in the pharmaceutical excipients industry. With a continued increase in the development of new drugs to treat some of the largest segments of the human population affected by chronic diseases, such as diabetes and cancer, as well as the newly occurring infectious diseases, the need to find reliable excipients that perform and meet the required benchmarks rises.

Excipients play a vital role in achieving drug safety, stability, efficacy, and patient compliance- qualities which are becoming important as formulations are becoming complex. Pharma companies are always on the lookout for new excipient systems that can augment the bioavailability, targeted delivery, and controlled release of the active material. Moreover, the entry of generic/over-the-counter manufacturers of drugs has increased the number of people using excipients.

Rising Prevalence of Chronic Diseases

A surge in the occurrence of chronic diseases like diabetes, cardiovascular disorders, respiratory diseases, and cancer is contributing to the expanded growth of the pharmaceutical excipients market. With the steadily increasing global burden of these chronic conditions, there is a demand to be met for continuous, as well as effective and accessible treatment. The presence of excipients is important to increase the performance of drugs, to sustain stability, and improve compliance in patients, particularly in chronic disease treatment.

The sustained-release and targeted delivery formulations and formulations depend on novel excipient solutions to achieve therapeutic effectiveness with extended duration. Companies that produce pharmaceuticals are also investing in research and developing excipients that fit chronic treatments to aid controlled and better bioavailability.

Restraint

High-cost parentage of novel and specialized excipients

The costs of development and production of new and specialized pharmaceutical excipients are usually very high and pose a significant barrier to the market of pharmaceutical excipients. Due to complexity, these sophisticated excipients may necessitate considerable expenditure in terms of research and development, regulatory, and manufacturing facilities. This may be so costly, especially in the budgets of small-sized and medium-sized pharmaceutical companies. Time-to-market of new formulations may also be hindered by cost barriers, thus slowing down innovation.

Opportunity

Growing Demand for Green and Sustainable Excipients

Green excipients, usually plant-based or bio-based materials, are becoming popular as they have a lower environmental impact when it comes to manufacturing, use, and disposal. Moreover, sustainability options in excipients assist pharmaceuticals in managing their carbon footprint, optimizing global supply chains to enhance product differentiation in the competitive market. Governments and regulatory authorities are catalyzing this transition by providing incentives to engage in greener manufacturing processes and ingredients from cleaner sources.

With the pharmaceutical industry working to achieve sustainability goals that are in tandem with sustainability progress in the world, the global green excipients market is projected to increase, leading to a good opportunity for manufacturers innovating and becoming leaders in creating pharmaceutical-related solutions that do not harm the environment.

Segment Insights

Functionality Insights

Why did the fillers and diluents segment dominate in 2025?

The fillers and diluents segment led the pharmaceutical excipients market and accounted for the largest revenue share in 2025. Such excipients are essential in oral solid dose, especially tablets and capsules. Fillers, which may be referred to as bulking agents or diluents, are substances to make a tablet or capsule larger, particularly where the active pharmaceutical ingredient is in low quantity. Besides enhancing the size and the consistency of the tablets, fillers also help reduce uniformity of the dosages, improve the compressibility, and improve stability in the storage and transportation of the drug.

The increased dependence on these excipients is due to the increasing need for oral solid dosage forms, especially in the management of chronic diseases. Moreover, due to the rising global manufacturing of generic drugs and OTC preparations, the utilization of fillers continues to be crucial in terms of the delivery of correct doses and regulatory business operations.

The coating agents segment is expected to grow at a significant CAGR over the forecast period. Prompted by the growing demand for better drug delivery, patient adherence. Tablets or capsules are usually coated with coating agents on the outer surface of the tablets or capsules to fulfill certain functions. These entail the concealment of bitter taste or smell of active pharmaceutical ingredients, the improvement of the cosmetic characteristics of dosage forms, and the protection of drugs against environmental factors, which include moisture, oxygen, and light.

The controlled or delayed release of drugs is simplified by the use of advanced coatings, especially in the case of extended and enteric-coated preparations. Drug properties and targeted release, polymers, sugars, and cellulose derivatives are used as coating materials and selected carefully.

Excipient Type Insights

Did the lactose-based excipients segment hold a substantial share in 2025?

The lactose-based excipients dominated the market in 2025 and are expected to dominate throughout the projected period. Lactose is economical, easily accessible, and compatible with a large number of active pharmaceutical ingredients, making it a favorite of pharmaceutical manufacturers. Moreover, Lactose has been used in the processing of both branded and generic drug products, including over-the-counter medicine, which has further strengthened its market domination. Due to the ever-increasing demand for oral dosage type drugs, especially in the area of treating chronic diseases, lactose-type excipients will be a pillar in pharmaceutical formulation.

The cellulose-based segment is expected to grow substantially in the pharmaceutical excipients market. Naturally occurring polymers, cellulose, naturally occurring polymers, including cellulose and derivatives, such as microcrystalline cellulose (MCC), hydroxypropyl methylcellulose (HPMC), and carboxymethylcellulose (CMC), are commonly used as binders, fillers, film-formers, disintegrants, and stabilizers. They are being used in the newer methods of delivering drugs, like sustained-release and enteric-coated tablets, which is creating an increase in interest.

Regional Insights

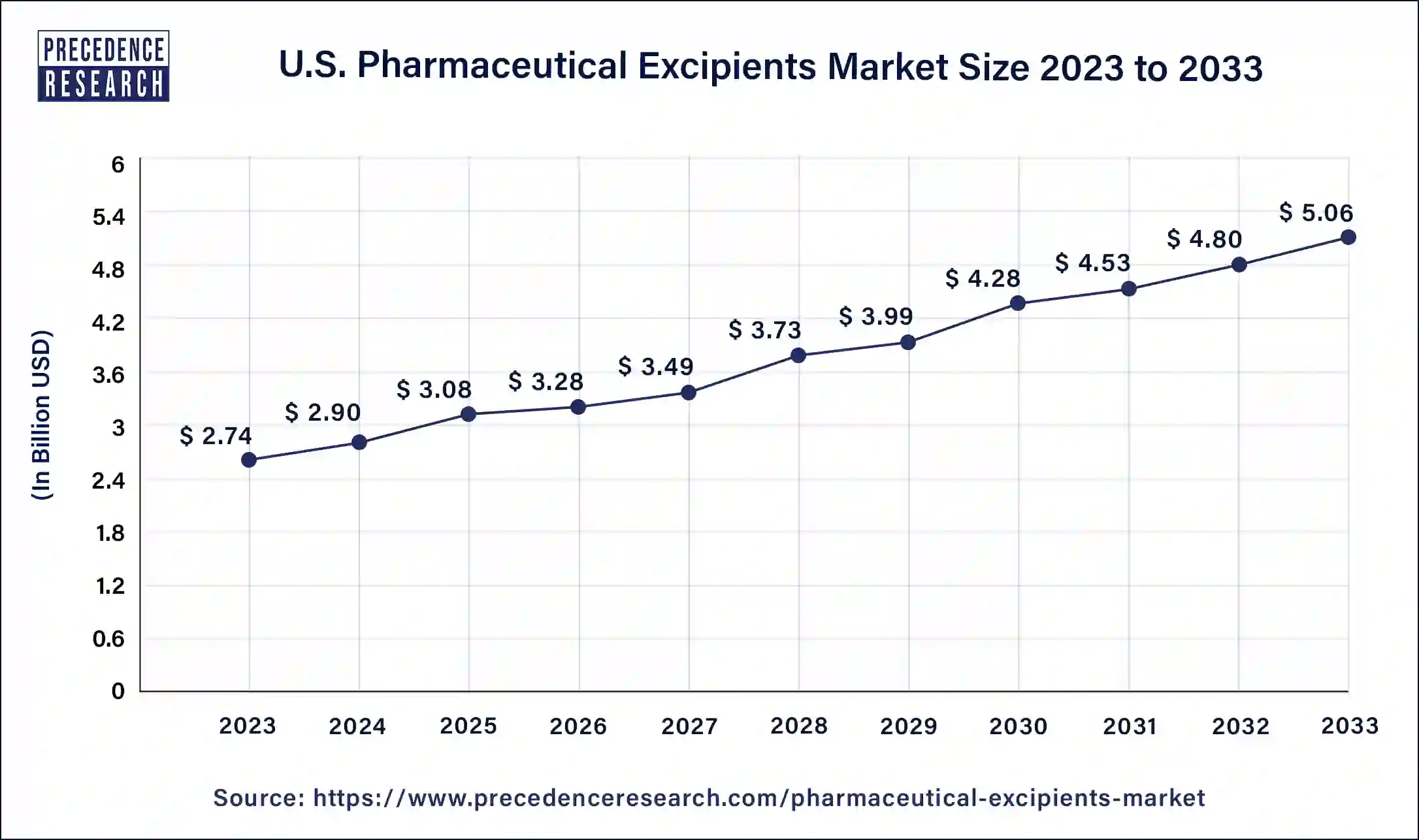

How Big is the U.S. Pharmaceutical Excipients Market Size?

The U.S. pharmaceutical excipients market size is valued at USD 3.08 billion in 2025, and it is expected to surpass around USD 5.58 billion by 2035, registering a CAGR of 6.12% from 2026 to 2035.

Europe is also expected to witness a significant growth rate during the forecast period. Many European countries are focusing on the generics market owing to the expiration of the medicines patents in the upcoming years. Thus, due to this, the European countries such as Germany, UK, France and others are expected to witness significant growth rate during the forecast period which in turn is likely to drive the demand for pharmaceutical excipients in this region.

Additionally, the growing government initiatives for reducing the prices of the drugs in the market are anticipated to drive the market for generic drugs in these countries. The aforementioned factors, along with the rising investments for the development of biologics as well as advanced dosage forms, are likely to increase the demand for new excipients and thereby contributing in the growth of the pharmaceutical excipients market in Europe. However, the Asia-Pacific region is expected to register the highest CAGR, owing to low cost of raw materials and availability of cost-effective workforce.

What Are the Key Trends Driving the Asia Pacific Pharmaceutical Excipients Market?

The Asia Pacific pharmaceutical excipients market is expected to account for a substantial market share in 2024. Investments in premium pharmaceutical research and advanced drug delivery systems, and the demand for functional and specialty excipients with advanced formulations, are increasing. An increasingly old population, a burgeoning middle class, and increasing chronic problems like diabetes or cardiovascular disease are driving the demand to develop effective and scalable solutions in the form of drugs throughout the region.

The high manufacturing infrastructural capabilities and rising investment in research and development activities in China have made it one of the main players in the Asia-Pacific pharmaceutical excipients industry.

The nation has low-cost production capabilities, human resources, and government policies to assist the country. Also, the competition due to innovation and quality standards has made China highly competitive globally, and this makes the country a key supplier in the emerging pharmaceutical excipients industry in Asia-Pacific.

Regional Landscape

- The North America pharmaceutical excipients market size was estimated at USD 3.15 billion in 2024 and is projected to hit around USD 5.66 billion by 2034 with a CAGR of 6.04% from 2025 to 2034.

- The Europe pharmaceutical excipients market size was exhibited at USD 2.35 billion in 2024 and is predicted to reach around USD 3.95 billion by 2034, growing at a CAGR of 5.30% from 2025 to 2034.

- The Asia Pacific pharmaceutical excipients market size accounted for USD 1.94 billion in 2024 and is expected to grow at a CAGR of 6.53% from 2025 to 2034, to reach around USD 3.65 billion by 2034.

- The MEA pharmaceutical excipients market size is expected to be worth around USD 454.85 million by 2034 from USD 294.40 million in 2024 and expanding at a CAGR of 4.44% from 2025 to 2034.

How did North America dominate the pharmaceutical excipients market in 2024?

North America held the dominating share of the pharmaceutical excipients market in 2024, due to the strong pharmaceutical manufacturing sector, advanced research perspective, and excellent healthcare infrastructure. The world's leading pharmaceutical and biotechnology firms invest in drug innovation and formulation technologies. North America holds a well-established regulatory framework, headed by the U. S Food and Drug Administration (FDA), and thus, this means quality control is very high, and therefore, there is more confidence concerning the safety and performance of excipients.

The U.S. has a great standing in the North American market of pharmaceutical excipients due to its big R&D setting, high level of production sophistication, and expenditure on healthcare. The generic and over-the-counter drugs manufacturing activity is further growing significantly in the U.S. The excipient development is also promoted by such a combination of industry and academia partnership, and government programmes to investigate and innovate.

Value Chain Analysis for Pharmaceutical Excipients Market

1. Raw Material / Feedstock Supply

- Involves sourcing of plant-derived materials (e.g. starch, cellulose), minerals (e.g. calcium phosphate, silica), synthetic chemicals, and polymers.

- Key value drivers include purity, consistency, cost, availability, sustainability, and origin (e.g. plant-based, animal-free).

2. Processing & Intermediate Manufacturing

- Involves conversion of raw materials into functional excipient intermediates through operations such as purification, milling, drying, and granulation.

- High emphasis on quality control, with compliance to pharmacopeial standards.

3. Formulation / Customization

- Specialized processing to create co-processed or multifunctional excipients tailored for specific drug formulations.

Value is added through innovation and product differentiation, such as sustained release, solubility enhancement, or compatibility with biologics.

4. Regulatory Compliance

- Involves meeting national and international regulations, pharmacopeial standards, and safety/toxicology requirements.

Regulatory approval for novel excipients can be time-consuming and costly.

5. Final Manufacturing

- Large-scale production of excipients under stringent quality assurance and GMP (Good Manufacturing Practices).

Focus on batch consistency, high purity, and minimizing contamination.

Pharmaceutical Excipients Market Companies

- Ashland Global Holdings

- BASF SE

- DuPont

- Roquette Feres

- Evonik Industries AG

- Associated British Foods

- Archer Daniels Midland Company

- Lubrizol Corporation

- Croda International

- Kerry Group

Government Policies to Support Pharmaceutical Excipients Market:

- In January 2025, the State Drug Administration of China announced an important update aimed at enhancing the quality management of pharmaceutical excipients and packaging materials. This updated regulation is set to take effect on January 1, 2026, and is designed to align industry practices with stringent quality standards, ultimately ensuring the health and safety of the public. (Source: https://www.arqon.com)

Recent Developments

- In January 2025, GELITA launched the Endotoxin Controlled Excipients (ECE) portfolio. Its portfolio consists of vaccine stabilization products with medical-grade gelatin and collagen peptides, medical devices, as well as 3D bioprinting.

- In September 2024, Evonik opened a new spray drying plant at its Darmstadt-based site to manufacture EUDRAGIT polymers, functional excipients in oral drug delivery. The plant uses green electricity and steam generated through local waste incineration, which proves to give savings of more than 1,000 2 equivalents per annum.

- In May 2024, Roquette launched hydroxypropyl pea starch, LYCAGEL Flex, which is a premix to bring flexibility to pharmaceutical and nutraceutical softgel capsules. The new excipient is free of plasticizer, which provides the manufacturer with the opportunity to select the most suitable formulations of plasticizers and the possibility to select the formulation of the excipient.

Segments Covered in the Report

By Functionality

- Fillers and Diluents

- Suspending and Viscosity Agents

- Coating Agents

- Binders

- Disintegrants

- Colorants

- Lubricants and Glidants

- Preservatives

- Emulsifying Agents

- Flavoring Agents and Sweeteners

- Other Functionalities

By Excipient Type

- Lactose-based Excipients

- α-lactose monohydrate

- Anhydrous α-lactose

- Anhydrous β-lactose

- Amorphous Lactose

- Cellulose-based

- Microcrystalline Cellulose (MCC)

- Cellulose Ethers

- Others

- Starches

- Carboxymethylcellulose Sodium (CCS)

- Sodium Starch Glycolate (SSG)

- Fine Chemicals

- Mannitol

- Biopharma Excipients

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting