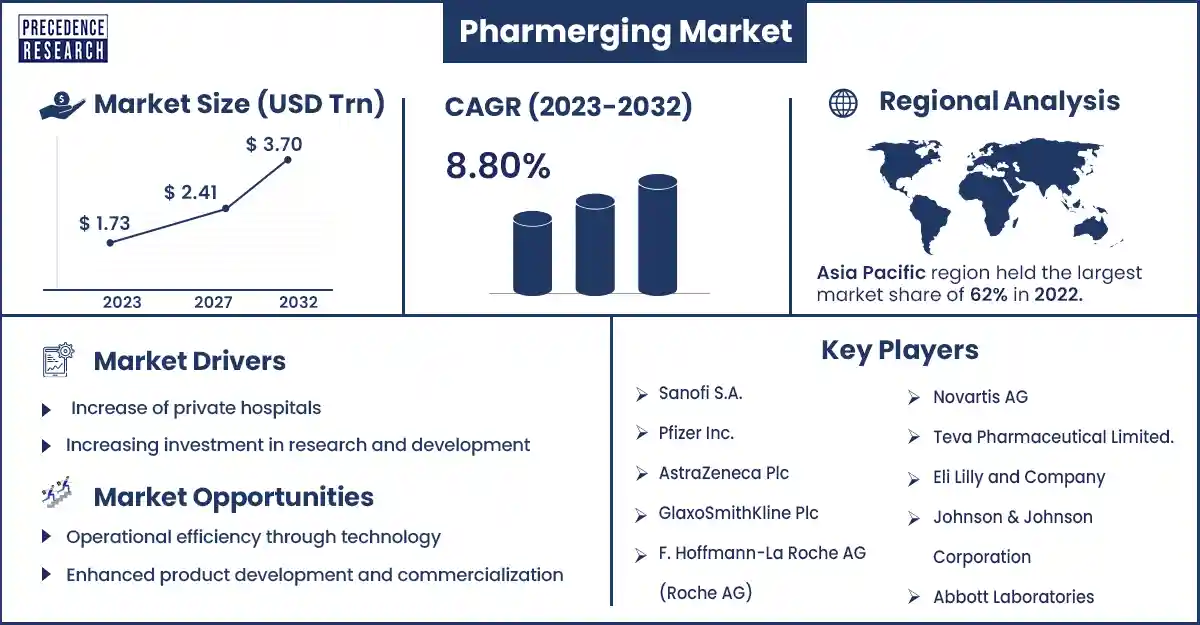

Pharmerging Market Size to Attain USD 3.70 Trillion by 2032

The global pharmerging market size surpassed USD 1.73 trillion in 2023 and is estimated to attain around USD 3.70 trillion by 2032, growing at a CAGR of 8.80% from 2023 to 2032.

Market Overview

Pharmerging is a term used to describe a group of countries, such as India, China, Russia, Indonesia, South Africa, Brazil, and Turkey, with relatively weak positions in the pharmaceutical market but are rapidly growing. With the growth of the global pharmaceutical market, collaborative acquisitions, international mergers, and expansion of public and private healthcare insurance are expected to increase. The global pharmerging market is caused by several factors, including increasing healthcare expenses and the rising number of private hospitals.

Additionally, the majority of people are suffering from multiple chronic illnesses, which has led to an increased understanding of early illness detection and therapy methods, further boosting the market growth. The elderly population is growing, and they are more prone to medical needs. The increasing number of insurance companies in pharmerging countries offering numerous insurance guidelines to decrease out-of-pocket costs has also increased the need for pharmaceuticals in these countries. In addition, the market is experiencing growth due to the increasing investments in expansive R&D activities in immunology, biotechnology, oncology, and other areas aimed at introducing cutting-edge treatments.

Regional Snapshot

Asia Pacific dominated the global pharmerging market in 2023. This is the growing patent expiration, booming urbanization, and a point in medical research investments by different governments. It is counted that the Asia Pacific market will stay on top. In the Asia Pacific market, china is the dominant country. China holds the prospect of growing exponentially during the forecast. Expanded penetration of insurance guidelines and the entry of significant companies into new markets with a wide variety of outcome portfolios is anticipated to grow the Asian Pacific market.

There will be significant intimidation in the U.S. because of the price, which will boost. To make up for the failure during the pandemic, commercial insurance providers and the cliff methods are pursuing forms to push it up. Among the different regional markets, Latin America and Europe are likely to witness a healthy evolution soon in the pharmerging market. Growing understanding of the remedy and management of healthcare facilities, vast research and development, and specialized advances are driving the growth of the Latin American market. Due to the significant people size and the rising majority of diseases, the European market is anticipated to develop well during the forecast. In the coming years, the Middle East and Africa are expected to have a small share of the global farming market.

Pharmerging Market Report Scope

| Report Coverage | Details |

| Market Revenue in 2023 | USD 1.73 Trillion |

| Projected Forecast Revenue by 2032 | USD 3.70 Trillion |

| Growth Rate from 2023 to 2032 | CAGR of 8.80% |

| Largest Market | Asia Pacific |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Increase of private hospitals

In the pharmerging market, the increasing expense of healthcare initiatives and the increase of private hospitals are leading to the development of the global farming market. The prevalence of chronic diseases amongst customers and the rising awareness of early illness detection and remedy techniques show growth in this market. The aged people in many countries are highly prone to intense medical illnesses like cardiac failure, dementia, and hypertension. These age-related diseases are creating a need for medications. Countries deliver multiple repayment schemes to decrease the cost of remedies for chronic illnesses. Also, various governments have presented guidelines that help develop the market. These chronic diseases require regular and lengthy treatment.

Increasing investment in research and development

With the increasing rate of various diseases, the interest in profoundly innovative and more valuable outcomes is further expanding, which will likely bring about significant growth in this market later on. The ongoing development and progress in the drug are also anticipated to drive this market over the next few years. The worldwide pharmerging market is overlooking a crucial ascent, especially in the rising economies worldwide. The growing pervasiveness of non-infectious diseases, growing populace, expanding future, increasing pay, barraging government consumption on medical care, global collaboration, and constant creative work are essential aspects of this market's development.

Restraints

Integration challenges

In the pharmerging market, merging pharmaceutical companies often face significant challenges in integrating their operations, cultures, and technologies. This can lead to inefficiencies, delays in product development, and increased costs. Merging two companies with different operational standards, technologies, and data systems can be complex and time-consuming, potentially affecting the market's growth and innovation capabilities.

Regulatory and compliance issues

Pharmaceutical mergers can also lead to compliance issues with regulations in various countries in the pharmerging market. Companies must navigate the complexities of regulatory environments, including patent laws, clinical trial regulations, and marketing approvals. Failure to comply with these regulations can lead to penalties, delays in product launches, and damage to the company's reputation.

Opportunities

Opportunities for collaboration

In the pharmerging market, many appearing markets already own strong research and drug manufacturing resources, unlocking potential collaborations with pharmaceutical companies. India and South Africa have long been significant participants in pharmaceutical manufacturing and analysis, presenting fantastic opportunities for collaboration. Global pharmaceutical companies are setting up manufacturing skills in emerging needs to fulfill rising demand. These regional investments decrease production expenses, facilitate partnerships with regional providers and management, and help evolve in-country diffusion networks for their outcomes. Regional manufacturing also creates jobs and fosters economic growth.

Operational efficiency through technology

In the pharmerging market, the pharmaceutical industry is increasingly leveraging artificial intelligence (AI) and analytics to streamline operations and drive innovation. By analyzing vast amounts of data, AI can help pharmaceutical companies optimize their supply chains, reduce waste, and improve the efficiency of their manufacturing processes. This lowers costs and allows for the development of more targeted and personalized treatments, enhancing patient outcomes.

Enhanced product development and commercialization

The use of simulation and virtual reality technologies in pharmaceutical research and development is opening up new avenues for drug discovery and development in the pharmerging market. These technologies allow scientists to model complex biological systems and drug interactions in a virtual environment, accelerating growth and reducing costs associated with traditional laboratory experiments.

Recent Developments

- In January 2023, in order to provide more consumers with same-day delivery, Kroger teamed with Instacart.

- In February 2023, Walmart Grocery will now offer delivery from over 1,000 locations thanks to a partnership with DoorDash.

Key Market Players

- Sanofi S.A.

- Pfizer Inc.

- AstraZeneca Plc

- GlaxoSmithKline Plc

- F. Hoffmann-La Roche AG (Roche AG)

- Novartis AG

- Teva Pharmaceutical Limited.

- Eli Lilly and Company

- Johnson & Johnson Corporation

- Abbott Laboratories

Market Segmentation

By Product

- Pharmaceuticals

- Patented Prescription Drugs

- Generic Prescription Drugs

- OTC Drugs

- Healthcare

- Medical Devices

- Clinical Diagnosis

- Others

By Indication

- Lifestyle Diseases

- Cancer and Autoimmune Diseases

- Infectious Diseases

- Others

By Economy

- Tier-1

- Tier-2

- Tier-3

By Distribution Channel

- Hospitals

- Online Stores

- Retail Pharmacies

- Others

Buy this Research Report@ https://www.precedenceresearch.com/checkout/1767

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 650 460 3308