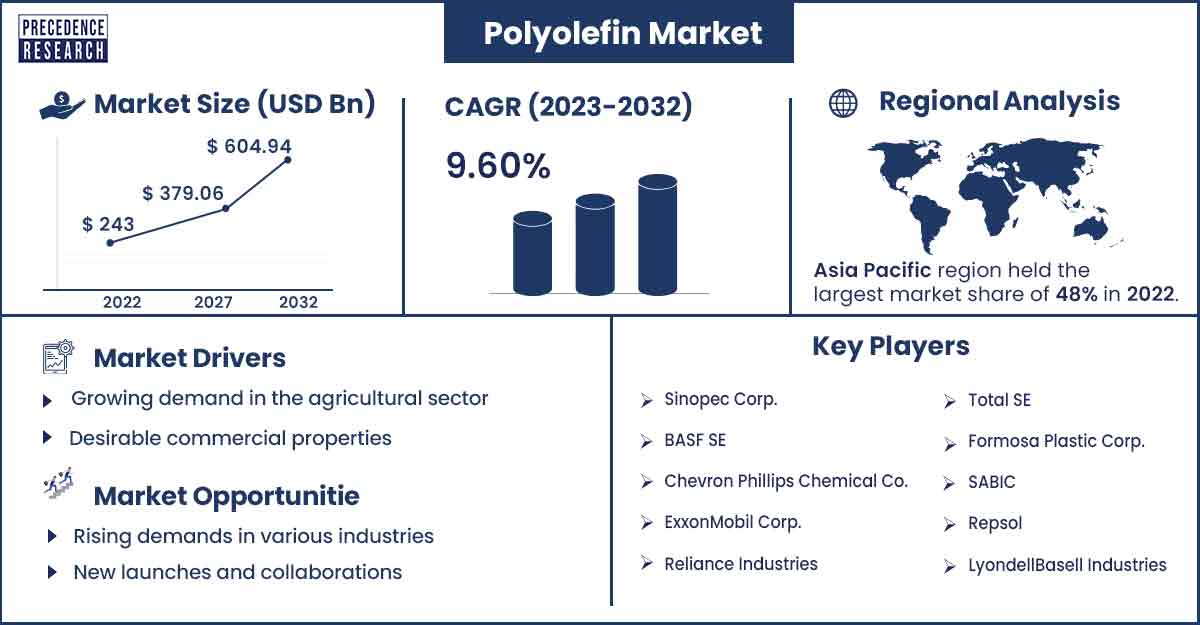

Polyolefin Market Will Grow at CAGR of 9.6% By 2032

The global polyolefin market size was exhibited at USD 243 billion in 2022 and is anticipated to touch around USD 604.94 billion by 2032, expanding at a CAGR of 9.6% from 2023 to 2032.

Market Overview

Polyolefin is any artificial resin created by polymerizing olefins and hydrocarbons with molecules connected by a double bond. Typical examples are derived from natural gas or low-weight petroleum components, ethylene and propylene. Ethylene and propylene are lower olefins with one pair of carbon atoms in their molecules. There are also higher olefins like butene and methyl pentane, which have more than one carbon atom per molecule. These olefins are processed into polymers, with polyethylene and polypropylene being the most significant.

Polyolefin is widely used in textiles, packaging, and consumer goods. The market is experiencing growth due to increasing demand for polyolefin in packaging and solar power applications. Polyolefin is easily transformed into fibrous structures like non-woven, knitted, and yarns, making it a common choice in the textile industry. The global expansion of the textile sector is driving the demand for polyolefin. Furthermore, industry players' ongoing research and development activities may lead to potential polyolefin applications with nanotechnologies across various industries.

The growing demand for polyolefins in automotive, electrical, electronics, and food and beverage industries propels market growth. Polyolefins, known for their high rigidity, excellent moisture, and chemical resistance, are well-suited for industrial applications, especially in packaging automotive and electrical spare parts. In the automotive sector, there is a focus on enhancing vehicle efficiency by reducing weight. Polyolefins are preferred due to their lightweight nature, ease of processing, sealing capabilities, and stiffness properties.

The growing demand for polyolefins in automotive, electrical, electronics, and food and beverage industries propel market growth. Polyolefins, known for their high rigidity, excellent moisture, and chemical resistance, are well-suited for industrial applications, especially in packaging automotive and electrical spare parts. In the automotive sector, there is a focus on enhancing vehicle efficiency by reducing weight. Polyolefins are preferred due to their lightweight nature, ease of processing, sealing capabilities, and stiffness properties. Key players in the polyolefins market employ multiple strategies, including product launches, business expansion, acquisitions, partnerships, collaborations, joint ventures, and agreements to maintain competitiveness.

- In the fiscal year 2022, India had a total polyolefins production capacity exceeding 12 thousand kilotons. Most polyolefins were manufactured by Reliance Industries Limited, constituting nearly 47% of India's overall production capacity.

Regional Snapshot

Asia Pacific is observed to sustain its position in the polyolefin market. The Asia-Pacific construction industry is anticipated to emerge as the world's largest and fastest-growing, contributing 45% to global construction spending. This growth is expected to drive increased demand for films and sheets. The electronic sector, particularly smartphones, OLED TVs, tablets, and other consumer electronics, is experiencing rapid expansion, further fueled by a growing middle class with increased disposable income. This economic trend is poised to elevate the demand for polyolefins in the region, making them a sought-after commodity in the foreseeable future.

- In August 2023, during the Reliance AGM, Mukesh Ambani emphasized the necessity for a digital infrastructure ready for artificial intelligence (AI). He can effectively manage the substantial computational requirements of AI.

China dominates the polyolefins market, driven by a surge in e-commerce and a robust manufacturing sector. China's pivotal role as a major global consumer of polyolefins is evident, fueled by increased demand for plastic packaging in the flourishing courier business. Moreover, the Chinese government's ambitious construction plans, including relocating 250 million people to new megacities, present a substantial opportunity for utilizing construction chemicals to enhance building properties during construction, further contributing to the region's dominance in the polyolefins market.

- In May 2023, China Petroleum & Chemical Corp. (Sinopec) announced their intentions to collaborate with Kazakhstan's state-owned JSC NC KazMunayGas to develop a new polyethene plant in Kazakhstan's Atyrau region.

Polylactic Acid Market Report Scope

| Report Coverage | Details |

| Market Revenue in 2023 | USD 265.11 Billion |

| Projected Forecast Revenue by 2032 | USD 604.94 Billion |

| Growth Rate from 2023 to 2032 | CAGR of 9.6% |

| Largest Market | Asia Pacific |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Growing demand in the agricultural sector

The market is experiencing growth due to increased demand for polyolefin films and sheets, mainly driven by the agricultural sector. Polyolefin films find applications in greenhouses, mulch, silage stretch films, and more. They protect crops from environmental factors and enhance ripening, allowing multiple annual harvests. In the medical field, polyolefin-based films are also utilized. Additionally, polyolefin sheets play a crucial role in construction, acting as vapor retarders beneath slabs. Their durable nature leads to prolonged effectiveness, contributing to rising demand in the construction industry.

Desirable commercial properties

Polyolefins possess versatile properties that make them well-suited for various applications. While having low strength and hardness, they exhibit high flexibility and excellent impact strength, allowing them to stretch. Polyolefins are water-resistant and durable, offering prolonged durability when exposed to the elements compared to other polymers. They serve as effective electric insulators, resistant to electric shocks. The transparency of low-density polyolefins makes them suitable for packaging, while high-density polyolefins like HDPE can be recycled, providing a cost-effective alternative to manufacturing new plastic products. Additionally, their heat-resistant properties enable use in both high and low-temperature environments.

Restraint

Environmental concerns and stringent policies

The increasing global focus on environmental protection and various countries' imposition of plastic bans stem from alarming projections. Researchers estimate that by 2050, oceans might contain more plastics than fish in terms of weight. Polyolefins, such as HDPE, LLDPE, and LDPE, contribute to this environmental concern, being non-biodegradable and persisting in the environment for many years.

The extensive use of plastic bags made from polyolefins poses significant environmental and health hazards. The worldwide production of plastics has led to severe environmental pollution, prompting governments worldwide to take action, including implementing plastic bans. For instance, France passed a 'Plastic Ban' law to reduce plastic bag usage by half by 2025. The growing environmental concerns have led to more stringent regulations, hindering market growth and emphasizing the need to safeguard ecosystems and lives.

Opportunities

Rising demands in various industries

The demand for polyolefins is experiencing a surge across diverse industries, including automotive, electrical and electronics, food and beverage, and consumer goods. Polyolefins, known for their high rigidity, excellent moisture resistance, and chemical durability, are particularly suitable for industrial applications, notably in packaging automotive and electrical components. In the automotive sector, a concerted effort is to enhance vehicle efficiency by reducing weight. Polyolefins are favored for their lightweight nature, ease of processing, sealing capabilities, and stiffness.

In the food and beverage industry, polyethylene consumption is rapidly increasing due to its usage in packaging materials. Furthermore, Polyolefins find growing applications in fashion, sports, and toys thanks to their ability to withstand physical stresses, durability, flexibility in packaging, and ease of molding.

New launches and collaborations

In the polyolefin market, major players implement strategic initiatives like introducing new products, expanding production, mergers, acquisitions, and more. These strategies help them sustain a competitive edge and meet global demand.

- In May 2023, Borealis, a provider of advanced and circular polyolefin solutions, added Stelora to its existing portfolio. This sustainable engineering polymer offers strength, durability, and increased thermal resistance. Such initiatives have the potential to create lucrative opportunities in the future.

Recent Developments

- In August 2023, Borouge PLC, a petrochemical company specializing in polyolefin solutions, and Borealis, a polyolefin manufacturer, introduced two new sustainable polymer products designed for the automotive industry. These products, made from up to 70% recycled materials, mark the first sustainable offerings developed at Borouge's compounding manufacturing plant (CMP) in Shanghai, China. The CMP recently attained ISO 14067 certification for carbon footprint assessment.

- In November 2022, Stavian Quang Yen Petrochemical, Ltd. chose LyondellBasell's polypropylene (PP) technology for a new large-scale production facility. The facility is set to house a 600-kiloton-per-annum PP plant equipped with LyondellBasell's Spheripol technology. This collaboration marks LyondellBasell as the opportunity licensor for the group's inaugural polyolefin facility.

- In February 2023, Borealis announced the launch of a new line of sustainable polyolefins. These polyolefins are made from renewable feedstocks and are designed to help customers reduce their environmental impact.

Major Key Players

- Sinopec Corp.

- BASF SE

- Chevron Phillips Chemical Co.

- ExxonMobil Corp.

- Reliance Industries

- Total SE

- Formosa Plastic Corp.

- SABIC

- Repsol

- LyondellBasell Industries

Market Segmentation

By Type

- Polyethylene

- Polypropylene

- Polyolefin Elastomer

- Ethylene Vinyl Acetate

By Application

- Film & Sheet

- Injection Molding

- Blow Molding

- Profile Extrusion

Buy this Research Report@ https://www.precedenceresearch.com/checkout/1290

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 650 460 3308