Probiotic Ingredients Market Will Grow at CAGR of 12.20% By 2032

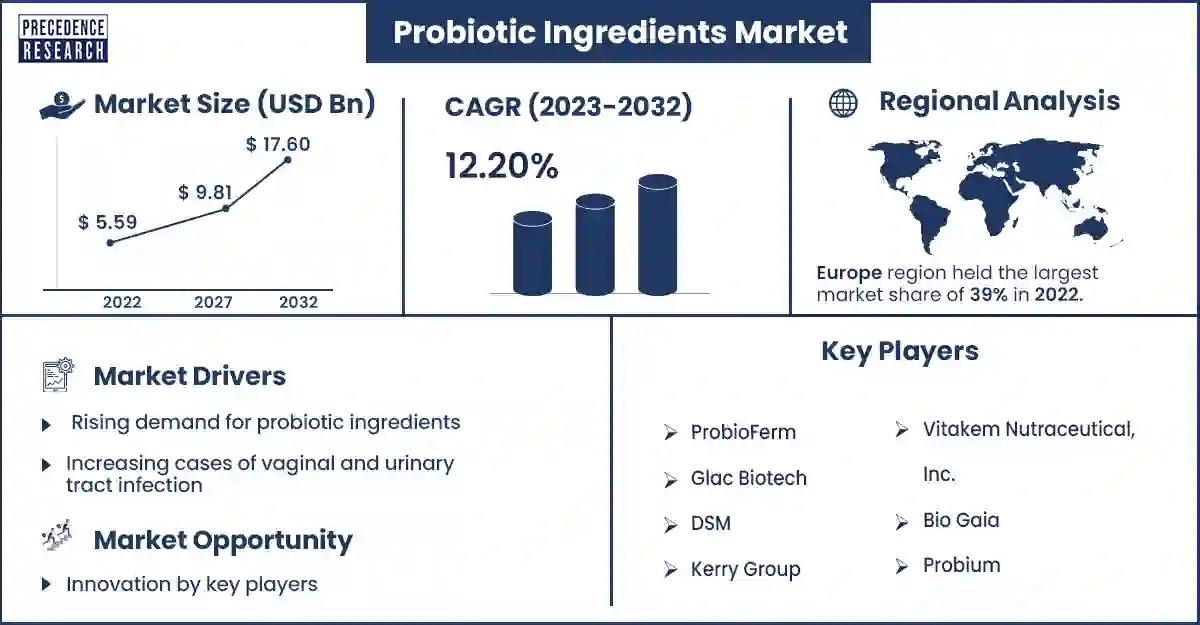

The global probiotic ingredients market size was exhibited at USD 5.59 billion in 2022 and is anticipated to touch around USD 17.60 billion by 2032, expanding at a CAGR of 12.20 % from 2023 to 2032.

Market Overview

Probiotics are the live little microorganisms intended with claims that they come up with health-related benefits when consumed, usually by developing or reestablishing the stomach microbiota. Probiotics are generally considered safe to intake, but sometimes, they may cause unwanted side effects and bacterial interactions in rare cases.

Probiotics are generally used for the prevention of situations such as urinary bladder infections, bacterial vaginal infections, and mouth health problems. In addition, they can be used to cure necrotizing enterocolitis, bowel disorders, and respiratory diseases. The increased awareness among patients worldwide about the intake of healthy and natural products surpassed the drive of the industry's growth in the coming years. Moreover, consumers know the advantages of improved stomach or abdominal health.

Crucial regions of the probiotic ingredients market are in North America and Europe. Some countries, including the U.K., the U.S., Italy, France, and Spain, have been seriously impacted by the COVID-19 pandemic. This has led to an increasing demand for immunity-boosting products and supplements being derived by consumers from different channels such as pharmacies, drug stores, food stores, hypermarkets, and supermarkets. This large stream of requirements for immunity-based products has positively affected the industry's progress. Topmost probiotic manufacturers such as Chr. Hansen (Denmark), Lallemand (U.S.), Kerry Group (Republic of Ireland), and DuPont (U.S.) have together accounted for more than one-third of the market share.

Regional Snapshots

The European region has the highest probiotic ingredients market share in 2023. Some essential factors were driven by market shares, including high demand for dairy products and functional foods, major key players in these regions, and awareness about the advantages of using probiotics.

The Asia Pacific region is estimated to grow fastest in the forecast period. This region is considered to have the highest share of the probiotic ingredients market in 2023. These are the substantial opportunities to meet increasing customer demand for fortified food and beverage products, contributed by Catarina Rodrigues, senior marketing manager of women and infant health, who presented their insights on microbiome at Fi Asia Bangkok 2023.

The North American region also impacts the growth of the probiotic ingredients market. Adopting many energy efficiency laws and regulations in North America also meets the demand for probiotic ingredients in the animal feed and agriculture industries. Probiotic components persistently work in fuel market extension and animal nutrition to encourage stomach or abdomen health and increase animal performance.

Probiotic Ingredients Market Report Scope

| Report Coverage | Details |

| Market Revenue in 2023 | USD 6.24 Billion |

| Projected Forecast Revenue by 2032 | USD 17.6 Billion |

| Growth Rate from 2023 to 2032 | CAGR of 12.20% |

| Largest Market | Europe |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Rising demand for probiotic ingredients

Probiotics are highly effective in healing diseases within the least possible period, but their side effects are common and transparent. Due to increasing consumer awareness, researching antiinfection agents using probiotics has become important over the years. Intake of a probiotic diet after medicine results in the extension of valuable microbes, which are similar to nourish immunity and protect the body from further illness during recovery.

Increasing cases of vaginal and urinary tract infection

The probiotic ingredients market is predicted to improve from growing cases of vaginal and Urinary portion infections. These infections are responsible for millions of doctor visits yearly. It is making them the most common bacterial infections. Probiotic ingredients-based additives offer a modern-day solution to these analytical problems encountered by the female groups. Due to the lack of awareness in education of vaginal issues, so many females are facing vaginal infection. That's why probiotic ingredients target females.

Restraint

Lack of knowledge about probiotics

The significant challenges and restraints in the probiotic ingredients market are the need for more awareness among consumers about the benefits of probiotics and the high cost of probiotic supplements. Probiotics are live microorganisms like the beneficial bacteria in the human stomach or bacteria. They offer several health benefits, including improving gut health, boosting immunity, and reducing the risk of allergies and infections. However, many consumers need to be aware of these benefits and are unwilling to purchase probiotic supplements. Moreover, probiotic ingredients are often more costly than other dietary supplements, which can discourage consumers from buying them.

Opportunity

Innovation by key players

Probiotic ingredients are generally considered the most creative in probiotic ingredients market positioning, packaging, delivery forms, and formulation. Frequency creation in high investment and product offerings factories in illuminative advertisements related to the consumption of probiotics ingredients is expected to balance consumers' interest in probiotics supplements in upcoming years. This element is expected to balance the demand for probiotic ingredients.

- For instance, in April 2022, Pantheyx, an immune and digestive support supplements company specializing in colostrum, extended its potentiality to launch probiotic-colostrum combo supplements for kids' and adults' dietary ingredients. The new formulation contains strains, such as Bifidobacterium animalist BB-12, Lactobacillus rhamnoses LGG+, Lactobacillus plantarum HEAL9, Lactobacillus paracasei 8700:2, and B. subtilis DE111. The company offers dietary ingredient manufacturers the capacity to create new digestive and immune health duo products through this creative combo. Such creations are expected to create opportunities for market growth.

Recent Developments

- In February 2024, New Delhi discussed unsupervised consumption and expensive pricing of probiotics supplements for special medical purposes/food for particular dietary use; the health ministry plans to bring them under the Central Drugs Standard Control Organization (CDSCO), highly placed sources told TNIE. These things currently come under the purview of the Foods Safety and Standards Authority of India (FSSAI). As per sources, the Ministry has also proposed forming a committee chaired by the Secretary of Health to locate overlapping concerns between Probiotics and Drugs.

- In August 2023- Probiotics, a global leader in precision probiotics ingredients, introduced PRO-IBS Support, an advanced, dual-action synergistic blend of Lactiplantarum plantarum 299v and the highly bioavailable Boswellia serrata extract.

- In March 2024, The Kerry Group announced the launch of its first postbiotic ingredient, Plenibiotic. They offer dual advantages for stomach and skin health to customers looking to handle healthy aging holistically.

- In December 2023, Cometic Design successfully developed a hydrolyzed collagen serum derived from fish skin by-products in the USA.

Key Market Players

- ProbioFerm

- Glac Biotech

- DSM

- Vitakem Nutraceutical, Inc.

- Bio Gaia

- Probium

- Kerry Group

Segments Covered in the Report

By Type

- Bifidobacterium animalis

- Bifidobacterium breve

- Bifidobacterium longum

- Lactobacillus Reuteri

By Application

- Food and Beverages

- Dairy Products

- Yogurt

- Cheese

- Other

- Non-dairy Products

- Vegetable-based probiotic products

- Fruit-based probiotic products

- Meat-based probiotic products

- Dairy Products

- Dietary Supplements

- Tablets

- Probiotic Drinks

- Powders

- Capsules

- Powder

- Granule

- Animal Feed

By Components

- Bacterica

- Yeast

By Form

- Dry Form

- Liquid Form

By End User

- Human Probiotic

- Animal Probiotic

Buy this Research Report@ https://www.precedenceresearch.com/checkout/1826

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 650 460 3308