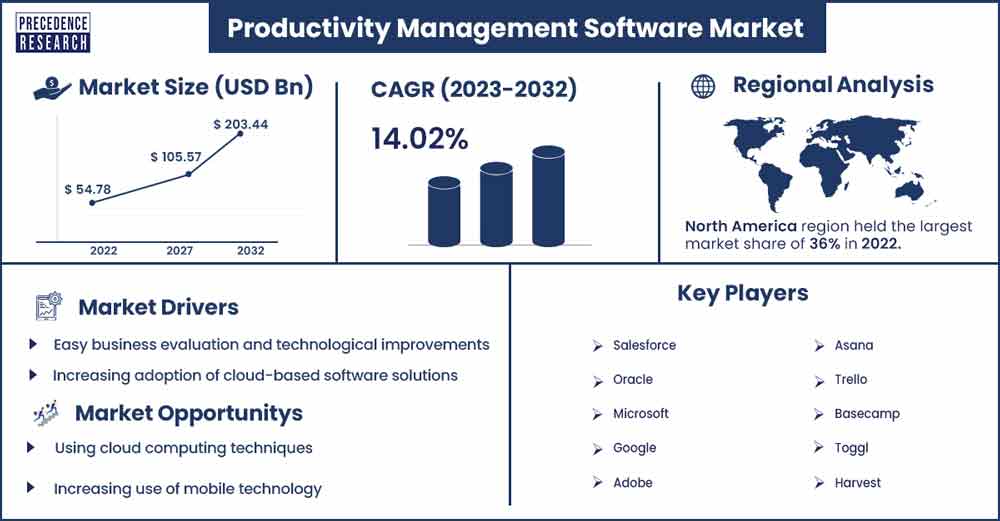

Productivity Management Software Market Will Grow at CAGR of 14.02% By 2032

The global productivity management software market size is anticipated to reach around USD 203.44 billion by 2032 up from USD 54.78 billion in 2022 with a CAGR of 14.02% between 2023 and 2032.

Software for productivity management is a program that generates statistics. Users can use it to make slideshows, spreadsheets, graphs, worksheets, and papers. These efficiency tools are typically employed in commercial settings. Productivity management software encompasses all teamwork and communication-related applications that assist users in performing their tasks.

Word processors, database management systems (DBMS), graphics programs, and spreadsheet programs are a few instances of workplace productivity tools. Workforce productivity is the measurement of an employee's or a collection of employees' effort or success, and production management software improves productivity by assisting employees.

The availability of efficiency management software is greatly facilitating the launch of these devices, which include cell phones, laptops, and other digital devices. The demand for production management software is increasing as a result of developments in machine learning and artificial intelligence.

One of the main factors behind using personal computers is the application of productivity management software. Users become efficient and effective in their everyday job thanks to the productivity management software. The need to acquire this software for work is growing. This software helps handle the workflow and duties in the business to enhance a company's development.

Report Highlights

- Over the course of the projection period, the AI and predictive analytics sector is expected to expand at the quickest rate. The expansion can be ascribed to the increased use of various risk analytics tools for risk detection and risk reduction strategies.

- From 2022 to 2030, it is predicted that the cloud sector will expand at the fastest rate. The pay-as-you-go approach offered by the cloud enables companies to pay for cloud services according to their usage, resulting in reduced costs.

- By 2030, the market in Asia Pacific is anticipated to account for the lion's share of revenue with a value of USD 35.96 billion. The growing sector segments such as healthcare, IT and telecom, BFSI, and others are anticipated to support regional development. The expansion of the market over the anticipated time will also be aided by the rising number of small and midsize businesses in the area.

Regional Snapshots

The market for corporate efficiency software is anticipated to be dominated by North America. Early adoption of technical developments has been a key factor in this market's success. Due to a number of variables, including the existence of numerous businesses with cutting-edge IT infrastructure and the accessibility of technological knowledge, North America is the most developed market in terms of the adoption of cloud computing services as well as AI and IoT.

Due to the presence of the main productivity software providers in this area, such as Amazon Web Services Inc. (US), Microsoft (Office 365), Google, etc., there is fierce rivalry. Furthermore, thanks to its solid financial standing, North America can make significant investments in cutting-edge products and innovations. These benefits have given local businesses a competitive boost in the market.

The increased use of cloud-based technology is expected to drive growth in the market for efficiency management software. Cloud-based technology provides access to stored data via linked devices. Cloud-based technology helps with efficiency management by reducing employee delay and boosting output.

Productivity Management Software Market Report Scope

| Report Coverage | Details |

| Market Revenue in 2023 | USD 62.46 Billion |

| Projected Forecast Revenue by 2032 | USD 203.44 Billion |

| Growth Rate from 2023 to 2032 | CAGR of 14.02% |

| Largest Market | North America |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

The main factors driving the market development are the rising need for businesses to handle workflow and duties to support growth and the quickly expanding advancements in the fields of artificial intelligence (AI) and machine learning (ML). The demand for productivity management software will also increase due to the rising usage of cloud computing in business operations, Bring Your Own Device (BYOD), workplace mobility, and smartphones to extend the mobile workforce. Business efficiency is an organization's capacity to effectively implement its general plan. Moreover, the productivity of a company is closely linked to the productivity of its employees. Data and procedures are facilitated and integrated for every part of the company by the productivity management software. Additionally, it is essential for facilitating cooperation with workers, consumers, customers, sellers, and partners.

Additionally, growing Internet and Smart Device Use is Extremely Boosting Market Development. Today's workplace routinely involves arranging meetings, and the development of mobile technology has decreased the complexity and length of meetings. Mobile technology advancements have increased the use of business efficiency apps.

As a result, a number of vendors of business productivity software have created programs that enable users to arrange and plan meetings on mobile devices like cellphones and iPads. As a result, the market for business efficiency software has tangentially benefited from the rise in smartphone usage.

Additionally, as IT becomes more consumer-oriented, mobile devices like cellphones, tablets, computers, and notebooks are now frequently used in businesses for communication. In order to enhance user experience, efficiency, and security, business productivity software vendors have been compelled by the BYOD (Bring Your Own Device) idea to create cutting-edge business productivity solutions.

Restraints

An issue with managing efficiency tools is human error. Accurate program handling is necessary for system administration. This program cannot be used by all companies. The development of efficiency management software systems is significantly threatened by the need for more qualified workers who can use this platform. The managers must research the uses of this software and comprehend how it operates before they can work on these systems. A sum of money is needed to pay for this system and implement, administer, and configure it.

Opportunities

Factors such as higher technical advancements are also pushing the industry. For instance, the increasing use of mobile technology and the quick uptake of "bring your own device" (BYOD) are augmenting market development and will do so in the years to come. For instance, the use of mobile devices like cellphones, laptops, iPads, and computing devices for communication has become widespread in businesses as IT becomes more consumer-oriented.

The growing amount of staff data has also resulted in a substantial demand for productivity solutions. Additionally, market development is anticipated to be supported in the upcoming years by the increasing penetration of cutting-edge technologies like artificial intelligence and machine learning, creating a plethora of possibilities for the sector.

Challenge

The expensive expense of the productivity Tools Software's deployment is a significant barrier to market expansion. The absence of job engagement cost businesses an estimated USD 7 trillion in lost productivity in 2017 around the globe. Productivity management software depends on the power of technology to speed up processes and reduce the tedious activities of the workers and inspire productivity.

Recent Developments

- Slack Technologies, Inc. and Amazon Web Services will enter a strategic collaboration in June 2020 to develop robust interfaces between Amazon AppFlow and AWS Chatbot. To improve team collaboration, AWS will adopt Slack across the entire company.

- To rethink the modern, flexible workplace, Microsoft worked with the software firm Citrix Systems, Inc. on July 2020. The firms' joint goal was to assist businesses in hastening their migration to the cloud and their usage of virtual desktops and digital workplaces.

- In July 2019, Red Hat declared that the historic purchase by IBM had been completed. In a nutshell, IBM will pay $190,00 per share in cash to purchase all of Red Hat's issued and outstanding common shares, which would equal a $34 billion total company value. Keeping Red Hat unbiased and independent allows IBM to aspire to a top-tier mixed cloud service position.

Major Key Players

- Salesforce

- Oracle

- Microsoft

- Adobe

- Asana

- Trello

- Basecamp

- Toggl

- Harvest

- Evernote

- IBM

- OneNote

- Slack

- Microsoft Teams

- Monday.com

- Podio

- ClickUp

- Wrike

- Zoho Projects

- Smartshee

Market Segmentation

By Solution

- Content Management & Collaboration

- AI & Predictive Analytics

- Structured Work Management

- Other Solutions

By Deployment

- On-Premise

- Cloud

By Enterprise Size

- Large Enterprises

- Small & Mid-Size Enterprises

Buy this Research Report@ https://www.precedenceresearch.com/checkout/2826

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 9197 992 333