Protein Ingredients Market Revenue to Attain USD 138 Bn by 2033

Protein Ingredients Market Revenue and Trends 2025 to 2033

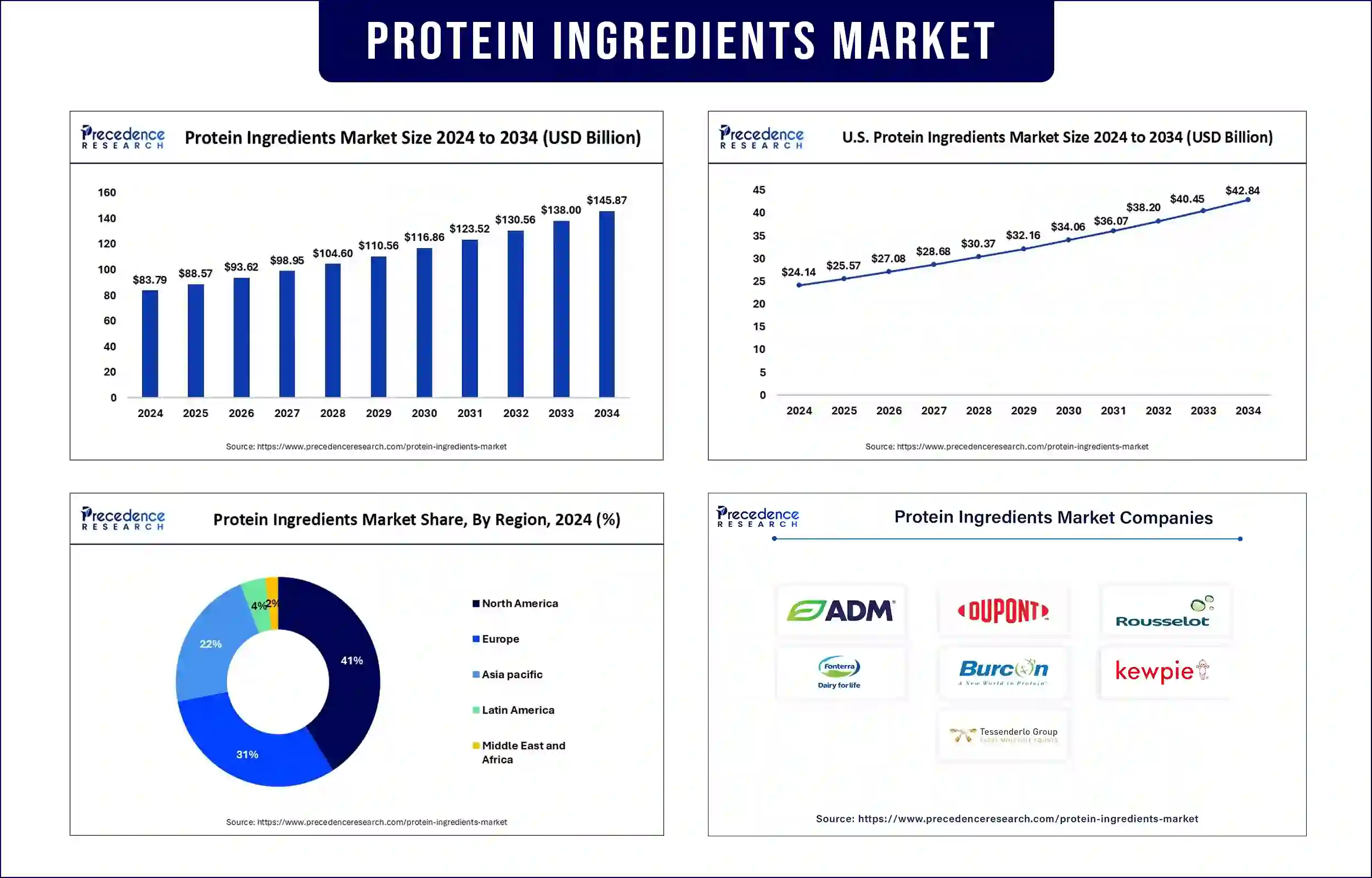

The global protein ingredients market revenue reached USD 88.57 billion in 2025 and is predicted to attain around USD 138 billion by 2033 with a CAGR of 5.7%. The demand for protein ingredients is increasing due to growing consumer awareness regarding nutritious food products.

Market Overview

Proteins are the major constituent of skin, bones, blood, and muscles. Protein is required by the human body to create enzymes, hormones, and other bodily substances. Due to surging public awareness of concerns about obesity and other healthcare issues, protein supplements are currently in high use. Hence, consumers are seeking nutritious food options made with both plant and animal protein. Major players in the protein ingredients market are increasingly investing in research & development, impacting positive market growth.

Report Highlights

- By product, the animal proteins segment dominated the protein ingredients market in 2024. The dominance of the segment can be attributed to the surge in fitness and health consciousness across the globe. The plant protein segment is expected to grow at the fastest rate over the forecast period. The growth of the segment can be credited to the increasing adoption of plant protein by the majority of consumers.

- By application, the food and beverages segment led the market in 2024. The dominance of the segment can be linked to the rising demand for nutritional and functional food by consumers. The infant formulations segment is anticipated to grow at the fastest rate during the projected period. The growth of the segment can be driven by the large availability of ready-to-eat liquid food products in the market.

Market Trends

Increasing Demand for Proteins as Dietary Elements

Growing concerns regarding obesity and raised health awareness among consumers are facilitated by a surge in the utilization of protein supplements globally. Plant-based protein and animal sources have several benefits, such as the capability to keep an individual feeling energized for longer periods, which decreases the need for unhealthy cravings.

Growing Demand for Convenience Food Products

The increasing need for convenience food products that contain added nutrients is the major driver for the protein ingredients market. Convenience food is pre-prepared and pre-packaged meals designed for easy and quick consumption, which requires no preparation and minimal time. Furthermore, the prevalence of convenience food is increasing due to raised disposable incomes and busy lifestyles.

Product Innovation

The introduction of organic and lactose-free proteins is expected to increase demand among health-aware populations, creating new avenues for market expansion. Moreover, market players in animal ingredients are working extensively on R&D projects to enhance protein components' scent, flavor, and performance. This can give producers crucial chances to provide a wider choice of protein components.

Regional Insight

North America dominated the protein ingredients market in 2024. The dominance of the region can be attributed to the increasing trend of consuming nutritious and hea; thy food products among the consumers in the country. Moreover, the fitness sector is expected to expand rapidly in countries like the U.S. and Canada and shows no signs of slowing down over the foreseeable future.

- In March 2025, Vivici launched Vivitein BLG in the U.S. market. The flagship ingredient under its Vivitein protein platform, Vivitein BLG, is available now, enabling B2B customers to launch disruptive and differentiated products to consumers in the U.S. market. Vivitein BLG is a dairy protein (beta-lactoglobulin) that is produced through precision fermentation, with no animals involved in the production process.

Asia Pacific is expected to grow at the fastest rate in the protein ingredients market over the projected period. The growth of the region can be credited to the increase in demand for plant and animal protein ingredients. Furthermore, the expansion of the food and beverage sector, coupled with the rapid economic development in developing countries such as China and India, can soon drive regional growth.

Protein Ingredients Market Coverage

| Report Attribute | Key Statistics |

| Market Revenue in 2025 | USD 88.57 Billion |

| Market Revenue by 2033 | USD 138 Billion |

| CAGR | 5.7% |

| Quantitative Units | Revenue in USD million/billion, Volume in units |

| Largest Market | North America |

| Base Year | 2024 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market News

- In April 2023, at the Vitafoods event, Rousselot, a health brand under Darling Ingredients, showcased its collagen peptides solution PEPTAN®, emphasizing its holistic well-being benefits. This premium protein-based ingredient is supported by scientific research and boasts versatile formulation properties.

- In June 2023, Roquette unveiled its new food innovation center in Lestrem, France, featuring a sensory analysis laboratory, a demonstration kitchen, and collaborative labs for pilot-scale testing of various plant-based ingredients.

- In February 2023, Roquette embarked on a collaborative project with Eurial, Agri Obtentions, Greencell, Université Lumière Lyon 2, and INRAE to develop AlinOVeg, focusing on French plant-based protein extraction and product development.

Protein Ingredients Market Key Players

- Archer Daniels Midland Company

- DuPont

- Rousselot

- Fonterra

- BurconNutraScience

- Kewpie Corporation

- Tessenderlo Group

- Roquette Freres

- The Scoular Company

- CHS Inc.

Market Segmantation

By Product

- Plant Proteins

- Cereal-based

- Legumes-based

- Root-based

- Nuts & Seeds-based

- Ancient Grains

- Animal/Dairy Proteins

- Egg Protein

- Milk Protein Concentrates/Isolates

- Whey Protein Concentrates

- Whey Protein Hydrolysates

- Whey Protein Isolates

- Gelatin

- Casein/Caseinates

- Collagen Peptides

- Microbe Proteins

- Algae

- Bacteria

- Yeast

- Fungi

- Insect Proteins

- Coleoptera

- Lepidoptera

- Hymenoptera

- Orthoptera

- Hemiptera

- Diptera

- Others

By Application

- Food & Beverages

- Bakery & Confectionery

- Beverages

- Dairy Alternatives

- Breakfast Cereals

- Dietary Supplements/Weight Management

- Sports Nutrition

- Meat Alternatives & Extenders

- Snacks

- Others

- Infant Formulations

- Clinical Nutrition

- Animal Feed

- Others

By Form

- Isolates

- Concentrates

- Hydrolyzed

Get this report to explore global market size, share, CAGR, and trends, featuring detailed segmental analysis and an insightful competitive landscape

overview @ https://www.precedenceresearch.com/sample/1685

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com| +1 804 441 9344