Recombinant Proteins Market Will Grow at CAGR of 12.4% By 2032

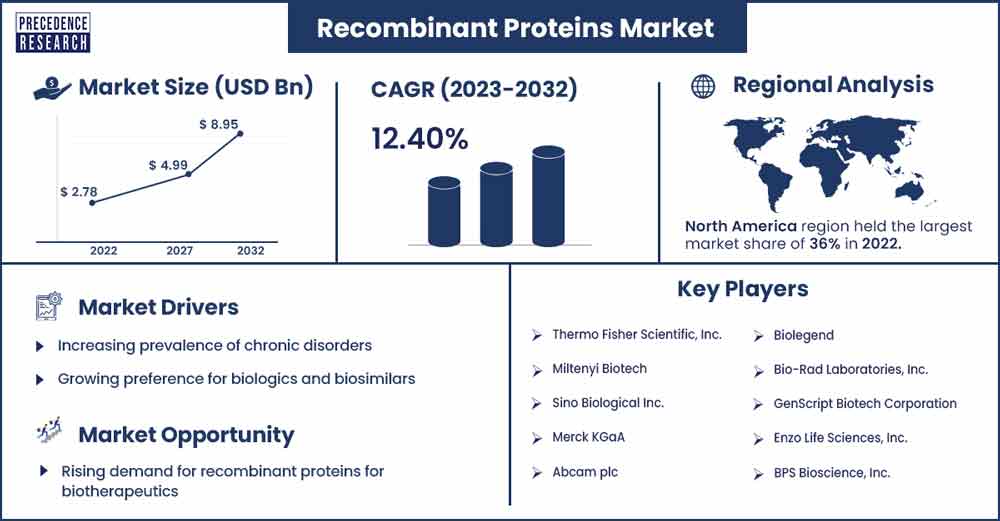

The global recombinant proteins market size is anticipated to reach around USD 8.95 billion by 2032 up from USD 2.78 billion in 2022 with a CAGR of 12.4% between 2023 and 2032.

The prevalence of various diseases like multiple sclerosis, thrombocytopenia, anaemia, asthma, and dwarfism is on the rise, which has led to a significant increase in the demand for recombinant protein drugs and related treatment methods like cancer therapy, recombinant protein western blot, mammalian cell culture, recombinant DNA, and animal cells in culture. Furthermore, the increasing research and development activities are also likely to support the growth of the recombinant proteins market within the estimated timeframe.

Market Overview

The market is growing as a result of a number of factors, including rising R&D expenditures, an ageing population, an increase in the prevalence of chronic diseases, a growing preference for biologics and biosimilars, and the launch of sophisticated recombinant products. According to American Cancer Society projections for 2022, there would be roughly 1,918,030 new cases of cancer in the country. Recombinant proteins are frequently used in therapeutics and the development of cancer therapies, so an increase in cancer cases is anticipated to drive demand for recombinant proteins and thereby contribute to the growth of the market. Given the high burden of cancer, there is a need for advanced therapeutics.

Furthermore, the market growth is also owing to the growing propensity for the development of novel therapeutic recombinant proteins. According to a report from the National Institutes of Health (NIH) in May 2022, the NIH's funding for autoimmune disease research and development was USD 1,021 million in 2021 and is projected to rise to USD 1,061 million in 2022. This surge in investment is fueling the market's expansion and advancing the development of medications based on recombinant proteins. For instance, Aviva Systems Biology introduced its new protein-on-demand, semi-custom recombinant protein portfolio in September 2021 to meet the demands of life scientists working on fundamental research and preclinical investigations.

Regional Insights

North America registered the largest revenue share in 2022. The presence of well-established healthcare infrastructure, major market players, and increased spending on research and development are contributing to the growth of the recombinant protein market in the region. With the rise in chronic diseases across the region, there is a growing demand for recombinant protein therapies as they are proven solutions for such diseases.

Additionally, the market is being propelled by the development of innovative research aimed at treating neurodegenerative diseases like Alzheimer's and dementia. The research community is focusing on amyloid protein as a potential target for treating Alzheimer's, which is expected to increase the demand for amyloid-based therapies. Furthermore, the increased government initiatives are also anticipated to augment the growth of the market within the estimated timeframe.

Asia Pacific is expected to register a rapid CAGR during the forecast period. The growing transportation sector due to the increase in healthcare expenditure and rising income levels of the consumers is likely to fuel the demand for recombinant proteins in the region in the near future. Furthermore, the increasing investments in the biotechnology industry along with growing awareness about it in the region are also likely to support the growth of the recombinant proteins market in the years to come. Additionally, the surge in demand for recombinant protein-based medicines is also expected to contribute to the regional growth of the market in the near future.

Recombinant Proteins Market Report Scope

| Report Coverage | Details |

| Market Revenue in 2023 | USD 3.12 Billion |

| Projected Forecast Revenue by 2032 | USD 8.95 Billion |

| Growth Rate from 2023 to 2032 | CAGR of 12.4% |

| Largest Market | North America |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Report Highlights

- By Product, the cytokines & growth factors segment held the largest share in the global recombinant proteins market. This is owing to the increasing research studies towards the development of cytokines. Additionally, cytokines demand is also increasing due to the increasing clinical trials in the field of biopharmaceuticals.

- By Application, the drug discovery & development segment held the largest share in the global recombinant proteins market. This is attributable to the increasing regulatory approvals of cell and gene therapies. Furthermore, rising investment from major market players is also expected to support the segmental growth of the market in the near future.

- By End-User, the pharmaceutical & biotechnology companies held the largest share in the global recombinant proteins market. This is due to the increasing investments in the R&D activities by the bio-manufacturers.

Market Dynamics

Drivers

Rising government initiatives & funding

The increasing initiatives & funding by the government are anticipated to augment the growth of the recombinant proteins market during the forecast period. For instance, in July 2020, Sanofi and GSK with the U.S. government announced a collaborative effort to speed up the manufacturing and development of a COVID-19 recombinant protein-based vaccine. For the development including manufacturing, clinical trials, scale-up and delivery of the first 100 million doses, the U.S. government provided a funding of around US $2.1 billion.

Also, in August 2020, Novavax, Inc. announced a partnership with Takeda Pharmaceutical Company Limited for the manufacturing, development, and commercialization of NVX‑CoV2373. To support the establishment of infrastructure and scale-up of manufacturing Takeda received funding from the Government of Japan’s Ministry of Health, Labour and Welfare (MHLW). Consequently, this is likely to support the growth of the market within the estimated timeframe.

Restraint

Loss of expression due to structural changes

Effective gene expression is essential for sufficient recombinant protein output in custom gene synthesis. However, structural modifications to host or recombinant genes might result in the loss of expression. Plasmids are frequently employed in antibody sequencing services as molecular carriers for recombinant genes since they are simple to work with and enable standard genetic plasmid expressions.

The plasmid copy number, which is often larger when recombinant genes are integrated into the host chromosome, determines the gene dose. Plasmid copy number is controlled by copy-number genes and is influenced by host, plasmid, and culture conditions. Plasmids can have anywhere from a few to 200 copies, but they can put a strain on the host's metabolism by consuming its resources to reproduce and express the genes they carry, which slows the rate at which plasmid-bearing cells grow.

The rise in temperature, the size of the insert, the amount of expression, the production of recombinant proteins, and the level of protein toxicity towards the host are all closely correlated with this increase in metabolic load. As a result, the growth rate decreases, and plasmid-free cells may overtake the culture and this is further likely to restrain the growth of the market during the forecast period.

Opportunities

Increasing technologies and innovations

The progress made in the molecular and cellular technologies, along with the advent of gene editing techniques like CRISPR-Cas9, has led to significant accomplishments in the vector engineering. This has resulted in improved yield and quality as well as accelerated the processing time for recombinant protein drugs, emphasizing their crucial role in biopharmaceutical production.

With these advances, there is a growing demand for advanced purification processes that range from single-column chromatography to modern online multidimensional chromatographic systems combined with MCSGP technology. These purification processes are all aimed at enhancing the efficiency and purity levels in the manufacturing of these essential medicines. These technological advancements are likely to create immense opportunities for the growth of the recombinant proteins market in the years to come.

Challenges

Post translational processing challenges in recombinant protein production

Two essential molecules, chaperones and foldases, play a key role in the folding of proteins. While foldases hasten protein folding, chaperones stop the production of non-native, insoluble folding intermediates. The formation of misfolded proteins in intracellular aggregates known as inclusion bodies occurs when the folding process does not always go as planned. Protein folding that is incorrectly regulated is largely due to cell stress, which is triggered by events like food deprivation and heat shock. Cells express more chaperones, including several from the hsp70 and hsp100 families, in response to stress.

A metabolic burden and an energy drain is the synthesis of inactive proteins. Furthermore, the buildup of inclusion bodies may cause structural stresses in cells, and improper folding may have adverse consequences. Additionally, in solid phase peptide synthesis, signal peptides are necessary to direct proteins to specific cell compartments. If these peptides are not removed properly, proteins may end up being retained and aggregating in the wrong compartments, like the endoplasmic reticulum, which will significantly lower the yields of proteins that are released. These factors are likely to limit the growth of the market in the years to come.

Recent Developments

- In September 2021, Repligen Corporation announced the development and validation of a novel protein A ligand along with Navigo Proteins GmbH. The protein helps overcome the challenges linked with the purification of Fc-fusion proteins and pH sensitive antibodies.

- In July 2021, Eli Lilly and Company declared the acquisition of Protomer Technologies. The acquisition was done in order to enhance Lilly’s diabetes pipeline with the innovative technology offered by Protomer Technologies.

Key Market Players

- Thermo Fisher Scientific, Inc.

- Miltenyi Biotech

- Sino Biological Inc.

- Merck KGaA

- Abcam plc

- Biolegend

- Bio-Rad Laboratories, Inc.

- GenScript Biotech Corporation

- Enzo Life Sciences, Inc.

- BPS Bioscience, Inc.

Segments Covered in the Report

By Product

- Cytokines & Growth Factors

- Antibodies

- Immune Checkpoint Proteins

- Virus Antigens

- Enzymes

- Recombinant Regulatory Protein

- Hormones

- Others

By Application

- Drug Discovery & Development

- Biologics

- Vaccines

- Cell & Gene Therapy

- Biopharmaceutical Production

- Biotechnology Research

- Academic Research Studies

- Others

By End-User

- Pharmaceutical & Biotechnology Companies

- Academic Research Institutes

- Contract Research Organizations

- Others

Buy this Research Report@ https://www.precedenceresearch.com/checkout/2840

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 9197 992 333