Semi-Trailer Market Revenue to Attain USD 52.15 Bn by 2033

Semi-Trailer Market Revenue and Trends 2025 to 2033

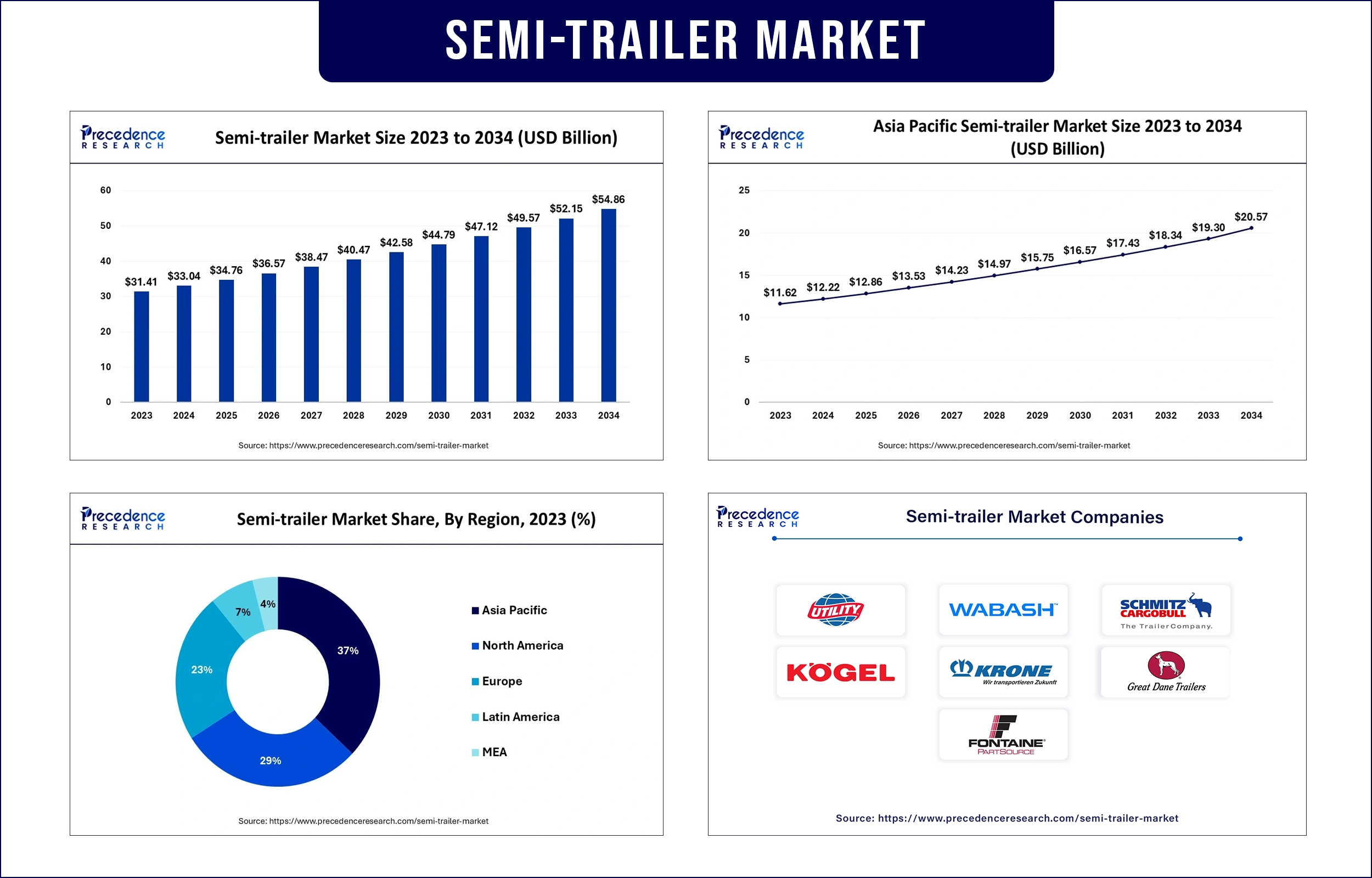

The global semi-trailer market revenue surpassed USD 34.76 billion in 2025 and is predicted to attain around USD 52.15 billion by 2033, growing at a CAGR of 5.20%. The market is propelled by the expanding e-commerce sector, greater industrial production levels, and specific transportation requirements for numerous industries.

Market Overview

Non-motorized semi-trailers function as towed vehicles for tractor units to carry freight throughout different industrial sectors. The market contains various types of vehicles which respond to different operational requirements, such as dry vans, reefers, flatbeds, tankers, lowboys, along with automobile carriers and livestock trailers. The continuous growth of manufacturing operations, combined with rising international business activities, creates demand for semi-trailers.

Dry van containers function as the main transportation method for goods because e-commerce has created new requirements for efficient delivery solutions. The expansion of the market will be facilitated by an increasing demand from the cold chain industry for temperature-sensitive transportation services that handle perishable food, pharmaceuticals, and chemicals. The semi-trailer market will experience sustained growth due to developments in trailer engineering and growing investments in infrastructure.

Report Highlights

- By type, the dry van segment held a significant share in 2024. The dry van transport need is mainly limited protection of goods that experience regular road conditions and weather conditions. The flatbed segment is anticipated to record the highest CAGR during the forecast period. Flatbed trailers are used for moving large freight items that consist of machines, building supplies, and industrial tools.

- By tonnage, the below 25T segment held a significant share in 2024. Trucks equipped with below 25-tonne semi-trailers are popular because they provide economical shipping rates and handle large volumes of shipments effectively. The 25 - 50T is growing notably, as it is primarily utilized in flat-bed and low-boy trailers.

- By axles, the 3 to 4 axles segment held a significant share in 2024. The capacity of these trailers extends over diverse distances, which especially satisfies needs across manufacturing, agriculture, and construction sectors.

- By end-use, the FMCG segment dominated the largest market share in 2024. Multiple factors consisting including increasing population, rising incomes, favorable government policies, brand consciousness, and purchasing process digitalization drive the expansion of the FMCG industry.

Market Trends

Demand in the FMCG Industry

The FMCG industry drives the semi-trailer market through high demand for perishable goods such as meat, dairy, and baked products. A secure transport system for perishable goods requires the market to develop advanced and efficient temperature-controlled semi-trailers.

Growing Use of Multimodal Transportation

The growing market stems from customers who integrate multiple transportation systems by uniting trucks with trains and ships. The combined transportation approach utilizes economical distant rail and marine routes to achieve waste reduction and quick delivery times that semitrailers finalize during last-mile delivery.

Expansion of E-Commerce Distribution Networks

The expanding e-commerce industry causes significant changes in the market for semi-trailers. The rising global e-commerce sector drives market demand for progressive semi-trailer systems, which enable fast delivery speed.

Regional Outlooks

The North American semi-trailer market accounted for the largest share in 2024. The transportation and logistics systems across North America, especially in the U.S. and Canada, maintain operational capacity, which allows for market development. The growth of market demand for effective transportation systems has created a need for advanced semi-trailers to address these requirements.

Since the U.S. transportation infrastructure operates at complex levels, manufacturers design advanced trailers to achieve better safety and operational efficiency. The market demand for durable semi-trailers with efficiency and versatility keeps increasing due to the expanding e-commerce sector and requirements from last-mile logistics. Customer demand within the North American market remains strong because companies invest in developing automatic systems alongside safety technology capabilities.

Asia Pacific is anticipated to emerge as the fastest-growing semi-trailer market. The countries are rapidly developing their supply chains and logistics systems to become major forces in the regional industry. The surge in Asia Pacific e-commerce drives companies to seek efficient transport options for dry vans and other trailer types to fulfill their rapidly expanding consumer market needs.

The development of major infrastructure projects across China, India, Japan, and South Korea pushes up the necessity for powerful trailers to transport building materials and machinery. The Asia Pacific semi-trailer market demonstrates rapid expansion because companies are implementing energy-efficient, lightweight, sustainable transportation solutions, which require trailers for electric and hydrogen-powered trucks.

Semi-Trailer Market Coverage

| Report Attribute | Key Statistics |

| Market Revenue in 2025 | USD 34.76 Billion |

| Market Revenue by 2033 | USD 52.15 Billion |

| CAGR | 5.20% |

| Quantitative Units | Revenue in USD million/billion, Volume in units |

| Largest Market | North America |

| Base Year | 2024 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market News

- In September 2023, Carrier Transicold unveiled its Vector 8400R refrigeration unit to meet cooling and freezing requirements. The compact, portable design of this device and its sleek dimensions offer numerous functional options to maintain proper temperatures during the transport of perishable commodities across several applications.

- In March 2023, Eurocold launched Revora as a new company built to develop and produce totally electric refrigerated trucks from its manufacturing facility in Australia. The Brisbane-based organization maintains sustainability through electric refrigeration technology development for commercial vehicles operating within the Australian market.

- In February 2023, Great Dane LLC released the availability of its products, such as FleetPulse intelligent trailer upgrades and trailer electrification with SAF-Holland. The ABS fault code alerts, along with hub rotation miles, integrate into FleetPulse as an upgrade tool to enable fleets to enhance safety results as well as operational effectiveness.

Semi-trailer Market Key Players

- Utility Trailer

- Wabash

- Schmitz Cargobull

- Kogel Trailer GmbH & Co.KG

- Krone Commercial Vehicle Group

- Great Dane Trailers

- Fahrzeugwerk Bernard Krone

- Fontaine Commercial Trailer, Inc

- Lamberet SAS

- China International Marine Containers (Group) Ltd

- Hyundai Translead

- Polar Tank Trailer, LLC

Market Segmentation

By Type

- Tankers

- Refrigerated

- Dry Van

- Lowboy

- Flatbed

- Others

By Length

- Up to 45 feet

- Above 45 feet

By Tonnage

- Below 25T

- 25T - 50T

- 51T - 100T

- Above 100T

By Axles

- Below 3 axles

- 3 - 4 axles

- 4 axles

By End-Use

- Logistics

- Healthcare

- Oil & gas

- Automotive

- Chemical

- FMCG

- Heavy Industry

- Others

Get this report to explore global market size, share, CAGR, and trends, featuring detailed segmental analysis and an insightful competitive landscape

overview @https://www.precedenceresearch.com/sample/2125

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com|+1 804 441 9344