Smart Factory Market Revenue to Attain USD 352.78 Bn by 2033

Smart Factory Market Revenue and Trends 2025 to 2033

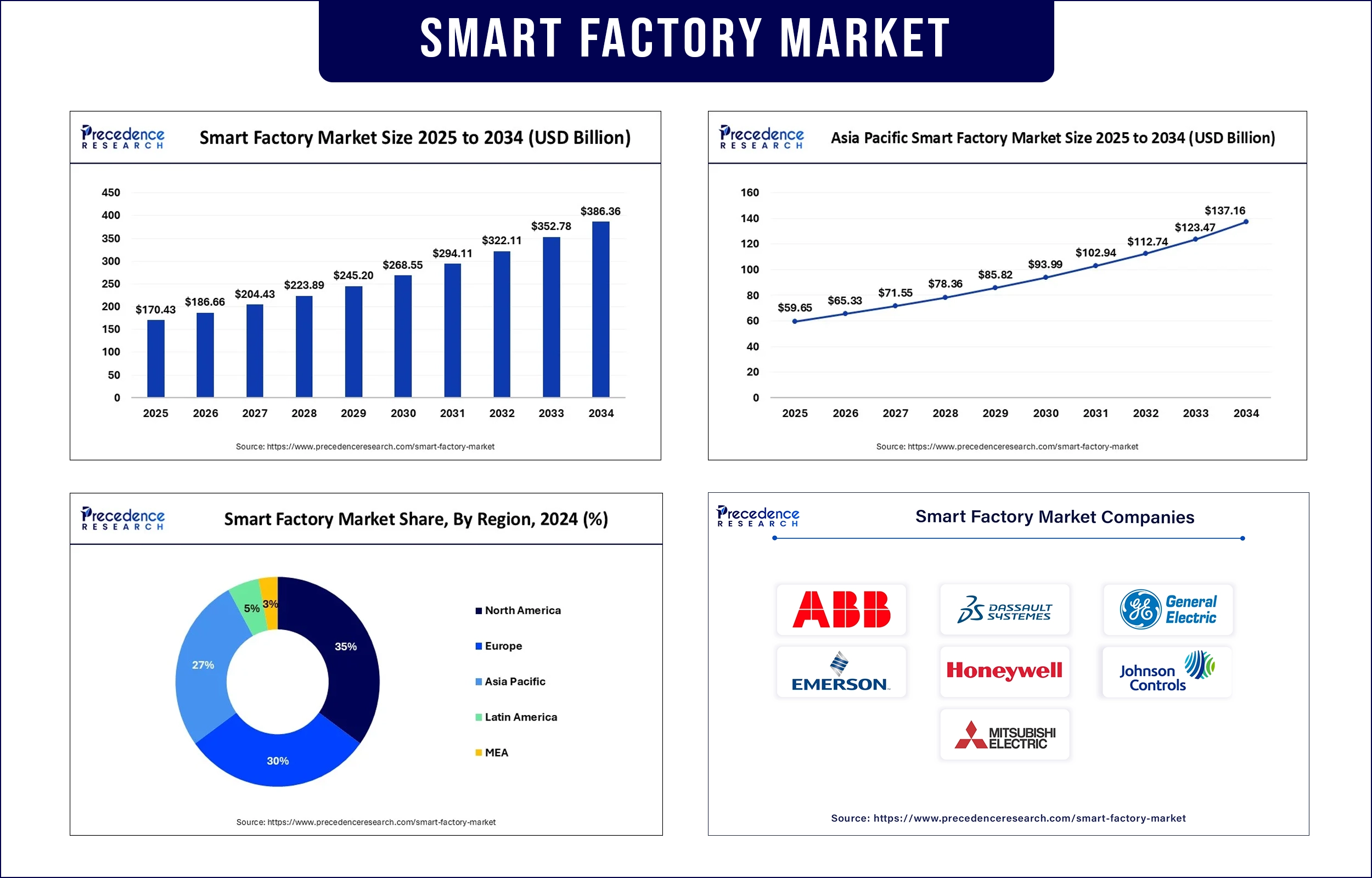

The global smart factory market revenue surpassed USD 170.43 billion in 2025 and is predicted to attain around USD 352.78 billion by 2033, growing at a CAGR of 9.52%. The market is experiencing significant growth due to the rising industrial automation, government support for digital transformation, and the integration of advanced technologies, including internet of things IoT, AI, and robotics, into manufacturing facilities.

Market Overview

Smart factories integrate complete systems that automatically respond to instant changes and market requirements. The implementation of automation, AI robotics, IIoT (Industrial Internet of Things), and cloud computing in factories enhances productivity while minimizing operational costs. The smart factory market continues to evolve due to the rising need for energy-efficient production and downtime reduction. The revolution of Industry 4.0 further supports market growth. The growing need to minimize manufacturing costs while increasing production output significantly influences the market.

Manufacturers now embrace intelligent automation for managing intricate manufacturing processes and supply chains through reduced human involvement. Programs like Smart Manufacturing Leadership Coalition (SMLC) are accelerating the digital transformation of manufacturing facilities, contributing to the market’s expansion.

Key Trends in the Smart Factory Market

Surge in Adoption of IIoT

Through smart sensors, real-time analytics, and edge computing, Industrial Internet of Things (IIoT) transforms factory operations. The International Telecommunication Union (ITU) states that IIoT connectivity enhances the efficiency of industrial machines while managing operations at peak capacity. Improved machine communication and data sharing enable predictive maintenance, reducing production outages and increasing operational safety. UNIDO 2024 report shows that smart sensors integrated with IIoT infrastructure allow digital factories to minimize material waste by about 15%.

Adoption of AI and ML

The manufacturing sector experiences a revolutionary transformation through artificial intelligence (AI) and machine learning (ML) technologies, as they optimize operations while detecting defects and making self-adjusting process changes. The U.S. National Institute of Standards and Technology (NIST) reported in 2024 that AI-powered smart factories showed a 20% better operational throughput during pilot testing. Through machine learning algorithms, manufacturers achieve dynamic quality control and resource allocation. This produces lower waste and optimized yields in diverse production environments. Industrial ecosystems are transitioning toward self-optimization because intelligent algorithms have converged with automated manufacturing systems.

Rising Demand for Sustainable and Energy-Efficient Manufacturing

Stringent environmental regulations and corporate sustainability targets have encouraged the adoption of smart factory solutions, which achieve both minimal waste production and energy consumption. The United Nations Industrial Development Organization (UNIDO) demonstrates how digital technologies enable the accomplishment of worldwide emissions reduction targets. Real-time monitoring of energy-efficient manufacturing systems demonstrated a 12% decrease in electricity usage in 2024, according to the U.S. Department of Energy demonstration projects. The World Bank funded projects for smart manufacturing that worked on circular economy principles to reduce waste from industrial landfills. Furthermore, these programs demonstrate how the global community is moving toward sustainable manufacturing systems, which can automatically monitor and adjust their resource consumption.

Global Push for Industry 4.0

Worldwide governments actively support smart factory development through funding and regulatory measures. The European Commission's Digital Europe Program 2024 has dedicated over €200 million toward digital industrial transformation projects that work to improve EU manufacturing competitiveness through smart systems. National and regional strategies serve as accelerating forces to expand the smart factory market. The United Nations Economic Commission for Europe (UNECE) noted that state policy standardization resulted in better execution of smart factory requirements between member states. The International Telecommunication Union declared that 5G network extension is essential for guaranteeing real-time factory communications, which supports the worldwide push for industrial digitalization.

Highlights of the Smart Factory Market

Product Insights

The industrial robotics segment dominated the market in 2024. This is mainly due to the increased need for factory automation. Industrial robots automate various mundane tasks, reducing the need for human intervention. The shortage of labor further bolstered the segmental growth.

Technology Insights

The product lifecycle management segment led the market in 2024 due to its ability to streamline product design, development, and production processes. PLM tools are critical for sustainable manufacturing, reducing design cycle times and improving resource utilization.

End-User Industry Insights

The oil and gas segment held the largest share of the market in 2024. This is mainly due to the increased adoption of smart systems for remote monitoring, predictive maintenance, and safety compliance. Digital transformation in oil and gas facilities improved operational uptime through real-time analytics and automated asset management.

Regional Insights

Asia Pacific

Asia Pacific registered dominance in the smart factory market in 2024. This is mainly due to the increased manufacturing activities in the last few years. Government support for digital transformation and rising focus on industrial automation further bolstered the market in the region. China's Made in China 2025, India's Smart Advanced Manufacturing and Rapid Transformation Hub (SAMARTH), and Southeast Asia's focus on smart manufacturing further ensure long-term market growth in the region. The Ministry of Electronics and IT worked with NITI Aayog to launch AI Centers of Excellence in 2024, which accelerated digital manufacturing in India.

- In February 2025, China established over 30,000 basic-level smart factories as part of its aggressive push toward intelligent manufacturing. This massive expansion leverages automation, AI, and digital tools to modernize traditional industries and strengthen China’s manufacturing leadership.

North America

North America is expected to witness the fastest growth in the coming years. This is mainly due to its robust industrial base and rising adoption of advanced automation solutions. The U.S. Department of Energy and NIST form partnerships with manufacturers to create open-source digital infrastructure that enhances the adoption of smart manufacturing. Various public-private collaborations throughout the area work to advance the deployment of smart systems throughout automotive, aerospace, and electronics applications. Through the CHIPS and Science Act, the Biden Administration further activated innovation hubs to rapidly transform the North American manufacturing sector into a digital setting, further fueling the market growth in the region.

Smart Factory Market Coverage

| Report Attribute | Key Statistics |

| Market Revenue in 2025 | USD 170.43 Billion |

| Market Revenue by 2033 | USD 352.78 Billion |

| CAGR | 9.52% |

| Quantitative Units | Revenue in USD million/billion, Volume in units |

| Largest Market | North America |

| Base Year | 2024 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Recent Developments in the Smart Factory Market

- In December 2025, ONERugged, a leader in rugged computing solutions, launched its advanced smart factory in Shenzhen. The AI-powered facility features real-time data analytics, IoT integration, and automated inspection systems to enhance production efficiency and product quality. This next-generation plant enables ONERugged to manufacture over 1 million rugged tablets and laptops annually, meeting surging global demand for durable devices built for extreme conditions.

- In September 2024, Panasonic Smart Factory Solutions India (PSFSIN), a division of Panasonic Life Solutions India, unveiled its latest lineup of smart manufacturing technologies at Productronica India 2024. The exhibition showcased a fully operational mini production line with surface mount technology (SMT) machines like the NPM-GH and NPM-GP/L, modular placement machines, and inspection and MES solutions. These advancements are tailored to help Indian OEMs transition to autonomous factory operations, boosting productivity and precision in PCB assembly.

- In January 2025, Nulogy, a key player in collaborative supply chain solutions, introduced its latest innovation, Nulogy Smart Factory. This platform offers real-time production visibility through bi-directional machine monitoring and automated data capture. It enables manufacturers to react immediately to production issues while using actionable insights to drive operational efficiency and sustainable growth.

Smart Factory Market Companies

- ABB Ltd.

- DassaultSystèmes

- General Electric Co.

- Emerson Electric Co.

- Honeywell International Inc.

- Johnson Controls International

- Mitsubishi Electric Corporation

- Microsoft Corporation

- Robert Bosch GmbH

- Schneider Electric SE

- Siemens AG.

Segments Covered in the Report

By Product

- Machine Vision Systems

- Cameras

- Processors

- Software

- Enclosures

- Frame Grabbers

- Integration Services

- Lighting

- Industrial Robotics

- Articulated Robots

- Cartesian Robots

- Cylindrical Robots

- SCARA Robots

- Parallel Robots

- Collaborative Industry Robots

- Control Devices

- Relays and Switches

- Servo Drives and Motors

- Sensors

- Communication Technologies

- Wired

- Wireless

- Other Products

By Technology

- Product Lifecycle Management (PLM)

- Human Machine Interface (HMI)

- Enterprise Resource and Planning (ERP)

- Distributed Control System (DCS)

- Manufacturing Execution System (MES)

- Programmable Logic Controller (PLC)

- Supervisory Controller and Data Acquisition (SCADA)

- Other Technologies

By End-User Industry

- Automotive

- Semiconductors

- Oil and Gas

- Chemical and Petrochemical

- Pharmaceutical

- Aerospace and Defense

- Food and Beverage

- Mining

- Other End-user Industries

Get this report to explore global market size, share, CAGR, and trends, featuring detailed segmental analysis and an insightful competitive landscape

overview @https://www.precedenceresearch.com/sample/2533

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com |+1 804 441 9344