Smart Water Metering Companies | Forecast by 2033

Smart Water Metering Market Growth, Trends and Report Highlights

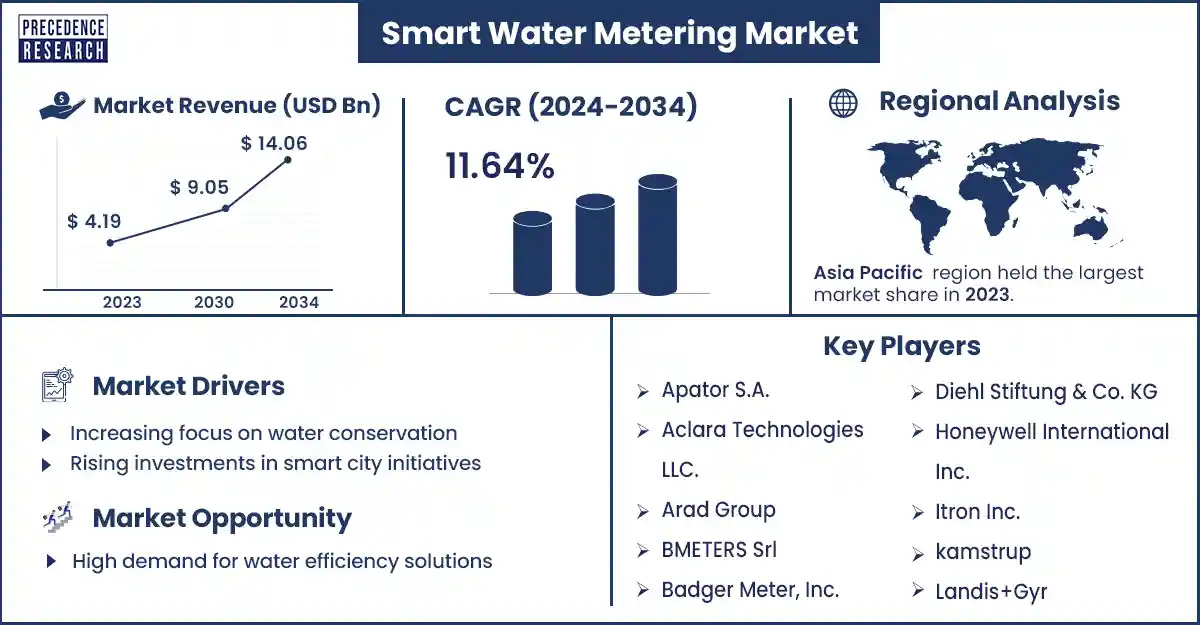

The global smart water metering market exceeded USD 4.19 billion in 2023 and is predicted to cross around USD 12.59 billion by 2033, growing at a CAGR of 11.64% during the forecast period. To acquire an adequate water management facility and advancement in technology, which includes proper water distribution, reduced leaks, and efficient irrigation control. This is expected to be achieved by the smart water metering market.

The Full Study is Readily Available | Download the Sample Pages of this Report@ https://www.precedenceresearch.com/sample/4808

Market Overview

A device that measures and records the water usage data and transfers it from the consumer to the provider to ease water management and proper water billing. This is executed through a smart water meter device feature called an electronic computing unit (ECU), which communicates from the meter to the supplier. The rise in expectations of consumers from water management devices resulted in the development of smart water meters. This advanced technology aids the consumer in tracking down water usage and accurate measurements using ultrasonic and electromagnetic fields.

The traditional water meter was made with metals like brass and copper. However, smart water meters are made with materials, such as thermoplastic, that promote sustainability by recycling the device at the end of its service life. In Asia, smart water devices are used on a wide scale, whereas in countries like Africa and the Middle East, the water scarcity problem is resolved with the help of these devices.

Smart Water Metering Market Emerging Trends

- Data collection and analysis: Technology facilitates the seamless collection of real-time data about water quantity, quality, and utilization using remote sensing, IoT devices, and sensory networks. This valuable data aids in assessing water availability, recognizing patterns, and making well-informed decisions to enhance water management efficiency.

- Water supply and distribution: Modern technologies like SCADA (Supervisory Control and Data Acquisition) systems, smart meters, and automation play a vital role in enhancing the oversight and management of water supply networks. Through their implementation, these advanced solutions contribute to the reduction of leaks, optimization of water distribution, and the promotion of fair and efficient access to water resources.

- Water treatment and purification: Cutting-edge filtration systems, membrane technologies, and effective disinfection processes (e.g., UV and ozone treatment) play an important role in treating and purifying water from diverse sources. This ultimately ensures consumer safety for consumption while eliminating the risk of waterborne diseases.

- Water conservation: Technology plays a crucial role in water conservation through the development of efficient irrigation systems such as drip irrigation and precision farming techniques. Furthermore, water management software and modeling tools greatly contribute to optimizing water usage, minimizing wastage, and improving sustainable water practices. These advancements in technology are instrumental in promoting responsible water management and supporting environmentally conscious practices.

- Water quality monitoring: Technology is essential for continuously monitoring water quality parameters. Sensors, drones, and remote sensing technologies allow us to detect pollutants, harmful algal blooms, and changes in water quality. This enables us to take timely remedial actions, ensuring the protection of human and environmental health.

Smart Water Meter Technology Drives the Market

Smart water technology is crucial in the water conversation. This provides real-time data on water usage to the supplier companies and municipalities; later, the companies identify the high water usage area and implant a limited conversation initiative. This process leads to significant water saving and sustainability.

The smart water metering market is not limited to hardware devices through the advancement of NB-IoT (Narrow Band-Internet of Things), which significantly improves the power consumption of the user and LoRaWAN (long-range wide area network), provides maximum reliability and saving, and ultrasonic metering technology communication has developed in the digital platform. Along with this, the digital payment is executed by M-PESA, MTN, etc.

As a smart water meter detects abnormal distribution of water, similarly, it identifies the leaks occurring within property plumbing; through early detection, the water wastage is prevented by timely repairs.

Although the concept of smart water meters has been around for over twenty years, many failed projects exist, especially in Africa. Due to the installation of devices in environments with high humidity and lack of maintenance, many initial projects ended with bad impressions in areas such as in Nigeria Lusaka, Zambia.

Top Companies in the Smart Water Metering Market

- LAISON Technology Co., Ltd

- Itron, Inc

- Landis+Gyr AG

- Badger Meter

- Kamstrup

- Sensus

- Diehl

- Aclara Technologies

- Neptune Technology Group

- Datamatic

- ZENNER

- Schneider Electric SE

- Siemens AG

- ARAD Group

- Ningbo Water Meter Group Co Ltd

Recent Developments in the Siemens AG Company

| Company Name | Siemens AG |

| Headquarters | Munich, Germany |

| Developments | In September 2023, with the aid of Sieman, Northumbrian water groups implanted more than a million smart water meters. Cloud-based system technology is used to identify household leaks and help prevent water consumption. |

Recent Developments in the Siemens AG Company

| Company Name | Neptune Technology Group |

| Headquarters | Alabama, United States |

| Developments | Neptune Technology Groups has selected BillingPlatform for its subscription-based billing and revenue management needs. This partnership aims to enhance Neptune’s ‘Smart Water’ solutions, enabling efficient billing and data management for over 4,000 water utilities across North America. |

Regional Insight

North America is expected to grow at the fastest CAGR in the smart water metering market during the forecast period. It holds a significant presence in the sectors of both AMI (Advanced metering infrastructure) and AMR (Automated meter reading) solutions. The smart water metering market is driven in North America by government norms and the dynamic development of water infrastructure and urban cities.

The Environmental Protection Agency (EPA) is committed to minimizing water usage within its facilities. Additionally, a key objective is to maintain the quality of water as it travels through the agency's premises, its associated infrastructure, and the surrounding landscape. To achieve these goals, the EPA has implemented various initiatives aimed at conserving water, reducing water usage for landscaping, and effectively managing stormwater as it re-enters the natural environment. The EPA remains dedicated to sustaining this progress by actively managing water resources and pursuing new projects aimed at further reducing water consumption.

- EPA has achieved a significant reduction of 38.9% in water intensity in the fiscal year 2022 compared to the fiscal year 2007.

Asia Pacific dominated the smart water metering market in 2023. Asia Pacific is noticed to be utilizing smart water meter technology. Government encouragement and rapid urbanization in the region are vital factors contributing to the growth of smart water meters. This technology is witnessed in countries such as China, India, Japan, and Australia, where it is used to focus on subjects like water storage and optimal distribution. Smart water meter devices are installed in commercial buildings and infrastructure under environmental standards.

Market Potential & Growth Opportunity

Water utilities are discovering new ways to adjust to climate change. This has created water conservation policies focused on reducing leaks and minimizing water loss. Increasing water scarcity has resulted in the need for more effective water handling systems, which has led to the development of advanced water meters that are more precise and able to ensure community safety. A manufacturer must balance design costs with unique challenges like corrosion, heavy metal contamination, and warping when developing water meters.

For the advancement of water management technology, manufacturers need materials that are seamless, highly durable, and exceptionally stable.

Smart Water Metering Market Highlights

| Report Attribute | Key Statistics |

| Market Revenue in 2024 | USD 4.67 Billion |

| Market Revenue by 2033 | USD 12.59 Billion |

| CAGR | 11.64% |

| Quantitative Units | Revenue in USD million/billion, Volume in units |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market News

- In March 2024, one million NB-IoT smart meters will be managed by TPG Telecom under a 10-year deal with South East Water in Victoria. Following the installation of nearly 100,000 smart meters in Melbourne’s south-east in March, customers have saved more than AUD 5.2 million. It is aimed to replace 1 million traditional meters with digital ones by 2029.

- In June 2024, IoT network operator Sigfox South Africa was awarded a major government contract to adapt or replace around 15 million water meters in the country with ‘smart’ connected metering devices.

Market Segmentation

By Meter Type

- Ultrasonic Meters

- Smart Mechanical Meters

- Electromagnetic Meters

By Technology

- AMR

- AMI

By Component

- IT Solution

- Meter & Accessories

- Communications

By Application

- Industries

- Water Utilities

Buy this Research Report@ https://www.precedenceresearch.com/checkout/4808

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 650 460 3308