Space Launch Services Market Revenue to Attain USD 57.94 Bn by 2033

Space Launch Services Market Revenue and Trends 2025 to 2033

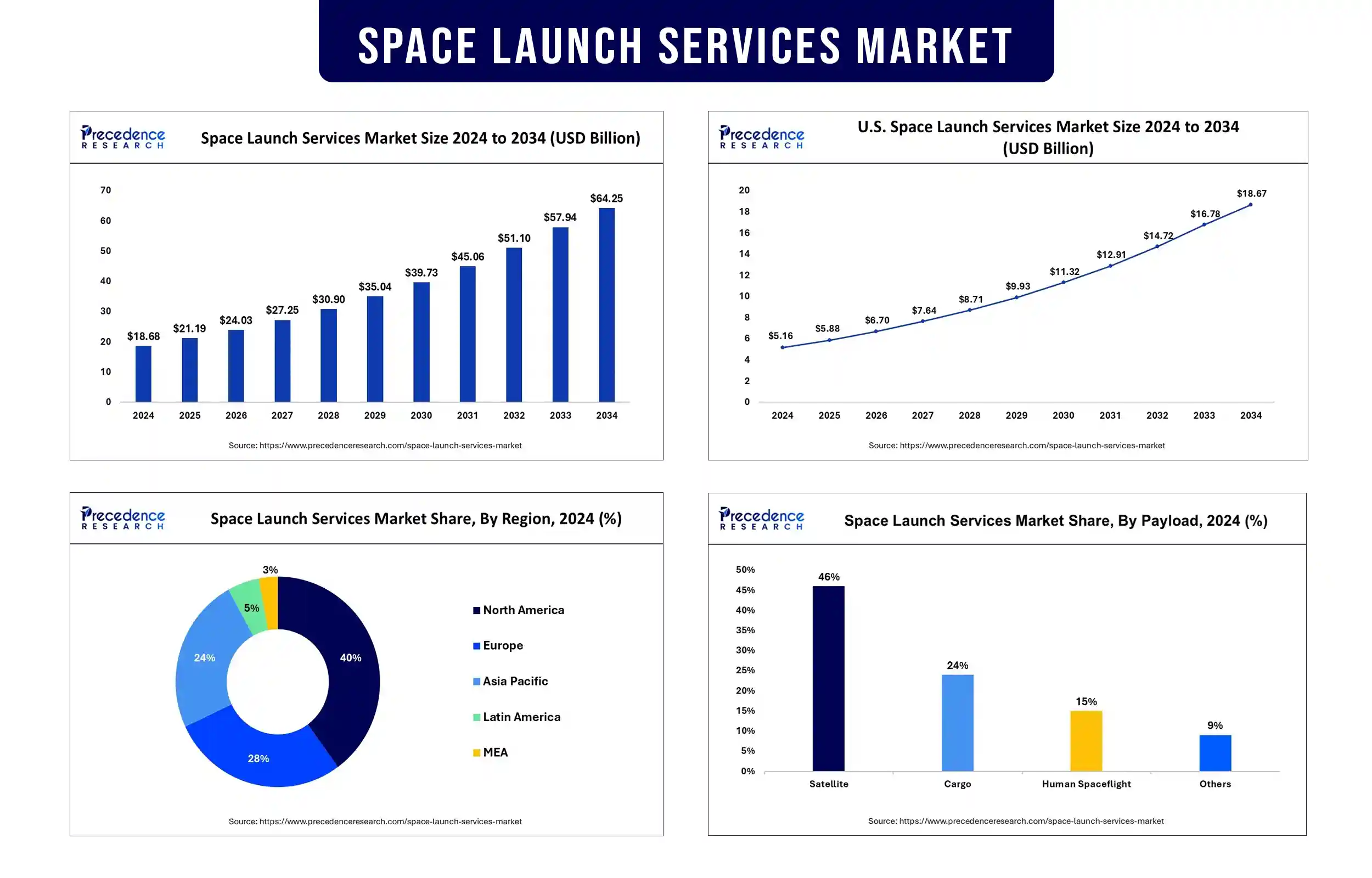

The global space launch services market revenue reached USD 21.19 billion in 2025 and is predicted to attain around USD 57.94 billion by 2033 with a CAGR of 13.15%. The market is witnessing rapid growth due to increasing demand for satellite deployment, expansion of commercial space enterprises, and heightened investment in reusable launch vehicles.

Market Overview

The space launch services industry is gaining momentum as satellite-based technologies, space exploration, and defense modernization continue to evolve. With the growing need for broadband connectivity, Earth observation, and global navigation, satellite launches are in high demand. Changes in the space industry are being brought on by more public-private partnerships, new advances in rocket technology, and the switch to reusing rockets.

The report from the Satellite Industry Association (SIA) for 2024 stated that over 85% of all launches last year were for communication, imaging, and internet services. Reusable rockets, led by pioneers including SpaceX, have significantly reduced launch costs, democratizing space access for smaller enterprises and emerging nations. The development of spaceports in various regions is also enhancing market accessibility and operational capacity. (Source: https://sia.org)

Space Launch Services Market Trends

Rise of Reusable Launch Vehicles (RLVs)

The transition from expendable to reusable rockets is revolutionizing the economics of space launches. The flights of SpaceX’s Falcon 9 and Falcon Heavy, Blue Origin’s New Shepard and expected systems from Rocket Lab and ISRO are preparing for affordable and environmentally friendly space transportation. The FAA found that, as of 2024, more than 60% of all orbital launches involved some reusable technology. While depending on traditional big boosters, NASA’s Artemis program has chosen SpaceX’s Starship for future cargo missions to the Moon. SpaceX reached a new milestone in 2024 by flying the same Falcon 9 first stage for the 20th time. The European Space Agency (ESA) started Themis to test reusable stages that are part of its next generation of launch vehicles. Furthermore, these innovations greatly cut down on the time needed for a flight, raise the number of flights and draw new players to the space industry, thus facilitating the space launch service industry growth.

Growing Demand for Satellite Mega-Constellations

Mega-constellation projects such as Starlink, OneWeb, and Amazon’s Project Kuiper are key drivers of market demand. As per the Satellite Industry Association (SIA), 4,562 LEO satellites were launched in 2024, and it predicts that by 2030 there will be as many as 50,000. Their presence supports broadband access worldwide, remote sensing and IoT applications. The high demand leads to frequent launches, with most being rideshare or launches dedicated to small satellites. In late 2024, ULA’s Vulcan Centaur first launched Project Kuiper on behalf of Amazon. CNSA’s Guowang project also planned to launch more than 600 LEO satellites in 2024. Such efforts at global expansion are leading countries to coordinate rocket launches and find solutions for orbital crowding and dependable flight plans.

Public-Private Partnerships and Government Support

Spacefaring nations continue investing heavily in launch services via partnerships with private entities. Nations active in space travel are still spending big on launch services by partnering with private companies. Space industries, such as NASA, ESA, ISRO, and CNSA, turn to commercial space companies for their orbital deliveries, which helps lower costs. SpaceX, ULA, and Blue Origin were all awarded contracts by NASA in 2024 as part of the CLPS initiative, which helped create competition in the field. ISRO’s NSIL division handled about 20 satellite launches for public and private customers in 2024, mostly in cooperation with international clients. In addition, Roscosmos has reached new partnerships with Russian private launch companies to help modernize its facilities. They are helping speed up change, making launches more efficient, and ensuring solid support for the country’s space plans.

Infrastructure Expansion and Spaceport Development

Global investments in launch infrastructure are accelerating. Countries like the UK, India, Australia, and Brazil are developing new spaceports to support vertical and horizontal launches. In 2024, ISRO inaugurated the second commercial spaceport in Kulasekarapattinam, Tamil Nadu to handle the rising launch demand and reduce overcrowding at Sriharikota. The UK Space Agency helped develop SaxaVord Spaceport, and in 2024, it performed its inaugural suborbital mission, intended to bring orbital missions to life by 2025. The goal is to move beyond high-profile sites and ensure that more people and space programs everywhere access space launch services, avoid delays, and add more stakeholders to the global space field. (Source: https://www.isro.gov.in)

Report Highlights of the Space Launch Services Market

Payload Insights

The satellite segment accounted for the largest market share in 2024. This is mainly due to the increased demand for communications, Earth observation, and navigation satellites. This dominance is supported by the continuous deployment of mega-constellations and advanced imaging satellites by both government and commercial players.

Service Insights

The pre-launch services segment is projected to lead the market during the forecast period due to the rising demand for mission planning, integration, and testing. As the complexity of payloads increases, governments and commercial clients are investing more in pre-launch reliability and technical assurance.

Orbit Insights

The low-earth orbit (leo) segment led the market in 2024 and is expected to register the highest CAGR in the coming years. This is mainly due to the proliferation of satellite constellations and smallsat deployments. LEO offers lower latency and reduced launch costs, making it ideal for communication, surveillance, and climate monitoring missions.

Application Insights

In 2024, the government segment dominated the global market with the largest share, driven by increased government investments in defense, space exploration, and civil missions. Agencies such as NASA, ISRO, and CNSA continue to rely on both institutional and commercial launch providers to support national objectives.

Regional Outlook

North America dominated the space launch services market with the largest share in 2024 due to strong commercial presence, government funding, and technological innovations. The SpaceX’s launches in 2024 supported Starlink and government contracts. Blue Origin started testing its New Glenn rocket in space again at the end of 2024, showing progress toward beginning full-scale operations. ULA used its Vulcan Centaur rocket to contribute to both U.S. space security and the missions to the moon for NASA and the Space Force. Working together, NASA and SpaceX advanced the Artemis missions by launching cargo and crew this year, strengthening the U.S. role in the exploration of deep space. Canada boosted its credentials by starting RADARSAT+ and declaring plans to support a Canadian launch site project in Nova Scotia. Furthermore, these efforts make North America the leading region and strong public-private collaboration, thus boosting the market. (Source: https://www.cnbc.com)

Asia Pacific is emerging as the fastest-growing market due to increasing public-private initiatives. China and India are aggressively expanding their space programs. During 2024, China completed 67 rocket flights, with activities such as tests of the lunar lander and putting Beidou navigation satellites into operation, the China National Space Administration (CNSA) informed. Two IN-SPACe joint missions were carried out by ISRO, with both PSLV-C58 and SSLV bringing up over fifteen commercial payloads last year.

South Korea's KARI performed the third launch of the Nuri rocket in 2023, helping the nation develop its launching abilities. According to the Satellite Industry Association, activity at spaceports in the Asia-Pacific region is rising, and they are building new ones in both the Philippines and Indonesia. Moreover, the region is expanding its role in world markets and supporting its own technology groups in joint efforts with foreign partners, further propelling the market in this region.

- (Source: https://currentaffairs.adda247.com)

- (Source: https://www.space.com)

Space Launch Services Market Coverage

| Report Attribute | Key Statistics |

| Market Revenue in 2025 | USD 21.19 Billion |

| Market Revenue by 2033 | USD 57.94 Billion |

| CAGR from 2025 to 2033 | 13.15% |

| Quantitative Unit | Revenue in USD million/billion, Volume in units |

| Largest Market | North America |

| Base Year | 2024 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Space Launch Services Market News

- In March 2025, SpaceX announced significant expansion of its Starship program beyond its existing infrastructure at Starbase, Texas, by accelerating development at Florida’s Space Coast. The company is constructing Gigabay, a state-of-the-art integration facility adjacent to HangarX at NASA’s Kennedy Space Center, aimed at enhancing Starship production and assembly operations. Concurrently, SpaceX is finalizing construction of the Starship launch pad at Launch Complex 39A (LC-39A) and progressing on Environmental Impact Statements for future Starship flight operations from both LC-39A and Space Launch Complex 37 (SLC-37) at Cape Canaveral Space Force Station (CCSFS). These developments mark a strategic shift toward establishing Florida as a dual hub for Starship development and orbital launch capability.

- In May 2025, Rocket Lab USA, Inc. has confirmed the launch window for its upcoming mission “Full Stream Ahead”, targeting a May 28, 2025, UTC liftoff from Launch Complex 1 in New Zealand. The mission will deliver the next BlackSky Gen-3 satellite to a 470 km mid-inclination orbit, bolstering BlackSky’s real-time geospatial intelligence constellation. This high-resolution satellite will support daily imagery and AI-powered analytics for defense, commercial, and humanitarian applications, further demonstrating Rocket Lab’s reliable access to precise orbital deployment for critical Earth observation missions. (Source: https://www.businesswire.com)

Space Launch Services Market Key Players

- Airbus S.A.S

- Antrix Corporation Ltd.

- China Aerospace Science, and Technology Corporation

- Lockheed Martin Corporation

- Mitsubishi Heavy Industries

- Northrop Grumman Corporation

- Rocket Lab U.S.A.

- Safran S.A.

- Space Exploration Technologies Corp.

Market Segmentation

By Payload

- Satellite

- Human Spaceflight

- Cargo

- Testing Probes

- Others

By Launch Platform

- Land

- Air

- Sea

By Service

- Pre-launch Services

- Post-launch Services

By Orbit

- Low Earth Orbit

- Medium Earth Orbit

- Geosynchronous Orbit

- Polar Orbit

By Application

- Commercial

- Government

- Military

Get this report to explore global market size, share, CAGR, and trends, featuring detailed segmental analysis and an insightful competitive landscape

overview @https://www.precedenceresearch.com/sample/2888

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com |+1 804 441 9344