System Integration Market Revenue to Attain USD 1,704.65 Bn by 2033

System Integration Market Revenue and Trends 2025 to 2033

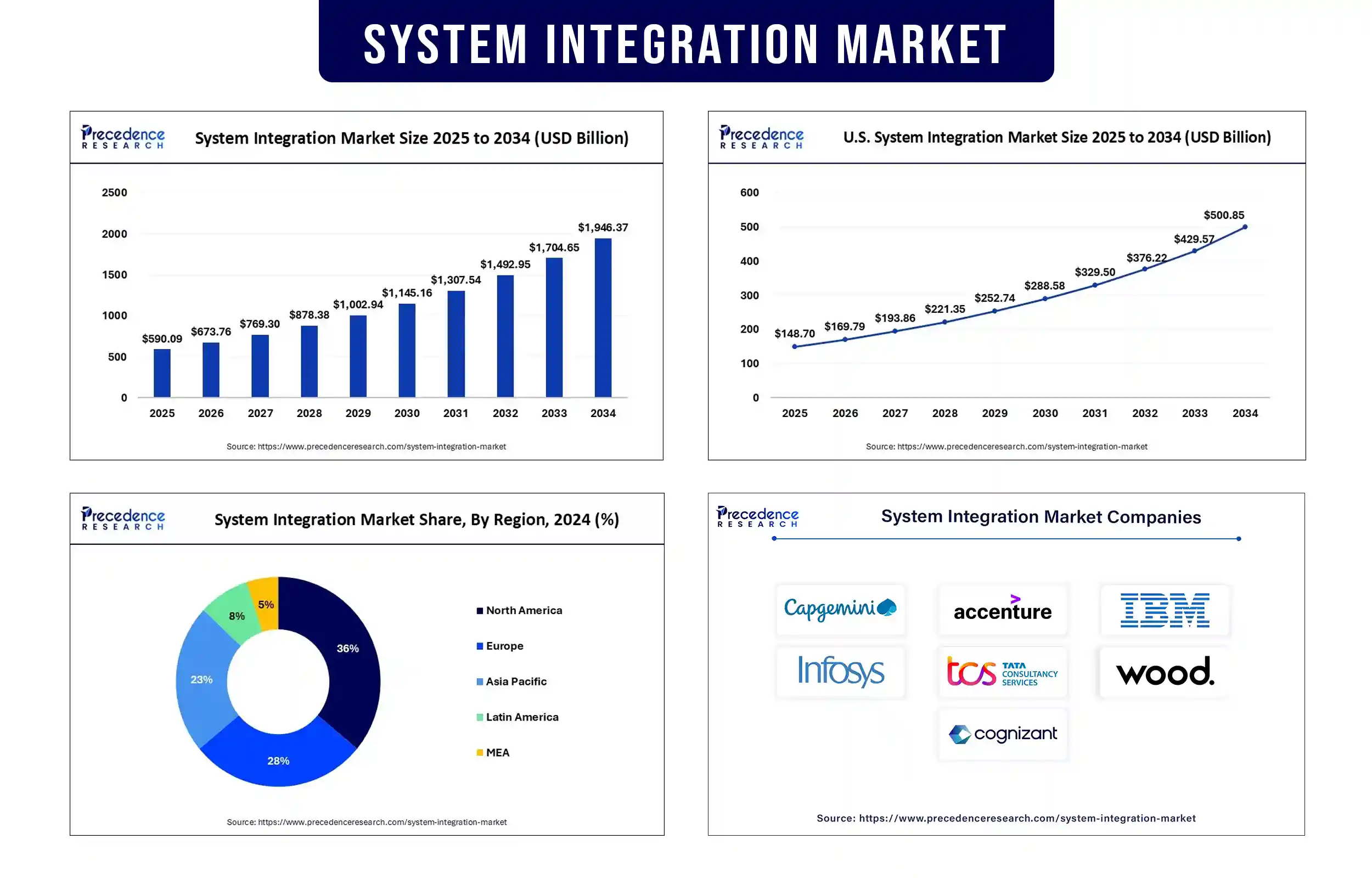

The global system integration market revenue is reached USD 590.09 billion in 2025 and is predicted to attain around USD 1,704.65 billion by 2033 with a CAGR of 14.18%. The system integration market is expected to experience robust growth due to the widespread adoption of cloud computing, increasing complexity of IT environments, and the rising demand for seamless, end-to-end technological infrastructure.

Market Overview

The purpose of the system integration market is to put together all necessary IT parts, including hardware, software, networking, and storage, into one efficient, functional, and scalable infrastructure. The main reasons are increased enterprise spending on automation, tighter linkage between past and modern software systems, and the growing number of Internet of Things devices that all need to be managed on one system. With companies putting greater emphasis on operations, cybersecurity, and agility, system integrators are more important than ever for digital success. Additionally, due to the rise of Industry 4.0 and smart infrastructure, integration services are now more important than ever for allowing different technologies to interact. Vendors provide integration modules that are designed for different cloud services to allow companies to keep updating their technology.

According to a CISA report in 2024, 67% of critical infrastructure sectors had adopted an approach that closely integrated IT and OT to improve their operations and cybersecurity. In addition, ENISA found in 2024 that organizations that use integrated cybersecurity systems were able to respond to threats 40% faster. Furthermore, the need for digital public health platforms in response to global health priorities has raised the need for security and compatibility between systems, especially for vaccines and patients’ data exchange across various nations.

(Source: https://www.cisa.gov)

(Source- https://www.enisa.europa.eu)

Report Highlights of the System Integration Market

By Services, the hardware integration segment led the market, driven by growing demand for seamless connectivity between physical devices, data centers, and IoT-enabled infrastructure. Organizations prioritized the integration of advanced hardware components to support high-performance computing, edge computing deployments, and secure data transmission.

By End-use, the banking, financial services, and insurance (BFSI) segment recorded the largest market share in 2023, reflecting the sector’s critical need for secure, real-time integration of legacy systems with innovative digital platforms. BFSI institutions emphasized the integration of AI-driven analytics, blockchain technology, and fraud detection systems to enhance customer experience and regulatory compliance

System Integration Market Trends

Rise of Cloud-Native and Hybrid Integration

Firms are now shifting from building applications as one large set to developing them as sets of microservices. These services are now concerned with controlling APIs, coordinating containers, and merging different types of cloud platforms. NIST stated in its report that safe frameworks for using hybrid environments were now top priority as most federal systems started using multiple cloud platforms. In 2024, the DG CONNECT from the European Commission underlined that similar API standards reduced the effort required to integrate digital services across borders. Nowadays, joining different parts of a system means both identity sharing and automatic policy management in the cloud. Since the needs for operations have gone up, enterprises are now focusing on real-time orchestration tools for quick deployment and system responsiveness. Furthermore, the businesses are realizing that hybrid integration is necessary for continuing their work and improving technology.

(Source: https://digital-strategy.ec.europa.eu)

Integration for Smart Cities and Infrastructure

Investment from governments and municipalities is supporting work on smart cities, leading to an increase in demand for traffic system, surveillance, utility, and emergency response platforms. Digital infrastructure investment in Asia-Pacific and the Middle East is leading to more ICCCs being set up as important parts of urban planning. The World Economic Forum (WEF) found that using real-time data in smart infrastructure reduced traffic jams by up to 30% in 2024 in the selected pilot cities. DHS recommended adding cybersecurity procedures to ICCCs to prevent critical urban infrastructure from falling victim to evolving attacks. With integrated platforms powered by AI-driven analytics, municipalities can now take steps to prevent and manage congestion and security issues ahead of time. Efforts by different Asian-Pacific countries are helping to speed up the exchange of data for strengthening urban resilience. Moreover, due to these improvements, integrated systems play a key role in making cities smarter, safer, more sustainable, and engage citizens more.

(Source: https://unctad.org)

AI and Automation in System Integration

Automating integration, detecting errors, and improving how orchestration happens in a system are now common uses for artificial intelligence. AI helps platforms to spot and respond to maintenance issues, find anomalies, and decide on certain tasks. This allows people to focus on different tasks and react promptly, mainly useful in defense, manufacturing, and health sectors. In 2024, CISA pointed out that using AI to automate tasks is a main factor in raising the resilience of critical infrastructure against cyber threats. According to NIST, in 2024, AI is expected to be seamlessly connected to daily monitoring and automatic system changes in complex IT systems. ENISA called for transparency in AI algorithms, underlining that doing so keeps AI-driven activities secure and trusted. Additionally, the AI technology is now a vital component in building up integrated digital systems all around the world, thus further showcasing the growing adoption of system integration technology.

(Source: https://www.nist.gov)

Cybersecurity-Driven Integration Demand

Since the number of cyber threats is growing, businesses are putting more focus on securing their systems first. Vendors of integration products regularly offer zero-trust architectures, SIEM software, and IAM technologies as part of their packages. In 2024, the U.S. Cybersecurity and Infrastructure Security Agency pointed out how important it is to protect national critical infrastructure using integrated cybersecurity frameworks against these complicated threats. The WEF encouraged global efforts to develop common cybersecurity standards and make sure they are enforced in all large organizations. Many vendors now have automated threat detection and response as part of their integrated platforms for real-time security. Keeping businesses safe and running smoothly in a world of rising cyber risks relies on integration based on security. Companies are now recognizing that good integration is important for the overall stability and security of their digital systems.

(Source: https://www.cisa.gov)

Regional Outlook

North America

North America dominated the market, with strong technology, earlier adoption of AI and cloud computing, and constant care for IT governance are helping North America stay ahead in the world of system integration. FedRAMP and cybersecurity rules have made it necessary for the government and defense sectors to require more secure systems. Core banking is being combined with AI-driven analysis of risks and blockchain in high demand in the U.S. financial services sector. In 2024, the Cybersecurity and Infrastructure Security Agency (CISA) found that the use of several cybersecurity frameworks had risen among federal agencies trying to combat advanced persistent threats. In 2024, the National Institute of Standards and Technology (NIST) added stronger guidelines on how hybrid cloud and AI systems can be integrated in its cybersecurity framework. Furthermore, the World Economic Forum also recognized that North America is leading the way in using responsible AI for infrastructure in its 2024 digital governance report. Such developments are helping companies innovate quickly and ensuring that their systems operated efficiently while meeting all changing regulations.

(Source: https://www.cisa.gov)

(Source- https://www.trendmicro.com)

Asia-Pacific

Asia Pacific is anticipated to grow at the fastest rate in the market during the forecast period, owing to the industrial growth, digitalization of government services, and many smart infrastructure projects. In China, India, and Singapore, major government plans for digitalization are underway. More SMEs using technology in their operations with the involvement of the government is also increasing demand for integration services that are easy on the budget. According to WEF’s 2024 Global Technology Report, the region is taking the lead in integrating AI into smart cities. Partnerships with Asia-Pacific countries are also planned by DG CONNECT, which focus on making cybersecurity rules consistent in digital projects in 2024. Support from regulators and incentives provided by the government keep making it easier for businesses to use modern, integrated systems. They are helping to build a strong and connected digital environment across the region.

(Source: https://www.weforum.org)

System Integration Market Coverage

| Report Attribute | Key Statistics |

| Market Revenue in 2025 | USD 590.09 Billion |

| Market Revenue by 2033 | USD 1,704.65 Billion |

| CAGR from 2025 to 2033 | 14.18% |

| Quantitative Units | Revenue in USD million/billion, Volume in units |

| Largest Market | North America |

| Base Year | 2024 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

System Integration Market News

- In April 2025, Razorpay, a leading payment service provider, has unveiled the industry’s first Model Context Protocol (MCP) Server, a groundbreaking development aimed at revolutionizing the integration process between AI business assistants and payment infrastructure. As the first payment gateway to adopt the MCP framework, Razorpay's latest innovation enables businesses to directly link their AI agents with the company’s core payment systems. This server dramatically reduces integration timelines—from several months to just 15 minutes—empowering businesses to activate AI-driven payment functionalities almost instantly. The launch signifies a major leap in accelerating AI adoption across digital commerce platforms, improving efficiency, and enhancing the end-user payment experience.

- In April 2025, Swiss marine power company WinGD has announced a milestone agreement to equip four 113,600 DWT wind-assisted tankers—currently under construction for Union Maritime Limited (UML)—with its X-EL Integrated Energy solution. This marks the first deployment of WinGD’s hybrid power and energy management system in conjunction with wind-assisted propulsion. Built by Xiamen Shipbuilding Industry Co., the vessels will feature a comprehensive hybrid configuration including shaft generators connected to the main engines and the advanced X-EL energy management system. This system will intelligently coordinate power distribution between the engines, shaft generator (operating in power-take-out mode), and wind propulsion systems, enabling optimal energy use across all operating conditions and voyage ranges. Additionally, this project represents the first instance where WinGD will apply its integrated energy solution to vessels powered by third-party main engines—underscoring the flexibility and scalability of the X-EL system for broader maritime decarbonization initiatives.

(Source: https://www.financialexpress.com)

(Source- https://wingd.com)

System Integration Market Key Players

- Capgemini

- Accenture

- IBM

- Infosys Limited

- Tata Consultancy Services

- John Wood Group

- Cognizant

- Wipro

- Johnson Controls

- JR Automation

Market Segmentation

By Services

- Infrastructure Integration

- Application Integration

- Consulting

By End-Use

- IT & Telecom

- Defense & Security

- BFSI

- Oil & Gas

- Healthcare

- Transportation

- Retail

- Food and & Beverages

- Automotive

- Others

Get this report to explore global market size, share, CAGR, and trends, featuring detailed segmental analysis and an insightful competitive landscape overview @https://www.precedenceresearch.com/sample/2775

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com|+1 804 441 9344