Travel Insurance Companies | Forecast by 2033

Travel Insurance Market Growth, Trends and Report Highlights

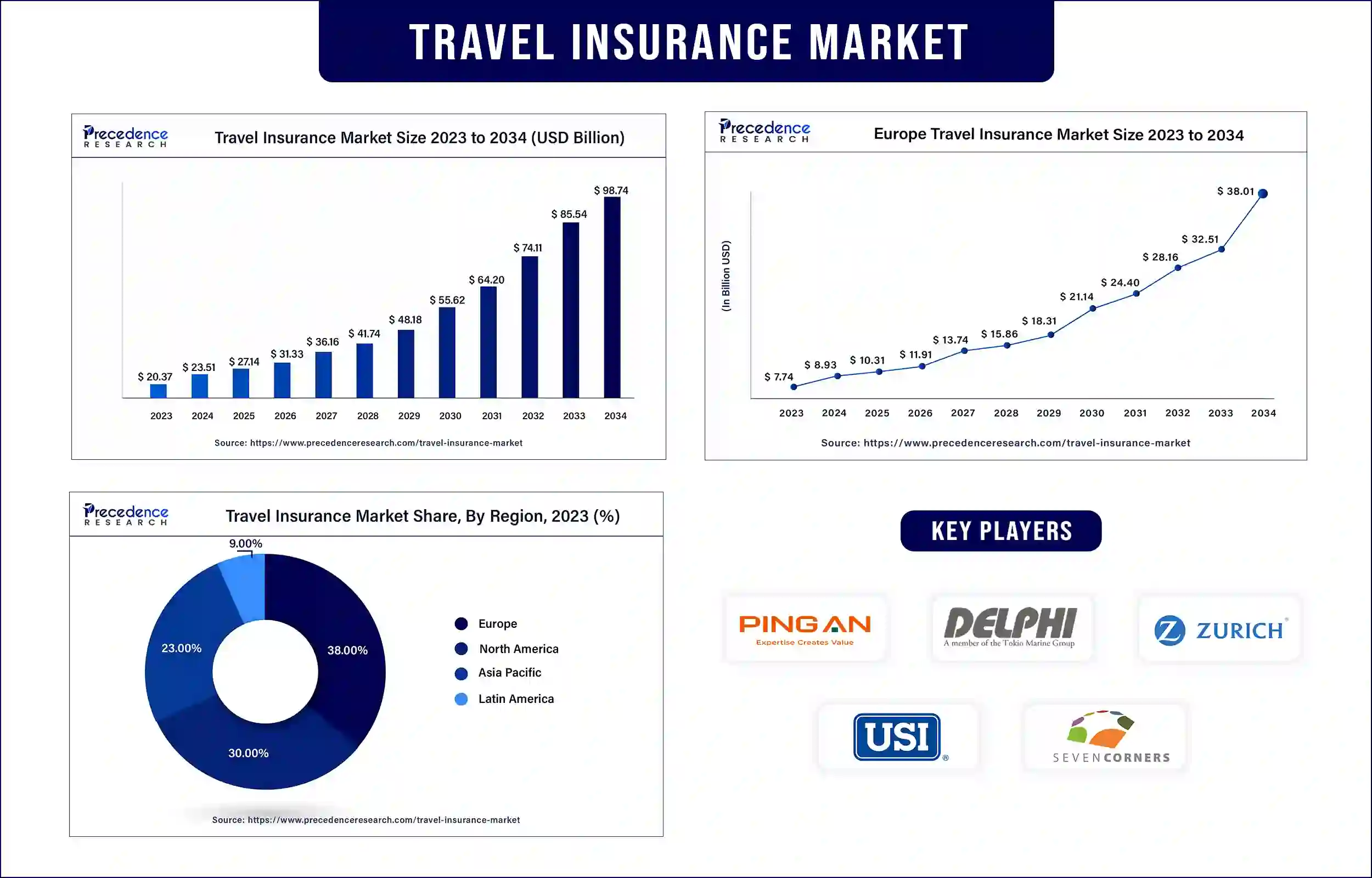

The global travel insurance market was exhibited at USD 20.37 billion in 2023 and is predicted to attain around USD 85.54 billion by 2033, growing at a CAGR of 15.43% during the forecast period. The increase in travel expenditure and the rise in awareness of the importance of travel insurance contribute to the growth of the market.

Market Overview

The travel insurance market includes the selling and buying of insurance products developed to reduce financial risks related to travel, including lost baggage, medical emergencies, and cancellations. The benefits of travel insurance include saving money in the long run, customized for medical needs, insurance expectations, and travel style, personal liability coverage, covering against trip itinerary changes, providing coverage for medical expenses, providing compensation for lost belongings, giving us a piece of mind, etc. contribute to the growth of the market.

Travel Insurance Market Trends

- Rising demand for single-trip travel insurance: The benefits of rising demand for single-trip travel insurance include coverage for car rental, baggage, trip delay, trip interruption/cancellations, medical expense coverage, etc., contributing to the growth of the travel insurance market.

- High medical treatment expenses: Travel insurance, which includes medical expense coverage, can help cover the high expenses of medical treatments.

Advanced technologies driving the market

The advanced technologies used in travel insurance contribute to the growth of the travel insurance market. Travel insurance providers imposing technology to improve their services. This includes digital platforms for safety measures, policy management, and telemedicine services. The recent developments in travel insurance technologies help cutting-edge solutions to improve the effectiveness, efficiency, and convenience of insurance services helping the market’s growth.

- In July 2024, ICICI Lombard, a leading private general insurer in India, launched an AI-powered health insurance plan, Elevate. Elevate comes with 15 in-build coverage and many personalization options, including 20 critical illness coverage accommodations, maternity and newborn coverage, personal accidents, personalized home care, air ambulance, inflation protector, preventive care, travel benefits, and more.

However, the downsides of travel insurance include waiting periods, advantages from other insurance policies that may overlap, not all activities being covered, specific loopholes, travel insurance claims rejected, not providing coverage for preexisting disorders, etc., and hampering the growth of the travel insurance market.

Top Companies in the Travel Insurance Market

- Ping An Insurance (Group) Company of China, Limited

- Delphi Financial Group, Inc.

- Zurich Insurance Group AG

- Travel Insured International

- Seven Corners, Inc.

- Battleface

- USI Insurance Services, LLC.

- ASSICURAZIONI GENERALI S.P.A.

- AXA Travel Insurance

- American International Group, Inc. (AIG)

- Allianz Partners

- China Pacific Insurance (Group) Co. Ltd

- Arch Capital Group Limited

- American Express Company

- ERGO Group AG

- Aviva PLC

- PassportCard

- Everest Insurance

- Staysure

- World Nomads

- Trailfinders Ltd.

- Just Travel Cover

- Insurefor. Com

Recent Development in the Travel Insurance Market by World Nomads

| Company Name | World Nomads |

| Headquarters | Sydney, New South Wales, Australia |

| Development | In July 2024, a new annual multi-trip (AMT) product was launched by the global travel insurance provider World Nomads. The key benefit of the product is Air Doctor, which helps connect travelers to medical advice and private doctors in destinations where public health services cannot treat international travelers. |

Recent Development in the Travel Insurance Market by Everest Insurance

| Company Name | Everest Insurance |

| Headquarters | Hamilton, Bermuda |

| Development | In September 2023, a comprehensive business travel accident insurance was launched by the insurance division of Everest Group, Ltd, Everest Insurance. This innovative addition improves its Health and Accident portfolio, providing an extensive solution that combines insurance protection with an array of important security, travel, and medical assistance services. |

Regional Insights

Asia Pacific is estimated to be the fastest-growing during the forecast period of 2024-2034. Rising security and agility and the rising development in travel insurance policies related to medical treatment contribute to the growth of the travel insurance market in the Asia Pacific region. The increasing awareness about travel insurance, increasing travel expenditure, and rising disposable incomes contribute to the growth of the market.

- In June 2024, the ‘KBL WISE Senior Citizens Saving Bank Account’ was launched by Karnataka Bank, it is designed to provide wellness, banking, and healthcare needs for senior citizens.

Europe dominated the travel insurance market in 2023. Factors like rising travel and tourism lead to peace of mind, wealth, and modern communication, which contribute to the growth of the market in the European region. Well-developed travel infrastructure, increased travel of population, strong regulatory framework, and increased awareness of travel insurance importance help to the growth of the market.

- In May 2024, Insuretech Company Qover collaborated with Bunq, which is the second-largest Neobank in Europe and launched travel insurance across seven markets. Together, the company provides an exceptional user experience for ‘Eva,’ a bunk’s model user. This helps to expand insurance products with excellent AI-based customer care and an efficient stream process.

Market Opportunity and Growth Potential

Collaboration and safety and security measures

Insurers are collaborating with insurance companies to cutting-edge and streamline processes. It helps to make travel insurance more efficient and accessible. Insurers are also focusing on security-related coverage, safety protocols, and emergency assistance to address the concerns of travelers. Collaboration also offers many benefits, including innovative solutions, speed-up production, enhanced learning opportunities, increased employee engagement, stronger interpersonal relationships, enlarged customer pool, etc., contributing to the growth of the travel insurance market.

- In June 2024, a global leader in the travel experience and loyalty programs, Collinson, announced a strategic collaboration with the global travel insurance provider World Nomads to launch a new AMT (Annual Multi-Trip) product in the UK and Ireland.

Travel Insurance Market Highlights

| Report Attribute | Key Statistics |

| Market Revenue in 2024 | USD 23.51 Billion |

| Market Revenue by 2033 | USD 85.54 Billion |

| CAGR | 15.43% |

| Quantitative Units | Revenue in USD million/billion, Volume in units |

| Largest Market | Europe |

| Base Year | 2023 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Travel Insurance Market News

- In June 2024, an accidental insurance policy goal to provide affordable coverage to those who were unable to pay higher amounts was launched by a division of India that is under the ownership of the Department of Post, India Post Payment Bank (IPPB).

- In August 2024, a new travel coverage offering, including car, travel, and backpackers hire excess insurance, was launched by an insurtech platform, Gigasure.

Market Segmentation

By Insurance Coverage

- Single Trip Travel Insurance

- Annual Multi-Trip Travel Insurance

- Long Stay Travel Insurance

By Distribution Channel

- Insurance Intermediaries

- Insurance Companies

- Banks

- Insurance Brokers

- Insurance Aggregators

By End-users

- Education Travelers

- Business Travelers

- Senior Citizens

- Family Travelers

- Others

Buy this Research Report@ https://www.precedenceresearch.com/checkout/4867

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 650 460 3308