Veterinary Imaging Companies | Forecast by 2033

Veterinary Imaging Market Growth, Trends and Report Highlights

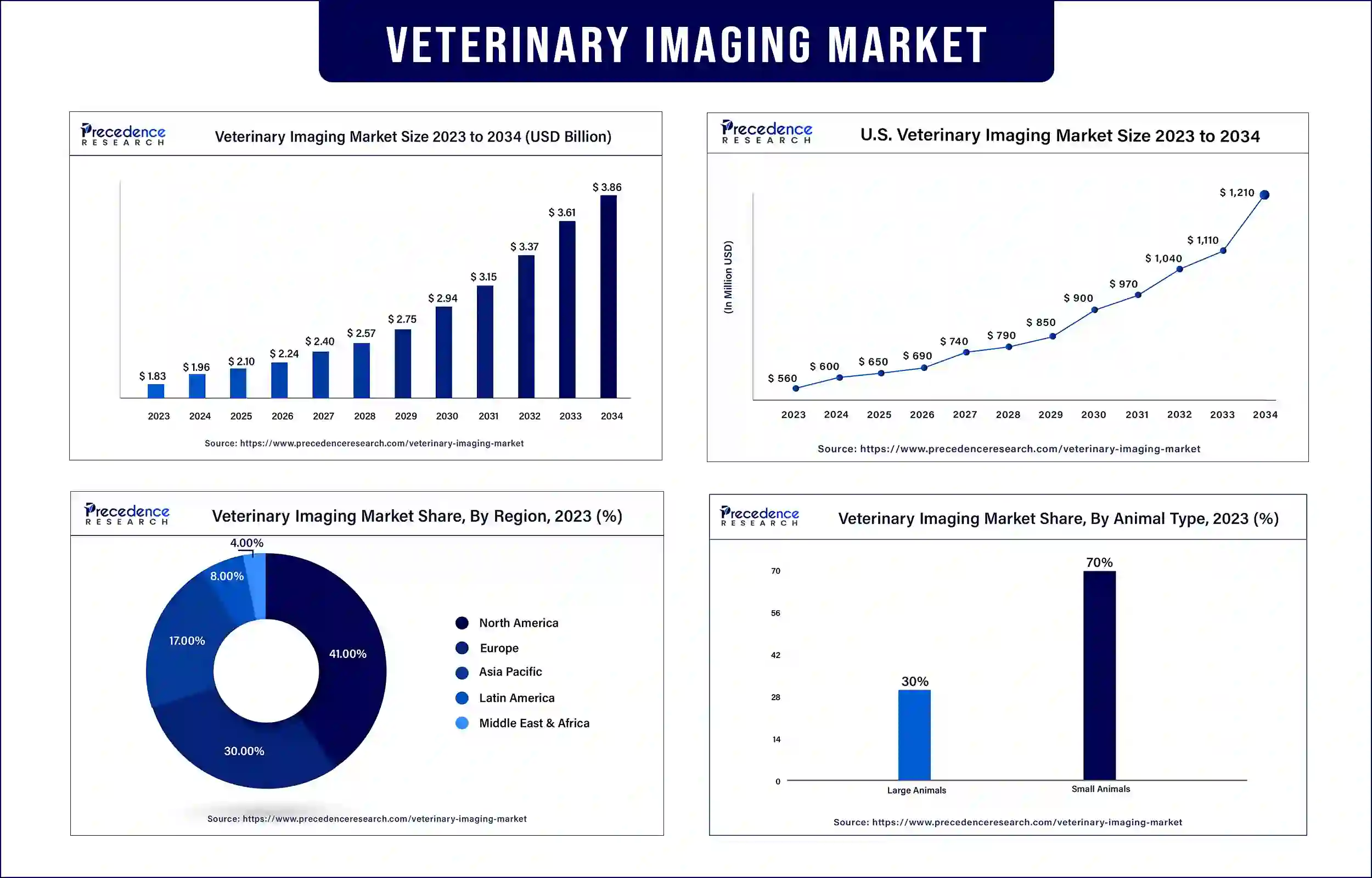

The global veterinary imaging market was exhibited at USD 1.83 billion in 2023 and is projected to attain around USD 3.61 billion by 2033, poised to grow at a CAGR of 7.02% during the forecast period. For pet insurance, increasing surging demand, advanced imaging technologies, rising animal health spending, rising pet adoption demand in developing countries, rising zoonotic diseases, etc., driving the growth of the market.

Market Overview

The veterinary imaging market is a highly specialized discipline that focuses on the development and deployment of an extensive array of imaging technologies that cater to the medical requirements of animals. The benefits of veterinary imaging include minimizing the period of hospitalization, ensuring that animals are provided with the right level of care, making it easy to diagnose cancer, minimizing the exploratory surgery possibilities, understanding if surgery is essential, etc.

Veterinary Imaging Market Trends

- Increasing pet adoption demand: The increasing pet adoption demand and awareness for high quality, effective, innovative products contribute to the growth of the veterinary imaging market.

- Increasing many veterinary practitioners: Veterinary practitioners provide public health at the time of routine practice, which helps the market’s growth.

Advanced technologies driving the market

The use of advanced technologies in the veterinary imaging helps in improving efficiency and enabling new applications which help to the growth of the veterinary imaging market. Advanced technologies in areas such as automation, artificial intelligence, and machine learning are mainly important. Fast technological changes may provide existing services and products obsolete.

- In February 2023, a mouse model to study mpox virulence was developed by NIH Scientists. Standard inbred laboratory mice are resistant to MPXV infection, and the absence of a small animal model of mpox made it hard to study how genetic differences contribute to observed differences in virulence.

However, the challenges of veterinary imaging include technological disruption, geopolitical tensions and economic fluctuations, market saturation, critical regulatory landscape, and the high cost of veterinary imaging machines can hamper the growth of the veterinary imaging market.

Top Companies in the Veterinary Imaging Market

- IMV Imaging

- Shenzhen Mindray Animal Medical Technology, Co., Ltd.

- Canon Medical Systems Corporation

- Hallmarq Veterinary Imaging

- FUJIFOLD Holdings America Corporation

- Midmark Corporation

- GE Healthcare

- Mars, Inc.

- ESAOTE SPA

- IDEXX Laboratories

- Epica International Inc.

- Carestream Health

- BCF

- Agfa-Gevaert Group

- Reproscan

- SonoScape Medical Corp.

- MinXray, Inc.

- DRAMINSKI S.A.

- Siemens Healthcare Limited

- Hitachi Healthcare Americas

- General Electric Company

- Konica Minolta Healthcare Americas, Inc.

- Antech Diagnostics

- Bruker

Recent Development in the Veterinary Imaging Market by Konica Minolta Healthcare Americas, Inc.

| Company Name | Konica Minolta Healthcare Americas, Inc. |

| Headquarters | Marunouchi, Chiyoda, Tokyo, Japan |

| Development | In July 2023, a new handheld, wireless ultrasound for point of care, high-quality imaging applications named ‘PocketPro H2’ was launched by Konica Minolta Healthcare Americas, Inc. for human and veterinary applications with a new level of affordability and flexibility in ultrasound. |

Recent Development in the Veterinary Imaging Market by Antech Diagnostics

| Company Name | Antech Diagnostics |

| Headquarters | Mount Herrmann St, Fountain Valley, CA, United States |

| Development | In November 2023, in the UK, a complete veterinary diagnostic offered with a novel state-of-the-art reference laboratory, software, imaging, and in-house diagnostics was launched by the full veterinary diagnostics service, which is part of the Science and Diagnostics Divisions of Mars Pet Care. Antech Diagnostics. |

Recent Development in the Veterinary Imaging Market by ESAOTE SPA

| Company Name | ESAOTE SPA |

| Headquarters | Genoa, Italy |

| Development | In May 2024, Esaote Group specialized in developing medical imaging systems like MRI and ultrasound machines and other healthcare technologies. A new ultrasound system named ‘MyLabFOX’ with adoptable and multifaceted scanning solution for veterinary imaging was launched by Esaote North America. |

Regional Insights

Asia Pacific is estimated to be significantly growing during the forecast period of 2024-2034. The rising disposable incomes and rising awareness related to advanced imaging technologies, increasing animal health concerns, increasing animal health vigilance, and rising prevalence of animal disorders are driving the growth of the veterinary imaging market in the Asia Pacific region.

- In February 2024, Tata Trusts was set to launch India’s first state of art Small Animal Hospital in Mahalakshmi, Mumbai. The small animal hospital will launch in March 2024. The hospital is the first of its kind and is across five floors, spanning over 98,000 square feet, with a capacity of more than 200 beds.

North America dominated the veterinary imaging market in 2023. The rising adoption of companion animals, the increasing focus on protein-based foods for livestock, and the increasing spending on animal health are contributing to the growth of the market in the North American region. In the United States and Canada, there is a high rate of pet ownership worldwide. A large pet population is driving the demand for diagnostic imaging in veterinary healthcare services.

- In April 2024, in the U.S., MiREYE Imaging officially launched its innovative line of AI-powered Veterinary X-ray machines. These artificial intelligence (AI) based machines help to improve efficiency and accuracy in veterinary diagnostics imaging.

Market Opportunity and Growth Potential

Future scope of veterinary imaging

The rising adoption of pets and the increasing demand for diagnostics procedures in animal healthcare are contributing to the growth of the veterinary imaging market. The development of advanced imaging technologies like CT scans, MRI, and ultrasound has helped to expand the market. Increasing investment in research and development contributes to the growth of the market in the future.

- In January 2024, a new product named SignalSTAT was launched by SignalPET, a veterinary radiology company that it consistently blends innovative AI technology with human expertise to offer pets rapid, most detailed care possible.

Veterinary Imaging Market Highlights

| Report Attribute | Key Statistics |

| Market Revenue in 2024 | USD 1.96 Billion |

| Market Revenue by 2033 | USD 3.61 Billion |

| CAGR | 7.02% |

| Quantitative Units | Revenue in USD million/billion, Volume in units |

| Largest Market | North America |

| Base Year | 2023 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Veterinary Imaging Market News

- In February 2024, the most advanced Endoscopic Ultrasound Machine, ALOKA ARIETTA 850, was launched by FUJIFILM India. The first ever installation was in Fortis Hospital Bengaluru, Karnataka, India.

- In April 2024, the phase 2 AVC Veterinary Teaching Hospital expansion project was launched by Atlantic Veterinary College (AVC).

- In July 2024, Korea’s largest mobile carrier, SK Telecom, signed contracts with the United States distributor MyVet Imaging and Canada’s Nuon & Nikki to integrate veterinary imaging software Skyline Picture Archiving & Communication System for wets (Sky PACS) with X- Caliber, for to launch its AI-powered veterinary medical service.

Market Segmentation

By Product

- X-ray

- Ultrasound

- MRI

- CT Imaging

- Video Endoscopy

By Solutions

- Equipment

- Accessories/Consumables

- PACS

By Animal Type

- Small Animals

- Large Animals

By Application

- Orthopedics And Traumatology

- Neurology

- Respiratory

- Cardiology

- Dental Application

- Others

By End-use

- Veterinary Hospitals & Clinics

- Other end use

Get this report to explore global market size, share, CAGR and trends, featuring detailed segmental analysis and an insightful competitive landscape overview@ https://www.precedenceresearch.com/checkout/4959

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 650 460 3308