Veterinary Imaging Market Size and Forecast 2025 to 2034

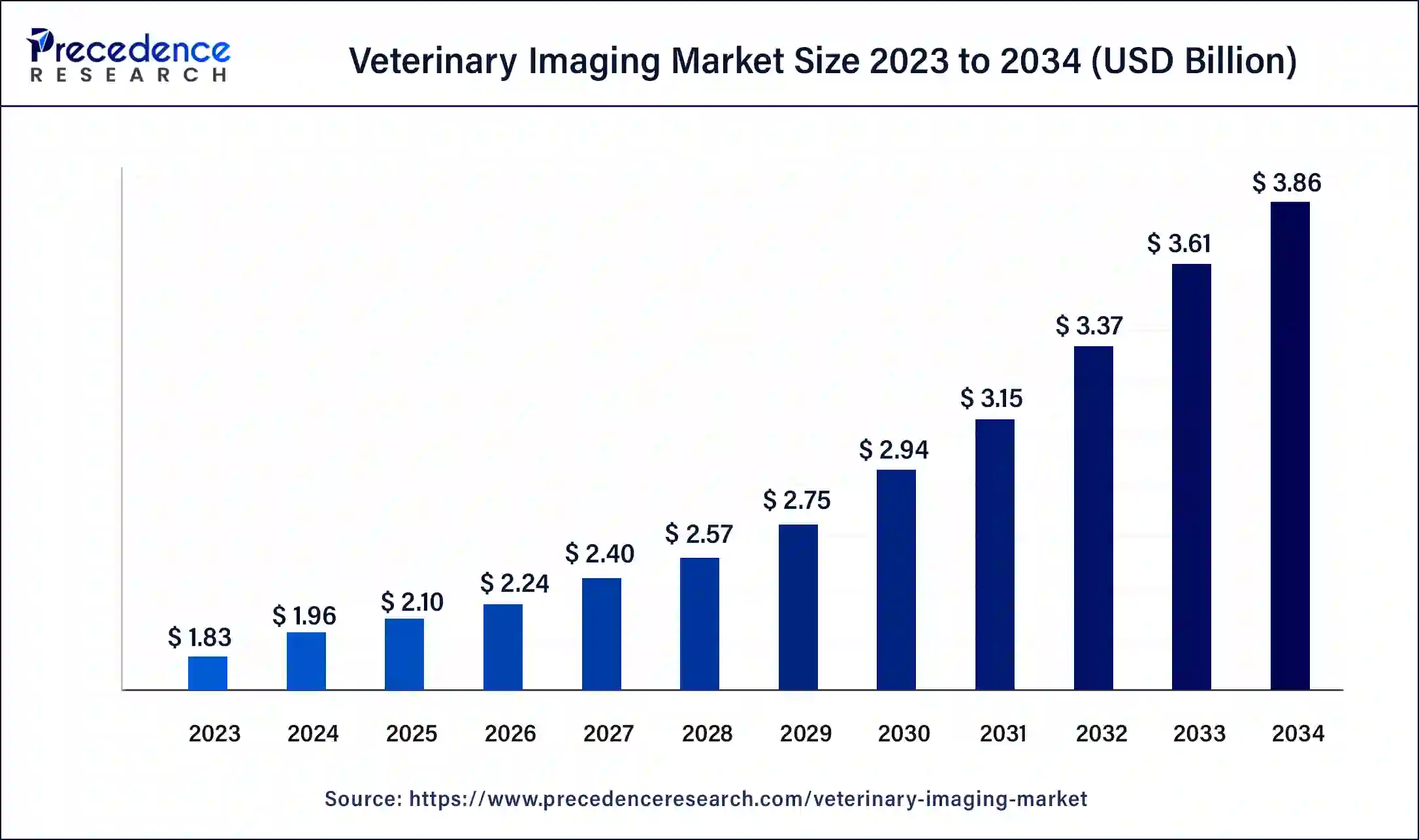

The global veterinary Imaging market size accounted at USD 1.96 billion in 2024 and is anticipated to reach around USD 3.86 billion by 2034, growing at a CAGR of 7.01% over the forecast period 2025 to 2034.

Veterinary Imaging Market Key Takeaways

- The global veterinary Imaging market was valued at USD 1.96 billion in 2024.

- It is projected to reach USD 3.86 billion by 2034.

- The veterinary Imaging market is expected to grow at a CAGR of 7.01% from 2025 to 2034.

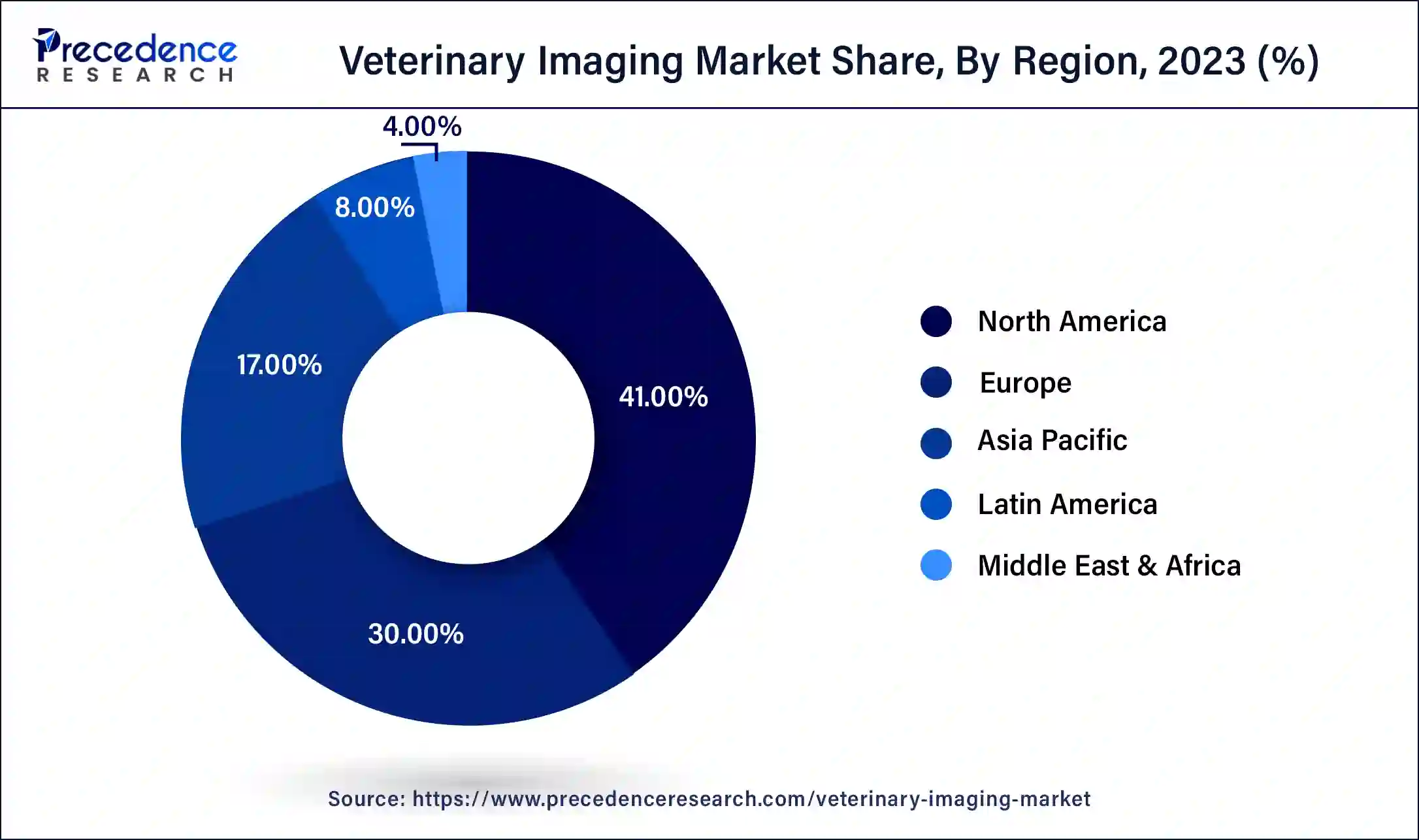

- North America dominated the veterinary imaging market with the largest market share of 41% in 2024.

- Asia Pacific is estimated to be significantly growing during the forecast period of 2025-2034.

- By product, the X-ray segment contributed more than 39% of the market share in 2024.

- By product, the video endoscopy segment is expected to be the fastest-growing during the forecast period.

- By solutions, the equipment segment generated the highest market share of 57% in 2024.

- By solutions, the PACS segment is anticipated to grow at a solid CAGR of 8.07% during the forecast period.

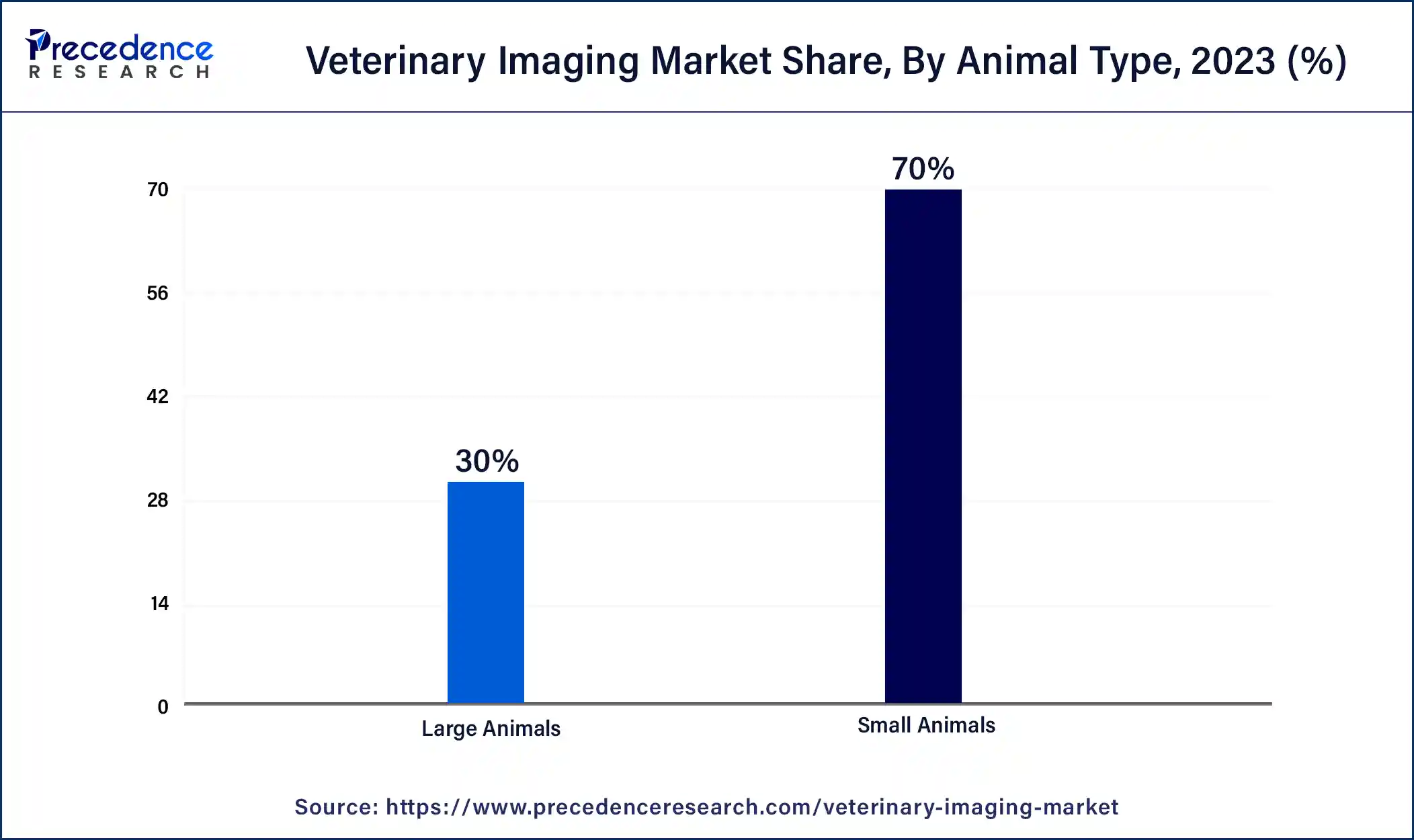

- By animal type, the small animals segment recorded the largest market share of 70% in 2024.

- By application, the orthopedics and traumatology segment captured the major market share of 39% in 2024.

- By application, the oncology segment is expected to expand at a remarkable CAGR of 9.45% during the forecast period.

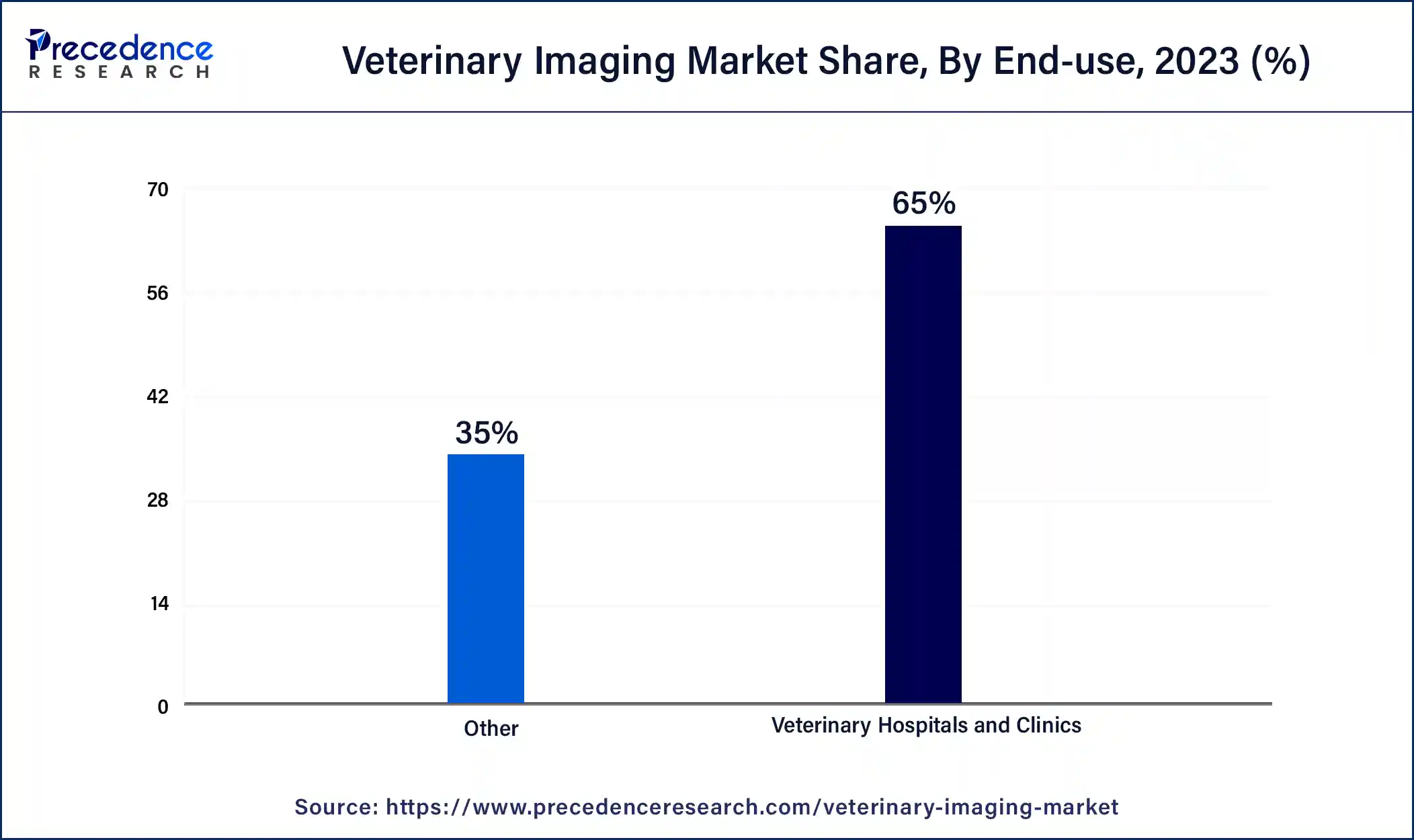

- By end-use, the veterinary clinics and hospitals segment accounted for the highest market share of 65% in 2024.

What is the role of AI in the Veterinary Imaging Market?

Artificial intelligence (AI) in veterinary medicine is an emerging field. Machine learning (ML) is a subfield of artificial intelligence (AI) that enables computer programs to examine large imaging datasets and to learn to perform veterinary diagnostics imaging. AI in veterinary imaging plays an important role in filling the gaps and providing important information for evaluating illness and injury and for routine prevention. The benefits also include accurate, precise, and faster diagnosis and help to improve care.

- In April 2024, the two new developments named ‘AI-powered radiology and Targeted Cancer Screening Tools to release a new chapter for veterinary diagnostics, were launched by the veterinary diagnostics company Antech that focused on collaboration with veterinary professionals to predict, diagnose, and monitor wellness and diseases.

U.S. Veterinary Imaging Market Size and Growth 2025 to 2034

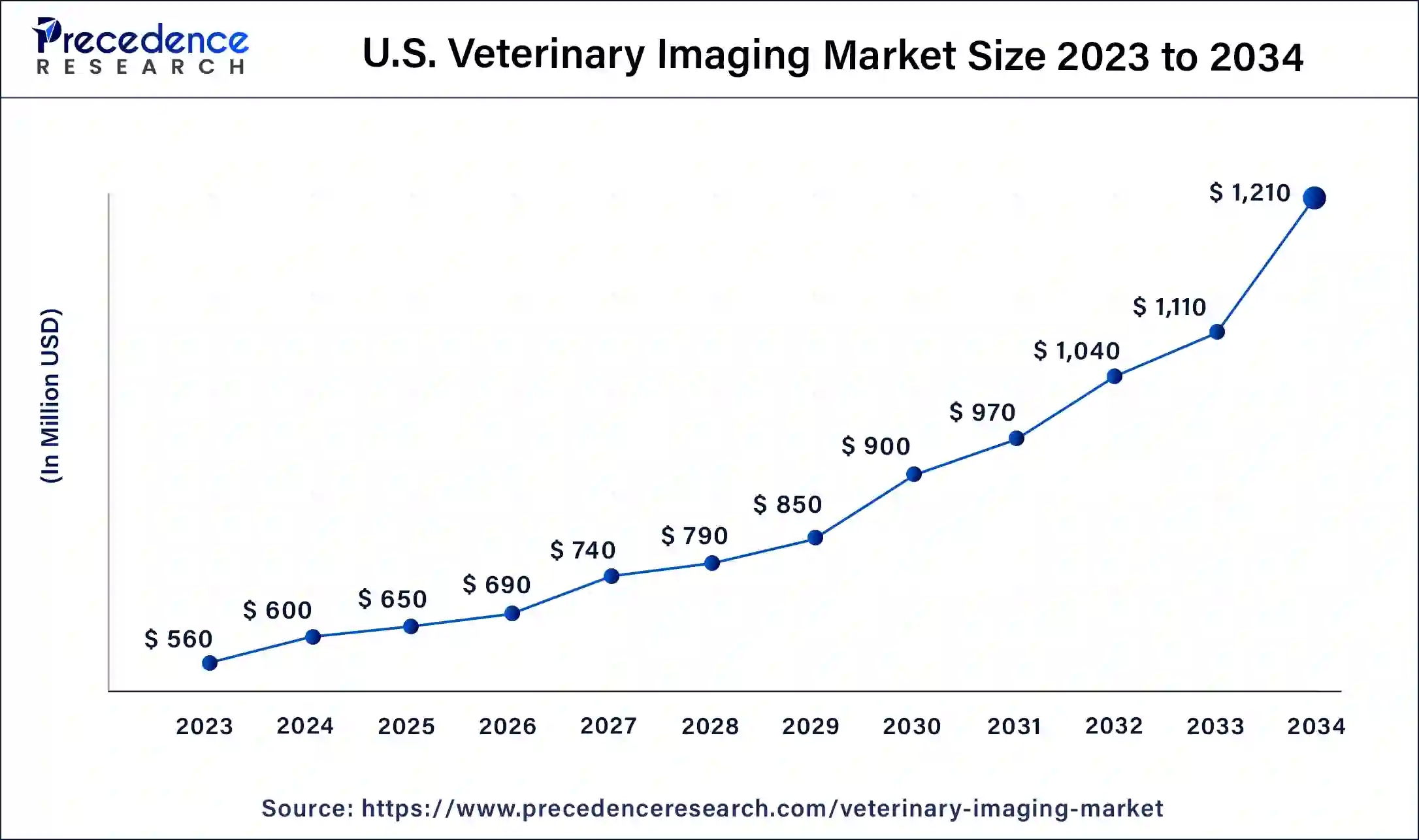

The U.S. veterinary Imaging market size was accounted at USD 600 million in 2024 and is projected to be worth around USD 1,210 million by 2034, poised to grow at a CAGR of 7.27% from 2025 to 2034.

North America dominated the veterinary imaging market in 2024. The United States and Canada are the leading countries for the growth of the market in the North American region. The increasing demand for veterinary healthcare services is due to the increased pet population. In the United States, many animals suffer from different diseases, such as an increase in orthopedics conditions and incidences contributing to the market's growth.

- In July 2024, Korea's largest mobile carrier, SK Telecom, signed contracts with the United States distributor MyVet Imaging and Canada's Nuon & Nikki to integrate veterinary imaging software Skyline Picture Archiving & Communication System for wets (Sky PACS) with X- Caliber, for to launch its AI-powered veterinary medical service.

Asia Pacific is estimated to be significantly growing during the forecast period of 2025-2034. The rising prevalence of animal disorders, increasing livestock population, rising animal health vigilance, increasing health concerns, rising pet animals' adoption, and increased healthcare spending on veterinary services and animal health are contributing to the growth of the veterinary imaging market.

- In February 2024, the most advanced Endoscopic Ultrasound Machine, ALOKA ARIETTA 850, was launched by FUJIFILM India. The first ever installation was in Fortis Hospital Bengaluru, Karnataka, India.

Market Overview

The veterinary imaging market is a highly specialized discipline that focuses on the development and deployment of an extensive array of imaging technologies that cater to the medical requirements of animals. Veterinary imaging is one of the most frequently used types of diagnostic testing in both large and small animal hospitals across the world. Imaging provides a high amount of information by non-invasive means and does not cause unacceptable discomfort to patients or alter disease processes.

Veterinary Imaging Market Growth Factors

- The benefits of veterinary images include minimizing the length of hospitalization, making it easy to diagnose cancer, etc.

- It also includes the benefits of understanding the surgery is necessary and minimizing the exploratory surgeries.

- It helps to ensure that the animal is provided the right level of care, and that may be an intensive care unit in some cases.

- The applications of veterinary imaging include neurology, cardiology, oncology, orthopedics, traumatology, etc., contributing to the growth of the veterinary imaging market.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 3.86 Billion |

| Market Size in 2025 | USD 2.10 Billion |

| Market Size in 2024 | USD 1.96 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 7.01% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Solution, Animal Type, Application,End-use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Driver

Increasing pet adoption demand

The increasing pet adoption demand and awareness for innovative, efficient, and high-quality products are pushing companies to improve their offspring, contributing to the growth of the veterinary imaging market. This demand from emerging economies and developed markets helps the growth of the market. Also, supportive government regulations and policies help the market's growth.

Restraint

Limitations that investors and businesses need to consider

The limitations that investors and businesses need to consider include technological disruptions, geopolitical tensions, and economic volatility that may impact the stability of the market, affecting business operations and investment returns. In some segments of the market, competition is great, which leads to market saturation, regulatory hurdles, etc., which can hamper the growth of the veterinary imaging market.

Opportunity

Advanced imaging technology

The use of advanced imaging technologies like CT scans, MRIs, and ultrasound contributes to the growth of the veterinary imaging market. Increasing investment in research and development and exposure to advanced imaging system technology help the market's growth. The increasing prevalence of many veterinary disorders and the need for early and accurate diagnosis fueled the growth of veterinary imaging.

- In January 2024, a new product named SignalSTAT was launched by SignalPET, a veterinary radiology company that consistently blends innovative AI technology with human expertise to offer pets the rapid, most detailed care possible.

Product Insights

The X-ray segment dominated the veterinary imaging market in 2024. In veterinary diagnosis, X-rays, also called radiographs, play an important role. They can provide a comprehensive image of the internal structures of animals, like abdominal organs, lungs, joints, and bones. This painless technique enables veterinarians to visualize potential foreign objects, tumors, fractures, and other abnormalities, which helps them understand many conditions accurately. It is a readily available and quick imaging method, enabling veterinarians to receive critical diagnostic information rapidly.

- In April 2024, in the United States, MiREYE Imaging officially launched its innovative line of AI-powered Veterinary X-ray machines. These artificial intelligence (AI) based machines help to improve efficiency and accuracy in veterinary diagnostics imaging.

The video endoscopy segment is expected to be the fastest-growing during the forecast period. Video imaging has many benefits in terms of documentation, operator comfort, teaching, and client relations, which help the growth of the veterinary imaging market. Video endoscopy also allows endoscopists to work more effectively with any assistance who is supporting the process. The advanced and innovative video endoscopy includes minimally invasive procedures, video recording capabilities, high-resolution images, etc. The benefits of veterinary imaging video endoscopy for veterinarians include customer satisfaction, greater efficiency, a wide range of procedures, accurate diagnosis, exceptional customer service, competitive prices, superior quality, etc.

Ottomed Endoscopy provides veterinary video endoscopes for large and small animals with next-generation imaging technology, which is designed to help veterinary endoscopists enhance the precision diagnostic at the time of making diagnosis and therapeutic endoscopic treatments:

Solution Insights

The equipment segment dominated the veterinary imaging market in 2024. The benefits of veterinary imaging equipment include saving money on costs, lower exposure, more accurate images, and seeing images that are clearer and more defined to reduce guesswork needed for accurate diagnosis making. The rapid imaging process is able to access images in an effective way, which helps to save time and also makes rapid diagnosis and treatment decisions in emergency situations. Veterinary imaging equipment can be used to analyze dental problems, evaluate soft tissue, determine bone issues, and more.

The PACS segment is anticipated to be the fastest-growing during the forecast period. The PACS solution plays an important role in improving animal care. The benefits of PACS for veterinary imaging include less time wasted because of inaccessible images and downtime; better patient diagnoses because of accurate diagnoses, and improved workflows for less frustration and stress for the staff, leading to less burnout and better outcomes.

Animal Type Insights

The small animals segment dominated the veterinary imaging market in 2024, and it is estimated to be the fastest-growing segment during the forecast period. Small animals play an important role in veterinary imaging. Specific molecular target imaging with small animal PET allows earlier detection and characterization of diseases. The benefits of small animal veterinary imaging include screening of drug candidates, detailed biochemical parameters, complete kinetics, statistical benefits, lowered use of animals, etc., contributing to the market's growth.

- In February 2024, Tata Trusts was set to launch India's first state of art Small Animal Hospital in Mahalakshmi, Mumbai. The small animal hospital will launch in March 2024. The hospital is the first of its kind and is across five floors, spanning over 98000 square feet, with a capacity of more than 200 beds.

Application Insights

The orthopedics and traumatology segment dominated the veterinary imaging market in 2024. Veterinary imaging plays an important role in the diagnosis and management of orthopedics and traumatology conditions. The benefits of veterinary imaging for orthopedics and traumatology include accurate diagnosis, treatment planning for soft tissue injuries, joint diseases, fractures, monitoring progress, etc.

The oncology segment is expected to be the fastest-growing during the forecast period. Veterinary imaging plays an important role in adequate diagnosis and staging in human and veterinary oncology, contributing to the growth of the veterinary imaging market. Sensitive detection of lesions is essential to determine proper local and systematic therapy and to monitor therapeutic results.

End-use Insights

The veterinary clinics and hospitals segment dominated the veterinary imaging market in 2024, and the segment is anticipated to be the fastest-growing during the forecast period. The benefits of veterinary clinics and hospitals include tax benefits for veterinary practices, potential practices for business expansion and franchising, fulfilling work that helps animals and their owners, potential to specialize and offer unique services, potential for repeat business and customer loyalty, recession-resistant industry because of pet ownership, steady income from pet care routine care, etc.

- In April 2024, the phase 2 AVC Veterinary Teaching Hospital expansion project was launched by Atlantic Veterinary College (AVC).

Veterinary Imaging Market Companies

- IMV Imaging

- Shenzhen Mindray Animal Medical Technology, Co., Ltd.

- Canon Medical Systems Corporation

- Hallmarq Veterinary Imaging

- FUJIFOLD Holdings America Corporation

- Midmark Corporation

- GE Healthcare

- Mars, Inc.

- ESAOTE SPA

- IDEXX Laboratories

- Epica International Inc.

- Carestream Health

- BCF

- Agfa-Gevaert Group

- Reproscan

- SonoScape Medical Corp.

- MinXray, Inc.

- DRAMINSKI S.A.

- Siemens Healthcare Limited

- Hitachi Healthcare Americas

- General Electric Company

- Bruker

Recent Developments

- In July 2023, a new handheld, wireless ultrasound for point of care, high-quality imaging applications named ‘PocketPro H2' was launched by Konica Minolta Healthcare Americas, Inc. for human and veterinary applications with a new level of affordability and flexibility in ultrasound.

- In November 2023, in the UK, a complete veterinary diagnostic offered with a novel state-of-the-art reference laboratory, software, imaging, and in-house diagnostics was launched by the full veterinary diagnostics service as part of the Science and Diagnostics Divisions of Mars Pet Care, Antech.

- In May 2024, Esaote Group specialized in developing medical imaging systems like MRI and ultrasound machines and other healthcare technologies. A new ultrasound system named ‘MyLabFOX' with an adaptable and multifaceted scanning solution for veterinary imaging was launched by Esaote North America.

Segments Covered in the Report

By Product

- X-ray

- Ultrasound

- MRI

- CT Imaging

- Video Endoscopy

By Solutions

- Equipment

- Accessories/Consumables

- PACS

By Animal Type

- Small Animals

- Large Animals

By Application

- Orthopedics And Traumatology

- Neurology

- Respiratory

- Cardiology

- Dental Application

- Others

By End-use

- Veterinary Hospitals & Clinics

- Other

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting