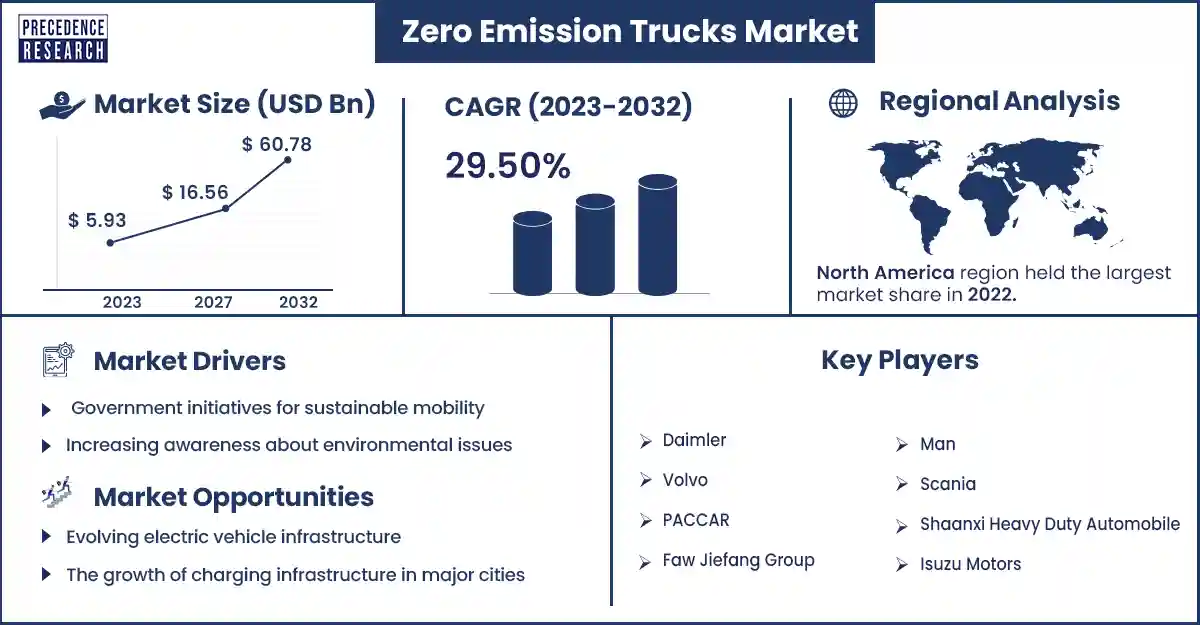

Zero Emission Trucks Market Size to Rise USD 60.78 Bn By 2032

The global zero emission trucks market size surpassed USD 5.93 billion in 2023 and is expected to rise around USD 60.78 billion by 2032, expanding at a CAGR of 29.50% during the forecast period from 2023 to 2032. The zero emission trucks market is observed to expand in the upcoming years with evident government support in order to curb environmental concerns across the globe. Alongside, the expansion of logistics and transportation businesses is observed to fuel the market’s expansion.

Market Overview

The zero emission trucks market is a subcategory of the automotive industry involved in the production, commercialization, and maintenance of trucks and other similar vehicles that utilize non-traditional energy sources. These vehicles may be powered via electricity, hydrogen fuel cells, etc., that do not release exhaust gas or other pollutants in the form of tailpipe emissions. The automotive sector is a major contributor to pollution, especially air, due to the partial burning of the onboard source in fossil fuel-powered vehicles. These growing environmental concerns largely promote the adoption of these electric trucks and fuel cell trucks.

Penetration of Novel Technologies to Fuel the Market’s Growth

The global zero emission trucks market is observed to grow with the emergence of technologies. Transportation-enhancing technologies are a good indicator of the status of its niche market. Novel ideas and developments of crucial technologies such as GPS, AI and automation, radar sensing, and laser instrumentation are an important part of the growth of the zero-emission truck market. Furthermore, the adoption of computer-controlled technologies has been able to boost the development of these technologies, further developing the market.

However, the expenditure involved in the manufacturing process is observed to act as a major hindering factor for the market. Establishing a robust charging or refuelling infrastructure for zero-emission trucks requires a substantial initial investment. Governments, private companies, or a combination of both are often required to invest heavily in developing the necessary infrastructure, which can strain budgets and financial resources. Obtaining the necessary permits and complying with regulatory requirements for the installation of charging or refueling infrastructure can be a time-consuming and complex process. This can result in delays and increased costs associated with navigating regulatory landscapes.

Zero Emission Trucks Market Report Scope

| Report Coverage | Details |

| Market Revenue in 2023 | USD 5.93 Billion |

| Projected Forecast Revenue by 2032 | USD 60.78 Billion |

| Growth Rate from 2023 to 2032 | CAGR of 29.50% |

| Largest Market | North America |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Top Companies in the Zero Emission Trucks Market

- Daimler

- Volvo

- PACCAR

- Faw Jiefang Group

- Ashok Leyland

- Scania

- Shaanxi Heavy Duty Automobile

- Isuzu Motors

Recent Development by Ashok Leyland

- Ashok Leyland declared in June 2023 that the light commercial vehicle (LCV) plant at its Hosur production complex will be the site of production for its upcoming electric compact trucks. The Hinduja brand has previously announced that it will be launching two new electric small trucks, the electric Dost and the electric Bada Dost, as part of its bigger goals to grow the LCV volumes through new product rollouts.

Regional Insights

According to market analysis, Asia Pacific holds the fastest-growing zero emission trucks market. This is supported by rapid product launches and the expansion of local companies' services into the global market. For instance, the China-based Zhejiang Geely Holding Group is responsible for releasing the nation's first ever zero emission truck, RD6 EV, into the international market. Similarly, other countries are rapidly expanding their services to maintain their presence in the competitive market landscape as well as meet their sustainability goals. Asian coutries such as Japan, Korea, and China are rapidly engaging in initiatives to support the development of hydrogen refueling station.

- BYD Auto Co., Ltd., a subsidiary of the Chinese multinational, BYD is a key market player in the Chinese zero emission trucks market. According to external sources, the net earnings of the automobile giants' second quarter of 2023 were estimated to be over 10 billion yuan. This was 204.7% higher than the same quarter of the previous year of 3.6 billion yuan.

- Isuzu Motors Ltd. is a Japanese multinational automobile manufacturer. Also known as Isuzu, the company is determined to change the face of the commercial truck industry with the addition of electric units and related technologies. Isuzu sales for the first half of the 2023 financial year were 1,638.0 billion yen. This is 10% more than 1,493.3 billion yen for the same period of the previous year.

North America dominated the global zero emission trucks market in 2023. This is mainly due to lucrative business opportunities emerging in light of various state policies. Some notable projects involve the United States Postal Service Advanced-Drive Transport, Frito-Lay Zero- and Near-Zero Emission Project, and Delivery Vehicle Demonstration and The Green On-Road Linen Delivery Project by the San Joaquin Valley Air Pollution Control District.

- The California Air Resources Board (CARB) invested $4,555,670, $1,5,382,243, and $7,125,515 in these projects, respectively. The NorCAL Zero-Emission Regional and Drayage Operations with Fuel Cell Electric Trucks by the Center for Transportation and the Environment in Port of Oakland received $11,979,914 and are a major factor affecting the battery electric truck segment of the market.

Within North America, Canada has shown notable growth in the market. This surge in demand for electric trucks can be easily attributed to advanced technology utilizing various electronic components for various functions. Moreover, numerous companies are adopting strategies such as partnerships and collaborations to strengthen their market position. Aside from the business perspective, the nation's zero emission market growth can be attributed to environmental concerns.

Canada's transportation sector contributes towards 22% of its greenhouse gas emissions. The government's overall plan is to combat this climate challenge through regulatory mandates. According to an external source, Canada aims to make all passenger cars, SUVs, crossovers and light trucks sold by 2035 zero-emission vehicles.

Market Potential and Growth Opportunity

Evolving electric vehicle infrastructure

The growth of charging infrastructure in major cities worldwide opens lucrative opportunities for businesses to participate in the market's growth. Local companies, along with several automotive giants, will capitalize on government funding and grants and simultaneously grow their market presence while developing the smart city infrastructure. Companies often bid on contract segments for public charging ports and service centers. This evolution supports the expansion of heavy-duty electronic vehicle transportation systems.

Zero Emission Trucks Market News

- In February 2022, China-based BYD Auto Ltd. launched its BYD 8TT. This automobile model offers outputs of 483 horsepower, a top speed of 74 miles/hr, and 422 kWh of battery mileage. BYD 8TT found its niche in logistics for several client companies.

- In June 2023, Air Liquide and Iveco Group collaborated to establish high-pressure hydrogen refueling stations for long-haul trucks in the European region. The station built in several cities is a major advancement toward encouraging hydrogen-powered long-distance transportation in the region.

Market Segmentation

By Vehicle Type

- Electric Light-Duty Trucks

- Electric Medium-Duty Trucks

- Electric Heavy-Duty Trucks

By Source

- Battery Electric Trucks (BEVs)

- Hydrogen Fuel Cell Electric Trucks

- Hybrid Electric Trucks

By Application

- Last Mile Delivery

- Logistics and Transportation

- Construction

- Waste Management

Buy this Research Report@ https://www.precedenceresearch.com/checkout/3653

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 650 460 3308