What is the Pyrogel Insulation Market Size?

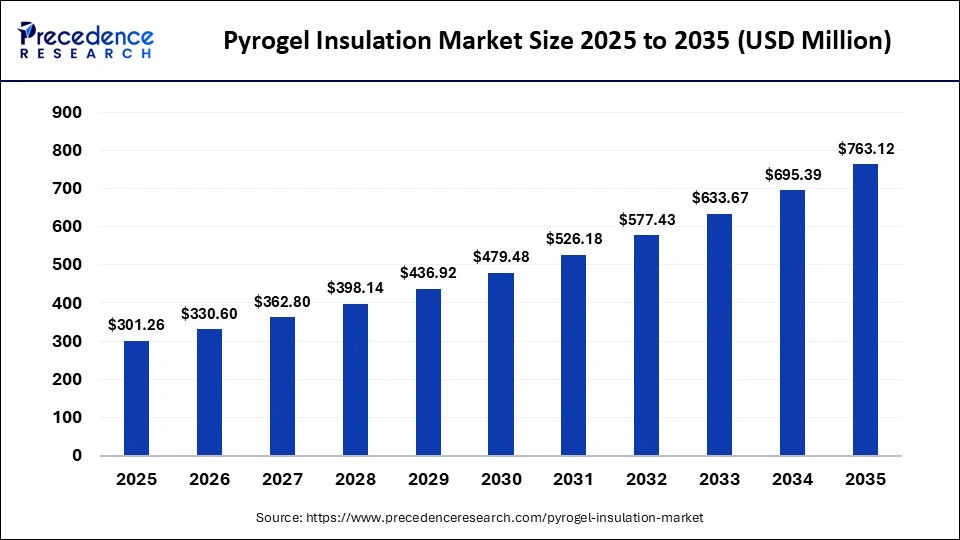

The global pyrogel insulation market size accounted for USD 301.26 million in 2025 and is predicted to increase from USD 330.60 million in 2026 to approximately USD 763.12 million by 2035, expanding at a CAGR of 9.74% from 2026 to 2035. The growth of the pyrogel insulation market is driven by rising demand for energy-efficient and fire resistance materials from the oil & gas, power, and automotive industries.

Market Highlights

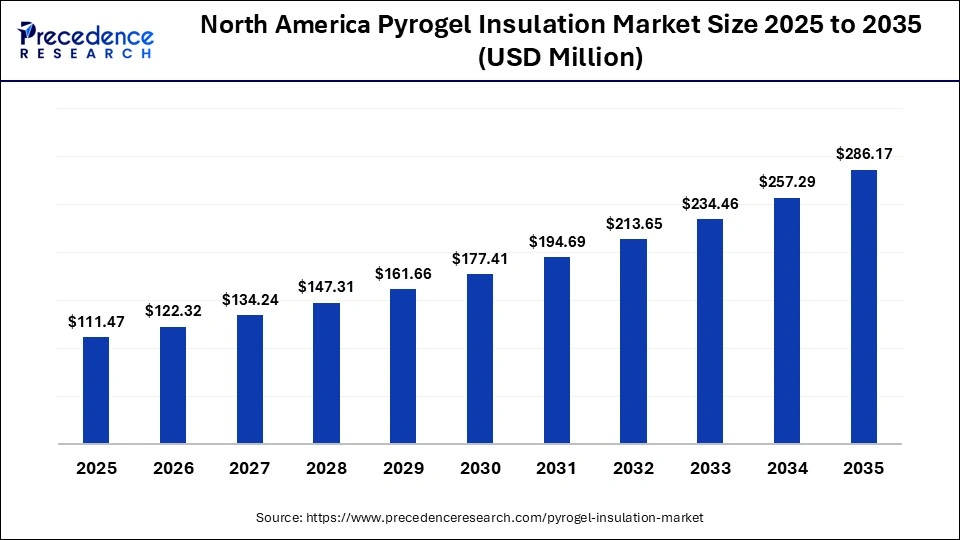

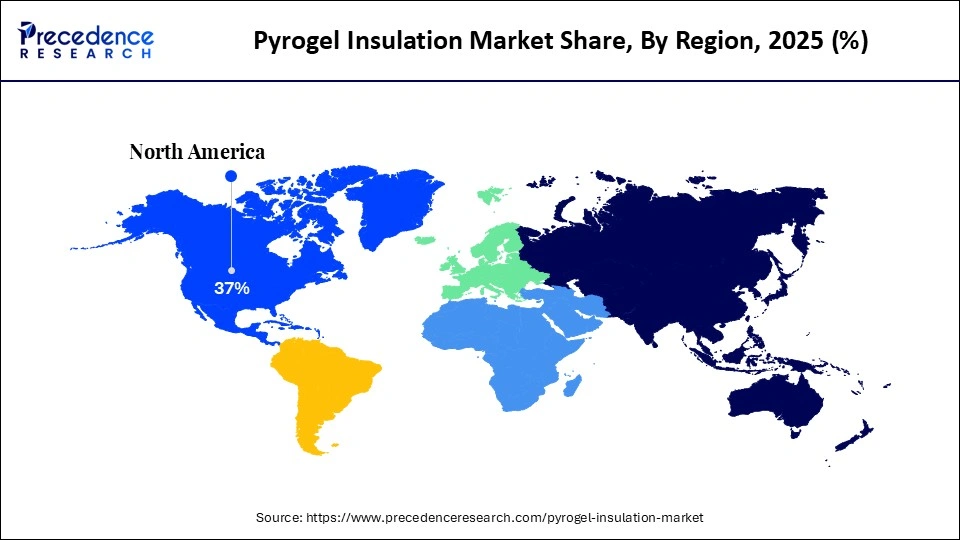

- North America accounted for the largest share of 37% in 2025.

- Asia Pacific is expected to grow at the fastest CAGR from 2026 to 2035.

- By product type, the pyroogel XT/XTE segment contributed a significant market share in 2025.

- By product type, the Pyrogel XTF (fire protection) segment is growing at a considerable CAGR from 2026 to 2035.

- By material composition, the silica-based aerogel segment held a major share of the market in 2025.

- By material composition, the polymer-modified aerogel segment is growing at a significant CAGR from 2026 to 2035.

- By form, the blankets segment captured the largest share of the market in 2025.

- By form, the preformed shapes segment is expected to grow at a fastest CAGR from 2026 to 2035.

- By application, the pipe insulation segment generated the biggest market share in 2025.

- By application, the passive fire protection segment is expanding at a considerable CAGR from 2026 to 2035.

- By end-use industry, the oil & gas segment captured the highest market share in 2025.

- By end-use industry, the building & construction segment is growing at a considerable CAGR from 2026 to 2035.

- By distribution channel, the direct sales segment held a major share in 2025.

- By distribution channel, the online sales segment is poised to grow at a considerable CAGR from 2026 to 2035.

Market Overview

The pyrogel insulation market refers to the industry focused on high-performance, silica aerogel-based flexible blanket insulation materials known for exceptional thermal performance, minimal thickness, and low weight. Pyrogel products, developed primarily using patented aerogel technology, are widely used in oil & gas, petrochemical, power generation, industrial processing, construction, and transportation sectors for their ability to reduce energy loss, enhance personnel protection, and withstand high temperatures.

Pyrogel insulation is especially valued in applications where space, weight, and thermal efficiency are critical. It often replaces conventional insulation such as mineral wool, calcium silicate, and fiberglass. The Pyrogel insulation market is booming due to rapid industrialization, stricter energy standards, and the need for advanced thermal insulation. Pyrogel, known for its excellent thermal resistance, low mass, and minimal profile, is ideal for industries like oil & gas, power generation, marine, and construction.

How is AI Integration Shaping the Pyrogel Insulation Market?

Artificial intelligence is enhancing product development, process optimization, and predictive maintenance in the pyrogel insulation market. Machine learning and data analysis streamline design and thermal efficiency, boosting efficiency and reducing waste. AI simulations also help in creating application-specific products, cutting down testing time and costs. This technological advancement improves operations, enhances energy management, and supports smarter decision-making, thereby increasing the adoption of pyrogel insulation across various demanding sectors. Overall, AI can optimize the complex manufacturing processes of pyrogel, improving efficiency, reducing waste, and lowering production costs.

What Factors are Boosting the Growth of the Pyrogel Insulation Market?

- Industrial Growth: The demand for efficient thermal insulation in oil & gas, power generation, and construction industries is rising due to rapid industrialization. Pyrogel, due to its thermal resistance and strength, is the perfect insulator to protect the equipment and prevent energy losses.

- Environmental Regulations: Stringent regulations to reduce carbon intensity and boost energy use propel the demand for pyrogel, as it helps companies meet environmental standards and promotes sustainability.

- Extreme Conditions Applications: Industries operating in extreme temperatures, such as offshore rigs, chemical plants, and power plants, require robust insulation solutions. Due to its moisture resistance, high durability, and high thermal performance in the harsh environments, pyrogel is well-suited for applications exposed to harsh environments, ensuring efficient performance and protection in challenging conditions.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 301.26 Million |

| Market Size in 2026 | USD 330.60 Million |

| Market Size by 2035 | USD 763.12 Million |

| Market Growth Rate from 2026 to 2035 | CAGR of 9.74% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Product Type, Material Composition, Form, Application, End-Use Industry, Distribution Channel, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Increased Demand for Lightweight Insulation Products

A major factor driving the growth of the market is the rising demand for lightweight insulation materials, especially in offshore oil & gas, marine, construction, and power generation industries, where space and weight are critical. Conventional insulation materials, such as mineral wool and calcium silicate, are bulky, making them unsuitable for applications in ships, offshore platforms, and buildings. Pyrogel, a silica aerogel-based insulation, offers excellent thermal resistance with minimal thickness and mass.

It can be compressed and bent to fit into tight spots while maintaining performance. Pyrogel's ultralightweight nature and high insulation capabilities have made it popular, making it the preferred choice in applications with limited space and high-performance demands, leading to its widespread use in new designs and retrofits across various industries. The rising demand from industries like oil & gas, petrochemicals, and construction drives market growth. These industries require high-performance insulation for pipelines, equipment, and buildings.

Restraint

High Production Costs and Complex Manufacturing Processes

The high cost and complex production of aerogel-based materials are major factors restraing the growth of the pyrogel insulation market. The manufacturing process for aerogels is complex and energy-intensive, which can impact production costs and availability. Unlike conventional materials like fiberglass, mineral wool, or EPS, aerogel production requires advanced, energy-intensive methods, supercritical drying process, specific chemicals, and precision equipment, which increases manufacturing costs. The need for controlled environments and raw material supply also adds to the expense. This makes pyrogel insulation relatively expensive, limiting its adoption, especially in cost-sensitive markets.

Opportunity

Sustainability Trend

The pyrogel insulation market has a substantial opportunity driven by the increasing global emphasis on sustainability and the need to adhere to environmental, social, and governance (ESG) standards. Its exceptional thermal efficiency plays a crucial role in reducing energy waste, thereby supporting decarbonization initiatives. Furthermore, pyrogel's long service life, reusability, and lower operational energy demands are well-aligned with corporate sustainability goals. It also contributes to achieving LEED credits and green building codes. Governments and corporations are actively implementing policies geared towards net-zero emissions and energy-efficient infrastructure, which is significantly boosting the demand for advanced insulation systems.

Segment Insights

Product Type Insights

Why Did the Pyrogel XT/XTE Segment Hold the Largest Share in 2025?

The pyrogel XT/XTE segment dominated the pyrogel insulation market with the largest revenue share in 2025. This is because of their extensive application in energy-intensive sectors like oil & gas, power generation, and petrochemicals. These products boast excellent thermal insulation properties, with a thin and lightweight profile. Pyrogel XT is well-suited for static systems, while XTE is designed for dynamic systems, offering simpler installation and handling. They are also moisture-resistant and can endure harsh working conditions, making them highly suitable for industrial applications.

The pyrogel XTF (fire protection) segment is expected to grow at the fastest CAGR over the forecast period. Pyrogel XTF is specifically engineered for passive fire protection, retaining the key benefits of aerogel insulations (low thermal conductivity, moisture resistance, and a thinner, lightweight profile). It is widely used in oil and gas, chemical processing, and industrial infrastructure. The material offers high fire resistance, extending heat transfer during a fire, thus enhancing the safety of critical equipment and personnel. The flexible design of pyrogel XTF allows for easy installation in complex and tight spaces, making it suitable for retrofitting and new constructions.

Material Composition Insights

What Made Silica-Based Aerogel the Dominant Segment in the Pyrogel Insulation Market in 2025?

The silica-based aerogel segment dominated the market with the largest share in 2025. This is primarily due to the exceptional thermal insulation capabilities, ultralow thermal conductivity, and the lightweight nature of silica aerogels. In addition to these properties, silica aerogels are highly fire-resistant, hydrophobic, and exhibit remarkable tolerance to extreme environmental conditions, making them suitable for high-performance applications. Industries like oil & gas, power generation, marine, construction, and aerospace heavily use these materials in various applications where efficient heat management is crucial.

The polymer-modified aerogel segment is expected to grow at the highest CAGR in the coming years. These superior materials provide the excellent thermal insulation of conventional aerogels, combined with the increased mechanical strength and flexibility of pure-silica-based aerogels. Polymer-modified aerogels are particularly appealing in applications where the insulation material must withstand mechanical loads, vibration, or regular handling. Their enhanced toughness and strength extend to transportation, building insulation, wearable technology, and industries where adaptability and durability are crucial.

Form Insights

How Does the Blankets Segment Lead the Pyrogel Insulation Market in 2025?

The blankets segment led the market for pyrogel insulation while holding the largest revenue share in 2025. Pyrogel blankets are easy to install, lightweight, and flexible, making them suitable for wrapping around complex equipment structures like pipes, tanks, and vessels. They are made by Impregnating silica aerogel into fiber and then reinforcing them into mats. The blankets perform exceptionally well in preventing thermal energy transfer. They conform to irregular surfaces, which, combined with moisture resistance and long-term reliability, enhance system reliability and reduce the risk of issues like corrosion under insulation (CUI).

The preformed shapes segment is expected to grow at a significant CAGR over the forecast period. PTFE preformed pyrogel components ensure a snug fit, increasing installation convenience and optimizing thermal performance by minimizing seams and avoiding heat bridges. The reduction in downtimes and enhanced system efficiency, along with growing energy conservation standards, are driving the demand for performed shapes. They are also moisture-resistant and durable, making them reliable for use in rugged environments like offshore platforms and chemical plants.

Application Insights

Why Did the Pipe Insulation Segment Dominate the Market in 2025?

The pipe insulation segment dominated the pyrogel insulation market with the largest revenue share in 2025. This is mainly due to increased demand from industries like oil & gas, petrochemicals, and construction. These industries require high-performance insulation for pipelines. Due to high thermal efficiency, light weight, and thin structure, pyrogel is an excellent choice for insulating pipes in harsh environments such as the oil and gas, power generation, chemical process, and manufacturing industries. Its performance in delivering insulation value with minimal space and weight is especially important for complex piping systems on offshore platforms and in refineries.

The increased efficiency, safety, and system optimization, along with improved high-performance pipe insulation, bolstered segmental growth. As industries focus on maximizing thermal efficiency to achieve energy conservation goals and carbon reduction, the demand for high-performance insulation materials will increase. Due to its positive impact on energy conservation and operational efficiency, pyrogel is the ultimate choice, ensuring the continued growth of the segment.

The passive fire protection segment is expected to grow at a rapid pace in the market. Fire-protective insulations, like pyrogel XTF Insulation, offer thermal insulation and fire resistance, thus offering necessary protection in hazardous areas such as oil and gas refineries, chemical process facilities, and transportation infrastructure. These materials can delay the speed of fire spread by retarding heat movement, providing crucial time for evacuation and system shutdown. Due to the increasing regulatory standards regarding fire safety globally and the need for industries to enhance structural safety, the consumption of passive fire protection materials is growing.

Pyrogel insulation products developed for fire temperature, including Pyrogel XTF, combining superior thermal insulation with advanced fire-retardant features. The materials are designed to provide essential fire safety to dangerous areas such as oil refineries, offshore platforms, chemical facilities, and commercial structures.

End-Use Industry Insights

How Does the Oil & Gas Segment Contribute the Most Revenue Share in 2025?

The oil & gas segment contributed the most revenue share in 2025. The segment's dominance stems from the expanding pipe network, along with the increased demand for insulating materials that achieve high levels of thermal resistance, moisture resistance, and longevity. Moreover, pyrogel insulation is easy to install and reusable, contributing to its low implementation cost. With more oil & gas firms focusing on optimizing operational efficiency, safety levels, and carbon emission reduction, pyrogel will continue to attract those who need to insulate the oil and gas pipeline.

The building & construction segment is expected to grow at the fastest CAGR in the upcoming. The growth of the segment is attributed to the increasing demand for energy-efficient and sustainable construction materials. As the world starts to take notice of global warming and the restrictions placed upon the consumption of energy, developers and architects are exploring the benefits of the highly efficient insulation technology to increase the performance of the building. It also helps with green building certifications, including LEED, in improving energy efficiency and cutting the expenses on heating and cooling. Rising government investments in smart city projects and the rapid infrastructure development further support segmental growth.

Distribution Channel Insights

Why Did the Direct Sales Segment Dominate the Market in 2025?

The direct sales segment dominated the pyrogel insulation market in 2025. Direct sales are key for distributing products to major clients in oil & gas, power generation, marine, and construction. This approach fosters strong relationships, offers customized solutions, and provides technical support throughout the project lifecycle. As demand for high-performance insulation grows, direct sales are likely to be the most effective distribution method, especially in developing regions with stringent operational needs.

The online sales segment is expected to grow at the highest CAGR over the studied period. Digital platforms and e-commerce are increasingly influencing the purchase of standardized insulation products. Online sales minimize the need for physical intermediaries and automate the ordering process. This appeals to small contractors, distributors, and end-users seeking quick solutions. As digital procurement and remote project management become more common, the online sales segment is expected to expand significantly.

Region Insights

How Big is the North America Pyrogel Insulation Market Size?

The North America pyrogel insulation market size is estimated at USD 111.47 million in 2025 and is projected to reach approximately USD 286.17 million by 2035, with a 9.89% CAGR from 2026 to 2035.

What Made North America the Dominant Area in the Pyrogel Insulation Market?

North America dominated the global market with the highest market in 2025. This dominance is attributed to the early and widespread use of high-technology insulation materials across major industries, including oil and gas, construction, aerospace, and power generation. The region's developed industries, rapid transformation, and increasing investments in energy-saving plants, along with its large manufacturing plants and research and development centers, have also contributed to this market leadership. Moreover, stringent regulations regarding energy efficiency and safety standards boosted the demand for high-performance insulation solutions like pyrogel.

What is the Size of the U.S. Pyrogel Insulation Market?

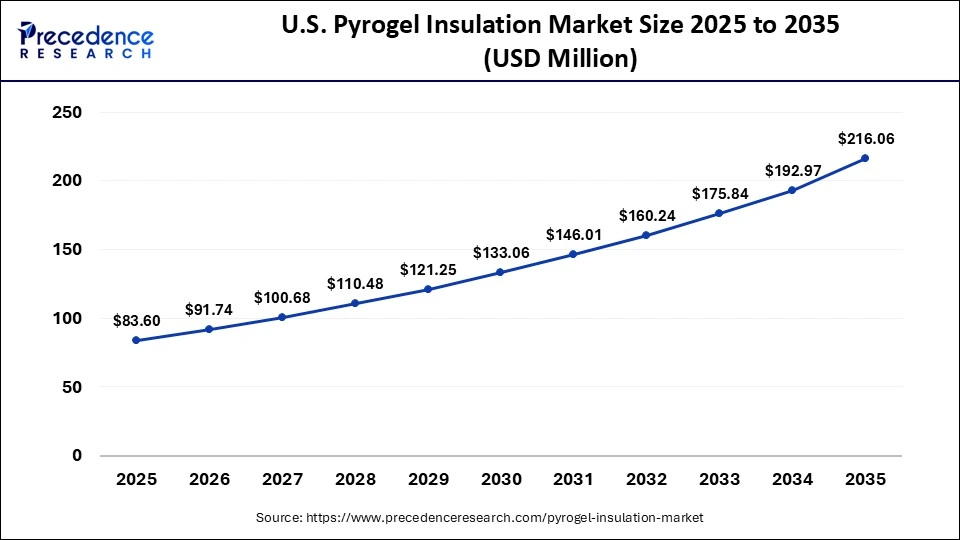

The U.S. pyrogel insulation market size is calculated at USD 83.60 million in 2025 and is expected to reach nearly USD 216.06 million in 2035, accelerating at a strong CAGR of 9.96% between 2026 and 2035.

U.S. Pyrogel Insulation Market Analysis

The U.S. is a major contributor to the market due to the growing awareness regarding energy sustainability and stricter regulatory demands. There is high adoption of energy-efficient solutions to meet federal policies, such as the Energy Policy Act, and comply with state building energy codes. The U.S.'s leadership in sustainable construction and industrial advancements indicates that the demand for high-efficiency insulation, like pyrogel, will likely continue to rise, further supporting market growth.

Why is Asia Pacific Experiencing the Fastest Growth in the Pyrogel Insulation Market?

Asia Pacific is expected to experience the fastest growth during the forecast period, driven by rising demand for energy-efficient insulation in various industries. The construction industry's growth, alongside increased industrialization and infrastructure modernization is boosting the adoption of advanced thermal insulation solutions. Governments around the region are prioritizing sustainability, energy efficiency, and carbon footprint reduction through policies and incentives, boosting the acceptance of insulation materials.

China is a major player in the pyrogel insulation market within the Asia Pacific region. The country's rapid urbanization and industrialization impact both construction and energy sectors. Furthermore, rising investments in green construction and technological innovations are boosting the potential of pyrogel insulation. Massive infrastructure projects, including new power plants, refineries, and construction of buildings, boost the need for insulation materials.

What are the Major Factors Boosting Growth of the the European Pyrogel Insulation Market?

Europe is expected to witness a notable growth in the coming years. This is driven by the increasing need for energy-efficient materials and strict regulations promoting sustainable materials and low carbon emissions. Pyrogel's ultra-thin profile, low thermal conductivity, and non-hazardous nature make it safe for use in building repairs and retrofits. European Union guidelines, including the Energy Performance of Buildings Directive (EPBD) and the Green Deal, are promoting new insulation technologies. Furthermore, government incentives for green renovations and the push for decarbonized infrastructure are driving demand for pyrogel.

The U.K. is a key player in the European market, given its focus on energy saving, climate goals, and building efficiency. A target to drastically reduce carbon emissions by 2050 has increased the prominence of green buildings and energy-efficient materials in all U.K. constructions. With government support for decarbonization and city redevelopment, the demand for innovative construction materials like pyrogel insulation is set to rise.

Pyrogel Insulation Market Companies

- Aspen Aerogels, Inc.

- Cabot Corporation

- Armacell International S.A.

- Nano Tech Co., Ltd.

- BASF SE

- 3M Company

- Owens Corning

- Johns Manville Corporation

- Aerogel Technologies, LLC

- JIOS Aerogel Limited

- Enersens SAS

- Guangdong Alison Hi-Tech Co., Ltd.

- Green Earth Aerogel Technologies AB

- The Dow Chemical Company

- Morgan Advanced Materials

- Puyang Huicheng Electronic Material Co., Ltd.

- Insulcon Group

- NICHIAS Corporation

- Thermablok Aerogel

- Svenska Aerogel AB

Recent Developments

- In September 2025, Armacell, a worldwide provider of flexible foam and engineered insulation materials, declared the accelerated introduction of a new advanced aerogel technology. With the rapid growth of its aerogel-based ArmaGel product range, Armacell will enhance its supply security and market dominance in the high-performance insulation market segment.(Source: https://www.armacell.com)

- In June 2023, Aspen Aerogels opened its 59,000-square-foot (6,000 m 2) Advanced Thermal Barrier Center (ATBC), an expansion of its manufacturing plant in Marlborough, Massachusetts. The launch of ATBC will have a considerable effect on the pyrogel insulation as the technology of next-generation aerogels will grow rapidly, particularly regarding electrification and thermal management of new industries.(Source: https://ir.aerogel.com)

Segments Covered in the Report

By Product Type

- Pyrogel XT

- Pyrogel XTE

- Pyrogel HPS

- Pyrogel XTF

- Other Custom Formulations

By Material Composition

- Silica-Based Aerogel

- Polymer-Modified Aerogel

- Fiber-Reinforced Aerogel

By Form

- Rolls

- Blankets

- Panels

- Preformed Shapes

By Application

- Pipe Insulation

- Equipment Insulation

- Tank & Vessel Insulation

- Duct & HVAC Insulation

- Passive Fire Protection

- Subsea Insulation

By End-Use Industry

- Oil & Gas

- Power Generation (Thermal, Nuclear, Renewables)

- Petrochemical & Refineries

- Industrial Processing (Cement, Steel, Food)

- Building & Construction

- Transportation (Rail, Marine, Aerospace)

By Distribution Channel

- Direct Sales

- Distributors & Channel Partners

- Online Sales

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting