What is the Rail Logistics Market Size?

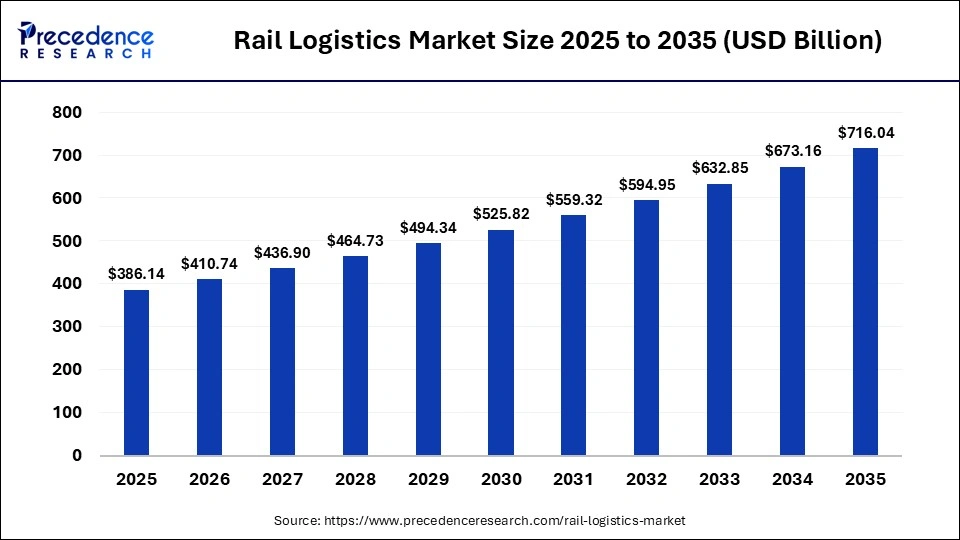

The global rail logistics market size accounted for USD 386.14 billion in 2025 and is predicted to increase from USD 410.74 billion in 2026 to approximately USD 716.04 billion by 2035, expanding at a CAGR of 6.37% from 2026 to 2035. The rail logistics market is experiencing unprecedented growth, fueled by the rapid expansion of e-commerce, increasing industrial development, and the rise in cross-border trade.

Market Highlights

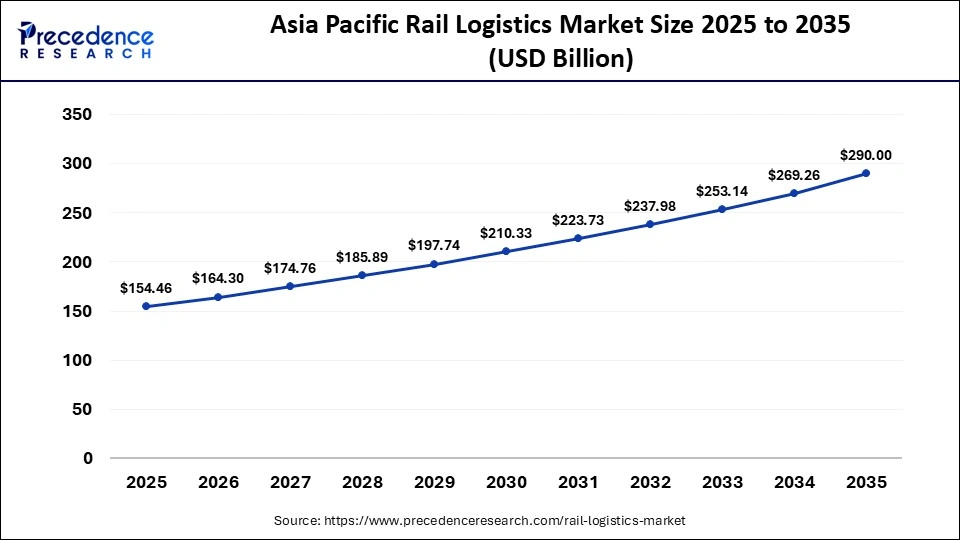

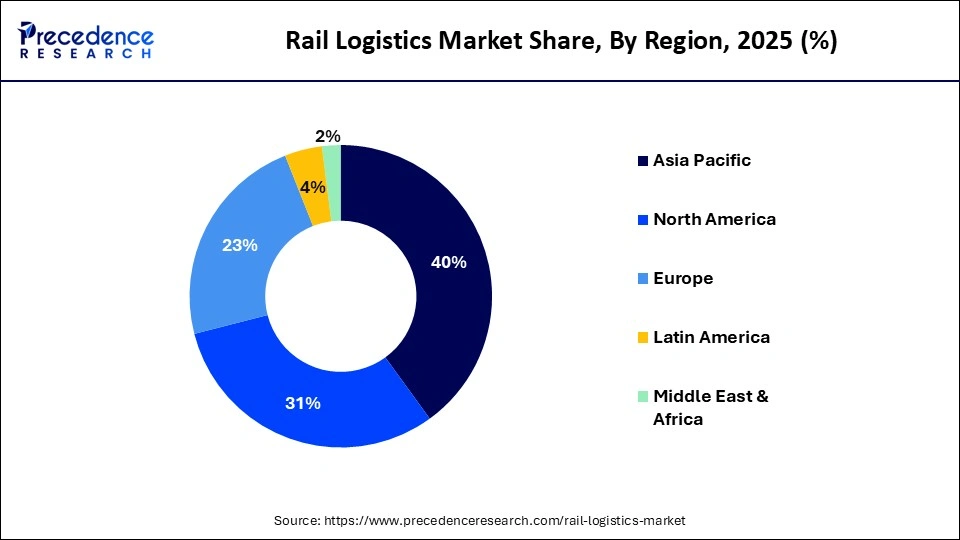

- Asia-Pacific dominated the market, holding the largest market share of approximately 40% in 2025 and is expected to grow at the fastest CAGR of 6.5% during 2026-2035.

- North America is expected to expand at a significant rate in the rail logistics market between 2026 and 2035.

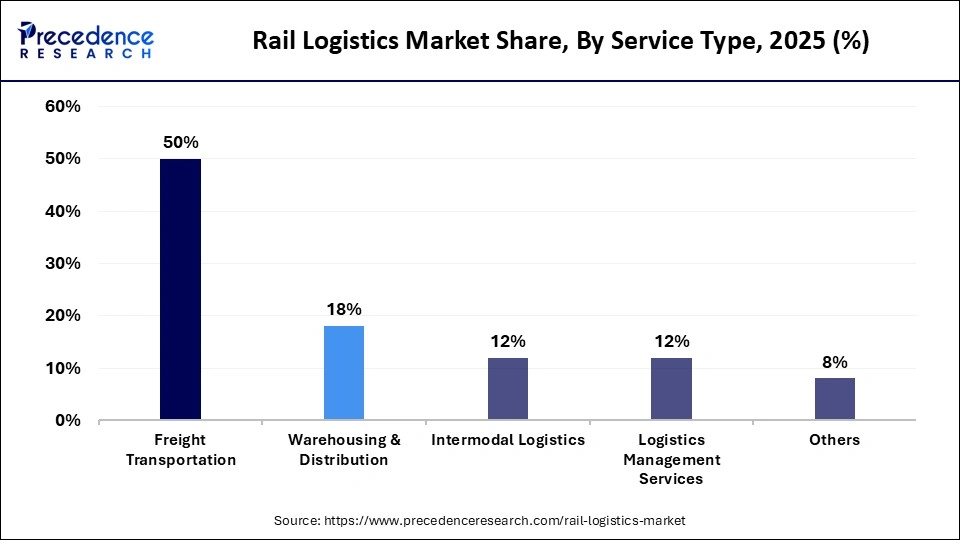

- By service type, the freight transportation segment held the largest market share of approximately 50% in 2025.

- By service type, the warehousing & distribution services segment is expected to grow at a remarkable CAGR of 5.7% between 2026 and 2035.

- By cargo type, the bulk cargo segment held the largest share of approximately 38% in the rail logistics market during 2025.

- By cargo type, the containers segment is set to grow at the fastest CAGR of 5.5% between 2026 and 2035.

- By end-use industry, the manufacturing segment held the largest market share of approximately 31% in 2025.

- By end-use industry, the retail & e-commerce segment is expected to experience a remarkable growth of 5.6% CAGR between 2026 and 2035.

What Comes under the Rail Logistics Market?

The rail logistics market encompasses freight and cargo transportation services utilizing rail networks, including freight haulage, intermodal solutions, warehousing, and logistics management integrated with rail operations. It supports the movement of bulk commodities, containers, liquids, and other goods across domestic and cross-border routes. Rail logistics are safe and less prone to adverse weather conditions while traveling over long distances. Rail logistics plays a key role in supply chains by linking production, storage hubs, and ports, while reducing carbon emissions compared to road transport.

How is AI impacting the growth of the rail logistics market?

In today's interconnected world, the integration of Artificial Intelligence (AI) represents a transformative force and is accelerating the growth of the rail logistics market through predictive maintenance, route optimization, and real-time visibility, and automating operations. AI contributes to sustainability by optimizing energy consumption and lowering the carbon footprint of rail transport. AI is making rail logistics reduce delays, minimizing human error, and improving operational efficiency, which leads to better resource allocation and enhances customer satisfaction. AI agents are rapidly transforming rail logistics by providing advanced capabilities for infrastructure management and automation deployment.

These systems enhance market efficiency through optimized resource allocation, enhanced deployment processes, and predictive maintenance capabilities. AI-embedded logistics applications assist in demand forecasting to predict issues that might delay the delivery of finished products. The demand forecasting applications allow logistics managers to prioritize the delivery of products that are likely to have a significant impact on customer satisfaction.

What are the Emerging Trends in the Rail Logistics Market?

- The rapid expansion of global trade and the rapid growth of e-commerce have significantly increased demand for rail logistics as reliable, cost-effective, and high-volume logistics solutions.

- The growing demand for cost-efficient, secure, and bulk transportation solutions in emerging economies is anticipated to promote the market's growth during the forecast period.

- The rising need for long-distance transport for bulk goods to distribution hubs and the growing need for efficient intermodal solutions (rail and road) for last-mile delivery are anticipated to accelerate the growth of the rail logistics market during the forecast period.

- The rapid technology integration, such as AI, automation, and IoT for real-time tracking and route optimization, is bolstering the growth of the rail logistics market during the forecast period.

- The increasing government investment in several countries to upgrade rail infrastructure is expected to create significant growth opportunities for the rail logistics market during the forecast period.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 386.14 Billion |

| Market Size in 2026 | USD 410.74 Billion |

| Market Size by 2035 | USD 716.04 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 6.37% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Service Type, Cargo Type, End-Use Industry, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segmental Insights

Service Type Insights

What caused the Freight Transportation Segment to Dominate the Rail Logistics Market in 2025?

Freight Transportation

The freight transportation segment held the largest market share of approximately 50% in 2025. Freight transportation remains the dominant category in the market, owing to various benefits such as its cost-effectiveness for long-distance shipping, high volume handling capabilities, and higher fuel economy than roadways. It is most widely utilized across various sectors such as mining, agriculture, manufacturing, and others. Rail is significantly more energy-efficient and produces fewer emissions than road transport to meet sustainability goals.

Warehousing & Distribution Services

On the other hand, the warehousing & distribution services segment is expected to grow at a remarkable CAGR of 5.7% between 2026 and 2035. The growth of the segment is primarily driven by the rise in global e-commerce growth, growing demand for integrated supply chain solutions, and adoption of advanced technologies like the internet of things (IoT), artificial intelligence (AI), and warehouse management systems (WMS). Warehouses and distribution centers located near rail corridors act as vital hubs, allowing for smooth integration between long-distance rail transport and last-mile road delivery. Warehousing and distribution centers are crucial hubs to meet consumer expectations for fast delivery. Warehousing allows businesses to efficiently manage inventory, synchronize supply with demand, and maintain enough stock to handle seasonal fluctuations or supply chain disruptions.

Cargo Type Insight

Which Cargo Type Segment Dominated the Rail Logistics Market in 2025?

Bulk Cargo

The bulk cargo segment is dominating the rail logistics market by holding a majority share of approximately 38%. The dominance of the bulk cargo segment in rail logistics is supported by its cost-effectiveness, energy efficiency, and high carrying capacity for moving large volumes of raw materials over long distances. Bulk cargo primarily deals with unpackaged and high-tonnage commodities such as coal, iron ore, grains (wheat, corn, rice), construction materials, oil, and others. The transportation of bulk cargo involves various legal and regulatory considerations, such as contracts, insurance, and liability. These regulations are designed to prevent accidents and protect the environment, as well as crucial for the smooth operation of the rail logistics industry.

Containers

On the other hand, the containers segment is set to grow at the fastest CAGR of 5.5% between 2026 and 2035, owing to its due to its efficiency, versatility, reliability, and flexibility. Standardized containers allow for seamless intermodal transport. These containers can be transferred between different transportation modes without the need for unloading and reloading the cargo itself, which leads to streamlining the supply chain and reducing handling time and costs. Containers are secure and reduce damage as they are sealed within durable steel containers from the point of origin to the final destination, protecting goods from extreme weather conditions, damage, and theft during transit. Containers facilitate the efficient transport of a vast array of products, such as consumer goods, vehicles, heavy industrial equipment and machinery, electronics, food & agricultural products, chemicals, and oils.

End-use industry Insights

How the Manufacturing Segment Dominated the Market in 2025?

Manufacturing

The manufacturing segment is dominating the rail logistics market with the largest market share of approximately 31% in 2025. Manufacturing heavily relies on rail logistics for moving large volumes of raw materials to factories and finished products to markets. Rail is cheaper, environmentally sustainable, reliable, and more fuel-efficient for transporting goods over long distances compared to trucks, directly benefiting manufacturing industries. Manufacturers often sign long-term contracts for consistent and cost-effective bulk transport of raw materials and finished products, ensuring uninterrupted supply.

Retail & E-Commerce

On the other hand, the retail & e-commerce segment is a rapidly growing segment and is expected to experience remarkable growth of 5.6% between 2026 and 2035. The rapid growth of the retail & e-commerce industry, especially in developed and developing nations, creates substantial demand for moving large quantities of products to distribution hubs, driving growth for efficient and high-capacity rail logistics over long distances. Rail logistics is significantly cheaper for long-haul and high-volume shipments compared to trucking, allowing retailers & e-commerce companies to manage logistics costs effectively. Moreover, the rising technology Integration like AI, IoT, and automation, significantly enhances efficiency, security, and speed, making rail logistics ideal for long-haul distribution to hubs.

Regional Insights

What is the Asia Pacific Rail Logistics Market Size?

The Asia Pacific rail logistics market size is expected to be worth USD 290.00 billion by 2035, increasing from USD 154.46 billion by 2025, growing at a CAGR of 6.50% from 2026 to 2035.

What made Asia Pacific the Dominant Region in the Market?

Asia-Pacific dominates the rail logistics market, holding a market share of approximately 40% in 2025 and is estimated to achieve the fastest CAGR of 6.5% during the forecast period. Countries like China, India, and Japan are leading the rail logistics market in the region. The region's rapid growth of the region is driven by the increasing industrial expansion, rising urbanization, expanding trade flows, growing demand for cost-effective long-distance transport of goods, increasing need for fuel-efficient logistics solutions, and rapid e-commerce growth.

The increasing government investments in rail infrastructure and the development of intermodal terminals facilitate seamless transfers between rail, road, and sea, bolstering the region's growth. The adoption of train logistics has significantly increased among businesses as a sustainable and environmentally friendly transport solution, addressing the concerns of reducing carbon emissions. The rapid technological advancement, such as Artificial Intelligence (AI) and the Internet of Things (IoT), and automation in railway logistics, improves sustainability, security, and productivity. AI-driven predictive maintenance predicts the need for repairs by efficiently evaluating real-time data from trains and their infrastructure, which reduces the risk of accidents and equipment malfunctions.

In November 2025, the Indian Railway Ministry announced its plan to introduce a policy that could potentially transform the landscape of cement transportation in the country. This new initiative aims to allow the construction of cement terminals on unused railway land, a move that may have significant implications for the logistics sector. CONCOR has unveiled new tank containers specifically designed for bulk cement transportation. The railway minister announced this innovation, which is suitable for multi-modal transport operations. This move significantly enhances CONCOR's logistics capabilities in the cement sector.

In July 2025, DP World, the Deendayal Port Authority (DPA), and Nevomo signed a Memorandum of Understanding (MoU) to explore potential opportunities for cooperation in the development and implementation of a pilot project using Nevomo's MagRail proprietary technology for the self-propelled movement of rail-based cargo and freight within the existing port ecosystems.

China's Rail Logistics Market Trends

China leads the rail logistics market. China is a major contributor to the rail logistics market in the Asia Pacific region. The country holds a substantial market share in the rail logistics market. The growth is largely driven by the rapid economic growth, rising expansion of e-commerce, growing demand for integrated, value-added logistics solutions, and increasing need for efficient & high-capacity transport for large volumes. China has built one of the largest high-speed rail networks and an extensive freight rail system, connecting major cities such as Beijing, Shanghai, Guangzhou, Shenzhen, and Chengdu, and remote areas.

China now has the largest rail network in the world, with over 162,000 kilometers of track, including 48,000 km dedicated to high-speed rail. The government is investing heavily to expand and modernize its rail infrastructure, with plans to reach 200,000 km of rail lines by 2035, including 70,000 km of high-speed lines, which makes high-speed trains accessible to cities with more than 500,000 inhabitants. In addition, increasing focus on environmental sustainability and technological integration, especially AI, IoT, and 5G, improves real-time tracking to route optimization, supporting the demands for faster delivery of goods.

The Chinese government announced its 2024 Budget in March 2024. The budget includes an expenditure of CNY28.6tn ($4tn) in 2024, which is an increase of 3.8% compared with the 2023 Budget. Additionally, in March, the government announced it plans to invest CNY1.2tn ($173bn) in transport infrastructure projects by the end of this year.

In March 2024, the Yangtze River Delta region government announced an investment of CNY140bn ($19.6bn) to develop 32 railway infrastructure projects in the region in 2024.

What Factors Support the Growth of the Market in North America?

North America is estimated to grow at a significant CAGR in the rail logistics market. The growth of the region is attributed to strong cross-border trade, extensive rail networks, rising intermodal growth, increasing demand for efficient & sustainable transport solutions, and the booming e-commerce sector. The early adoption of technology such as AI, predictive analytics, and IoT enhances efficiency, reliability, safety, and speed of rail logistics. The region is experiencing freight volumes from industries like agriculture, automotive, energy, mining, manufacturing, and others. Additionally, the rising government investment in advanced rail infrastructure and the strategic development of efficient rail corridors.

The U.S. Rail Logistics Market Trends

The country is experiencing significant growth. The rail logistics market growth is supported by robust rail infrastructure, high industrial activity, rising cross-border trade, strong technology innovation, expansion of e-commerce, increasing adoption on energy efficient logistics, a surge in freight volumes from various industries, and growing focus on infrastructure modernization. The country's growth is also driven by the inherent benefits of rail logistics for moving large volumes of raw materials and finished goods cost-effectively, securely, and sustainably over long distances.

As rail logistics has a lower carbon footprint than road freight, it is increasingly becoming more popular among businesses in the country seeking to improve supply chain sustainability. Additionally, rising government initiatives and investment is supporting the rapid infrastructure development and intermodal connectivity, enhancing the market potential in the country. These collective factors are anticipated to accelerate the country's growth during the forecast period.

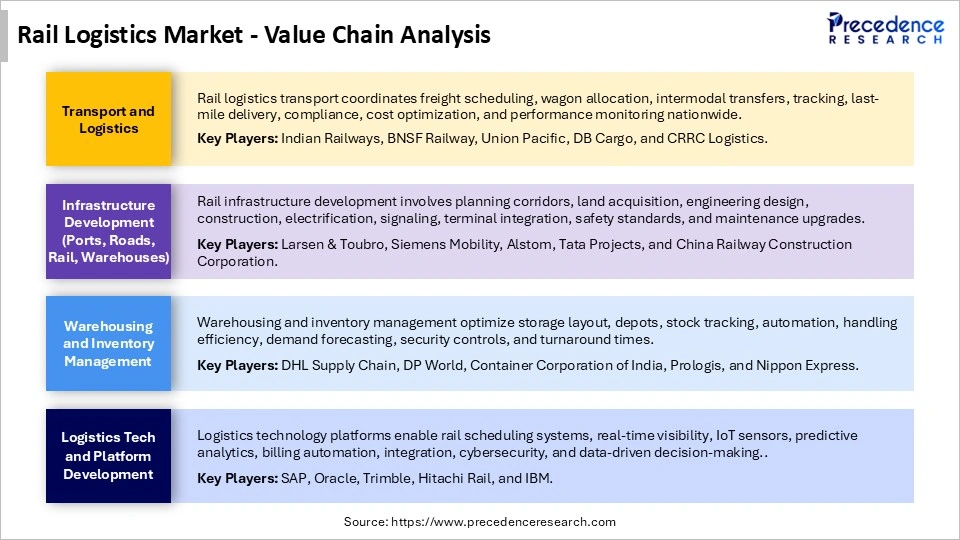

Rail Logistics MarketValue Chain Analysis

Who are the Major Players in the Global Rail Logistics Market?

The major players in the rail logistics market include Union Pacific Railroad, BNSF Railway, CSX Transportation, Canadian National Railway (CN), Canadian Pacific Kansas City (CPKC), Deutsche Bahn (DB Cargo), China Railway Freight, Indian Railways, DHL (Rail Logistics Division), CEVA Logistics, Rhenus Group, PLS Logistic Services, US Rail & Logistics, and Aurizon.

Recent Developments

- In September 2025, the CMA CGM Group announced the acquisition of Freightliner in the United Kingdom. The transaction encompasses rail and road operations, inland terminals, as well as the Freightliner brand. This acquisition underlines CMA CGM's ambition to build a sustainable and competitive transport offering in Europe. By adding a long-standing name in UK rail freight, the Group reaffirms its commitment to supporting the modal shift from road to rail, a cornerstone of decarbonising global supply chains.(Source: https://www.multimodal.org.uk)

- In January 2025, two leading industrial rail service providers announced their merger to combine their rail fleet logistics and asset management expertise into one company solution. Bourque Logistics, the leader in rail logistics systems, and AllTranstek, the leader in rail asset management services, have combined operations to provide a complete and unified offering to rail shippers, railcar owners, and their railcar maintenance providers.(Source: https://www.prnewswire.com)

Segments Covered in the Report

By Service Type

- Freight Transportation

- Warehousing & Distribution

- Intermodal Logistics

- Logistics Management Services

- Others

By Cargo Type

- Bulk Cargo

- Containers

- Liquid Cargo

- Automotive

- Temperature-Controlled

By End-Use Industry

- Manufacturing

- Mining & Metals

- Agriculture

- Retail & E-Commerce

- Energy & Chemicals

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting