What is the Renal Denervation Devices Market Size?

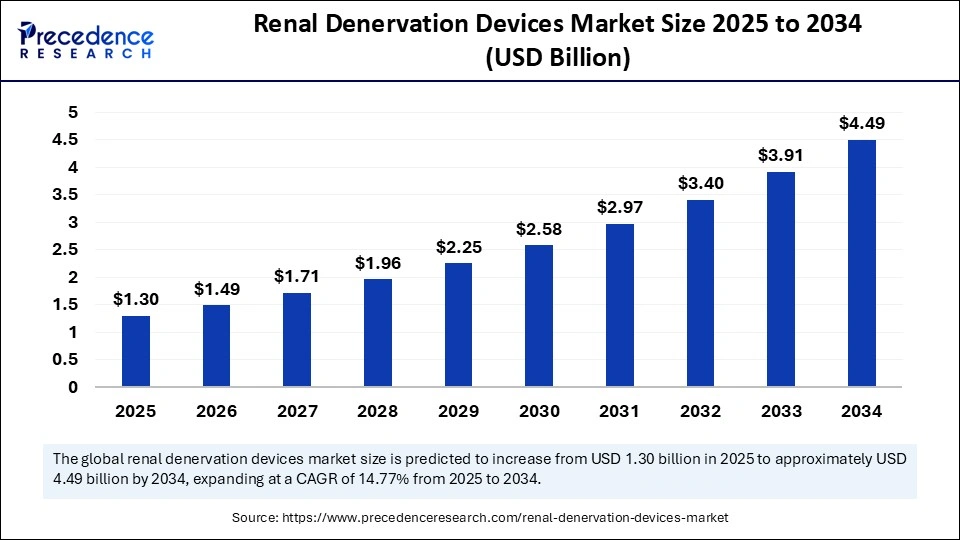

The global renal denervation devices market size accounted for USD 1.13 billion in 2024 and is predicted to increase from USD 1.30 billion in 2025 to approximately USD 4.49 billion by 2034, expanding at a CAGR of 14.77% from 2025 to 2034. The market is growing due to the rising prevalence of hypertension and increasing adoption of minimally invasive treatments for cardiovascular diseases.

Renal Denervation Devices Market Key Takeaways

- In terms of revenue, the global renal denervation devices market was valued at USD 1.13 billion in 2024.

- It is projected to reach USD 4.49 billion by 2034.

- The market is expected to grow at a CAGR of 14.77% from 2025 to 2034.

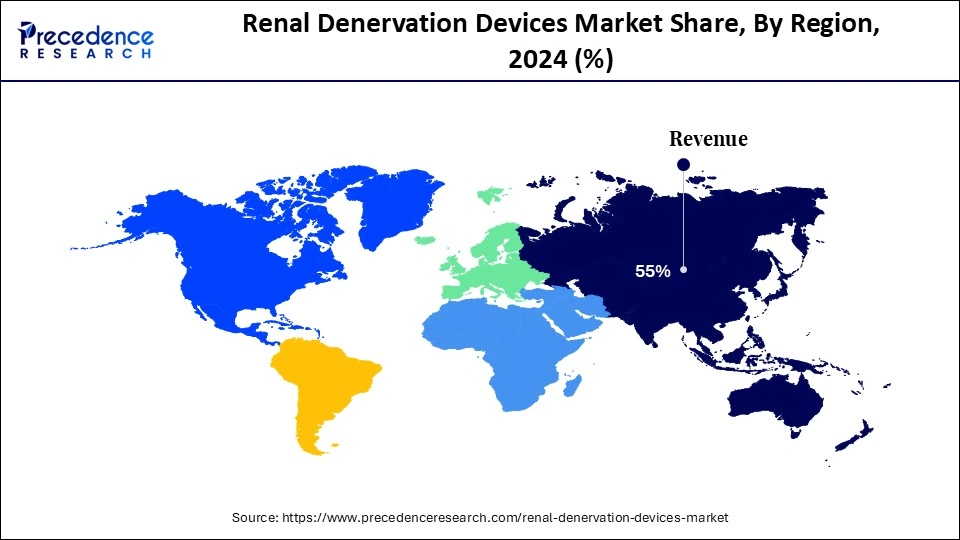

- North America dominated the renal denervation devices market with the largest market share of 55% in 2024.

- Asia Pacific is expected to grow at the fastest CAGR during the forecast period.

- By technology/energy source, the radiofrequency (RF) ablation systems segment led the market in 2024.

- By technology/energy source, the ultrasound-based RDN systems segment is expected to grow at the fastest rate during the forecast period.

- By product type/system component, the disposable catheters segment held the biggest market share in 2024.

- By product type/system component, the procedural generators/energy consoles segment is projected to grow at the fastest CAGR during the forecast period.

- By procedure approach/clinical technique, the main renal-artery ablation segment captured the highest market share in 2024.

- By procedure approach/clinical technique, the main artery+distal/branch ablation segment is the fastest-growing during the forecast period.

- By indication/clinical use, the resistant/uncontrolled hypertension segment contributed the maximum market share in 2024.

- By indication/clinical use, the routine hypertension management segment is emerging as the fastest-growing during the forecast period.

- By end user/buyer, the interventional cardiology departments segment generated the major market share in 2024.

- By end user/buyer, the hypertension specialty clinics and integrated systems segment is expected to grow at the fastest CAGR during the forecast period.

Market Overview

The global renal denervation devices market is witnessing steady growth because hypertension is becoming more common, and there is a growing need for less invasive treatment options. Because renal denervation is now safer and more effective thanks to advancements in catheter-based technologies and procedural innovations, more doctors are choosing to use these treatments. The benefits of renal denervation over long-term medication are becoming more widely recognized among patients and healthcare professionals, which is further encouraging market growth. Furthermore, the trend toward precision therapies and personalized medicine is increasing interest in this market niche, opening doors for device manufacturers to launch next-generation solutions.

- In March 2025, Medtronic announced the launch of an updated renal denervation system designed to simplify the procedure and enhance precision during treatment. (Source: https://news.medtronic.com)

Impact of AI on Renal Denervation Devices Market

The impact of AI on the renal denervation devices market is becoming increasingly significant, since clinical results and procedural efficiency are improved by artificial intelligence. AI-powered diagnostic and imaging technologies improve the accuracy of device placement during denervation procedures by enabling more accurate identification of hypertensive targets and renal artery anatomy. AI systems can also predict patient responsiveness by analyzing vast datasets from clinical trials and patient records, which aids doctors in choosing the best patients for treatment. Incorporating AI into post-procedure follow-ups and device monitoring allows for real-time blood pressure response assessment, which lowers complications and improves patients' safety.

Renal Denervation Devices Market Growth Factors

- Rising Prevalence of Hypertension: Increasing cases of resistant and uncontrolled hypertension globally are driving demand for effective treatment options like renal denervation devices.

- Technological Advancements: Innovations in minimally invasive catheter-based devices and improved safety profiles are boosting adoption among healthcare providers.

- Growing Awareness Among Physicians and Patients: Increased awareness of renal denervation as an alternative to long-term pharmacological treatment is encouraging its uptake.

- Expanding Geriatric Population: The rising elderly population, who are more prone to cardiovascular disorders, contributes to the growing market demand.

- Supportive Clinical Evidence: Positive outcomes from clinical trials and studies demonstrating the efficacy and safety of renal denervation procedures are fostering market growth.

- Rising Healthcare Expenditure: Improved healthcare infrastructure and increasing investments in cardiovascular disease management are facilitating the adoption of advanced medical devices.

- Preference for Minimally Invasive Procedures: Patients and physicians are increasingly favoring minimally invasive treatments over traditional surgeries, enhancing market growth.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 4.49 Billion |

| Market Size in 2025 | USD 1.30 Billion |

| Market Size in 2024 | USD 1.13 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 14.77% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Technology/Energy Source, Product Type/System Component, Procedure Approach/Clinical Technique, Indication/Clinical Use, End-User/Buyer, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Rising Prevalence of Hypertension

The need for alternative therapies like renal denervation is fueled in large part by the rising number of patients with uncontrolled and treatment-resistant hypertension. The need for efficient interventions is further highlighted by the rising incidence of cardiovascular problems linked to hypertension. Additionally, governments and healthcare institutions are giving priority to programs that manage hypertension, which obliquely encourages the use of renal denervation devices. Obesity, sedentary lifestyles, and high-salt diets are among the risk factors that are prevalent and continue to drive market demand.

- In August 2025, Recor Medical responds to the updated guidelines from the American Heart Association and American College of Cardiology, highlighting the role of renal denervation in managing hypertension. (Source: https://recormedical.eu)

Increasing Physician and Patient Awareness

Greater understanding of the benefits of renal denervation over long-term medication drives adoption in clinical practice. Educational programs, medical conferences, and clinical guidelines are helping to increase awareness among healthcare professionals. Patients are increasingly seeking effective, non-pharmacological solutions for hypertension management, further boosting market penetration. Awareness campaigns highlighting improved quality of life and reduced medication dependency contribute to growing demand.

Restraints

High Procedure Cost

Due to sophisticated device technology and the requirement for specialized hospital infrastructure, renal denervation procedures continue to be expensive. Exorbitant procedure costs limit access for patients without sufficient insurance coverage and in emerging markets. Smaller clinics or hospitals with limited resources might find it difficult to implement these devices, which would slow the markets' overall growth. Additionally, the high cost of staff training and device maintenance raises operating costs.

Procedural Risks and Complications

Renal denervation is a minimally invasive procedure, but it carries some risks, including the possibility of bleeding, vascular injury, or renal artery damage. Patient eligibility may be restricted by the physician's caution due to safety concerns. Scaling procedures in smaller hospitals is challenging because specialized training is needed. Fear of adverse events can also reduce patients' willingness to undergo the procedure.

Opportunities

Expansion in Emerging Markets

Due to their limited adoption of advanced therapies and growing awareness of hypertension, emerging regions like Southeast Asia, Latin America, and parts of the Middle East offer significant opportunities. Market penetration can be accelerated by increasing investments in healthcare infrastructure and interventional cardiology training. To promote adoption, businesses can launch affordable gadgets and awareness-raising initiatives. Increasing urbanization and better access to healthcare also contribute to these markets' potential for growth.

Technological Advancements

Significant growth potential exists in the field of renal denervation device innovation, including AI-assisted mapping, better energy delivery systems, and improved catheter designs. Better patient outcomes and more accurate procedures are made possible by advancements in imaging and navigation systems. With shorter procedure times and fewer complications, next-generation devices may encourage more doctors to use renal denervation. Ongoing innovation also gives device manufacturers a chance to stand out from the competition and dominate the market.

Technology/Energy Source Insights

Why did radiofrequency ablation systems dominate the renal denervation devices market in 2024?

The radiofrequency (RF) ablation systems segment continues to dominate the renal denervation devices market as they are the most established and widely studied technology for hypertension management. Their proven efficacy in clinical trials, along with strong physician confidence and broad regulatory approvals, make them the first choice in interventional cardiology. The reliability, availability of skilled operators, and reduced learning curve also contribute to their dominance.

The ultrasound-based RDN systems segment is growing rapidly because they can provide circumferential ablation in a single application, increasing the efficiency of the procedure. These systems have shown excellent safety results in recent clinical trials, cutting down on procedure time and minimizing patient discomfort. They are being adopted quickly due to the increasing need for sophisticated, less invasive procedures.

Product Type/ System Component Insights

Why did the Disposable Catheters Segment Dominate the Renal Denervation Devices Market in 2024?

The disposable catheters segment dominated the renal denervation devices market since they are essential to every procedure, as they are the main means of supplying energy to the renal nerves. Sterile patient safety and regulatory compliance are guaranteed by their single-use nature. They further solidify their dominant market share through high sales volumes and consistent demand. Continual advancements in catheter flexibility and design are improving procedural accuracy. Leading businesses also maintain their dominance by having robust distribution networks that guarantee their availability in international healthcare settings.

The procedural generators/energy consoles segment is growing rapidly because improvements in energy delivery technologies are improving control and accuracy during renal denervation. Their use is growing as a result of integration with imaging and AI-based mapping tools. To increase treatment accuracy and lower complications, hospitals are spending money on these systems. The trend toward multipurpose platforms that accommodate both ultrasonic and radiofrequency systems is driving up demand. To improve patient outcomes, hospitals are giving priority to these investments due to growing clinical evidence in favor of advanced consoles.

Procedure Approach/ Clinical Technique Insights

Why did the Main Renal-Artery Ablation Segment Dominate the Market in 2024?

The main renal-artery ablation segment dominated the market as it is the most traditional and widely adopted technique, supported by long-term clinical evidence and physician familiarity. Its established procedural protocols make it the standard of care in resistant hypertension treatment. The simplicity and lower risk profile compared to branch ablation support its continued dominance. Physicians prefer this technique due to its efficiency and fewer procedural complications. Strong reimbursement structures are also more often aligned with the main renal-artery procedures, further consolidating their dominance.

The routine hypertension management segment is growing rapidly since multi-vessel targeting is now possible with newer systems, potentially improving blood pressure control. New clinical data points to better patient outcomes with combined ablation, which is spurring study and clinical uptake. As hospitals investigate cutting-edge techniques for cases that are challenging to treat, this strategy is becoming more popular. Adoption is also being accelerated by the expanding selection of devices designed specifically for branch ablation. It is anticipated that this market will grow considerably as doctors look for more all-encompassing treatment approaches.

Indication/Clinical Use Insights

Why did the Resistant/Uncontrolled Hypertension Segment Dominate the Renal Denervation Devices Market in 2024?

The resistant/uncontrolled hypertension segment dominated the market as renal denervation is primarily positioned as a therapy for patients who do not respond adequately to medications. This patient group faces higher cardiovascular risks, creating urgent demand for alternative treatments. Clinical validation and reimbursement frameworks are also heavily focused on this indication. The prevalence of resistant hypertension worldwide strengthens this segment's dominance. In addition, major device launches are specifically targeting this patient category, making it the foundation of the market.

The routine hypertension management segment is growing rapidly in the market, as further research shows the potential of renal denervation in larger patient groups. More cardiologists are thinking about using it earlier in the treatment pathway as a result of growing awareness and positive trial results. In the upcoming years, routine management could revolutionize the treatment of hypertension. This change is backed by medical professionals looking for alternatives to chronic drug abuse. Global adoption in routine care is anticipated to soar as regulatory bodies examine wider indications.

End User/Buyer Insights

Why did the Interventional Cardiology Departments' Segment Dominate the Market in 2024?

The interventional cardiology departments segment dominated the market since they have the infrastructure, knowledge, and services necessary to carry out renal denervation procedures. Their domination is further reinforced by their position as the early adopters of cutting-edge cardiovascular technologies. In order to increase adoption, hospitals are still providing interventional cardiology teams with training and resources. Strong ties with device manufacturers for training initiatives and clinical trials also support these departments. They are a dependable source of income for manufacturers of renal denervation devices due to their well-established integration into hospital systems.

The hypertension specialty clinics and integrated systems segment is growing rapidly as more specialized outpatient care for renal denervation is provided outside of tertiary hospitals. Because they concentrate on managing hypertension holistically, these centers are perfect candidates to implement cutting-edge therapeutic approaches. The increasing demand from patients for minimally invasive solutions is fueling their expansion. Adoption is being accelerated by growing collaborations between specialty clinics and device manufacturers. These facilities are becoming important market growth drivers due to their strong patient engagement and individualized care models.

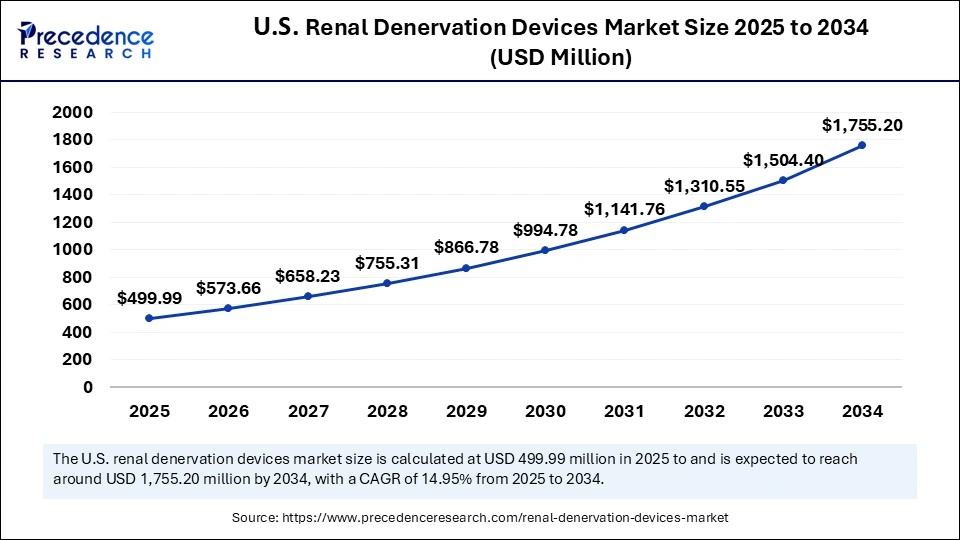

U.S. Renal Denervation Devices Market Size and Growth 2025 to 2034

The U.S. renal denervation devices market size was exhibited at USD 435.82 million in 2024 and is projected to be worth around USD 1,755.20 million by 2034, growing at a CAGR of 14.95% from 2025 to 2034.

What Made North America Dominate the Renal Denervation Devices Market in 2024?

North America dominates the renal denervation devices market due to its advanced healthcare infrastructure, strong presence of leading medical device companies, and early adoption of innovative cardiovascular treatments. The region benefits from supportive reimbursement policies and a large hypertensive population that creates strong demand for minimally invasive therapies. Continuous clinical trials, regulatory approvals, and physician training programs also reinforce its leadership. Moreover, robust R&D investments and collaborations between hospitals and device manufacturers are sustaining the region's market dominance.

Asia Pacific is growing rapidly, driven by the growing number of people with hypertension, the expansion of healthcare access, and the growing use of technologies for minimally invasive treatment. Renal denervation systems are being quickly added to hospitals and specialty clinics in cardiovascular treatment regimens. Moreover, the area gains from significant investments in medical technology and infrastructure. Furthermore, initiatives to train physicians and raise patient awareness are speeding up acceptance, making the Asia Pacific a crucial growth hub for renal denervation devices in the near future.

Renal Denervation Devices Market Companies

- Ablative Solutions, Inc.

- Abbott

- Avinger/related interventional companies

- Boston Scientific Corporation

- Kona Medical, Inc

- Mercator MedSystems, Inc

- Medtronic plc

- Neuravi/Renal-focused interventional firms

- PulseCath Technologies/investigational device firms

- ReCor Medical, Inc.

- Renal Dynamics Limited

- SoniVie/CardioSonic(historical ultrasound/early programs)

- Symple Surgical, Inc.

- Terumo Corporation

- Vascular/specialty device firms offering RDN-capable platforms

Recent Developments

- In August 2025, Ablative Solutions' new AI-assisted mapping tool integrates real-time imaging with machine learning algorithms to identify optimal treatment sites within the renal arteries. This technology aims to improve the consistency and effectiveness of renal denervation procedures.

- In September 2025, Boston Scientific's latest imaging system offers high-definition intravascular ultrasound (IVUS) capabilities, enabling clinicians to visualize renal artery structures in greater detail. This enhancement is designed to aid in the accurate placement of renal denervation catheters, potentially leading to better patient outcomes. (Source: https://news.bostonscientific.com)

Segments Covered in the Report

By Technology/Energy Source

- Radiofrequency (RF) ablation systems (multi-electrode and spiral catheters + generators)

- Ultrasound-based RDN systems (circumferential sonication catheters + consoles)

- Chemical/neurolytic denervation (injectable agents/chemical ablation catheters)

- Pulsed-field/electroporation and other emerging energy modalities

By Product Type/System Component

- Disposable catheters (single-use renal denervation catheters)

- Procedural generators/energy consoles (reusable capital equipment)

- Procedure kits and consumables (sheaths, guidewires, cooling/infusion sets)

- Software and mapping/registration aids (procedure planning and reporting)

By Procedure Approach/Clinical Technique

- Main renal-artery ablation only (standard technique)

- Main artery + distal/branch ablation (extended denervation)

- Bilateral vs unilateral procedures

- Staged/repeat denervation procedures

By Indication/Clinical Use

- Resistant/uncontrolled hypertension (adjunct to meds)

- Routine hypertension management (med-reduction strategies)

- Chronic kidney disease (CKD) with hypertension (investigational/adjunct)

- Other sympathetic-driven indications (heart failure, arrhythmia adjuncts — investigational)

By End-User/Buyer

- Interventional cardiology departments/cardiologists

- Vascular surgery and interventional radiology units

- Hypertension specialty clinics and integrated health systems

- Hospitals (capital procurement) vs private clinics (procedure buyers)

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting