What is the Respiratory Disease Vaccine Market Size?

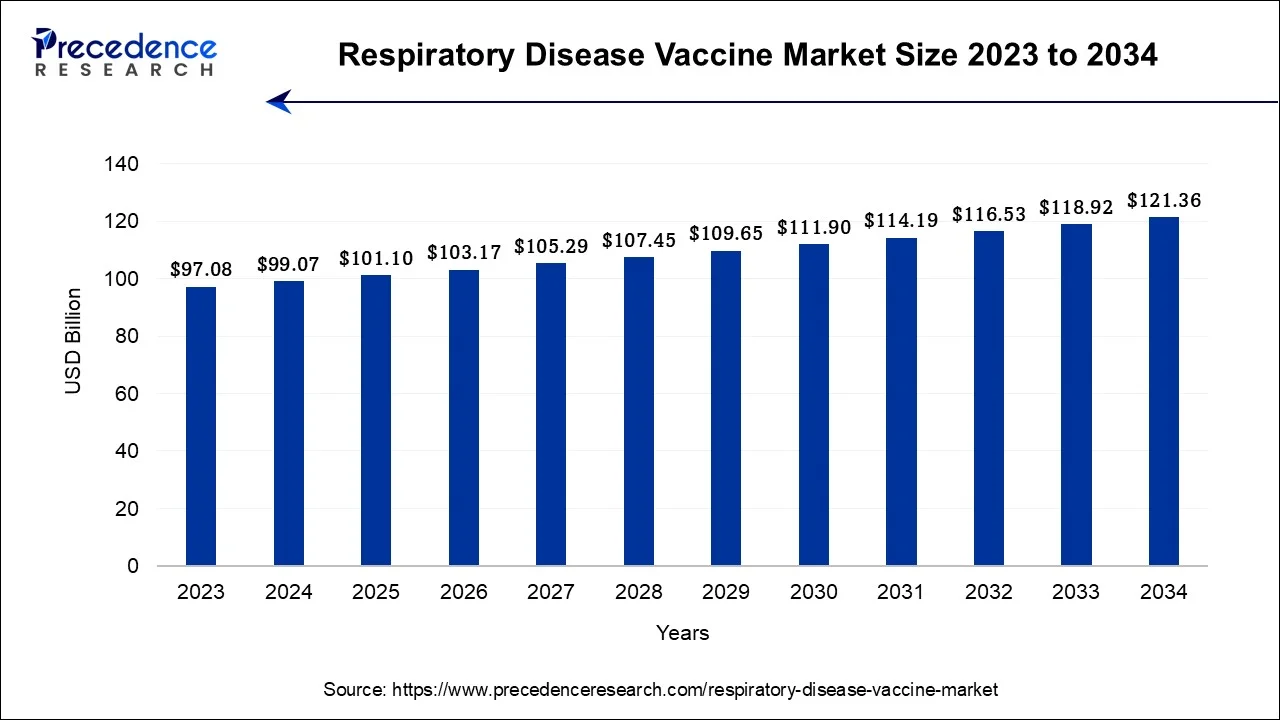

The global respiratory disease vaccine market size was estimated at USD 101.10 billion in 2025 and is anticipated to reach around USD 123.77 billion by 2035, growing at a CAGR of 2.04% between 2026 to 2035.

Respiratory Disease Vaccine Market Key Takeaways

- In terms of revenue, the respiratory disease vaccine market is valued at $101.10 billion in 2025.

- It is projected to reach $123.77billion by 2035.

- The respiratory disease vaccine market is expected to grow at a CAGR of 2.04% from 2026 to 2035.

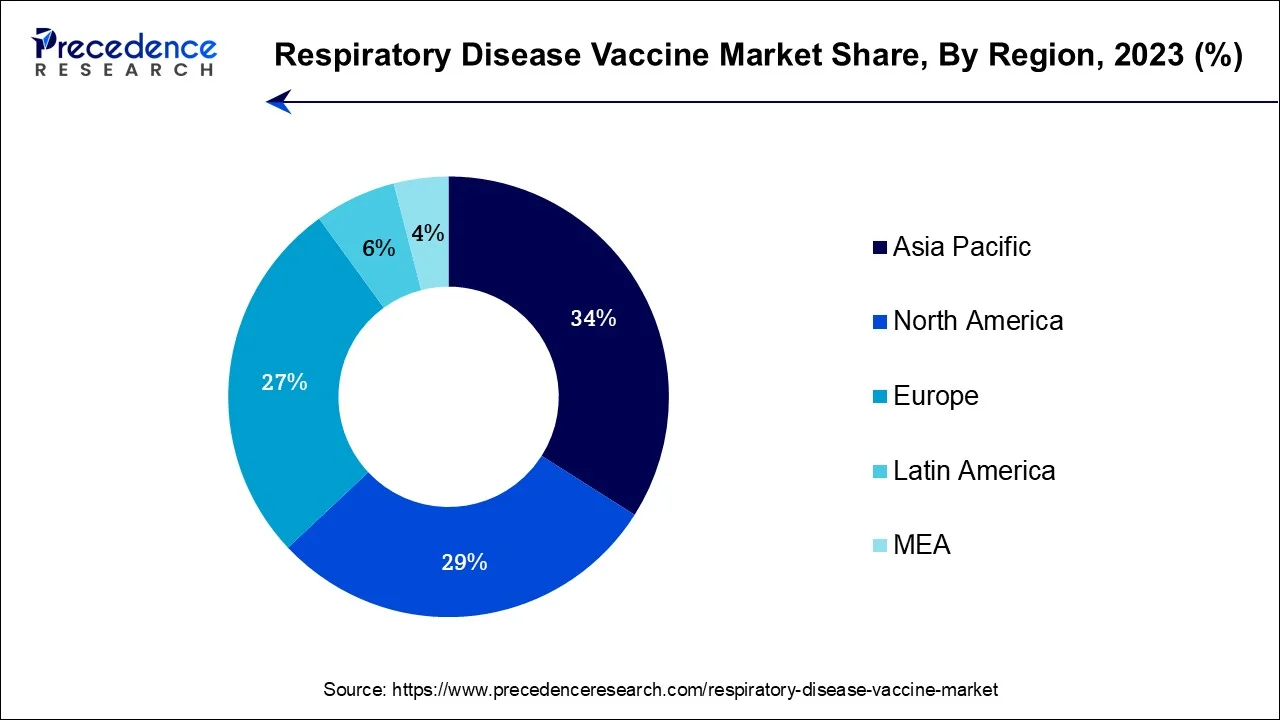

- Asia Pacific dominated the market in 2024 with the largest market share of 55%.

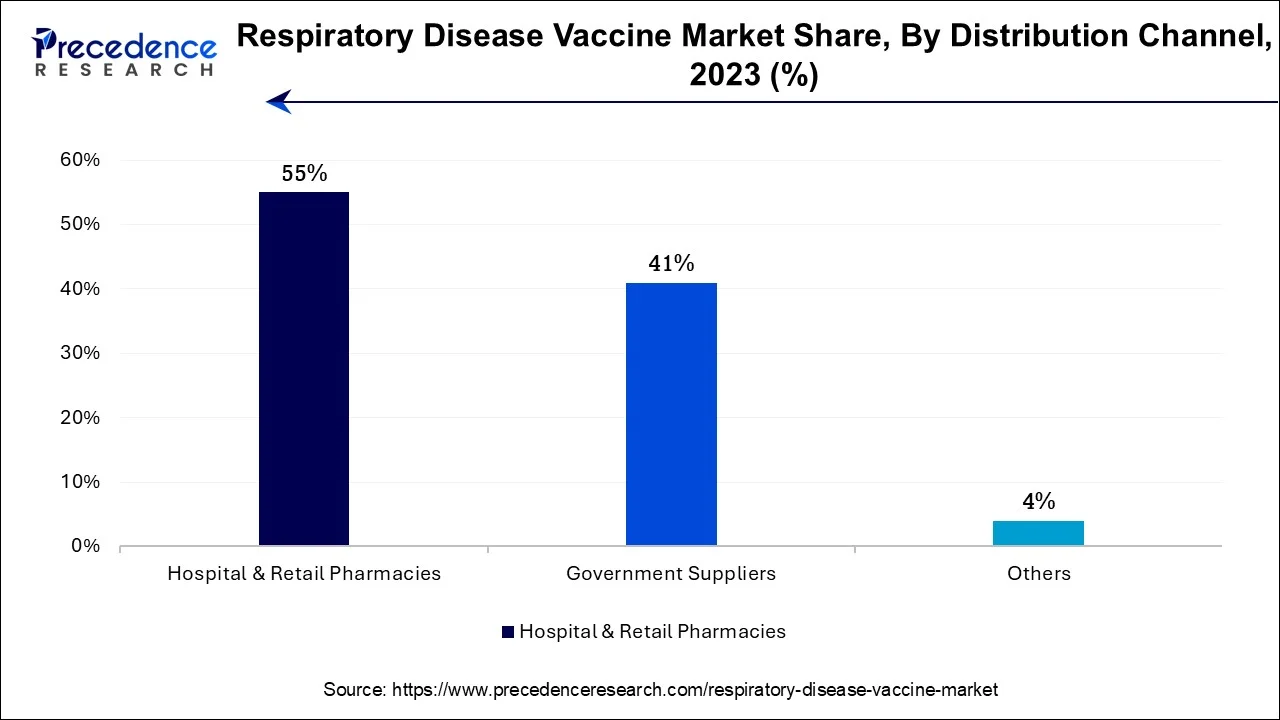

- By Distribution Channel, the hospital segment dominated the market with the highest market of 55% in 2025.

- By Disease Type, the chronic obstructive pulmonary disease (COPD) segment dominated the market in 2025.

- By Type, the viral vaccine segment contributed more than 55% of revenue share in 2025.

- By Type, the bacterial vaccine segment is expected to expand at a significant CAGR during the forecast period.

- By Age Group, the adult segment dominated the market with a major market share of 77% in 2025.

- By Age Group, the pediatric segment is expected to be the most lucrative segment of the market throughout the forecast period.

- By Infection, the COVID-19 segment captured more than 70% of market share in 2025.

- By Infection, the Respiratory Syncytial Virus (RSV) segment is expected to grow at a significant rate during the forecast period.

What is the Respiratory Disease Vaccine?

The global respiratory disease vaccine market revolves around the research, development, innovation and distribution of vaccines in order to prevent or cure potential respiratory diseases. Vaccination is considered to be the most vital part of healthcare services for every age group. Many vaccine-prevalent diseases are infectious means they can be spread from one person to another, such diseases can rapidly spread within a community. Thus, vaccination is one of the most potential media for the prevention or to stop the spread of diseases. If most of the community is vaccinated there is a lesser chance of the virus in the community or the atmosphere getting spread. Covid-19, influenza and RSV are major respiratory diseases that were covered for the research and development of vaccines in recent years.

How is AI contributing to the Respiratory Disease Vaccine Industry?

AI is changing the way respiratory vaccines are developed by improving the speed at which antigens are discovered with the help of genomics and predictive modeling. It allows designing vaccine structures according to deep learning tools and their optimization. Real-time monitoring and smarter recruitment with the application of AI enhances the efficiency of clinical trials.

Yield simulation and optimization of the cold chain are useful in manufacturing. Adjuvant innovation is another area where AI assists in improving the workability of immune response, as well as elevating the stability of formulation and efficiency of production in respiratory vaccine pipelines.

Respiratory Disease Vaccine Market Growth Factors

With several infectious or non-infectious respiratory diseases, there are several vaccinations for the prevention of the disease. Vaccines build immune power to resist the disease. The increasing population and changing lifestyle in the younger generation would highly create respiratory diseases and would drive the demand for the respiratory disease vaccine market during the forecast period.

Increasing industrialization in the urban area and rise in commercial and private vehicles cause enormous pollution in the environment. Higher pollution tends to increase in cases of respiratory tract infection and other diseases related to the respiratory tract. The shift in lifestyle in the younger generation increases in the consumption of cigarettes, weed, and vaping is highly causing lung disease and respiratory tract infections in the body. All these factors are driving the growth for the respiratory disease vaccine market worldwide.

Trends in the Respiratory Disease Vaccine Market

- Several leading healthcare companies are looking for various solutions to combat respiratory disease by developing novel vaccines and accelerating their effectiveness by offering highly advanced solutions to prevent and treat respiratory illnesses across the globe.

- An increasing prevalence of smoking among adults is a major driving factor for the development and growth of the respiratory disease vaccine market. Consumption of hazardous tobacco with cigarettes causes several respiratory complications, which lead to heart disease, stroke, and tracheitis, obligating healthcare companies to develop permanent solutions for them.

- Many research and development institutes are shifting their focus towards mRNA vaccines according to personal genetic profiles, health history, and more personalized solutions to create maximum efficacy and minimize side effects.

Market Outlook

- Industry Growth Overview: The demand is growing due to the usage of combination vaccines and the adoption of modern technologies, such as the use of mRNA platforms.

- Sustainability Trends: Producers enhance cold-chain systems and packaging that minimize production inefficiencies and environmental impact.

- Major investors: Pfizer, Johnson & Johnson, Merck, Sanofi, GlaxoSmithKline, AstraZeneca, Moderna, Serum Institute invest.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 101.10Billion |

| Market Size in 2026 | USD 103.17 Billion |

| Market Size by 2035 | USD 123.77Billion |

| Growth Rate from 2026 to 2035 | CAGR of 2.04% |

| Largest Market | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | By Disease Type, By Type, By Age Group, and By Infection, By Distribution Channel |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

The rising burden of respiratory diseases

The rising prevalence of respiratory diseases across the globe is expected to drive the growth of the market in the upcoming period. For instance, the Global Asthma Network stated in 2022 that approximately 35 million people in India are suffering from Asthma. The numbers are observed to grow in the upcoming years. The rising number of patients with respiratory diseases such as asthma, lung infection or other pulmonary diseases brings a demand for innovation of advanced and novel vaccine for either preventing or treating these diseases. The concern of such diseases also forces governments and healthcare-associated organizations to raise investments for research-based activities. All these elements create a significant potential for the market to grow.

Restraint

Stringent regulations

he research, development and distribution of respiratory disease vaccine are abided with multiple regulations and guidelines. For instance, the United States Food and Drug Administration focuses on approving vaccines or novel therapeutics for commercialization and even for clinical trials. Such stringent regulations can be complicated to follow or to cope with as they are highly time-consuming. These regulations can limit the overall penetration of key players in the market by restraining them from performing research-based activities for development and innovation purposes. Thus, stringent regulations act as a major restraint for the market.

Opportunity

Rising emphasis on research activities for tuberculosis vaccine

The successful development of a tuberculosis (TB) vaccine can be used as a model for public health messaging and education about the importance of vaccination. This can lead to increased acceptance and uptake of respiratory disease vaccines. Developing a TB vaccine requires cutting-edge research and technological advancements. These advancements can spill over into other areas of respiratory disease research, leading to improved understanding of the immune system and novel vaccine development techniques that can be applied to other respiratory diseases. Some respiratory diseases share similarities in the way they affect the respiratory system or the immune response they trigger. Research into TB vaccines might uncover insights into cross-immunity, where a vaccine developed for TB could also provide protection or benefits against other respiratory diseases. This could lead to the development of multi-purpose vaccines.

Segment Insights

Disease Type Insights

The Chronic Obstructive Pulmonary Disease (COPD) segment dominated the market in 2025, the segment is expected to continue to grow at a significant rate throughout the forecast period. The development of any vaccine requires rigorous testing for efficacy and safety. If researchers are able to create a safe and effective COPD vaccine, it could become a dominant product in the respiratory disease vaccine market. Regulatory agencies like the FDA in the United States play a critical role in approving vaccines for specific diseases. If a COPD vaccine were to undergo successfulclinical trials and gain regulatory approval, it could gain a significant share of the market. If COPD remains a highly prevalent respiratory disease in the population, there might be a strong incentive for pharmaceutical companies to invest in vaccine research and development.

Type Insights

The viral vaccine segment dominated the market in 2025. The growth of the segment is attributed to the rising prevalence of viral infection among the population. Viral vaccines are used as a precautionary method for the prevention of viral diseases such as influenza, coronaviruses, Respiratory Syncytial Virus (RSV), and Chronic Obstructive Pulmonary Disease (COPD), etc. Viral vaccines contain weakened or dead viruses which do not cause the disease but help to prevent it. There are several components including active ingredients, adjuvants, preservatives, and stabilizers. There are some types of live attenuated viral vaccines such as chickenpox vaccine, measles vaccine, mumps vaccine, rotavirus vaccine, rubella vaccine, andshingles vaccine.

The bacterial vaccines segment is expected to grow at a significant rate forecast period. The growth of the segment is expected to increase due to rising bacterial infections like Hemophilus influenzae type b (Hib) infections, pertussis (whooping cough), and pneumococcal pneumonia. Many bacterial vaccines contain inactivated protein exotoxins, live attenuated bacteria, capsular polysaccharides, and killed bacteria.

Age Group Insights

The adult segment dominated the market in 2025. The rapidly growing cases of respiratory diseases among adults create a significant driver for the segment. Adults with respiratory disease are more prone to get seriously affected by the same, this builds a requirement for novel vaccine for respiratory diseases in adults. The rising awareness about the prevention or early diagnosis of respiratory diseases among adults, especially in well-developed regions creates a significant opportunity for the segment to grow.

The pediatric segment is expected to be the second-largest segment of the market throughout the forecast period. The growth of the segment is attributed to the substantial efforts to boost vaccination programs for infants and children due to the increasing cases of infectious diseases in the low-age group of children. The increasing awareness of the vaccination for infants and children to protect them against respiratory disease is also contributing to the growth of the segment.

Infection Insights

The Covid-19 segment dominated the market in 2025. The segment dominated due to the outbreak of Covid-19 across the globe. The rapidly spreading corona virus built a demand for novel therapeutics during the pandemic. The Covid-19 infected patients get mild or severe symptoms of having a respiratory illness. Many of the people need special treatment to recover from it. For the treatment of Covid-19 infection, there are several vaccines have been launched in the market. Multiple regulatory bodies across the globe boosted the pace of clinical trials and approvals for vaccines during the pandemic, this acted as a significant factor for the segment's growth.

The respiratory syncytial virus (RSV) segment is expected to grow at a significant rate during the forecast period. The growth of the segment is attributed to the rising prevalence RSV-related infections and the increasing support by the key players for the development of RSV vaccines. It is a common infectious virus that causes infection in the respiratory tract, the emphasis on prevention of infection creates a significant driver for the segment.

Distribution Channel Insights

The hospital segment dominated the market in 2025, the segment will continue the trend of dominance throughout the forecast period. The growth of the segment is attributed to the increasing prevalence of respiratory disease in the population. Hospitals dominated the vaccination process due to the presence of highly professional workforce such as doctors, nurses, and other healthcare professionals.

Hospitals are responsible for providing vaccination to patients with highly trained staff. The hospital manages patients with a high risk of respiratory disease like old-age people or the underlying patient health conditions.

Regional Insights

What is the Asia Pacific Respiratory Disease Vaccine Market Size?

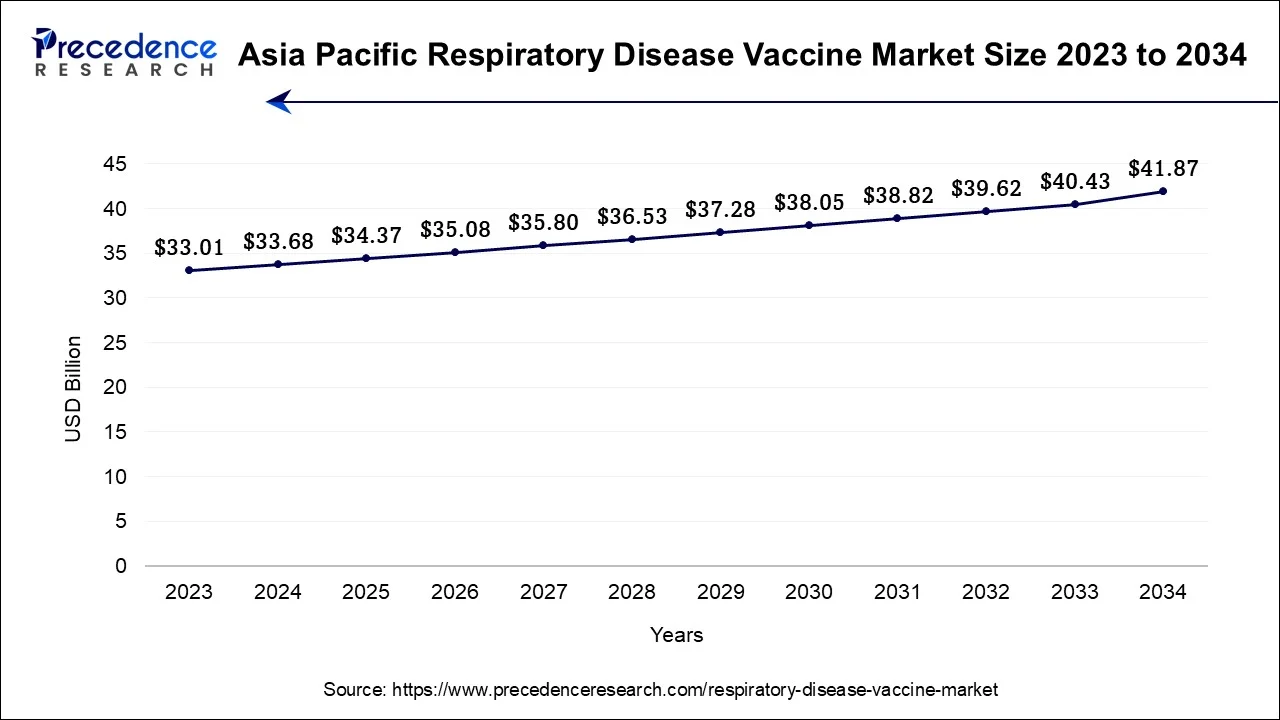

The Asia Pacific respiratory disease vaccine market size accounted at USD 34.37 billion in 2025 and is expected to be worth around USD 42.89 billion by 2035, at a CAGR of 2.24% between 2026 and 2035.

Asia Pacific dominated the respiratory disease vaccine market in 2025, the region is expected to sustain the trend throughout the forecast period. Large population and rapidly increasing rate of geriatric population act as drivers for the market's growth in Asia Pacific. Asia Pacific countries are continuously investing in research and development in the field of vaccine technology. This can result in the development of new and effective vaccines against respiratory diseases. Many countries in Asia Pacific have recognized the importance of vaccination in public health. Governments often implement vaccination programs and campaigns to combat respiratory diseases. These initiatives can drive demand for vaccines and increase their availability. Asia Pacific is home to a large and densely populated area, which can lead to a higher prevalence of respiratory diseases due to the close proximity of individuals. This creates a strong demand for respiratory disease vaccines to control outbreaks and prevent the spread of diseases like influenza and pneumonia.

North America is expected to witness the fastest rate of growth during the forecast period. Governments and healthcare agencies in North America are promoting vaccination as a crucial public health measure to reduce the burden of respiratory diseases. Information campaigns, public awareness, and vaccination mandates (for certain groups or professions) were part of these initiatives. Pharmaceutical companies and research institutions in North America are actively involved in developing vaccines for various respiratory diseases. These efforts include vaccines for not only COVID-19, influenza, and RSV but also for other respiratory pathogens like tuberculosis.

Value Chain Analysis of the Respiratory Disease Vaccine Market

- R&D: Discovery phase, where antigens were identified and designing vaccines that activate immune response to respiratory pathogens was an effective solution.

Key players: Moderna, Pfizer, GlaxoSmithKline (GSK) - Clinical Trials and Regulatory Approvals: Intensive clinical testing is done to be certain that the vaccines are safe and effective before they are submitted to regulatory bodies.

Key players: FDA/EMA (regulators), Pfizer, GSK, Moderna - Formulation and Final Dosage Preparation: the active ingredients of the vaccine are combined with stabilizers and adjuvants into final dosage forms to be injected.

Key players: GSK, Pfizer, Sanofi

Respiratory Disease Vaccine Market Companies

- Sanofi: Provides RSV prevention solutions, influenza vaccines, and pneumococcal protection due to the development of a diversified respiratory immunization portfolio.

- GSK plc: Specializes in the provision of RSV vaccine solutions, influenza, and pneumococcal vaccination programs against respiratory diseases.

- Merck & Co., Inc.: Provides pneumococcal vaccines, with respiratory vaccine candidates being developed in clinical innovation efforts that are underway.

Other Major Key Players

- Pfizer Inc.

- Bavarian Nordic

- EMERGENT

- CSL Limited

- Moderna, Inc.

- Serum Institute of India Pvt. Ltd.

- Sinovac Biotech

Recent Developments

- In May 2025, the U.S. Department of Health and Human Services, in collaboration with the National Institute of Health, introduced a universal, next-generation platform development 'gold standard' with the help of beta-propiolactone. Vaccines developed through this platform will be beneficial for broad-spectrum protection against various strains of pandemic-prone viruses. Thus, the generation gold standard is a paradigm shift in the development of vaccines specifically targeted for respiratory illnesses for every age group.

- In March 2025, the first maternal respiratory syncytial virus-RSV vaccine was pre-qualified by the World Health Organization, owing to the prevalence of an increasing mortality rate among children in the age group 0 to 5 years. And many deaths occur in low- and middle-income countries where limited access to supportive healthcare has been seen.

- In August 2023, a subsidiary of Cyrus Poonawalla Group and the Serum Institute of India, a biotechnology company that supplies and manufactures vaccines and manufacturing of immuno-biologicals announced that they have received an approval for the development of vaccine for the treatment of polio, tetanus, diphtheria, r-hepatitis B, mumps, measles, and rubella.

- In August 2023, recipients of the Innovation Awards in Community Health were announced by Direct Relief. These showcase the Infectious Diseases in Underserved Communities. With a focus on vaccine delivery and education, the Healthcare provider of the safety-net community supports an innovative approach to the treatment of infectious diseases.

- In August 2023, the Beijing Center for Disease Prevention and Control launched The Beijing Major Respiratory Epidemic Disease Center. The new research center works on transmission, quick diagnosis, control strategies, and early warnings. The main objective for the focus on epidemic disease control.

Segments Covered in the Report:

By Disease Type

- Chronic Obstructive Pulmonary Disease (COPD)

- Pertussis

- Pneumonia

- Measles

- Diphtheria

By Type

- Viral Vaccine

- Bacterial Vaccine

- Combination Vaccine

By Age Group

- Pediatric

- Adult

By Infection

- COVID-19

- Influenza

- Respiratory Syncytial Virus (RSV)

- Pneumonia

- Others

By Distribution Channel

- Hospital & Retail Pharmacies

- Government Suppliers

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting