What is Road Haulage Market Size?

The global road haulage market size was calculated at USD 3.67 trillion in 2025 and is predicted to increase from USD 3.86 trillion in 2026 to approximately USD 6.04 trillionby 2035, expanding at a CAGR of 5.10% from 2026 to 2035. The road haulage market is driven by expanding e-commerce and demand for flexible freight transportation.

Market Highlights

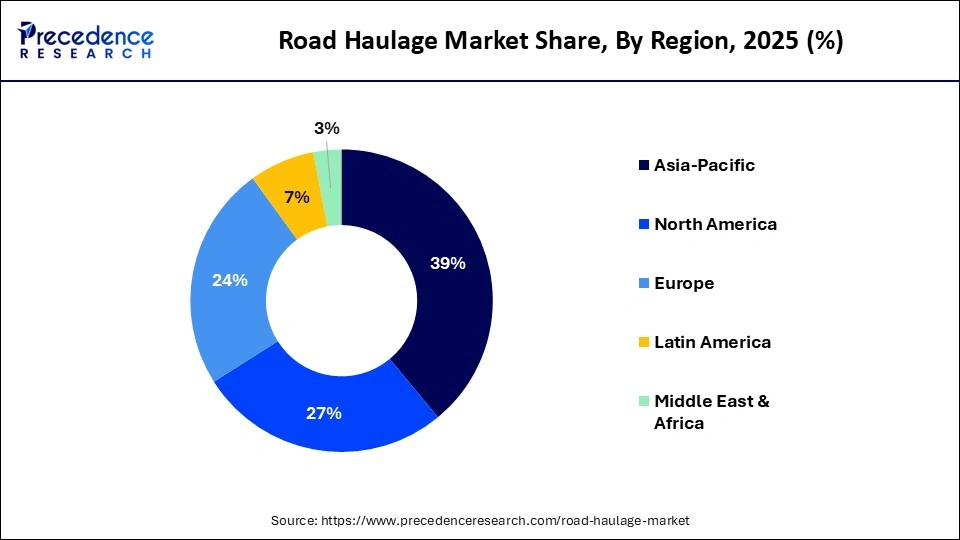

- Asia Pacific dominated the global market with a major share of 39% in 2025.

- By region, Latin America is expected to grow at the fastest CAGR in the market during the forecast period.

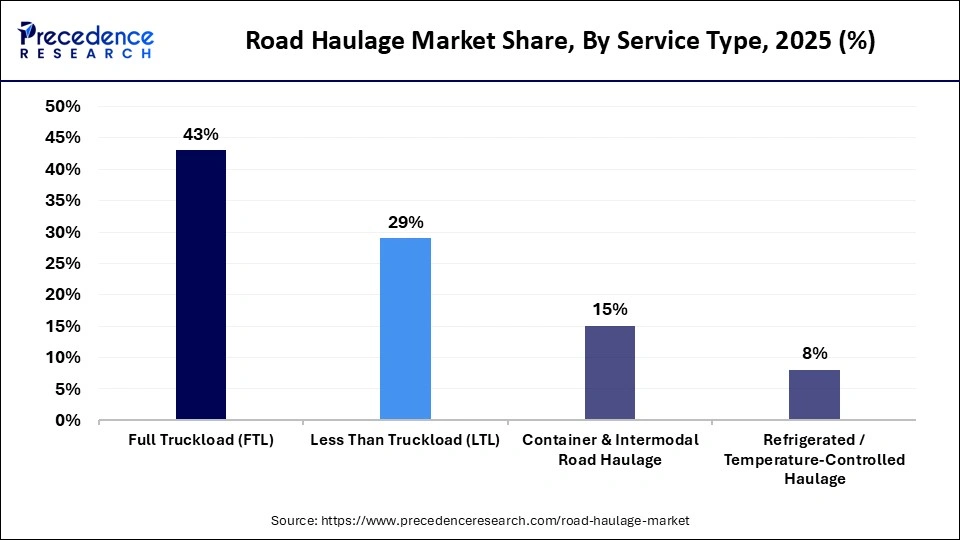

- By service type, the full truckload segment held a dominant position in the market with a share of 43% in 2025.

- By service type, the less than truckload segment is expected to grow at the fastest CAGR in the market between 2026 and 2035.

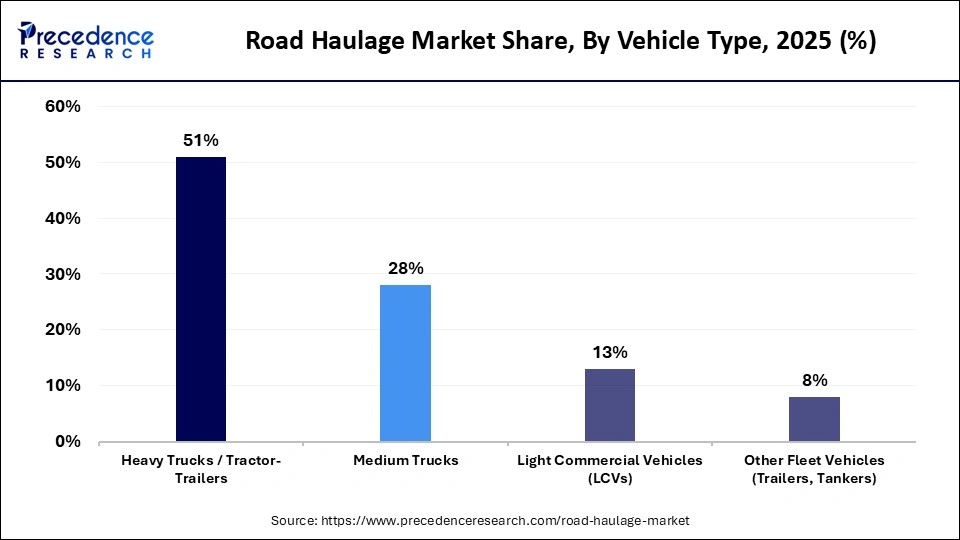

- By vehicle type, the heavy trucks/tractor-trailers segment held the largest share of 51% in the market in 2025.

- By vehicle type, the medium trucks segment is expected to grow at the highest CAGR in the market during the studied years.

- By ownership/provider type, the third-party logistics segment led the global market with a major share of 47% in 2025.

- By ownership/provider type, the contract carriage / outsourced segment is expected to expand rapidly in the market in the coming years.

- By cargo type, the dry & general goods segment registered its dominance in the global market with a share of 44% in 2025.

- By cargo type, the perishables / temperature-sensitive cargo segment is expected to witness the fastest growth in the market over the forecast period.

- By technology / digital integration, the telematics & fleet tracking segment dominated the global market with a share of 38% in 2025.

- By technology / digital integration, the route optimization & AI analytics segment is expected to grow at the highest CAGR between 2026 and 2035.

Transforming Logistics: The Future of the Road Haulage Market

The road haulage market is experiencing strong growth as it plays a crucial role in enabling efficient freight transportation across local and global supply chains. Its unmatched flexibility and door-to-door connectivity make it ideal for short, medium, and long-distance routes. The growth of the market is driven by the rapid expansion of global trade and e-commerce, which demand time-sensitive and reliable delivery systems. Investments in road networks, highways, and logistics parks, along with supply chain digitization through fleet management, route optimization, and real-time tracking, are further enhancing connectivity, efficiency, and transparency in the sector.

Road Haulage Market Trends

- Sustainability initiatives are driving the shift toward electric fleets, alternative fuels, and emission reduction measures to meet environmental regulations and corporate ESG goals.

- The rapid growth of e-commerce is increasing demand for time-sensitive road haulage, particularly last-mile and regional deliveries requiring flexible routes and shorter transit times.

- Digital technologies like fleet management systems, GPS tracking, and route optimization are improving operational efficiency, reducing fuel consumption, and enabling real-time visibility in road freight operations.

- Infrastructure development, including highways, logistics hubs, and multimodal corridors, is enhancing connectivity and enabling the smooth movement of larger freight volumes across domestic and cross-border networks.

How is AI Integration Influencing the Road Haulage Market?

Artificial intelligence is transforming the road haulage market by making freight operations more efficient, safer, and cost-effective. AI-powered route optimization analyzes traffic, weather, and delivery schedules to reduce transit times and fuel consumption. Logistics operators also leverage AI for truck allocation and capacity management through demand forecasting, especially during peak e-commerce periods. Additionally, computer vision and advanced driver-assistance systems enhance road safety by monitoring driver behavior, detecting hazards, and preventing accidents.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 3.67 Trillion |

| Market Size in 2026 | USD 3.86 Trillion |

| Market Size by 2035 | USD 6.04 Trillion |

| Market Growth Rate from 2026 to 2035 | CAGR of 5.10% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | Latin America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | By Service Type,Vehicle Type,Ownership / Provider Type,Cargo Type,Technology / Digital Integration, and region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segment Insights

Service Type Insights

Why Did the Full Truckload Segment Hold a Major Market Share in 2025?

The full truckload (FTL) segment held a major market share of 43% in 2025. This is mainly due to the heightened use of FTL in those industries that have high-volume transportation needs like manufacturing, automotive, and consumer goods. FTL reduces handling and transit time, decreases the risk of damage, and provides a more predictable delivery time. The ease of FTL logistics enables the ability to make better use of the fleet and plan the routes more optimally, reducing the cost of operations. There are also long-term contracts between shippers and logistics providers that contribute to the stability and reliability of FTL services, which is why it is a choice for large-scale freight movement.

The less than truckload (LTL) segment is expected to grow at the fastest CAGR in the market between 2026 and 2035, driven by the rising demand from small and medium-sized businesses requiring flexible and cost-effective shipping for smaller volumes. The rapid growth of e-commerce, omnichannel retail, and direct-to-consumer models has increased the need for fragmented shipments, making LTL essential for modern supply chains. Digitized freight platforms, automated sorting, and route optimization are enhancing LTL efficiency, reducing transit times, and improving service reliability.

Vehicle Type Insights

Why Did the Heavy Trucks / Tractor-Trailers Segment Lead the Road Haulage Market?

The heavy trucks / tractor-trailers segment led the global market with the largest share of 51% in 2025, as they are necessary in transporting large volumes of industrial, construction, agricultural, and energy products over intercity and cross-country routes. Heavy trucks are especially suitable in terms of carrying high volumes of shipments within a single trip, hence boosting cost-effectiveness and reducing per-unit transportation cost. They are widely used in port-to-inland logistics, manufacturing corridors, cross-border trade, and both domestic and international supply chains. Ongoing improvements in highways, freight corridors, and expressways are further strengthening their adoption.

The medium trucks segment is expected to grow at the highest CAGR throughout the forecast period. This is mainly due to their ideal payload capacity, last-mile delivery capabilities, and the ability to navigate congested city streets, which makes them the best options in terms of last-mile deliveries and short to medium distance hauls. Growth in e-commerce, organized retail, and food delivery has increased demand for vehicles that efficiently serve both urban and suburban areas. Additionally, medium trucks are more cost-efficient than heavy trucks, making them attractive to small and mid-sized fleet operators.

Ownership / Provider Type Insights

Why Did the Third-Party Logistics Segment Dominate the Road Haulage Market?

The third-party logistics segment registered its dominance in the global market by holding a share of 47% in 2025. This is because companies across manufacturing, retail, and e-commerce are outsourcing logistics to 3PL providers to concentrate on business operations. 3PL providers offer a full range of services, including freight transportation, warehousing, inventory management, route optimization, and real-time shipment tracking, leveraging large fleets and advanced technology platforms to handle high shipment volumes efficiently. Long-term contracts with major shippers further ensure stable demand and operational reliability for 3PL providers.

The contract carriage / outsourced segment is expected to witness the fastest growth in the market over the forecast period. This is because it allows logistics providers to offer dedicated fleets and tailored services to select customers, ensuring reliable capacity and service. Retailers, FMCG companies, and e-commerce businesses are increasingly adopting this model to maintain dependable delivery schedules. Rising fuel price volatility, driver shortages, and operational challenges are further encouraging outsourcing, while contract carriage helps companies convert fixed transportation costs into variable expenses, enhancing financial flexibility.

Cargo Type Insights

Why Did the Dry & General Goods Segment Lead the Road Haulage Market?

The dry & general goods segment led the global market with a share of 44% in 2025. This is primarily due to the high-volume transportation of items such as consumer products, industrial parts, textiles, electronics, and packaged materials that require standard transport conditions. Steady demand for road haulage is supported by the expansion of retail networks and growing domestic and international trade. Increased production and distribution activities across various industries further contribute to the segment's dominance. Moreover, rising global economic activity and consumer demand continue to drive consistent shipments of dry and general cargo.

The perishables / temperature-sensitive cargo segment is expected to expand rapidly in the coming years. The segment growth is attributed to the growing demand for high-quality, fresh, and safe food and pharmaceutical products, which significantly boosts the demand for quality, reliable refrigerated transportation. The safety and compliance of perishable goods during transportation have been improved through technological innovations like temperature sensors, insulated trucks with reefer, and real-time tracking. Moreover, stringent regulations regarding the safety and efficacy of food and pharmaceutical products are encouraging investments in cold chain facilities, which are further stimulating the segment.

Technology / Digital Integration Insights

Why Did the Telematics & Fleet Tracking Segment Lead the Road Haulage Market?

The telematics & fleet tracking segment led the market by holding a major revenue share of 38% in 2025. This is because these technologies enable real-time monitoring of vehicles, driver behavior, fuel usage, and delivery status, improving operational visibility and control. Telematics is commonly used by fleet operators to optimize routes, lower fuel consumption, minimize idle time, and achieve better use of assets. Regulatory requirements related to driver safety, emissions, and working hours further drive adoption. Additionally, telematics supports theft prevention, preventive maintenance, and improved customer service with accurate delivery updates, making it a critical tool for efficient road haulage operations.

The route optimization & AI analytics segment is expected to expand at the fastest CAGR over the forecast period. The segment growth is driven by the increasing use of intelligent systems that analyze traffic patterns, weather, delivery schedules, and historical data to determine the most efficient routes in real time. These tools reduce transit time, fuel consumption, and carbon emissions, while improving on-time delivery performance. AI analytics also supports demand forecasting, predictive maintenance, and capacity planning, enabling smarter logistics decisions. Increasing customer demand for speed and reliability is prompting logistics providers to heavily invest in these advanced technologies.

Regional Insights

How Big is the Asia Pacific Road Haulage Market Size?

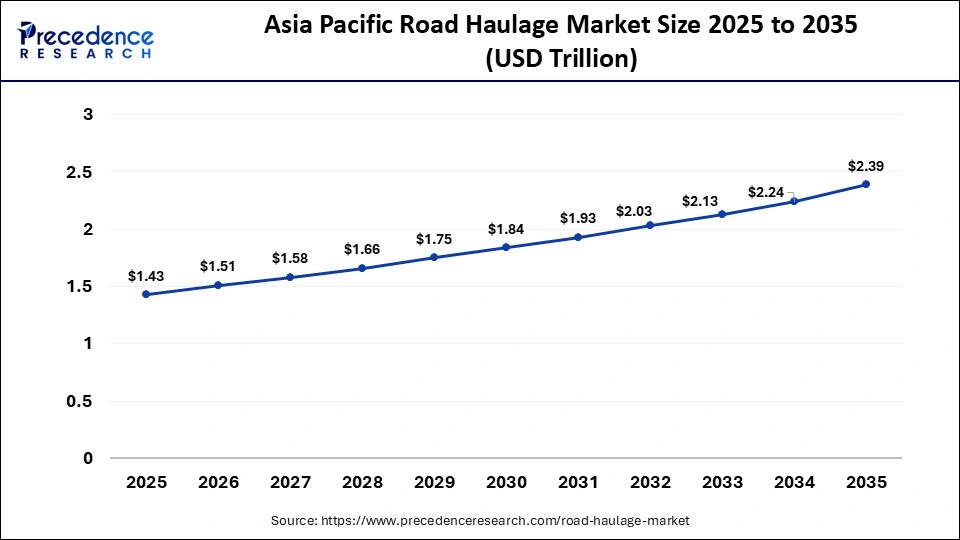

The Asia Pacific road haulage market size is estimated at USD 1.43 trillion in 2025 and is projected to reach approximately USD 2.39 trillion by 2035, with a 5.27% CAGR from 2026 to 2035.

Why Did Asia Pacific Lead the Global Road Haulage Market in 2025?

Asia Pacific led the road haulage market by holding the largest share of 39% in 2025 and is expected to sustain its position in the upcoming period. This dominance is attributed to strong industrial growth in major economies like China, India, Indonesia, and Vietnam, which are increasing production volume and consequently the demand for efficient goods transport. Expansion in exports, manufacturing infrastructure, and domestic consumption has further fueled road freight demand. Additionally, government investments in highways, expressways, logistics parks, and cross-border trade routes are enhancing connectivity and reducing transit times.

Why is Latin America Witnessing the Fastest Growth in the Road Haulage Market?

Latin America is expected to witness the fastest growth during the predicted timeframe, driven by improving economic conditions and expanding trade activities. Key countries like Brazil, Mexico, Chile, and Colombia are seeing growth in manufacturing, agriculture, and retail, boosting demand for road freight. Investments in highways, port links, and logistics centers are enhancing transportation efficiency and reliability. Additionally, the rise of e-commerce, regional retail, and digitized supply chains is increasing the need for last-mile and regional distribution services, positioning road haulage as a key facilitator of trade and economic growth in the region.

Who are the major players in the global road haulage market?

The major players in the road haulage market include CONCOR, AM Cargo, Gosselin, Kindersley Transport Ltd., LKW WALTER, Manitoulin Transport Inc., Monarch Transport, SLH Transport, LLC, UK Haulier, and Woodside Logistics Group.

Recent Developments

- In December 2024, the International Road Transport Union (IRU) presented AI-based digital solutions at a large-scale logistics conference in Saudi Arabia in order to make road transport efficient and sustainable. Another move taken by IRU was to introduce its Examiner and RoadMasters platforms that would facilitate standardized certification and assessment of driver skills.(Source: https://www.iru.org)

- In June 2024, the European Union and Ukraine signed a renewal and revision of their road transport agreement to enhance trade at the cross-border. This extension assisted Ukraine in accessing the EU markets and strengthened road freight links between the regions. (Source:https://transport.ec.europa.eu)

Segments Covered in the Report

By Service Type

- Full Truckload (FTL)

- Less Than Truckload (LTL)

- Container & Intermodal Road Haulage

- Refrigerated / Temperature-Controlled Haulage

- Specialized / Bulk Road Transport

By Vehicle Type

- Heavy Trucks / Tractor-Trailers

- Medium Trucks

- Light Commercial Vehicles (LCVs)

- Other Fleet Vehicles (Trailers, Tankers)

By Ownership / Provider Type

- Third-Party Logistics (3PL) Road Haulage

- In-House / Dedicated Fleet Haulage

- Contract Carriage / Outsourced Long-Term Contracts

- Other Provider Models

By Cargo Type

- Dry & General Goods

- Perishables / Temperature-Sensitive Cargo

- Automotive & Heavy Machinery

- Hazardous Materials & Chemicals

- Other Cargo Types

By Technology / Digital Integration

- Telematics & Fleet Tracking

- Transport Management Systems (TMS)

- Route Optimization & AI Analytics

- IoT / Sensor-based Cargo Monitoring

- Autonomous Driving Capabilities (emerging)

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting