What is the Rotary Sprinkler System Market Size in 2026?

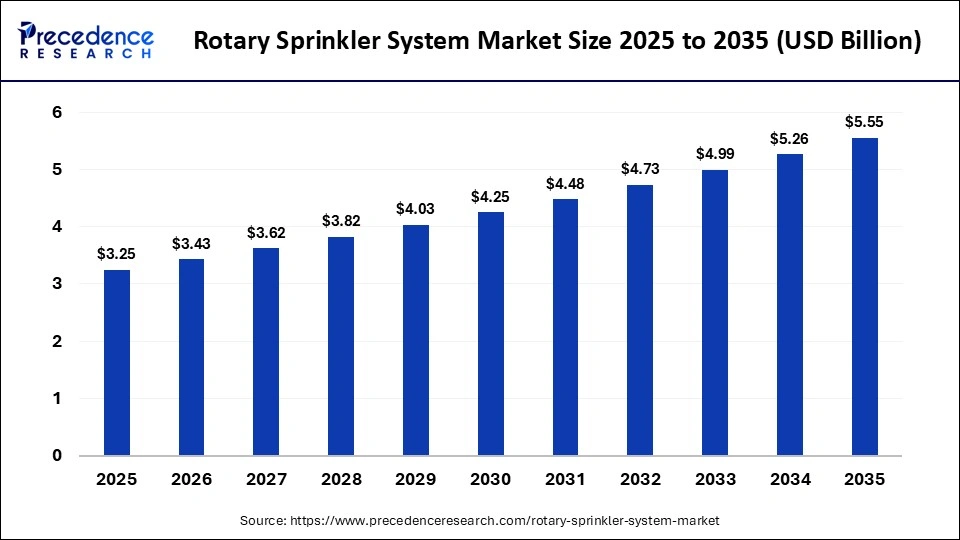

The global rotary sprinkler system market size accounted for USD 3.25 billion in 2025 and is predicted to increase from USD 3.43 billion in 2026 to approximately USD 5.55 billion by 2035, expanding at a CAGR of 5.50% from 2026 to 2035. The market growth is attributed to increasing global demand for water-efficient irrigation driven by agricultural intensification and water conservation priorities.

Key Takeaways

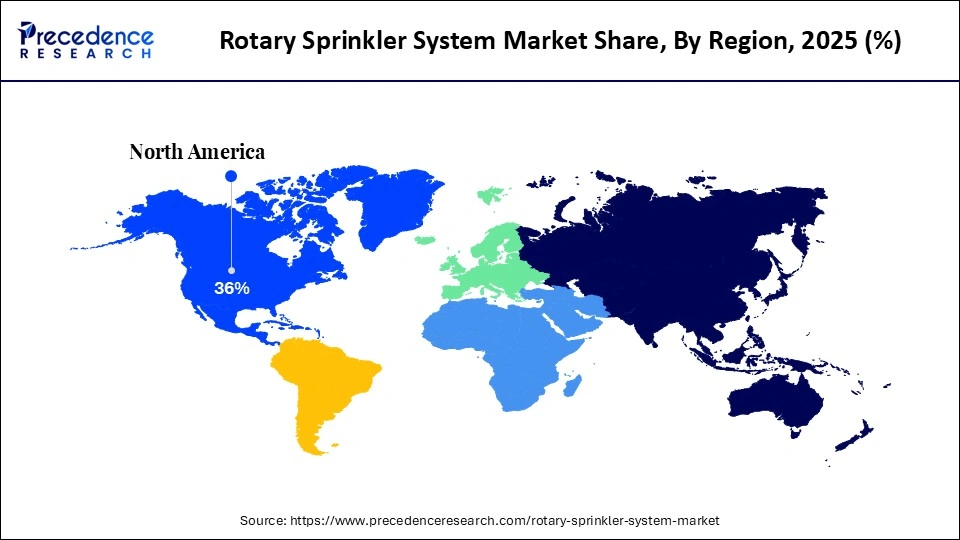

- North America dominated the global market with the largest share of 36% in 2025.

- Asia-Pacific is expected to grow at the fastest CAGR between 2026 and 2035.

- By type, the ram type segment contributed the highest market share in 2025.

- By type, the steam type segment is expected to grow at a rapid CAGR between 2026 and 2035.

- By application, the farmland segment held a major market share in 2025.

- By application, the lawn segment is expected to expand at the highest CAGR from 2026 to 2035.

Which Factors Drive the Rotary Sprinkler System Market?

The rising global pressure to improve water efficiency and ensure food security is a major driver boosting the market. Rotary sprinkler systems operate with rotary nozzles, with spray pressurized water in circular or sector formations. This achieves even distribution of farmland and minimizes losses of water through run-off and over-irrigation. Furthermore, the increasing global focus on water conservation, agricultural productivity, and sustainable farming continues to serve as a key driver supporting market growth.

Impact of Artificial Intelligence on the Rotary Sprinkler System Market

The market is transforming with artificial intelligence (AI), making it possible to accurately and automatically manage irrigation through data-informed systems. AI-based controllers are used to interpret soil moisture, evapotranspiration, and crop water demands to optimize the schedule of sprinkler rotations. Intelligent systems are applied by farmers to provide accurate amounts of water across vast agricultural land and avert excess irrigation in the fields. Additionally, it creates real-time visibility, leading to a quicker decision-making process and increased irrigation efficiency within mechanized farming activities.

Rotary Sprinkler System Market Trends

- Expansion of Climate-Resilient Irrigation Systems Supporting Extreme Weather Farming: Farmers increasingly install rotary sprinklers to operate efficiently under drought and extreme temperature conditions. These systems also aid in keeping the irrigation constant through the erratic climatic changes. This trend is increasing the demand in areas where the agricultural climate is becoming risky.

- Emergence of Autonomous Irrigation Systems Integrated with Robotic Farming Operations: Advanced farming operations deploy autonomous irrigation systems synchronized with robotic planting and crop monitoring equipment. Rotary sprinklers are automated and controlled by the input of robotic field intelligence. This technology is changing irrigation into a completely automated element of precision agriculture systems.

Rotary Sprinkler System MarketGrowth Factors

- Expansion of Precision Agriculture Practices: Rising adoption of data-driven farming is propelling demand for accurate rotary sprinkler irrigation systems globally.

- Government Irrigation Modernization Programs: Increasing public investment in efficient irrigation infrastructure is driving the installation of advanced rotary sprinkler equipment.

- Rising Water Scarcity and Conservation Requirements: Increasing pressure on freshwater resources is fuelling a transition toward efficient sprinkler-based irrigation technologies.

Transformative Expansion of Precision Irrigation Infrastructure Reinforcing the Rotary Sprinkler System Market Landscape

- According to the Food and Agriculture Organization (FAO) AQUASTAT database and 2024–2025 irrigation updates, more than 37 million hectares of agricultural land globally are equipped with sprinkler irrigation systems, representing roughly 10–12% of the world's total irrigated land, reflecting the extensive installed base of rotary and pressurized sprinkler systems used in mechanized farming and water-efficient agriculture.

- The U.S. Department of Agriculture (USDA) confirmed in its 2023 Irrigation and Water Management Survey that more than 53.1 million acres of U.S. farmland are irrigated using center pivot sprinkler systems, the majority of which rely on rotary sprinkler heads, making the U.S. the single largest installed base of rotary sprinkler irrigation globally.

- India has brought over 15.42 million hectares under micro-irrigation (including sprinkler systems) as of March 2024 through the Pradhan Mantri Krishi Sinchayee Yojana (PMKSY), making it one of the world's largest government-supported precision irrigation deployments, with sprinkler irrigation forming a major share across water-stressed states such as Rajasthan, Karnataka, and Maharashtra.

- Brazil's federal irrigation expansion initiatives, including the National Irrigation Policy, supported development of over 8.2 million hectares of irrigated land by 2024, with sprinkler irrigation representing one of the primary mechanized systems deployed in large-scale grain and sugarcane production regions, as reported by the Ministry of Integration and Regional Development and Brazilian Agricultural Research Corporation.

- The U.S. Department of Agriculture announced in 2024 a major water conservation and irrigation modernization investment program investing USD 400 million, supporting the adoption of advanced irrigation systems, including sprinkler technologies, to improve efficiency and drought resilience across western agricultural regions.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 3.25 Billion |

| Market Size in 2026 | USD 3.43 Billion |

| Market Size by 2035 | USD 5.55 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 5.50% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Type, Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segmental Insights

Type Insights

Why Did Ram Type Segment Dominate the Rotary Sprinkler System Market?

The ram type segment dominated the market in 2025, as they are highly mechanically reliable when operating in extended workloads of agricultural irrigation. These systems work under hydraulic power, which cuts the reliance on external electrical power infrastructure to a considerable degree.

Farmers with large farms favor using the ram-based sprinkler drive as it is compatible with constant rotation and more accurate water distribution. Moreover, the expansion of infrastructure in water-stressed farmlands also boosts the use of the ram-type sprinkler drive technologies.

The steam type segment is expected to expand rapidly in the market in the coming years, owing to its advanced pressure regulation and controlled rotary sprinkler movement capabilities. Such systems incorporate pressurized drive systems, enhancing consistency in rotations at varying irrigation pressure conditions. The increased investment in the automation of irrigation systems facilitates the use of advance stem type sprinkler drive systems that have facilitated the use of precision farming techniques.

Application Insights

Which Application Segment Led the Rotary Sprinkler System Market?

The farmland segment held the largest revenue share in the market in 2025, due to the growing demand for homogenous and scalable irrigation systems. Rotary sprinklers assist farmers in irrigating large areas of crops, besides enhancing efficiency in distributing water. Farmers spent a lot of money on mechanized irrigation to enhance productivity and stabilize the production output of products.

In 2024, the Food and Agriculture Organization stated that irrigated agriculture occupies more than 341 to 352 million hectares of land across the world, which contributes to approximately half of the total crop production. Planting of water-consuming foods like corn, wheat, and sugarcane enhanced the rates of installation of rotatory sprinkler systems. Furthermore, the global food demand increased steadily, which encouraged farmers to expand irrigation infrastructure investments rapidly.

The lawn segment is expected to witness the fastest growth in the market over the forecast period, owing to the fact that urban landscaping works are more common in residential and commercial lands. Rotary sprinklers help even out water application on lawns, parks, golf courses, and recreational landscapes. The development of the real estate was based on automated irrigation systems to preserve both aesthetic and environmental values.

It is expected that smart irrigation technologies enhance the faster adoption of rotatory sprinkler systems in urban and semi-urban infrastructure projects. City officials invested in communal green cover to enhance environmental sustainability and urbanity. Moreover, commercial property owners invested in intelligent irrigation equipment expected to improve landscape quality and operational efficiency, fuelling the segment's growth.

Regional Insights

North America Rotary Sprinkler System Market Size and Growth 2026 to 2035

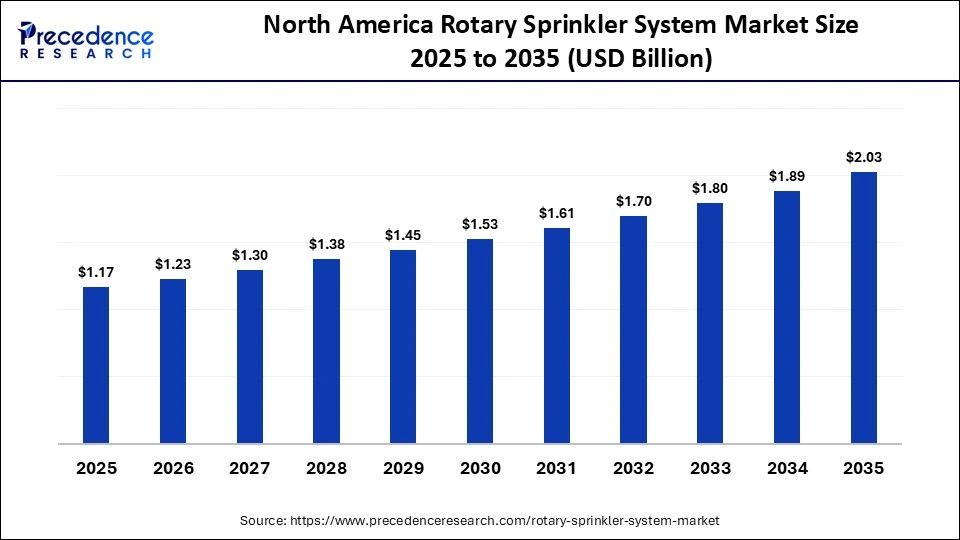

The North America rotary sprinkler system market size is estimated at USD 1.17 billion in 2025 and is projected to reach approximately USD 2.03 billion by 2035, with a 5.66% CAGR from 2026 to 2035.

Why Did North America Secure Dominance in the Rotary Sprinkler System Market?

North America held a major revenue share of the market in 2025, due to the use of highly mechanized irrigation systems by farmers in the large areas of cultivated land. The U.S. and Canada invest heavily in advanced irrigation to improve agricultural productivity and water management efficiency.

In 2024, the USDA found that, with the prevalence of irrigation reliance, irrigated farms occupying more than 53.1 million hectares had been reported. Major equipment manufacturers like the Valmont Industries and Lindsay Corporation develop center pivot sprinkler installations at a very high rate. Additionally, agricultural producers across the western U.S. increase sprinkler adoption to address declining groundwater availability and drought risks.

U.S. Rotary Sprinkler System Market Size and Growth 2026 to 2035

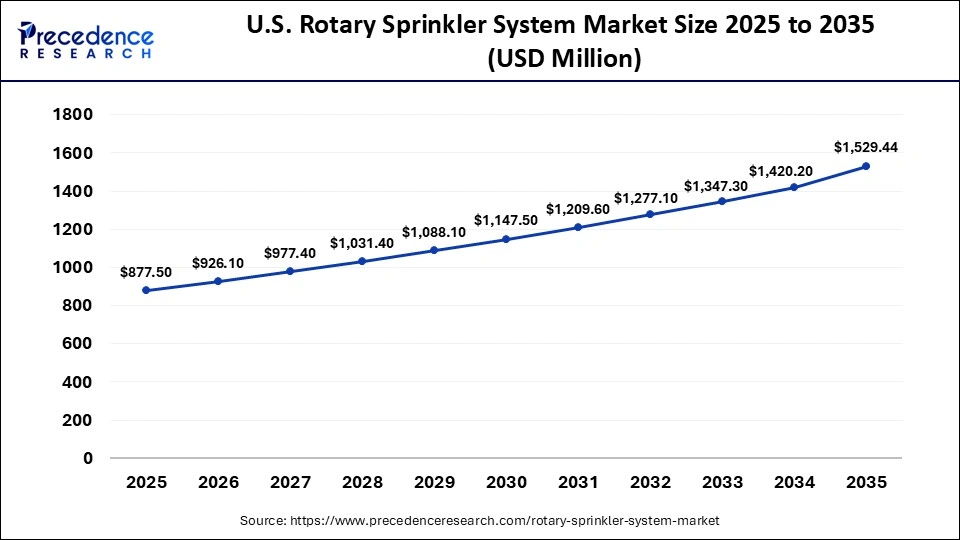

The U.S. rotary sprinkler system market size is calculated at USD 877.50 million in 2025 and is expected to reach nearly USD 1,529.44 million in 2035, accelerating at a strong CAGR of 5.71% between 2026 and 2035.

U.S. Strengthening Leadership through Advanced Precision Systems

The U.S. leads the market in the North America region, owing to massive commercial farms that accommodate mechanized irrigation on large production areas. The USDA reported in 2023 that irrigated agriculture covered about 22.1 million hectares. This boosted the need for long-time rotary sprinklers that are used in center-pivot and lateral-move systems. Furthermore, the integration of digital agriculture technologies and strong institutional support for irrigation efficiency propel market growth.

How is Asia-Pacific Growing in the Rotary Sprinkler System Market?

Asia-Pacific is expected to witness the fastest growth during the predicted timeframe, as governments accelerate irrigation modernization across major agricultural economies. Countries, including India, China, and Australia, are making more investments in the development of water-efficient irrigation systems. In 2025, the FAO stated that Asia comprises almost 70% of total global irrigated land, which implies enormous irrigation pressure.

The farmers implemented sprinkler systems as a way of increasing crop yield and also dealing with water shortage problems. The expansion is expected to increase further as a result of increasing agricultural intensification and irrigation expansion programs that are supported by the government. According to the Ministry of Agriculture and Farmers Welfare 2025 report, under national irrigation programs, the micro and sprinkler irrigation had spread to over 15 million hectares of land by 2025. Additionally, population growth increases food demand, which encourages farmers to improve irrigation efficiency across large cultivation zones.

India Accelerating through Large-Scale Irrigation Modernization Initiatives

India is leading the charge in the Asia-Pacific market, as national irrigation modernization programs accelerate sprinkler system adoption across major agricultural states. The Pradhan Mantri Krishi Sinchayee Yojana was one of the government programs that encouraged the use of water-efficient irrigation technologies that are expected to enhance agricultural productivity. Growth in this country increased owing to the rising investments in irrigation infrastructure and the increased use of water-efficient irrigation technologies.

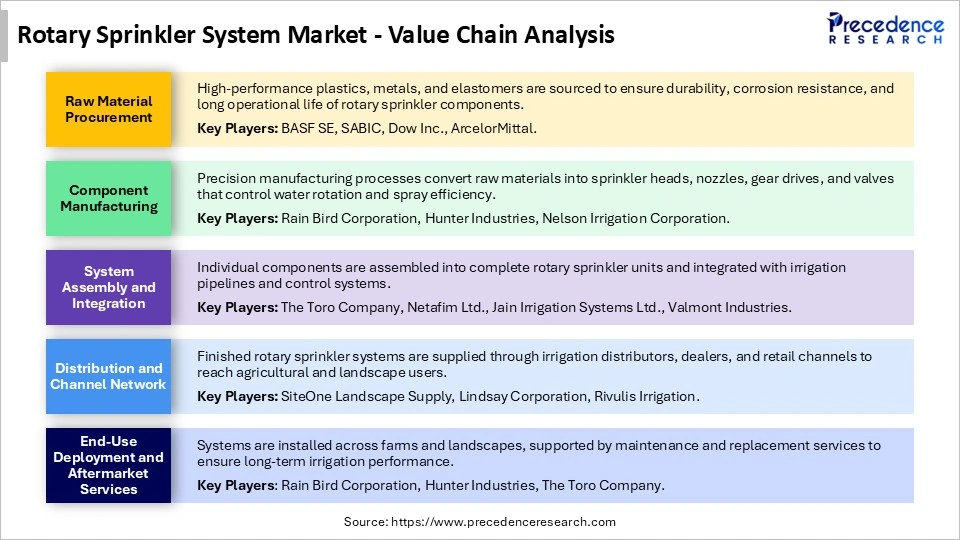

Rotary Sprinkler System Market Value Chain Analysis

Rotary Sprinkler System Market Companies

- Claber

- GARDENA

- Guardian Landscape

- HydroPoint Data Systems

- KNS Engineering

- Komatsu India Private Limited (KIPL)

- Krain

- MP Rotator

- Orbit

- Rain Bird Corporation

- Xylem

- BLURAIN Irrigation Systems

- Oasis Irrigation Equipment Co., Ltd.

Recent Developments

- In August 2025, Irrigreen launched Irrigreen 3.0, an advanced AI-driven lawn irrigation platform featuring the new Sprinkler 3 robotic head and Smart Controller 3, managed through a unified mobile application. Manufactured in the U.S., the system improves installation speed, adapts to complex terrain, and addresses challenges such as sandy soil conditions and fluctuating water pressure through proprietary control technologies.(Source: https://www.landscapemanagement.net)

- In August 2025, Valley Irrigation, a subsidiary of Valmont Industries, launched the ICON+ Smart Panel, expanding its ICON precision irrigation control portfolio. The system delivered essential automation features, improved operational simplicity, and provided farmers with a cost-efficient solution to enhance irrigation performance and overall farm productivity.(Source: https://www.americanagnetwork.com)

- In September 2024, Netafim, the precision agriculture division of Orbia Advance Corporation, introduced GrowSphere, a digital operating system designed to automate precision irrigation and fertigation processes. The platform enhanced farm productivity by improving operational efficiency, optimizing water and nutrient delivery, and supporting farmers across varied climates and agricultural environments.(Source: https://www.globalagtechinitiative.com)

- In November 2024, CropX unveiled a new above-canopy evapotranspiration sensor across the Australasia region, enabling real-time monitoring of crop water usage. Integrated with the CropX farm management platform, this innovation provided precise irrigation scheduling insights and enabled farmers to manage water resources more efficiently through remote digital monitoring.(Source:https://www.prnewswire.com)

Segments Covered in the Report

By Type

- Ram Type

- Steam Type

By Application

- Lawn

- Garden

- Farmland

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting