What is Screen-printed Electrodes Market Size?

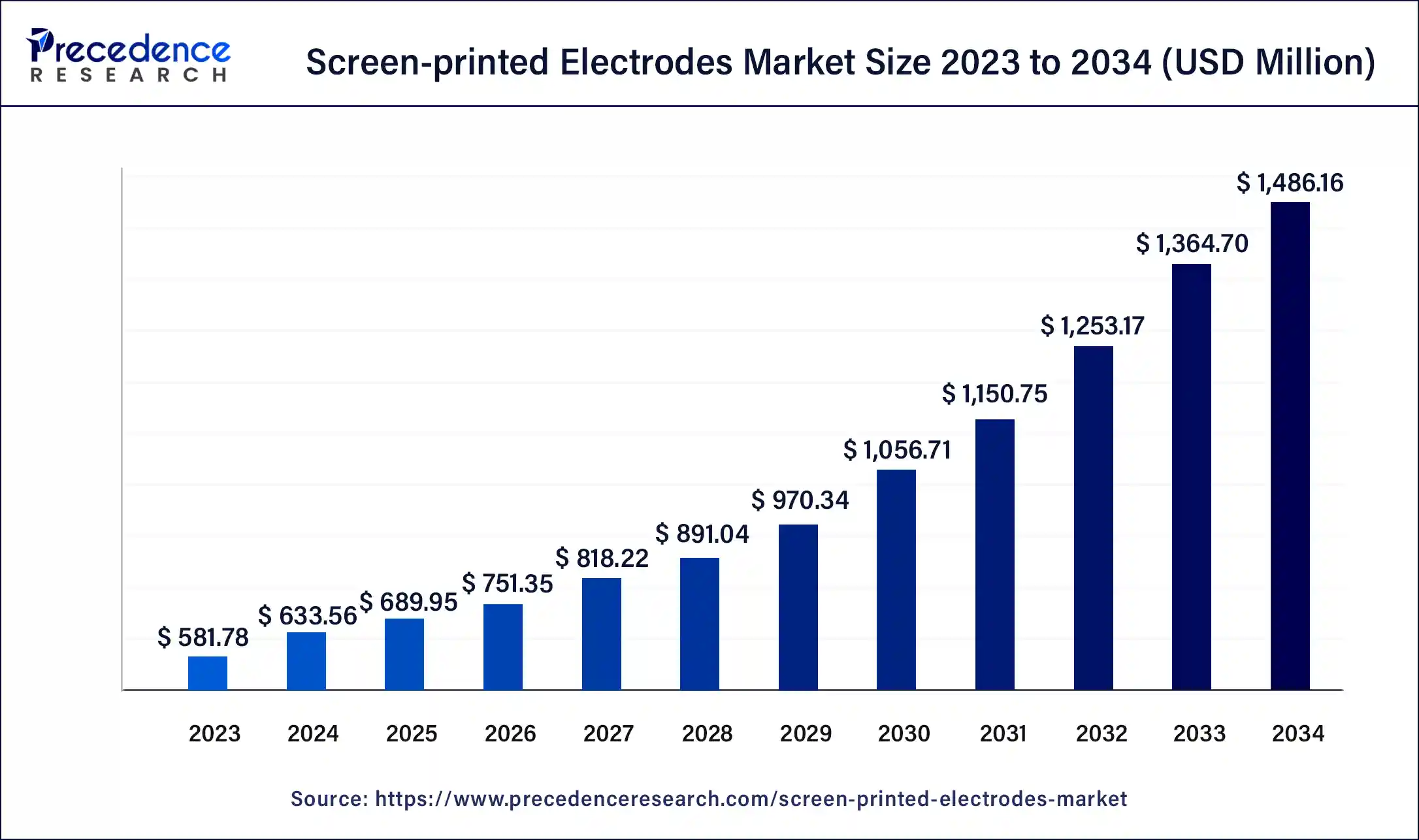

The global screen-printed electrodes market size is estimated at USD 689.95 million in 2025 and is predictedc to be worth around USD 1,601.00 million by 2035, growing at a 8.78% CAGR from 2026 to 2035.

Market Highlights

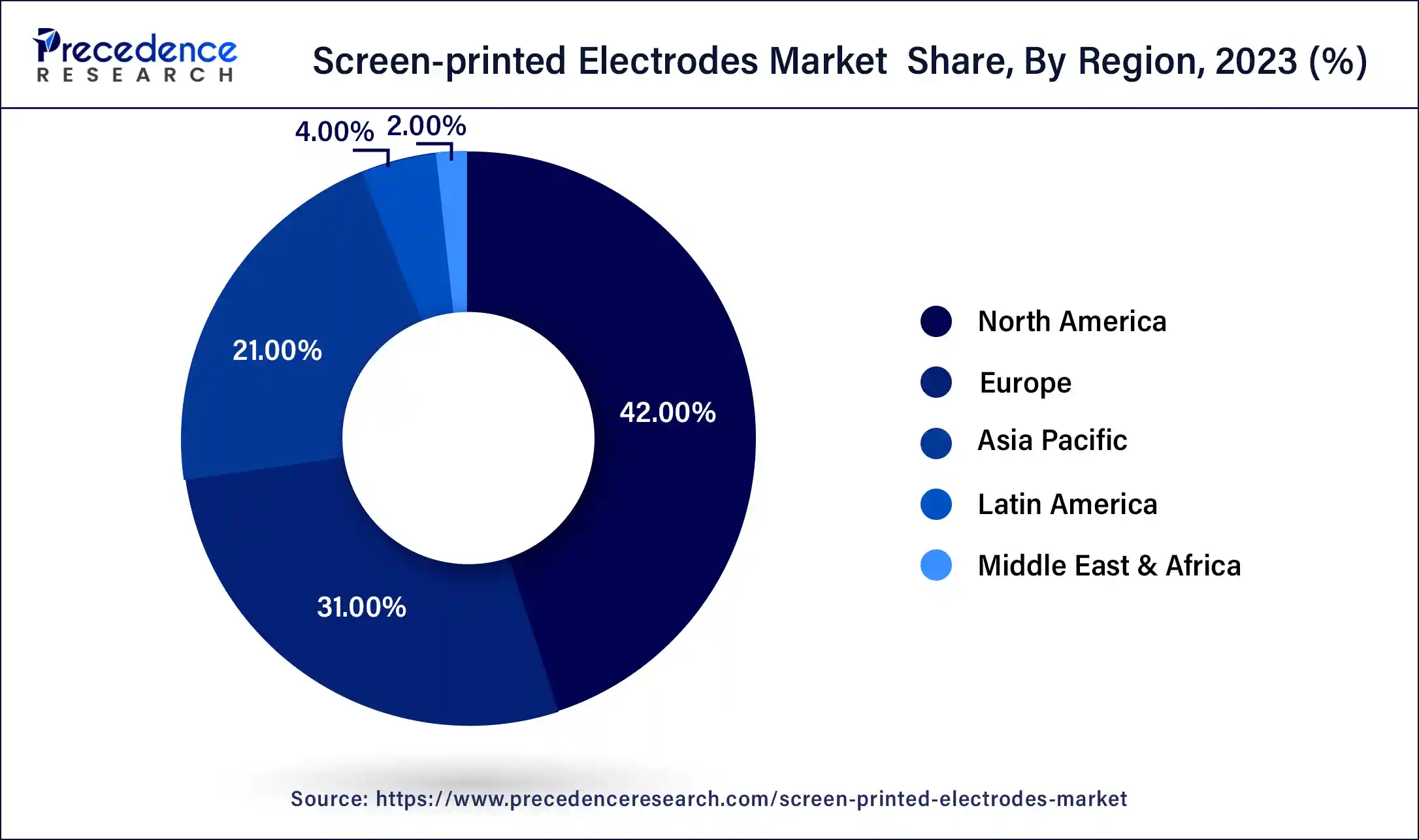

- North America contributed more than 42% of revenue share in 2025.

- Asia-Pacific is estimated to expand the fastest CAGR between 2026 and 2035

- By type, the carbon-based segment has held the largest market share of 40% in 2025.

- By type, the metal-based segment is anticipated to grow at a remarkable CAGR of 9.2% between 2026 and 2035

- By application, the medical diagnosis segment generated over 35% of revenue share in 2025.

- By application, the food analysis segment is expected to expand at the fastest CAGR over the projected period.

Market Overview

Screen-printed electrodes (SPEs) are a type of sensing platform widely used in electrochemical applications. These electrodes are created through a cost-effective and scalable screen-printing process, where conductive ink is deposited onto a substrate through a mesh screen. The resulting electrodes are characterized by their simplicity, versatility, and reproducibility. SPEs find applications in various fields, including biochemistry, environmental monitoring, and sensor development.

The manufacturing process allows for the customization of electrode designs, enabling the integration of different materials and configurations to meet specific application requirements. The simplicity of production makes SPEs an attractive choice for mass production and disposable sensor applications. Due to their miniaturized and portable nature, screen-printed electrodes have become integral components in point-of-care diagnostic devices and wearable sensors, facilitating rapid and on-site analysis. The versatility and accessibility of SPEs contribute to their growing popularity in research and industry, making them essential tools for electrochemical measurements in diverse fields.

Screen-printed Electrodes Market Growth Factors

- Increased Demand for Portable Sensors: Growing interest in portable and point-of-care diagnostic devices is boosting the demand for screen-printed electrodes (SPEs) due to their miniaturized and lightweight nature.

- Rising Importance in Environmental Monitoring: SPEs are gaining prominence in environmental monitoring applications, such as detecting pollutants and contaminants, driving market growth.

- Expanding Biomedical Applications: The biomedical field is witnessing a surge in the use of SPEs for applications like biosensors, immunoassays, and DNA sensing, contributing to market expansion.

- Advancements in Wearable Sensor Technologies: The integration of SPEs in wearable sensors for real-time health monitoring is a key growth factor, aligning with the increasing adoption of wearable technologies.

- Cost-Effectiveness and Scalability: The cost-effective and scalable manufacturing process of SPEs is fostering their widespread adoption in various industries, promoting market growth.

- Customization Capabilities: The ability to customize electrode designs to meet specific application requirements is driving the demand for SPEs in research and industry.

- Technological Innovations in Printing Techniques: Ongoing advancements in screen-printing techniques are enhancing the performance and capabilities of SPEs, opening up new opportunities in the market.

- Rising Focus on Point-of-Care Diagnostics: The emphasis on rapid and on-site analysis for medical diagnostics is fueling the demand for SPEs in point-of-care testing devices.

- Expanding Application in Food Safety Testing: SPEs are finding increased use in the food industry for detecting contaminants and ensuring food safety, contributing to market growth.

- Integration in Energy Storage Devices: The utilization of SPEs in energy storage devices, such as supercapacitors and batteries, is a key growth factor driven by the need for efficient energy storage solutions.

- Growing Importance in Neurochemical Sensing: The application of SPEs in neurochemical sensing for studying neurotransmitters is expanding, fostering growth in the market.

- Emergence of Printed Electronics: The broader trend of printed electronics is positively impacting the SPE market as printed components become integral in various electronic applications.

- Increased Research and Development Activities: Growing investments in research and development activities focused on improving SPE performance and applications are propelling market expansion.

- Expansion in Electroanalytical Techniques: SPEs are becoming increasingly vital in electroanalytical techniques, driving their adoption in laboratories and research institutions.

- Rising Awareness of Environmental Sustainability: The environmentally friendly nature of screen-printing processes is aligning with the global focus on sustainability, contributing to market growth.

- Demand in Aerospace and Defense: SPEs find applications in aerospace and defense industries for sensing and monitoring, leading to increased demand in these sectors.

- Collaborations and Partnerships: Collaborations between research institutions, manufacturers, and end-users are fostering innovation and driving the growth of the SPE market.

- Increasing Investments in Healthcare Infrastructure: The global increase in healthcare infrastructure investments is creating opportunities for the integration of SPEs in medical devices and diagnostics.

- Surge in Internet of Things (IoT) Applications: The rise of IoT applications is boosting the demand for SPEs as they play a crucial role in the development of smart sensors and connected devices.

- Enhanced Electrochemical Performance: Continuous efforts to enhance the electrochemical performance of SPEs, including sensitivity and selectivity, are contributing to their widespread adoption in diverse applications.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 689.95 Million |

| Market Size in 2026 | USD 751.35 Million |

| Market Size by 2035 | USD 1,601.00 Million |

| Growth Rate from 2026 to 2035 | CAGR of 8.78% |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Type, Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Rising demand for portable and point-of-care diagnostics

The rising demand for portable and point-of-care diagnostics is a key driver propelling the growth of the screen-printed electrodes (SPEs) market. As the healthcare industry undergoes a paradigm shift toward decentralized and patient-centric approaches, the need for compact, portable diagnostic devices is escalating. SPEs play a pivotal role in this trend due to their miniaturized form factor and suitability for on-the-go testing. Their lightweight nature and ease of integration make them essential components in biosensors and diagnostic platforms, enabling rapid and accurate analysis outside traditional laboratory settings.

Moreover, the increasing prevalence of diseases and the emphasis on early detection are fueling the adoption of portable diagnostic devices, where SPEs contribute to the development of efficient and sensitive sensors. This surge in demand aligns with the broader goal of providing accessible and timely healthcare solutions, driving the market for screen-printed electrodes across various medical applications.

Restraint

Challenges in mass production uniformity

Challenges in achieving mass production uniformity pose a significant restraint on the screen-printed electrodes (SPEs) market growth. The intricacies of large-scale manufacturing introduce variability in the printing processes and materials used, impacting the consistency and reproducibility of SPEs. Maintaining uniformity across electrodes is crucial for ensuring reliable and predictable performance, especially in applications demanding precision.

The difficulty in achieving consistent quality across a high volume of produced electrodes can deter manufacturers and end-users, limiting the scalability of SPEs. Variations in thickness, composition, or other key parameters can lead to performance disparities, hindering the widespread adoption of SPEs in critical applications. Addressing these challenges requires continuous advancements in manufacturing technologies and quality control measures to enhance the reproducibility of SPEs and instill confidence in industries relying on consistent and uniform sensor performance.

Opportunity

Rapid expansion in healthcare diagnostics

The rapid expansion of healthcare diagnostics is creating substantial opportunities for the screen-printed electrodes (SPEs) market. With an increasing emphasis on point-of-care testing and portable diagnostic solutions, SPEs have become pivotal components in the development of advanced biosensors. The miniaturized and cost-effective nature of SPEs makes them well-suited for integration into wearable health technologies and compact diagnostic devices, aligning with the evolving trends in personalized and continuous healthcare monitoring. SPEs offer precise and efficient electrochemical sensing capabilities, enabling the detection of biomarkers and analytes critical for disease diagnosis.

As the demand for quick and on-the-spot diagnostic results continues to surge, the versatility of SPEs positions them as key contributors to the development of innovative healthcare solutions. Their role in biosensors and wearable devices presents a promising avenue for growth, allowing for real-time health monitoring and early detection of various medical conditions, ultimately driving the expansion of the SPEs market in the healthcare diagnostics sector.

Segment Insights

Type Insights

In 2025, the carbon-based segment had the highest market share of 40% based on the type. The carbon-based segment in the screen-printed electrodes (SPEs) market includes electrodes predominantly composed of carbon materials such as graphite, carbon nanotubes, or graphene. These materials offer excellent electrical conductivity, chemical stability, and biocompatibility. In recent trends, there's a growing focus on enhancing the electrochemical performance of carbon-based SPEs for applications in biosensing, environmental monitoring, and energy storage. Innovations in carbon nanomaterials and advanced fabrication techniques contribute to improved sensitivity and selectivity, driving the adoption of carbon-based SPEs in diverse electrochemical applications.

The metal-based segment is anticipated to expand at a significant CAGR of 9.2% during the projected period. The metal-based segment in the screen-printed electrodes (SPEs) market refers to electrodes fabricated using various metals like gold, platinum, and silver. These metal-based SPEs exhibit excellent conductivity and stability, making them suitable for diverse electrochemical applications. A notable trend in this segment involves the increasing preference for gold-based electrodes due to their biocompatibility and corrosion resistance, particularly in biosensing applications. Additionally, ongoing research focuses on optimizing the design and composition of metal-based SPEs to enhance their sensitivity and selectivity, further driving advancements in electrochemical sensing technologies.

Application Insights

According to the application, the medical diagnosis segment has held a 35% revenue share in 2023. In the screen-printed electrodes (SPEs) market, the medical diagnosis segment involves the utilization of SPEs in biosensors and diagnostic devices for the accurate detection of biomarkers, pathogens, and other relevant analytes. The trend in this segment includes a growing focus on point-of-care testing and portable diagnostic solutions, leveraging the miniaturized and cost-effective nature of SPEs. As the demand for rapid and on-site medical diagnostics rises, the medical diagnosis segment is witnessing increased adoption of SPEs for their versatility and suitability in enabling quick and reliable electrochemical sensing in various healthcare applications.

The food analysis segment is anticipated to expand fastest over the projected period. In the screen-printed electrodes (SPEs) market, the food analysis segment involves the use of SPEs for detecting and quantifying analytes in food samples. SPEs are employed in food safety testing to identify contaminants, allergens, and quality parameters. A trend in this application is the development of portable and rapid testing devices for on-site food analysis. The demand for cost-effective, easy-to-use, and efficient sensors in the food industry is driving the adoption of SPEs, facilitating quick and reliable detection processes, and enhancing overall food safety and quality control measures.

Regional Insights

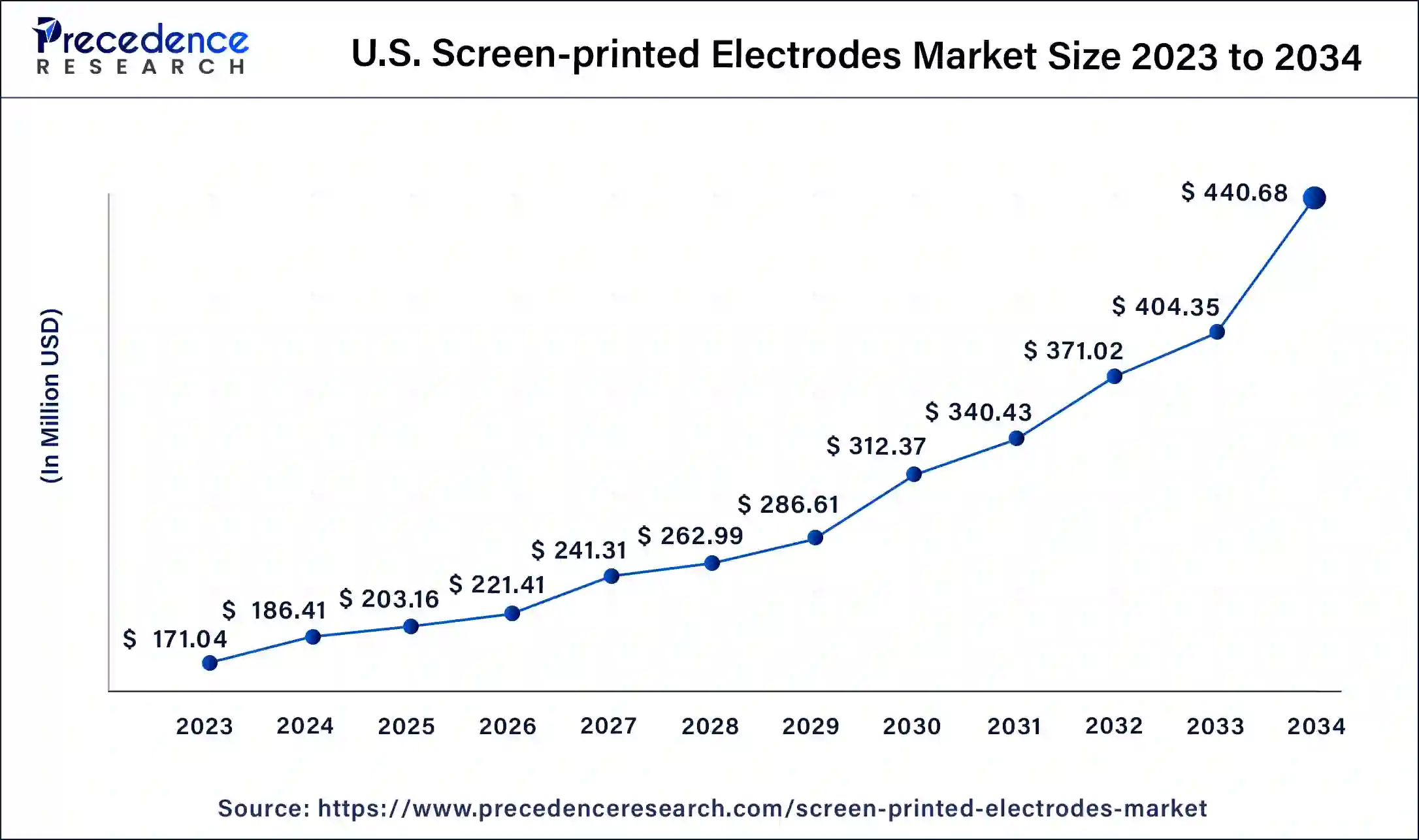

U.S. Screen-printed Electrodes Market Size and Growth 2026 to 2035

The U.S. screen-printed electrodes market size is valued at USD 203.16 million in 2025 and is anticipated to reach around USD 475.01 million by 2035, at a CAGR of 8.86% from 2026 to 2035.

U.S. Market Analysis

The U.S. screen-printed electrodes market is growing, driven by the rising demand for point-of-care (POC) diagnostics, R&D investments, and growth in wearables/biosensors. Advances in biosensor technology, combined with the rising prevalence of chronic diseases and the push for early disease detection, are further propelling the adoption of screen-printed electrodes in healthcare and environmental monitoring. Additionally, their integration in wearable devices and growing interest in electrochemical sensors for various applications like food safety and environmental testing contribute to the market growth.

North America has held the largest revenue share of 42% in 2025. North America holds a major share in the screen-printed electrodes market due to robust research and development activities, particularly in the healthcare and environmental sectors. The region's advanced technological infrastructure and significant investments in innovative technologies contribute to the widespread adoption of screen-printed electrodes. Moreover, a well-established healthcare industry and the presence of key market players further fuel the growth. The increasing demand for portable diagnostic devices and biosensors, coupled with a supportive regulatory environment, solidify North America's position as a leader in the screen-printed electrodes market.

What Makes Asia Pacific the Fastest-Growing Region in the Market?

Asia-Pacific is estimated to observe the fastest expansion. The Asia-Pacific region dominates the screen-printed electrodes market due to factors such as increasing industrialization, a rising focus on healthcare infrastructure, and a growing demand for portable diagnostic devices. The region's burgeoning economies, including China and India, contribute to the market share with expanding applications in diverse sectors. Additionally, the presence of key manufacturing hubs, research initiatives, and a proactive approach toward adopting innovative technologies further solidify Asia-Pacific's position as a major player in the screen-printed electrodes market.

India Market Analysis

The market in India is driven by the increasing demand for affordable, portable, and user-friendly diagnostic solutions, especially in healthcare and environmental monitoring. With the rise of chronic diseases and the need for early detection, the adoption of SPE-based biosensors in point-of-care (POC) devices is growing. Furthermore, government initiatives focused on improving healthcare infrastructure, combined with the growing use of SPEs in sectors like agriculture, food safety, and pollution monitoring, are contributing to the market's expansion in India.

Why is Europe Considered a Significant Market?

Europe is considered a significant market for screen-printed electrodes due to its strong focus on innovation in healthcare, environmental monitoring, and wearable technologies. The region is home to several key research institutions and companies advancing SPE technology, especially in biosensors used for diagnostics and point-of-care applications. Germany is a major contributor to the European market, owing to its emphasis on healthcare, automotive, and flexible electronics. The demand for lightweight, cost-effective sensors in electric vehicles (EVs), diagnostics, and smart packaging is fueling innovation in materials and manufacturing processes.

What Potentiates the Market within Latin America?

The screen-printed electrodes market in Latin America is driven by the growing need for affordable and efficient diagnostic solutions, especially in healthcare and environmental monitoring. The rising prevalence of chronic diseases and the increasing demand for point-of-care devices are driving adoption in medical applications. Additionally, the expanding agriculture and food safety sectors, along with the growing emphasis on sustainability and environmental monitoring, further contribute to the market's growth.

How is the Opportunistic Rise of the Middle East & Africa (MEA) in the Market?

The MEA is experiencing substantial growth in the screen-printed electrodes market, driven by the growing demand for affordable and portable diagnostic tools in healthcare, especially in remote and underserved areas. The region's increasing focus on improving healthcare infrastructure, along with rising awareness of chronic diseases, boosts the adoption of SPE-based biosensors in point-of-care applications. Additionally, industries like agriculture and environmental monitoring are contributing to market growth, as SPEs are increasingly used for food safety, pollution control, and water quality testing.

Screen-printed Electrodes Market Companies

- DuPont

- Heraeus

- Johnson Matthey

- Noviotech

- Henkel

- Gwent Electronic Materials Ltd.

- Metrohm DropSens

- Pine Research Instrumentation

- ALS Co., Ltd.

- Zimmer and Peacock

- InRedox

- Dr. E. Merck KG

- Sensit Smart Technologies

- ElectroChem, Inc.

- Blue Spark Technologies

Recent Developments

- In June 2023, DuPont announced that it has acquired Henkel's electronics materials business for USD 3.3 billion. This acquisition will give DuPont a strong position in the screen-printed electrodes market, as Henkel is a leading supplier of carbon-based screen-printed electrodes.

- In May 2023, Heraeus announced that it has acquired Noviotech, a French company that develops and manufactures screen-printed electrodes for medical diagnostics. This acquisition will expand Heraeus' product portfolio and give it access to Noviotech's expertise in the development of innovative screen-printed electrodes.

- In April 2023, Johnson Matthey announced that it has formed a joint venture with Methode Electronics to develop and manufacture screen-printed electrodes for wearable electronics. This joint venture will combine Johnson Matthey's expertise in materials science with Methode Electronics' expertise in manufacturing.

Segments Covered in the Report

By Type

- Carbon-based

- Metal-based

- Others

By Application

- Medical diagnosis

- Environmental monitoring

- Food analysis

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting