What is the Self-Driving Bus Market Size?

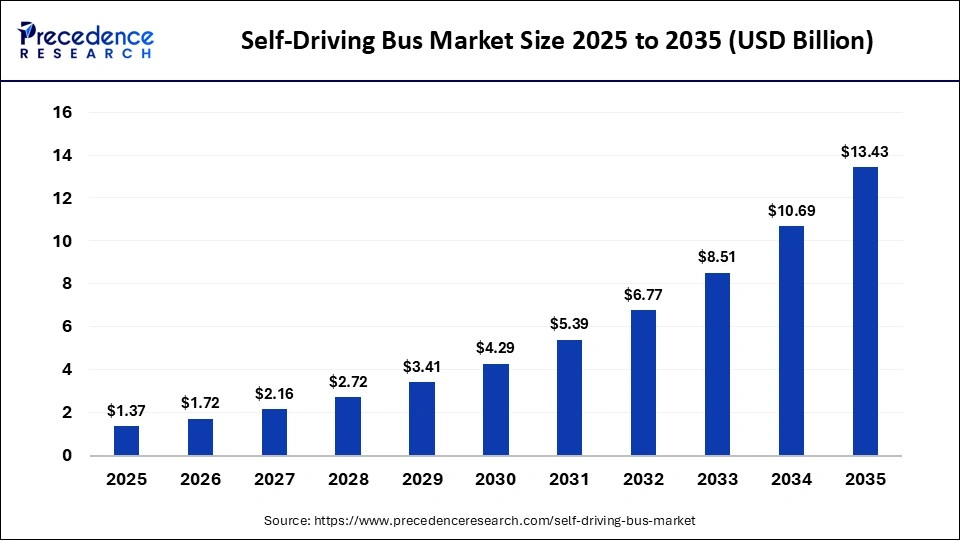

The global self-driving bus market size accounted for USD 1.37 billion in 2025 and is predicted to increase from USD 1.72 billion in 2026 to approximately USD 13.43 billion by 2035, expanding at a CAGR of 25.64% from 2026 to 2035. The market is driven by the need for safer, cost-efficient public transport and advances in autonomous driving technology.

Market Highlights

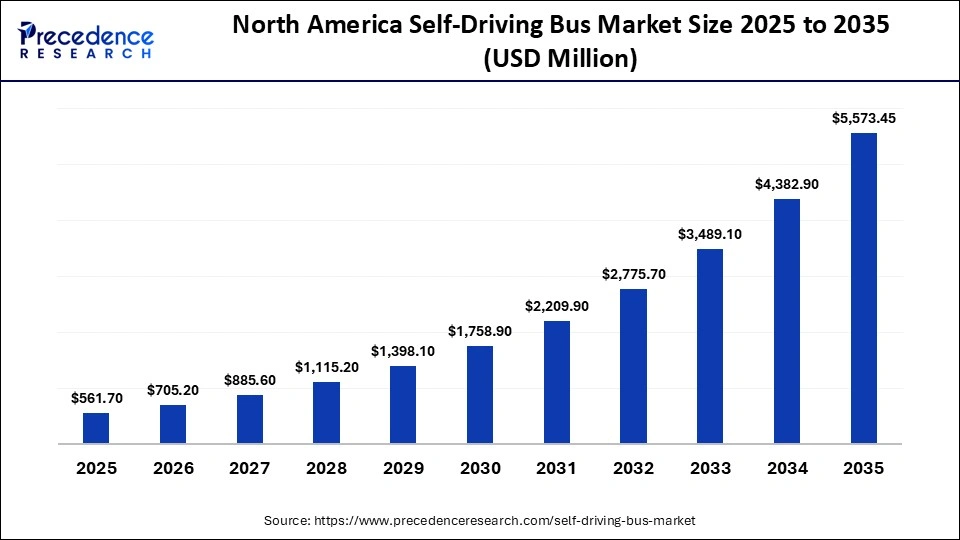

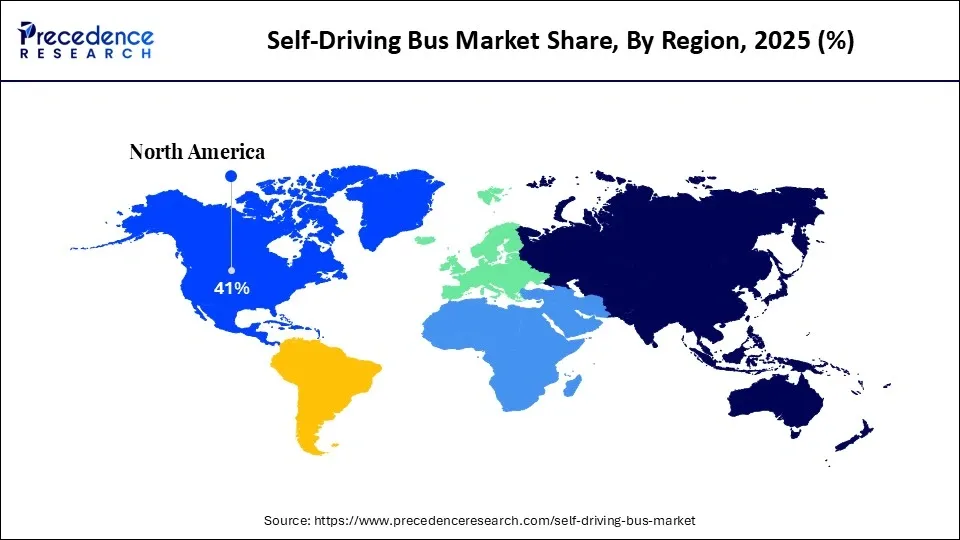

- North America accounted for the largest market share of 41% in 2025.

- The Asia Pacific is expected to witness the fastest growth during the forecasted years.

- By technology, the LiDAR-based navigation segment held a significant share of the market in 2025.

- By technology, the V2X communication technology segment is expected to show significant growth in the market over the forecast period.

- By level of automation, the level 3 segment dominated the market in 2025.

- By level of automation, the level 5 segment is expected to grow at the fastest rate over the forecast period.

- By application, the public transportation systems segment led the market in 2025.

- By application, the corporate campuses segment is expected to grow at a significant rate in the market over the forecast period.

- By end user, the government agencies segment held a major market share in 2025.

- By end user, the private transportation companies segment is expected to grow at the fastest rate in the market over the forecast period.

- By vehicle type, the shuttle buses segment held a significant share of the market in 2025.

- By vehicle type, the standard buses segment is expected to expand at a notable rte in the market over the forecast period.

Market Overview

The self-driving bus market is experiencing strong growth, fueled by ongoing advances in autonomous vehicle technologies and the surge in demand for efficient and intelligent public transport systems. The increasing traffic jams and fast urbanization are also contributing to the demand because the autonomous buses maximize the routes, enhance the frequency of service, and minimize the time per ride. A global focus on sustainable transportation is also a benefit to the market since self-driving buses, which may also be powered by electricity, help achieve lower emissions, lower fuel consumption, and higher energy efficiency. Market growth is further strengthened by favorable regulatory frameworks, advances in vehicle-to-everything connectivity, and the modernization of transportation infrastructure.

How is AI Integration Influencing the Self-Driving Bus Market?

The integration of artificial intelligence is transforming the self-driving bus market by enabling real-time vehicle control, decision-making, and enhanced passenger safety. AI systems aggregate data from LiDAR, radar, cameras, and ultrasonic sensors to accurately identify obstacles, recognize traffic signals, detect pedestrians, and continuously assess road conditions. Advanced driver assistance capabilities powered by AI support collision avoidance, lane keeping, adaptive cruise control, and emergency braking, ensuring smoother and safer vehicle operation. In addition, AI-driven fleet management allows operators to monitor vehicle performance, predictive maintenance requirements, and minimize downtime through predictive analytics.

Self-Driving Bus Market Trends

- Electrification and autonomous mobility are increasingly converging, with electric powertrains being integrated into self-driving buses to reduce emissions, optimize energy efficiency, and support global sustainability and clean transportation goals.

- Smart city initiatives are driving the deployment of autonomous buses, as governments seek to improve urban mobility, reduce congestion, and enable seamless transportation within intelligent infrastructure ecosystems.

- Advancements in AI and sensor technologies, including LiDAR, radar, and camera integration, are enhancing real-time perception, navigation accuracy, and overall safety of autonomous bus systems.

- Heightened focus on safety validation and regulatory compliance is shaping product development, building public trust, and enabling the large-scale deployment of autonomous bus solutions.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 1.37 Billion |

| Market Size in 2026 | USD 1.72 Billion |

| Market Size by 2035 | USD 13.43 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 25.64% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Technology, Level of Automation, Application, End-User, Vehicle Type, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segment Insights

Technology Insights

Why Does the LiDAR-based Navigation Segment Lead the Self-Driving Bus Market?

The LiDAR-based navigation segment led the market and accounted for the largest revenue share in 2025. This is mainly due to its ability to capture the surrounding environment precisely in 3 dimensions, which allows autonomous buses to identify obstacles, pedestrians, road edges, and traffic conditions in real time. This ability is essential to work safely in a complicated urban environment where traffic and unprecedented movements are typical. LiDAR is very appropriate for public transportation as it is consistent in different weather conditions relative to camera-only or radar-based systems.

The V2X communication technology segment is expected to grow at the fastest CAGR over the forecast period. This is because it enables real-time interaction between buses, surrounding vehicles, infrastructure, pedestrians, and traffic management systems, significantly enhancing situational awareness beyond onboard sensors. This connectivity improves safety, traffic flow, and routing efficiency through proactive decision-making, congestion reduction, and real-time hazard alerts. Additionally, increasing smart city investments, public transport prioritization at traffic signals, and regulatory support for connected mobility are accelerating V2X adoption in autonomous bus deployments.

Level of Automation Insights

Why Did the Level 3 Segment Contribute the Most Revenue Share in the Self-Driving Bus Market?

The level 3 - conditional automation segment contributed the most revenue share in 2025, driven by its strong alignment with existing regulatory frameworks and safety expectations. Compared to fully autonomous solutions, Level 3 systems offer greater commercial feasibility by allowing a gradual transition to automation while retaining driver oversight, thereby reducing operational and liability risks for transit authorities. Additionally, the relative maturity and lower cost of Level 3 technology enable faster and wider deployment across public transportation networks.

The level 5 - full automation segment is expected to grow at the fastest rate in the market during the projection period, as these buses operate entirely without human intervention, paving the way for fully autonomous public transportation. The increasing shortages of labor, the increase in the cost of operations, and the necessity of twenty-four-hour transit services are driving interest in fully autonomous solutions. Technology companies and governments around the world are also investing heavily in research and pilot programs and infrastructure improvements to support the deployment of level 5 autonomous buses, which further contribute to segmental growth.

Application Insights

Why Did the Public Transportation Systems Segment Dominate the Self-Driving Bus Market?

The public transportation systems segment dominated the market with the largest revenue share in 2025. This is because of the heightened use of self-driving vehicles in urban areas to make routes more efficient, reduce congestion, and enhance passenger safety. Governments consider self-driving buses as a strategic move to meet the increasing mobility needs and address environmental issues and driver shortage. The structured nature of public transit, with predictable routes and schedules, along with integration into smart city initiatives, has further accelerated adoption in this segment.

The corporate campuses segment is expected to grow at a significant CAGR over the forecast period. This is because companies with large campuses, technology parks, and industrial zones are capitalizing on self-driving buses to deliver safe, efficient, and sustainable movement to employees and visitors. Companies are increasingly adopting self-driving shuttles to enhance staff and visitor transportation, improve convenience, and reduce carbon footprints. Additionally, the simpler regulatory requirements on private roads allow faster implementation compared to public transportation networks.

End-User Insights

Why Did Government Agencies Segment Contribute the Most Revenue in the Self-Driving Bus Market?

The government agencies segment contributed the most revenue in 2025, as national and local governments have been vigorously adopting autonomous buses to modernize the transit system, reduce congestion, and meet the long-term sustainability and emission-reduction targets. These agencies often implement large-scale pilot projects and integrate autonomous buses into smart cities and intelligent transportation plans. Government-sponsored programs benefit from substantial budgets, extended planning horizons, and access to public infrastructure, enabling more efficient deployment of autonomous bus solutions.

The private transportation companies segment is expected to grow at the fastest CAGR in the coming years. These companies are rapidly turning toward self-driving buses in order to cut labor expenses, enhance efficiency in their operations, as well as diversifying the services that they provide. Advances in autonomous software have led to a drop in the cost of sensors, and vehicles have become more reliable, making them affordable for private firms. Growing consumer acceptance of autonomous transport, along with clearer regulatory frameworks, further supports the expansion of self-driving bus services in the private sector.

Vehicle Type Insights

Why Did the Shuttle Buses Segment Lead the Self-Driving Bus Market?

The shuttle buses segment led the market and accounted for the largest revenue share in 2025 because these vehicles operate on fixed, short-distance routes in controlled environments such as airports, campuses, and urban hubs, making them ideal for early autonomous deployment. Shuttle buses are smaller, are cheaper to start with, and are simpler to equip with sensors, artificial intelligence systems, and other navigation systems. Autonomous shuttles are preferred by transit authorities as well as private operators to provide first- and last-mile connectivity where frequency and efficiency are of importance.

The standard buses segment is expected to grow at a notable rate over the projection period, as these high-capacity vehicles serve densely populated routes and major commuter corridors. Advances in artificial intelligence, sensor redundancy, and vehicle control systems are improving the safety and reliability of automating larger buses in complex traffic conditions. Governments and transit authorities are testing self-driving standard buses to enhance route efficiency, reduce operating costs, and address workforce shortages in urban transportation.

Region Insights

How Big is the North America Self-Driving Bus Market Size?

The North America self-driving bus market size is estimated at USD 561.70 million in 2025 and is projected to reach approximately USD 5,573.45 million by 2035, with a 25.79% CAGR from 2026 to 2035.

Why Did North America Lead the Global Self-Driving Bus Market?

North America led the self-driving bus market by capturing the largest share in 2025. This is because of the early adoption of autonomous technologies and high investments in robust vehicle autonomous systems. The area boasts major developers of autonomous vehicles, technology firms, and research facilities that lead to consistent innovation. Favorable regulatory policies in the U.S. and Canada have facilitated extensive testing, pilot projects, and small-scale deployments. The adoption has been further supported by the high consumer awareness and increasing acceptance of self-driving technology. Also, robust investments in research and development and public-private collaboration have increased the commercialization of autonomous vehicles, contributing to the region's dominance in the market.

What is the Size of the U.S. Self-Driving Bus Market?

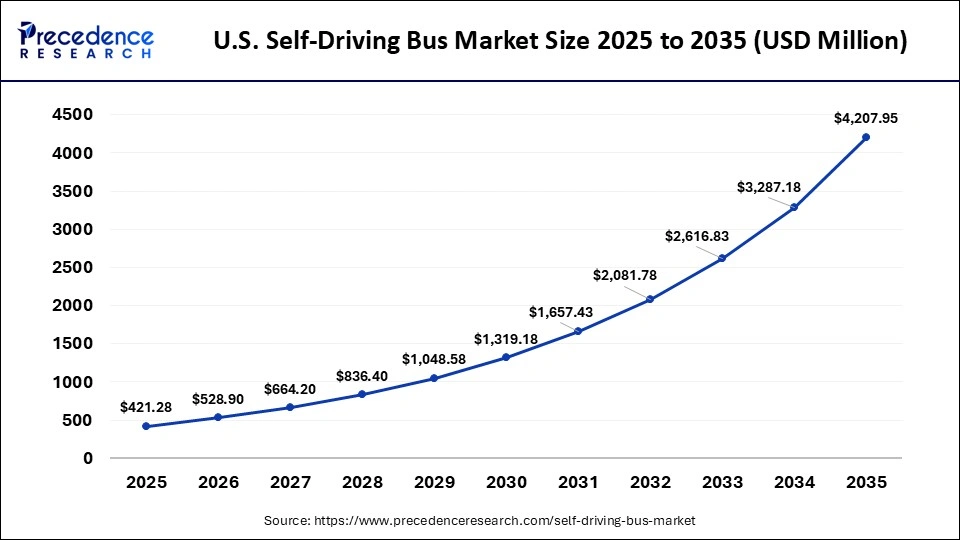

The U.S. self-driving bus market size is calculated at USD 421.28 million in 2025 and is expected to reach nearly USD 4,207.95 million in 2035, accelerating at a strong CAGR of 25.88% between 2026 and 2035.

U.S. Market Analysis

The self-driving bus market in the U.S. is growing due to increasing investments in smart city initiatives and advanced transportation infrastructure that support autonomous vehicle deployment. Rising labor costs, driver shortages, and the need for efficient, sustainable public transit are driving adoption by both government agencies and private operators. Additionally, advances in AI, sensor technologies, and regulatory frameworks are making autonomous buses safer, more reliable, and commercially viable across urban and campus environments.

Why is Asia Pacific Undergoing the Fastest Growth in the Self-Driving Bus Market?

Asia Pacific is expected to grow at the fastest CAGR during the forecast period because of the rapid urbanization and rising demand for efficient and sustainable public transport. Congestion and pollution are critical issues in big and crowded cities of the region, which stimulate the need to find autonomous mobility solutions. Governments in China, Japan, South Korea, and Singapore are supporting research, pilot projects, and commercialization through favorable policies, while heavy investments in digital infrastructure, 5G connectivity, and smart transit systems are boosting the deployment of autonomous buses.

China Market Analysis

China is the major contributor to the Asia Pacific self-driving bus market due to its rapid urbanization, high population density, and significant investment in smart city and autonomous mobility initiatives. China has a robust automotive and electric vehicle manufacturing base, enabling faster production and scaling of autonomous bus technologies. Moreover, subsidies, tax benefits, and grants for autonomous vehicle development are encouraging companies to adopt and deploy self-driving buses.

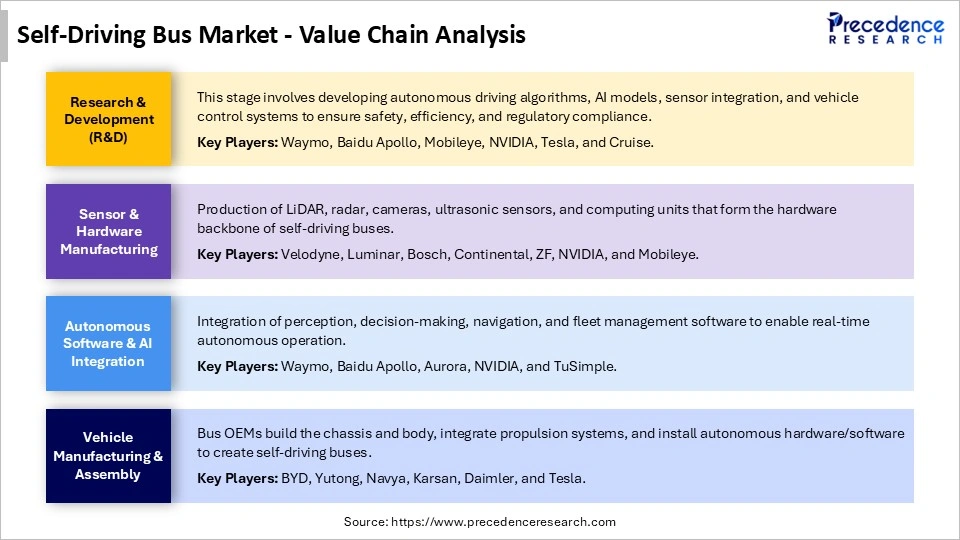

Self-Driving Bus Market Value Chain Analysis

Who are the Major Players in the Global Self-Driving Bus Market?

The major players in the self-driving bus market include AB Volvo (Sweden), Volkswagen AG (Germany), Proterra (U.S.), Hyundai Motor Company (South Korea), Hino Motors, Ltd (Japan), Apollo Baidu (China), MAN Truck & Bus (Germany), EasyMile (France), New Flyer (Canada), Toyota Motor Corporation (Japan), Yutong Group (China), Navyo (France), Novus Hi-Tech Robotic Systems (India), and COAST AUTONOMOUS, INC. (U.S.).

Recent Developments

- In January 2026, Johor Bahru announced that it would introduce a driverless bus service to serve tourists and would be the first Malaysian city to conduct autonomous buses to serve domestic and international visitors. This project can help MBJB realize its vision of transforming Johor Bahru into a smart city that has modern technology to facilitate tourism, traffic control, and the security of citizens.(Source: https://www.caricarz.com)

- In January 2025, May Mobility collaborated with Tecnobus to unveil a new platform of electric autonomous minibus at CES 2025. The car carries 30 passengers, needs a speed of 72 km/h, and has wheelchair accessibility, which is a reinforcement of the MaaS May Mobility.(Source: https://www.autonomousvehicleinternational.com)

- In December 2024, Karsan announced plans to deploy Sweden's first Level-4 autonomous bus, the Autonomous e-ATAK, in Gothenburg from August 2025. The bus will operate between Central Station and Liseberg Station, enhancing transit efficiency in the Gårda area.(Source: http://bus-news.com)

Segments Covered in the Report

By Technology

- LiDAR-based Navigation

- Camera-based Systems

- Radar-based Systems

- Ultrasonic Sensors

- V2X Communication Technology

By Level of Automation

- Level 1 - Driver Assistance

- Level 2 - Partial Automation

- Level 3 - Conditional Automation

- Level 4 - High Automation

- Level 5 - Full Automation

By Application

- Public Transportation Systems

- Airport Shuttle Services

- Corporate Campuses

- University Campuses

- Tourism and Sightseeing

By End-User

- Government Agencies

- Private Transportation Companies

- Educational Institutions

- Tourism Operators

- Healthcare Institutions

By Vehicle Type

- Mini Buses

- Shuttle Buses

- Standard Buses

- Double-Decker Buses

- Articulated Buses

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting