What is the Sensor Fusion Market Size?

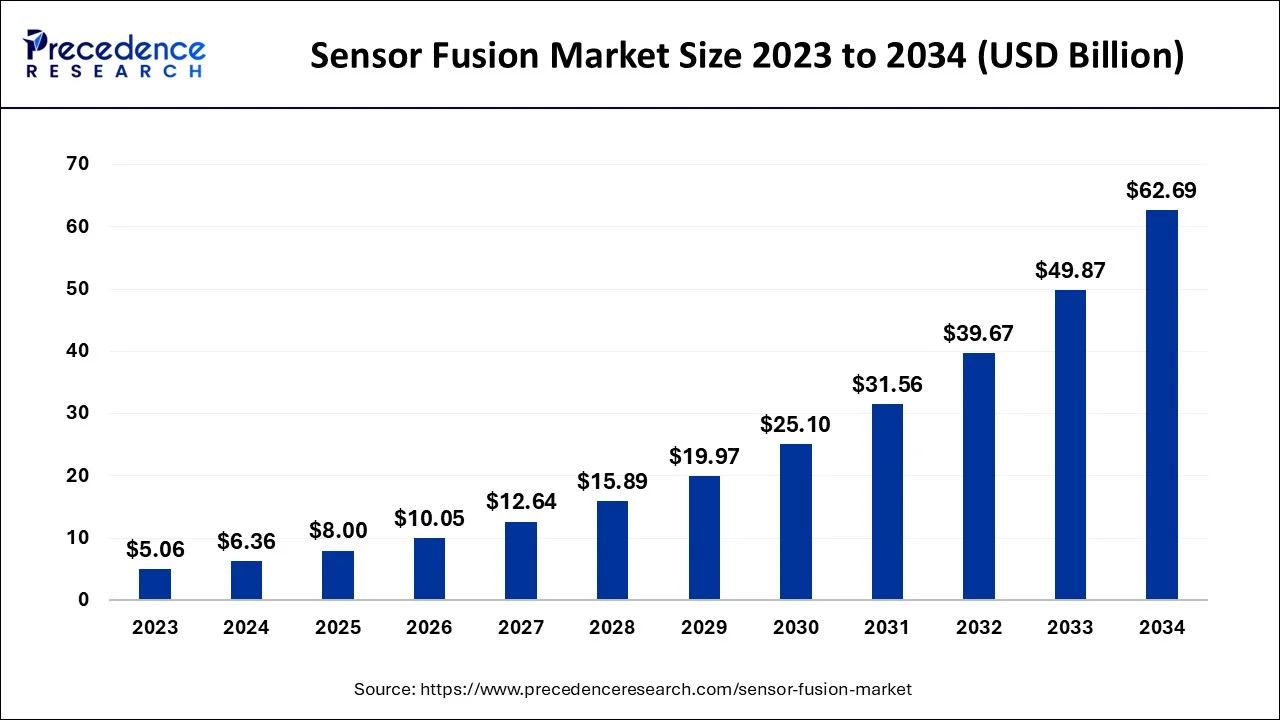

The global sensor fusion market size is calculated at USD 8.0 billion in 2025 and is predicted to increase from USD 10.54 billion in 2026 to approximately USD 75.51 billion by 2035, expanding at a CAGR of 24.71% from 2026 to 2035.

Sensor Fusion Market Key Takeaways

- Europe dominated the global market in 2025

- Asia-Pacific region is expected to expand at the fastest CAGR between 2026 to 2035.

- By Technology, the non-MEMS segment led the global market in 2025.

- By Product Type, the IMU segment led the global market in 2025.

- By End User, the automotive segment dominated the market in 2025.

- By End User, the consumers electronics segment is expected to expand at the fastest CAGR from 2026 to 2035.

Market Overview

Sensor fusion is software that combines data from multiple sensors to improve an application's or system's performance. It combines data from various sensors, and the inability of a single sensor to determine the accurate position and orientation information can be compensated. Sensor fusion technology is becoming increasingly popular in consumer electronics and automotive applications helps in propelling the industry forward.

The growing trend of self-driving or automated cars is one of the major factors driving the use of sensor fusion and it provides advanced driver assistance (ADAS) features and automatic driving functions. Furthermore, road safety authorities around the world are implementing a variety of measures to reduce fatal road accidents, which is fueling the market growth. In navigation-based applications, sensor fusion combines global positioning systems (GPS) with phone data such as compass, gyroscope, and accelerometer resulting in increasing demand for mobile mapping technologies positively influencing the industry growth.

Furthermore, the increasing Use of Internet of Things (IoT) devices in smart water meters and internal temperature monitoring systems is increasing global demand for sensor fusion. Data from IoT sensors is shared and aggregated. Sensor fusion technology is becoming more popular in wearable fitness devices as the emphasis on health and fitness grows. In addition, industry participants are working on software solutions to improve user experience in high-speed, intuitive gaming. This software can also be used for industrial control, oil exploration, and climate monitoring, propelling the market forward.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 8Billion |

| Market Size in 2026 | USD 10.54 Billion |

| Market Size by 2035 | USD 75.51Billion |

| Growth Rate from 2026 to 2035 | CAGR of 24.71% |

| Largest Market | Europe |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | By Technology, By Product Type, and By End User |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

The growing use of image sensors in intelligent devices driving the market growth

The growing demand for next-generation smartphones with advanced features and modern integrated sensors drives the sensor fusion market forward. Manufacturers of various smart devices are increasing their demand for image sensors. Most digital cameras now use the standard configuration: A pixel array sits on top of a 2D Bayer array of RGB color filters. Each pixel contains a photodetector, which absorbs filtered light to produce one of the primary colors.

Moreover, Image sensors are becoming the backbone of new vehicles, innovative medical devices, driver assistance systems, automated production technologies, innovative building technologies, and power supply systems. Furthermore, sensors are becoming more robust, specific, precise, often more innovative, communicative, and affordable, making them more popular to deploy in developing smart infrastructure. The image sensors are expanding rapidly as demand for cameras, camcorders, multimedia mobile phones, and security cameras rises. The critical player heavily invested in image sensors; Sony is leading the image sensors with more than 45% market share.

Restrain

Development and maintenance costs will limit growth

The development and maintenance cost of sensors is very high as it is very sensitive and requires more time for development, in a 2019 teardown of the Samsung Galaxy S10 5G SM-G977N, Tech Insights estimated the cost of the category “sensors” at $2.50, or roughly 0.5% of the total hardware cost of $490.06. Moreover, A lack of standardization in software design and hardware platforms can result in higher development and maintenance costs hindering market growth.

Opportunity

Increasing technological advancement provides lucrative opportunities

Sensor fusion is becoming more popular as technology advances, as it aids in creating more accurate sensor mechanisms to improve advanced system performance or fix modern applications. Sensor fusion technology, also known as multisensory data fusion or progressive sensor-data fusion, is a sub-discipline of data fusion. This sensor-data fusion is used in various scientific research setups, current camera systems, and primary image processing and is also used in autonomous vehicles. Recent technological advances have also enabled the generation or collection of large amounts of valuable data from various sources in various real-world applications. Sensor data, for instance –, can be easily generated and collected in a variety of Internet of Things (IoT) applications such as smart homes, smart grids, smart retail, intelligent cars, and smart cities.

Furthermore, Industry 4.0 has influenced OEMs to implement IoT across their operations. According to Maryville University, over 180 trillion gigabytes of data will be created globally each year by 2025. Industrial IoT (IIoT)-enabled industries are expected to generate a significant amount of data. According to a survey conducted by the industrial IoT (IIoT) behemoth Microsoft, 85% of businesses have at least one IIoT use case project. This figure is likely to rise, as 94% of respondents and planned to implement IIoT strategies by 2021.

Segment Insights

Technology Insights

The MEMS segment dominated the sensor fusion market in 2025

Based on technology, the sensor fusion market is categorized into MEMS and Non-MEMS. The non-MEMS segment dominated the sensor fusion market in 2023. Owing to the rising demand for image and radar-based products to improve vehicle safety systems, the level of complexity is very high when integrating it into automotive applications such as lights and engines.

On the other hand, the MEMS segment is estimated to dominate the market in the forecast period. MEMS are widely used in vehicle safety applications, as well as step counting, gesture recognition, mobile device screen rotation, and personal navigation. MEMS are also widely used for monitoring and controlling various utilities, including lighting, automation appliances, the environment, and security. This factor is expected to drive market growth during the forecast period.

Type Insights

The IMU segment dominated the sensor fusion market in 2023. The increased high-volume production of smartphones and increased smartphone sales and shipment across the globe is the key factor driving the IMU market growth. The increased use of auto vehicles and automated devices boosted the market growth in the forecast period.

On the other hand, the Image sensors segment is growing with the increased use of image sensors in hospitals and labs. The rising number of patients with cardiovascular and lung diseases demand X-ray and CT scans, resulting in a demand for image sensors.

End-User Insights

The automotive segment dominated the sensor fusion market in 2023. Sensor fusion market growth is fueled by rising demand for automotive safety features, electric and connected vehicle advancements, and government regulations governing vehicle safety and emissions. Furthermore, internal sensors are used to regulate and measure the motion of the vehicle. In contrast, external sensors measure the things in their environment, and some communicate with other vehicles and infrastructure.

As a result, these factors are expected to drive demand for sensor fusion in automotive applications during the forecast period. For instance, according to the World Economic Forum, by 2035, more than 12 million fully autonomous cars will be sold yearly, with autonomous vehicles accounting for 25% of the global automotive market. According to Intel, a single autonomous vehicle can generate an average of 4 terabytes of data per day, and sensor fusion solutions can significantly utilize this massive data in real time.

On the other hand, the consumers electronics segment will be estimated to grow in the forecast period. The electronics segment is influenced by rising demand for EV vehicles and electronic devices. For instance, according to the World Economic Forum, by 2035, more than 12 million fully autonomous cars will be sold yearly, with autonomous vehicles accounting for 25% of the global automotive market. According to Intel, a single autonomous vehicle can generate an average of 4 terabytes of data per day, and sensor fusion solutions can significantly utilize this massive data in real-time.

Regional Insights

Why is Asia Pacific the Fastest-Growing Region in the Sensor Fusion Market?

During the forecast period, the Asia-Pacific region is expected to be the largest market for sensor fusion in the automotive sector. The Asian Region market is expected to grow because of the increased Use of advanced ADAS features such as automated emergency braking (AEB), lane departure warning (LDW), adaptive cruise control (ACC), and other similar technologies.

China and Japan Sensor Fusion Market Analysis

China and Japan now have the largest sensor fusion markets in the Asia Pacific. The primary driving change in these two countries is the rising vehicle production rate combined with stringent safety requirements that require ADAS capabilities to be included in vehicle models. The region's market is expected to be driven by rising demand for premium and luxury vehicles and advancements in sensor fusion hardware.

How did the Europe Region dominate the Sensor Fusion Market in 2025?

On the other hand, Europe dominated the sensor fusion market in 2022. The market is influenced by the expansion of government programs and policies for automobiles, healthcare IT equipment, and increased investment in research and development centers, which are the main factors for market expansion in the European region.

Germany Sensor Fusion Market Analysis

Moreover, the increasing development of new treatments and rising medical technology and protocols help the area expand for medical gadgets and equipment, which increases the demand for sensors. In addition, it is expected that the Europe region will experience growth in the market for pressure sensors owing to the rising government spending on healthcare. As Germany is leading in this field, the automotive sector is expanding significantly. The demand for pressure sensors in the region is expected to experience significant expansion due to rising electric vehicle production and rising connected vehicle infrastructure in Europe.

North America: How is the Notable Growth of North America in the Sensor Fusion Market?

North America is expected to experience notable growth during the forecast period due to digital transformation and the huge adoption of autonomous and semi-autonomous vehicles. Sensor fusion solutions are increasingly used in IoT devices, wearables and smart manufacturing, with innovation focused on AI-enhanced algorithms, low-power designs and multi-sensor integration to improve accuracy and real-time decision-making.

- In October 2025, the U.S. Department of Energy (DoE) announced a national strategy regarding fusion science and technology. The technology is designed boost the development and commercialization of fusion energy.

South America: What are the Major Factors Contributing to the Sensor Fusion Market within South America?

South America is expected to experience significant growth during the forecast period due to industrial automation and IoT, and advancements in the automotive sector. The South American government focused on addressing broader security, maritime surveillance, and defense modernization.

Brazil's segment is the largest in the region, while Colombia, Peru and Chile also register notable expansion as sectors such as industrial automation, agricultural technology and infrastructure development increasingly deploy sensor fusion systems to enhance efficiency and decision-making.

MEA: What Opportunities Exist in the Middle East and Africa in the Sensor Fusion Market?

MEA is expected to grow at a lucrative rate in the market in the coming years, driven by the huge adoption of advanced automotive safety systems, smart city infrastructure, and industrial automation. Regulatory emphasis on modernization and economic diversification strategies is further catalyzing investment in sensor fusion solutions, even as challenges like skills gaps and limited local R&D capacity persist.

Sensor Fusion MarketCompanies

- Analog Devices Inc.

- NXP Semiconductor

- Renesas Electronics Corporation

- Bosch Sensor Tec GmbH

- Inven Sense Inc.

- Infineon Technologies

- STMicroelectronics

- Asahi Kasei Microdevices

- BASELABS

- Maxim Integrated

Recent Developments

- In April 2025, Bosch Sensor Tec GmbH introduced new software and hardware for assisted and automated driving and parking. The solutions expand its extensive portfolio of innovative products and solutions.

(Source: bosch-presse.de ) - In October 2025, Infineon Technologies launched next-generation, highly integrated XENSIV 60 GHz CMOS radar for low-power IoT solutions. These solutions are aiming to enhance the intelligence of IoT devices and smart homes.

(Source: infineon.com ) - In 2021, Bosch sign an agreement with Microsoft to develop a software platform to connect cars to the cloud seamlessly. The new platform is based on Microsoft Azure and uses software modules from Bosch.

- In 2021, Continental AG offers new radar sensors for 360-degree coverage with a longer range. The generation sensor has been created as a modular system with less complexity allowing for cost savings, and potential expenditure.

- In 2021, STMicroelectronics launched ALED6000, a single-chip automotive LED driver with an integrated DC/DC converter. It is a low-BoM solution that allows design flexibility and keeps light intensity consistent as electrical conditions within the vehicle fluctuate. It is suitable for exterior lighting such as daytime running lights, headlights, rear lights, turn signals, and interior lighting. The ALED6000 drives a single string of LEDs at up to 3A and has a wide input-voltage range of 4.5 V to 61 V.

Segments Covered in the Report:

By Technology

- Mems

- Non – Mems

By Product Type

- Radar Sensors

- Image Sensors

- IMU

- Temp Sensors

By End User

- Consumers Electronics

- Automotive

- Home Automation

- Medical

- Military

- Industrial

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting