What is the Sequencing Consumables Market Size?

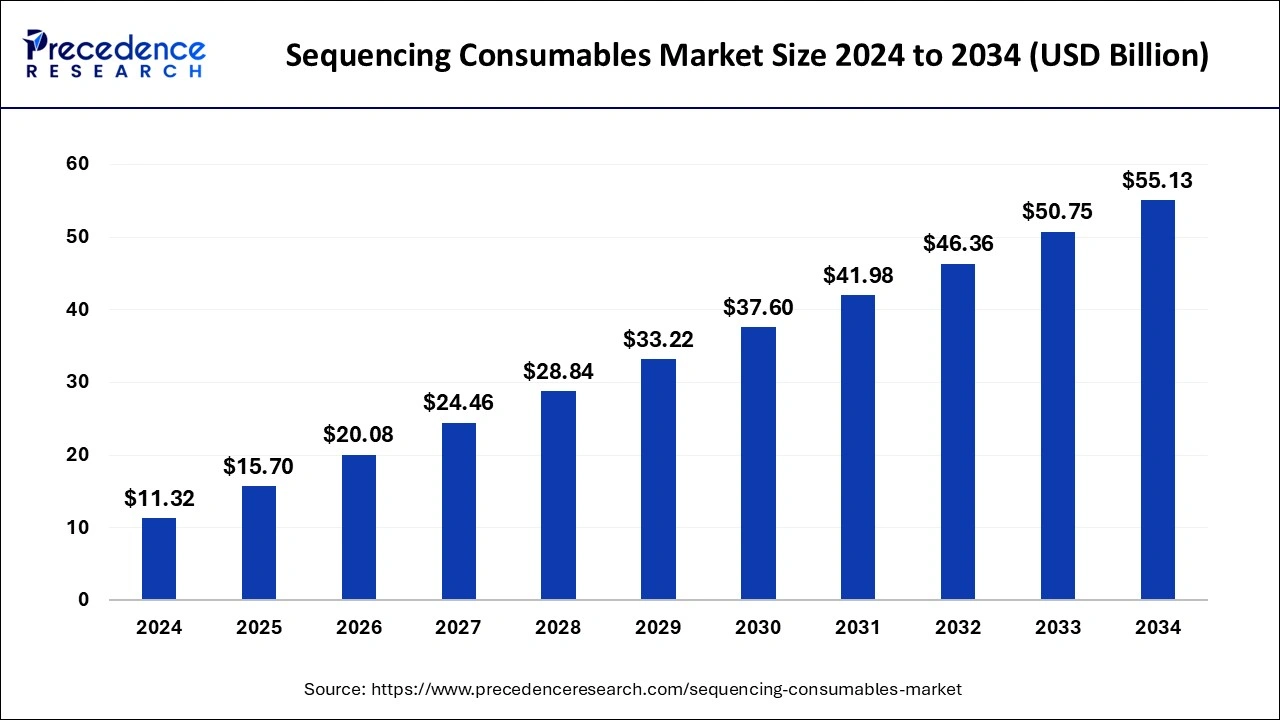

The global sequencing consumables market size accounted for USD 15.70billion in 2025 and is predicted to increase from USD 15.70 billion in 2026 to approximately USD 59.52 billion by 2035, expanding at a CAGR of 17.15% from 2026 to 2035.

Sequencing Consumables Market Key Takeaways

- The global sequencing consumables market was valued at USD 15.70 billion in 2025.

- It is projected to reach USD 59.52billion by 2035.

- The sequencing consumables market is expected to grow at a CAGR of 14.26% from 2026 to 2035.

- Asia Pacific is expected to witness the fastest rate of growth in the sequencing consumables market during the forecast period.

- By product, the kits segment held the largest segment of the sequencing consumables market in 2025.

- By product, the reagents segment is expected to grow at a significant rate during the forecast period.

- By platform, the second-generation sequencing consumables segment is expected to hold the dominating share of the market.

- By platform, the third-generation sequencing consumables segment is expected to grow at a notable rate.

- By application, the cancer diagnostics segment is expected to hold the dominating share of the market during the forecast period.

- By application, the pharmacogenomics segment is expected to grow at a notable rate.

What is the Sequencing Consumable?

The sequencing consumables market encompasses a diverse range of products essential for DNA sequencing processes, including reagents, kits, and other consumables used in various sequencing technologies. The demand for these consumables has surged with the continuous evolution of genomics and advancements in sequencing techniques. Next-generation sequencing (NGS) technologies, in particular, have witnessed widespread adoption in research, clinical diagnostics, and personalized medicine, driving the need for specialized consumables. The market is characterized by key players offering a variety of products designed to support different sequencing platforms. As genomics plays an increasingly integral role in biomedical research and healthcare, the sequencing consumables market is expected to experience sustained growth, influenced by technological innovations, expanding applications, and the global push towards more personalized and precise approaches in genomics.

How is AI contributing to the Sequencing Consumables Industry?

AI is used to streamline the sequencing consumables management with predictive inventory control, smart procurement, and automated monitoring of the lab. Machine learning predicts the demand for reagents to eliminate shortages and waste. The computer vision will monitor inventory in real time with minimal errors by human beings.

Sequencing Consumables Market Data and Statistics

MGI Tech announced a successful Series D funding round, securing an impressive $400 million. This substantial funding infusion is earmarked to propel MGI Tech's Research and Development (R&D) initiatives, further advancing its capabilities in genomics and molecular sequencing technologies.

In September 2023, Roche Diagnostics made a significant move by acquiring GenMark Diagnostics for $1.8 billion, marking a strategic expansion in the field of infectious disease diagnostics. This acquisition enhances Roche's capabilities in molecular diagnostics and strengthens its position in addressing infectious diseases through advanced diagnostic technologies.

Sequencing Consumables Market Growth Factors

- The increasing integration of genomics into healthcare practices fuels the demand for sequencing consumables. Applications such as clinical diagnostics, oncology, and pharmacogenomics drive market growth. As genomic information becomes more central to disease understanding and treatment strategies, the need for consumables in laboratories and clinical settings continues to rise.

- A significant driver for market expansion is the ongoing reduction in the cost of DNA sequencing. The achievement of the "$1000 genome" milestone and continuous efforts to lower sequencing expenses make genomic analysis more accessible. The declining costs stimulate increased adoption of sequencing technologies, consequently boosting the demand for consumables.

- The paradigm shift toward personalized medicine, tailoring treatments based on individual genetic profiles, fuels the demand for sequencing consumables. The ability to identify genetic markers and variations crucial for personalized treatment strategies propels the use of sequencing technologies in clinical practice. As personalized medicine gains prominence, the market for consumables is propelled by the increasing need for accurate and comprehensive genomic data.

Market Outlook

- Industry Growth Overview: Oncology diagnostics and high-throughput workflows are major factors for market growth.

- Major investors: Illumina Inc., Thermo Fisher Scientific Inc., Agilent Technologies Inc., Qiagen, and Danaher Corporation.

Market Scope

| Report Coverage | Details |

| Growth Rate from 2026 to 2035 | CAGR of 14.26% |

| Market Size in 2025 | USD 15.70Billion |

| Market Size in 2026 | USD 20.08 Billion |

| Market Size by 2035 | USD 59.52Billion |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Product, Platform, and Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Advancements in sequencing technologies

- Next-generation sequencing (NGS) technologies have significantly reduced the time and cost of sequencing compared to traditional Sanger sequencing. Illumina's NovaSeq X Plus system can sequence a human genome in less than 24 hours for under $2000, democratizing access to this powerful tool.

Advancements in sequencing technologies are propelling the sequencing consumables market, driving substantial growth. The continuous evolution of next-generation sequencing (NGS) has significantly impacted the genomics landscape. The decreasing cost of sequencing, exemplified by Illumina achieving the $1000 genome milestone in 2014, has democratized genomic research. This accessibility fuels demand, contributing to market expansion. NGS technologies, known for their speed and accuracy, have found applications in diverse fields, including clinical diagnostics, agriculture, and pharmaceuticals. Moreover, initiatives like the All of Us Research Program, aiming to sequence a diverse population, showcase the increasing integration of genomics into healthcare. As a result, the sequencing consumables market is poised for sustained growth, driven by the transformative impact of technological advancements on genomic research and its expanding applications.

Restraint

Data analysis challenges

Data analysis challenges pose a significant restraint on the growth of the sequencing consumables market. The high-throughput nature of next-generation sequencing generates massive volumes of complex genomic data. Interpreting and analyzing this data require sophisticated bioinformatics tools and skilled personnel, contributing to increased operational costs. Additionally, the shortage of bioinformatics expertise can hinder effective data interpretation, leading to potential errors and delays in research outcomes. The complexity of data analysis also acts as a barrier for smaller research institutions and clinical laboratories, limiting their ability to fully leverage sequencing technologies. Addressing these challenges requires ongoing investment in bioinformatics infrastructure, training programs, and standardization efforts, impacting the overall market expansion by creating barriers to seamless data interpretation and utilization.

Opportunity

Renewable energy targets

Increased funding for genomic research is a key driver of opportunities in the sequencing consumables market.

- As of 2021, global investment in genomics reached billions of dollars, with government initiatives like the Precision Medicine Initiative in the United States allocating over $200 million annually.

This surge in funding supports large-scale genomic studies, pushing the boundaries of research in areas such as disease genetics, precision medicine, and population genomics. The demand for sequencing consumables rises in tandem with the expansion of these ambitious research projects, creating opportunities for market growth. Research funding enhances technological innovation, enabling the development of advanced sequencing technologies that, in turn, boost the consumption of related consumables. The collaborative nature of funded projects also drives partnerships between research institutions and sequencing consumable providers, fostering innovation and fueling the market's expansion.

Segment Insights

Product Insights

The kits segment dominated the sequencing consumables market in 2025; the segment is observed to continue the trend throughout the forecast period. In the sequencing consumables market, the "kits" segment refers to packaged sets of consumables essential for DNA sequencing processes. These kits typically include reagents, enzymes, buffers, and other necessary components, streamlining the sequencing workflow.

- In February 2023, Thermo Fisher Scientific developed a new kit format “MagMAX CORE Kit for NGS Library Preparation”. This single-tube kit streamlines the library preparation workflow by combining multiple steps into one tube, reducing hands-on time and minimizing reagent waste. This not only increases efficiency and saves time but also minimizes the risk of errors and contamination.

A notable trend in the kits segment is the increasing demand for user-friendly and comprehensive kits that cater to various sequencing applications. Market players are focusing on developing kits that offer convenience, accuracy, and cost-effectiveness, meeting the diverse needs of researchers and laboratories engaged in genomics research and applications.

On the other hand, the reagents segment is expected to grow at a significant rate throughout the forecast period. In the sequencing consumables market, reagents constitute a crucial segment, encompassing chemical substances essential for DNA and RNA sequencing processes. These include buffers, enzymes, primers, and nucleotides required for DNA amplification, purification, and sequencing reactions. A notable trend in reagents for sequencing consumables involves continuous advancements to enhance sequencing accuracy and efficiency. Manufacturers focus on developing high-performance reagents, optimizing reaction conditions, and ensuring compatibility with evolving sequencing platforms, reflecting a commitment to driving the overall improvement of sequencing technologies in genomics research and diagnostics.

Platform Insights

The second-generation sequencing consumables segment is observed to hold the dominating share of the sequencing consumables market during the forecast period. The second-generation sequencing consumables segment refers to materials used in next-generation sequencing (NGS) platforms, including technologies like Illumina sequencing. These consumables encompass reagents, kits, and cartridges required for high-throughput DNA sequencing. Trends in this segment include a continuous focus on enhancing sequencing accuracy, reducing costs per base pair, and improving turnaround times. Advancements in library preparation kits, sequencing-by-synthesis chemistry, and the development of novel sequencing platforms contribute to the dynamic landscape of second-generation sequencing consumables, meeting the evolving demands of genomics research, clinical diagnostics, and personalized medicine applications.

On the other hand, the third-generation sequencing consumables segment is expected to generate a notable revenue share in the market. Third-generation sequencing consumables cater to platforms that utilize advanced technologies, offering long-read sequencing capabilities. These consumables are designed for emerging platforms like Pacific Biosciences (PacBio) and Oxford Nanopore Technologies. The third-generation sequencing segment is witnessing increased demand due to the advantages of longer reads, which enhance genome assembly and aid in resolving complex genomic structures. As the field of genomics evolves, third-generation sequencing consumables are expected to play a pivotal role in enabling more accurate and comprehensive genomic analyses, contributing to the overall growth of the sequencing consumables market.

Application Insights

The cancer diagnostics segment is observed to hold the dominating share of the sequencing consumables market during the forecast period. The cancer diagnostics segment in the sequencing consumables market pertains to the utilization of sequencing technologies for analyzing genomic data in cancer cells. This involves identifying genetic mutations, variations, and biomarkers associated with different types of cancer. Trends in this segment include a growing emphasis on liquid biopsy methods, enabling non-invasive detection, and monitoring of cancer through the analysis of circulating tumor DNA. Additionally, advancements in bioinformatics tools enhance the precision of cancer diagnostics, driving the demand for sequencing consumables in oncology research and personalized medicine applications.

On the other hand, the pharmacogenomics segment is expected to generate a notable revenue share in the market. Pharmacogenomics, a pivotal segment in the sequencing consumables market, involves studying how an individual's genetic makeup influences their response to drugs. This field aims to optimize medication selection and dosage based on genetic factors. A notable trend is the integration of pharmacogenomic data into clinical decision-making, enhancing precision medicine initiatives. As genetic insights become more accessible, the demand for sequencing consumables in pharmacogenomics rises, facilitating the analysis of patient genomes for personalized drug therapy, minimizing adverse reactions, and optimizing treatment efficacy.

Regional Insights

What is the U.S. Sequencing Consumables Market Size?

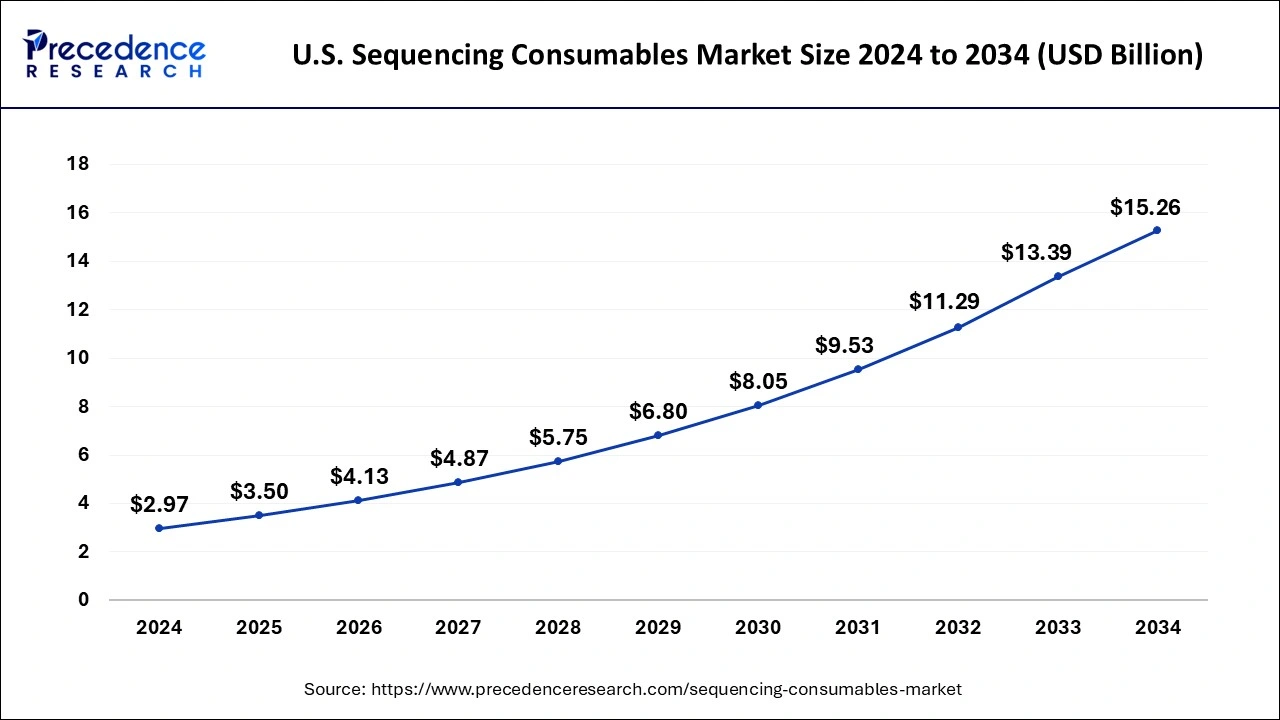

The U.S. sequencing consumables market size was exhibited at USD 3.50 billion in 2025 and is projected to be worth around USD 17.28 billion by 2035, growing at a CAGR of 17.31% from 2026 to 2035.

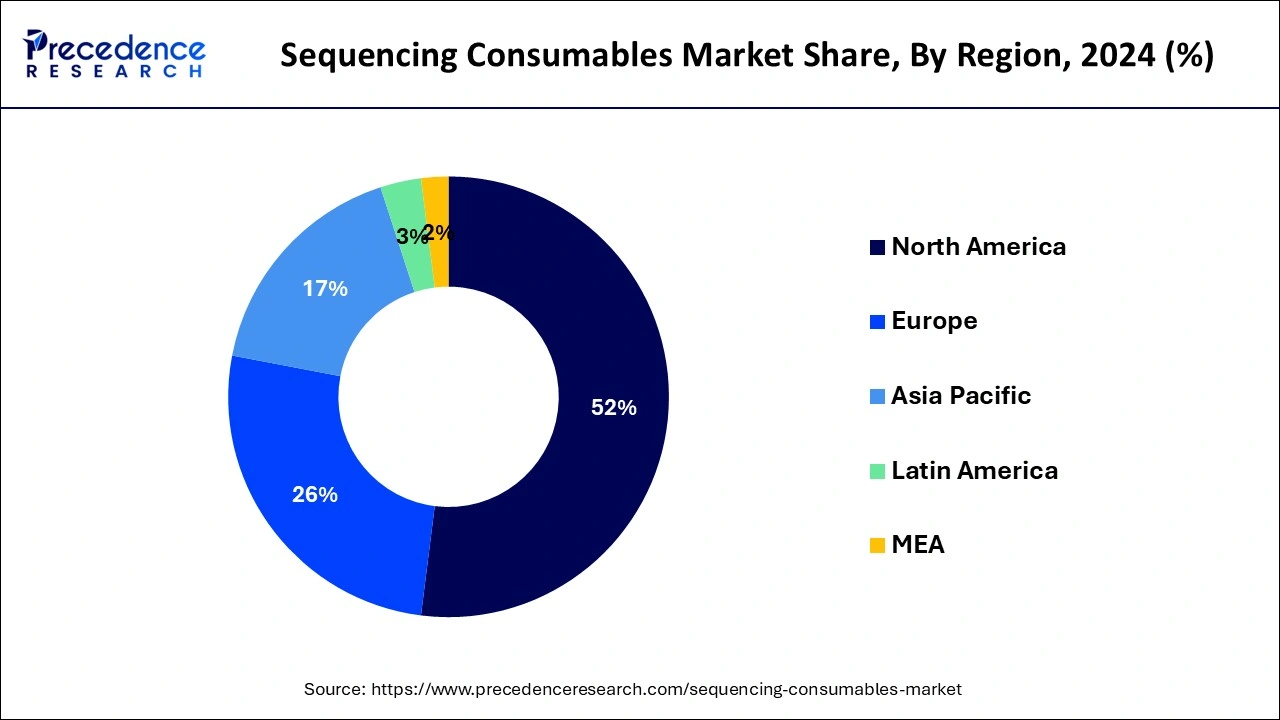

North America dominates the sequencing consumables market due to its advanced healthcare infrastructure, robust research and development activities, and significant investments in genomics. The region houses major biotechnology and pharmaceutical companies, renowned research institutions, and hosts large-scale genomics projects.

- In July 2022, Genome Canada revealed a financial commitment of USD 1.5 million toward the Bison Integrated Genomics (BIG) project, designed to safeguard the endangered Canadian bison population. The funding underscores a significant investment in genomics research, facilitating initiatives focused on the genetic analysis, conservation, and protection of these threatened bison. This initiative is poised to contribute valuable insights into the genetic health, diversity, and adaptive traits of the Canadian bison, thereby enhancing conservation strategies for this vulnerable species.

Additionally, favorable government initiatives, such as the Precision Medicine Initiative in the United States, drive demand. The well-established presence of key market players and a high adoption rate of advanced sequencing technologies contribute to North America's major share in the global sequencing consumables market.

U.S. Sequencing Consumables Market Trends

The rate of China's expansion occurs as a result of government-supported adoption of population genomics and hospital-based sequencing. The manufacture of reagents by domestic firms is very cost-effective and less dependent on imports. NIPT and infectious disease testing are sponsored by high routine consumption. High-throughput deployment and massive scale of the platform bring constant reagent requirements in the country.

Asia-Pacific is poised for rapid growth in the sequencing consumables market due to expanding genomics research, increasing healthcare investments, and a rising focus on precision medicine. With a CAGR of approximately 15%, the region is a hotspot for market expansion. Countries like China and Japan drive this growth with significant investments in genomics, large-scale research initiatives, and a burgeoning biotechnology sector. Additionally, rising awareness, evolving healthcare infrastructure, and government support contribute to the Asia-Pacific position as the fastest-growing market for sequencing consumables.

Meanwhile, Europe is growing at a notable rate in the sequencing consumables market to increasing investments in genomics research, expanding applications in healthcare, and a surge in precision medicine initiatives. In 2020, the European genomics market was valued at over $9 billion. Factors such as collaborative research projects, advancements in healthcare infrastructure, and a rising focus on personalized medicine contribute to this growth. The region's commitment to large-scale genomics initiatives and a supportive regulatory environment positions Europe as a key contributor to the expanding global sequencing consumables market.

Germany Sequencing Consumables Market Trends

Germany is a motivated demand force with the growing clinical oncology sequencing and precision medicine initiatives. Powerful localization of the reagent production enhances the supply security of academic and hospital labs. Cancer genomics: Integrated sample-to-insight kits gain momentum. The regulations of data privacy determine the handling of genetic information as well as the usage of reagents.

Sequencing Consumables Market Companies

- Illumina, Inc. (US): Provides SBS sequencing reagents, flow cells, and library preparation kits that provide scalable, high-precision next-generation sequencing on several platforms.

- Thermo Fisher Scientific Inc. (US): Offers prepared Ion Torrent assay library preparation kits and reagent consumables to enable efficient workflows of clinical and research sequencing in hours.

- Qiagen N.V. (Netherlands): Sells QIAseq kit sets, automated library preparation solutions, and high-quality reagents to facilitate the efficient sample-to-insight genomic research solutions.

Other Major Key Players

- F. Hoffmann-La Roche Ltd. (Switzerland)

- Agilent Technologies, Inc. (US)

- Pacific Biosciences of California, Inc. (US)

- PerkinElmer, Inc. (US)

- Oxford Nanopore Technologies Ltd. (UK)

- Bio-Rad Laboratories, Inc. (US)

- BGI Genomics Co., Ltd. (China)

- GenScript Biotech Corporation (China)

- Eurofins Scientific (Luxembourg)

- Macrogen Inc. (South Korea)

- New England Biolabs, Inc. (US)

- Swift Biosciences, Inc. (US)

Recent Developments

- In January 2026, PacBio announced a community-developed method, CiFi, enabling chromosome-scale, haplotype-resolved genome assemblies from limited samples. Researchers at UC Davis demonstrated CiFi's ability to overcome short-read Hi-C limitations, generating long, accurate reads that capture multiple chromatin interactions, benefiting genome biology and biodiversity studies.

(Source: https://www.tradingview.com ) - In February 2025, Illumina, Inc. launched a comprehensive portfolio of omics solutions, enhancing sequencing applications across genomics, single-cell analysis, CRISPR, and more. These innovations, showcased at the AGBT General Meeting, promise superior scale, accuracy, and reliability for groundbreaking disease research insights. (Source: https://www.illumina.com )

- In October 2022, Illumina (US) collaborated with GenoScreen (France) to extend genomic testing accessibility for multidrug-resistant tuberculosis, particularly in countries heavily affected by tuberculosis. This partnership aims to enhance diagnostic capabilities and contribute to the global effort to combat tuberculosis.

- In October 2022, Illumina (US) entered into a strategic research collaboration with AstraZeneca (UK). The partnership focuses on improving pharmaceutical pipelines by leveraging genomic insights to identify genetic variants associated with human diseases. This collaboration underscores the increasing importance of genomics in drug development and precision medicine.

- In September 2022, Thermo Fisher Scientific (US) achieved FDA approval for the Oncomine Dx Target Test. This marked a milestone as the first Next-Generation Sequencing (NGS)-based companion diagnostic, designed to aid in therapy selection for patients with RET mutations/fusions in thyroid cancers. The FDA approval highlights the growing role of genomics in guiding personalized treatment decisions for cancer patients.

Segments Covered in the Report

By Product

- Kits

- Reagents

- Accessories

By Platform

- 1st Generation sequencing consumables

- 2nd Generation sequencing consumables

- 3rd Generation sequencing consumables

By Application

- Cancer Diagnostics

- Infectious Disease Diagnostics

- Reproductive Health Diagnostics

- Pharmacogenomics

- Agrigenomics

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting