What is Next-generation Sequencing Library Preparation Market Size?

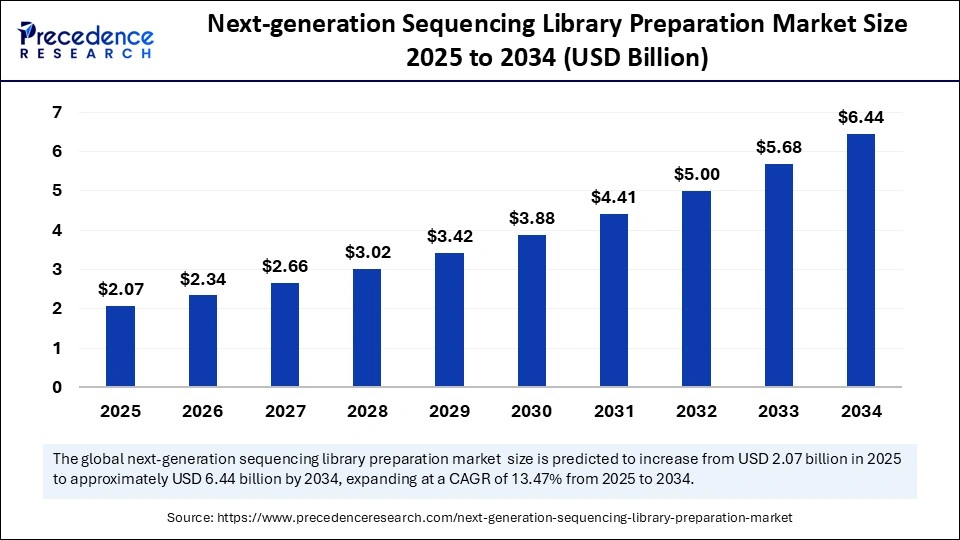

The global next-generation sequencing library preparation market size is calculated at USD 2.07 billion in 2025 and is predicted to increase from USD 2.34 billion in 2026 to approximately USD 6.44 billion by 2034, expanding at a CAGR of 13.47% from 2025 to 2034. This market is growing due to increasing demand for precise genomic analysis and advancements in sequencing technologies.

Market Highlights

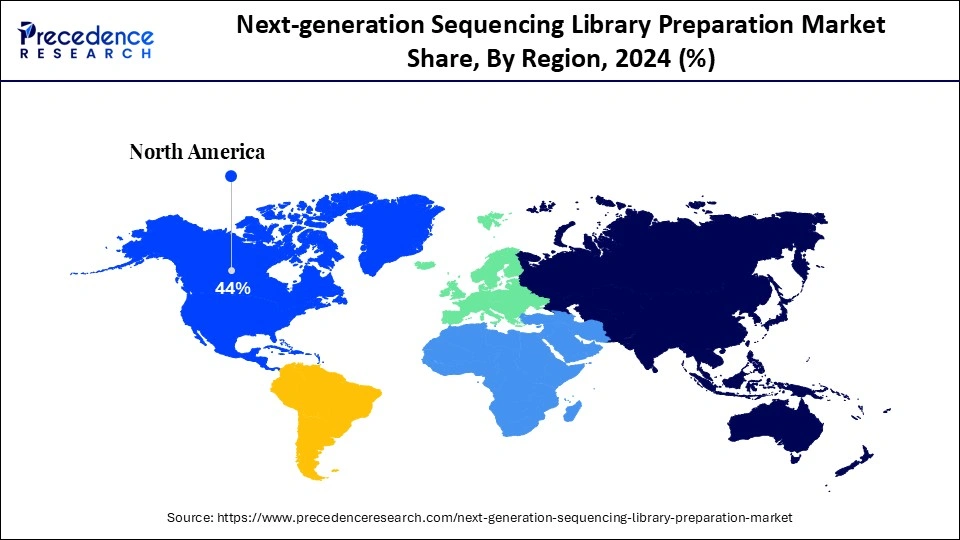

- By region, North America dominated the market, holding the largest market share of 44% in 2024.

- By region, Asia Pacific is expected to grow at a notable CAGR of CAGR of 15% from 2025 tp 2034.

- By product type, the library preparation kits segment held the largest share of 50% in 2024.

- By product type, the automation & library prep instruments segment is growing at the fastest CAGR of 13% between 2025 to 2034.

- By technology/sequencing platform compatibility, the Illumina preparation kits segment contributed the major market share of 45% in 2024.

- By technology/sequencing platform, the Oxford Nanopore Technologies platforms segment is expected to expand at a solid CAGR of 14% from 2025 to 2034.

- By application, the clinical research segment captured the biggest market share of 40% in 2024.

- By application, the pharmaceutical & biotech R&D segment is expected to grow at the fastest CAGR of 40% between 2025 and 2034.

- By end user, the hospitals & clinical laboratories segment held the major market share at 42% in 2024.

- By end user, the biotechnology & pharmaceutical companies segment is growing at a notable CAGR of 13% during the forecast period.

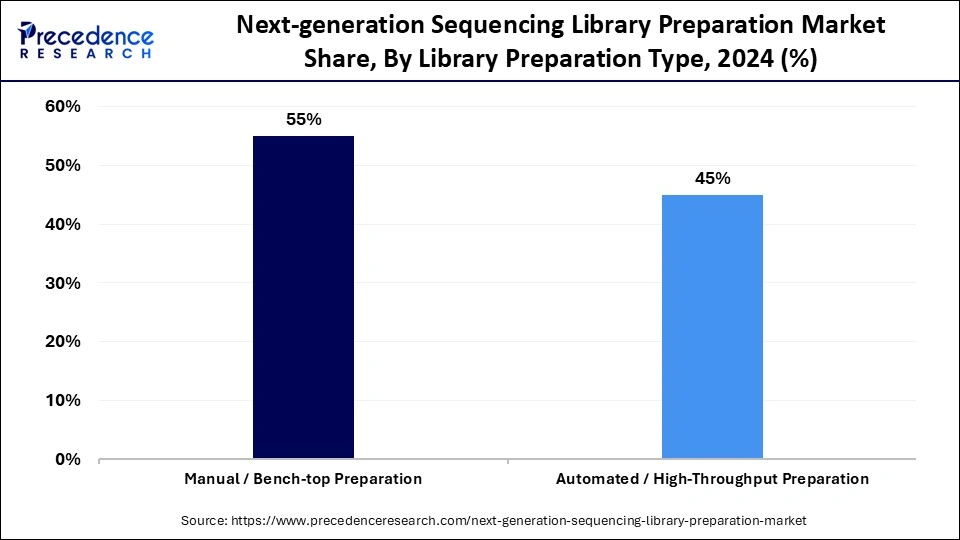

- By library preparation type, the manual/bench-top preparation segment accounted for the largest market share of 55% in 2024.

- By library preparation type, the automated/high-throughput preparation segment is expected to grow at the fastest CAGR of 14% from 2025 to 2034.

Market Size and Forecast

- Market Size in 2025: USD 2.07 Billion

- Market Size in 2026: USD 2.34 Billion

- Forecasted Market Size by 2034: USD 6.44 Billion

- CAGR (2025-2034): 13.47%

- Largest Market in 2024: North America

- Fastest Growing Market: Asia Pacific

Key Technological Shifts in Next-generation Sequencing Library Preparation Market

- Automation of workflows: Reducing manual intervention, automation in NGS library preparation is increasing throughput efficiency and reproducibility. Faster and more accurate genomic analysis results from its ability to process hundreds of samples at once at high-throughput sequencing facilities, while cutting expenses and turnaround times.

- Integration of microfluidics technology: Because microfluidics integration allows for precise microscale control of sample and reagent volumes, library preparation has been completely transformed. This technology increases the efficiency of genomic workflows by supporting miniaturization of, conserving reagents, and guaranteeing consistent and scalable results across multiple samples.

- Advancement in single-cell and low-input library preparation kits: Innovations in single-cell and low-input kits now allow high-quality sequencing from minimal DNA or RNA quantities. These advancements expand applications in oncology, developmental biology, and personalized medicine, offering deep insights into cellular diversity and rare genetic events.

Market Overview

What is the Next-generation Sequencing Library Preparation Market?

The next-generation sequencing library preparation market is experiencing transformative growth driven by the need for high-throughput, economical sequencing workflows, precision medicine, and the wider adoption of genomic research. Leading businesses are taking advantage of this expansion by introducing cutting-edge products.

- In 26 June 2024, Meridian Bioscience announced its lyophilized NGS library prep kit to remove cold-chain shipping constraints. (Source: https://www.prnewswire.com)

Market Outlook

- Industry Growth Overview: Due to increased demand for precision medicine, genomic research, and quicker, more economic workflows, the market for NGS library preparation is expanding quickly. Clinical and research labs are now able to perform high-throughput, precise sequencing thanks to automation and sophisticated library kits.

- Sustainability Trends:To cut down on energy use, cold-chain shipping, and reagent use, businesses are implementing lyophilized and miniaturized kits. Efficiency in processes and the use of environmentally friendly materials are enhancing sustainability in the sector.

- Startup Ecosystem:Innovative kits, automation platforms, and AI-powered solutions are being used by startups to propel innovation. Greater funding assists in the development of specialized, quicker, and easier-to-use library preparation technologies.\

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 2.07 Billion |

| Market Size in 2026 | USD 2.34 Billion |

| Market Size by 2034 | USD 6.44 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 13.47% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product Type, Technolgy Type, Application, End User,Library Preparation Typeand Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segmental Insights

Product Type Insights

Why Did the Library Preparation Kits Segment Dominate the Next-Generation Sequencing Library Preparation Market in 2024?

The library preparation kits segment dominates the next-generation sequencing library preparation market, holding a 50% share in 2024, due to their key function in creating high-quality DNA and RNA libraries for sequencing. Their adaptability to a wide range of uses and their extensive use in clinical, pharmaceutical, and research labs are the reasons for their dominance.

The automation & library prep instruments segment is expected to be the fastest-growing segment in the market with a 13% CAGR during the forecast period. This is because labs are adopting automated solutions in response to the growing demand for high-throughput sequencing, which reduces manual intervention and improves reproducibility. These solutions support large-scale genomics projects while saving time.

Technology/Sequencing Platform Compatibility Insights

What Made the Illumina Platforms Segment Dominate the Next-Generation Sequencing Library Preparation Market in 2024?

The Illumina platforms segment dominates the market with a 45% share in 2024 due to their broad compatibility with various library preparation kits, high accuracy, and scalability. Their market dominance is strengthened by their well-established presence in clinical and research settings, robust technical support, and a sizable user base.

Oxford Nanopore Technologies' platforms segment is expected to be the fastest-growing segment in the market during the forecast period with a 14% CAGR, driven by its capacity to provide real-time data output, portable sequencing solutions, and long read sequencing, which satisfy the growing need for quick diagnostics and thorough genome analysis, especially in emerging markets and field-based research.

Application Insights

What Made the Clinical Research Segment Dominate the Next-Generation Sequencing Library Preparation Market?

The clinical research segment dominates the market with a 40% share in 2024, driven by the rising need for precision medicine, biomarker discovery, and genetic disease research, as well as extensive adoption of NGS for patient stratification, diagnostic validation, and translational studies.

The pharmaceutical & biotech R&D segment is expected to be the fastest-growing segment in the market during the forecast period with a 13.5% CAGR. This growth is driven by the adoption of NGS library preparation technologies, accelerated by increasing investments in clinical trials, personalized therapies, and drug discovery, particularly for extensive genomic and transcriptomic research.

End User Insights

What Made the Hospitals & Clinical Laboratories Segment Dominate the Next-Generation Sequencing Library Preparation Market in 2024?

The hospitals & clinical laboratories segment dominates the next-generation sequencing library preparation market with a 42% share in 2024 because NGS is increasingly used in infectious disease detection, oncology testing, and diagnostics. The foundation of this dominance is the requirement for precise, quick, and repeatable outcomes in clinical settings.

The x & pharmaceutical companies segment is expected to be the fastest-growing segment in the market during the forecast period with a CAGR of 13%. Rising R&D activities, an increasing focus on genomics-driven therapeutics, and investment in automated and high-throughput library prep solutions drive this growth.

Library Preparation Type Insights

What Made the Manual /Bench-Top Preparation Segment Dominate the Next-Generation Sequencing Library Preparation Market in 2024?

The manual/bench-top preparation segment dominates the market with a 55% share in 2024 due to its extensive use in research labs for cost-effectiveness, flexibility, and customization. For specialized applications or small-scale studies, researchers still use manual methods.

The automated/high throughput preparation segment is expected to be the fastest-growing segment in the market during the forecast period. This growth is driven by the adoption of automated platforms and labs, increasing demand for large-scale genomics, standardized workflows, and the reduction of human error.

Regional Insights

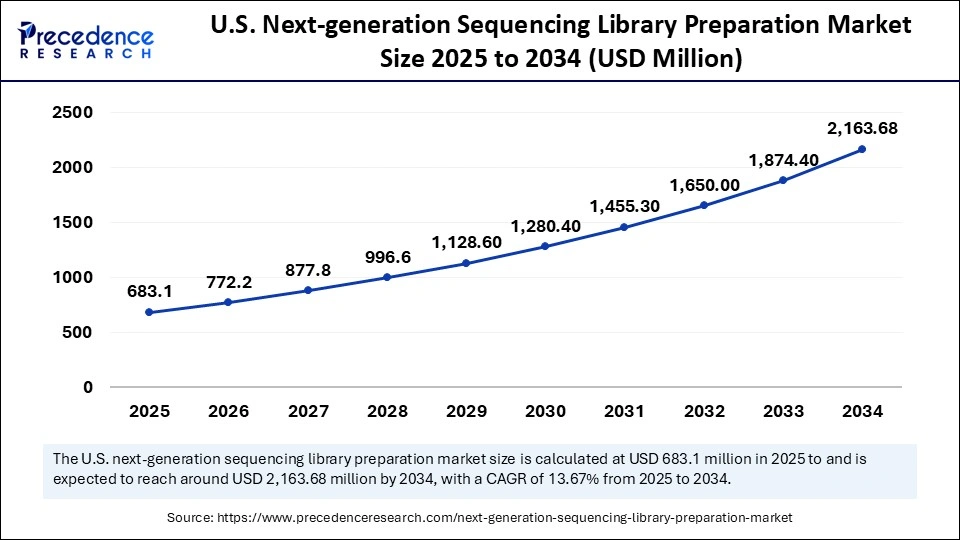

U.S. Next-generation Sequencing Library Preparation Market Size and Growth 2025 to 2034

The U.S. next-generation sequencing library preparation market size is exhibited at USD 683.1 million in 2025 and is projected to be worth around USD 2,163.68 million by 2034, growing at a CAGR of 13.67% from 2025 to 2034.

What Made North America Dominate the Next-Generation Sequencing Library Preparation Market in 2024?

North America dominated the market in 2024 with a 44% share due to advanced genomic research facilities, a well-established healthcare infrastructure, and the presence of significant market players, all contribute to the region's leadership. NGS technologies are also widely used, have substantial government funding for precision medicine, and are highly recognized by researchers.

U.S. Next-generation Sequencing Library Preparation Market Trends

The U.S. remains to largest market for NGS library preparation, accounting for the highest share in 2024, owing to its advanced research facilities and established healthcare ecosystem. Its dominant position is supported by significant market players like Illumina, Thermo Fisher, and QIAGEN, as well as robust investments in precision medicine and broad use of NGS platforms.

Asia Pacific is expected to be the fastest-growing segment in the market during the forecast period. This growth is driven by rapidly growing healthcare systems, rising investments in biotech and genomics research, and encouraging government initiatives. The market is expanding due to growing pharmaceutical R&D, the increasing prevalence of genetic disorders, and the arrival of international NGS companies in the area.

India Next-generation Sequencing Library Preparation Market Trends

India is emerging as one of the fastest-growing markets for NGS library preparation due to increasing investment in healthcare, the expansion of pharmaceutical and biotech research, and the rising use of advanced sequencing technologies. Further propelling market expansion are encouraging government regulations, increasing funding for genomics startups, the growing incidence of genetic illnesses, and oncology research.

|

Market Characteristic |

North America (e.g., US) |

Asia-Pacific (e.g., China, India) |

Europe (e.g., UK, Germany) |

|

Market Status |

The dominant market, attributed to high R&D investments, advanced healthcare infrastructure, and significant government funding. |

The fastest-growing market, driven by expanding healthcare access, increasing awareness of genomics, and rising investments. |

An established and rapidly growing market, benefiting from integrated genomic initiatives within national healthcare systems. |

|

Key Drivers |

Rising demand for precision medicine, with extensive genomic research in oncology, rare diseases, and reproductive health. |

Lower sequencing costs, coupled with government support for large-scale sequencing projects and clinical genomics. |

Integration of NGS into national health services (e.g., NHS), coupled with collaborative research and favorable regulatory policies. |

|

Emerging Trends |

Automation and high-throughput solutions are highly sought-after to standardize workflows and increase efficiency in clinical labs. The integration of AI for data analysis is also a growing trend. |

The focus on infectious disease surveillance and drug discovery is significantly impacted by the need to monitor viral mutations. |

Advances in companion diagnostics and liquid biopsy for oncology, as well as advancements in targeted therapy development. |

|

Focus Areas |

Drug and biomarker discovery and disease diagnostics, particularly for cancer, drive the market. Large academic and research institutions are major end-users. |

Clinical diagnostics, epidemiology, personalized medicine, and agricultural research are key application areas receiving significant investment. |

Diagnostic applications for genetic disorders and cancer, with a strong emphasis on translational research and precision medicine. |

|

Key Players |

There is a major presence of large companies like Illumina and Thermo Fisher Scientific, along with innovative startups focusing on niche applications and technology. |

A mix of global players and strong local contenders like BGI, often expanding through partnerships and focusing on regional needs. |

A robust mix of global and regional players, with significant collaborations between biotech firms, research institutions, and healthcare providers. |

Top Next-generation Sequencing Library Preparation Market Companies

- Illumina, Inc.: Illumina is the global leader in next-generation sequencing and provides a comprehensive suite of library preparation kits covering DNA, RNA, and methylation workflows. Its Nextera and TruSeq kits are widely used for high-throughput and clinical sequencing. The company's innovations emphasize accuracy, automation compatibility, and streamlined preparation for its sequencing platforms.

- Thermo Fisher Scientific: Thermo Fisher offers a complete range of library preparation kits under the Ion Torrent, Invitrogen, and Applied Biosystems brands. Its solutions support DNA, RNA, and epigenetic studies with automation-ready workflows. The company focuses on enhancing reproducibility and scalability for both clinical and research sequencing applications.

- Agilent Technologies: Agilent provides high-quality NGS library prep kits, such as SureSelect and SureScan, for targeted sequencing, RNA-seq, and exome enrichment. The company emphasizes precision and customization, offering automation integration for large-scale sequencing projects. Its strength lies in flexible library design and robust bioinformatics support.

- QIAGEN: QIAGEN's QIAseq NGS portfolio offers comprehensive library preparation solutions for DNA, RNA, and liquid biopsy analysis. The company focuses on accuracy, reproducibility, and minimal input requirements, supporting clinical diagnostics and translational research. Its automated QIAcube and QIAstat platforms simplify complex sequencing workflows.

- 10x Genomics Inc.: 10x Genomics is a leader in single-cell and spatial genomics, providing advanced library preparation technologies such as Chromium and Visium platforms. These enable researchers to map gene expression and spatial organization at cellular resolution. The company's technology plays a critical role in precision medicine and multi-omics research.

Other Companies in the Next-generation Sequencing Library Preparation Market

- Beckman Coulter Inc.: Offers automated liquid handling and magnetic bead-based cleanup systems for high-throughput NGS library preparation workflows.

- BGI Group: Integrates proprietary sequencing platforms and optimized library preparation solutions to deliver cost-effective genomic and transcriptomic analysis.

- Bio-Rad Laboratories: Supplies precision reagents and automation systems for library preparation and nucleic acid quantification, supporting diverse sequencing applications.

- F. Hoffmann-La Roche Ltd.: Develops advanced library preparation chemistries for clinical sequencing and personalized medicine through its genomics and diagnostics division.

- Hamilton Company: Designs automated liquid handling robots that streamline NGS library prep, ensuring high reproducibility and sample integrity across workflows.

- New England Biolabs Inc.: A major supplier of NGS library preparation reagents, including ligases, polymerases, and enzyme kits optimized for various sequencing platforms.

- Oxford Nanopore Technologies: Offers library preparation kits tailored for nanopore sequencing, enabling real-time long-read sequencing and epigenetic analysis.

- Pacific Biosciences of California Inc. (PacBio): Provides library preparation solutions for its SMRT sequencing platforms, optimized for high-fidelity long-read sequencing and genome assembly.

- PerkinElmer Inc.: Develops automated sample preparation and nucleic acid extraction systems that support high-throughput NGS workflows in clinical and research labs.

- Takara Bio Inc.: Focuses on high-quality reagents and library prep kits for RNA-seq, single-cell sequencing, and full-length transcriptome analysis.

- Tecan Group AG: Offers precision liquid handling and NGS library preparation automation solutions for scalable and reproducible sequencing workflows.

- Thermo Fisher Scientific: Provides a full portfolio of NGS library preparation kits under its Ion Torrent and Invitrogen brands, covering DNA, RNA, and epigenetic sequencing applications.

Recent Developments

- In June 2024, Meridian Bioscience unveiled an industry-first lyophilized NGS library preparation kit to eliminate the need for cold-chain shipping and storage.(Source: https://www.meridianbioscience.com)

- In July 2025, New England Biolabs (NEB) launched the NEBNext Low-bias Small RNA Library Prep Kit, targeting reduced bias and a broader input range for small RNA sequencing.

Segments Covered in the Report

By Product Type

- Library Preparation Kits

- DNA Library Preparation Kits

- Whole Genome Sequencing (WGS) Kits

- Targeted Sequencing Kit

- Exome Sequencing Kits

- DNA Library Preparation Kits

- RNA Library Preparation Kit

-

- mRNA Sequencing Kits

- Total RNA / rRNA Depletion Kits

- Small RNA / miRNA Sequencing Kits

- Single-Cell Library Preparation Kits

- Other Specialized Kits (ChIP-Seq, Methylation Kits, etc.)

-

- Library Preparation Reagents & Consumables

- Enzymes (Reverse Transcriptase, DNA Polymerase, Ligases, etc.)

- Adapters & Indexes

- Buffers & Reaction Mixes

- Purification & Cleanup Kits

- Automation & Library Prep Instruments (Optional)

- Robotic Liquid Handling Systems

- Microfluidics-Based Platforms

By Technology / Sequencing Platform Compatibility

- Illumina Platforms

- Thermo Fisher / Ion Torrent Platforms

- Pacific Biosciences (PacBio) Platforms

- Oxford Nanopore Technologies Platforms

- Other Sequencing Platforms

By Application

- Clinical Research

- Genetic Disorders & Rare Disease Research

- Cancer Genomics

- Infectious Disease / Pathogen Detection

- Pharmaceutical & Biotech R&D

- Drug Discovery & Development

- Personalized Medicine Research

- Academic & Basic Research

- Functional Genomics

- Transcriptomics & Epigenomics

- Agrigenomics & Plant/Animal Research

- Other Applications

- Microbiome Analysis

- Metagenomics

- Environmental & Industrial Research

By End User

- Hospitals & Clinical Laboratories

- Biotechnology & Pharmaceutical Companies

- Academic & Research Institutes

- Contract Research Organizations (CROs)

- Government & Public Health Laboratories

By Library Preparation Type

- Manual / Bench-top Preparation

- Automated / High-Throughput Preparation

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content