Next-Generation Cancer Therapeutics Market Size and Forecast 2025 to 2034

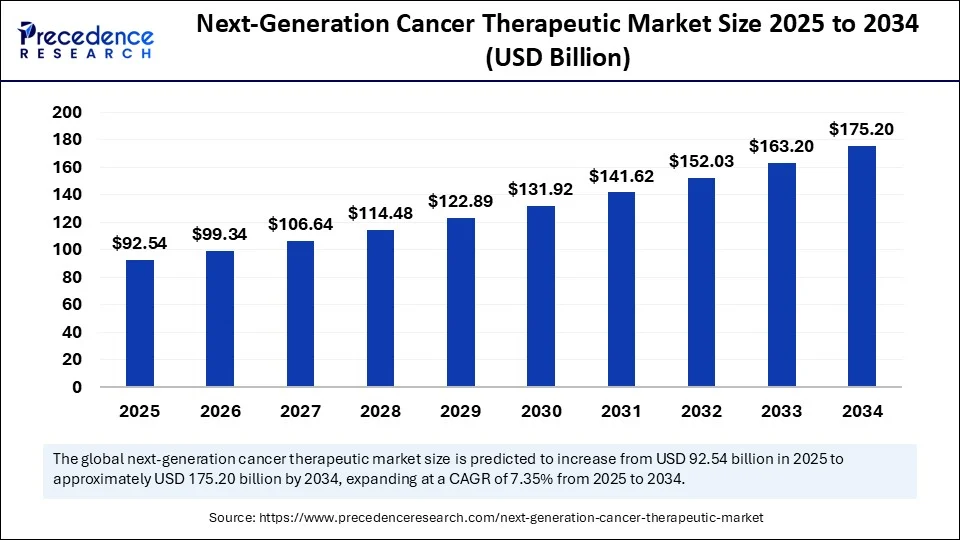

The global next-generation cancer therapeutics market size was estimated at USD 86.20 billion in 2024 and is predicted to increase from USD 92.54 billion in 2025 to approximately USD 175.20 billion by 2034, expanding at a CAGR of 7.35% from 2025 to 2034. The growth of the next-generation cancer therapeutics market is driven by the rising development of novel immunotherapy, increasing prevalence of cancer, and substantial government funding. The rising demand for personalized treatments and advances in mRNA technology are expected to drive market growth in the coming years.

Next-Generation Cancer Therapeutics Market Key Takeaways

- In terms of revenue, the global next-generation cancer therapeutics market was valued at USD 86.20 billion in 2024.

- It is projected to reach USD 175.20 billion by 2034.

- The market is expected to grow at a CAGR of 7.35% from 2025 to 2034.

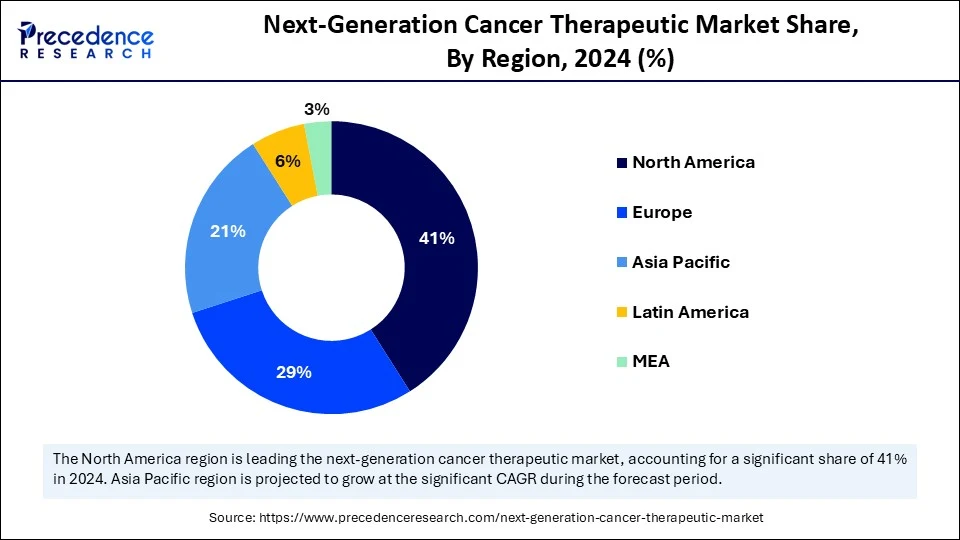

- North America dominated the next-generation cancer therapeutics market with the largest market share of 41% in 2024.

- Asia Pacific is expected to expand at the fastest CAGR between 2025 and 2034.

- By therapy type, the targeted therapy segment held the biggest market share in 2024.

- By therapy type, the antibody-drug conjugates (ADCs) segment is expected to grow at a significant CAGR between 2025 and 2034.

- By cancer type, the lung cancer segment captured the highest market share in 2024.

- By cancer type, the blood cancers segment is expected to expand at the fastest CAGR over the projected period.

- By modality, the monotherapy segment contributed the largest market share in 2024.

- By modality, the combination therapy segment is expected to expand at a notable CAGR over the projected period.

- By route of administration, the intravenous (IV) segment held the major market share in 2024.

- By route of administration, the subcutaneous segment is expected to expand at a notable CAGR over the projected period.

- By mechanism of action, the immune activation (Checkpoint Inhibition) segment generated the highest market share in 2024.

- By mechanism of action, the tumor microenvironment modulation segment is expected to expand at a notable CAGR over the forecast period.

- By end user, the specialized cancer hospitals segment led the market in 2024.

- By end user, the homecare (for oral or SC delivery) segment is expected to expand at a significant CAGR over the projected period.

Impact of AI on the Next-Generation Cancer Therapeutics Market

Artificial intelligence is revolutionizing the market for next-generation cancer therapeutics by accelerating drug discovery, streamlining clinical trials, and enabling personalized treatment strategies. AI can analyze vast datasets of genomic and proteomic to identify potential drug targets. In drug discovery, AI algorithms predict the efficacy and safety of drug candidates, reducing side effects. In clinical trials, AI predicts the patient response to a specific drug, allowing for more personalized treatment strategies.

In prostate cancer, AI used to analyze imaging biopsy to predict which men would benefit from abiraterone and associated biomarkers, decreasing mortality rates in men by about 9% to 17. In breast cancer therapeutics, Rakovina and Variational AI have developed first ATR-inhibitor compounds from generative AI. Such innovative move through AI, ranging from image review to drug discovery, indicates AI's potential to transform cancer therapeutics.

U.S. Next-Generation Cancer Therapeutics Market Size and Growth 2025 to 2034

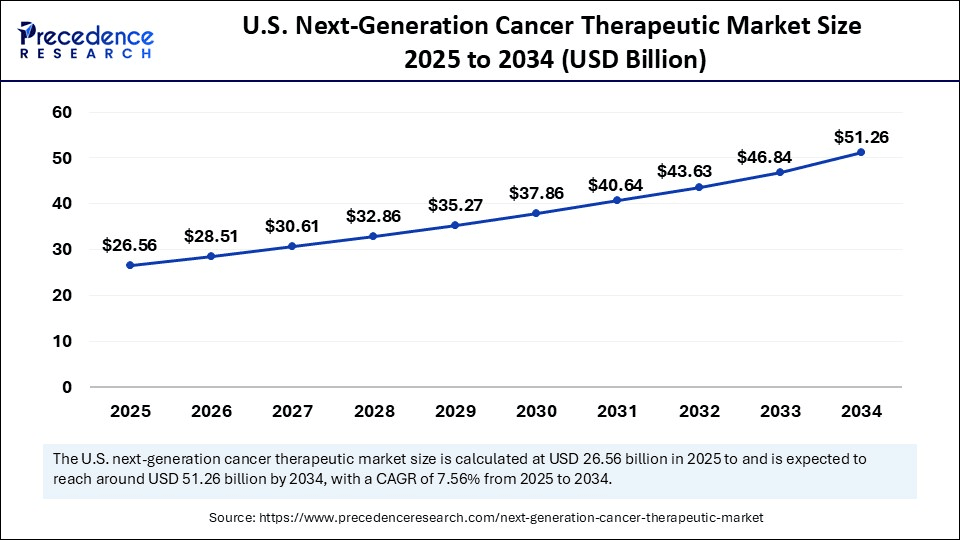

The U.S. next-generation cancer therapeutics market size was evaluated at USD 24.74 billion in 2024 and is projected to be worth around USD 51.26 billion by 2034, growing at a CAGR of 7.56% from 2025 to 2034.

Next‑Generation Cancer Therapeutics Market Driven by Personalized and Precision Medicine

North America leads the market due to its research infrastructure, government support, and innovation-friendly environment. The U.S. FDA approved novel therapies, supporting product pipeline in targeted and next-generation immune-mediated therapies. The National Cancer Institute funds oncology programs through grants, covering all research phases. Biotech hubs in Boston, California, and Texas concentrate clinical trials and partnerships, creating a market for next-generation therapies. Regulatory advances and funding have made the U.S. the global R&D leader. In August 2024, the FDA approved "afami-cel," a T-cell therapy for solid tumors. North America also had over 5,000 active oncology clinical trials in late 2024. Investments from the NIH and strategic investments fuel the demand for novel cell and gene therapies. Moreover, the shift toward personalized medicine, where treatments are tailored to individual patients based on their genetic profiles, is driving market growth.

What Factors Contribute to the Growth of the Next-Generation Cancer Therapeutics Market in Asia Pacific?

Asia Pacific is expected to grow at the fastest rate during the forecast period due to healthcare modernization, policy changes, and rising clinical trials. The rising incidence of cancer fuels the demand for advanced treatments. Governments in China, India, Japan, and South Korea are simplifying approvals and boosting domestic biotech R&D. China leads the region with rapid growth from regulatory reform and R&D investment. The NMPA now considers global trial data and offers priority review, fast-tracking approvals, and commercial planning, shortening timelines. Akeso's bispecific antibody drug "Ivonescimab" for lung cancer, approved in 2024, is gaining national attention for its performance.

Market Overview

The next-generation cancer therapeutics market encompasses a broad spectrum of innovative, highly targeted, and personalized treatment modalities that go beyond conventional chemotherapy and radiotherapy. These therapies leverage genomic, immunologic, and molecular insights to improve efficacy, minimize toxicity, and often target the cancer's root cause or specific mutations. These include immunotherapies, gene and cell therapies, targeted inhibitors; antibody-drug conjugates (ADCs), RNA-based therapies, and tumor-agnostic treatments. These modalities are transforming oncology by offering precision medicine approaches, especially for hard-to-treat or metastatic cancers.

Next-Generation Cancer Therapeutics Market Growth Factors

- Increasing Cancer Burden: The rise in cancer incidence worldwide has created an urgent need for innovative therapies with high efficacy and low toxicity and personalized treatment regimens, boosting the growth of the market.

- Advances in Genomics: Advancements in genomic sequencing technology are fostering the identification of novel tumor-specific mutations that could lead to unprecedented precision therapies such as gene editing and targeted drugs to directly combat cancer-specific functional alterations.

- Immunotherapy Innovation: New developments, such as CAR-T cells, checkpoint inhibitors, and other related innovations are transforming the field of oncology by creating durable responses, while also expanding treatment options for previously untreatable, or consecutively treated, hands-off cancers.

- Favorable Regulatory Climate: Regulatory agencies are fast-tracking approvals for breakthrough and orphan drugs while also offering incentives to expedite the clinical adoption and commercialization of next-generation cancer therapies, supporting market growth.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 175.20 Billion |

| Market Size in 2025 | USD 92.54 Billion |

| Market Size in 2024 | USD 86.20 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 7.35% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Therapy Type, Cancer Type, Modality, Route of Administration, Mechanism of Action, End-User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Could regulatory relief improve access to next-gen CAR-T cancer therapies?

Yes, regulatory relief could definitely boost access to next-generation CAR-T cancer therapies. Regulatory changes are speeding up the development of new cancer treatments, especially cell-based immunotherapies like CAR-T therapies. In June 2025, the FDA removed a major safety requirement (REMS) for approved CAR-T therapies such as Breyanzi, Abecma, Carvykti, Kymriah, Tecartus, and Yescarta, stating that updated labeling was enough to ensure safety. This shift suggests regulators are gaining trust in the safety of these therapies, potentially leading to faster approvals, wider use, and more investment in advanced cell therapies. Supportive regulatory frameworks and expedited approval processes for breakthrough therapies support market growth.

Restraint

Is high pricing and taxation stifling next-generation cancer therapies?

High treatment costs and heavy taxation significantly limit access to next-generation cancer therapeutics. The World Health Organization (WHO) reported 20 million new cancer cases in 2022, with 9.7 million deaths, underscoring the need for advanced treatments. The price of innovative therapies, such as CAR-T and bispecific antibodies, often runs into the thousands per dose, leading to higher patient costs and burdening health systems. In India, cancer drugs are typically taxed at 12%, impacting patient affordability.

- In January 2025, Biocon advocated for the Indian government to exempt all cancer and rare-disease drug products from the excise taxes to help reduce out-of-pocket costs for patients.

(Source: https://www.reuters.com)

For countries that do not have enough healthcare budgets or insurance coverage, healthcare policymakers need to be much more cognizant of drug product pricing and taxation policies that negatively affect access to disruptive and potentially highly beneficial therapies, such as CAR-T. If public policy doesn't address pricing and tax burdens, access to these groundbreaking cancer treatments will suffer, especially in low- and middle-income countries.

Opportunity

Is mRNA technology transforming the landscape of cancer treatment?

The key opportunity in the next-generation cancer therapeutics market lies in the quick adoption of mRNA technology and its accelerating innovation cycle. In April 2024, the UK approved the world's first mRNA-based cancer vaccine, BNT122/RO7198457, developed by BioNTech and Genentech. This highlights the regulatory pathways available for personalized mRNA treatments for advanced cancers like melanoma. mRNA vaccines enable rapid development of targeted approaches that use immune function, offering a faster path to regulatory approval compared to traditional methods. This presents an opportunity to lead in personalized, minimally invasive cancer treatments, potentially improving patient outcomes through accelerated timelines. Moreover, the rising development of targeted therapies that specifically attack cancer cells while sparing healthy cells opens new growth avenues.

(Source: https://www.europeanpharmaceuticalreview.com)

Therapy Type Insights

Why Did the Targeted Therapy (Small Molecule Inhibitors) Segment Dominate the Next-Generation Cancer Therapeutics Market in 2024?

The targeted therapy segment dominated the market with the largest share in 2024. Small molecular inhibitors are still by far the most prevalent next-generation cancer therapies. They offer advantages of selective targeting cancer-specific proteins and cancer-specific signaling pathways. Small molecule inhibitors find applications in a variety of cancers, such as breast, lung, and colorectal cancer. They are orally delivered, easily integrated into existing treatment paradigms, and can manage acquired resistance all while addressing the growing shift towards precision oncology.

The antibody drug conjugates (ADCs) segment is expected to grow at the fastest rate in the coming years. They have developed quickly as next-generation cancer therapies using monoclonal-based targeting strategies with the addition of very cytotoxic agents to targeted tumor cells instead of systemic cancer treatment. There have been a number of high-profile drugs such as Enhertu for breast and gastric cancers and companies such as Seagen and AstraZeneca are increasing their ADC pipelines. The proven effectiveness of ADCs in treating a range of cancers and their reduced side effects further support segmental growth.

Cancer Type Insights

Which Cancer Type Dominate the Market in 2024?

Lung cancer continues to be the dominant segment in the next-generation therapeutics market due to the increased mortality rate associated with it. According to the WHO, lung cancer is the leading cause of cancer-related deaths worldwide, responsible for approximately 85% of all cases. This prompted the need for next-generation targeted therapies. The combination of EGFR, ALK, and KRAS inhibitors and checkpoint inhibitors has changed the treatment approaches.

The blood cancer segment is expected to grow at the fastest rate in the coming years. With the growing prevalence of leukemia, lymphoma, and myeloma, the demand for new therapies, CAR-T cell therapy, bispecific antibodies, and new immunotherapies is rising. Rising regulatory approvals for new agents applicable to relapsed or refractory leukemia and lymphoma have made momentum in the market.

Modality Insights

Why Did the Monotherapy Segment Dominate the Market in 2024?

The monotherapy dominated the next-generation cancer therapeutics market in 22024 due to its specificity in action, fewer side effects, and applications in treatments involving immune checkpoint inhibitors and targeted therapies for malignancies such as melanoma and lung cancer. Monotherapy continues to dominate the market due to the relatively straightforward processes involved in manufacturing and the clinical success that is expected to persist in the future.

Meanwhile, the combination therapy segment is expected to grow at the fastest rate in the coming years. It produces the potential to improve standardized regimens for every modality, including pharmacodynamic drugs that span combinations like immune-oncology with targeted therapeutics or ADCs, and/or chemotherapy, mRNA, or with checkpoint inhibitors. These combinations will maximally demonstrate either additive or synergistic (hopefully), which in either case will improve a patient's survival and recurrence. Currently, the focus on oncology-based combinations, an ongoing clinical trial pipeline with investment around multi-modality treatments, is accelerating the rate of combination therapy quite rapidly in oncology.

The use of combination therapies, which involve multiple drugs or treatment modalities, can improve efficacy and overcome drug resistance. Combination therapies are increasingly used to treat all cancers, aiming to overcome tumor heterogeneity and resistance by targeting multiple pathways at once. Combining checkpoint inhibitors with chemotherapy or targeted agents has shown improved outcomes in cancers like NSCLC and melanoma.

Route of Administration Insights

How Does the Intravenous (IV) Segment Dominate the Market in 2024?

The intravenous (IV) segment dominated the next-generation cancer therapeutics market in 2024. This is mainly due to the increased demand for targeted drug delivery approaches. IV administration allows for precise dosing and delivery control, which is crucial for drugs with narrow therapeutic windows. Healthcare professionals favor IV routes due to monitoring capabilities, especially for patients undergoing intensive cancer treatments.

The subcutaneous (SC) segment is expected to grow at the fastest CAGR during the forecast period. The rise in the preference for SC delivery is due to patient convenience, reduced administration time, and the potential for home-based delivery, ensuring patients have access to their treatment and are tracked throughout their cycle. SC delivery is becoming more popular in cancer treatments, and this trend is expected to continue with more approvals of SC cancer immunotherapies, like atezolizumab.

Mechanism of Action Insights

Why Did the Immune Activation (Checkpoint Inhibition) Segment Dominate the Next-Generation Cancer Therapeutics Market?

The immune activation (checkpoint inhibition) dominated the market with a major revenue share in 2024. This is mainly due to the increased demand for immunotherapies. Checkpoint inhibitors, such as PD-1/PD-L1 and CTLA-4 inhibitors, activate the immune system and provide lasting responses in various cancers. Drugs like pembrolizumab and nivolumab are standard in melanoma, NSCLC, and bladder cancer.

The tumor microenvironment modulation segment is expected to grow at the fastest rate in the coming years. Modulating the tumor microenvironment (TME) is a promising method to fight immune resistance and improve efficacy. Therapies targeting myeloid cells, stromal barriers, and hypoxia are being actively developed. More biotechs are focusing on agents targeting the TME to use with existing immunotherapies.

End-User Insights

What Made Specialized Cancer Hospitals the Dominant Segment in the Market in 2024?

The specialty cancer hospitals segment dominated the next-generation cancer therapeutics market while holding the largest share in 2024. Specialty hospitals lead in adopting next-generation cancer therapies due to their infrastructure, access to clinical trials, and skilled oncology teams. They are often the first to implement cutting-edge therapies and participate in international studies. With experience in complex therapies like CAR-T and high-dose immunotherapy, these hospitals will be central to innovative cancer care models.

The homecare segment is expected to grow at the highest CAGR in the upcoming period. This is mainly due to the shift to patient-driven care, which is rapidly expanding homecare settings for therapies that can be delivered parenterally or orally. The pandemic accelerated this trend, with patients seeking less hospital initiation. As patients become more familiar with home cancer care, along with digital monitoring tools, patient education, administration kits, and patient self-injections, home care for cancer has evolved and continues to grow.

Next-Generation Cancer Therapeutics Market Companies

- Roche Holding AG

- Bristol Myers Squibb

- Merck & Co., Inc.

- Pfizer Inc.

- Novartis AG

- AstraZeneca plc

- Eli Lilly and Company

- Gilead Sciences, Inc.

- Seagen Inc. (Pfizer)

- Amgen Inc.

- Genentech, Inc.

- Moderna, Inc.

- BioNTech SE

- Bluebird Bio, Inc.

- BeiGene, Ltd.

- Innovent Biologics

- Immatics Biotechnologies

- Adaptimmune Therapeutics

- Fate Therapeutics

- Legend Biotech Corporation

Recent Developments

- In April 2025, Nona Biosciences and Atossa Therapeutics formed a partnership to co-develop next-generation antibody therapies for breast cancer, leveraging Nona's Harbour Mice platform for therapeutic antibody discovery.

(Source: https://www.finansavisen.no) - In October 2024 AbbVie and EvolveImmune Therapeutics announced a collaboration and option-to-license agreement to develop next-generation cancer biotherapeutics using EvolveImmune's novel costimulatory T cell platform to target immune-suppressive tumors.

(Source: https://www.prnewswire.com)

Segments Covered in the Report

By Therapy Type

- Targeted Therapy (Small Molecule Inhibitors)

- Immunotherapy

- Checkpoint Inhibitors (PD-1, PD-L1, CTLA-4)

- CAR-T Cell Therapy

- Cancer Vaccines

- Gene Therapy

- Cell Therapy (e.g., TILs, NK cells)

- Antibody-Drug Conjugates (ADCs)

- RNA-based Therapy (mRNA, siRNA, ASO, LNA, etc.)

By Cancer Type

- Lung Cancer

- Breast Cancer

- Colorectal Cancer

- Blood Cancers (Leukemia, Lymphoma, Myeloma)

- Prostate Cancer

- Brain Cancer (e.g., GBM)

- Pan-Tumor (Tumor-agnostic therapies)

By Modality

- Monotherapy

- Combination Therapy

- Immunotherapy + Targeted Drugs

- Chemotherapy + ADC

- mRNA + Checkpoint Inhibitors

By Route of Administration

- Intravenous (IV)

- Oral

- Intratumoral / Localized

- Subcutaneous

By Mechanism of Action

- Immune Activation (Checkpoint Inhibition)

- Oncogene Targeting (e.g., BRAF, KRAS, EGFR)

- DNA Damage Response Modulators (e.g., PARP inhibitors)

- Tumor Microenvironment Modulatio

- Apoptosis Induction

By End-User

- Specialized Cancer Hospitals

- Academic & Research Institutes

- Ambulatory Infusion Centers

- Homecare (for oral or SC delivery)

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting