Next-Generation IVD Market Size and Forecast 2025 to 2034

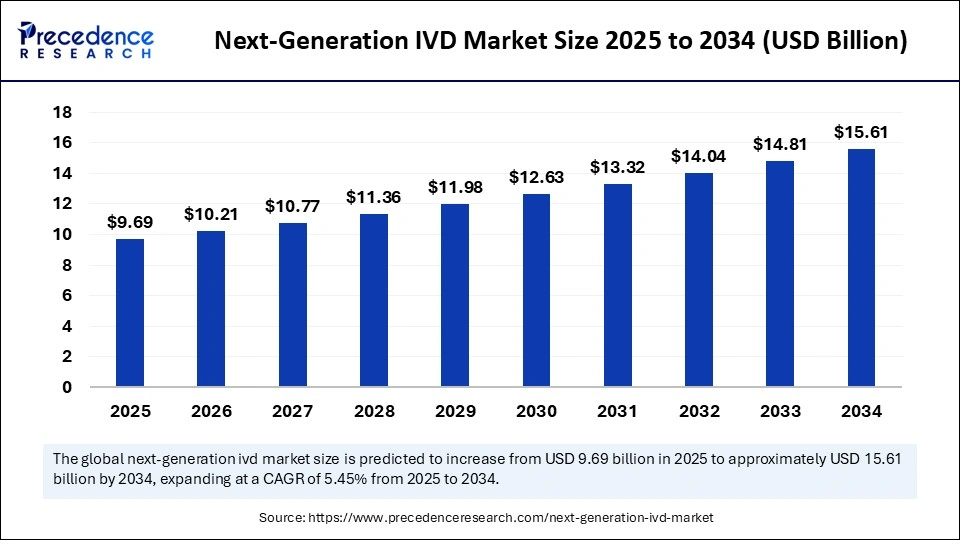

The global next-generation IVD market size accounted for USD 9.18 billion in 2024 and is predicted to increase from USD 9.69 billion in 2025 to approximately USD 15.61 billion by 2034, expanding at a CAGR of 5.45% from 2025 to 2034. Ongoing technological advancements, innovations in genomics, proteomics, and molecular diagnostics, and rising development of personalized and precision medical are driving the growth of the market.

Next-Generation IVD Market Key Takeaways

- North America led the next-generation IVD market with the largest share of 41% in 2024.

- Asia Pacific is expected to expand the fastest CAGR between 2025 and 2034.

- By type, the core laboratory diagnostics segment held the largest market share in 2024.

- By type, the point of care testing segment is anticipated to grow at a remarkable CAGR between 2025 and 2034.

- By product, the consumables segment captured the largest market share in 2024.

- By product, the software segment is expected to expand to a significant CAGR over the projection period.

- By application, the oncology/cancer segment held the biggest market share in 2024.

- By application, the diabetes segment is projected to expand at the fastest CAGR over the projection period.

- By end-user, the hospitals and clinics dominated the market in 2024.

- By end-user, the diagnostic laboratories segment is expected to expand at a significant CAGR during the forecast period.

Role of AI in In Vitro Diagnostics (IVD) and Precision Medicine

Artificial intelligence (AI) is shaping the future of IVD. AI-driven tools can streamline laboratory workflows, enhancing testing accuracy and assisting with complex diagnostic tasks. AI facilitates the integration of patient-specific data, enabling a more personalized approach to diagnostics and treatment. This tailoring of medical interventions based on individual characteristics can lead to improved outcomes and reduced adverse effects. AI is revolutionizing liquid biopsy in IVD by enabling early disease detection and real-time monitoring. AI algorithms improve data analysis and predictive accuracy by analyzing biomarkers such as circulating tumor DNA (ctDNA) and extracellular vesicles from non-invasive samples like blood and tissues. AI also enables precise identification of complex genetic and molecular patterns, facilitating early detection of cancer, drug resistance monitoring, and minimal residual disease (MRD) tracking.

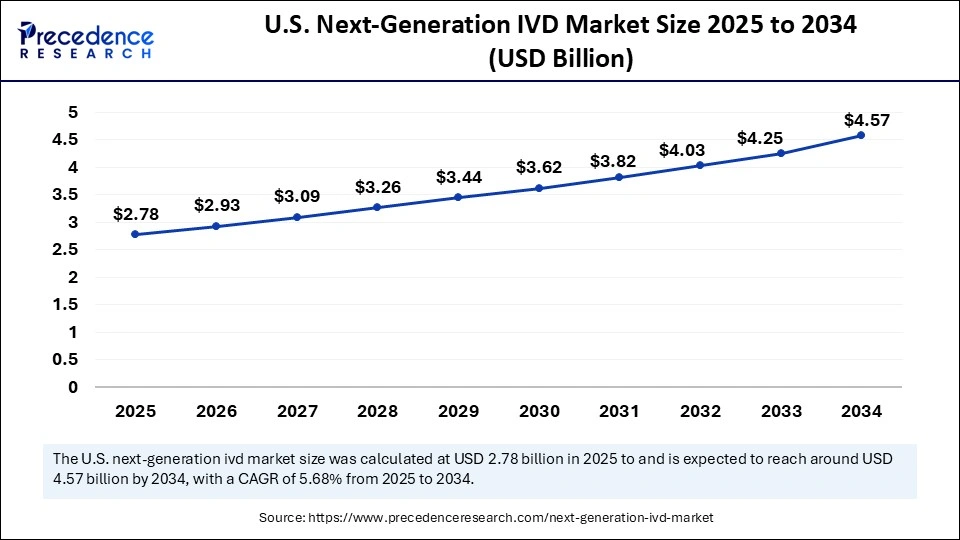

U.S. Next-Generation IVD Market Size and Growth 2025 to 2034

The U.S. next-generation IVD market size was exhibited at USD 2.63 billion in 2024 and is projected to be worth around USD 4.57 billion by 2034, growing at a CAGR of 5.68% from 2025 to 2034.

North America registered dominance in the next-generation IVD market by capturing the largest share in 2024. This is mainly due to the presence of sophisticated healthcare systems, increased research funding, and ongoing advances in diagnostic technologies. There is a heightened adoption of molecular diagnostics and next-generation sequencing. With the increased burden of chronic diseases, the demand for point-of-care testing is increasing in the region. Most importantly, the significant innovations in IVD technologies are underpinned by substantial investments from governments in healthcare research.

The U.S. remains a dominant force in the North American next-generation IVD market, driven by the country's strong healthcare infrastructure and advanced research institutions. The rising prevalence of chronic and infectious diseases is boosting the adoption of innovative diagnostic tools. The U.S. Food and Drug Administration (FDA) has streamlined approval processes for many novel IVD devices, further encouraging innovations.

Asia Pacific is projected to witness the fastest growth during the forecast period. This is mainly due to the rising government investments in advancing healthcare and laboratory infrastructures. People are becoming more aware of early disease detection, boosting the need for novel diagnostic solutions. Increasing healthcare expenditure, particularly in countries like China and India, further supports regional market growth. The region is becoming a hub for the development and manufacturing of affordable diagnostic products, especially in emerging markets where healthcare access is limited.

China is likely to have a stronghold on the APAC next-generation IVD market. The rising government emphasis on healthcare reform and technological innovation contributes to market growth. Programs like "Healthy China 2030" have spurred the development of diagnostic infrastructure, leading to wider availability of advanced IVD solutions across the country. China's aging population, along with an increasing number of cases of chronic diseases, is boosting the demand for early diagnosis. In addition, the Chinese government is fostering local production of IVD devices to reduce reliance on imports, which further supports market growth.

Europe is considered to be a significantly growing area. The growth of the next-generation IVD market in Europe can be attributed to the rising healthcare spending and the growing geriatric population. There is a strong focus on prevention or early detection of diseases. The region has a well-established healthcare industry, supporting market growth. Germany plays a key role in the regional market growth. This is mainly due to its strong healthcare system and commitment to technological advancement. Germany is a hub for the development and manufacturing of diagnostic devices. The country is investing heavily in digital health and molecular diagnostics, with key initiatives aimed at enhancing early detection and improving healthcare access.

Market Overview

The next-generation in vitro diagnostics (IVD) refers to medical tests that characterize advanced diagnostic technology to identify diseases or conditions via human samples, such as blood, tissue, and saliva. The next-generation IVD market encompasses molecular diagnostics, point-of-care testing, next-generation sequencing, and digital diagnostics. Next-generation IVD technologies are gaining traction as a result of an increasing demand for early detection of diseases and personalized medicine.

The increasing focus on new technological innovations, rising expenditures on healthcare, and demand to address the rising burden of chronic and infectious diseases are also significant contributors to the market growth. The increasing research and development (R&D) activities and a rapid shift toward decentralized, interconnected, and patient-centric healthcare delivery solutions further support market expansion.

Next-Generation IVD Market Growth Factors

- The increasing demand for early and accurate diagnosis is boosting the growth of the market. People are becoming more aware about the benefits of early diagnosis, boosting the demand for timely and reliable diagnostic tools, particularly for cancer, infectious diseases, and genetic diseases.

- There is a high demand for personalized and precision medicine, supporting market growth. Greater emphasis is given to treatments specific to the genetic and molecular profile of the patient, leading to stronger need for diagnostics that align with the development of targeted therapy and patient-specific management.

- Rapid shift toward point-of-care testing is also boosting the growth of the market. Demand for diagnostic that are real time and closer to the patient are increasing, particularly in remote, or resource-limited areas of the world, which improves accessibility and decreases wait times for results.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 15.61 Billion |

| Market Size in 2025 | USD 9.69 Billion |

| Market Size in 2024 | USD 9.18 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 5.45% |

| Dominated Region | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Product, Application, End User, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Drivers

Demand for Decentralized Laboratory Testing (DLT)

The rising demand for decentralized laboratory testing, including point-of-care (POC) diagnostics, is a key factor driving the growth of the next-generation IVD market. In 2024, the U.S. Food and Drug Administration (FDA) approved the use of over-the-counter (OTC) molecular tests for influenza and respiratory syncytial virus (RSV), providing patients with the ability to test independently in their homes. About 70% of India's population lives in rural areas; however, approximately 70% of healthcare infrastructure is in urban areas. This highlights that there is an important need for decentralized diagnostic solutions. Furthermore, the World Health Organization (WHO) has promoted the use of POC diagnostics in less resource settings and provides access to and improves outcomes for underserved communities. These activities highlight the important role of decentralized testing in advancing global healthcare delivery and developing the IVD market.

Restraint

Regulatory Challenges

Regulatory approvals for next-generation in vitro diagnostics (IVD) technologies represent a major barrier to market growth. The more complicated nature of novel diagnostics usually requires additional validation studies and stricter regulations; therefore, they are likely more expensive to develop and will take more time to become available to the market compared to prior products. Under the European Union's In Vitro Diagnostic Regulation (IVDR), for example, many products considered low-risk previously are now subject to new regulations and lengthy, limiting applications.

There have also been recent updates to the classification of IVD in India, requiring registration through the ePortal or obtaining a Form MD-15 import license before importation, representing an updated classification of IVD analyzers and instruments. Navigating such regulations is often more difficult, creating barriers for smaller companies, who will often lack the financial and technical resources to meet these criteria.

Opportunity

Rising Chronic Disease Burden and Aging Population

The increasing worldwide burden of chronic diseases, such as diabetes, heart disease, cancer, and stroke, creates immense opportunity in the next-generation IVD market. According to the World Health Organization, non-communicable diseases are responsible for 73.9% of all deaths globally, while diabetes affects over 422 million people globally. Chronic diseases regularly require ongoing monitoring and time-sensitive diagnosis, which encourages patients and healthcare providers to use rapid, accurate, and minimally invasive diagnostic technology.

As the global population continues to age, the prevalence of chronic disease is expected to increase, creating more demand for IVD technology in both hospital and home-care settings. Cancer cases alone are expected to rise by almost 77% by 2050, creating the need for early detection and personalized treatment alternatives. Next-generation IVD tools present significant viable solutions for patient care management and global health outcomes.

Type Insights

The core laboratory diagnostics segment dominated the next-generation IVD market with the largest share because it is used in almost all centralized laboratories for high-throughput testing. Core laboratory diagnostics are required for regular testing and can perform complex testing in a larger healthcare system. They have the ability to process large volumes of testing and provide a high level of accuracy and reliability in testing. In fact, they have historically been the backbone of clinical diagnostics. Similar to most health systems, efficiency has been improved with the introduction of automation and data management tools integrated into core lab systems, boosting the adoption across hospitals and reference laboratories. The rise in demand for accurate diagnostics bolstered segmental growth.

The point of care testing segment is anticipated to grow at a remarkable CAGR during the forecast period. The growth of the segment can be attributed to the rising need for rapid diagnostics. POCT can be performed at or near the site of patient care. POCT can be done with urgent samples in clinics, emergency rooms, or even at patients' homes and is not reliant upon the workflow of a healthcare system, thereby shortening turnaround times and enhancing decision making.

Product Insights

The consumables segment led the next-generation IVD market by capturing the largest share in 2024. Almost every diagnostic procedure needs consumables, such as reagents, test kits, and cartridges. Consumables are less expensive and provide recurrent revenue compared to instruments. As the volumes of tests increase, so does the need for consumables. The reliance on consumables for accurate testing and the ongoing need to use them across diagnostic platforms affirm the segment's position in the market.

The software segment is expected to expand at a significant CAGR over the projection period. With the increasing reliance on digital health solutions, the need for software integration into diagnostics is increasing. The interest and desire for data analytics, AI-driven diagnostic interpretation and testing, and interoperability across the healthcare ecosystem continue to drive the importance of IVD software solutions. Software solutions also complement the growing demand for automated workflow, remote access to diagnostic tools and testing, and reporting and monitoring diagnostics in real-time, which support clinical outcomes and operational outcomes. As the field continues to shift to personalized medicine, software tools that can capture data can be necessary for optimizing diagnostic accuracy and management of patients.

Application Insights

The oncology/cancer segment held the largest share of the next-generation IVD market in 2024. This is mainly due to the ever-growing cancer burden globally and the need for early intervention and personalized treatment paradigms. The field of advanced molecular and genomic diagnostics has become the focal point for identifying markers in cancer even more thoroughly for future screening, prognostics, therapy selection, and monitoring of treatment response. There is a significant increase in investment from governments and private entities in cancer research and diagnostics. Increased acceptance of precision oncology and companion diagnostics further bolstered the growth of the segment.

The diabetes segment is projected to expand at the fastest rate over the projection period. The increasing number of individuals diagnosed with diabetes is boosting the demand for next-generation diagnostic tools for early detection and monitoring over time. Next-gen IVD technologies, such as biosensors and wearable devices, have become ideal for non-invasive and timely glucose and health monitoring. Furthermore, the development of digital health tools and algorithms based on both data science and artificial intelligence are revolutionizing personalized and functional health management for diabetes, perpetuating the segment's growth.

End-User Insights

The hospitals & clinics segment dominated the next-generation IVD market. The settings serve as a hub for a wide range of diagnostic and treatment options. Hospitals and clinics frequently have advanced infrastructures to support high-end instruments and software platforms, which provide access to accurate and timely diagnostic capabilities. Hospitals and clinics also administer tests in various specialties, making them well-suited to integrating diagnostic platforms into their organizations. Furthermore, increased patient volumes in hospitals bolstered the growth of the segment.

The diagnostic laboratories segment is expected to expand at a significant rate during the forecast period. Diagnostic labs are quickly using next-generation IVD technologies to expand their testing capabilities. The scalable nature of centralized labs, alongside the rise of specialist testing, also drives investments in laboratory automation and informatics. The rising focus on improving laboratory infrastructure contributes to segmental growth.

Next-Generation IVD Market Companies

- Abbott

- Agilent Technologies, Inc.

- bioMérieux SA

- Bio-Rad Laboratories, Inc.

- Charles River Laboratories

- Danaher Corporation

- F. Hoffmann-La Roche Ltd.

- Qiagen

- Quest Diagnostics Incorporated

- QuidelOrtho Corporation

- Siemens Healthineers AG

- Sysmex Corporation

Announcement by Industry Leader

- In January 2025, Revvity and Element Biosciences collaborated to advance sequencing-based IVD neonatal testing. The collaboration involves the co-development of a comprehensive IVD solution tailored for newborn sequencing. Yaron Hakak, senior vice president of Element Biosciences, said, “Collaboration with Revvity on this IVD solution will provide a comprehensive, high-quality offering that meets the unique needs of newborn screening programs worldwide.”

Recent Developments

- In October 2024, Yourgene Health, a leading international molecular diagnostics group, launched the first non-invasive prenatal testing (NIPT) workflow in Colombia at Genetix, a high-tech medical organization specializing in human genetic diagnosis. This service offers expectant parents safe, fast, and accurate prenatal testing.

- In August 2024, Sysmex Corporation announced that it has expanded its strategic Alliance Agreement with QIAGEN N.V. to deepen its collaboration in genetic testing, including research and development, production, clinical development, and sales marketing. These can detect genetic abnormalities to provide insights that guide clinical decision-making about treatments. From polymerase chain reaction (PCR), multiplex PCR, digital PCR (dPCR)5 to next-generation sequencing (NGS)6, QIAGEN offers an unmatched breadth of technologies, which means it can tailor products to the needs of pharmaceutical companies.

Segments Covered in the Report

By Type

- Core Laboratory Diagnostics

- Point of Care Testing

- Molecular Diagnostics

By Product

- Consumables

- Instruments

- Software

By Application

- Oncology/Cancer

- Infectious Diseases

- Diabetes

- Cardiology

- Other Applications

By End-User

- Academic & Research Institutions

- Diagnostic Laboratories

- Hospitals & Clinics

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting