Next-Generation Biologics Market Size and Forecast 2025 to 2034

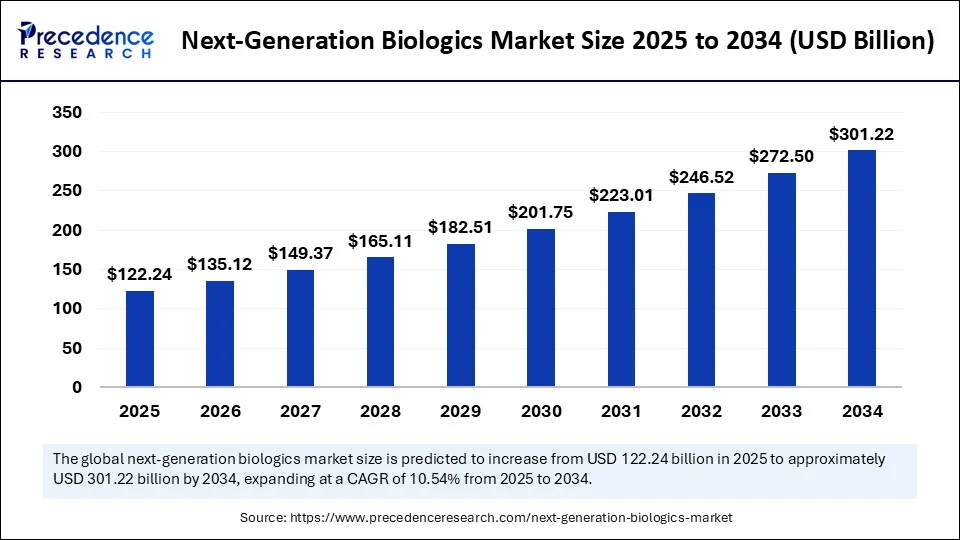

The global next-generation biologics market size was estimated at USD 110.58 billion in 2024 and is predicted to increase from USD 122.24 billion in 2025 to approximately USD 301.22 billion by 2034, expanding at a CAGR of 10.54% from 2025 to 2034. The market is witnessing rapid growth because of the increasing demand for targeted and more effective therapies, along with innovations such as bispecific antibody drugs, conjugates, and gene and cell therapies. These developments are driving market expansion by offering improved efficacy, reduced side effects, and personalized treatment options across various chronic and rare diseases.

Next-Generation Biologics Market Key Takeaways

- In terms of revenue, the global next-generation biologics market was valued at USD 110.58 billion in 2024.

- It is projected to reach USD 301.22 billion by 2034.

- The market is expected to grow at a CAGR of 10.54% from 2025 to 2034.

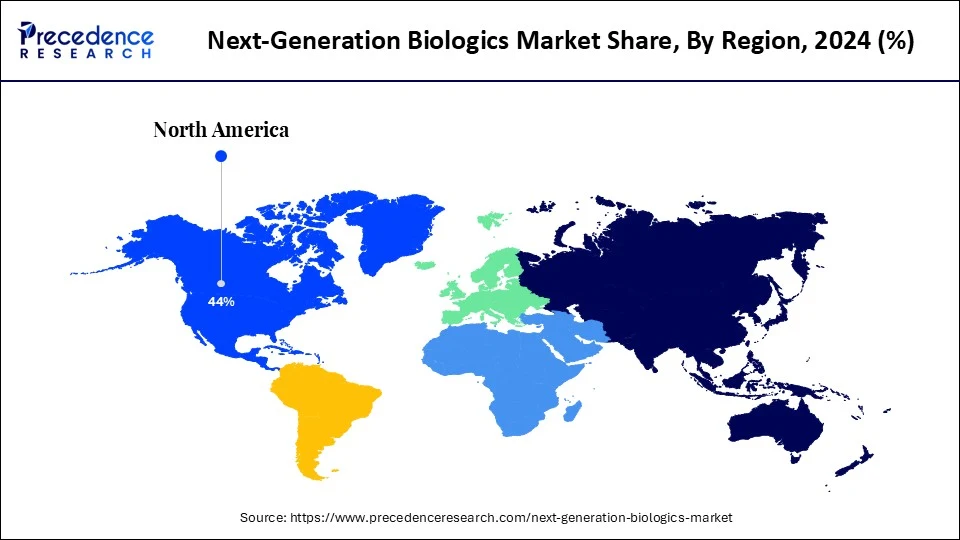

- North America dominated the next-generation biologics market with the largest share of 44% in 2024.

- Asia Pacific is expected to grow at the fastest CAGR from 2025 to 2034.

- By product type, the bispecific antibodies captured the biggest market share of 26% in 2024.

- By product type, the RNA-based biologics (e.g., siRNA, mRNA) segment is expected to grow at a significant CAGR over the projected period.

- By disease area, the oncology segment held the major market share of 42% in 2024.

- By disease area, the genetic disorders (e.g., hemophilia, SMA) segment is projected to grow at the fastest CAGR between 2025 and 2034.

- By manufacturing platform, the mammalian cell culture segment held the major market share of 61% in 2024.

- By manufacturing platform, the RNA synthesis segment is expanding at a significant CAGR from 2025 to 2034.

- By route of administration, the intravenous segment contributed the highest market share of 58% in 2024.

- By route of administration, the subcutaneous segment is anticipated to grow at a significant CAGR from 2025 to 2034.

- By distribution channel, the hospital pharmacies segment accounted for significant market share of 49% in 2024.

- By distribution channel, the specialty pharmacies segment is expected to grow at a significant CAGR over the projected period.

How Can AI Impact the Next-Generation Biologics Market?

Artificial intelligence (AI) is transforming the market for next-generation biologics by accelerating drug discovery, enhancing bioprocesses, and enabling personalized medicine. AI algorithms can predict protein structures, design new molecules, and optimize manufacturing processes, leading to more efficient and effective therapies. AI also helps in patient recruitment, clinical trial design, and predicting trial outcomes, making trials more efficient and cost-effective. Additionally, AI assists in monitoring and optimizing various stages of biologics manufacturing, including cell culture, purification, and formulation. This results in increased efficiency, reduced costs, and better product quality.

U.S. Next-Generation Biologics Market Size and Growth 2025 to 2034

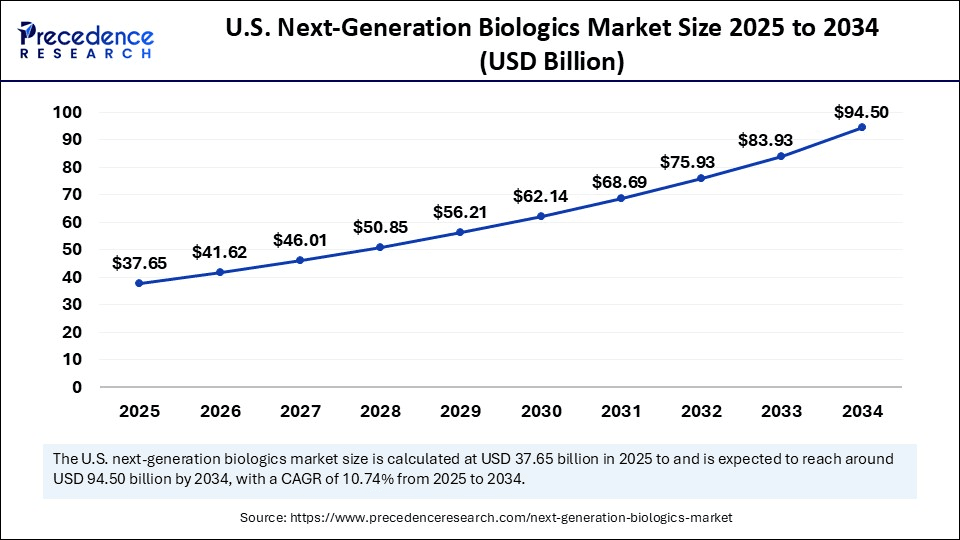

The U.S. next-generation biologics market size was exhibited at USD 34.06 billion in 2024 and is projected to be worth around USD 94.50 billion by 2034, growing at a CAGR of 10.74% from 2025 to 2034.

What Made North America the Dominant Region in the Next-Generation Biologics Market in 2024?

North America continues to lead the global next-generation biologics market. The region's dominance stems from its strong biopharmaceutical ecosystem, substantial research and development investments, favorable regulations, and skilled workforce. High patient demand for innovative treatments, driven by the high prevalence of chronic diseases, also supports this growth. Favorable regulatory procedures, such as the U.S. Food and Drug Administration's (FDA) streamlined approval pathways, facilitate biologics development. North America benefits from advanced manufacturing facilities, cutting-edge technologies, including high-throughput screening, and AI-powered drug discovery tools.

U.S. Next-Generation Biologics Market Trends

The U.S. is a major contributor to the market within North America. This is mainly due to its robust research infrastructure, significant investment in R&D from the National Institutes of Health and the National Science Foundation, and the growing prevalence of chronic disorders. Innovations in protein engineering and high-throughput screening have enabled the development of effective biologics. The U.S. biopharmaceutical companies are making strides by developing antibody-drug conjugates, bispecific antibodies, and gene therapies while expanding biomanufacturing capacity for complex biologics. The U.S. FDA oversees biologics to ensure their safety and effectiveness, contributing to market expansion.

What Makes Asia Pacific the Fastest-Growing Region in the Next-Generation Biologics Market in 2024?

Asia Pacific is emerging as the fastest-growing area, driven by a substantial aging population, increased healthcare spending, and advances in research and development, especially in China and Japan. The region is becoming a biomanufacturing hub, benefiting from competitive production costs and government support for the biopharmaceutical industry. Governments around the region are actively increasing healthcare budgets and investing in improving healthcare infrastructure and access to innovative therapies. Expansion of biomanufacturing facilities and contract development and manufacturing organizations (CDMOs) is likely to drive regional market growth. The region is emerging as a global biomanufacturing center, attracting investments from international pharmaceutical companies due to its cost advantages and skilled labor supply.

China Next-Generation Biologics Market Trends

China is a major player in the market. There is a rapid shift from generic drug production to an innovation-driven hub. The country is continuously increasing its biomanufacturing capabilities, supported by investments and favorable regulations. Companies like WuXi Biologics are expanding their capacity to meet rising demand, and CDMOs are broadening their services. Additionally, Western pharmaceutical firms are entering licensing agreements with Chinese biotech companies due to the presence of well-established biomanufacturing infrastructure in China.

Why is Europe Considered a Notable Region in the Next-Generation Biologics Market?

Europe is expected to witness notable growth soon, mainly due to its emphasis on regulatory compliance, sustainability, and advanced engineering, particularly in Germany, France, and the UK. These countries are adopting green technologies, automation, and digital transformation within the biologics sector. Europe has a clear regulatory framework for biologics, including biosimilars, which encourages innovation and maintains market stability. The European Medicines Agency has been proactive in developing and implementing pathways for biosimilars. Significant investment in pharmaceutical R&D, combined with a strong intellectual property environment, fuels innovation and growth in Europe's biologics market.

What Opportunities Exist in the Latin America Next-Generation Biologics Market?

Latin America is becoming an important growth area for the market for next-generation biologics, driven by rising chronic diseases such as cancer, diabetes, and rheumatoid arthritis. This significantly boosts the demand for advanced biological therapies. Advances in biotechnology, an increasing pipeline of monoclonal antibodies and biosimilars, and a shift toward personalized therapies further support regional market growth. The region is also seeing increased investment in biotech and cell line engineering, resulting in innovative biologics, including monoclonal antibodies and biosimilars. Supportive regulatory policies and government initiatives, like Brazil's National Program for the Development of Biotechnology, provide resources, while Chile offers incentives such as tax exemptions and patent protections to biopharmaceutical companies. Mexico's COFEPRIS is working to improve regulatory processes and establish a biosimilar unit to boost market access.

What Factors Contribute to the Next-Generation Biologics Market Within Middle East & Africa?

The market in the Middle East & Africa is growing due to the rising prevalence of various life-threatening diseases and increasing awareness of the benefits of biology. Domestic pharma companies are heavily investing in research and development, leading to the development of new treatments. The rising focus on improving healthcare infrastructure and accelerating drug development is likely to contribute to regional market growth. Countries like the UAE are promoting biosimilars through regulatory reforms and healthcare investments. South Africa is also witnessing increased adoption of biosimilars, driven by government initiatives and the need for more affordable healthcare.

Market Overview

Next-generation biologics refer to innovative biologic therapies developed to overcome the limitations of first-generation biologics, such as monoclonal antibodies and recombinant proteins. These biologics are characterized by improved efficacy, enhanced target specificity, reduced immunogenicity, longer half-lives, and innovative delivery systems. The category often involves novel drug designs, including bispecific antibodies, antibody-drug conjugates (ADCs), fusion proteins, cell and gene therapies, RNA-based therapies, and newer modalities like nanobodies and protein scaffolds. These are increasingly used in oncology, autoimmune diseases, rare genetic disorders, and infectious diseases. The market is experiencing rapid growth due to the increasing prevalence of chronic diseases, advancements in genetic research, and the development of personalized medicine approaches.

What are the Key Trends in the Next-Generation Biologics Market?

- Advanced Therapeutic Modalities: The development and adoption of innovative biologics, such as bispecific antibodies, antibody-drug conjugates, and engineered proteins, are driving market growth by providing more targeted and effective treatments for a wider range of diseases. The availability of biosimilars is improving access to these therapies and has the potential to lower healthcare costs.

- Advancements in Genetic Research:Recent breakthroughs in genetic research and a deeper understanding of disease mechanisms at the molecular level are enabling the creation of more precise and personalized biological treatments. Innovations in genetic engineering, protein engineering, and cell-based technologies are fueling the development of novel biologics.

- Increased Demand for Personalized Medicine :The trend toward personalized medicine approach, which tailors treatments to individual patient characteristics, is boosting the demand for biologics, especially those that can be customized for specific patient populations. This approach leads to more effective and targeted treatments.

- Growing Investment in Research and Development:Significant investments in research and development, particularly in areas like cancer immunotherapy and gene therapy, are driving innovation in the field. Increased funding from pharmaceutical companies and research institutions is accelerating the development and approval of new and improved biologic therapies.

- Expansion of Healthcare Infrastructure:In emerging economies, the growth of healthcare infrastructure and increased access to healthcare services are contributing to the rising demand for biologics. The development of healthcare systems and greater awareness of the benefits of biologics in these areas are creating new market opportunities.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 301.22 Billion |

| Market Size in 2025 | USD 122.24 Billion |

| Market Size in 2024 | USD 110.58 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 10.54% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product Type, Disease Area, Manufacturing Platform, Route of Administration, Distribution Channel and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Increasing Prevalence of Chronic and Life-Threatening Diseases

The primary driver of the next-generation biologics market is the growing prevalence of chronic and life-threatening diseases across the world. This includes conditions like cancer, autoimmune disorders, and neurological diseases, which drive the demand for more effective, targeted treatments. There is a high demand for advanced therapies to treat the large and growing number of cancer patients, which can be effectively met by next-generation biologics. Additionally, autoimmune diseases like rheumatoid arthritis and multiple sclerosis also contribute to the demand for biologics, as these therapies offer promising solutions for chronic illnesses by providing targeted treatments with fewer side effects.

Restraint

High Cost of Development

The main restraint in the next-generation biologics market is the high cost associated with biologics development and manufacturing. Developing and producing biologics can cost billions of dollars, making them unaffordable for many patients and healthcare systems. Biologics manufacturing is a complex process that requires specialized facilities, expertise, cutting-edge technology, and strict quality controls, presenting significant challenges. The high costs can limit access to these therapies, especially in emerging markets and for patients with limited financial resources. Although biosimilars offer a more affordable alternative, the approval process for biosimilars is lengthy, which limits their market penetration.

Opportunity

Rising Development of Next-Generation Antibody Therapies

A key future opportunity in the next-generation biologics market lies in the development of next-generation antibody therapies, particularly antibody-drug conjugates (ADCs) and bispecific antibodies, as well as cell and gene therapies. These combine the targeting ability of monoclonal antibodies and the cell-killing power of cytotoxic drugs, enabling targeted destruction of cancer cells. Additionally, bispecific antibodies can bind to two different targets, allowing for new mechanisms of action, such as engaging immune cells to attack tumors, thereby offering improved efficacy, precision, and safety profiles compared to traditional biopharmaceuticals. Advances in gene editing tools, such as CRISPR, provide precise options for modifying genes, potentially leading to cures for genetic disorders.

Product Type Insights

What Made Bispecific Antibodies the Dominant Segment in the Next-Generation Biologics Market in 2024?

The bispecific antibodies segment dominated the market with the largest share in 2024. This is mainly due to the increased incidence of drug resistance. Bispecific antibodies have the ability to provide unique therapeutic advantages over traditional monoclonal antibodies as they simultaneously target two different antigens. This dual targeting ability allows for precise drug delivery, redirecting immune cells and blocking two pathways at once, making them especially promising for treating complex diseases like cancer and autoimmune disorders. They are also used to target different epitopes or pathways, potentially overcoming drug resistance that may develop with single-target therapies and enabling new treatment approaches for cancer and autoimmune diseases. The rising approvals for these antibodies facilitate the long-term growth of the market.

In May 2024, the FDA granted accelerated approval to tarlatamab-dlle for extensive-stage small cell lung cancer (ES-SCLC) in patients whose disease progressed after platinum-based chemotherapy. This bispecific T-cell engager (BiTE) antibody targets DLL3 on SCLC cells and CD3 on T cells, activating the immune system to destroy cancer cells. The approval was based on the DeLLphi-301 clinical trial and includes warnings for cytokine release syndrome and neurologic toxicity, including immune effector cell-associated neurotoxicity syndrome.

(Source: https://www.fda.gov)

The RNA-based biologics (e.g., siRNA, mRNA) segment is expected to grow at the fastest CAGR during the forecast period. The growth of the segment is mainly driven by their versatility and potential in treating a wide range of diseases. mRNA therapies are designed to instruct cells to produce any protein, offering options for treating genetic disorders, cancer, and infectious diseases. Unlike traditional therapies that target proteins directly, mRNA therapies address diseases at the genetic level for more targeted and effective treatment. Meanwhile, siRNA therapies use RNA interference to silence specific genes, providing a way to treat diseases caused by overexpression or mutations. The rising number of clinical trials and development of new RNA-based therapies are likely to drive segmental growth.

Disease Area Insights

How Does the Oncology Segment Dominate the Next-Generation Biologics Market in 2024?

The oncology segment led the market with a major revenue share in 2024, driven by the high incidence and mortality rates of cancer. Biologics have the potential to provide targeted, effective therapies, increasing their usage in immunotherapies and antibody-drug conjugates (ADCs). Cancer remains a leading cause of death worldwide, with a significant impact on life expectancy. Biologics, especially monoclonal antibodies and immunotherapies, offer more targeted treatment options compared to traditional chemotherapy, resulting in better efficacy and fewer side effects. The rising demand for combination therapies and novel immunotherapies contributes to the segment's dominance.

The genetic disorders (e.g., hemophilia, SMA) segment is expected to expand at the fastest growth in the upcoming period, driven by rising demand for advanced therapeutics to reduce the burden of genetic disorders. Biologics have the potential to offer curative treatments for a wide range of inherited diseases, including rare genetic disorders. These therapies aim to address the root cause of genetic disorders by correcting or replacing faulty genes, making it possible to achieve one-time cures, which is a major advancement over traditional treatments that primarily manage symptoms.

The growth of the segment is also attributed to advances in nucleic acid-based therapies like CRISPR-Cas9, antisense oligonucleotides, and RNA interference, along with the development of more effective delivery systems such as lipid nanoparticles. Due to the rising infant mortality rate linked to genetic disorders, there is a high demand for biological therapies.

According to a report published by the World Health Organization (WHO) in February 2023, approximately 240,000 newborns die worldwide within 28 days of birth every year due to congenital disorders. Moreover, congenital disorders are responsible for about 170,000 deaths of children between the ages of 1 month and 5 years.

Manufacturing Platform Insights

Why Did the Mammalian Cell Culture Segment Lead the Next-Generation Biologics Market in 2024?

The mammalian cell culture segment dominated the market in 2024 because of its ability to produce complex, human-like proteins with proper modifications. This makes it essential for therapeutic proteins, monoclonal antibodies, and vaccines, key for the safety and effectiveness of many biopharmaceutical products. Mammalian cell culture systems, especially CHO cell-based systems, are well-established and widely used across the industry, with a wealth of knowledge and expertise available. Improvements in cell culture techniques and bioreactor technology have significantly increased productivity, enabling large-scale production of biologics.

The RNA synthesis segment is expected to expand at the highest CAGR over the projection period. This is mainly due to the rising demand for mRNA vaccines and therapies. The versatility of RNA in various biomedical applications makes RNA synthesis essential. Advances in RNA synthesis technology and the rising demand for personalized medicine further contribute to segmental growth.

Route of Administration Insights

How Did the Intravenous (IV) Segment Dominate the Next-Generation Biologics Market in 2024?

The intravenous (IV) segment dominated the market in 2024 because of its high bioavailability, rapid onset of action, and established clinical use for various conditions. This method bypasses absorption barriers in the gastrointestinal tract and other tissues, ensuring the entire dose reaches the bloodstream, resulting in 100% bioavailability. It also provides the fastest way for biologics to reach the bloodstream and the target site, leading to quicker therapeutic responses. Additionally, it allows for the delivery of large doses of biologics, which is especially important for treating severe conditions requiring high medication concentrations. IV administration is critical in critical care settings where rapid and reliable drug delivery is essential, such as in emergencies or for patients with compromised digestive systems.

The subcutaneous segment is expected to grow at a rapid pace in the upcoming period due to its patient-friendly administration method and potential to improve efficacy. Subcutaneous injections offer convenience, enabling self-administration and reducing the need for clinic visits, while inhalable biologics provide targeted delivery to the lungs, potentially reducing systemic side effects. Innovations in delivery devices like autoinjectors, pen injectors, and inhaling systems are making these routes more efficient and patient-friendly. Many biologics, especially monoclonal antibodies, are now being developed for subcutaneous use, allowing targeted delivery and potentially better efficacy.

Distribution Channel Insights

What Made Hospital Pharmacies the Dominant Segment in the Next-Generation Biologics Market in 2024?

The hospital pharmacies segment led the market while holding the largest share in 2024 due to the specialized care and infusion-based administration needed for complex conditions like autoimmune diseases. These medications, often used for rare diseases, are usually managed within hospital settings, including specialized hematology centers, which serve as key infusion sites. The pharmaceutical industry faces increasing regulation complexity, and hospital pharmacies are well-equipped to adapt, especially regarding drug development and clinical trials. They play a vital role in monitoring medication therapy, ensuring patient safety, and managing potential side effects of potent medications.

The specialty pharmacies segment is expected to experience the fastest growth over the forecast period, driven by their ability to handle complex therapies, provide specialized patient support, and offer cost-effective solutions compared to traditional hospital settings. These pharmacies are equipped to meet the needs of patients on complex biologics, offering services such as medication adherence support, side effect management, and coordination with healthcare providers. They are increasingly using technology like telepharmacy and remote patient monitoring to improve medication management and patient care. The growth of biosimilars, which are designed to closely resemble existing biologics, further boosts the market for specialty pharmacies, given their expertise in handling these complex medications.

Next-Generation Biologics Market Companies

- Roche Holding AG

- Amgen Inc.

- Johnson & Johnson (Janssen Biotech)

- Bristol-Myers Squibb (BMS)

- Pfizer Inc.

- Novartis AG

- Merck & Co., Inc.

- AbbVie Inc.

- Gilead Sciences, Inc.

- Sanofi S.A.

- AstraZeneca plc

- Takeda Pharmaceutical Co. Ltd.

- Regeneron Pharmaceuticals

- Biogen Inc.

- UCB S.A.

- Alnylam Pharmaceuticals

- Moderna, Inc.

- BioNTech SE

- Bluebird Bio

- Sangamo Therapeutics

Recent Developments

- In June 2025, Zydus Lifesciences revealed plans to enter the global biologics CDMO sector by acquiring Agenus's biologics manufacturing facilities in California. This move establishes Zydus in the growing CDMO market and enhances its capability to partner with biotech companies. Zydus will also become the exclusive contract manufacturer for Agenus's advanced immuno-oncology products, Botensilimab and Balstilimab.

(Source: https://www.indianpharmapost.com) - In May 2025, Biocon Biologics Ltd. announced access agreements for Yesintek™ (ustekinumab-kfce), its biosimilar to Stelara, covering over 100 million lives in the U.S. Major payers like Express Scripts, Cigna, UnitedHealthcare, CVS Health, and Optum Rx added it to their formularies. CEO Shreehas Tambe called the launch of Yesintek™ a significant achievement, showing payors' confidence in their ability and their commitment to providing affordable treatments.

(Source: https://www.biocon.com) - In February 2025, BioNTech SE announced its acquisition of Biotheus, a clinical-stage biotechnology company focused on developing novel antibodies for oncological and inflammatory diseases. This followed their successful collaboration on an investigational bispecific antibody targeting PD-L1 and VEGF-A. The $800 million deal in cash and stock gives BioNTech full rights to Biotheus' pipeline and antibody platform, with potential performance payments of up to $150 million.

(Source: https://investors.biontech.de) - In September 2024, Temple OrthoBiologics, a spin-off from Temple Therapeutics, officially launched on International Arthrofibrosis Awareness Day, intending to fight scar tissue in orthopedic sports medicine. With an R&D center in Liège and partnerships across the USA, Canada, the UK, and the Netherlands, the company focuses on knee and joint injury treatments. Co-Founder Dr. Riley J. Williams III, an orthopedic surgeon and athlete, highlights the potential of their innovative treatment, TX-33, to transform sports medicine.

(Source: https://www.businesswire.com) - In April 2024, the FDA developed the Biosimilars Action Plan (BAP) to simplify the biosimilar development and approval process, improve scientific and regulatory clarity, educate stakeholders, and promote biosimilar adoption. The main goal of this plan is to encourage innovation and competition in the market for biological products and facilitate the development of biosimilars and interchangeable biosimilars.

(Source: https://www.fda.gov)

Segments Covered in the Report

By Product Type

- Antibody Drug Conjugates (ADCs)

- Bispecific Antibodies

- Fusion Protein Therapeutics

- Monoclonal Antibody Fragments (e.g., Fab, scFv)

- Engineered Cytokines

- Cell-Based Therapies (e.g., CAR-T)

- Gene Therapies

- RNA-Based Biologics (e.g., siRNA, mRNA)

- Nanobodies & Single-Domain Antibodies

- Others (e.g., Protein Scaffolds, Aptamers)

By Disease Area

- Oncology

- Autoimmune & Inflammatory Disorders

- Genetic Disorders (e.g., hemophilia, SMA)

- Infectious Diseases (e.g., HIV, COVID-19)

- Ophthalmic Diseases (e.g., AMD)

- Neurological Disorders

- Others (e.g., metabolic, cardiovascular)

By Manufacturing Platform

- Mammalian Cell Culture (CHO, HEK293)

- Microbial Systems (E. coli, Yeast)

- Cell-Free Expression Systems

- Viral Vectors (Lentivirus, AAV)

- RNA Synthesis Platforms

- Others (e.g., Plant-based, Insect cell systems)

By Route of Administration

- Intravenous (IV)

- Subcutaneous (SC)

- Intramuscular (IM)

- Intrathecal/Intraocular

- Others (e.g., Inhalation, Topical)

By Distribution Channel

- Hospital Pharmacies

- Specialty Pharmacies

- Retail Pharmacies

- Others (e.g., Direct-to-Patient, Clinical Sites)

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting