What is the Skin Cancer Diagnostic Market Size?

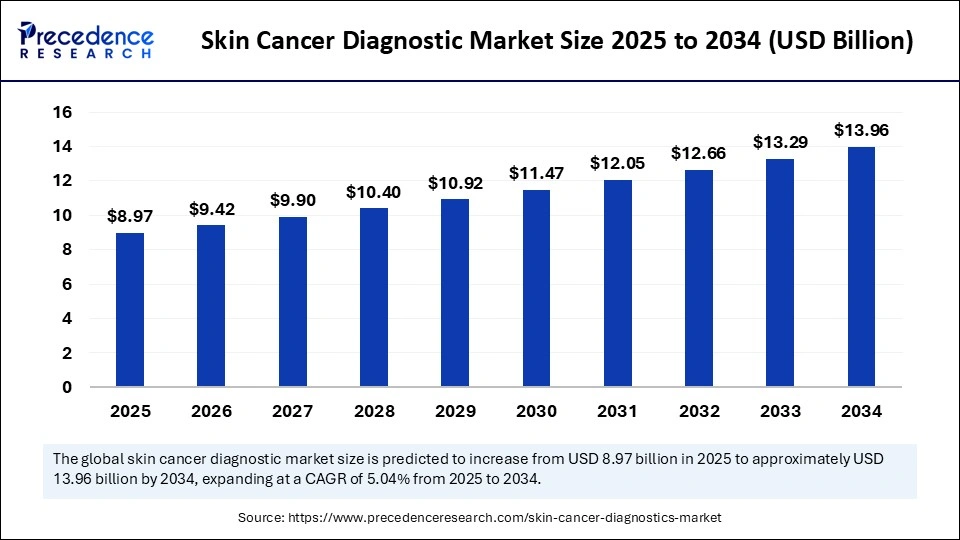

The global skin cancer diagnostic market size is valued at USD 8.97 billion in 2025 and is predicted to increase from USD 9.42 billion in 2026 to approximately USD 13.96 billion by 2034, expanding at a CAGR of 5.04% from 2025 to 2034. The growth of the market is driven by the rising global incidence of skin cancer, increasing awareness of early detection, advancements in diagnostic technologies, and growing adoption of AI-based imaging tools.

Market Highlights

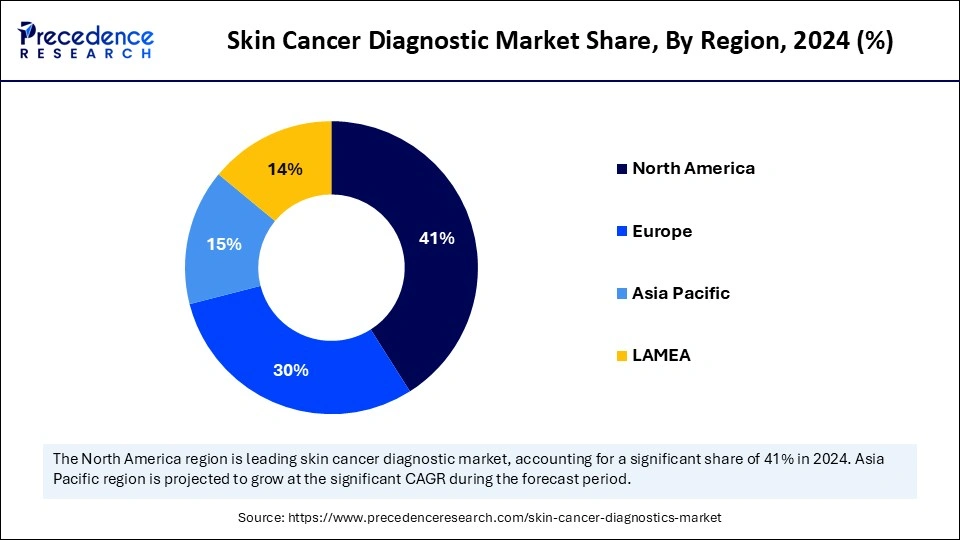

- North America dominated the skin cancer diagnostic market with the largest share in 2024.

- The Asia Pacific is expected to experience the fastest growth between 2025 and 2034.

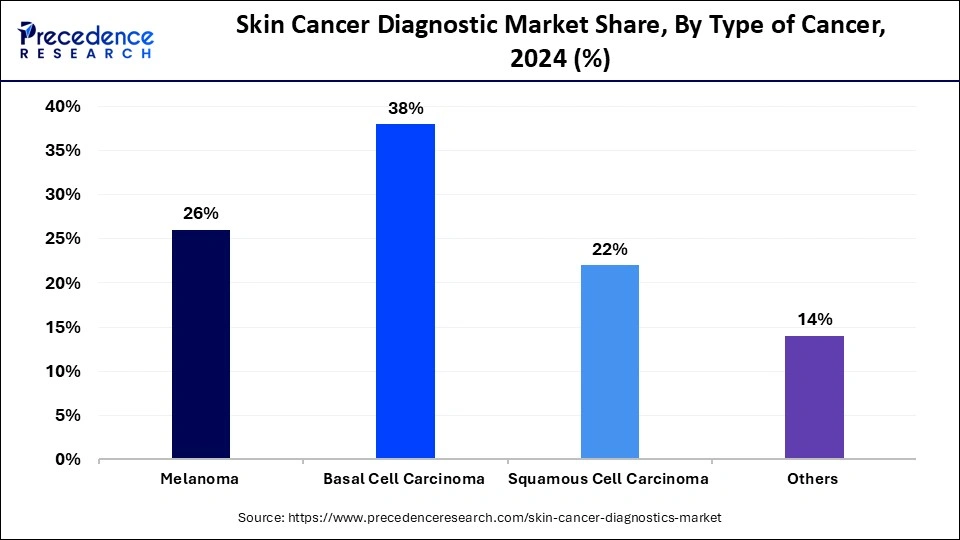

- By type of cancer, the basal cell carcinoma segment dominated the market with a 38% share in 2024.

- By type of cancer, the melanoma segment is expected to grow at the fastest CAGR during the forecast period.

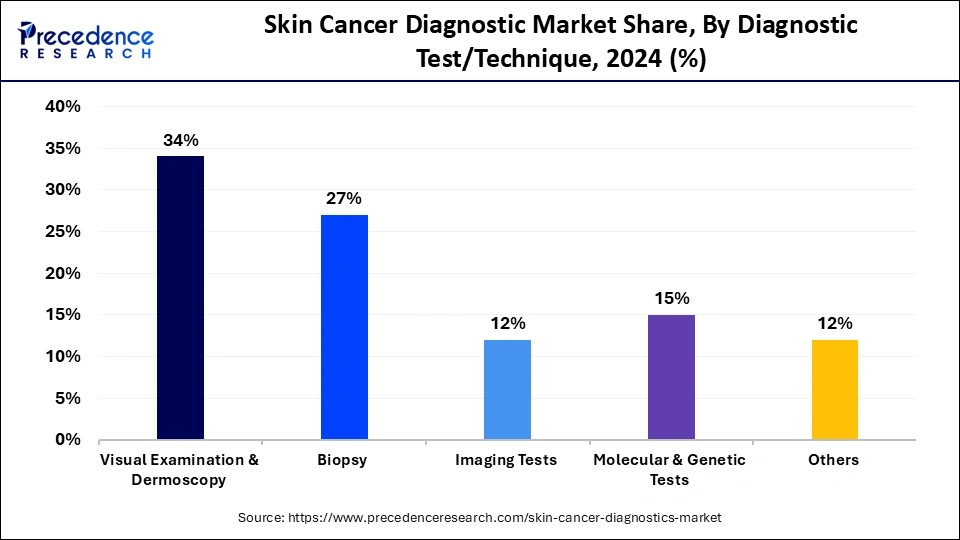

- By diagnostic test/technique, the visual examination & dermoscopy segment held a 34% share of the market in 2024.

- By diagnostic test/technique, the molecular & genetic tests segment is expected to grow at the highest CAGR in the coming years.

- By diagnostic tool/device, the biopsy instruments segment led the market with a 31% share in 2024.

- By diagnostic tool/device, the molecular diagnostic kits segment is expected to expand at the highest CAGR over the projection period.

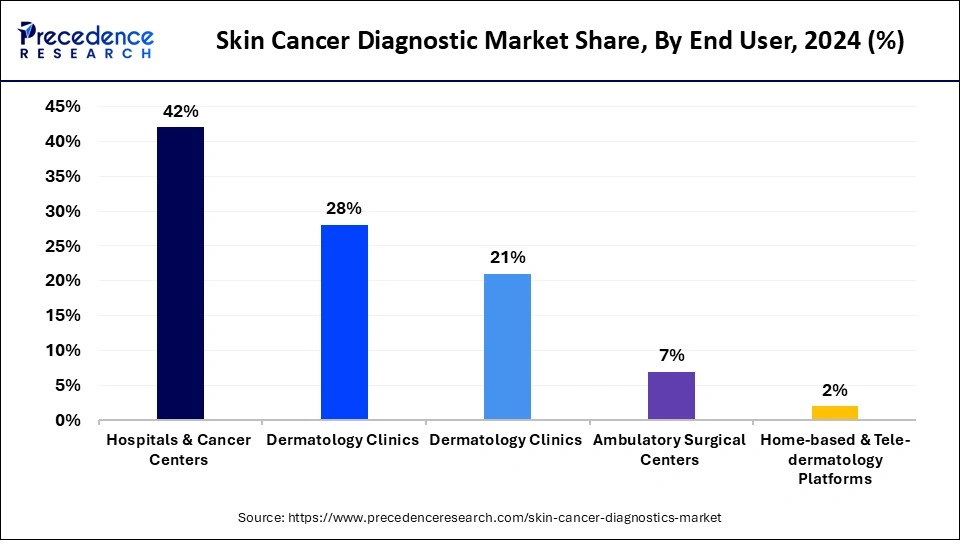

- By end user, the hospitals & cancer centers segment contributed the largest market share of 42% in 2024.

- By end user, the home-based & tele-dermatology platforms segment is likely to grow at a significant CAGR throughout the projection period.

Market Size and Forecast

- Market Size in 2024: USD 8.54 Billion

- Market Size in 2025: USD 8.97 Billion

- Forecasted Market Size by 2034: USD 13.96 Billion

- CAGR (2025-2034): 5.04%

- Largest Market in 2024: North America

- Fastest Growing Market: Asia Pacific

What is the Skin Cancer Diagnostic Market?

The skin cancer diagnostic market encompasses tools, assays, and devices used for early detection and confirmation of malignant and pre-malignant skin lesions. It includes traditional methods like visual examination and biopsy, along with advanced imaging, molecular diagnostics, and AI-based screening. Rising incidence of melanoma and non-melanoma cancers, coupled with growing emphasis on early detection, is driving adoption. Technological advancements, particularly in molecular assays, digital dermoscopy, and tele-dermatology, are reshaping the market.

How is AI Impacting the Skin Cancer Diagnostic Market

Artificial intelligence is significantly transforming the skin cancer diagnostic market by enhancing the speed, accuracy, and accessibility of diagnosis. Advanced algorithms, particularly deep learning models, are being trained to detect melanoma and other skin cancers with accuracy comparable to dermatologists. AI-powered tools, such as dermoscopy analysis apps and image recognition systems, enable early detection and help reduce diagnostic errors. These technologies also support teledermatology services, making skin cancer screening more accessible in remote or underserved areas. As a result, AI is not only improving clinical outcomes but also driving efficiency and scalability in dermatological care.

- For instance, a new AI tool developed at the University of Melbourne is revolutionizing skin cancer detection by enabling real-time, point-of-care diagnosis using thermal multimodal imaging. Led by Research Fellow Dr. Noor E. Karishma Shaik, this technology aims to save lives, reduce unnecessary biopsies, lower healthcare costs, and address diagnostic equity gaps.(Source: https://www.unimelb.edu.au)

Skin Cancer Diagnostics Market Outlook

- Industry Growth Overview: The market for skin cancer diagnostics is poised for substantial growth between 2025 and 2034, driven by the rising global incidence of melanoma and non-melanoma skin cancers, growing public awareness, and the demand for non-invasive screening methods. High-growth segments include AI-powered imaging systems and molecular diagnostics, which improve accuracy and enable earlier detection compared to traditional visual inspection.

- AI and Digital Imaging Revolutionize Dermatology: A key trend in dermatology diagnostics is the integration of digital tools and AI. R&D is focused on sophisticated imaging and AI algorithms for automated analysis. This technology aims to improve diagnostic accuracy, standardize results, and streamline clinical workflows with instant, data-driven insights

- Global Expansion:Leading players are expanding their presence worldwide, particularly in high-growth regions such as Asia-Pacific, Latin America, and Europe. This expansion is driven by increasing cancer incidence in these regions, improving healthcare infrastructure, and government initiatives promoting early detection and screening programs. North America currently dominates the market due to advanced healthcare infrastructure and high awareness, but APAC is projected to be the fastest-growing region.

- Major Investors: Venture capital firms, private equity funds, and strategic investors are actively investing in the space, drawn by the high unmet clinical need and the potential for technological innovation. Major pharmaceutical and diagnostic firms such as Roche, Merck, Amgen, and Castle Biosciences are key players, investing heavily in R&D, advanced diagnostic platforms, and strategic partnerships.

- Startup Ecosystem:The startup ecosystem is maturing, with innovation concentrated in areas such as AI-driven image analysis, genetic profiling, and non-invasive diagnostic platforms. Emerging firms such as DermTech, Skin Analytics, and Cureskin are attracting significant funding by developing scalable, clinically validated solutions, including AI-powered apps and handheld devices that can make autonomous clinical decisions without human review.

What are the Major Trends in the Skin Cancer Diagnostic Market?

- Growth of Non-Invasive Diagnostic Techniques: Technologies like dermoscopy, confocal microscopy, and optical coherence tomography are gaining traction as they offer detailed imaging without the need for biopsy, improving patient comfort and reducing diagnostic delays.

- Expansion of Teledermatology Services: Remote skin cancer screening through telemedicine platforms is rising, especially in underserved or rural regions, improving access to timely diagnosis and specialist consultation.

- Increasing Use of Biomarker-Based Tests: Molecular diagnostics and genetic biomarker tests are emerging to help differentiate between benign and malignant lesions, supporting personalized treatment planning and improved diagnostic accuracy.

- Rising Public Awareness and Screening Programs: Governments and healthcare organizations are launching awareness campaigns and national screening initiatives, leading to higher detection rates and increased demand for diagnostic solutions.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 8.97 Billion |

| Market Size in 2026 | USD 9.42 Billion |

| Market Size by 2034 | USD 13.96 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 5.04% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type of Cancer, Diagnostic Test/Technique, Diagnostic Tool/Device, End User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Rising Incidence of Skin Cancer Worldwide

The global burden of skin cancer, particularly melanoma and non-melanoma skin cancers, is increasing due to factors such as excessive UV exposure, aging populations, and changing lifestyle habits. Countries with high sun exposure like Australia, the U.S., and parts of Europe are seeing higher diagnosis rates annually. As more individuals are affected, the demand for early detection tools and diagnostic technologies continues to grow. This surge is pressuring healthcare systems to invest in faster, more accurate, and cost-effective diagnostic methods. Consequently, this trend is directly driving the expansion of the skin cancer diagnostic market.

- Skin cancer ranks as the 17th most common cancer globally and the 14th most common in both men and women, with 331,722 new cases reported in 2022.

Technological Advancements in Diagnostic Tools

Rapid innovation in diagnostic technologies is significantly driving market growth. AI-driven image analysis, dermoscopy, confocal laser scanning microscopy, and mobile diagnostic applications are enhancing accuracy and accessibility of skin cancer diagnosis. These tools not only reduce the need for invasive procedures but also empower general practitioners and even patients to screen lesions at early stages. Integration of cloud-based data sharing and real-time analysis also supports faster clinical decision-making. These advancements are making diagnostics more scalable and efficient across both high- and low-resource settings.

Restraint

High Cost and Limited Access in Low-Income Regions

Despite advancements, the high cost of advanced imaging technologies and limited access to dermatological care remain significant barriers, especially in developing countries. Many rural and underserved areas lack specialists and the infrastructure needed for early skin cancer diagnosis. This leads to delayed detection, higher treatment costs, and worse clinical outcomes. Additionally, AI-based and digital diagnostic solutions often require internet access and trained personnel, which can be scarce in low-resource settings. As a result, the market's growth is unevenly distributed globally, limiting its full potential.

Opportunity

Growing Adoption of Teledermatology and Remote Diagnostics

Teledermatology is emerging as a transformative opportunity, especially in the post-pandemic healthcare landscape. It enables patients in remote or underserved regions to access dermatological evaluations through digital platforms, reducing the need for in-person visits. AI-integrated telemedicine apps and smartphone-compatible dermatoscopes are making it easier to screen for suspicious lesions from home. This is particularly beneficial in areas with dermatologist shortages or during public health crises. As digital health ecosystems expand, remote diagnostics are expected to play a critical role in scaling skin cancer detection globally.

Segment Insights

Type of Cancer Insights

Why Did the Basal Cell Carcinoma Segment Dominate the Market in 2024?

The basal cell carcinoma segment dominated the skin cancer diagnostic market while holding a 38% share in 2024 due to its significantly higher prevalence compared to other skin cancers. BCC accounts for approximately 70–80% of all non-melanoma skin cancer cases globally, largely driven by prolonged sun exposure, aging populations, and increasing awareness that encourages early skin checks. Although BCC rarely metastasizes, it requires timely diagnosis and treatment to prevent local tissue damage, contributing to the growing demand for diagnostic tools.

The wide adoption of non-invasive diagnostic techniques, such as dermoscopy and AI-assisted imaging, has further enhanced early detection of BCC. Additionally, the cost-effectiveness and relatively straightforward clinical management of BCC support its diagnostic prioritization in both clinical practice and screening programs.

The melanoma segment is expected to grow at the fastest CAGR during the forecast period due to its aggressive nature and higher mortality rate compared to other skin cancers. Although less common than basal or squamous cell carcinoma, melanoma poses a significant health threat if not detected early, driving demand for advanced and accurate diagnostic solutions. Increased public awareness, targeted screening programs, and improved access to dermatological care have led to more frequent and earlier detection of melanoma cases.

Technological advancements such as AI-powered dermoscopy, digital imaging, and molecular diagnostics are also improving the precision of melanoma diagnosis. As healthcare systems prioritize early intervention to reduce treatment costs and improve survival rates, the melanoma segment continues to gain momentum.

Diagnostic Test/Technique Insights

What Made Visual Examination & Dermoscopy the Dominant Segment in the Market?

The visual examination & dermoscopy segment dominated the skin cancer diagnostic market, holding a 34% share in 2024. This is mainly due to its widespread accessibility, non-invasive nature, and effectiveness in early lesion assessment. Dermoscopy enhances the ability of clinicians to distinguish between benign and malignant skin lesions by providing magnified, detailed views of skin structures not visible to the naked eye. It is a cost-effective and rapid diagnostic method that can be used in routine clinical practice without the need for complex equipment or lab processing.

The growing use of dermoscopy by general practitioners, coupled with increasing training and AI-assisted interpretation, has further strengthened its dominance. As early detection remains critical for successful treatment outcomes, visual examination and dermoscopy continue to be frontline tools in skin cancer diagnosis.

The molecular & genetic tests segment is expected to grow at the highest CAGR in the coming years due to the increasing demand for precision and personalized diagnostics. These tests enable the identification of specific genetic mutations, biomarkers, and molecular pathways associated with melanoma and other aggressive skin cancers, allowing for more accurate diagnosis and prognosis. As targeted therapies and immunotherapies become more prevalent, molecular profiling plays a crucial role in selecting the most effective treatment options. Moreover, advancements in next-generation sequencing (NGS) and decreasing costs of genetic testing are making these tools more accessible in clinical settings.

Diagnostic Tool/Device Insights

How Does the Biopsy Instruments Segment Lead the Market?

The biopsy instruments segment led the skin cancer diagnostic market with a 31% share in 2024 due to their critical role in confirming skin cancer diagnoses with high accuracy. While non-invasive methods like dermoscopy are valuable for initial screening, biopsies remain the gold standard for definitive diagnosis, especially in suspicious or high-risk lesions. The widespread availability of punch, excisional, and shave biopsy tools across hospitals and dermatology clinics further supports their dominance. Additionally, increasing skin cancer awareness and screening rates have led to a higher volume of biopsies being performed globally. This consistent demand for histopathological confirmation has solidified the leading position of biopsy instruments in the diagnostic landscape.

The molecular diagnostic kits segment is expected to expand at the highest CAGR over the projection period due to the rising demand for advanced, precise, and personalized diagnostic approaches. These kits help detect specific genetic mutations, biomarkers, and molecular signatures associated with melanoma and other aggressive skin cancers, enabling earlier and more accurate diagnosis. As targeted therapies and personalized treatment plans become more common, molecular diagnostics play a key role in guiding clinical decisions. Technological advancements and increasing affordability of these kits are further accelerating their adoption in both clinical and research settings.

End User Insights

Why Did Hospitals & Cancer Centers Hold the Largest Market Share in 2024?

The hospitals & cancer centers segment held a 42% share of the skin cancer diagnostic market in 2024. This is primarily due to their comprehensive facilities and access to advanced diagnostic technologies. These centers offer a multidisciplinary approach, combining dermatology, pathology, and oncology expertise, which is essential for accurate diagnosis and effective treatment planning. Hospitals and cancer centers also handle a higher volume of complex cases, including late-stage skin cancers, driving demand for sophisticated diagnostic tools and procedures.

Additionally, their role in research and clinical trials fosters early adoption of innovative diagnostic methods. This combination of resources, expertise, and patient volume positions hospitals and cancer centers as the leading end users in the market.

The home-based & tele-dermatology platforms segment is likely to grow at the fastest CAGR throughout the projection period due to increasing demand for convenient, accessible, and remote healthcare solutions. These platforms allow patients to receive preliminary assessments and monitoring from the comfort of their homes, reducing the need for in-person visits. Advances in smartphone imaging and AI-powered diagnostic tools have improved the accuracy and reliability of remote skin evaluations. Additionally, the rising awareness of skin cancer and the need for early detection are driving the adoption of tele-dermatology, especially in underserved or remote areas.

Regional Insights

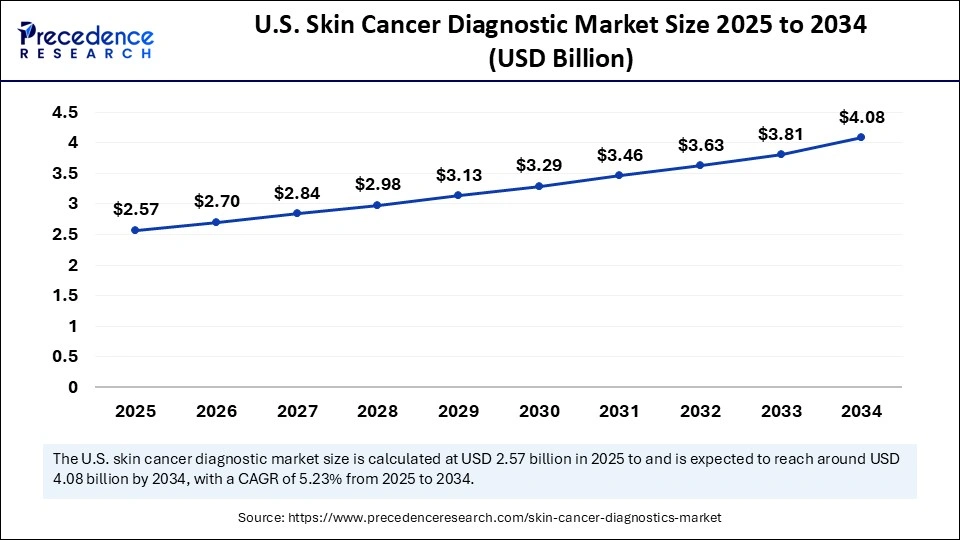

U.S. Skin Cancer Diagnostic Market Size and Growth 2025 to 2034

The U.S. skin cancer diagnostic market size is exhibited at USD 2.57 billion in 2025 and is projected to be worth around USD 4.08 billion by 2034, growing at a CAGR of 5.23% from 2025 to 2034.

What Made North America the Dominant Region in the Market?

North America dominated the skin cancer diagnostic market by capturing a 41% share in 2024. This is due to its high prevalence of skin cancer, driven by factors such as extensive sun exposure and a large aging population. The region benefits from advanced healthcare infrastructure and widespread availability of cutting-edge diagnostic technologies, including AI-based tools and molecular testing. Strong government initiatives, awareness programs, and high healthcare spending further support early detection and diagnosis efforts. Additionally, the presence of leading dermatology research centers and key market players accelerates innovation and adoption of new diagnostic solutions, reinforcing North America's market dominance.

The U.S. is the major contributor to the North America skin cancer diagnostic market. This is due to its high skin cancer prevalence, advanced healthcare infrastructure, and widespread availability of cutting-edge diagnostic technologies. The U.S. also has strong government initiatives promoting skin cancer awareness and early detection, alongside significant investment in research and development. Additionally, a large aging population and high healthcare spending further drive demand for advanced skin cancer diagnostic solutions in the country.

What Makes Asia Pacific the Fastest-Growing Market?

Asia Pacific is expected to experience the fastest growth in the coming years due to increasing awareness about skin cancer and improving healthcare infrastructure across emerging economies. Rising disposable incomes and better access to advanced diagnostic technologies are encouraging more people to seek early detection and treatment. Additionally, expanding urbanization and lifestyle changes, such as greater sun exposure, contribute to a growing incidence of skin cancer in the region. Governments and private sectors are also investing in healthcare initiatives and telemedicine platforms, further driving market growth in Asia Pacific.

India Skin Cancer Diagnostic Market Trends

The market in India is rapidly growing, as the country is known for significant innovation hub in skin cancer diagnostics. Driven by rising awareness and healthcare spending, the country is heavily investing in AI and machine learning to enable accurate, non-invasive detection. The expansion of teledermatology services is also crucial for increasing accessibility in rural areas, positioning India as a key developer of cost-effective, scalable diagnostic solutions.

Why is Europe Considered a Significant Market?

Europe is a mature and significant market for skin cancer diagnostics, characterized by a high incidence of melanoma and non-melanoma skin cancers. The market benefits from strong awareness campaigns, well-established healthcare infrastructure, and technological advancements, including the adoption of non-invasive imaging techniques such as dermoscopy and AI-powered diagnostic platforms. Strict regulatory frameworks and a high volume of diagnostic testing contribute to a competitive landscape dominated by major players that are heavily investing in research and development to deliver innovative, accurate, and rapid diagnostic solutions.

Germany Skin Cancer Diagnostic Market Trends

Germany leads the European skin cancer diagnostics market, backed by strong government support for early detection programs and high public awareness of skin cancer symptoms. The country boasts significant research and development and manufacturing capabilities for diagnostic products, with companies focusing on both traditional biopsy methods and innovative technologies. The market is heavily influenced by a preference for non-invasive diagnostic tools and an emphasis on reliable, high-quality testing to enhance diagnostic accuracy.

How is the Opportunistic Rise of Latin America in the Skin Cancer Diagnostic Market?

Latin America is experiencing an opportunistic rise in the skin cancer diagnostics market due to heightened awareness of the disease and an increasing number of skin cancer cases. Although challenges such as limited healthcare access and high treatment costs persist in some regions, technological advancements, including advanced imaging and molecular testing, are expected to drive market expansion. There is a growing emphasis on early detection programs and non-invasive diagnostic methods, which should attract investment in healthcare infrastructure and improved screening initiatives across the region.

Brazil Skin Cancer Diagnostic Market Trends

Brazil leads the skin cancer diagnostics market in Latin America, where skin cancer is a major health concern, making up a large part of all cancer cases. Market growth is driven by national awareness campaigns, such as the December Orange initiative, which encourages photoprotection and early detection. The demand for both traditional biopsy procedures, considered the gold standard, and advanced techniques like liquid biopsy and molecular testing is rising, with more partnerships between key market players and health organizations.

What Potentiates the Growth of the Middle East and Africa Skin Cancer Diagnostic Market?

The market in the Middle East and Africa is experiencing steady growth, but it remains less profitable than those in other regions. The market is primarily driven by government efforts for healthcare modernization and high demand for quality care. The market is seeing more research opportunities and strategic actions by companies to introduce advanced diagnostic tools to fill access gaps.

Saudi Arabia's skin cancer diagnostics market is expanding, driven by rapid urbanization, significant investments in green infrastructure mega-projects, and a heightened awareness of skin health. Although the most common cancers differ from those in Western countries, there is a rising demand for advanced diagnostic and dermatological devices to address various skin conditions, including cancer, attracting global players like Roche and Abbott to introduce next-generation sequencing and other advanced diagnostic technologies.

Value Chain Analysis

- Research and Development & Innovation

This involves the discovery and development of new diagnostic technologies to improving diagnostic accuracy.

Key Players: F. Hoffmann-La Roche Ltd, Quest Diagnostics, Castle Biosciences, DermTech, Abbott Laboratories. - Clinical Trials and Regulatory Approval

This ensures that products meet stringent quality and performance standards.

Key Players: Castle Biosciences, DermTech, Thermo Fisher Scientific, Ergomed, ICON. - Manufacturing and Production

This involves the large-scale production of diagnostic equipment, biopsy tools, molecular testing kits, and related software.

Key Players: Thermo Fisher Scientific Inc., QIAGEN, Agilent Technologies Inc., Abbott Laboratories, bioMérieux. - Distribution and Supply Chain Management

Efficient distribution is crucial to ensure that diagnostic products and equipment reach hospitals, clinics, and laboratories promptly.

Key Players: Large-scale medical and pharmaceutical distributors. - Service Delivery and Diagnosis

This is the core, patient-facing stage where screenings, examinations, and diagnostic procedures take place.

Key Players: Hospitals, clinics, specialized dermatological centers, and independent diagnostic laboratories. - Patient Support, Awareness, and Payments

This involves increasing public awareness about skin cancer, managing patient education, and handling insurance and payment processing.

Key Players: The American Academy of Dermatology and the Skin Cancer Foundation run awareness campaigns.

Top Companies for the Skin Cancer Diagnostic Market and Their Offerings

- F. Hoffmann-La Roche Ltd.: Advanced genomic and molecular diagnostic assays, digital pathology, IHC, and ISH assays for comprehensive cancer management.

- Siemens Healthineers: Advanced imaging, digital platforms, and diagnostic systems for high-resolution skin lesion analysis and risk assessment.

- Abbott Laboratories: Extensive portfolio of biomarker and molecular tests for early detection and risk assessment of various cancers.

- Castle Biosciences:Specialized molecular diagnostics, including the DecisionDx-Melanoma GEP test for predicting melanoma recurrence risk.

- DermTech Inc.:Non-invasive skin patch genomic tests (e.g., PLA) for melanoma detection without surgical biopsy.

Other Key Players

- F. Hoffmann-La Roche Ltd.

- Abbott Laboratories

- Siemens Healthineers

- Philips Healthcare

- Leica Biosystems (Danaher)

- Agilent Technologies

- Illumina Inc.

- DermLite

- FotoFinder Systems GmbH

- Heine Optotechnik

- Verisante Technology

- Strata Skin Sciences

- Caliber Imaging & Diagnostics

- DermTech Inc.

- Myriad Genetics

- Castle Biosciences

- SkinVision

- Canfield Scientific

- 3Gen Inc.

- Novartis

Recent Developments

- In May 2025, NICE endorsed DERM, an autonomous AI device by Skin Analytics, for skin cancer detection, marking a key advancement in AI-driven care within the NHS. After reviewing multiple technologies, NICE recommended DERM as the sole AI tool fit for NHS use. It is the first dermatology solution to receive a class III CE mark under EU regulations and a positive Early Value Assessment from NICE.

(Source: https://pharmatimes.com) - In January 2025, the FDA approved DermaSensor, the first AI-powered, noninvasive handheld device for diagnosing skin cancer, including melanoma, basal cell carcinoma, and squamous cell carcinoma, at the point of care. Using spectroscopy and an FDA-cleared algorithm, DermaSensor analyzes lesions at the cellular level. Evaluated in the Mayo Clinic-led DERM-SUCCESS study involving over 1,000 patients, it demonstrated 96% sensitivity across 224 skin cancer types and a 97% negative predictive value for benign lesions.

(Source: https://www.targetedonc.com)

Segments Covered in the Report

By Type of Cancer

- Melanoma

- Cutaneous melanoma

- Acral lentiginous melanoma

- Lentigo maligna melanoma

- Nodular melanoma

- Others (rare forms)

- Basal Cell Carcinoma

- Nodular BCC

- Superficial BCC

- Infiltrative BCC

- Pigmented BCC

- Squamous Cell Carcinoma

- Cutaneous SCC

- Bowen's disease (in-situ SCC)

- Keratoacanthoma-type SCC

- Others

- Merkel Cell Carcinoma

- Cutaneous Lymphoma

- Rare/Genetic skin cancers

By Diagnostic Test/Technique

- Visual Examination & Dermoscopy

- Naked-eye examination

- Standard dermoscopy

- Digital dermoscopy (AI-assisted)

- Biopsy

- Shave biopsy

- Punch biopsy

- Excisional biopsy

- Incisional biopsy

- Imaging Tests

- CT scans

- MRI scans

- PET scans

- High-frequency ultrasound

- Molecular & Genetic Tests

- PCR-based tests

- Next-generation sequencing (NGS) panels

- Gene expression profiling

- Liquid biopsy (circulating tumor DNA, biomarkers)

- Others

- Confocal laser scanning microscopy

- Optical coherence tomography (OCT)

- AI-powered skin imaging apps/platforms

By Diagnostic Tool/Device

- Dermatoscopes

- Handheld dermatoscopes

- Digital dermatoscopes

- AI-integrated dermatoscopes

- Imaging Systems

- Confocal microscopy devices

- OCT devices

- Multispectral imaging systems

- Biopsy Instruments

- Punch instruments

- Shave/excisional tools

- Disposable biopsy kits

- Molecular Diagnostic Kits

- PCR kits

- NGS panels

- Biomarker detection kits

- AI & Tele-dermatology Platforms

- Mobile-based diagnostic apps

- Cloud-enabled diagnostic platforms

- Remote dermatology services

By End User

- Hospitals & Cancer Centers

- Multispecialty hospitals

- Oncology-focused hospitals

- Research/teaching hospitals

- Dermatology Clinics

- Independent dermatology practices

- Group dermatology centers

- Cosmetic dermatology clinics (with diagnostic services)

- Diagnostic Laboratories

- Central laboratories

- Molecular/genetic testing labs

- Specialty cancer diagnostic labs

- Ambulatory Surgical Centers

- Home-based & Tele-dermatology Platforms

- Direct-to-consumer diagnostic apps

- AI-driven virtual dermatology service

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting