What is the Smart Finance Hardware Market Size?

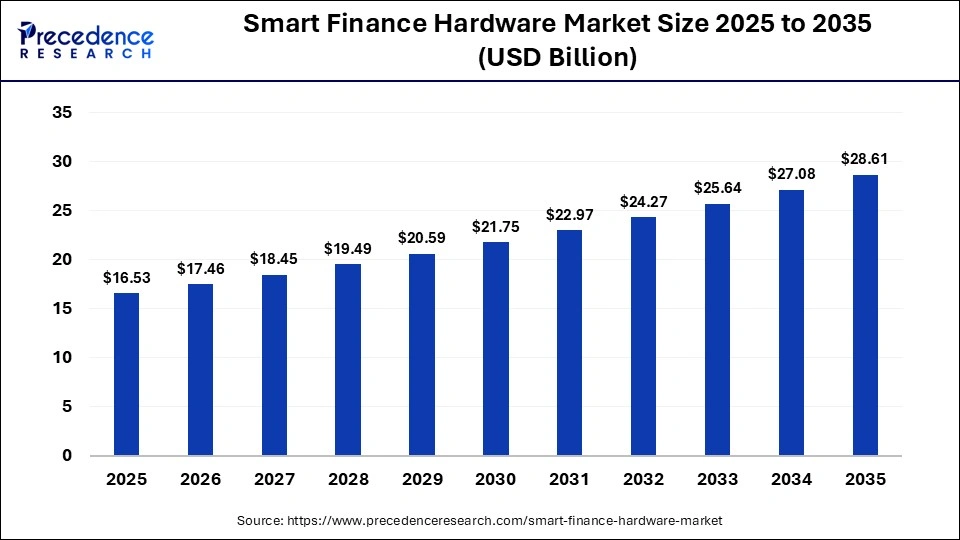

The global smart finance hardware market size accounted for USD 16.53 billion in 2025 and is predicted to increase from USD 17.46 billion in 2026 to approximately USD 28.61 billion by 2035, expanding at a CAGR of 5.64% from 2026 to 2035. The market is growing steadily, driven by the expansion of digital and contactless payments, growing security concerns, cyber threats & fraud risk, and technological innovations.

Market Highlights

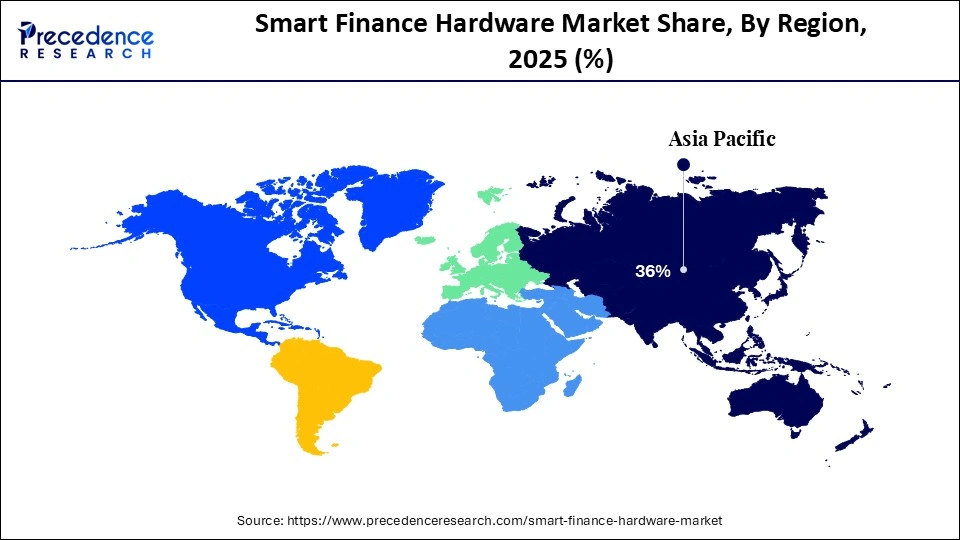

- Asia-Pacific led the smart finance hardware market with the largest market share of 36% in 2025.

- North America is estimated to expand at the highest CAGR in the market between 2026 and 2035.

- By hardware type, the smart POS (Point of Sale) terminals segment held a dominant revenue share in the market in 2025.

- By hardware type, the IoT-enabled devices & sensors segment is expected to grow at the highest CAGR between 2026 and 2035.

- By deployment type, the on-premises segment led the global market in 2025.

- By deployment type, the field-based deployment segment is expected to expand at the fastest CAGR from 2026 to 2035.

- By end user, the banks & financial institutions segment held a dominant smart finance hardware market share in 2025.

- By end user, the fintech companies segment is expected to grow at a solid CAGR between 2026 and 2035.

Is Smart Finance Hardware Shaping the Future of Digital Payments?

Smart finance hardware refers to intelligent physical devices such as smart POS terminals, biometric authentication systems, payment kiosks, and secure card readers used in modern financial transactions. By enabling contactless payments, real-time data processing, enhanced security, and seamless integration with digital platforms, smart finance hardware is reshaping digital payments, improving transaction efficiency, trust, and user experience across global financial ecosystems.

How Can AI Integration Transform the Smart Finance Hardware Market?

AI integration is rapidly transforming the smart finance hardware industry by enabling real-time intelligence, enhanced security, and autonomous transaction capabilities. AI-powered devices can detect fraud instantly by analyzing complex behavioral and transactional patterns, moving beyond traditional rule-based systems to predictive and adaptive protection. In 2026, banks and hardware providers are increasingly embedding AI into ATMs and POS terminals to support personalized interfaces, predictive maintenance, and biometric authentication, significantly improving customer experience and operational uptime.

Industry events like Global Fintech Fest 2025 highlighted AI as a core driver for smarter financial ecosystems, stressing integration across hardware and software layers. As these intelligent systems evolve, AI-enabled finance hardware will increasingly automate decision-making, reduce risk, and bridge digital and physical payment environments with unprecedented efficiency and security.

Primary Trends Influencing the Smart Finance Hardware Market

- Biometric Authentication Becoming Mainstream: Biometric authentication technologies, such as fingerprint, facial, and iris recognition, are increasingly being embedded in smart financial devices to replace traditional PINs and passwords. This trend is driven by demand for more secure, user-friendly verification methods that reduce fraud risk and transaction friction. Biometric systems provide a seamless customer experience while ensuring only authorized users can complete sensitive transactions. As these technologies mature, they are expanding into ATMs, self-service kiosks, and wearable payment devices.

- Contactless & Digital Payments Driving Hardware Upgrades: The global shift toward contactless and digital-only payments is significantly reshaping the smart finance hardware market. Devices that support NFC, QR code scanning, mobile wallets, and touch-free transactions are in high demand across retail, banking, transportation, and service sectors. This trend has been accelerated by changing consumer expectations for hygiene, convenience, and speed, pushing financial institutions and merchants to upgrade legacy hardware to meet modern digital payment needs across different environments.

- Blockchain and Decentralized Finance (DeFi) Integration: Blockchain technology is emerging as a key trend in smart finance hardware by enabling secure, transparent, and tamper-resistant transaction records at the device level. Some hardware manufacturers are developing products that interface with blockchain platforms and support digital assets or decentralized finance applications. This not only enhances data integrity and reduces fraud but also positions hardware to support future payment innovations like cryptocurrency transactions and decentralized identity verification directly through physical devices.

- Edge Computing & Connected IoT Devices: The smart finance hardware market is increasingly incorporating edge computing and Internet of Things (IoT) connectivity to process data locally, reduce latency, and communicate in real time with backend systems. These capabilities allow for faster fraud detection, adaptive user interfaces, and continuous remote monitoring. IoT-enabled terminals and sensors can update software, share performance data, and integrate with cloud services seamlessly. This trend supports scalability while improving reliability and reducing operational costs.

- Modular & Sustainable Hardware Designs: Manufacturers are shifting toward modular and energy-efficient designs in smart financial hardware to align with sustainability goals and reduce long-term costs. Modular components make it easier to upgrade parts (like processors or sensors) without replacing entire units, which extends device lifecycles. Energy-efficient hardware also reduces power consumption in ATMs, POS terminals, and kiosks. Such innovations are increasingly important as institutions seek to lower environmental impact while maintaining high performance.

- Personalized and Customer-Centric Experience Enhancements: The smart finance hardware industry is placing greater emphasis on user experience and personalization. Devices are being designed with intuitive interfaces, faster processing speeds, and seamless interactions across channels, bridging physical and digital touchpoints. Personalized offerings (such as customizable transaction options or targeted content on payment displays) help financial service providers improve engagement. This trend reflects the broader push toward customer-centric services in fintech and retail environments.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 16.53 Billion |

| Market Size in 2026 | USD 17.46 Billion |

| Market Size by 2035 | USD 28.61 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 5.64% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Hardware Type, Deployment Type, End User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segmental Insights

Hardware Type Insights

Why Was the Smart POS (Point of Sale) Terminals Segment Dominant?

The smart POS (point of sale) terminals segment dominated the global smart finance hardware market because it supports seamless digital payments, contactless transactions, and multi-channel integration. Its versatility across retail, hospitality, and services, paired with advanced security features and real-time analytics, drives adoption. Retailers favor smart POS for faster checkout, improved customer experience, and efficient inventory and data management, making it central to modern payment ecosystems.

The IoT-enabled devices & sensors segment is expected to witness the fastest growth in the market over the forecast period, because connected sensors deliver real-time data, automated monitoring, and remote management. These devices enable smarter security, predictive maintenance, seamless integration with cloud systems, and faster transaction processing. Their scalability and ability to support analytics, connectivity, and edge computing make financial ecosystems more efficient, resilient, and adaptive to evolving digital demands

Deployment Type Insights

Why Did the On-Premises Segment Dominate the Smart Finance Hardware Market?

The on-premises segment contributed the biggest revenue share in the market in 2025, because financial institutions prioritize data control, security, and regulatory compliance, keeping sensitive operations in-house. It offers low latency, customized configurations, and direct infrastructure management, which enhances reliability and performance. These advantages make on-premises deployment preferable for mission-critical smart finance hardware systems.

The field-based deployment segment is expected to expand rapidly in the market in the coming years, because it enables remote, on-site financial services through IoT-connected ATMs, kiosks, and mobile terminals. Its scalability, reduced infrastructure needs, and support for real-time monitoring and updates make it ideal for underserved areas. This flexibility enhances accessibility, improves customer engagement, and accelerates the adoption of smart finance hardware outside traditional branch networks.

End User Insights

Which End User Segment Led the Smart Finance Hardware Market?

The banks & financial institutions segment led the global market with a share in 2025, because these organizations require extensive smart finance hardware for secure transactions, high-volume processing, and customer engagement. They invest in advanced ATMs, smart POS systems, and biometric authentication to enhance security and efficiency. Their large infrastructure, regulatory compliance needs, and focus on digital transformation drive widespread adoption of sophisticated hardware across branches and channels.

The fintech companies segment is expected to grow at the fastest CAGR between 2026 and 2035, because fintechs rapidly adopt smart finance hardware to deliver innovative, seamless payment solutions. Their focus on digital wallets, contactless transactions, and integrated ecosystems drives demand for advanced POS and IoT-enabled devices. Agile deployment, customer-centric services, and partnerships with retailers and banks accelerate hardware adoption, boosting efficiency and market reach.

Regional Insights

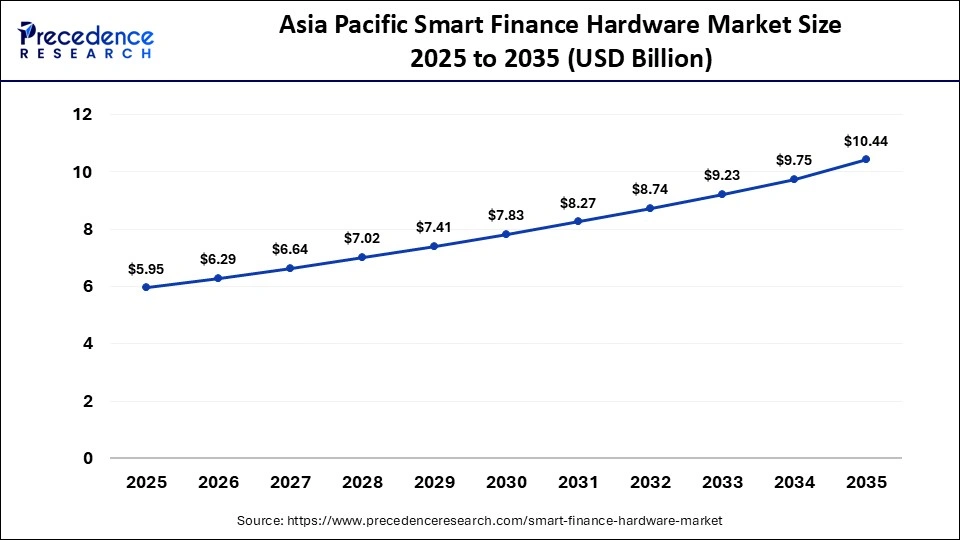

What is the Asia Pacific Smart Finance Hardware Market Size?

The Asia Pacific smart finance hardware market size is expected to be worth USD 10.44 billion by 2035, increasing from USD 5.95 billion by 2025, growing at a CAGR of 5.78% from 2026 to 2035.

Why Asia-Pacific Dominated the Smart Finance Hardware Market?

Asia-Pacific held a major revenue share of the market in 2025, due to rapid digital payment adoption, government initiatives, and advanced financial ecosystems. High smartphone penetration and widespread use of mobile and contactless payments have driven demand for smart POS, IoT devices, and advanced ATMs across retail, banking, and service sectors. Governments and regulators in key markets like China, India, and Southeast Asia promote cashless infrastructure and financial inclusion, further accelerating hardware deployment and innovation.

Additionally, a growing preference for on-premises deployment enables financial institutions to maintain control over sensitive data, meet strict regulatory and data-localization requirements, and integrate with legacy systems, thereby enhancing security and operational performance for critical financial hardware systems. The increasing investments in AI infrastructure also propel the market.

China Smart Finance Hardware Market Trends

China holds a major share in the Asia-Pacific market due to its rapid digitalization, strong banking infrastructure, and government-backed financial initiatives. People are increasingly using digital payment systems for online transactions. As of May 2024, over 8 in 10 Chinese, or 84% of people, use mobile wallets for financial transactions.

Rising on-premises deployment ensures data control, regulatory compliance, and integration with legacy systems, meeting strict local requirements. The growing preference for on-premises setups reflects China's emphasis on secure, reliable, and scalable financial hardware solutions, supporting both traditional banks and emerging fintech services while fueling overall market growth in the region.

How is North America Growing in the Smart Finance Hardware Market?

North America is expected to witness the fastest growth during the predicted timeframe, due to the rapid adoption of advanced payment technologies, strong fintech innovation, and high demand for secure, AI‑enabled devices. Widespread use of contactless payments, robust infrastructure, and major investments by banks and enterprises in next‑generation POS and IoT systems drive growth. Regulatory emphasis on data security further accelerates smart hardware deployment.

U.S. Smart Finance Hardware Market Trends

In the U.S., the market is expanding due to widespread fintech adoption, advanced digital infrastructure, and growing demand for secure, efficient financial transactions. Field‑based deployments, including mobile ATMs and portable POS terminals, are rising to support remote banking, retail payments, and on‑the‑go financial services. Fintech companies are driving adoption by integrating AI, digital wallets, and contactless payment solutions with smart hardware. Recent initiatives by U.S. banks to deploy AI-powered ATMs and next-generation POS systems further strengthen the market's growth.

Will the Middle East & Africa Grow in the Smart Finance Hardware Market?

The Middle East & Africa are expected to grow at a notable CAGR in the foreseeable future, as the region offers a growing opportunity for smart finance hardware driven by rapid digital payment adoption, expanding financial inclusion, and strategic infrastructure initiatives. In the Middle East, countries like Saudi Arabia are expanding global digital payment platforms such as Google Pay and Alipay+ by 2026, accelerating cashless usage and fintech innovation.

Across Africa, regional efforts like the COMESA Digital Retail Payments Platform are streamlining cross‑border transactions, lowering costs, and supporting broader digital payment systems. Investments by major payment networks, such as Visa's new data center in Johannesburg, strengthen local processing and digital ecosystem resilience. These developments indicate increasing adoption of smart POS, IoT‑enabled systems, and secure payment hardware as digital finance expansion continues.

Who are the Major Players in the Global Smart Finance Hardware Market?

The major players in the smart finance hardware market include Diebold Nixdorf, NCR Atleos, Hyosung TNS, GRG Banking Equipment Co. Ltd., PAX Technology Inc., Ingenico Group, VeriFone Systems Inc., Hitachi Channel Solutions Corp., OKI Electric Industry Co., Ltd, Castles Technology Co., Ltd., Nexgo (SZ Xinguodu Technology), and AURES Group.

Recent Developments

- In December 2025, JDH Wealth Ltd. announced the launch of its AI-powered digital asset platform, JDH AI, to empower digital investors in the global cryptocurrency market. The platform combines AI, blockchain technology, and sustainable computing. It provides technology-driven long-term asset allocation solutions for institutional and high-net-worth clients.(Source: https://markets.businessinsider.com)

- In October 2025, fintech leaders introduced multiple innovations at the Global Fintech Fest 2025 that will impact smart finance hardware deployments in 2026 and beyond. Key launches include IoT‑enabled UPI payments, allowing everyday connected devices like smart cars and smart TVs to make digital payments, and AI‑powered support for UPI complaint resolution and mandate management.(Source: https://www.vortexindia.co.in)

- In September 2025, Partisia and Squareroot8 launched a joint system, FracQtion, to protect financial institutions and telecom providers from quantum decryption threats. The system was designed by combining Partisia's multi-party computation (MPC) technology with Squareroot8's quantum random number generator and quantum key distribution.(Source: https://www.iotinsider.com)

- In October 2025, Zoho unveiled its latest suite of POS terminals, smart POS devices, and QR payment hardware designed to deepen its fintech ecosystem at the Global Fintech Fest 2025. These new devices support tap, dip, swipe, and UPI‑based payments, with built‑in billing, printing, and enhanced merchant features, improving business transaction workflows.(Source: https://www.fintechweekly.com)

Segments Covered in the Report

By Hardware Type

- Smart POS (Point of Sale) Terminals

- Smart ATMs (Automated Teller Machines)

- Kiosks & Self-Service Terminals

- Payment Cards & Terminals with Embedded Chips

- IoT-enabled Devices & Sensors

- Digital Signage & Display Hardware

- Others (Smart Modules & Embedded Components, etc.)

By Deployment Type

- On-Premises

- Cloud-Based/Hybrid

- Field-Based Deployment

By End User

- Banks & Financial Institutions

- Independent ATM Deployers

- Non-Banking Financial Companies

- Corporate & Institutional Banks

- Government Institutions

- Fintech Companies

- Others (Retail, etc.)

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content