What is theSmart Solar Inverter Connectivity Market Size?

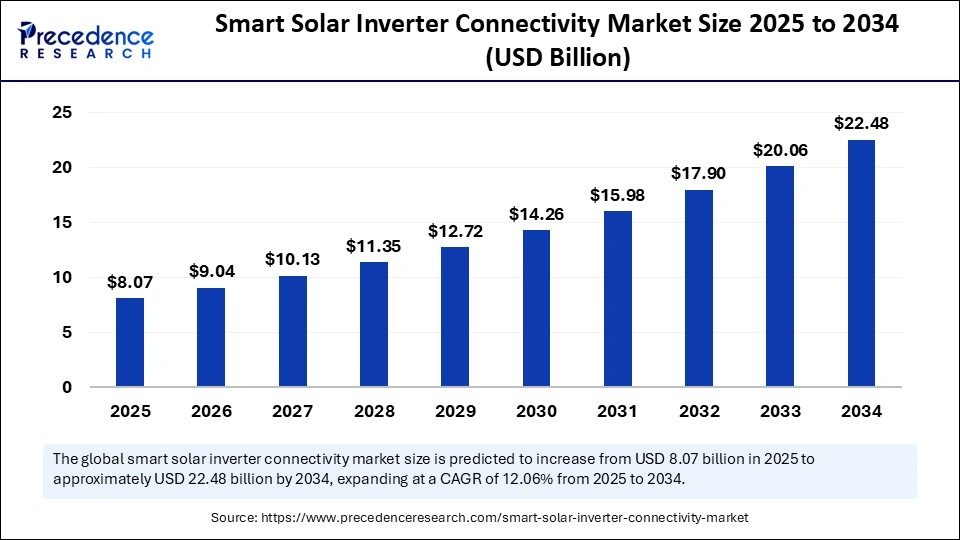

The global smart solar inverter connectivity market size was calculated at USD 8.07 billion in 2025 and is predicted to increase from USD 9.04 billion in 2025 to approximately USD 22.48 billion by 2034, expanding at a CAGR of 12.06% from 2025 to 2034.The market growth is driven by the increased adoption of renewable energy sources and the shift toward smarter grids. This transition is fueled by the integration of solar power with battery storage, which enhances grid stability and energy independence. Additionally, supportive government policies and rising demand for efficient energy management and remote monitoring are accelerating the development of advanced inverters.

Market Highlights

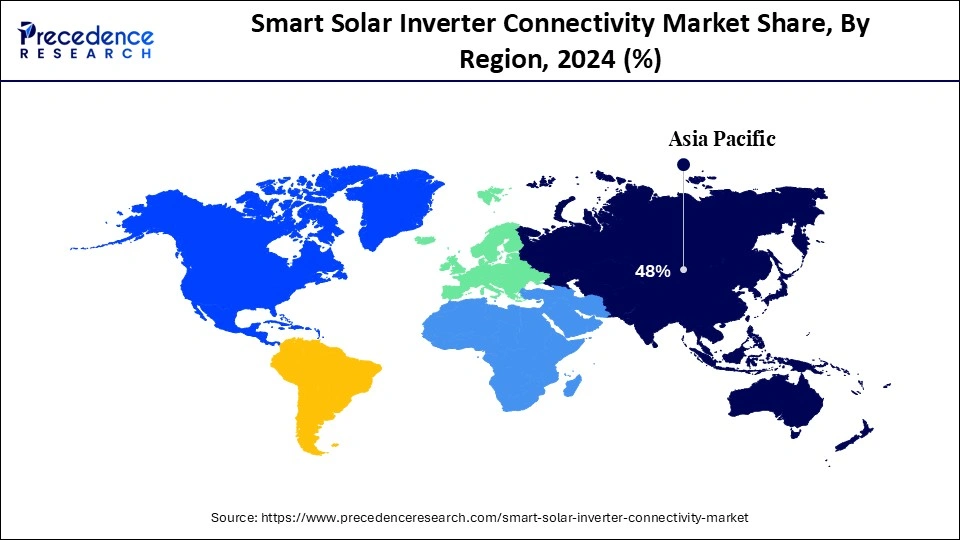

- Asia Pacific dominated the market with a 48% share in 2024 and is expected to sustain growth trajectory during the forecast period.

- By inverter type, the string inverters segment dominated the market with a major market share of 55% in 2024.

- By inverter type, the microinverters segment is expected to grow at the fastest CAGR from 2025 to 2034.

- By connectivity technology, the wired segment led the market with largest market share of 62% in 2024.

- By connectivity technology, the cellular / wide-area segment is expected to register the fastest CAGR during the foreseeable period.

- By software, the monitoring and telemetry dashboards segment held the largest market share of 40% in 2024.

- By software, the derms/VPP integration segment is expected to witness the fastest CAGR during the foreseeable period.

- By application, the commercial and industrial (C&I) segment held the largest market share of 46% in 2024.

- By application, the residential rooftop segment is expected to expand at the fastest CAGR during the foreseeable period.

- By communication standards, the device and fieldbus segment held the largest market share of 58% in 2024.

- By communication standards, the grid/utility & IoT segment is expected to register the fastest CAGR during the foreseeable period.

Market Size and Forecast

- Market Size in 2025: USD 8.07 Billion

- Market Size in 2026: USD 9.04 Billion

- Forecasted Market Size by 2034: USD 22.48 Billion

- CAGR (2025-2034): 12.06%

- Largest Market in 2024: Asia Pacific

What is Smart Solar Inverter Connectivity?

Smart solar inverter connectivity encompasses communication-enabled PV inverters and associated gateways/platforms that enable real-time telemetry, remote O&M, grid-interactive functions, cybersecurity, and integration with energy management, DERMS/VPPs, and utility systems. Connectivity spans wired, wireless, and cellular links, standardized protocols, and cloud/edge software that orchestrate device-to-platform data flows and grid services.

Key Technological Shifts in the Smart Solar Inverter Connectivity Market

There is strong potential to enhance the efficiency, performance, and flexibility of solar energy systems with IoT, enabling remote monitoring, real-time energy optimization, and predictive maintenance. These connected systems analyze data to improve efficiency, reliability, and grid stability, creating a more dynamic and responsive renewable energy ecosystem. AI-powered inverters integrate with smart grids to manage energy distribution dynamically. They intelligently control battery storage, deciding when to charge and discharge based on consumption patterns, grid pricing, and predicted outages.

AI enables smart inverters to analyze vast amounts of data in real-time, such as weather patterns, solar irradiance, and consumption trends. By processing this data, AI dynamically adjusts inverter settings to optimize energy output, ensuring that solar systems operate at peak efficiency. This leads to better energy management, reduced waste, and increased overall system performance.

Smart Solar Inverter Connectivity Market Outlook

- Market Growth Overview: The market for smart solar inverter connectivity is set for explosive growth from 2025 to 2034, driven by the global push for renewable energy, a rapid decline in solar equipment costs, and the proliferation of IoT devices and 5G networks. Additionally, hybrid inverters with energy storage integration and microinverters for residential and commercial applications.

- Sustainability Trends: Sustainability is a core market driver, with demand rising for intelligent systems that maximize energy efficiency, reduce waste, and improve grid stability. Innovations like AI-powered energy management optimize power generation based on real-time data forecasts, reducing reliance on conventional power sources and minimizing the environmental footprint.

- Global Expansion: Leading manufacturers are expanding their reach into fast-growing regions like Asia-Pacific, Latin America, and Eastern Europe to capitalize on industrialization and supportive government policies. In developed markets like North America and Europe, the adoption is driven by replacement cycles and the integration of advanced, grid-supporting functionalities.

- Major Investors: Significant investment from venture capital, private equity, and major tech firms is flowing into the sector. Investors are drawn by strong margins, high technical barriers, and the market's alignment with smart grid technologies and the broader renewable energy transition, which involves integrating edge AI into their core offerings.

- Startup Ecosystem: The startup ecosystem is maturing rapidly, with a focus on innovation in IoT-enabled hardware, real-time analytics platforms, and advanced AI integration. Emerging firms are attracting significant funding by offering scalable and specialized solutions that address the evolving needs of residential and commercial solar installations.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 8.07 Billion |

| Market Size in 2026 | USD 9.04 Billion |

| Market Size by 2034 | USD 22.48 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 12.06% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | North America |

| Base Year | 2025 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Inverter Type, Connectivity Technology Software, Application, Communication Standard, and region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Increasing Focus on Energy Independence and Efficiency

The main driver for the smart solar inverter connectivity market is the increasing focus on energy independence and optimizing efficiency through renewable energy integration. This is largely due to supportive government policies, declining costs of solar equipment, and widespread adoption of solar power systems for residential and commercial use. Smart inverters allow users to track energy generation and consumption data via mobile apps or web platforms. The development of intelligent, connected inverters is a crucial technology for achieving these goals, maximizing self-consumption, and providing backup power during outages.

Restraint

Lack of Standardization and Interoperability Issues

The primary restraint in the smart solar inverter connectivity market is the lack of standardization, which results in interoperability issues. As more smart inverters are integrated into the grid, the lack of standardized communication makes it difficult for utilities to monitor and control distributed energy resources effectively. This also makes it easier for threats like remote tampering or data theft to be exploited. Because many manufacturers use proprietary communication protocols, smart inverters from different companies can struggleto work together, leading to fragmented ecosystems and security vulnerabilities.

Opportunity

Advanced Grid Integration and Energy Management

A key future opportunity in the smart solar inverter connectivity market lies in advanced grid integration and energy management powered by AI. Next-generation smart inverters are transforming solar systems from simple power sources into intelligent, active participants in the grid. This evolution opens up opportunities for enhanced grid stability, dynamic power optimization, and advanced energy storage management. By analyzing weather patterns, consumption data, and environmental factors, AI algorithms dynamically adjust inverter settings to maximize efficiency, minimize downtime, and prevent costly repairs.

Segments Insights

Inverter Type Insights

What Made String Inverters the Dominant Segment in the Smart Solar Inverter Connectivity Market?

The string inverters segment dominated the market while holding a 55% market share in 2024. This dominance is due to their cost-effectiveness, modularity, technological advancements, and high efficiency across residential, commercial, and utility-scale projects. Manufacturers have incorporated advanced digital technologies and smart features into string inverters. Modern string inverters, especially three-phase models, are used in residential, commercial, and large utility projects, ensuring higher overall system reliability compared to a single large central inverter.

The microinverter segment is expected to experience the fastest growth in the market. This is mainly because of its advanced features, including higher efficiency, improved safety, panel-level monitoring, and greater design flexibility. Microinverters convert DC to AC power at the panel level, eliminating the high-voltage DC wiring that runs from panels to a central inverter. These benefits directly address key pain points for homeowners and small commercial users, who are the primary consumers in this market.

Connectivity Technology Insights

How Does the Wired Segment Lead the Smart Solar Inverter Connectivity Market?

The wired segment led the market with a 62% share in 2024. This is because of its superior reliability, security, and bandwidth for data transmission compared to wireless options. Wireless technology also offers convenience and is far more resistant to cybersecurity threats like hacking, data manipulation, and Distributed Denial of Service attacks that threaten wireless networks. These wired systems also provide faster and more consistent data transfer speeds, which are crucial for smart inverters that need to send large amounts of data quickly to optimize system performance, ensuring long-term durability and reliability.

The cellular wide-area segment is expected to expand at the fastest rate during the forecast period. This is because of its superior reliability, universal coverage, security, and independence from local network infrastructures. Cellular technology offers a dedicated, long-term connection that is essential for mission-critical monitoring and management of solar assets, especially compared to less reliable options like Wi-Fi. The development of cellular technology towards 5G and beyond ensures long-term viability and scalability for smart inverter deployments, making it a top choice for large-scale and remote projects.

Software Insights

Why Did the Monitoring & Telemetry Dashboards Segment Lead the Market in 2024?

The monitoring & telemetry dashboards segment led the smart solar inverter connectivity market, holding a 40% share in 2024. This is because it is the most crucial function for ensuring optimal performance, maximizing return on investment, and maintaining the long-term health of solar systems. These systems provide actionable data and remote capabilities that are vital for managing modern solar installations, from residential rooftops to utility-scale farms. Additionally, by ensuring the system operates at peak efficiency and minimizing downtime, this segment directly boosts the financial return on solar investments.

The DERMS/VPP integration segment is expected to grow at the fastest rate during the projection period. This is mainly because of its ability to address the core challenges of a modern, decentralized energy grid. By aggregating and intelligently managing a fleet of distributed energy resources, including solar and storage, DERMS and VPP platforms help utilities and grid operators maintain stability and efficiency while monetizing these assets in energy markets. Consequently, a single software platform can manage assets for both DERMS and VPP, offering greater interoperability and lower costs than separate systems.

Application Insights

How Does the Commercial & Industrial (C&I) Segment Dominate the Smart Solar Inverter Connectivity Market in 2024?

The commercial & industrial (C&I) segment maintains leadership in the market with a 46% share in 2024. This is due to the rising high energy consumption, complex energy management needs, and a push for corporate sustainability. C&I customers face higher electricity tariffs and significant operational costs related to energy use. The need to optimize costs and enhance energy independence drives many businesses to adopt smart solar solutions. Moreover, the sophisticated energy needs of C&I facilities require intelligent management systems to provide advanced monitoring and control capabilities.

The residential rooftop segment is expected to grow at the fastest CAGR in the market. This growth is driven by strong government support, technological advances, rising electricity costs, and increasing consumer demand for energy independence. Smart inverters allow homeowners to optimize energy use, manage battery storage, and monitor their systems in real time, making residential solar solutions more attractive and viable. Frequent power outages and grid instability also boost demand for energy independence solutions that provide a reliable power supply during grid failures.

Communication Standards Insights

Why Did the Device & Fieldbus Segment Dominate the Smart Solar Inverter Connectivity Market?

The device & fieldbus segment dominated the market by capturing a 58% share in 2024. This is mainly due to its reliability, cost-effectiveness, and suitability for real-time industrial and device-level communication. Established protocols like Modbus and CAN bus provide a robust, proven foundation for connecting inverters and other system components, facilitating easier troubleshooting and predictive maintenance. Fieldbus systems reduce overall installation costs by using less cabling and simplifying network topology, which improves system reliability and reduces downtime.

The grid/utility and IoT segment is expected to expand at the fastest rate in the market. This is mainly because it is essential for modernizing power grids to handle the complexities of renewable energy. IoT-enabled smart inverters enable a crucial two-way flow of communication and energy, allowing for real-time monitoring and dynamic management of power resources. Smart grids enable bidirectional energy flow, allowing homes and businesses to consume power and generate and sell excess energy back to the grid. This capability enables better forecasting of demand and more efficient energy distribution.

Regional Insights

Asia Pacific Smart Solar Inverter Connectivity Market Size and Growth 2025 to 2034

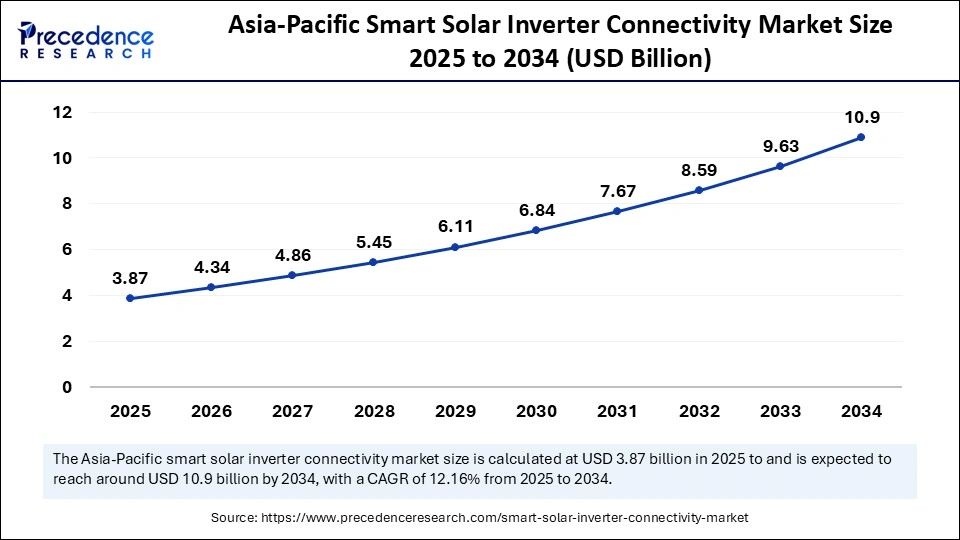

The Asia Pacific smart solar inverter connectivity market size was exhibited at USD 3.87 billion in 2025 and is projected to be worth around USD 10.9 billion by 2034, growing at a CAGR of 12.16% from 2025 to 2034.

What Made Asia Pacific a Leader in the Smart Solar Inverter Connectivity Market?

Asia Pacific led the market while capturing a 48% share in 2024 and is expected to sustain its growth during the forecast period. This growth is driven by robust government support, rapid technological advancements, and increasing electricity demand. Significant solar installation growth, especially in China and India, has fueled the need for advanced inverters that offer real-time monitoring and enhanced grid management. Governments across the region have implemented supportive policies and financial incentives, such as tax rebates, subsidies, and feed-in tariffs, to encourage solar adoption. Major smart solar inverter manufacturers, like Huawei, Sungrow, and Growatt, are headquartered in the region, giving them a competitive edge through economies of scale, robust supply chains, and ongoing R&D investment.

India Smart Solar Inverter Connectivity Market Trends

India is a major contributor to the market is the global market, primarily due to its ambitious renewable energy targets and supportive government initiatives. The country is emerging as both a major consumer and an innovation hub for smart inverters, with significant growth in utility-scale projects and a rapidly expanding decentralized rooftop sector. Policies such as the Production Linked Incentive (PLI) scheme are boosting domestic manufacturing, while increasing demand for hybrid and smart inverters with IoT and AI capabilities is driving technological advancements.

PM Surya Ghar, a Muft Bijli Yojana, offering household subsidies for rooftop solar installations (₹30,000 for 1kW, ₹60,000 for 2kW, and ₹78,000 for 3kW and above).

The PLI Scheme (₹19,500 crore outlay for Tranche-II) boosts local manufacturing of solar components. The National Smart Grid Mission (NSGM) supports smart grid deployment for renewable energy integration and grid reliability.

China Smart Solar Inverter Connectivity Market Trends

China plays a distinctive role in the market through its unparalleled manufacturing scale, technological innovation, and strategic market expansion. Leveraging massive state investments, low-cost production, and a near-monopoly on solar supply chains, Chinese firms like Huawei and Sungrow have become global market leaders, significantly driving down costs for solar hardware worldwide. China also heavily exports advanced inverter technologies to both developed and developing nations, solidifying its dominant position and shaping global market trends and pricing.

- Huge government capital injection into the solar PV industry, including low-rate loans, driving scale and cost reduction. Invested over $50 billion in solar supply capacity (2011-2022).

- Direct subsidies, tax rebates, and low-interest loans for manufacturers. For example, Sungrow Power Supply Co. Ltd. received $17 million in government subsidies in 2023, positioning its manufacturers as global leaders.

Regulatory Landscape for Smart Solar Inverter Connectivity

| Country | Regulatory Bodies | Regulations and Mandates |

| India |

|

Recent updates (2025):

|

| Germany |

|

Solarpaket 1 legislation (2024):

|

| U.S. |

|

Industry Standards and State Mandates:

|

Top Companies Operating in the Smart Solar Inverter Connectivity Market

Tier I: Major Global Leaders

These companies dominate the market with strong global presence, advanced technology, and significant financial backing. They lead in both market share and technological innovation.

- Huawei Technologies Co., Ltd.: The company is a global leader in solar inverters and smart grid technologies. It is known for its FusionSolar platform integrating AI, IoT, and cloud technology.

- Sungrow Power Supply Co., Ltd.: One of the largest manufacturers of solar inverters, with strong focus on R&D and product innovation.

- FIMER S.p.A.: A leading European inverter manufacturer, focusing on high-efficiency inverters for both commercial and residential solar systems.

- Schneider Electric: Known for smart inverters and integrated energy management solutions, leveraging AI and IoT technologies in its product offerings.

- ABB Ltd. (Power Grids Division): ABB's inverter products are known for integration with grid management systems and advanced digital technologies.

Tier II: Strong Regional Players

These companies have a significant regional presence and contribute substantially to the market but do not have the same global reach as Tier I companies. They typically focus onspecific geographic regions or particular technology sectors.

- Enphase Energy, Inc.: Leading U.S.-based company specializing in microinverters and home energy management systems.

- SMA Solar Technology AG: Based in Germany, SMA is a key player in both residential and commercial solar inverters, with an emphasis on innovation.

- SolarEdge Technologies: It is known for its power optimizers and innovative inverter solutions, particularly in the residential sector.

- TMEIC (Toshiba Mitsubishi-Electric Industrial Systems Corporation):It focuses on industrial-grade inverters and solar power systems, particularly in large-scale utility projects.

- Ginlong Technologies (Solis): A leading Chinese solar inverter manufacturer, known for cost-effective solutions with growing market share in emerging regions.

Tier III: Emerging and Niche Players

These companies are smaller or emerging players in the smart solar inverter connectivity market. They often focus on niche markets or specific technologies, with a regional or limited global presence.

- GoodWe Power Supply Technology Co., Ltd.: It offers a range of inverters for both residential and commercial solar systems, with a strong presence in China and growing international markets.

- Victron Energy: A Dutch company known for off-grid and hybrid solar inverter solutions, with strong foothold in the recreational vehicle (RV) and off-grid markets.Fronius

- International GmbH: Austrian-based manufacturer, known for its high-quality residential and commercial inverters, particularly in European markets.

- KACO New Energy: German company providing inverters for industrial and commercial solar applications, with a growing presence in global markets.

- Delta Electronics, Inc.A Taiwan-based manufacturer that focuses on solar inverters and energy management systems for both residential and industrial sectors.

Recent Developments

- In June 2025, Amber Enterprises India announced that ILJIN Electronics entered into a Share Purchase Agreement and Shareholders' Agreement with Power-One Micro Systems (Power-One) and other parties for the acquisition of a majority stake in Power-One offers comprehensive solutions of Battery Energy Storage Systems, solar inverters, solar power plants, UPS solutions, EV chargers, and other products to a wide spectrum of customers.(Source: https://www.business-standard.com)

- In January 2024, Enphase Energy, Inc. started shipping its new IQ8™ Microinverters, IQ8HC™, and IQ8X™. With peak output AC power of 384W, IQ8HC and IQ8X Microinverters are designed to seamlessly pair with a full range of solar modules up to 540W DC. The high-quality manufacturing process and low failure rates unlock an industry-leading 25-year warranty for all IQ8 Microinverters, enabling newer, more powerful systems.(Source: https://investor.enphase.com)

- In April 2024, Huawei Digital Power launched the ground-breaking SUN2000-150K-MG0 inverter for the Commercial & Industrial (C&I) market. With an ultra-high efficiency of 98.8% and active safety features, this state-of-the-art solution represents a significant step forward for the fast-growing C&I solar sector in the Middle East region.

(Source: https://www.tahawultech.com)

Expert Analysis on the Smart Solar inverter Connectivity Market

The smart solar inverter connectivity market is positioned for significant growth, driven by the convergence of multiple macroeconomic, technological, and regulatory factors. As the global energy paradigm shifts towards decentralization and decarbonization, the demand for smart, connected solar inverters, integrated with IoT and AI capabilities, is poised to accelerate. These inverters enable real-time energy optimization, advanced grid integration, and enhanced operational efficiency, positioning them as critical components in the transition to more resilient and efficient energy systems.

The market is benefitting from substantial government support across key regions, particularly in Asia-Pacific, Europe, and North America, where ambitious renewable energy targets and regulatory frameworks incentivize the adoption of advanced solar technologies. Moreover, the surge in solar installations, coupled with the growing adoption of energy storage systems, is creating an expanding need for intelligent inverters capable of managing multi-source energy flows, predictive maintenance, and energy storage optimization.

The integration of AI and data analytics into these systems opens new avenues for predictive energy management, fault detection, and performance optimization, significantly enhancing the economic and environmental value of solar installations. In addition, emerging markets in Southeast Asia, Africa, and Latin America offer untapped opportunities, driven by increasing energy demand, low-cost solar deployments, and the need for off-grid solutions. As such, the market presents ample growth prospects, with incumbents and new entrants alike set to capitalize on advancements in digital energy solutions, offering promising avenues for investment and technological innovation in the coming decade.

Segments Covered in the Report

By Inverter Type

- String Inverters

- Single-MPPT string

- Multi-MPPT string

- Hybrid string (PV + storage)

- Central Inverters

- Station-skid integrated

- MV-connected central

- Microinverters

- Optimizer-Based Architectures

By Connectivity Technology

- Wired

- Ethernet

- RS-485 / Modbus RTU

- Power Line Communication (PLC)

- Wireless (Local)

- Wi-Fi

- Bluetooth LE

- Zigbee / Thread

- Cellular / Wide-Area

- LTE / LTE-M / NB-IoT

- 5G (SA/NSA)

- LPWAN / Others

- LoRaWAN

- Satellite IoT

By Software

- Monitoring & Telemetry Dashboards

- Remote O&M / Diagnostics / OTA Firmware

- Asset & Fleet Management (multi-site)

- Energy Management Systems (EMS) / Optimizers

- DERMS / VPP Integration

- Predictive Maintenance (AI/ML)

- Revenue-Grade Metering / Billing Interfaces

- Cybersecurity Posture Management

By Application

- Residential Rooftop

- Single-phase homes

- Solar-plus-storage

- Commercial & Industrial (C&I)

- Rooftop C&I

- Carports / Canopies

- Behind-the-meter storage hybrids

- Utility-Scale

- Ground-mount PV plants

- PV-plus-storage plants

By Communication Standards

- Device & Fieldbus

- Modbus RTU/TCP

- SunSpec models

- CAN (select)

- Grid / Utility & IoT

- IEEE 2030.5 (SEP 2.0)

- IEC 61850 / DNP3

- MQTT / REST APIs

- DLMS/COSEM

- Charging / Building Interop

- OCPP

- BACnet / OPC UA

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting