What is Solar EPC Market Size?

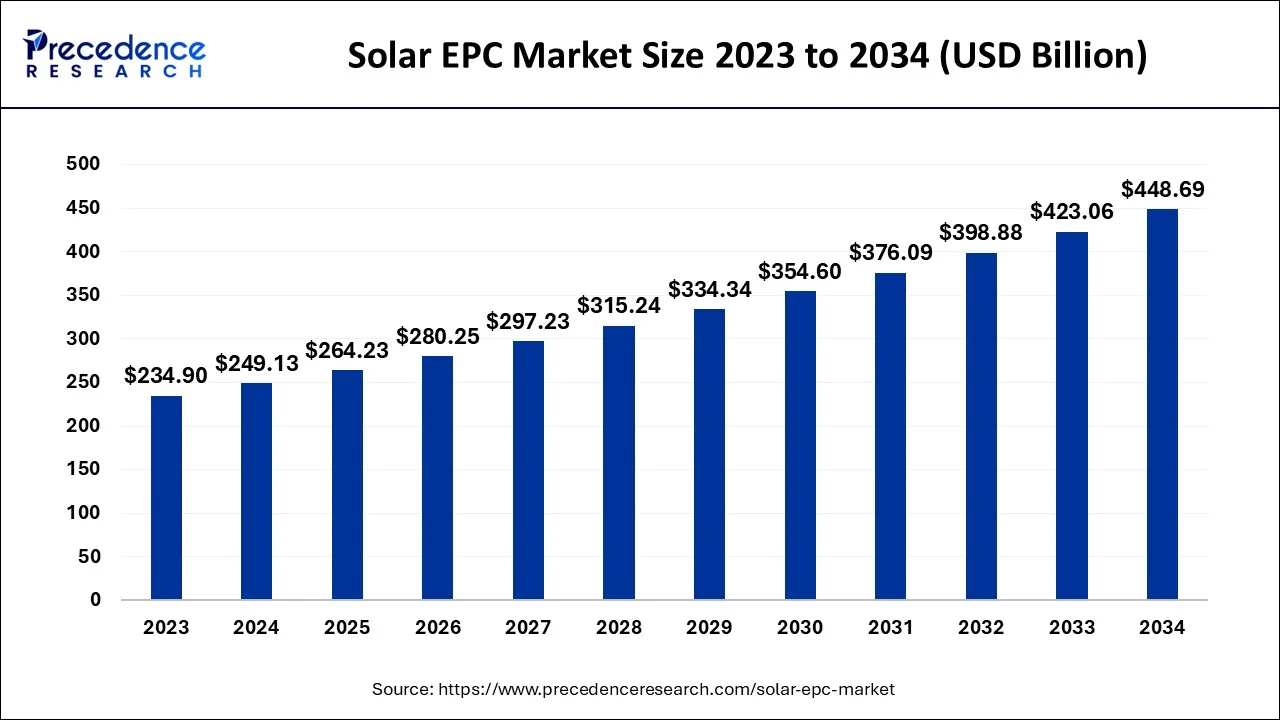

The global solar EPC market size is estimated at USD 264.23 billion in 2025 and is anticipated to reach around USD 448.69 billion by 2034, expanding at a CAGR of 6.06% between 2024 and 2034.

Market Highlights

- North America is predicted to be an important region for the global market between 2024 and 2034.

- Asia Pacific is expected to expand at the fastest-growing region from 2025 to 2034.

- By type, the rooftop segment is predicted to grow at the highest CAGR from 2025 to 2034.

- By type, the ground-mounted segment is expected to grow at the fastest CAGR from 2025 to 2034.

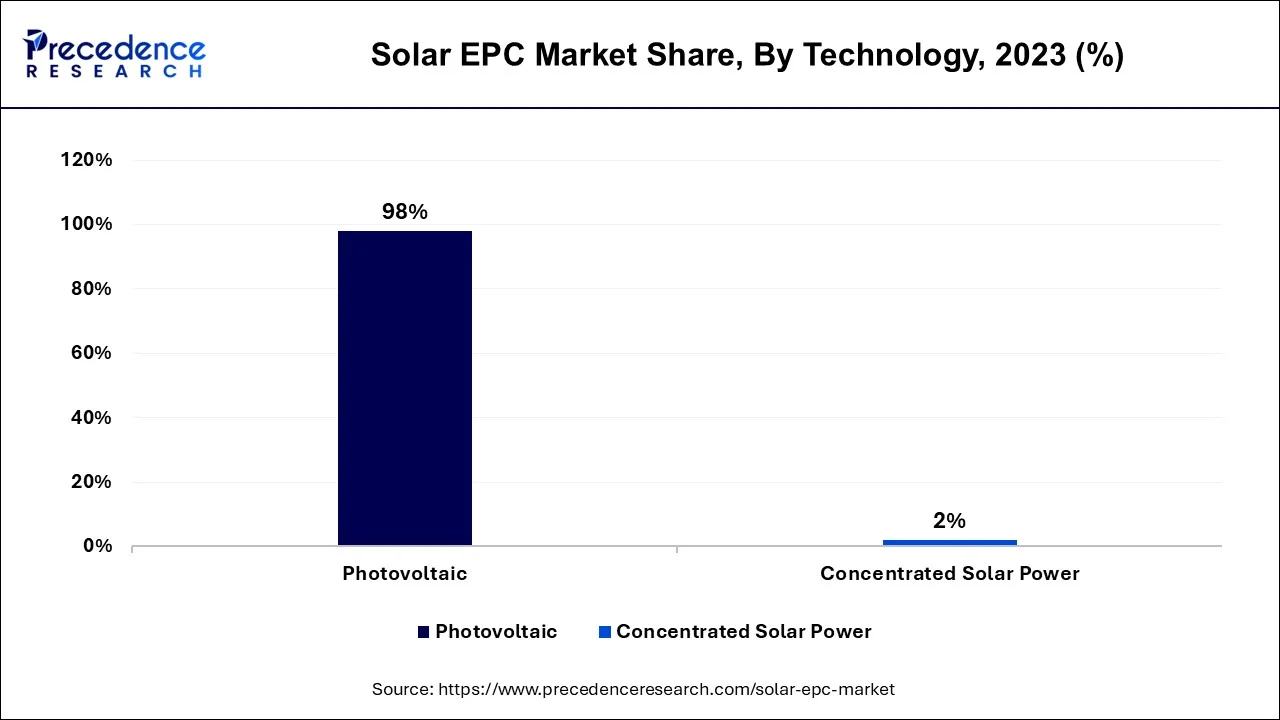

- By technology, the photovoltaic segment held the largest market share in 2023.

- By technology, the concentrated solar power segment is expected to expand at the fastest CAGR from 2025 to 2034.

- By end-user, the residential segment is expected to expand at a remarkable CAGR from 2025 to 2034.

- By end-user, the commercial segment is predicted to grow at a significant rate from 2025 to 2034.

Market Overview

Growing environmental concerns, as well as stringent regulatory mandates to reduce GHG emissions, are fueling the development of the Solar EPC Market. EPC is used to provide end-to-end solar services such as system design, component procurement, as well as project installation. Engineering design involves customer requirement analysis, site survey, weather monitoring, structural design, determining power generation capability, equipment selection, engineering design, and 3D modeling of the proposed solar power plant.

The growth factor, such as favorable government plans, which include investment tax credits, tax rebates, and FiT, along with the rising environmental concerns to limit GHG emissions, are projected to propel the Solar EPC industry. Furthermore, rising demand from end-user industries such as commercial, residential, industrial, utility, and institutional is also projected to propel the Solar EPC Market.

Solar EPC Market Outlook

- Industry Growth Overview: The Solar EPC market is expected to see robust and consistent growth between 2025 and 2030, driven by large-scale solar rollout initiatives aligned with national renewable energy transition plans. Growth is supported by favorable policy frameworks, green financing options, and the broader industry shift toward grid parity. Additionally, the rising adoption of decentralized solar microgrids in developing economies is boosting demand for modular and scalable EPC solutions.

- Technological Innovations:The solar EPC industry is undergoing a significant transformation driven by technological advancements, emphasizing automation, digitalization, and hybrid energy systems. Companies are adopting advanced project design software and real-time monitoring platforms to improve construction precision and reduce project timelines. Innovative solutions like floating solar farms and agrivoltaic systems are gaining traction in land-constrained regions, while bifacial panels and robotic cleaning systems are enhancing the efficiency and long-term output of large-scale solar installations.

- Global Expansion:Major solar EPC companies are strategically expanding into emerging markets to build strong project pipelines and leverage government-backed policy incentives. Regions like Southeast Asia, the Middle East, Africa, and Latin America are particularly attractive due to abundant solar resources, extensive grid infrastructure, and supportive renewable energy programs. Companies such as Canadian Solar are actively increasing their EPC and development activities in countries like Brazil, Indonesia, and the UAE to capitalize on the rapidly growing utility-scale solar project market.

- Major Investors:The solar EPC sector is increasingly attracting institutional investors, private equity, and sovereign wealth funds seeking sustainable infrastructure assets. Major investors such as BlackRock, Brookfield Renewable Partners, KKR, and Macquarie Group are actively investing in solar developer projects and EPC consortia to build long-term, ESG-aligned portfolios. Rising global interest in the clean energy transition has also encouraged financial institutions to launch green bonds and climate-focused funds specifically aimed at supporting EPC-driven solar expansion.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 264.23 Billion |

| Market Size in 2026 | USD 280.25 Billion |

| Market Size by 2034 | USD 448.69 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 6.06% |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Type, By End-User and By Technology and region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Drivers

Concerns regarding fuel demand are growing

Due to the ongoing debate over the degradation of the environment, the worldwide solar EPC industry has gained significant traction. Significant increases in consumer environmental issues, as well as the adoption of different stringent rules to lower greenhouse gas (GHG) emissions, forced organizations to implement impactful energy-saving methods such as solar EPC. Considerable improvements and modifications, as well as enhanced cost, are expected to benefit the market in the coming years.

Rising electricity demand

Global power consumption increased considerably as a result of growth in population and economic activity. The rising standard of living and infrastructure development is driving the requirement for power generation. To meet rising demand, most countries are constructing new solar power plants or widening the capacity of currently operational ones. This is expected to encourage the growth of the solar power sector, generating potential for key players in the solar EPC market over the forecast period.

Restraints

Investment, as well as a lack of facilities, continue to pose a risk to market expansion

The overall expenditure for solar PV is greater than the expense of installing routine solar panels, which may limit its approval in residential houses with low energy demands. For instance, 15 ground-mounted 300-watt solar panels would cost USD 14,625. With each solar panel costing an additional USD 500 due to the solar structure, the solar power generation structure is used less frequently. Furthermore, a shortage of facilities is a barrier to investment in this market. Lack of knowledge regarding the advantages of solar PV over primary grid electricity in countries like Asia-Pacific and Europe may hinder market expansion.

Opportunities

As solar tariff barriers fall, large IPPs and incorporated utilities are likely to invest in internal EPC capabilities in order to improve the project economy, boosting the percentage of industries with in-house EPC features. This changing industry trend may result in the consolidation of the Solar EPC market. As a result, stand-alone EPC companies are anticipated to merge with larger players or incorporate into full project developers and power producers. Furthermore, the rise of automation technology has resulted in leaner operations, resulting in higher initial capital costs but larger savings over the project's lifetime. Due to the growing usage of information technology in the solar energy sector, automation is going to have to be included as a key component.

Segment Insights

Type Insights:

The rooftop segment is anticipated to grow at the highest CAGR from 2025 to 2034. The rooftop sector is projected to be in high demand since it receives a greater quantity of solar power than ground mounted. Solar EPC rooftop segment involves several steps, including site assessment, system design, equipment procurement, installation, and commissioning. Rooftop solar installations have become increasingly popular in recent years due to the declining cost of solar panels, government incentives, and increasing environmental awareness. These installations provide numerous benefits, including lower electricity bills, reduced carbon emissions, and increased energy independence.

The ground-mounted sector is expected to expand at the fastest CAGR from 2025 to 2034. A ground-mounted solar energy system is installed on the ground rather than on a rooftop. Ground-mounted solar systems offer several advantages over rooftop systems, including the ability to install larger systems, improved energy production due to optimal panel orientation and tilt, and easier maintenance and cleaning. Ground-mounted solar systems are typically larger in size and capacity than rooftop systems and are often used for utility-scale or commercial projects.

Technology Insights

The photovoltaic sector held a maximum market share in 2023, and this trend is expected to continue during the projected period due to ongoing initiatives and growth in the energy sector. Photovoltaic technology converts sunlight into electricity by using a semiconductor material, such as silicon, to create an electric field. When sunlight hits the semiconductor material, it releases electrons, which are captured and used to generate electricity. Solar EPC (Engineering, Procurement, and Construction) refers to the process of designing, procuring, and building solar power plants or solar energy systems. These are widely used due to their adoption in various industrial sectors.

The concentrated solar power sector is anticipated to expand at the fastest CAGR from 2025 to 2034. CSP installation is expected to increase in the solar EPC industry because of greater efficiency, lower operating expenses, installation simplicity, and lower carbon emissions. Furthermore, a significant decrease in the price of plant components due to tax and duty revisions or improvements has impacted technological deployment. Ongoing manufacturing trends have encouraged solar deployments around the world, which is expected to boost product demand even further.

End-User Insights

Due to the favorable regulatory scheme as well as rapid technological advancement, the residential sector is projected to expand rapidly in this industry from 2025 to 2034. The residential segment of solar EPC involves installing solar energy systems in residential buildings, such as single-family homes, townhouses, and apartments. The residential segment of solar EPC is gaining popularity as more homeowners are looking to reduce their energy bills and carbon footprint. The solar energy systems installed in residential buildings typically include solar panels, inverters, and a monitoring system.

The solar panels are installed on the roof of the building or in a location with optimal sunlight exposure. The inverters convert the direct current (DC) power generated by the solar panels into alternating current (AC) power that is used in the home or fed back into the grid. The monitoring system allows homeowners to track the performance of their solar energy system.

The commercial sector is anticipated to grow at a remarkable pace from 2025 to 2034. Solar EPC for a commercial project involves several steps, including site assessment, design and engineering, procurement, installation, commissioning and testing, and ongoing monitoring and maintenance. Working with an experienced solar EPC contractor is crucial to ensure the successful installation and long-term performance of a commercial solar power system.

Regional Insights

U.S. Solar EPC Market Analysis

The U.S. Solar EPC market has been dominated by utility-scale projects, driven by stringent renewable energy mandates, federal tax incentives, and large corporate clean energy procurement. Integration of energy storage and grid-interactive technologies has become essential for stabilizing the grid and optimizing energy output. Looking ahead, the commercial and industrial (C&I) segment is expected to drive future growth, fueled by rising rooftop solar adoption and reforms in net-metering policies.

North America is expected to be an important region for the Solar EPC Market during the projected period. As one of the industrialized regions, the energy and power sectors are critical to the operations of many companies in this region. This is one of the key elements driving the Solar Engineering, Procurement, and Construction (EPC) Market in these areas. The solar EPC segment in North America is highly competitive, with many companies vying for a share of the growing market. Some of the top solar EPC companies in North America include First Solar, SunPower, Swinerton Renewable Energy, and Mortenson. These companies provide turnkey solar solutions, from design and engineering to procurement and construction.

What Makes Asia Pacific the Fastest-Growing Market for Solar EPC?

During the projected period, Asia Pacific is expected to be one of the fastest-growing regions for the Solar Engineering, Procurement, and Construction (EPC) Market. The demand in this region is anticipated to be driven by several of the fastest emerging markets and the rising need for power and energy to support a large population and numerous industries. India and China are expected to have significant demand during the projected period.

India Solar EPC Market Analysis

India continues to lead the market in Asia-Pacific, driven by the National Solar Mission and large utility-scale solar park tenders. Major construction and EPC firms such as Adani Solar, Sterling and Wilson, and Tata Power Solar are capitalizing on favorable policies and rapid capacity expansions in states like Rajasthan, Gujarat, and Tamil Nadu. Additionally, the development of green hydrogen plants and solar-powered industrial zones is strengthening India's position as a global EPC powerhouse.

How is the Opportunistic Rise of Europe in the Solar EPC Market?

The market in Europe is expected to grow at a notable rate in the upcoming period, driven by the EU's Fit for 55 initiative and strong decarbonization policies. EPC contractors are focusing on deploying high-efficiency solar modules and grid-integrated renewable networks to meet growing carbon-neutral energy demand. Supportive policies, along with long-term financing from institutions like the European Investment Bank (EIB), continue to position Europe as a high-potential region for innovative solar EPC development.

German Solar EPC Market Analysis

Germany leads the market with its policy of Energiewende and has achieved the highest levels of photovoltaic installations in Europe in history. The country's focus on decentralized and community-based solar energy production has provided a steady market for EPC companies involved in small to medium-scale project development. Policy incentives and financing support from KfW Bank and the EU Green Deal funds underpin Germany's dominance in the European solar EPC market.

How Big is the Opportunity for the Solar EPC Market in Latin America?

Latin America offers significant opportunities for market expansion, driven by utility-scale projects primarily in Brazil, Chile, and Mexico. Large ground-mounted solar farms are increasingly cost-effective due to high solar irradiance and competitive power auction mechanisms. The growth is further supported by expanded renewable energy financing from regional institutions like the Inter-American Development Bank (IDB) and private renewable investment funds, boosting EPC adoption across the region.

Brazil Solar EPC Market Trends

Brazil leads the market in Europe, supported by abundant solar irradiance, competitive power auctions, and pro-renewable energy policies. Large utility-scale projects in Minas Gerais and Bahia have attracted major EPC developers, often under long-term power purchase agreements. Government-backed credit schemes via BNDES, combined with growing private sector participation, are expected to accelerate the solar EPC project pipeline in the country.

What Factors Boost the Growth of the Middle East & Africa Solar EPC Market?

The market in the Middle East & Africa is expanding due to ambitious government renewable energy programs and ample land availability. Strategic partnerships with international firms like Bechtel, ACWA Power, and Masdar have enhanced project efficiency and facilitated funding access. Ongoing policy reforms, global investment inflows, and technology localization are expected to strengthen long-term solar EPC growth in the region.

UAE Solar EPC Market Trends

The UAE leads the Middle East & Africa solar EPC market, driven by large-scale projects under the Dubai Clean Energy Strategy and Abu Dhabi Vision 2030. Flagship developments like the Mohammed bin Rashid Al Maktoum Solar Park, executed by global EPC leaders such as Bechtel, ACWA Power, and Masdar, highlight the UAE's commitment to utility-scale renewable capacity. Supportive policies, strong international funding partnerships, and continuous R&D are expected to position the UAE as a key hub for innovation and investment in the regional solar EPC industry.

Solar EPC Market – Value Chain Analysis

- Raw Material Sourcing The foundation of solar EPC operations begins with the extraction and supply of essential materials required for solar module and infrastructure production — including silicon, glass, aluminum, copper, and steel. These materials are crucial for manufacturing photovoltaic cells, mounting structures, cabling, and inverters.

• Key Players: Wacker Chemie AG, GCL-Poly Energy Holdings, OCI Company Ltd., Alcoa Corporation, Jiangxi Copper Co. Ltd. - Component ManufacturingRaw materials are processed into critical solar components such as photovoltaic (PV) cells, modules, inverters, mounting systems, and tracking equipment. These components form the technological backbone of solar power generation systems.

• Key Players: LONGi Green Energy Technology, Trina Solar, JinkoSolar, First Solar, Sungrow Power Supply Co. - Project Design and EngineeringEngineering firms and EPC contractors design the system layout, perform feasibility and environmental studies, and plan electrical and civil works to optimize energy yield and cost efficiency. This phase involves grid connection design, site assessment, and detailed engineering documentation.

• Key Players: Bechtel Corporation, Sterling and Wilson Renewable Energy, Black & Veatch, Juwi AG, Canadian Solar. - Procurement and LogisticsThis stage focuses on sourcing and supplying all required components, balance-of-system parts, and materials. Efficient logistics, supplier management, and cost optimization are critical for project success, especially for utility-scale solar farms.

• Key Players: Adani Solar, Siemens Energy, ABB Ltd., Schneider Electric, Huawei Digital Power. - Construction and InstallationEPC contractors oversee site preparation, mounting structure assembly, module installation, electrical connections, and grid tie-in. Safety, quality assurance, and on-time execution are key in this labor-intensive phase.

• Key Players: Belectric Solar & Battery, Blattner Energy, Swinerton Renewable Energy, Strata Solar, ENERPARC AG. - Commissioning and Grid IntegrationOnce construction is complete, the project undergoes system testing, performance validation, and grid synchronization to ensure optimal efficiency and regulatory compliance.

• Key Players: Black & Veatch Holding Co., DEPCOM Power, Renewable Energy Systems Ltd., Sika AG. - Operations and Maintenance (O&M)Post-installation, long-term O&M ensures consistent performance through remote monitoring, cleaning, repairs, and performance optimization of solar assets. This stage directly impacts plant lifespan and return on investment.

• Key Players: First Solar, Sterling and Wilson Pvt. Ltd., Adani Group, ENERPARC AG, Juwi AG. - Power Distribution and End UseThe generated solar energy is transmitted to utilities, grid operators, or commercial consumers, contributing to renewable energy targets and carbon reduction goals.

• Key Players: Tesla Energy, ENGIE, Iberdrola, EDF Renewables, TotalEnergies.

Solar EPC Market Companies

- Canadian Solar (Canada): A leading integrated solar company delivering EPC, module manufacturing, and energy storage solutions for large-scale solar projects worldwide.

- Bechtel Corp. (USA): A global engineering and construction powerhouse, Bechtel provides full-scope EPC services for utility-scale solar and hybrid renewable energy facilities.

- BELECTRIC Solar & Battery Holding GmbH (Germany): Specializes in solar power plant construction and battery storage integration with a strong focus on grid stability and efficiency.

- Alas Solar System LLC (UAE): Offers end-to-end solar EPC and O&M services across the Middle East, emphasizing commercial and industrial solar installations.

- Adani Group (India): Through Adani Solar, the group develops and constructs utility-scale solar projects, integrating manufacturing, EPC, and renewable infrastructure capabilities.

- Xylem (USA): While primarily a water technology leader, Xylem provides solar-powered water pumping and smart infrastructure solutions supporting renewable-powered utilities.

- ENERPARC AG (Germany): A global EPC and asset manager known for designing, building, and operating large-scale solar power plants across Europe, Asia, and North America.

- Blattner Energy (USA): A top EPC contractor specializing in renewable energy infrastructure, with extensive expertise in large solar farms and hybrid energy systems.

- Qcells (South Korea/Germany): A major solar technology provider delivering modules, energy storage, and turnkey EPC services for utility and distributed generation projects.

- Sterling and Wilson Pvt. Ltd. (India): One of the world's largest solar EPC companies, delivering high-efficiency utility-scale solar and hybrid power solutions globally.

- Juwi AG (Germany): A leading renewable project developer and EPC contractor offering solar, wind, and hybrid energy plant engineering and implementation.

Recent Developments

- In October 2025, Germany's ABO Energy GmbH & Co KGaA expanded its portfolio to include EPC services for solar and solar-storage projects, aiming to deliver technically and economically optimized solutions that enhance resource efficiency and earnings growth.

- In July 2025, India's Solex Energy Limited launched two advanced high-performance solar products as part of its strategic expansion in Rajasthan, reinforcing its commitment to providing robust and climate-resilient solar technologies to meet the region's rising renewable energy needs.

Segments Covered in the Report

By Type

- Rooftop

- Ground Mounted

By End-User

- Commercial

- Residential

- Industrial

- Others

By Technology

- Photovoltaic

- Concentrated Solar Power

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- The Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting