What is the Space Division Multiplexing Devices Market Size?

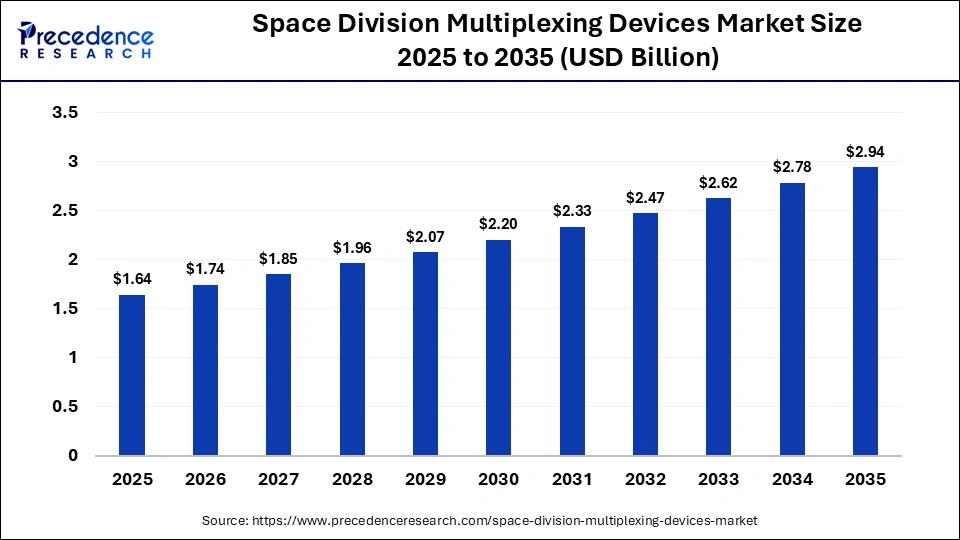

The global space division multiplexing devices market size was calculated at USD 1.64 billion in 2025 and is predicted to increase from USD 1.74 billion in 2026 to approximately USD 2.94 billion by 2035, expanding at a CAGR of 6.00% from 2026 to 2035.The market is driven by increasing demand for high-quality 5G networks from the military and defense sector.

Market Highlights

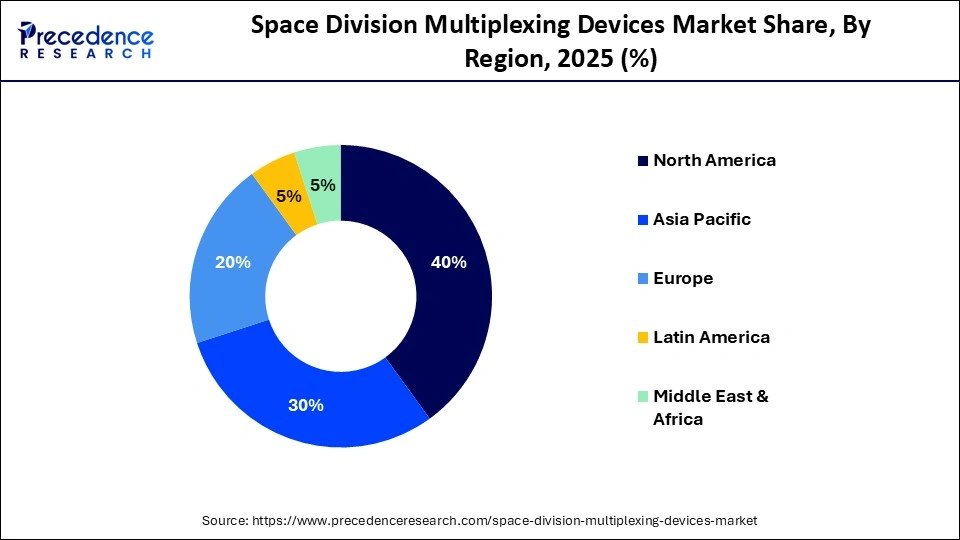

- North America led the space division multiplexing devices market with a share of 40% in 2025.

- Asia Pacific is expected to grow at a robust CAGR of 6.5% during the forecast period.

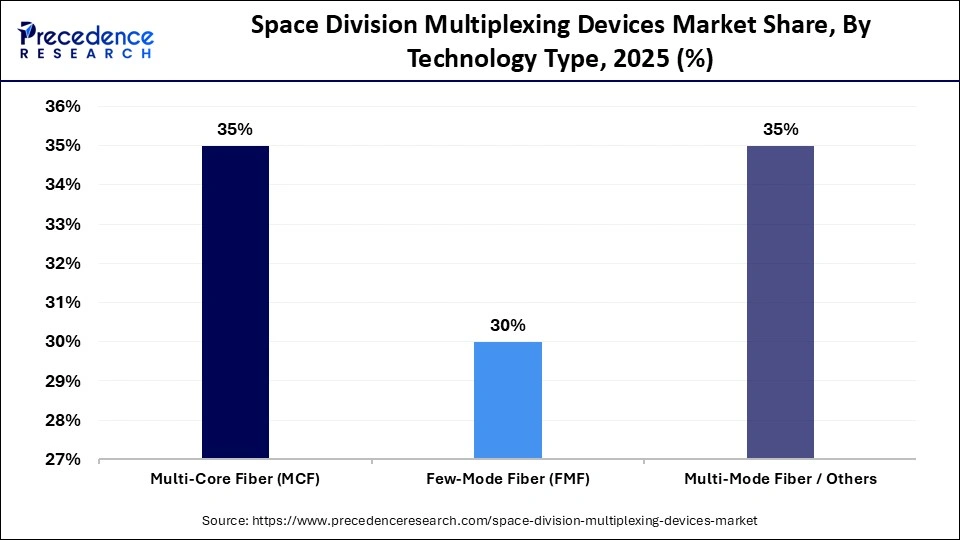

- By technology type, the multi-core fiber (MCF) segment held the largest market share of 35% in 2025.

- By technology type, the few-mode fiber (FMF) segment is expected to grow at the highest CAGR of 5.6% between 2026 and 2035.

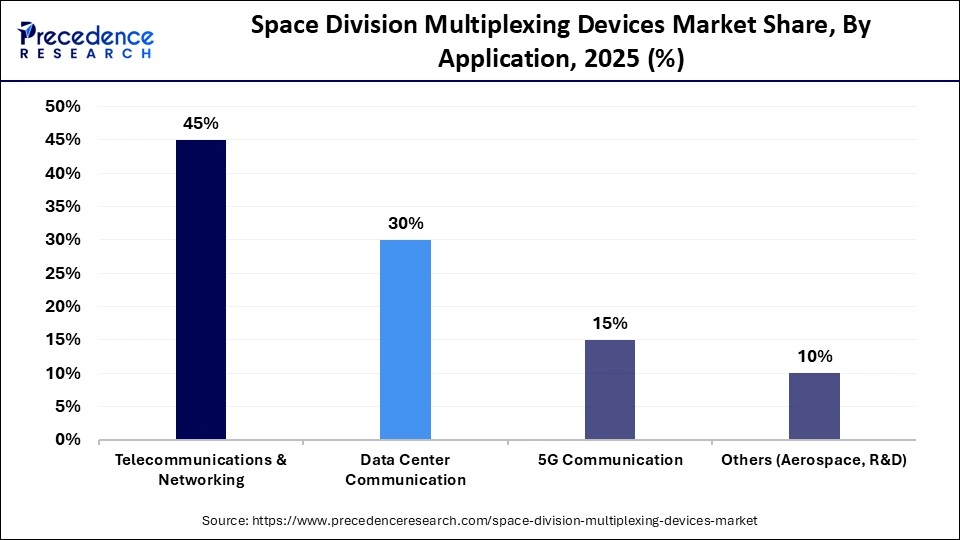

- By application, the telecommunications & networking segment held the largest share of 45% in 2025.

- By application, the 5G communication segment is expected to expand with the fastest CAGR of 5.1% during the forecast period.

- By device / form factor, the multiplexers/demultiplexers segment held the highest market share of 40% in 2025.

- By device / form factor, the optical fiber cables segment is expected to grow at a significant CAGR during the forecast period.

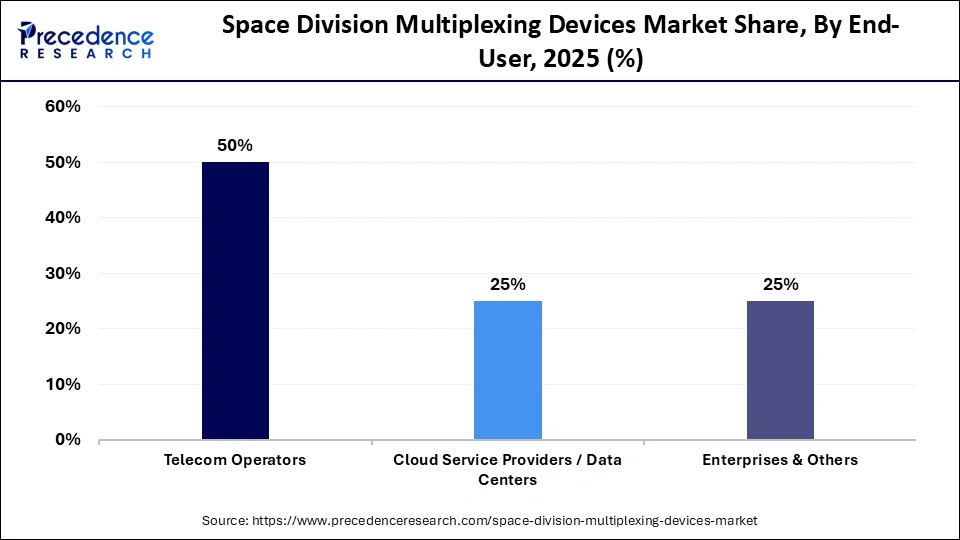

- By end-user, the telecom operators segment dominated the market with a major share of 50% in 2025.

- By end-user, the enterprises & others segment is expected to expand with the highest CAGR of 5.5% during the forecast period.

Transforming Optical Networks: Space Division Multiplexing Devices Market Overview

The space division multiplexing devices industry is a prominent segment of the IT sector. This industry deals with the production and distribution of multiplexing devices. Space division multiplexing (SDM) devices are advanced electronics components that help in increasing communication capacity by transmitting multiple data streams through parallel spatial paths. SDM devices such as multi-core/few-mode fibers, spatial multiplexers/demultiplexers, and related hardware are critical for high-bandwidth applications in telecommunications, data centers, 5G networks, satellite, and long-distance communications.

The increasing demand for multiplexers and couplers from cable TV operators is driving the market. Moreover, surging data demand, fiber-optic upgrades, next-generation network rollouts, and the expansion of the telecom industry across the globe are contributing to market growth.

How is AI Impacting the Space Division Multiplexing Devices Market?

Advancements inartificial intelligence significantly impacted the development of the telecom and IT industries. AI has been deployed in the telecom sector to enhance network optimization & maintenance, enhance consumer experience, increase operational efficiency, fraud detection, and IoT management. Additionally, AI is integrated into space division multiplexing devices for optical network optimization, reducing latency, on-device processing, data routing, and improving signal quality. AI also enables predictive maintenance, allowing SDM devices to proactively detect faults and optimize performance, leading to reduced downtime and enhanced network reliability.

- In March 2025, AMD, Cisco, and Nokia collaborated with Jio Platforms Limited (JPL). This collaboration is inaugurated to launch a new AI platform to enhance security and efficiency in the telecom sector.

Space Division Multiplexing Devices Market Trends

- Partnerships: Numerous connectivity providers are partnering with telecom operators to deploy advanced networking solutions globally. For instance, in January 2026, Nokia partnered with Constl. This partnership aims to deploy a dense wavelength-division multiplexing (DWDM) optical transport network in India.

- Product Launches: Various market players are launching different types of multiplexing devices for end-user industries. For instance, in September 2025, Nexperia launched NMUX27518-Q100, a 2:1 multiplexer designed specifically for the automotive sector

- Government Investments: The governments of several nations, including Morocco, India, the UK, Canada, and the U.S., are investing rapidly in strengthening the 5G infrastructure. For instance, in July 2025, the government of Morocco announced an investment of US$ 8 billion. This investment is made to develop the 5G infrastructure in this nation.

- Demand for High Speed Data Transmission: As bandwidth requirements grow with cloud computing, streaming services, and 5G rollout, SDM devices are increasingly adopted to support high-capacity optical networks.

Expansion of Satellite and Telecom Networks: Growth in satellite communications and 5G/next generation networks is accelerating demand for SDM devices to enhance connectivity, reduce latency, and handle increasing data volumes.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 1.64Billion |

| Market Size in 2026 | USD 1.74 Billion |

| Market Size by 2035 | USD 2.94Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 6.00% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Technology Type, Application,Device/Form Factor, End-User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segment Insights

Technology Type Insights

Why Did the Multi-Core Fiber (MCF) Segment Dominate the Market?

The multi-core fiber (MCF) segment dominated the space division multiplexing devices market with a major revenue share of 35% in 2025. This is mainly due to the increased usage of multi-core fiber in the telecom sector to increase data transmission capacity and network efficiency. MCF enables multiple spatial channels within a single fiber, supporting high-speed, high-bandwidth communication required for modern networks, including 5G, data centers, and long-haul optical systems. Additionally, its growing application in 3D shape sensing and strain/temperature monitoring is expected to sustain segmental dominance in the coming years.

The few-mode fiber (FMF) segment is expected to grow at the highest CAGR of 5.6% between 2026 and 2035. This is mainly due to the surging use of FMF for higher power transmission in optical amplifiers and fiber lasers. It supports multiple spatial modes, which significantly increases data transmission capacity while maintaining signal integrity over long distances. Also, numerous advantages of this technology, such as superior transmission capability, enhanced sensing capability, and optimized performance, are expected to boost its adoption.

Device / Form Factor Insights

What Made Multiplexers Demultiplexers the Leading Segment in the Space Division Multiplexing Devices Market?

The multiplexers/demultiplexers segment led the market while holding a 40% share in 2025. This is mainly due to the increased use of multiplexers for combining multiple data streams into one channel in communication systems. These devices are pivotal in managing and directing the high-capacity data channels facilitated by SDM technologies. The growing demand for bandwidth in telecommunications, cloud computing, and data center applications also bolstered segmental growth.

The optical fiber cables segment is expected to grow at a significant CAGR during the forecast period. The growth of the segment is driven by the growing use of optical fiber cables to transmit voice, data, and video signals over long distances at extremely high speeds. These cables are essential for implementing multi-core and few-mode fiber technologies, which allow multiple spatial channels in a single fiber, significantly increasing bandwidth and network efficiency. Additionally, the increasing application of these cables in the military sector due to the need for high bandwidth is expected to accelerate the growth of the segment.

Application Insights

How Does the Telecommunication & Networking Segment Dominate the Space Division Multiplexing Devices Market?

The telecommunications & networking segment dominated the market with a 45% share in 2025. This is mainly due to the high usage of advanced multiplexers in the telecom industry for expanding internet facilities in different regions. SDM devices, including multi-core and few-mode fibers, multiplexers, and demultiplexers, are critical for enabling faster data transfer, long-haul communication, and efficient bandwidth management in telecom networks and data centers. The segment's dominance is further reinforced by surging investments by telecom providers to rollout 5G networks and advanced devices in their networking centers.

The 5G communication segment is expected to expand at a robust CAGR of 5.1% during the forecast period. The growth of the segment is attributed to the increasing demand for high-quality 5G networks from the cloud service providers to transfer data at a faster pace. Also, the rapid investment by the governments of several nations to develop the 5G infrastructure, along with the surging popularity of 5G communication in developed nations, is playing a prominent role in contributing to segmental growth. Moreover, collaborations among tech providers and AI companies to develop AI-integrated 5G processors are expected to boost the growth of the segment.

End-User Insights

Why Did the Telecom Operators Segment Dominate the Space Division Multiplexing Devices Market?

The telecom operators segment dominated the market while holding a 50% share in 2025. This is primarily due to the increased demand for high-quality multiplexing devices from telecom operators to enhance bandwidth efficiency in fiber optics. The rapid investment by the government for strengthening the telecom infrastructure, along with partnerships among telecom operators and chip manufacturers to develop advanced chips, bolstered the segment. Additionally, their focus on scalable and efficient solutions to meet rising connectivity demands ensures sustained adoption of SDM technologies.

The enterprises & others segment is expected to grow with the highest CAGR of 5.5% during the forecast period. The rising use of advanced multiplexing devices by enterprises to improve their operational efficiency is driving the segment. Also, the increasing application of demultiplexers in enterprises to optimize fiber utilization, increase bandwidth capacity, and reduce infrastructure costs is positively contributing to the market. The deployment of AI-based multiplexing devices is increasing in enterprises to enhance the efficiency of the network, which is expected to boost the growth of the segment.

Regional Insights

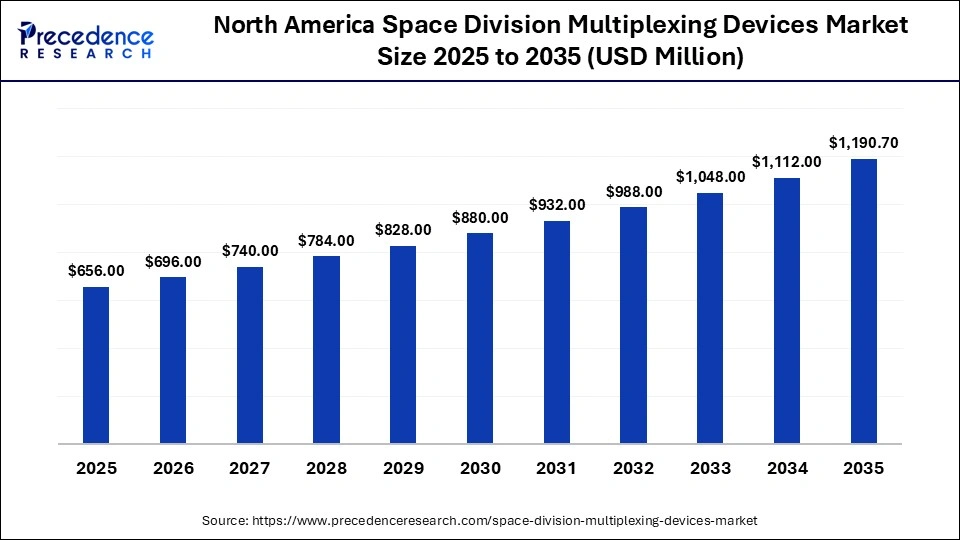

How Big is the North America Space Division Multiplexing DevicesMarket Size?

The North America space division multiplexing devicesmarket size is estimated at USD 656.00 million in 2025 and is projected to reach approximately USD 1,190.70 million by 2035, with a 26.14% CAGR from 2026 to 2035.

What Made North America the Dominant Region in the Space Division Multiplexing Devices Market?

North America dominated the space division multiplexing devices market by capturing the largest share of 40% in 2025. The dominance of the region in the market is mainly attributed to the increased demand for multiplexers and amplifiers from cloud service providers in several nations, including the U.S., Canada, and Mexico. Numerous government initiatives aimed at developing the 5G infrastructure, along with the rise in the number of telecom startups, also bolstered the market. Moreover, the presence of various market players, such as Finisar Corporation, Infinera Corporation, Lumentum Operations LLC, and Ciena Corporation, and rising investments in 5G networks and data centers are expected to sustain the region's long-term growth in the market.

- In April 2025, Lumentum Holdings Inc. launched indium phosphide (InP) photonic chip technologies. These chips are designed to deliver higher bandwidth and power-efficient connectivity for next-generation AI-driven data centers in the U.S.

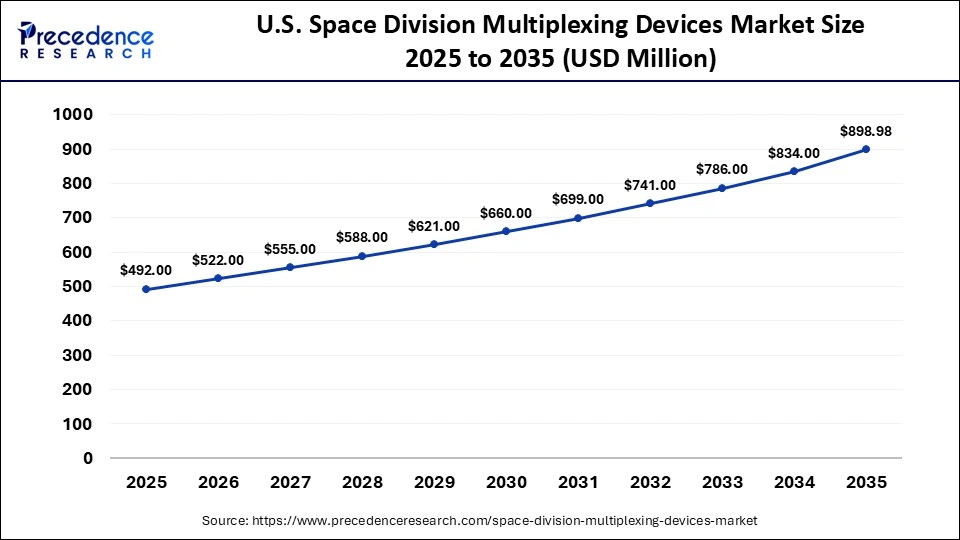

What is the Size of the U.S. Space Division Multiplexing DevicesMarket?

The U.S. space division multiplexing devices market size is calculated at USD 2 billion in 2025 and is expected to reach nearly USD 4 billion in 2035, accelerating at a strong CAGR of 2% between 2026 and 2035.

U.S. Space Division Multiplexing Devices Market Analysis

The market in the U.S. is growing due to a strong emphasis by telecom companies on expanding their network in remote areas, as well as technological advancements in the cloud sector. Also, the increasing use of advanced multiplexing devices from the aerospace sector, along with the growing demand for high-quality transceivers from cable operators, is playing a prominent role in shaping the industrial landscape.

Why is Asia Pacific Considered the Fastest-Growing Region in the Market?

Asia Pacific is expected to expand at the fastest CAGR of 6.5% during the forecast period. This is mainly due to the rising use of demultiplexers from the data centers in various nations, such as Japan, China, South Korea, and India. Rapid investment by the government for strengthening the defense and military sector, as well as the increase in the number of data centers, is positively contributing to the market. Moreover, the presence of numerous market players, such as Huawei Technologies Co., Ltd., Sumitomo Electric Industries, Fujitsu Limited, and Yangtze Optical Fibre, is expected to drive the growth of the space division multiplexing devices market in this region.

- In February 2025, Fujitsu launched an AI-enabled network technology in Japan. This solution is designed for optimizing 5G and optical networks in this nation.

Japan Space Division Multiplexing Devices Market Analysis

The market in Japan is expanding due to the rising investment by telecom service providers to expand their networks globally, as well as the increase in the number of cable TV operators. Rising demand for high-capacity, low-latency optical networks in enterprises, data centers, and telecom operators is driving adoption of SDM technologies. Additionally, significant investments in R&D, government initiatives supporting next-generation network deployment, and early adoption of advanced fiber-optic solutions contribute to the country's rapid market growth.

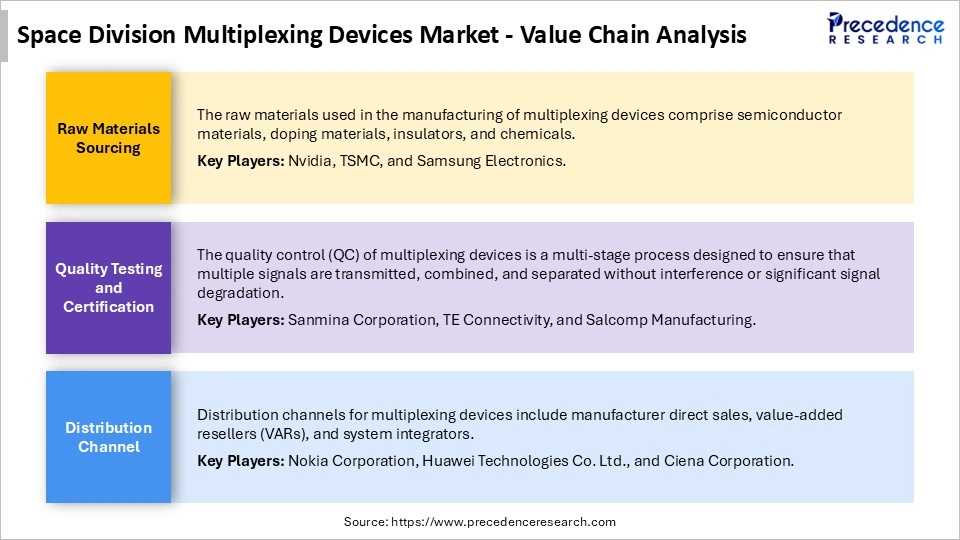

Space Division Multiplexing Devices MarketValue Chain Analysis

Who are the Major Players in the Global Space Division Multiplexing Devices Market?

The major players in the space division multiplexing devices market include Cisco Systems, Inc., Nokia Corporation, Ciena Corporation, Huawei Technologies Co., Ltd., infinera Corporation, ZTE Corporation, Lumentum Holdings Inc,. II-VI Incorporated (Coherent), Sterlite Technologies Limited, Prysmian Group, Fujitsu Limited, Sumitomo Electric Industries, Ltd,. NEC Corporation, Corning Incorporated, Furukawa Electric Co., Ltd

Recent Developments

- In November 2025, Exail launched Er: Yb optical fiber. This optical fiber is designed to enhance scalability in next-generation free-space communication systems.(Source: https://www.exail.com)

- In June 2025, CommScope launched the FiberREACH solution and CableGuide 360 platform. These solutions are designed to enhance networking capabilities across the world. (Source: https://www.commscope.com)

- In April 2025, Lightera launched AllWave FLEX 4X Multicore Fiber. AllWave FLEX 4X Multicore Fiber is an innovative fiber optic network solution designed for data centers.(Source: https://www.prnewswire.com)

Segments Covered in the Report

By Technology Type

- Multi-Core Fiber (MCF)

- Few-Mode Fiber (FMF)

- Multi-Mode Fiber / Others

By Application

- Telecommunications & Networking

- Data Center Communication

- 5G Communication

- Others (Aerospace, R&D)

By Device/Form Factor

- Multiplexers/Demultiplexers

- Optical Fiber Cables (MCF, FMF, etc.)

- Optical Amplifiers & Switches

- Others (Connectors, Transceivers)

By End-User

- Telecom Operators

- Cloud Service Providers / Data Centers

- Enterprises & Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting