What is Spare Parts Logistics Market Size?

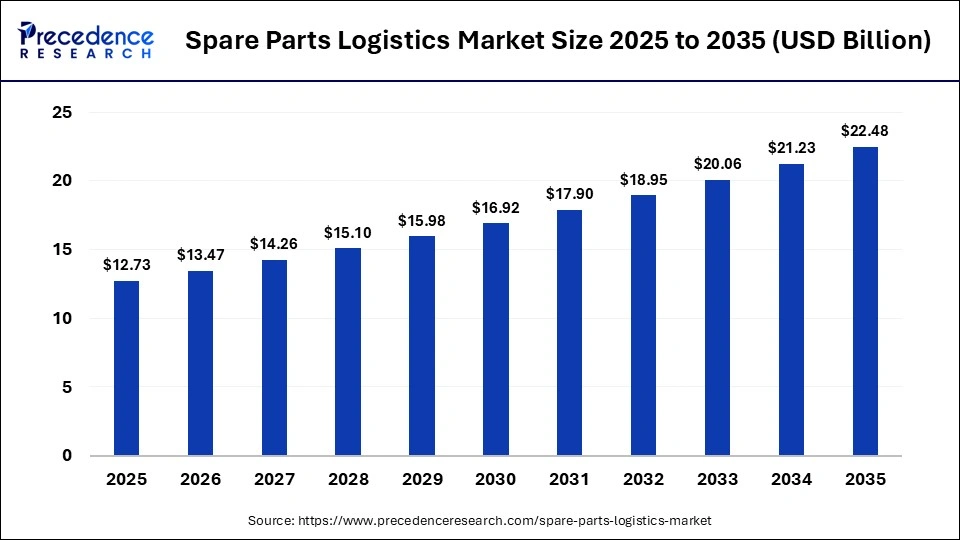

The global spare parts logistics market size was calculated at USD 12.73 billion in 2025 and is predicted to increase from USD 13.47 billion in 2026 to approximately USD 22.48 billion by 2035, expanding at a CAGR of 5.85% from 2026 to 2035, The market is driven by the growing need for efficient inventory management, rapid delivery, and minimized downtime across automotive, industrial, aerospace, and machinery sectors.

Market Highlights

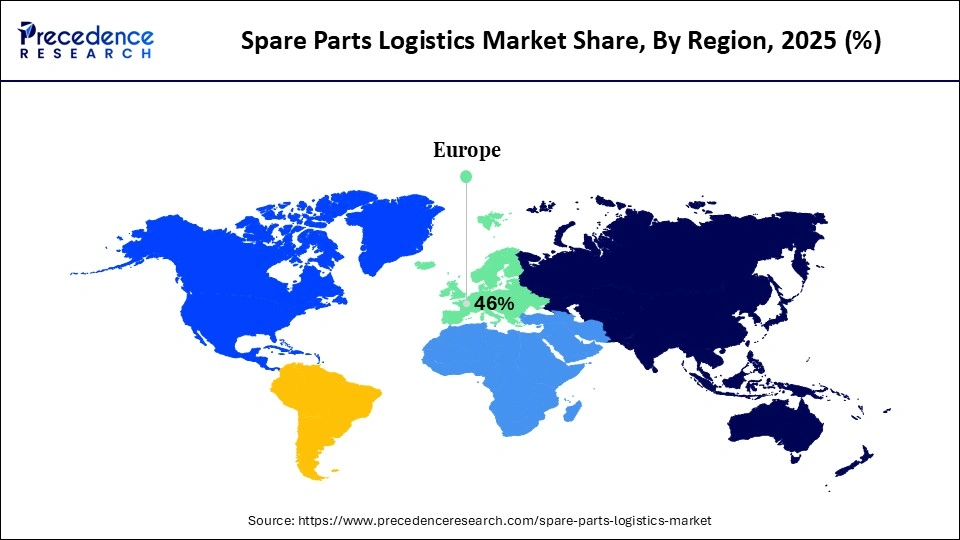

- Europe dominated the spare parts logistics market with a major share of 46% in 2025.

- By service type, the transportation segment accounted for the largest market share in 2025.

- By service type, the value-added services segment is expected to grow at a healthy CAGR between 2026 and 2035.

- By source channel, the OEM segment contributed the highest market share in 2025.

- By source channel, the independent aftermarket (IAM) segment is expected to grow at a robust CAGR between 2026 and 2035.

- By end-use industry, the automotive segment generated the biggest market share in 2025.

- By end-use industry, the healthcare equipment segment is expected to expand at the fastest CAGR between 2026 and 2035.

- By business type, the business-to-business (B2B) segment held a major market share in 2025.

- By business type, the business-to-consumer (B2C) segment is expected to expand at a notable CAGR from 2026 to 2035.

Market Overview

The spare parts logistics market encompasses the planning, storage, and rapid, often urgent, delivery of replacement components to minimize downtime for machinery, vehicles, and equipment. It focuses on sourcing, warehousing, and distributing spare parts to maintain service-level agreements and operational efficiency. Transportation often includes inventory management, warehousing, and value-added services such as reverse logistics and kitting. The market is driven by increased vehicle ownership, aging infrastructure, and the critical need to reduce downtime for high-value equipment.

Major Trends Influencing the Spare Parts Logistics Market

- Demand for AI-Driven Predictive Maintenance and Analytics: Many companies are adopting AI and ML to analyze data, anticipate spare parts demand, optimize inventory levels, and minimize equipment downtime for proactive replenishment.

- Rapid Digitization and IoT-Enabled Visibility: Real-time visibility platforms and IoT sensors are used to track, monitor, and manage inventory throughout the supply chain, ensuring faster, more accurate, and transparent operations.

- Shift towards 3D Printing and On-Demand Production: The growing use of 3D printing enables on-demand production of parts, drastically reducing lead times, shipping costs, and the need for large physical inventory warehouses.

- Sustainability and Green Logistics: There is a significant shift toward eco-friendly initiatives, including electric vehicles for last-mile delivery, optimized logistics routing, and circular supply chain practices focused on recycling and reusing parts.

How is AI Transforming the Spare Parts Logistics Market?

Artificial intelligence (AI) is transforming the spare parts logistics market by optimizing inventory levels, forecasting demand with high precision, and enhancing service levels, reducing stockouts and warehousing costs. By leveraging predictive algorithms, AI enables proactive maintenance to reduce downtime and automates warehousing and routing for faster, more efficient deliveries. AI analyzes historical data and market trends to predict demand for spare parts, helping to avoid both overstocking and understocking. Sensors on machines send real-time data to AI models, allowing organizations to predict when a part will fail and order replacements before downtime occurs.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 12.73 Billion |

| Market Size in 2026 | USD 13.47 Billion |

| Market Size by 2035 | USD 22.48 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 5.85% |

| Dominating Region | Europe |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | By Service Type,Source Channel,End-Use Industry,Business Type, and region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segment Outlook

Service Type Insights

What Made Transportation the Dominant Segment in the Spare Parts Logistics Market?

The transportation segment dominated the market with a major revenue share in 2025, primarily due to the need for timely, reliable, and efficient movement of parts across supply chains. The increasing demand for rapid delivery of spare parts is driven by the need to prevent costly machinery downtime, which creates a strong demand for specialized, fast, and reliable transportation services. In particular, high-speed, flexible, and last-mile delivery capabilities, especially in road transport, are essential for minimizing downtime in the automotive, manufacturing, and industrial sectors, ensuring efficiency, security, and real-time monitoring.

The value-added services segment is expected to grow at the fastest rate during the forecast period. This growth is mainly attributed to the necessity of moving parts and the rising demand for specialized, high-margin, and technology-driven services. Manufacturers increasingly prefer third-party logistics (3PL) providers to manage product kitting and light assembly in warehouses, which reduces the need for in-house assembly and accelerates the fulfillment process. Advanced VAS helps companies avoid stockouts and overstock scenarios, ensuring high parts availability while reducing holding costs.

Source Channel Insights

Why Did the OEM Channel Segment Lead the Spare Parts Logistics Market?

The OEM channel segment led the market with the largest share in 2025, driven largely by the high demand for quality, authentic parts, and strong brand partnerships along established supply chains. OEMs offer genuine parts that are critical for maintaining vehicle performance, safety, and warranties, making them the preferred choice for consumers. They also maintain a wide network of authorized dealers and service centers, ensuring high parts availability. The shift to electric vehicles has created a demand for specialized components, further solidifying their market position.

The independent aftermarket (IAM) segment is expected to grow at the fastest rate during the forecast period. This is primarily due to an aging global vehicle fleet, the cost advantage of independent parts, and the rapid expansion of e-commerce. Digital transformation in the automotive aftermarket and the rise of online parts distribution platforms have improved accessibility and delivery speed, making IAM parts a cheaper and more convenient alternative to OEM offerings. This shift is significantly boosting demand for efficient and specialized spare parts logistics providers.

End-Use Industry Insights

Why Did the Automotive Segment Dominate the Spare Parts Logistics Market?

The automotive segment dominated the market with the highest share in 2025, primarily due to the large and growing global vehicle fleet, high maintenance and repair frequency, and the complexity of multi-tiered supply chains for components. The increasing average age of vehicles drives continuous demand for replacement parts, while automakers' reliance on timely deliveries from global suppliers necessitates efficient and accurate logistics solutions. This combination of consistent demand, intricate supply networks, and the need for cost-effective operations makes the automotive sector the largest end-user in spare parts logistics.

The healthcare equipment segment is expected to expand at the fastest CAGR during the predicted timeframe. This growth is fueled by the increasing demand for hospitals, clinics, and home diagnostics to maintain critical medical devices with minimal downtime. The need for specialized logistics, such as GDP-compliant, cold-chain, and sterilized handling, drives the demand for high-precision, timely delivery services. Additionally, the adoption of technologies like IoT, AI, and blockchain for real-time tracking and enhanced supply chain visibility is further boosting the segment's growth.

Business Type Insights

What Made Business-to-Business (B2B) the Leading Segment in the Spare Parts Logistics Market?

The business-to-business (B2B) segment led the market in 2025, driven by large-volume, contractual, and high-frequency replenishment. Industrial procurement teams, manufacturers, and authorized service centers rely on B2B logistics, which focuses on consistent, scheduled replenishment rather than one-off purchases. These logistics services are crucial for the rapid, on-demand delivery of critical spare parts, helping keep machinery operational. This drives the need for advanced warehousing and last-mile delivery solutions, as well as the rapid adoption of digital B2B platforms and bulk procurement by manufacturers.

The business-to-consumer (B2C) segment is expected to experience the fastest growth in the market, primarily driven by the shift toward online sales of automotive, electronics, and home appliance parts. Rising demand for real-time tracking and visibility is fueling the need for faster, more efficient last-mile delivery solutions using GPS and AI technologies. Retailers are also integrating online and offline inventories to ensure product availability and enable immediate dispatch, enhancing consumer trust and adoption.

Regional Insights

What is the Europe Spare Parts Logistics Market Size and Growth Rate?

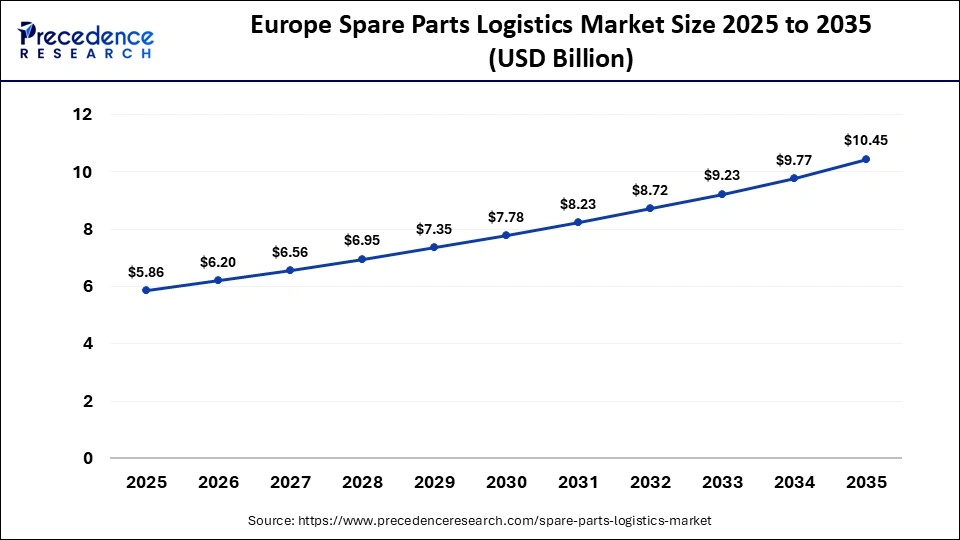

The Europe spare parts logistics market size has grown strongly in recent years. It will grow from USD 5.86 billion in 2025 to USD 10.45 billion in 2035 expanding at a compound annual growth rate (CAGR) of 5.96% between 2026 and 2035.

What Made Europe the Dominant Region in the Spare Parts Logistics Market?

Europe dominated the market by capturing the largest share in 2025 due to its well-established industrial base, advanced infrastructure, and strong automotive and manufacturing sectors. The presence of major OEMs and suppliers in the region drives high demand for efficient spare parts supply chains. Additionally, Europe benefits from robust logistics networks, advanced warehouse management systems, and integration of digital technologies such as IoT and AI for inventory optimization.

Germany Spare Parts Logistics Market Trends

Germany is one of Europe's largest manufacturing hubs, particularly for automotive, machinery, energy, and industrial equipment sectors. These industries require constant availability of spare parts to minimize downtime and ensure continuous operation, boosting the need for efficient logistics solutions. The growing emphasis on aftermarket services, maintenance efficiency, and fast delivery of critical components has further strengthened the country's leadership in the market within Europe.

What Makes Asia Pacific the Second-Largest Market for Spare Parts Logistics?

Asia Pacific is considered the second-largest market, holding a considerable share in 2025, and is expected to sustain its growth trajectory during the forecast period. This is mainly due to its role as a global manufacturing hub, rapid automotive production, and booming e-commerce. The region has the largest vehicle fleet and the highest production, leading to a surge in demand for aftermarket, repair, and replacement parts. China, Japan, and India serve as major manufacturing bases for automotive and electronics components, generating high demand for localized, efficient, and specialized logistics networks. Integration of AI-enabled predictive maintenance, digital freight platforms, and warehouse automation is accelerating logistics speed and reducing costs.

India Spare Parts Logistics Market Trends

India is an emerging market within the region, driven by initiatives like Make in India and a rapidly expanding, technology-driven logistics sector. Government initiatives like infrastructure status for logistics and PLI schemes have improved port facilities, cargo handling, and road networks, enabling better just-in-time delivery models. The sector is upgrading with AI-driven demand forecasting, real-time tracking, and automated, climate-controlled warehousing to improve efficiency and reduce delivery times.

How is the Opportunistic Rise of North America in the Spare Parts Logistics Market?

North America is expected to grow at a notable rate in the market, driven by the growing demand for efficient, just-in-time delivery solutions across automotive, industrial, and healthcare sectors. The rapid adoption of e-commerce, digital supply chain platforms, and advanced tracking technologies is enhancing visibility, speed, and accuracy in spare parts distribution. Additionally, increasing investments in modern warehousing, cold-chain logistics, and last-mile delivery infrastructure are creating opportunities for market expansion in the region.

U.S. Spare Parts Logistics Market Trends

The market in the U.S. is growing due to the large and aging vehicle fleet, high maintenance requirements, and the need for timely replacement of automotive and industrial components. The rapid rise of e-commerce and digital procurement platforms is boosting demand for faster, more efficient delivery and real-time tracking of spare parts. Additionally, investments in advanced warehousing, cold-chain solutions, and last-mile logistics are supporting the expansion of the market across automotive, healthcare, and industrial sectors.

Who are the Major Players in the Global Spare Parts Logistics Market?

The major players in the spare parts logistics market are DHL Supply Chain, DSV / DSV Panalpina , CEVA Logistics, UPS Supply Chain Solutions, DB Schenker, FedEx Logistics, Nippon Express, XPO Logistics, Ryder System, Inc., Geodis, Kerry Logistics Network, Yusen Logistics, Expeditors International, TVS Supply Chain Solutions, Rhenus Logistics, and Dachser

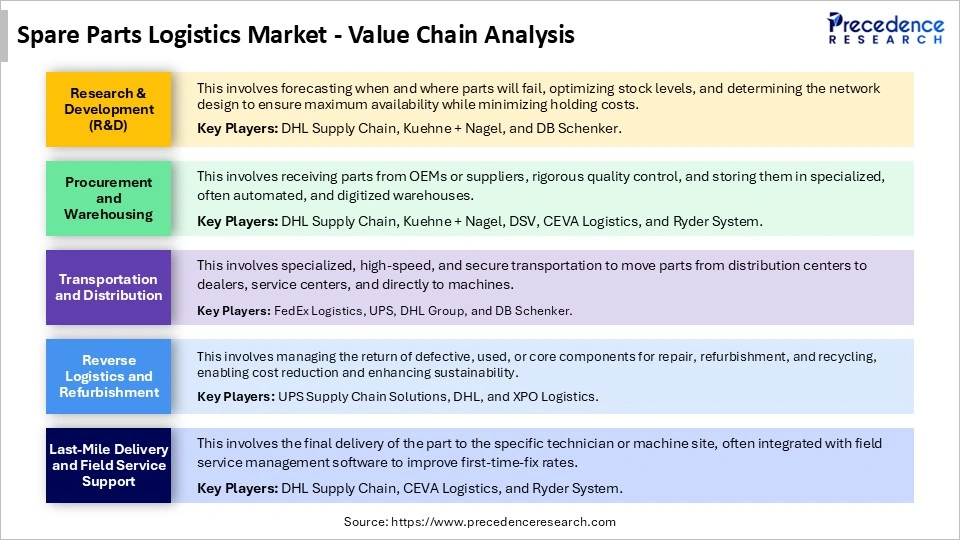

Spare Parts Logistics MarketValue Chain Analysis

Recent Developments

- In December 2025, YCH India expanded its nationwide Forward Stocking Location network with four Distribution Centres and advanced digital systems to enhance aftermarket spare-parts logistics, aiming to reduce turnaround times and improve service reliability for manufacturers and service providers. (Source:https://www.itln.in)

- In November 2025, Ascendo AI announced the release of its advanced AI-based Spares Planning and Prescriptive Service Intelligence capabilities. As enterprises navigate tariff turmoil and rising costs, sectors such as telecom and medical devices are leveraging AI to enhance operations. Ascendo AI's new system predicts spare parts demand accurately, prevents SLA failures, and reduces inventory costs through a self-improving multi-agent approach. (Source:https://aithority.com/machine-learning)

Segments covered in the Report

By Service Type

- Transportation

- Road

- Air

- Sea

- Rail

- Warehousing & Distribution

- Value-Added Services

By Source Channel

- OEM Channel

- Independent Aftermarket (IAM)

By End-Use Industry

- Automotive

- Aerospace & Defense

- Electronics & Semiconductors

- Industrial Machinery & Heavy Equipment

- Energy & Power

- Healthcare Equipment

- Maritime & Shipbuilding

- Others

By Business Type

- Business to Business (B2B)

- Business to Consumer (B2C)

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content