What is the Specimen Collection Cards Market Size?

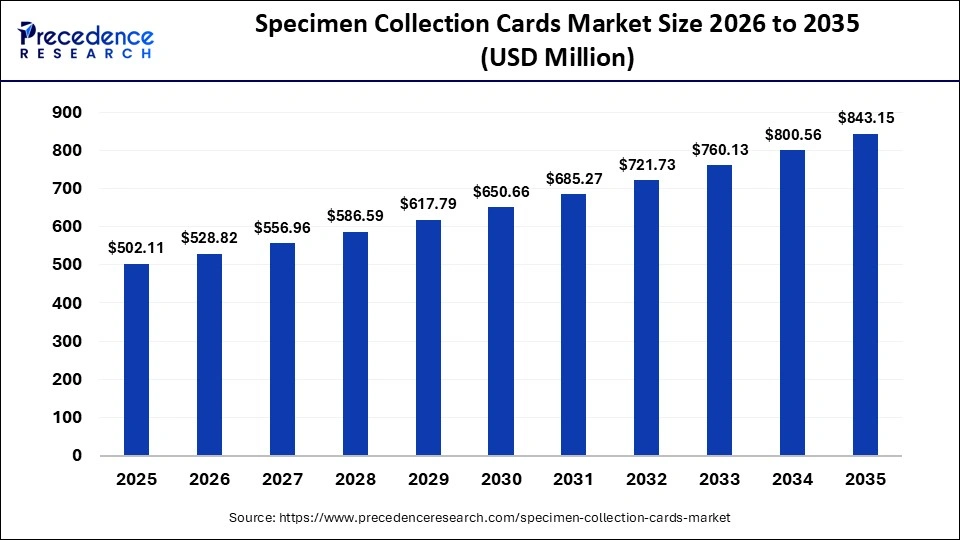

The global specimen collection cards market size accounted for USD 502.11 million in 2025 and is predicted to increase from USD 528.82 million in 2026 to approximately USD 843.15 million by 2035, expanding at a CAGR of 5.32% from 2026 to 2035. The market is driven by the expansion of modern healthcare infrastructure, the increasing prevalence of infectious diseases worldwide, the growing need for newborn screening, and ongoing technological advancements in specimen collection cards.

Market Highlights

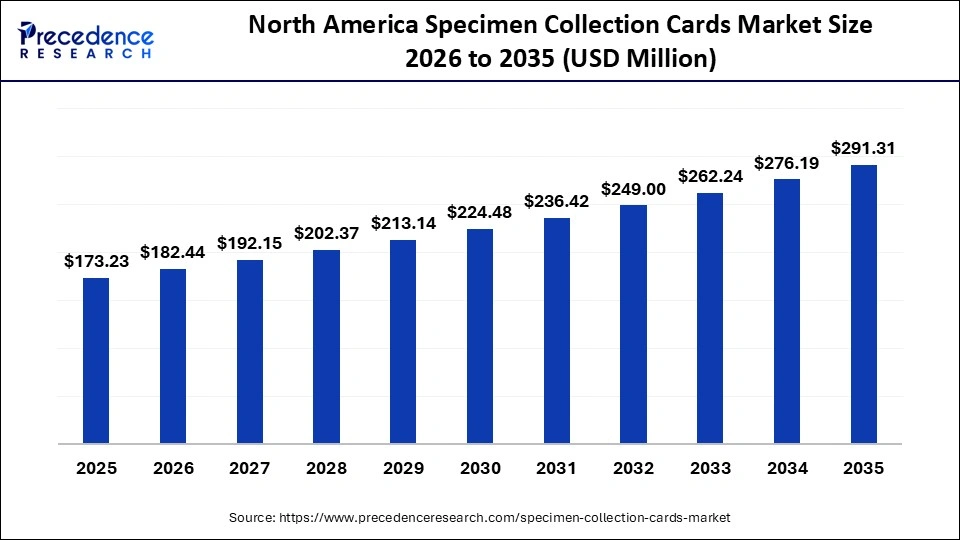

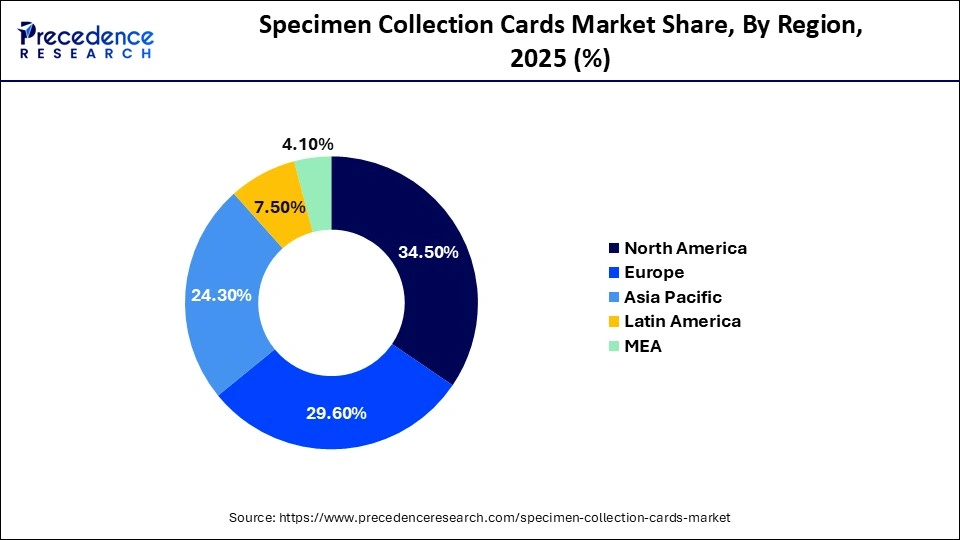

- North America dominated the market, holding the largest market share of 34.5% in 2025.

- The Asia Pacific is expected to grow at the fastest CAGR of 6.1% between 2026 and 2035.

- By specimen type, the blood segment held the largest market share of 89% in 2025.

- By specimen type, the saliva segment is expected to grow at a remarkable CAGR of 6% between 2026 and 2035.

- By material / card substrate, the cotton & cellulose-based segment contributed the largest market share of 60% in 2025.

- By material / card substrate, the fiber-based / synthetic segment is growing at a CAGR of 20% between 2026 and 2035.

- By application, the newborn screening (NBS) segment accounted for the highest market share of 22.6% in 2025.

- By application, the forensics & research segment is projected to expand at the fastest CAGR between 2026 and 2035.

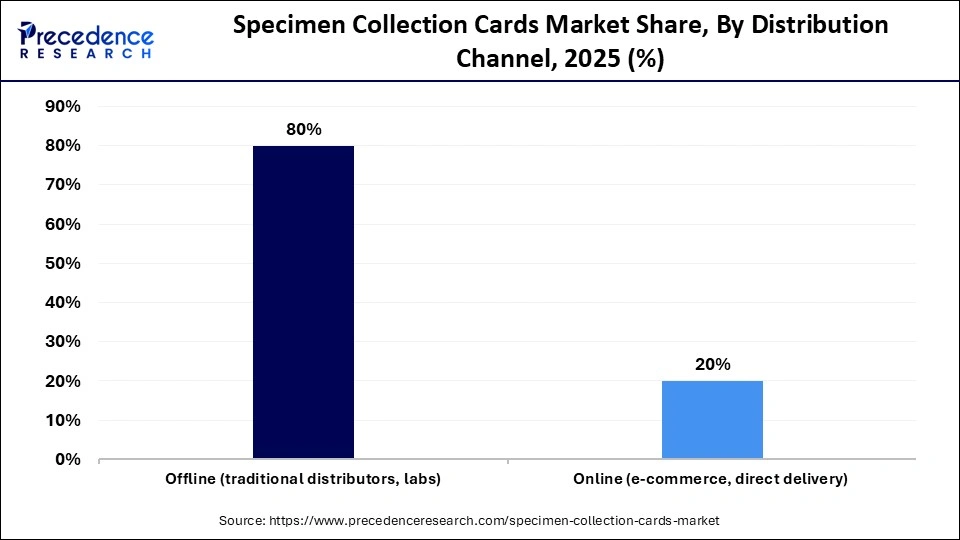

- By distribution channel, the offline segment captured the biggest share of 80% in the Specimen collection cards market in 2025.

- By distribution channel, the online segment is expanding at a solid CAGR between 2026 and 2035.

- By end-use sector, the hospitals & clinics segment held the major market share of 64% in 2025.

- By end-use sector, the research institutions & others segment is expected to grow at a noteworthy CAGR of 12% between 2026 and 2035.

Rise of Specimen Collection Cards: Spearheading the Future of Diagnostics

Specimen collection cards are specifically designed absorbent cards or filter-paper substrates used to collect, stabilize, store, transport, and analyze biological specimens such as blood, saliva, urine, buccal cells n diagnostics, screening, research, forensics, and therapeutic monitoring. They enable ambient-temperature transport, long-term sample stability, reduced bio-hazard risk, and simplified logistics, especially for remote, decentralized, or point-of-care settings.

How are AI-driven innovations reshaping the specimen collection cards market?

As technology continues to advance, artificial Intelligence (AI) integration is greatly accelerating the growth of the specimen collection cards market by reducing human error, boosting efficiency, and enabling quicker, more reliable diagnostics. AI-powered algorithms and machine vision can quickly evaluate the quality of a specimen immediately after collection, including checking fill volume, detecting hemolysis and clotting in blood samples, and accurately confirming the absence of contaminants to ensure the sample is suitable for testing. AI also helps manage the large datasets produced, facilitating smooth identification and rapid sample tracking, which leads to fewer misidentification errors.

Specimen Collection Cards Market Outlook

Between 2026 and 2035, the market is expected to experience rapid growth, driven by rising public awareness of routine health check-ups, expanding applications in forensics and toxicology, the rise of newborn screening programs, and growing demand for molecular diagnostics.

The market is expanding worldwide due to increasing demand for easy-to-transport, low-cost sample collection solutions for diagnostics, forensic testing, newborn screening, and biobanking. Emerging regions offer strong opportunities as healthcare infrastructure improves, point-of-care testing grows, and governments invest in scalable diagnostic tools for infectious diseases and population health programs.

Major investors in the market include diagnostic companies, biotechnology firms, healthcare providers, and government health agencies. They contribute by funding innovation in card materials and preservation technologies, expanding manufacturing capacity, and supporting large-scale adoption for disease surveillance, screening programs, and decentralized testing.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 502.11 Million |

| Market Size in 2026 | USD 528.82 Million |

| Market Size by 2035 | USD 843.15 Million |

| Market Growth Rate from 2026 to 2035 | CAGR of 5.32% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Specimen Type, Material, Application, Distribution Channel, End-Use Sector, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Specimen Collection Cards Market Segment Insights

Specimen Type Insights

The blood segment dominated the specimen collection cards market by holding a share of 89% in 2025. This is mainly due to the increasing application of blood samples in newborn screening, infectious disease testing, therapeutic drug monitoring, and forensic analysis. Moreover, the growing research and development in dried blood spot testing, along with the increasing focus on early detection of genetic and metabolic diseases, are driving demand for reliable blood sample collection methods.

The saliva segment is expected to grow at a CAGR of 6% during the forecast period. This growth is driven by the rising popularity of non-invasive diagnostics and the increasing demand for convenient at-home testing. Saliva specimen collection methods are widely used in various diagnostic fields, such as genetic testing, detection of infectious diseases, and hormonal imbalances.

The urine segment is expected to grow at a considerable rate in the coming years. At-home urine testing offers convenience and reflects consumer demand for accessible diagnostics. The growth of the segment is driven by the rising prevalence of urinary tract infections (UTIs) and chronic illnesses, as well as the demand for non-invasive diagnostic methods.

Material/Card Substrate Insights

The cotton & cellulose-based cards segment led the market with a 60% share in 2025. This dominance is mainly driven by the materials excellent absorption abilities, effective sample preservation, biocompatibility, and affordability. Cotton and cellulose-based cards are widely seen as the preferred choice for collecting biological samples such as dried blood spots in various diagnostic and research applications. They are extensively used in infectious disease testing, newborn screening, and forensic analysis.

On the other hand, the fiber-based / synthetic segment is expected to expand at a CAGR of 20% over the forecast period. The segments growth is attributed to its increasing adoption, driven by its ability to be tailored to a wider range of applications and needs. Fiber-based/synthetic cards made with synthetic materials can be personalized to meet diverse, specific application needs. Synthetic card innovations are designed to enhance sample stability.

Application Insights

The newborn screening (NBS) segment dominated the specimen collection cards market, accounting for 22.6% in 2025. This is primarily due to the growing number of government-led initiatives and newborn screening programs aimed at detecting metabolic and genetic disorders. Newborn screening is a crucial public health effort with a wide range of applications in healthcare and research, focusing on early diagnosis and timely medical intervention for serious health conditions. The screenings mainly include hearing tests, blood tests, and heart screenings.

The forensics & research segment is expected to grow at the fastest CAGR in the coming period. Specimen collection cards offer a reliable and cost-effective way to gather and store biological evidence, playing a crucial role in forensic investigations. The segments growth is also driven by increased R&D investments and therising demand for personalized medicine.

Researchers use samples from the specimen collection cards to study the genetic basis of diseases and identify biomarkers.

The infectious disease testing segment is expected to grow significantly. Specimen cards are commonly used in malaria research and diagnostics. Specimen collection cards, such as dried blood spot (DBS) and FTA cards, are frequently utilized in infectious disease testing. These cards are economical and simplify the collection, storage, and transportation of samples, reducing the reliance on a cold chain.

Distribution Channel Insights

The offline segment led the specimen collection cards market, holding an 80% share in 2025. The offline channel, which includes pharmacies, healthcare clinics, and diagnostic labs, is the main distribution channel. Offline channels provide the convenience of purchasing specimen collection cards through in-person visits. Distributors of laboratory and medical equipment serve as intermediaries between manufacturers and end-users such as clinics, hospitals, and research labs.

The online segment is expected to be the fastest-growing in the market, with a growth rate of 20%. The online channel, which includes e-commerce and direct delivery, is a rapidly expanding and significant distribution avenue in the market. E-commerce platforms offer a wide range of specimen collection cards for various sample types, such as saliva, blood, urine, and stool. Online channels are becoming increasingly popular for purchasing specimen collection cards because they provide convenience and access to products from multiple manufacturers. Major manufacturers like QIAGEN, Ahlstrom, Thermo Fisher Scientific, and PerkinElmer often sell their products directly through their own websites or dedicated portals.

End-Use Sector Insights

The hospital & clinics segment dominated the specimen collection cards market by holding a 64% share in 2025. Hospitals and clinics are essential parts of the healthcare system, offering comprehensive and specialized services for preventive care. Hospitals and clinics are the main end users due to mandatory newborn screening. In Germany, in 2022, nearly 738,819 newborns were born; as many as 96.25% of children were born in hospitals. An increase in the number of hospitals and clinics is expected to drive the growth of the segment during the forecast period.

The research institutions & others segment is expected to grow at the fastest CAGR of 12% in the coming years. Research institutions and other entities, such as forensic laboratories, academic labs, and public health organizations, are significant end users of specimen collection cards, primarily for dried blood spots (DBS) and FTA cards, for numerous studies. Researchers efficiently use these samples collected on these cards to develop and validate new diagnostic assays and screening methods for several health conditions, including infectious, chronic, and genetic disorders.

The diagnostic laboratories & centers segment is expected to grow at a significant rate during the forecast period. These laboratories and centers are key end users, as they play a crucial role in driving demand for these cards through their focus on cost-effective, efficient testing. Specimen collection cards are widely used for genetic testing, which is part of precision medicine, a growing trend in the diagnostics industry. Diagnostic centers process tests for infectious diseases like HIV and Hepatitis C using DBS cards, especially in developing regions where access to centralized labs is limited.

Specimen Collection Cards Market Regional Insights

The North America specimen collection cards market size is estimated at USD 173.23 million in 2025 and is projected to reach approximately USD 291.31 million by 2035, with a 5.34% CAGR from 2026 to 2035.

How does North America dominate the specimen collection cards market?

North America led the specimen collection cards market, holding a 34.5% share in 2025. The regions leadership is driven by a strong healthcare infrastructure, a rise in infectious disease cases, widespread use of advanced diagnostic technologies, and growing demand for drug profiling across various medications. Additionally, substantial investment in biomedical research and newborn screening programs is expected to boost the overall growth of the specimen collection cards market.

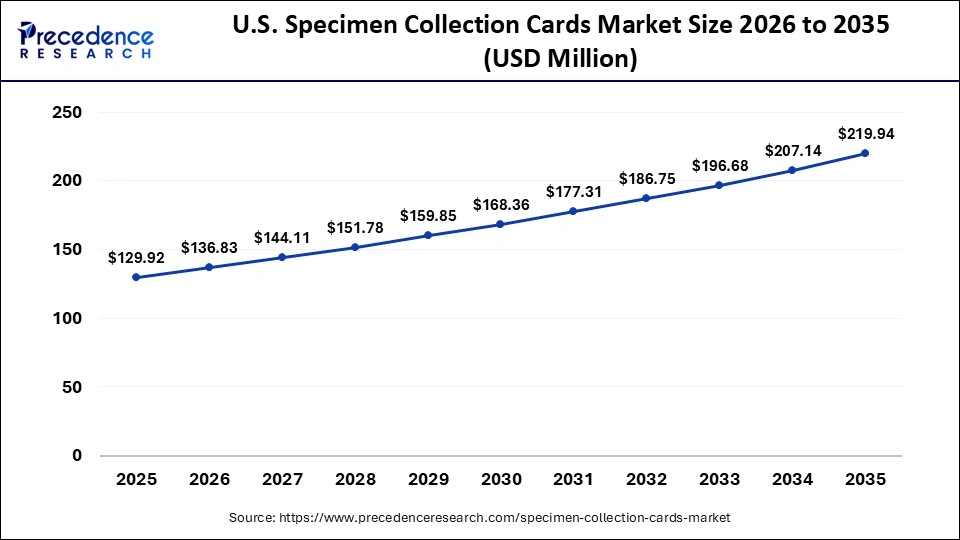

The U.S. specimen collection cards market size is calculated at USD 129.92 million in 2025 and is expected to reach nearly USD 219.94 million in 2035, accelerating at a strong CAGR of 5.41% between 2026 and 2035.

Major Market Trends in the U.S.

The U.S. leads the specimen collection cards market. The country market growth is driven by high healthcare spending, strong newborn screening programs, and rising demand for at-home therapeutic drug monitoring. Its well-established healthcare infrastructure and increased government and pharmaceutical company funding for research are expected to drive market expansion in the coming years, supporting advances in diagnostic and therapeutic applications. Rising birth rate also drives the market in the U.S.

- For instance, in 2025, 3.62 million babies were born in the U.S., a slight increase from 3.6 million in 2023.

Asia Pacific is expected to grow at the fastest CAGR of 6.1% over the forecast period. Factors contributing to the markets growth in the region include the rapid expansion of healthcare infrastructure, the expansion of newborn screening programs, a surge in cases of infectious diseases, and increased government funding for biomedical research and drug testing. Moreover, the ongoing research and development in dried blood spot (DBS) testing and its diagnostic benefits are anticipated to fuel the markets expansion in the coming years.

Major Market Trends in India

In India, the market is growing due to the development of modern healthcare facilities, the rising prevalence of infectious diseases, supportive government regulations, increased adoption of point-of-care molecular diagnostics, and greater focus on non-invasive procedures. Additionally, a surge in birth rates, along with a growing number of hospitals, clinics, diagnostic laboratories, and centers, supports the expansion of the specimen collection cards market. This combination of factors is driving the markets growth in the country.

In June 2025, Amazon India unveiled Amazon Diagnostics, a new at-home diagnostics service that enables customers to book lab tests, schedule and track appointments, and access digital reports instantly from the Amazon app. With Amazon Diagnostics, customers in 6 cities across 450+ pin codes can easily book from over 800 diagnostic tests, get doorstep sample collection in under 60 minutes, and digital reports in as little as 6 hours, for routine tests.

Europe is considered a notably growing region in the specimen collection cards market. Europes advanced healthcare ecosystem facilitates the growing adoption of diagnostic tools such as specimen cards, supported by established protocols from healthcare authorities. The regions growth is primarily driven by rising rates of infectious diseases, increasing demand for point-of-care testing devices, and the adoption of modern diagnostic technologies. The surge in birth rates has increased demand for newborn screening, further boosting market growth in the region. In addition, supportive government regulations and ongoing research and development efforts in disease diagnosis are expected to further drive the specimen collection cards industry in the European region.

Major Market Trends in Germany

Germanys high healthcare spending supports the market for specimen collection cards. The market in Germany is experiencing significant growth, driven by the countrys advanced healthcare infrastructure, government-mandated newborn screening programs, increased focus on research and development, and technological advancements in specimen collection. The market is largely fueled by the use of specimen cards for newborn screening, genetic testing, and the rising demand for infectious disease testing, such as HIV and HCV. Additionally, the country growth is supported by major industry players with strong local ties, as well as by a growing number of hospitals, diagnostic laboratories, and research institutions.

Regulatory Landscape

| Country/Region | Regulatory Body | Key Regulations | Focus Areas | Notable Notes |

| U.S. | U.S. Food and Drug Administration (FDA) | The Federal Food, Drug, and Cosmetic Act (FD&C Act) | Device Classification, Convenience Kits, Performance, and Validation | Under the FDAs regulatory the specimen collection cards are regulated as medical devices, generally falling into the lowest-risk Class I category. The FDA also monitors market trends such as the rise of home-based testing and miniaturization. |

| European Union | European Commission, the Medical Device Coordination Group (MDCG) | Regulation (EU) 2017/746 on in vitro diagnostic medical devices (IVDR) | CE Marking, Risk-Based Classification, Quality Management System (QMS), Technical Documentation, Registration and Traceability (EUDAMED), and Labeling and Instructions for Use | Manufacturers and economic operators in the EU specimen collection cards market must focus on the following regulatory areas. |

| India | Central Drugs Standard Control Organization (CDSCO) | The Drugs and Cosmetics Act, 1940 | Mandatory Licensing, Quality Management Systems (QMS), Performance Evaluation, and Post-Market Surveillance | The Central Drugs Standard Control Organization (CDSCO), which functions under the Ministry of Health and Family Welfare, ensures that manufacturers or importers are subject to a streamlined licensing process. |

Specimen Collection Cards Market Companies

QIAGEN offers advanced specimen collection cards designed for stable nucleic acid preservation and streamlined workflows in molecular diagnostics.

PerkinElmer provides high-quality dried blood spot (DBS) collection cards widely used in newborn screening, toxicology, and clinical research.

Danaher, through its life science brands, supplies reliable specimen collection cards and integrated testing solutions for clinical and genomic applications.

DBS System SA specializes in innovative dried blood microsampling cards that enable accurate, low-volume sample collection and remote testing.

Eastern Business Forms offers durable and cost-effective specimen collection cards used across clinical labs, public health programs, and forensic testing.

Other Major Companies

- Ahlstrom (Ahlstrom-Munksjo)

- ARCHIMED Life Science GmbH

- GenTegra LLC

- FortiusBio

- CENTOGENE N.V.

- Whatman (Cytiva)

- Shimadzu Corporation

- Spot On Sciences

- Sedia Biosciences Corporation

- HemaXis

Recent Developments

- In February 2025, Ahlstrom, a global leader in fiber-based specialty materials, announced that its biological sample collection cards had been officially classified as FDA Class 1 medical devices. This designation by the US Food and Drug Administration (FDA) affirms the safety, reliability, and compliance of GenSaver 2.0, GenSaver Color 2.0, AutoCollect, 5 circles, BioSample, HemaSep Strip, HemaSep Punch, and Lipid Saver sample collection cards with the highest industry standards. These products are designed for the secure and efficient collection, transportation, and ambient-temperature storage of biological samples.(Source: https://www.ahlstrom.com)

- In February 2025, Tufts researchers collaborate with scientists in South Africa to test a more precise medical device that more accurately measures HIV viral loads and detects drug-resistant mutations. In a clinical pilot with 75 South African patients living with HIV, the Tufts research teams device, called a plasma spot card, is used. While this technology helps track someones adherence to their drug regimen or monitor disease progression, the most frequently used devices dont control how much blood they collect, which leads to inaccurate readings of a persons infection.(Source: https://now.tufts.edu)

Specimen Collection Cards MarketSegments Covered in the Report

By Specimen Type

- Blood

- Saliva

- Urine

- Buccal Cells & Other

By Material

- Cotton & Cellulose-based

- Fiber-based/Synthetic

- Other materials

By Application

- Newborn Screening (NBS)

- Infectious Disease Testing

- Therapeutic Drug Monitoring (TDM)

- Forensics & Research

- Well-being/Health Monitoring

By Distribution Channel

- Offline (traditional distributors, labs)

- Online (e-commerce, direct delivery)

By End-Use Sector

- Hospitals & Clinics

- Diagnostic Laboratories & Centers

- Research Institutions & Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting