Starter Culture Market Size and Forecast 2025 to 2034

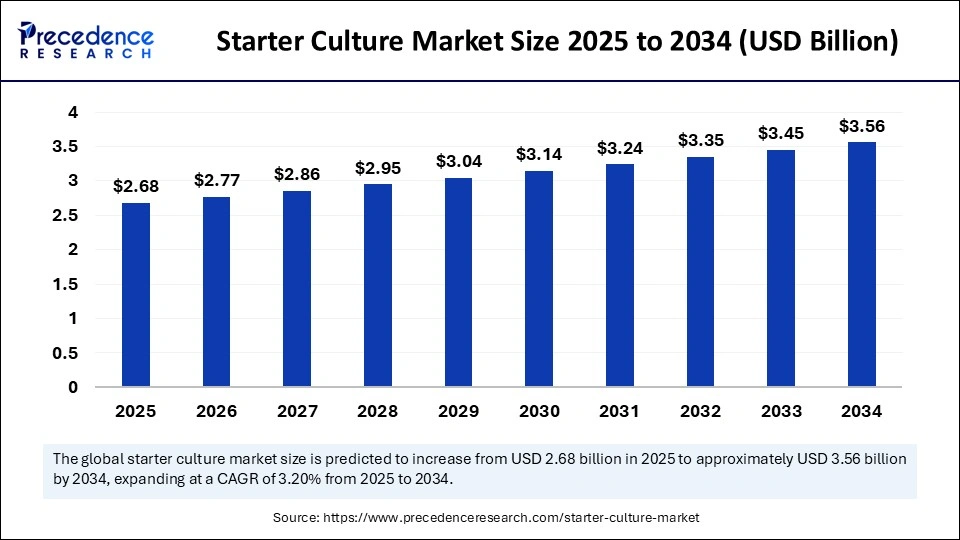

The global starter culture market size accounted for USD 2.6 billion in 2024 and is predicted to increase from USD 2.68 billion in 2025 to approximately USD 3.56 billion by 2034, expanding at a CAGR of 3.20% from 2025 to 2034.The growth of the market is driven by rising demand for fermented foods and innovation in food products.

Starter Culture MarketKey Takeaways

- In terms of revenue, the market is valued at $2.86 billion in 2025.

- It is projected to reach $3.56 billion by 2034.

- The market is expected to grow at a CAGR of 3.20% from 2025 to 2034.

- North America dominated the starter culture market in 2024.

- Asia Pacific is projected to expand at the fastest CAGR between 2025 and 2034.

- By product type, the yeast segment held the largest share of the market in 2024.

- By product type, the lactobacillus segment is anticipated to grow at a significant CAGR in the coming years.

- By application, the dairy products segment held the biggest market share in 2024.

- By application, the alcoholic beverages segment is expected to grow at a significant CAGR during the forecast period.

How is AI Reshaping the Starter Culture Industry?

Artificial Intelligence (AI) is revolutionizing the starter culture market by bringing unprecedented precision and efficiency to the fermentation landscape. Through advanced machine learning algorithms and predictive analytics, AI enables manufacturers to meticulously analyze and optimize microbial strain combinations. This not only enhances flavor development and shelf-life but also elevates the nutritional profile of both dairy and non-dairy fermented products. By simulating countless microbial interactions and environmental conditions, AI empowers producers to predict outcomes and fine-tune processes before they even begin.

Moreover, AI-integrated systems facilitate real-time monitoring of fermentation parameters, such as pH levels, temperature fluctuations, and microbial activity, ensuring greater consistency and fewer production errors. This technological leap reduces dependency on manual oversight, improves scalability, and allows for agile responses to any deviations in quality. Ultimately, AI is not just an operational upgrade; it is reshaping the very foundation of how starter cultures are researched, developed, and commercialized.

Fermenting the Future: Unlocking Growth Potential of the Starter Culture Market

The global starter culture market is witnessing robust growth, driven by rising demand for functional, fermented foods and beverages that align with health-conscious consumer preferences. Starter cultures comprising carefully selected microorganisms such as bacteria, yeasts, or molds play a pivotal role in initiating and controlling the fermentation process across a wide spectrum of products, including dairy, meat, beverages, and plant-based alternatives. The market is being propelled by the increasing popularity of probiotic-rich foods, clean-label trends, and the expansion of global dairy consumption.

Additionally, the surge in vegan and flexitarian lifestyles has amplified the need for non-dairy fermented alternatives, pushing innovation in plant-based starter cultures. Technological advancements, particularly in genomics, biotechnology, and artificial intelligence, are enabling more precise microbial strain selection and improved fermentation efficiency. This is significantly enhancing product quality, flavor, and nutritional value while reducing waste and production costs.

Starter Culture MarketGrowth Factors

- Health and Wellness Trends: Increasing consumer awareness about gut health, immunity, and probiotic benefits is fuelling demand for fermented foods. Functional foods enriched with live cultures are gaining popularity among health-conscious individuals.

- Surge in Plant-Based and Vegan Diets: The rising adoption of dairy alternatives and plant-based lifestyles is expanding the use of non-dairy starter cultures. Brands are innovating with soy, almond, oat, and coconut bases, supported by tailored microbial formulations.

- Advancements in Biotechnology and AI: Modern biotechnological tools and artificial intelligence are enhancing strain selection, fermentation efficiency, and product consistency. AI allows for predictive modeling and real-time monitoring, improving both quality and scalability.

- Clean Label and Natural Ingredient Demand: Consumers prefer products with fewer additives and natural fermentation processes, boosting the use of starter cultures as clean-label solutions.

- Expanding Processed and Convenience Food Sector: With growing urbanization and changing lifestyles, demand for ready-to-eat, long shelf-life fermented products like cheese, sausages, and yogurts is accelerating.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 3.56 Billion |

| Market Size in 2025 | USD 2.6 Billion |

| Market Size in 2024 | USD 2.68 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 3.20% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Rising Demand for Functional and Fermented Foods

The global surge in demand for functional foods and beverages is a primary driver of the starter culture market. Consumers are increasingly gravitating towards products that offer probiotic benefits, gut health support, and immune-boosting properties. Fermented dairy products like yogurt, cheese, and kefir, as well as plant-based alternatives, are gaining popularity across all demographics. Furthermore, traditional fermentation practices are being revived and modernized, supported by scientific validation and health trend endorsements. This consumer shift is not only shaping dietary preferences but also stimulating research and innovation in starter cultures to meet evolving nutritional and sensory expectations. Consumers have become more aware of the health benefits of fermented food, fueling the growth of the market.

- In March 2025, a study published in EMBO Molecular Medicine reveals that fermented foods like yogurt, kimchi, and miso may help reduce anxiety and depression by influencing gut bacteria, which in turn affects brain chemistry. Researchers found that probiotics in fermented foods can regulate neurotransmitters, reduce inflammation, and decrease activity in the amygdala, a brain region involved in stress and emotions. While promising, experts stress that fermented foods should not replace traditional mental health treatments.

(source: https://www.foodandwine.com)

Restraint

Stringent Regulatory Framework and Storage Challenges

Despite growth potential, the starter culture market faces regulatory hurdles related to microbial classification, labeling, and probiotic claims. Approvals for new strains often involve long timelines, high documentation requirements, and strict compliance with food safety norms. Moreover, starter cultures are biologically sensitive to temperature, moisture, and handling conditions, which can complicate storage and transportation, especially in countries lacking robust cold chain infrastructure. These factors can limit scalability, delay product launches, and increase operational costs, particularly for smaller or emerging players.

Opportunity

Adoption of Plant-Based and Clean-Label Food Ingredients

The rising adoption of vegan, lactose-free, and plant-based diets presents a significant opportunity for manufacturers to diversify their product offerings using starter cultures tailored for non-dairy bases like soy, oat, almond, and coconut. As consumers become more label-conscious, there is a growing preference for clean-label fermented products free from artificial additives. This trend is opening doors for custom starter culture development, leveraging biotechnology and AI to design blends that naturally deliver desired texture, flavor, and health benefits. Additionally, emerging markets in Asia, Africa, and Latin America are becoming fertile ground for plant-based product penetration, creating avenues for regional adaptation and new business models.

Type Insights

The yeast segment dominated the starter culture market with the largest share in 2024. Yeast remains the most used microorganism in the starter culture due to its versatile applications across multiple industries. It is widely used in the fermentation of dairy products, alcoholic beverages, and bakery items. It also enhances flavor and aroma. Yeasts such as Saccharomyces cerevisiae are essential to produce bread, wine, and beer, and are now being employed in more innovative applications like kombucha and plant-based drinks. Their ease of cultivation and compatibility with industrial processes make yeast-based cultures the go-to solution for large-scale food manufacturers.

On the other hand, the lactobacillus segment is anticipated to grow at a significant CAGR in the coming years, driven by the increasing popularity of probiotic-rich and gut-friendly foods. These bacteria play a critical role in dairy fermentation, especially in yoghurt, cheese, and kefir, but are also being extended to non-dairy fermented products like kimchi, pickles, and plant-based yoghurts. As consumers become more health-conscious and aware of the link between microbiome and immunity, the demand for lactobacillus-based functional foods is rising. Advances in strain engineering and biotechnology have further improved the shelf life, flavor, and nutritional profile of food products using these cultures.

Application Insights

The dairy products segment held the largest share of the starter culture market in 2024. Products such as yogurt, cheese, buttermilk, and sour cream rely on carefully selected starter cultures to achieve consistency, texture, acidity, and safety. The heightened demand for fermented dairy products, especially across North America, Europe, and Asia Pacific, combined with rising health awareness, continues to reinforce the dominance of this segment. Furthermore, a strong emphasis on developing mild-flavored, high-probiotic strains to cater to expanding clean-label and functional food segments bolsters segmental growth.

The alcoholic beverages segment is expected to grow at a significant rate during the forecast period. Starter culture is essential in the production of craft beer, wine, and artisanal spirits. The surge in demand for unique flavor profiles, natural fermentation, and authenticity in alcoholic beverages leads to increased use of specialized yeast and bacterial cultures. Regions like Europe and North America are witnessing a boom in microbreweries and local distilleries, where precision fermentation and starter cultures are employed to differentiate products. Additionally, non-traditional beverages like kombucha and hard seltzers are using hybrid cultures to tap into both the alcoholic and wellness markets.

Regional Insights

What are the Reasons Behind North America's Market Dominance?

North America dominated the starter culture market by capturing the major share in 2024 due to its deep-rooted tradition of fermented foods, expanding middle-class population, and evolving dietary habits. The region continues to observe steady growth in the market due to the rising health & wellness trends. As consumer interest in gut health, immunity, and sustainability intensifies, the starter culture market is poised to grow exponentially, opening doors to innovation, customization, and premiumization of fermented food products. With the growing health consciousness among consumers, the demand for fermented foods and personalized nutrition is rising, contributing to regional market growth.

What Opportunities Exist in the European Starter Culture Market?

Europe is the second-largest market and is projected to continue its growth trajectory in the upcoming period due to its long-standing culinary traditions, robust dairy sector, and stringent regulations regarding food safety and quality. Countries like Germany, France, Denmark, and the Netherlands have pioneered fermented product manufacturing, especially in cheese, yogurt, and wine production. European manufacturers invest heavily in R&D and biotechnology, continuously developing high-performance microbial strains to enhance the flavor, texture, and shelf life of both dairy and plant-based offerings. Moreover, growing consumer demand for organic, clean-label, and probiotic-rich foods has accelerated the adoption of advanced fermentation processes. Institutions and governments across the EU support microbiome research, sustainable agriculture, and functional food innovations, positioning Europe as a technological and commercial leader in the starter culture landscape.

How is Asia Pacific Leading the Starter Culture Market?

Asia Pacific is expected to witness the fastest growth trajectory in the coming years, driven by urbanization, increasing disposable income, and shifting dietary preferences. Traditionally known for fermented staples like kimchi, miso, tempeh, and idlis, the region is now embracing modern fermentation technologies in dairy, non-dairy, and functional beverages. Countries such as India, China, Japan, and South Korea play a major role in the market due to the heightened demand for fermented dairy and bakery products. India and China are seeing increased consumption of yogurt, probiotic drinks, and fermented snacks among middle-class consumers. In addition, the rising vegan and lactose intolerance population in the region are opening new avenues for plant-based starter cultures.

Recent Developments

- In April 2024, Nordmann entered into a partnership with Sacco System to supply meat starter cultures. These starters enable the production of cured and fermented meat products.

(Source: https://www.nordmann.global) - In September 2023, dsm-firmenich announced the launch of Delvo Fresh Pioneer, a new generation of starter cultures for very mild yogurts. This launch addresses yogurt manufacturers' need for high quality ingredients, stable production processes, and consistent mildness throughout shelf life by enabling exceptional pH stability during processing.

(Source: https://www.dsm-firmenich.com)

Key Players Operating in the Market

- Dohler Group

- Lesaffre Group

- Danisco A/S

- Angel Yeast CO. Limited

- CSK Food Enrichment B.V

- Wyeast Laboratories Inc.

- Lallemand Inc

- Lactina Limited.

Segments Covered in the Report

By Type

- Bacteria

- Yeast

- Molds

By Application

- Dairy Products

- Alcoholic Beverages

- Non-Alcoholic Beverages

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting