What is the Sterility Indicators Market Size?

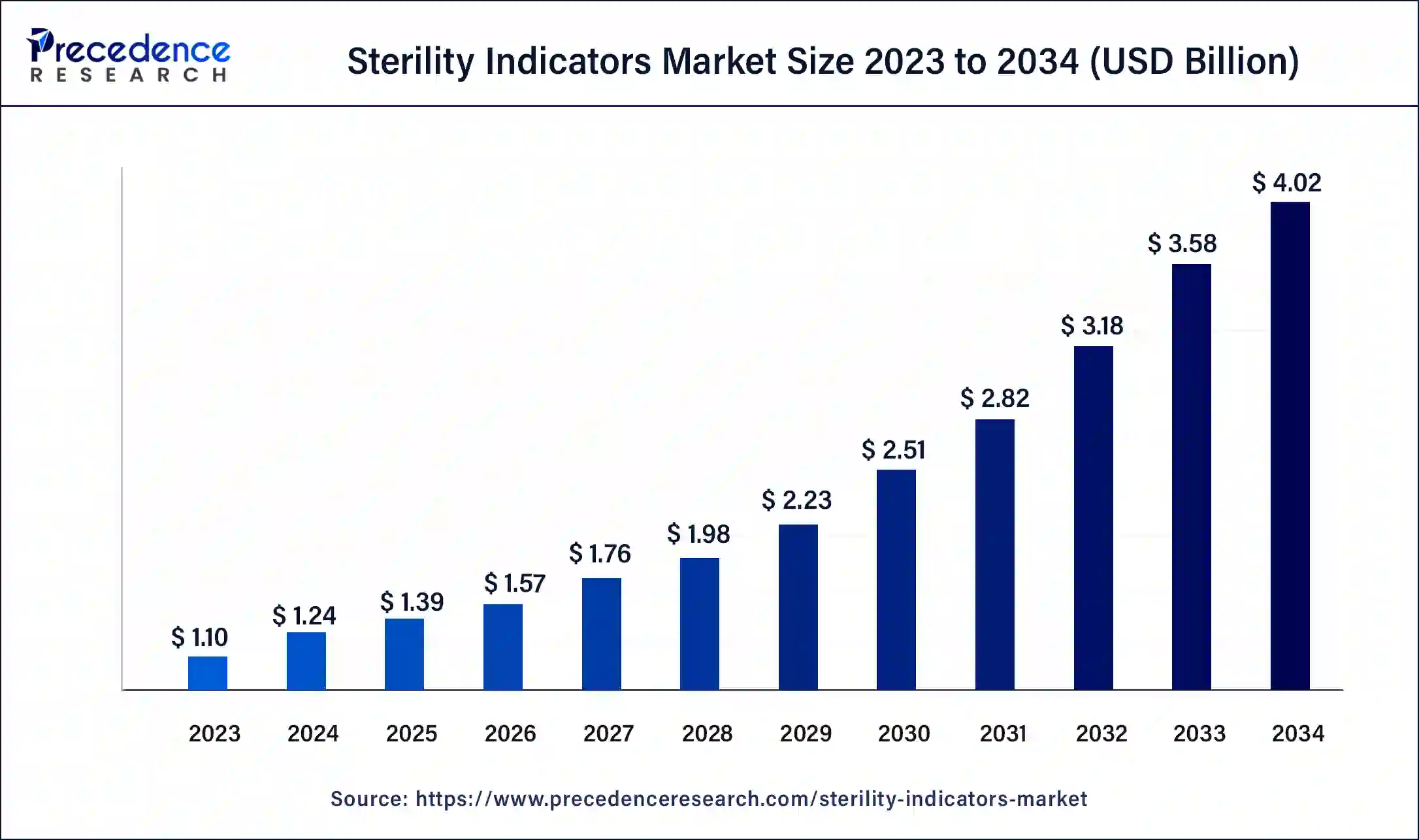

The global sterility indicators market size is calculated at USD 1.39 billion in 2025 and is predicted to increase from USD 1.57 billion in 2026 to approximately USD 4.43 billion by 2035, expanding at a CAGR of 12.29% from 2026 to 2035.

Sterility Indicators Market Key Takeaways

- The global sterility indicators market was valued at USD 1.39 billion in 2025.

- It is projected to reach USD 4.43 billion by 2035.

- The sterility indicators market is expected to grow at a CAGR of 12.29% from 2026 to 2035.

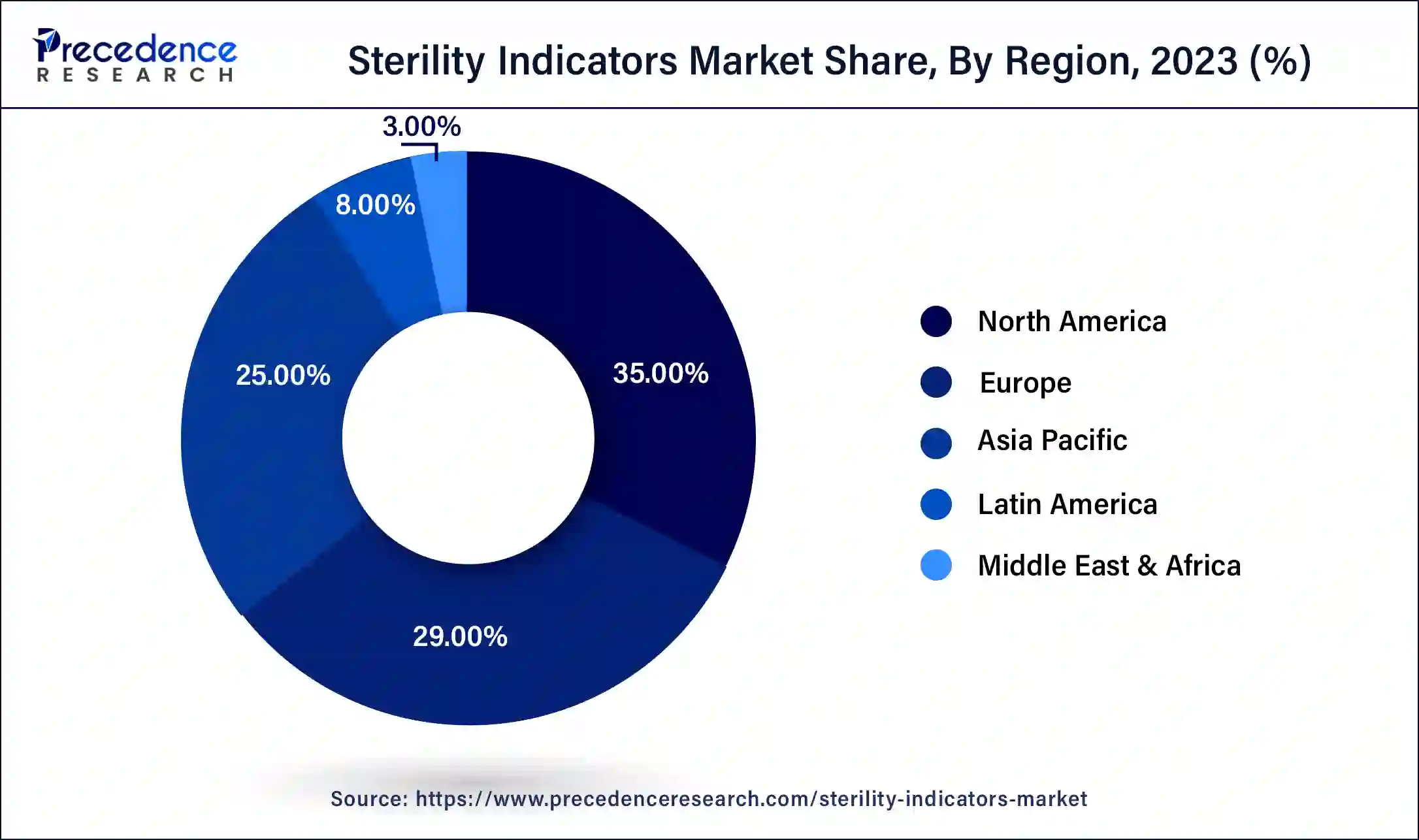

- North America led the global sterility indicators market with the largest market share of 35% in 2025.

- Asia Pacific is anticipated to grow notably in the market during the forecast period.

- By type, the biological indicators segment accounted for the biggest share of the market in 2025.

- By type, the chemical indicators segment is expected to witness significant growth in the market during the forecast period.

- By technique, the heat sterilization segment generated the biggest share of the market in 2025.

- By technique, the low-temperature sterilization segment is expected to grow significantly in the market during the forecast period.

- By end-use, the hospital segment dominated the market in 2025.

- By end-use, the pharmaceutical companies segment is estimated to grow significantly in the market during the forecast period.

Market Overview

Sterilization is a procedure of destruction of microorganisms, including spores and other forms, and is achieved by many physical and chemical means. Sterility indicators are used to monitor and evaluate the effectiveness of sterilization processes. They can reveal whether or not microbial growth was present after the process or if the sterilization. Sterilization indicators, such as spore strips and indicator tape, enable routine monitoring, qualification, and load monitoring of the sterilization process. There are several types of sterility indicators, like biological and chemical.

Sterility Indicators Market Growth Factors

- The increasing focus on the incidences of healthcare-associated infections.

- Growth in the healthcare sector, such as hospitals and laboratories across the world.

- Rising pharmaceutical and biotechnology industries improve the manufacturing of products.

- In the production of medical devices and pharmaceuticals, strict rules and regulations that control manufacturing processes require the use of integrity sterility indicators.

Market Scope

| Report Coverage | Details |

| Market Size by 2035 | USD 4.43 Billion |

| Market Size in 2025 | USD 1.39 Billion |

| Market Size in 2026 | USD 1.57 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 12.29% |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Type, Technique, End-user, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Driver

Increasing number of Hospital Acquired infections (HAIs)

The increasing number of hospital-acquired infections caused by viral, bacterial, and fungal pathogens is anticipated to drive the sterility indicators market. The most common types are bloodstream infections. An infection can be acquired in various clinical settings such as hospitals, nursing homes, and outpatient clinics. Infection is spread to susceptible patients in the healthcare setting, which has boosted the need for sterility indicators in hospital facilities.

- In May 2022, a report published by WHO out of every 100 patients in acute-care hospitals, seven patients in high-income countries and 15 patients in low- and middle-income countries will acquire at least one healthcare-associated infection (HAI) during their hospital stay.

- On average, 1 in every 10 affected patients will die from their HAI.

Restraint

Safety concerns related to ethylene oxide sterilization

The risks and challenges related to the ethylene oxide (EtO) sterilization process are restraints for the sterility indicators market. EtO is a highly toxic gas that is flammable and explosive and used in the sterilization of various medical requirements such as equipment, drugs, and any other products.

The use of such chemicals causes several safety problems like chronic toxicity, Irritation (skin, eyes, nose, throat, and lungs), possible harm to the brain, nervous system as well as reproductive system. These safety issues can result in increased regulation and decreased utilization of EtO sterilization, thus affecting sterility indicators demand.

Opportunity

Expansion of healthcare facilities

The expansion of healthcare facilities and infrastructure development is projected to boost the demand for the sterility indicators market. Sterilization proposes medical devices free from infectious agents, thus reducing the risk of patient harm and cross-contamination. As a hospital is established, effective sterility monitoring is needed to ensure the safety and efficiency of medical devices and equipment. Additionally, awareness of infection control is rising across the healthcare sector.

Segment Insights

Type Insights

The biological indicators segment accounted for the biggest share of the sterility indicators market in 2024. A biological indicator or BI is a test system used to assess the efficacy of sterilization processes or procedures. They consist of living organisms, mostly bacterial spores, which are very hard to eliminate by sterilization procedures. Biological indicators, depending on the specific type, can be used for various sterilization processes using steam, hydrogen peroxide gas, ethylene oxide, and more. These are most often strips, discs (metal or paper), or threads that are inoculated with a predetermined organism at a controlled resistance.

The chemical indicators segment is expected to witness significant growth in the sterility indicators market during the forecast period. Chemical indicators monitor whether the parameters to achieve sterilization have been met for a specific sterilization process, such as steam or vaporized hydrogen peroxide sterilization. Chemical indicators change their properties due to critical parameters such as temperature, time, or the type of sterility indicator being used in the process, and these changes can be easily viewed by the human eye. Chemical monitors are intended to alter one or more of the physical conditions present in the sterilizing chamber. These indicators employ temperature-sensitive solutions or chemicals that turn color when sterilization is complete.

Class of Chemical Indicators

| Class 1 Process Indicators |

Class 1 chemical indicators are designed to monitor the thermal sterilization process and are intended to provide visible indicators of the sterilization process. |

| Class 2 Specific-Use Indicators |

These indicators contain two components: a heat-sensitive indicator which changes color when exposed to the steam and a moisture-sensitive indicator which changes color when exposed to moisture. |

| Class 3 Single-Variable Indicators |

These indicators change color when exposed to their respective chemical reagents and can be a useful tool for ensuring that a load has been adequately treated. |

| Class 4 Multi-Variable indicators |

They can be used for steam, ethylene oxide, and hydrogen peroxide sterilization processes and should be employed whenever precise dosimetry of these chemicals or radiation is essential. |

| Class 5 Integrating Indicators (Integrators) |

They change color when exposed to a given parameter of their respective sterilization process, even in the presence of a competing chemical or process parameter. These indicators are especially useful for double-check monitoring of the sterilization process. |

| Class 6 Emulating Indicators (Cycle Verification Indicators) |

These are typically used to measure the actual presence of viable organisms in the load after treatment and are essential for determining the actual effectiveness of the sterilization process. |

Technique Insights

The heat sterilization segment generated the biggest share of the sterility indicators market in 2024. Heat sterilization is the traditional type of sterilization which is widely used. Such prospects are due to the effectiveness and convenience of this method. These methods include autoclaving, pasteurization, and fractional sterilization methods. Heat sterilization is generally the most efficient method of sterilization in which the killing of microbes is done through the destruction of the cell constituents and enzymes. In the recent past, moist sterilization techniques have grown in popularity because they have been used in the dairy and pharmaceutical industries as well as in research and development institutions.

The low-temperature sterilization segment is expected to grow significantly in the sterility indicators market during the forecast period. Low-temperature sterilization is a process that entails sterilization of tools or equipment using gases or chemicals. It is useful in reprocessing devices that are temperature and moisture-sensitive and cannot withstand full sterilization through autoclave sterilization. In addition, the use of expensive, complex, and delicate instruments for medical practice that are hard to sterilize promotes the development of low-temperature sterilization methods.

End-use Insights

The hospital segment dominated the sterility indicators market in 2024. The sterility indicators are used to detect the sterilization process of medical devices performed they are free from the microbes. Good manufacturing practices are performed on products that are directed to supporting human health, sterility testing is critical to ensure the products are free from contaminating microorganisms. In the hospital, the medical instruments, equipment, and articles are reused it is necessary to perform sterilization.

The pharmaceutical companies segment is estimated to grow significantly in the sterility indicators market during the forecast period. Pharmaceutical sterilization is a process that removes or kills microorganisms, such as bacteria, fungi, and spores, from pharmaceutical products and equipment. Sterilization is one of the effective ways of maintaining the quality and safety of pharmaceutical products because the products are regulated and standardized. Sterility indicators are employed by pharmaceutical companies as well as other companies to measure and check sterilization processes. They can indicate whether sterilization was effective.

Regional Insights

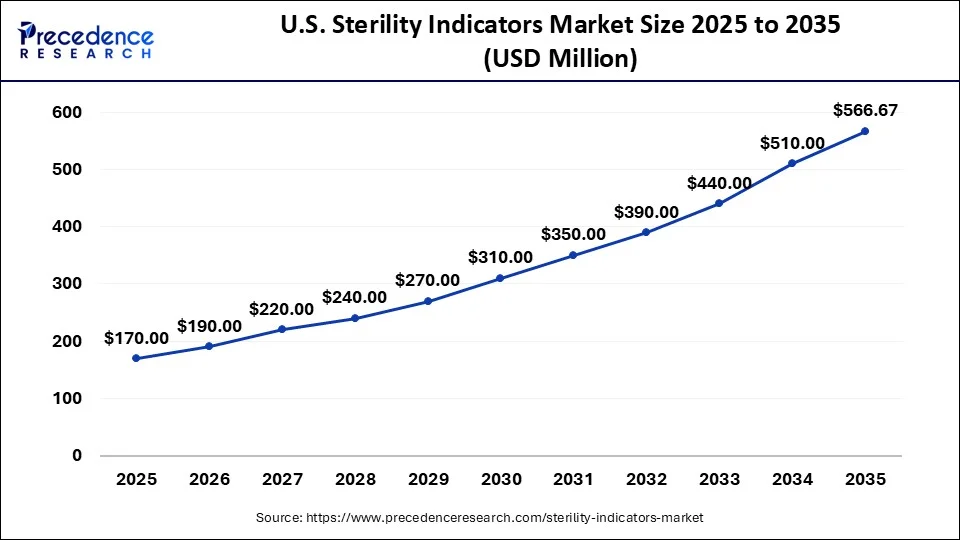

U.S. Sterility Indicators Market Size and Growth 2026 to 2035

The U.S. sterility indicators market size was exhibited at USD 170 million in 2025 and is projected to be worth around USD 566.67 million by 2035, poised to grow at a CAGR of 12.79% from 2026 to 2035.

North America led the global sterility indicators market in 2025, owing to the high standards for medical device sterilization and the well-developed healthcare industry. The United States and Canada have the availability of well-developed healthcare facilities, and the concern towards the spread of healthcare-associated infections increases the need for accurate sterility indicators. Also, the advancements in technology and a greater focus on patient care are other factors that drive the market growth continuously.

Asia Pacific is anticipated to grow notably in the sterility indicators market during the forecast period due to factors such as an increase in the number of newly constructed hospitals and clinics, which has increased the need for proper sterilization and sterility control methods. Countries, including China, India, and Japan, are expected to have a large share due to improved economic status, improved investment in health facilities, and enhanced sterilization technologies.

What are the advancements in Europe?

Europe is witnessing significant growth in the market, driven by factors like the increasing emphasis on infection control, stringent regulatory standards, and the rising demand for quality assurance in healthcare settings. The region also has stringent regulatory requirements that govern the sterilization processes in European healthcare facilities, pharmaceutical manufacturing and biotechnology firms, thus influencing the market. The growing healthcare expenditure in the region is also driven by advanced healthcare infrastructure and quality standards, contributing to market growth and development.

What are the advancements in Latin America?

Latin America is set to witness substantial growth during the forecast period, driven by rapid pharmaceutical production, stringent regulations and technological advancements in sterility testing methodologies. As the manufacturing process becomes more complex, the demand for rapid, accurate, and validated sterility assurance systems in the region is likely to expand. Digitalization is also helping to enhance data integrity and regulatory compliance, while their integration with manufacturing execution systems will enable proactive contamination control. Rising investments in biopharmaceutical production in the region will further drive the market.

What are the advancements in the Middle East and Africa?

The Middle East and African market is experiencing significant growth and is expected to maintain a steady growth trajectory in the upcoming years. This is due to the increasing demand for safe and effective healthcare products. The region's pharmaceutical and medical device industries are seen expanding at a rapid pace, leading to a greater need for robust sterility testing processes. The region is also characterized by the adoption of automated, rapid, and closed-system testing technologies, which is helping manufacturers meet strict compliance deadlines while simultaneously reducing the risk of human error. Rising investments in biopharmaceutical production are further propelling the market.

Value Chain Analysis

- Raw Material Supply

Sterility indicators require special chemical dyes, enzyme substrates, biological spores, plastics castings and several other components for packaging process. Suppliers provide quality, medical grade materials that are able to withstand steam, heat and other external fluctuations. Lately, the demand for faster reacting dyes, more stable spore strips and low temperature sterilizers has been on the rise.

Key Players: Mesa Labs, DuPont, Sartorius - Manufacturing and Processing

Here, manufacturers produce chemical and biological indicators by combining substrates, spores, dyes etc. This stage includes aspects like batch validation, performance testing and incubation stability. Companies are also seen automating all these processes in order to ensure consistency. As hospitals and pharma companies demand for rapid results, manufacturers are scaling up their production processes.

Key Players: 3M Healthcare, Cantel, Steris - Quality Control and Compliance

This stage ensures that every indicator meets regulatory and performance benchmarks before they are being supplied to hospitals, labs and sterilization centers. The testing procedure includes spore viability checks, response time verification, incubation reliability and dye colour accuracy. Manufacturers also conduct accelerated aging tests in order to confirm their shelf life viability.

Key Players: Mesa Labs, 3M Corporation, Nelson Labs

Sterility Indicators Market Companies

- Mesa Labs: Mesa Labs are known for precision biological indicators used in pharmaceutical and biotech settings. They differentiate by offering third-party sterilization validation and custom spore strip design for complex manufacturing environments. Their acquisition strategy has bolstered regional presence in Asia-Pacific and Latin America.

- Getinge AB: Getinge integrates sterility indicators into its hospital sterilization systems, emphasizing process validation and system compatibility. Their solutions are embedded within instrument reprocessing and central sterile supply department (CSSD) workflows , especially in European markets.

- Cantel Medical: Cantel is particularly strong in dental and endoscopy markets, offering compact, fast-reacting chemical indicators tailored to reusable medical device workflows. It focuses on cost-effective indicators for outpatient facilities and standalone clinics.

- Steris Corporation: Steris combines sterility indicators with sterilization equipment, providing end-to-end validation ecosystems. Its unique advantage lies in the synergy between custom PCDs and sterility monitoring kits. The company has made strategic acquisitions to enhance its presence in both North America and Europe.

Other Major Key Players

- Getinge Group

- Cantel Medical Corp.

- 3M Company

- Cardinal Health, Inc.

- Matachana Group

- Mesa Laboratories, Inc.

- Andersen Products, Inc.

Recent Developments

- In April 2024, MATACHANA introduced an innovative format for integrating chemical indicators. This format is aimed at maximizing sustainability of environment in sterilization industry. It has redefined resource management efficiency and has established new sustainability benchmarks in the medical sector. With these advancements, MATACHANA demonstrates its environmental commitment and enhances the operational efficiency of its users. This dual approach benefits both the planet and healthcare professionals by aligning sterilization practices with the principles of sustainability and efficiency.

(Source: matachana.com ) - In October 2023, Advanced Sterilization Products announced an expansion in its Sterilization Monitoring (SM) portfolio with new Steam Monitoring products that will help Sterile Processing Departments (SPDs) ensure sterility with greater efficiency and confidence in results.

- In October 2022, STEMart launched a biological indicator sterility testing service for medical devices. This testing is performed according to the exposure of biological indicators (BIs) after completion of the sterilization load, and it is a qualitative test that reveals results that can appropriately indicate the growth of organisms.

Segments Covered in the Report

By Type

- Chemical

- Class 1

- Class 2

- Class 3

- Class 4

- Class 5

- Biological

- Spore Ampoules

- Spore Suspensions

- Self-Contained Vials

- Spore Strips

By Technique

- Heat

- Low Temperature

- Filtration

- Radiation

- Liquid

By End-user

- Hospitals

- Pharmaceutical Companies

- Medical Device Companies

- Clinical Laboratories/Research Centers

- Others

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting