Subscription Billing Management Market Size and Forecast 2025 to 2034

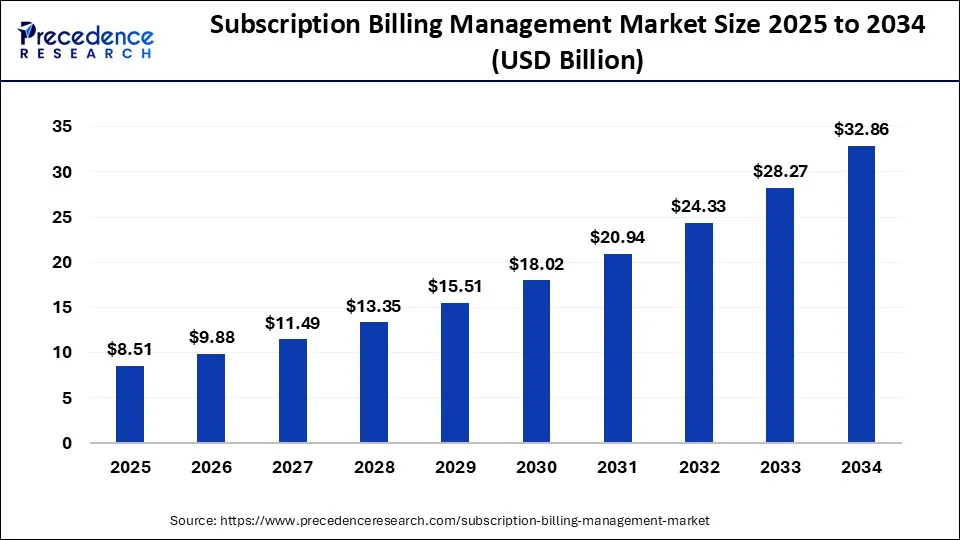

The global subscription billing management market size was calculated at USD 7.32 billion in 2024 and is anticipated to reach around USD 32.86 billion by 2034, growing at a solid CAGR of 16.20% over the forecast period 2025 to 2034. The rising adoption of digital platforms and high demand for flexibility have given a surge to subscription-based models across every sector, propelling the growth of the subscription billing management market.

Subscription Billing Management Market Key Takeaways

- The global subscription billing management market was valued at USD 7.32 billion in 2024.

- It is projected to reach USD 32.86 billion by 2034.

- The subscription billing management market is expected to grow at a CAGR of 16.20% from 2025 to 2034.

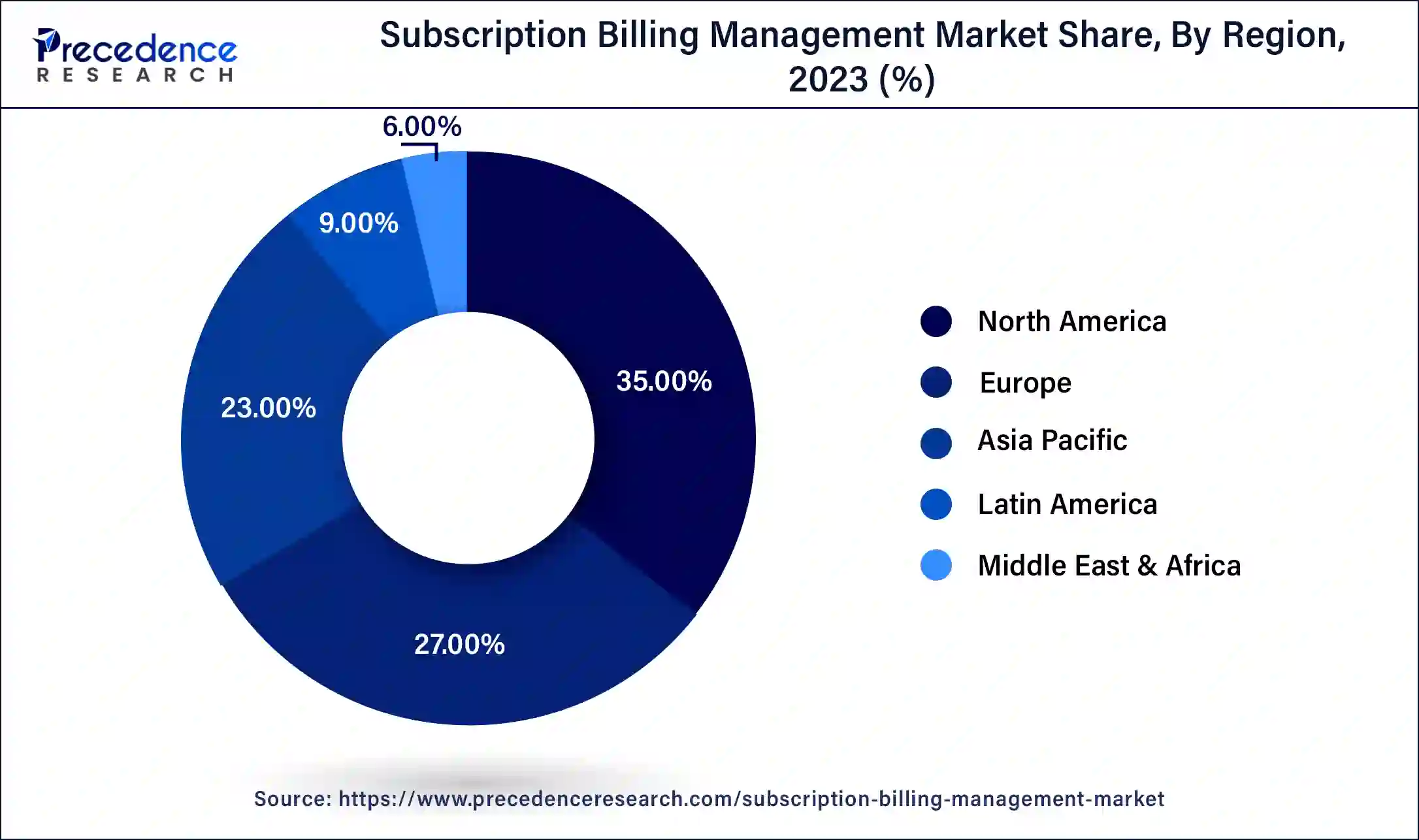

- North America held a substantial share of the global subscription billing management market in 2024.

- Asia Pacific is anticipated to witness the fastest growth in the market during the foreseeable period.

- By software, the subscription order management segment held the largest share of the global market in 2024.

- By software, the receivables management segment is expected to witness substantial growth in the market during the forecasted period.

- By services, the professional service segment accounted for the largest share of the market in 2024.

- By services, the managed services segment is anticipated to showcase the fastest growth in the market in the foreseeable period.

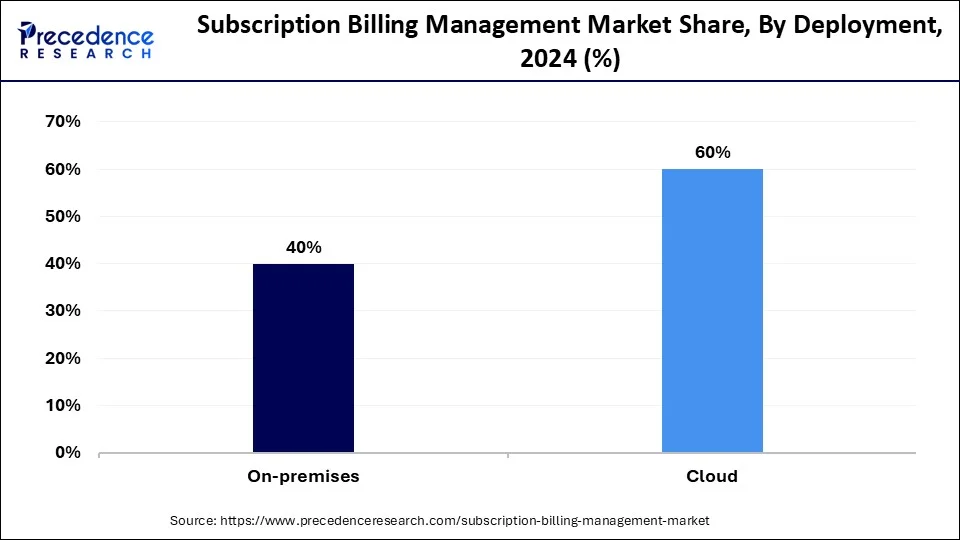

- By deployment, in 2024, the cloud segment registered the highest position in the global market.

- By deployment, the on-premises segment is expected to witness significant growth in the market in the upcoming period.

- By enterprise size, the large enterprise segment dominated the global market in 2024.

- By enterprise size, the small & medium enterprise segment is expected to witness substantial growth in the market during the forecasted years.

- By end use, the BFSI segment dominated the global market in 2024.

- By end use, the retail & e-commerce segment is anticipated to register a substantial growth in the market within the upcoming period.

Impact of AI on the Billing Management Services

AI significantly impacts the subscription billing management market by enhancing automation, predictive analytics, and customer personalization. AI-driven solutions streamline billing processes, reducing errors and operational costs. Predictive analytics helps businesses forecast revenue, identify churn risks, and optimize pricing strategies. Personalized customer experiences powered by AI improve retention and satisfaction by offering tailored recommendations and services. Additionally, AI enhances fraud detection and compliance, ensuring data security.

- In October 2023, ENet announced that it would replace its billing solution with Aria Systems' billing cloud solution. The company has made this decision to enable the company's wider digital transformation. The company mentioned that this deal reflects the strategy that shows they are implementing the latest technologies, including AI, to improve the customer experience.

U.S Subscription Billing Management Market Size and Growth 2025 to 2034

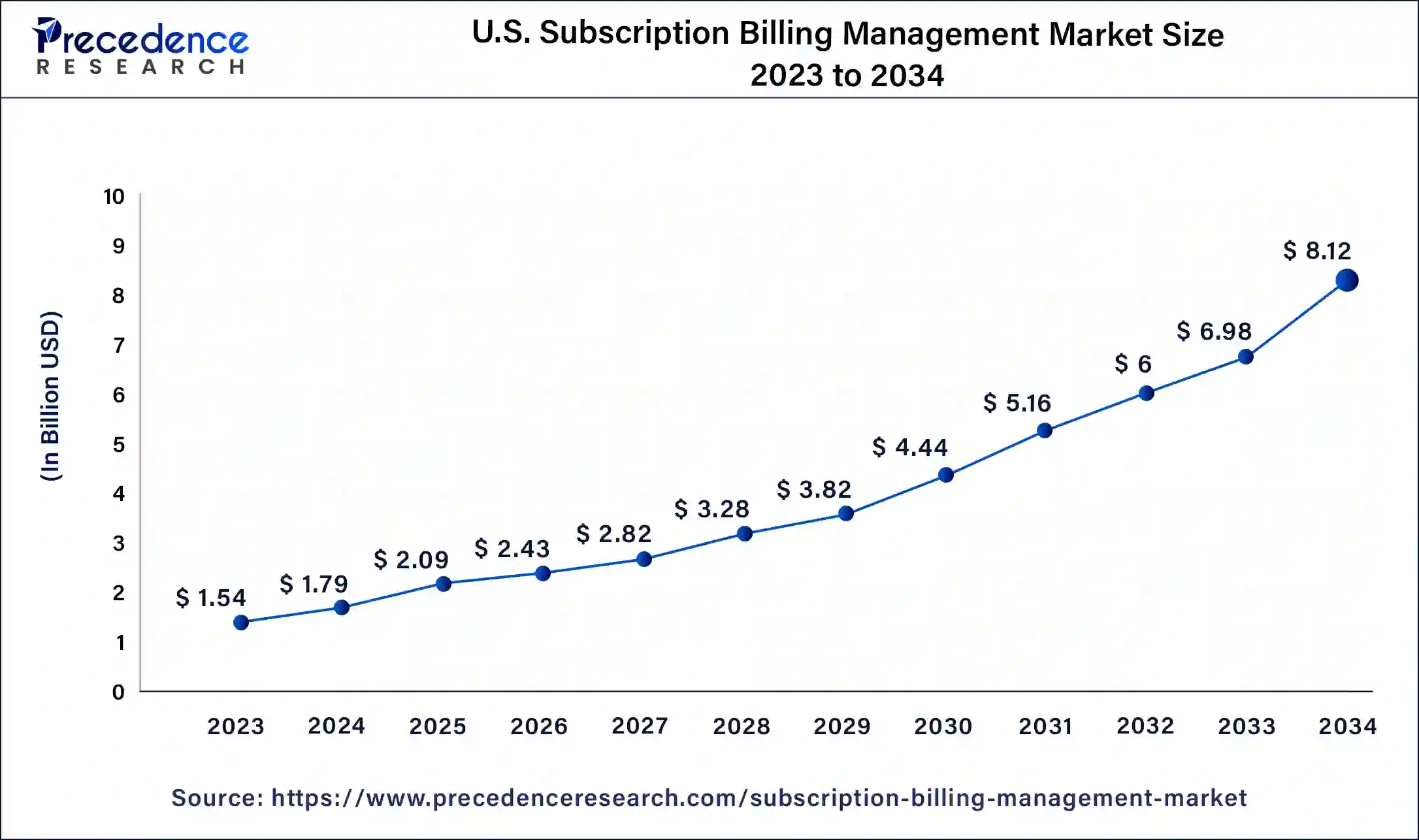

The U.S. subscription billing management market size was valued at USD 1.79 billion in 2024 and is projected to surpass around USD 8.12 billion by 2034, rising at a CAGR of 16.32% from 2025 to 2034.

North America held a substantial share of the global subscription billing management market in 2024 due to its advanced technological infrastructure and high adoption rates of subscription-based models across various industries, including SaaS, media, and e-commerce. The presence of major market players and continuous innovation in automation, AI, and machine learning contribute to this leadership. Additionally, the region's strong focus on customer experience and retention strategies drives the demand for sophisticated billing solutions. Regulatory compliance and robust data security measures also support market growth. Furthermore, North America's economic stability and significant investments in digital transformation further solidify its dominant position in the global market.

Asia Pacific is anticipated to witness the fastest growth in the market during the foreseeable period. Asia Pacific is fast growing in the subscription billing management market due to rapid digital transformation and increasing adoption of subscription-based models in emerging economies like China and India. The region's expanding internet penetration, rising smartphone usage, and growing middle-class drive demand for digital services. Additionally, government initiatives supporting digitalization and the presence of a large, tech-savvy population create a fertile ground for market growth, attracting investments from global and local players alike.

- In March 2023, monetization platform provides Zuora Inc, announced the opening of its new office in the city of Chennai. The new office in India is opened with the intention of providing a strategic center for the country's skilled talent. The company aims to provide a collaborative, flexible, and inclusive environment for talent to accelerate product innovation.

Market Overview

The subscription billing management market is experiencing robust growth, driven by the increasing adoption of subscription-based business models across various industries. Key sectors, including media and e-commerce, are fuelling demand for efficient billing solutions. The market benefits from advancements in automation, integration capabilities, and customer retention strategies. Cloud-based platforms are preferred for their scalability and flexibility. Challenges include data security, regulatory compliance, and the need for customization. Major players are investing in AI and machine learning to enhance analytics and optimize revenue management. Overall, the market is poised for continued expansion, with innovation and digital transformation as key drivers.

Subscription Billing Management Market Growth Factors

- Increasing adoption of subscription-based business models across industries drives the growth of the subscription billing management market.

- Advancements in automation and integration capabilities.

- Growing need for efficient customer retention strategies and a preference for scalable and flexible cloud-based platforms.

- In the subscription billing management market, investments in AI and machine learning for enhanced analytics and revenue optimization are observed.

- Expansion of SaaS, media, and e-commerce sectors.

- Rising demand for customized billing solutions and digital transformation initiatives across businesses.

- Emphasis on improving operational efficiency and reducing manual processes.

- Focus on data security and regulatory compliance drives the growth of the subscription billing management market.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 32.86 Billion |

| Market Size in 2025 | USD 8.51 Billion |

| Market Size in 2024 | USD 7.32 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 16.20% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Software, Services, Deployment, Enterprise Size, End use and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Drivers

Adoption of subscription-based models

The shift towards subscription-based business models is a significant driver for the subscription billing management market. Companies in diverse sectors, from software-as-a-service (SaaS) to media and e-commerce, are adopting these models to ensure steady revenue streams and enhance customer loyalty. Subscription models offer predictable income and the ability to upsell and cross-sell services, driving higher lifetime customer value. This trend necessitates sophisticated billing systems that can handle recurring payments, manage subscriptions, and provide detailed analytics. As more businesses recognize the benefits of this approach, the demand for advanced subscription and billing management solutions continues to grow.

Advancements in automation and integration

Advancements in automation and integration capabilities are propelling the growth of the subscription billing management market. Automation reduces the need for manual intervention, minimizing errors and enhancing efficiency in billing processes. Integration capabilities allow these systems to seamlessly connect with other business software, such as CRM and ERP systems, ensuring a streamlined flow of information across the organization. This interconnected approach enables businesses to manage customer data, track billing cycles, and generate insightful reports more effectively. The result is improved operational efficiency, better customer experience, and the ability to scale operations with ease, making these advancements crucial drivers for market growth.

Restraint

Data security and privacy concerns

Data security and privacy concerns pose a significant restraint on the subscription billing management market. Handling sensitive customer information, including payment details and personal data, requires robust security measures to prevent breaches and ensure compliance with regulations such as GDPR and CCPA. Any security lapses can lead to severe financial penalties, reputational damage, and loss of customer trust. Moreover, the increasing frequency and sophistication of cyberattacks elevate the risks associated with data handling. Implementing comprehensive security protocols and maintaining compliance with evolving regulations demand significant investments in technology and expertise. These challenges can deter smaller businesses from adopting advanced billing solutions, potentially limiting market growth.

Opportunities

Emerging markets adoption

The subscription billing management market has significant opportunities in emerging markets where digital transformation is accelerating. As businesses in these regions adopt subscription-based models to enhance customer retention and generate recurring revenue, the demand for advanced billing solutions grows. These markets offer a largely untapped customer base, allowing companies to introduce innovative billing technologies tailored to local needs. Additionally, increased internet penetration and smartphone usage in emerging economies further support the adoption of digital billing and subscription management systems, presenting a lucrative growth opportunity.

Advancement in machine learning integration

Integrating machine learning into the subscription billing management market presents a substantial growth opportunity. These technologies enable predictive analytics, personalized customer experiences, and enhanced fraud detection, improving overall system efficiency and customer satisfaction. By leveraging AI, businesses can automate complex billing processes, reduce churn through targeted retention strategies, and optimize pricing models. Machine learning algorithms can analyze vast amounts of data to identify trends and anomalies, providing actionable insights. This integration not only drives operational efficiency but also offers competitive advantages, making it a key opportunity for market expansion.

Software Insights

The subscription order management segment held the largest share of the global subscription billing management market in 2024. In subscription order management, there are some steps involved that help lower the consumer churn rate. It involves searching for the right products and their association, projects, one-time services, frequent services, and overall usage charges. The software segment is proliferating due to its function of storing and collecting precise information on customers' billing details and their subscription plans, which caters to the billing management process further while redirecting it to systems like payment gateway. The payment gateway is the system that helps the subscription business to meet the specific requirement.

The receivables management segment is expected to witness substantial growth in the subscription billing management market during the forecasted period. The growth of this segment is due to the inclination of the companies towards subscription business models, which include tracking customers' details and their subscription plans efficiently to provide better alternatives. To achieve this, many enterprises are collaborating with collection management enterprises to expand their receivable management faculty.

- In February 2022, collection management company numbers were acquired by subscription management provider Chargebee. They collaboratively launched a software called Chargebee Receivables, which helps automate the receivables process from the first purchase up to the payment mode.

Services Insights

The professional service segment accounted for the largest share of the subscription billing management market in 2024. The professional service segment is dominating due to its comprehensive service package, which includes integration and deployment, training and consulting, support, and maintenance for software. It helps align the new software with the existing system and does not need any significant changes to it so that the software can be operated seamlessly and efficiently. Therefore, many firms are prioritizing professional services by using a subscription model to enhance customers' flexibility.

The managed services segment is anticipated to showcase the fastest growth in the subscription billing management market in the foreseeable period. This segment of the market is expected to witness lucrative opportunities due to its additional benefits, which do not require any extra payment for managed services. It's basically a recurring billing system that comes up with integrated solutions like improvisation in customer billing, discount plans on custom billing, and a number of renewable alternatives that provide better customer loyalty. These factors are responsible for the managed service segment's expansion in the global market.

Deployment Insights

The cloud segment registered the highest position the global subscription billing management market in 2024. The growth of the cloud segment is attributed to the several factors offered by the deployment of the cloud, such as the automated billing process, high flexibility and scalability, and the support for business operations, eventually leading to an end-to-end customer lifecycle management for a better outcome. Moreover, cloud-based billing solutions can hold changes and potentially manage the evolving needs of the organization according to the consumer's preferences, which are the major factors propelling the cloud segments' growth on a large scale.

- In December 2022, Amazon Web Services Inc. announced that as its preferred public cloud service provider, Yahoo chose AWS for its advertising technology division, Yahoo Ad Tech. Based on its long-standing partnership with AWS, Yahoo Ad Tech moved all the workloads associated with its advertising technology from its on-premises data centers to Amazon, including its media-buying and supply-side platforms, analytics, and identification solutions and products.

The on-premises segment is expected to witness significant growth in the subscription billing management market in the upcoming period. The growth of this segment is attributed to the prominent security provided by on-premises software. This software runs without the involvement of third parties, which keeps the data safe, and privacy measures also get fulfilled with it. In the on-premises subscription billing software, data is also stored in the consumer's local server, which creates reliability between the consumer and enterprises. Also, it effectively aids in managing the changing needs of the market to cater to a successful business.

Enterprise Size Insights

The large enterprise segment dominated the global subscription billing management market in 2024. The growth of the large enterprise segment is due to its substantial assets and availability to use as per the demand of the business. Large enterprises have huge consumer bases that need to be managed efficiently to provide better billing management services with transparency since these customers are spread across the globe. To maintain customer retention, large enterprises invest heavily in subscription and billing management solutions. They also strive for acquisitions and collaborations to strengthen the company's roots on a global level.

The small & medium enterprise segment is expected to witness substantial growth in the subscription billing management market during the forecasted years. Cloud-based billing solutions are boons for small and medium enterprises as they cater to the retention rate of consumers by providing efficient solutions at the same time. SMEs are sensitive to economic changes; hence, they are looking for cost-effective solutions to grow exponentially in the market. Hence, SMEs prefer automating financial processes and accounting instead of manually completing them for precise outcomes. All these factors propel the SME's growth.

End Use Insights

The BFSI segment dominated the global subscription billing management market in 2024 due to its high volume of transactions, need for precise billing, and stringent regulatory compliance. Financial institutions require advanced, secure billing systems to manage subscriptions, detect fraud, and ensure seamless customer experiences, driving demand for sophisticated billing solutions in this sector.

The retail & e-commerce segment is anticipated to register a substantial growth in the subscription billing management market within the upcoming period. The retail & e-commerce segments are fast growing due to the increasing shift to online shopping, subscription box services, and the need for personalized customer experiences. These trends drive demand for advanced billing solutions to manage recurring payments, enhance customer retention, and streamline operations efficiently.

Subscription Billing Management Market Companies

- Aria Systems, Inc.

- Oracle

- BluSynergy

- SAP SE

- Conga

- Recurly, Inc.

- Gotransverse

- cleverbridge

- Zuora Inc.

- LogiSense Corporation

Recent Developments

- In January 2023, Salesforce announced the partnership with Walmart GoLocal and Walmart Commerce Technologies to provide later companies access to solutions that provide the ability to power frictionless local pickup and delivery for shoppers.

- In November 2023, Amazon Web Services, Inc. (AWS) announced the launch of Data Exports. Data Exports is the company's new billing & cost management feature that holds the capability of creating exports of building cost management and data. This is done by filtering the desired data using SQL column selections.

- In April 2023, Recurly launched app management capabilities within its platform. This was planned to help bridge the data gap for direct-to-consumer marketers by providing subscription analytics across app stores and the web.

Segments Covered in the Report

By Software

- Credit & Collection Management

- Receivables Management

- Quote & Pricing Management

- Subscription Order Management

- Dispute Management

- Others

By Services

- Professional Services

- Managed Services

By Deployment

- Cloud

- On-premises

By Enterprise Size

- Large Enterprises

- Small & Medium Enterprises

By End use

- BFSI

- Retail & e-commerce

- IT & telecom

- Media & entertainment

- Healthcare

- Others

By Geography

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting