Surgical Drainage Devices Market Size and Forecast 2025 to 2034

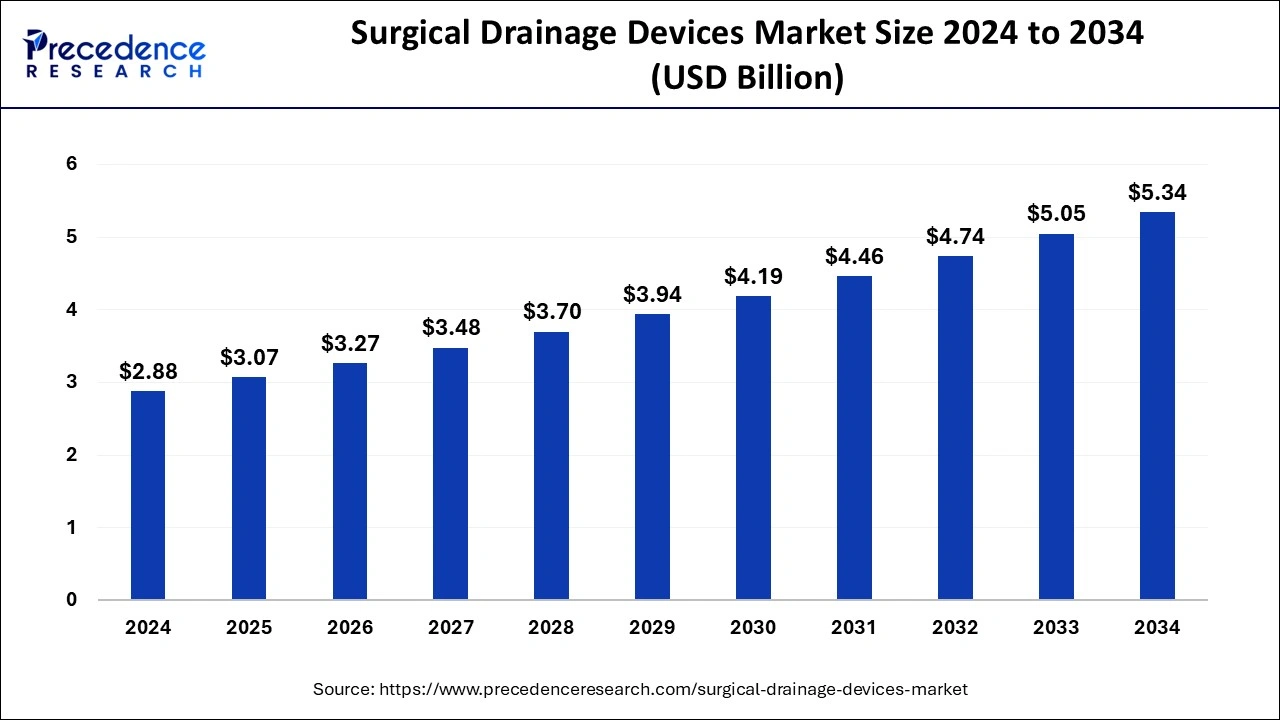

The global surgical drainage devices market size was estimated at USD 2.88 billion in 2024 and is predicted to increase from USD 3.07 billion in 2025 to approximately USD 5.34 billion by 2034, expanding at a CAGR of 6.37% from 2025 to 2034.

Surgical Drainage Devices MarketKey Takeaways

- The global surgical drainage devices market was valued at USD 2.88 billion in 2024.

- It is projected to reach USD 5.34 billion by 2034.

- The surgical drainage devices market is expected to grow at a CAGR of 6.37% from 2025 to 2034.

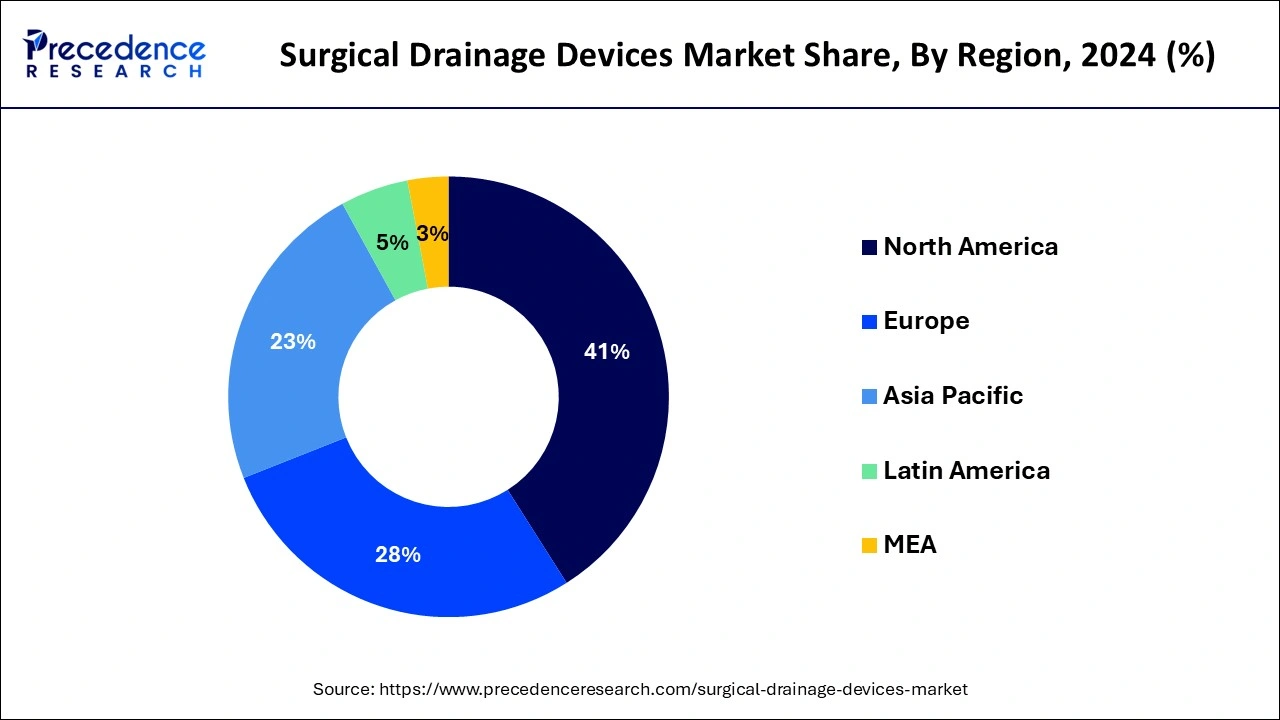

- North America has contributed more than 41% of the market share in 2024.

- Asia-Pacific is estimated to be the fastest-growing during the forecast period of 2025-2034.

- By product type, the active drains segment has held a major market share of 81% in 2024.

- By product type, the passive drains segment is the fastest-growing during the forecast period.

- By application, the thoracic and cardiovascular surgeries segment has accounted for more than 25% of the market share in 2023.

- By application, the neurosurgical procedures segment is the fastest-growing during the forecast period.

- By end-user, the hospitals segment has generated more than 46% of the market share in 2024.

- Based on the end-user, the ambulatory surgical center segment is the fastest-growing during the forecast period.

U.S.Surgical Drainage Devices Market Size and Growth 2025 To 2034

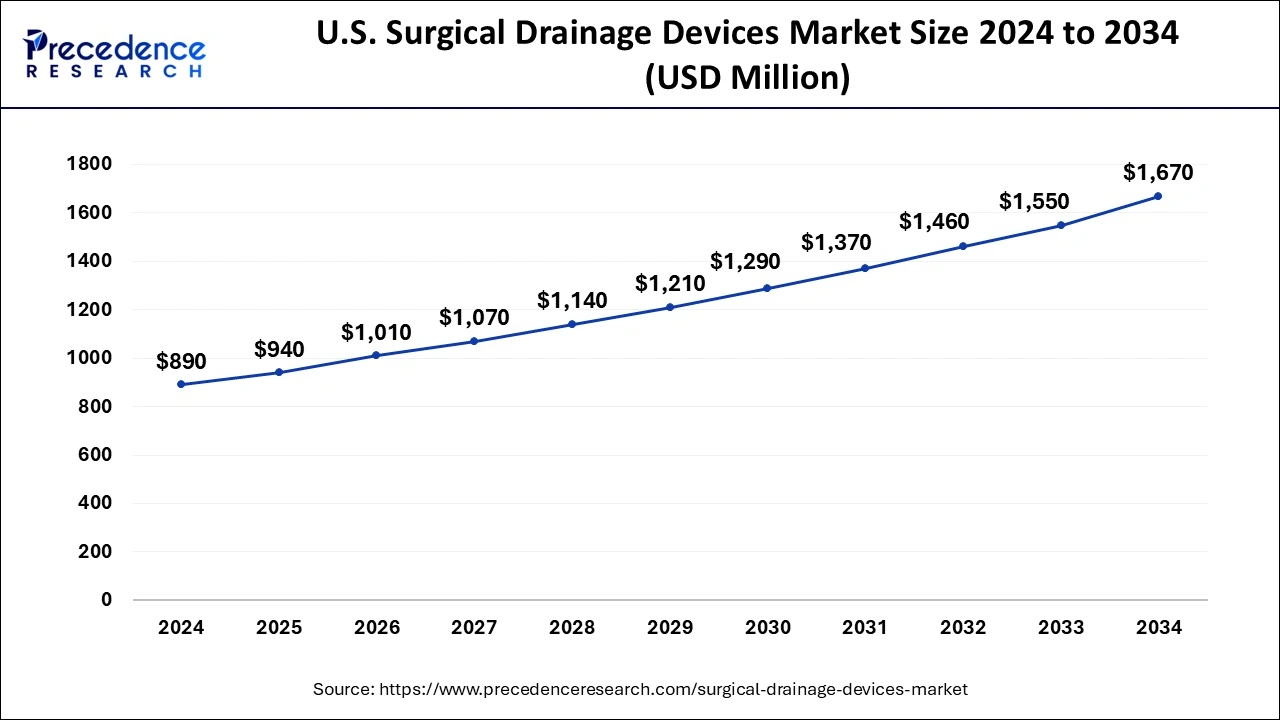

The U.S. surgical drainage devices market size reached USD 890 million in 2024 and is projected to be worth around USD 1,670 million by 2034, poised to grow at a CAGR of 6.50% from 2025 to 2034.

North America dominated the surgical drainage devices market with the largest share of 41% in 2024. In North America, the market is largest due to the increase in the senior population, increase in chronic diseases, and demand for advanced procedures in surgeries. Advanced healthcare infrastructure and advanced technologies are the other characteristics that have a role in the market's growth. Increasing research and development investments and government-supportive initiatives toward reducing chronic diseases contribute to the market's growth. The United States has the highest expenditure rates in the North American market. North America is the center for research and medical device innovation.

Asia-Pacific is estimated to be the fastest-growing during the forecast period of 2025-2034. Increasing healthcare companies and changing healthcare forms are constantly investing in this region, contributing to the growth of the surgical drainage devices market. A gradual increase in chronic diseases has been observed in Asia-Pacific countries like India, Japan, China, and Indonesia. The number of surgeries is increasing and contributing to the market.

Market Overview

The surgical drainage devices market consists of soft tubes, which remove fluid, blood, and pus from the wound to prevent it from accumulating in the body. Surgical drainage devices use the body parts after the surgery to drain body fluids. These devices prevent infection in surgical areas and remove dead space. In chronic diseases, surgical drainage devices are used. Interventional radiologists or surgeons usually place them after surgery or other injuries. They can also be used to relieve pressure in certain cases. Different types of drainage devices are available, and the choice of which one to use depends on the location of the drain placement and the duration it will be needed. Due to the rise in the number of diseases, there has been an increase in the use of surgical drainage devices in hospitals, clinics, and ambulatory surgical centers.

Surgical Drainage Devices MarketGrowth Factors

- There is a high demand for advanced wound care products in various regions, contributing to the growth of the surgical drainage devices market.

- The growing senior population and chronic diseases increase the number of diseases, which leads to surgical treatments and growth in the market.

- smoking and alcohol drinking also increase the diseases related to surgical treatments, and the use of market increases.

- Advantages of this surgical drainage device are less pain, more effectiveness, low infection, and accuracy, which may lead to market growth.

Market Scope

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 6.37% |

| Market Size in 2025 | USD 3.07 Billion |

| Market Size by 2034 | USD 5.34 Billion |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Product Types, By Applications, and By End-users |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

The number of surgeries is increasing

The increasing number of surgeries involves the necessities of the drainage devices market. Due to the rising number of senior patients, the demand for patients and other surgical diseases has increased. Increasing road accidents and sports incidents can cause an increase in surgeries. The increase in chronic diseases also increases the number of surgeries. Smoking and alcohol drinking also increase the diseases related to surgical treatments, and the use of surgical drainage devices market increases. Due to the advantages of less pain, more effectiveness, low infection, and accuracy, people demand surgery.

Chronic diseases are increasing

Chronic diseases include diabetes, cardiovascular diseases, genetic disorders, inflammation, cancer, etc. These diseases require surgical drainage devices. Chronic disease also affects the extraintestinal organs and gastrointestinal tract, so surgical drainage devices are needed. The medical surgery used on the market also treats inflammatory chronic disease. The drainage device market is necessary for these diseases to overcome fluid accumulation and other complications. Increasing research and development in chronic diseases cause the demand for devices to increase and contribute to market growth.

Restraint

Regulatory barriers

The surgical drainage device companies have to follow the guidelines and regulations the regulatory authority makes. The surgical drainage devices market has to invest in its research and development, quality control, documentation, and testing to get surety with the standards made by the authority. Getting approval from the regulatory authority for surgical drainage devices is too hard. It is a time-consuming process to get approval for the new device. The devices that are approved by regulatory authorities may be expensive. In the different regions, there are different regulatory authority agencies for the devices. Some surgical drainage device manufacturers delay the development of new devices in the market due to regulatory authority. Due to these high prices and time-consuming regulatory authorities' processes, the market's growth may be negatively affected.

In the surgical drainage devices market, regulatory barriers include adhesion barriers. It includes clinical trial information that is in progress and the development stages.

Opportunities

Smart and connected surgical drainage devices

There are various types of smart surgical drainage devices in the market. The smart drainage devices market in the healthcare market provides devices that can transmit and monitor data and remote monitoring devices. Various types of devices help in early disease detection, are active processes in patient care, and are time-consuming. Connected surgical drainage devices continuously monitor and help in hospitals with patient needs. These smart and connected surgical drainage devices are personalized and efficient for the patients.

In that one of the glaucoma drainage devices (GDD) is the smart self-clearing glaucoma drainage device made in November 2018 for patients who are not responsive to the pharmacological surgery of glaucoma.

- In June 2022, a smart sensor system was made for real-time characterization during surgery and also for digitalizing post-operative care for the patient's bedside abdominal drainage output. The smart sensor system is used in spectroscopic measurements of red blood cells, urea, amylase, lipase, protein, etc.

Product Type Insights

The active drains segment dominated the surgical drainage devices market in 2024. Active drains have features like customizable suction settings, enhanced drainage efficiency, and reduced risk of drain blockage. Active drains include the types of Blake drain, Jackson-Pratt drain, Redivac drain, EVD & Lumbar drain, Negative pressure wound therapy, Chest tube, and others. The active surgical drainage devices mostly use the negative pressure wound therapy from the surgical sight to drain the fluid. Active drains, also known as closed drains, are used in deep wounds where a large amount of fluid is drained. The suction device creates negative pressure, which is connected to these drains. Jackson-Pratt drain is an active drain that creates suction by using a plastic bulb to remove fluid. This Jackson-Pratt drain is used in breast, plastic, and abdominal surgeries.

A removal drain is also active, and the spring creates suction. The end of the drainage tube is attached to the plastic container of these drains. Radivac drain is a type of active drainage. When a tissue is removed during an operation, a thin PVC plastic tube is placed in the cavity, known as a Radivac drain. A plastic measuring bottle outside the body is connected to the tube stitched into the space. External ventricular drains (EVD) and lumbar drains are active drainage devices. Lumbar or EVD drains help reduce intracranial pressure and cerebrospinal fluid (CSF) leaks. A chest tube is a plastic flexible tube inserted in the chest wall to remove fluid or air.

During the forecast period, the passive drains segment is the fastest-growing surgical drainage devices market. Passive drains, also known as open drains, are put in the wound, and the ends are open in the air to remove fluid. Penrose drainage is the passive drain in which a soft rubber tube is placed in the wound to remove the fluid from the body. The Penrose drain is used in thoracic surgery and abdominal surgery.

Application Insights

The thoracic and cardiovascular surgeries segment dominated the market in 2024. Due to the increase in cardiovascular diseases increases the application of this segment in the market. There is market demand for thoracic and cardiovascular surgeries for efficient and easy removal of fluid for chest drainage. In these thoracic and cardiovascular surgeries, the devices are used to treat pleural effusions and pneumothorax and to remove fluid accumulated in the chest cavity.

Neurosurgical procedures of the application insights into the fastest-growing surgical drainage devices market during the forecast period. In the neurosurgical procedures, the devices are applied in managing brain disorders, viz. traumatic brain injury, brain hemorrhage, and hydrocephalus. The market removes blood or fluid from the central nervous system or brain in this application. These applications are also useful in external ventricular drains (EVDs), ambulatory surgical centers, and cerebrospinal fluid drainage. These surgical drainage devices are also used in the market for abdominal surgery.

In abdominal surgery, the devices detect bile leakage and remove fluid from the abdomen. A surgical drainage device is used to manage the intra-abdominal abscess. In orthopedics, surgical drainage devices are used in post-operative surgeries in large joints. Active drains are commonly used for orthopedic surgeries. Drains are used in orthopedic surgery to avoid infection in surgeries.

End-Users Insights

The hospital segment dominated the surgical drainage devices market in 2024. Hospitals, ambulatory surgical centers, and clinics are the segments by end-user insights. The hospital segment is the first user in the market. Hospitals take care of the safety of the patients. Hospitals improve their surgical drainage devices and surgical treatments and perform higher procedures. Hospitals primarily adopt new technologies and techniques. Hospitals also follow the guidelines and standards made by regulatory authorities. Hospitals have a high demand for surgical drainage devices. Healthcare providers and surgeons prefer to use specific devices in the surgical process based on their device efficacy and experience. A standard of care in many surgical specialties hospitals is surgical drainage devices.

The ambulatory surgical centers segment of the end-user insights is the fastest-growing market during the forecast period. Ambulatory surgical centers use surgical drainage devices to reduce surgical complications and infections during surgery. Compared to traditional inpatient services, ambulatory surgical centers offer the profit of short hospital stays. Patients' surgeries can be done quickly, and they can recover at home after discharge from the ambulatory surgical centers. These devices can minimize the risk of post-operative problems associated with the surgeries.

Surgical Drainage Devices Market Companies

- Acelity

- Cardinal Health

- Cook Medical

- Conva Tech Inc.

- C. R. Bard, Inc.

- Ethicon USA, LLC

- Medtronic

- Medline Industries Inc.

- Stryker

- Teleflex Incorporated

- Zimmer Biomet

Recent Developments

- In October 2023, Haermonics, a MedTech company, launched Haermonics Pure, a medical device. The device is capable of self-flushing the chest cavity of patients who have undergone heart surgery. The device can prevent the second surgery that is needed for the drainage of pus residual blood and blood clots and prevent life-threatening complications.

- In February 2023, Fujifilm launched an advanced endoscopic ultrasound machine. The machine will be able to provide enhanced diagnostic precision and image clarity. These features are useful in the management of Gallbladder drainage and bile duct drainage.

Segments Covered in the Report

By Product Types

- Active Drains

- Jackson-Pratt Drain

- Hemovac Drain

- Blake Drain

- Negative Pressure Wound Therapy

- Redivac Drain

- EVD & Lumbar Drain

- Chest Tube

- Others

- Passive Drains

- Penrose Drain

- Others

By Applications

- Thoracic and Cardiovascular Surgeries

- Neurosurgical Procedures

- Abdominal Surgery

- Orthopedics

- Others

By End-users

- Hospitals

- Ambulatory Surgical Centers

- Clinics

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting