What is Surgical Snare Market Size?

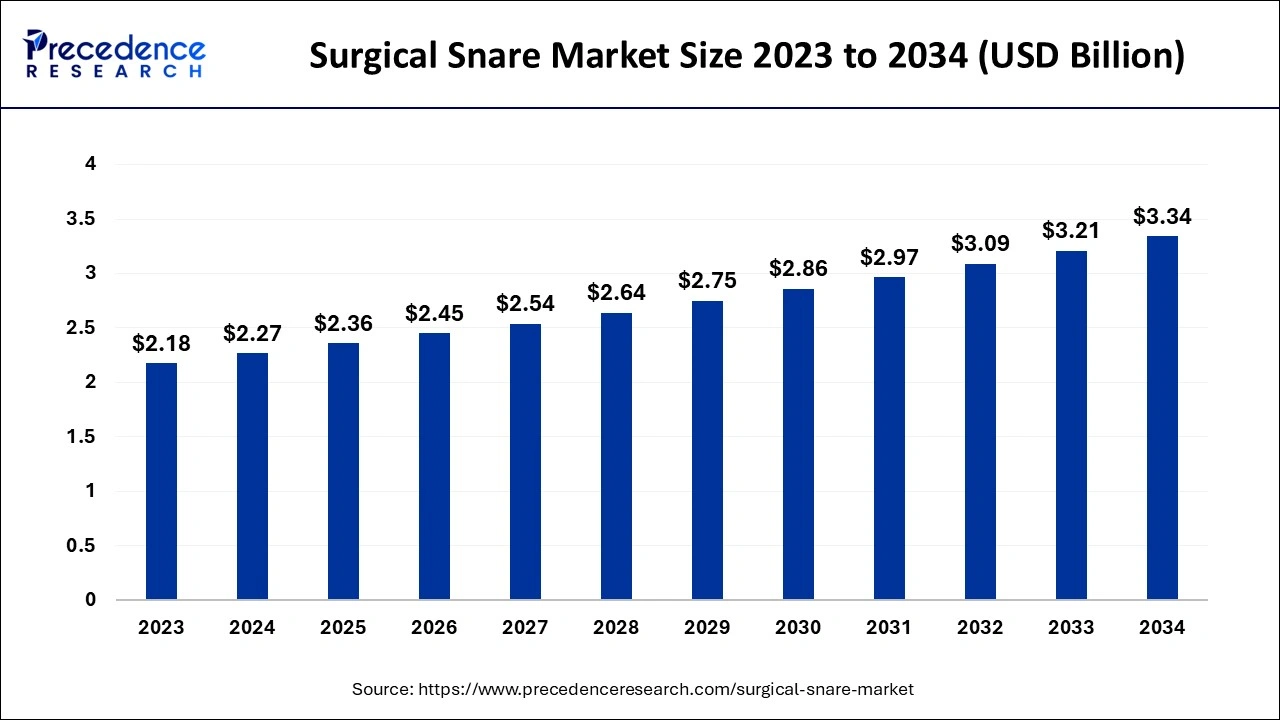

The global surgical snare market size is accounted at USD 2.36 billion in 2025 and is expected to exceed around USD 3.34 billion by 2034, growing at a CAGR of 3.94% from 2025 to 2034. The surgical snare market is driven by the increasing incidence of gastrointestinal (GI) conditions that necessitate minimally invasive operations like polypectomy and tumor removal, such as colorectal cancer and polyps.

Market Highlights

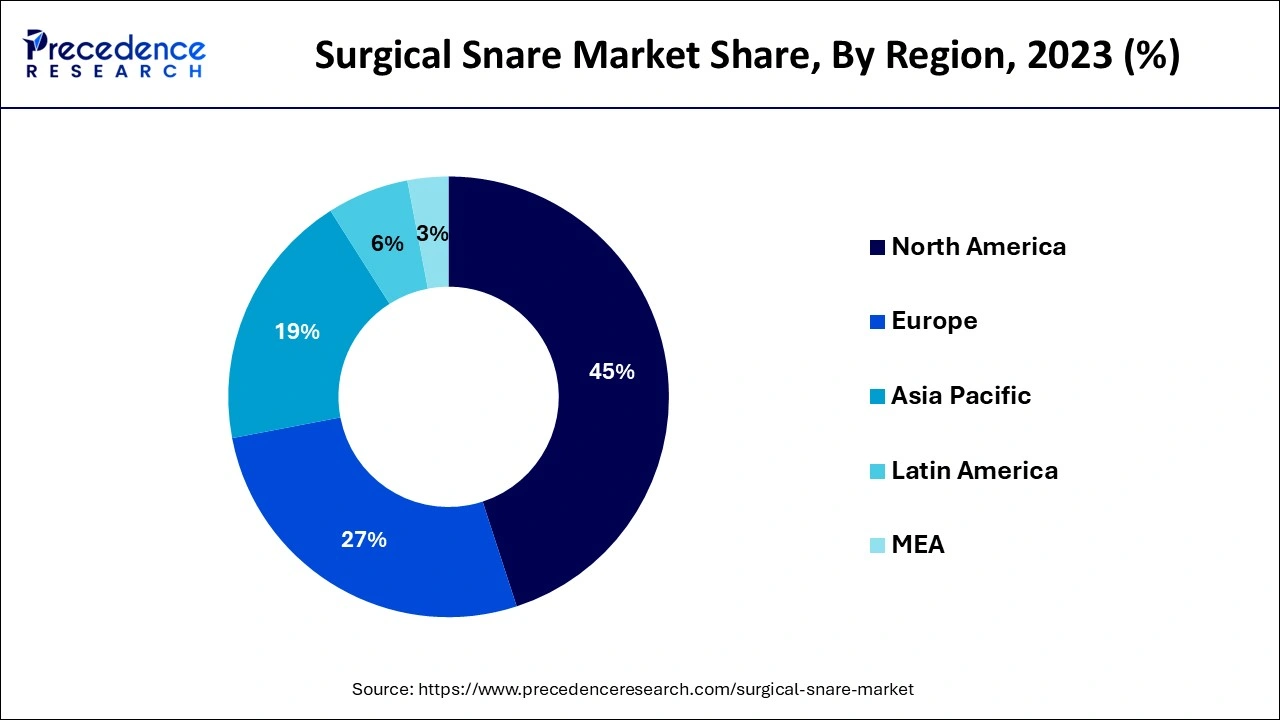

- North America dominated the global market with the largest market share of 45% in 2024.

- Asia Pacific is observed to be the fastest growing region during the forecast period.

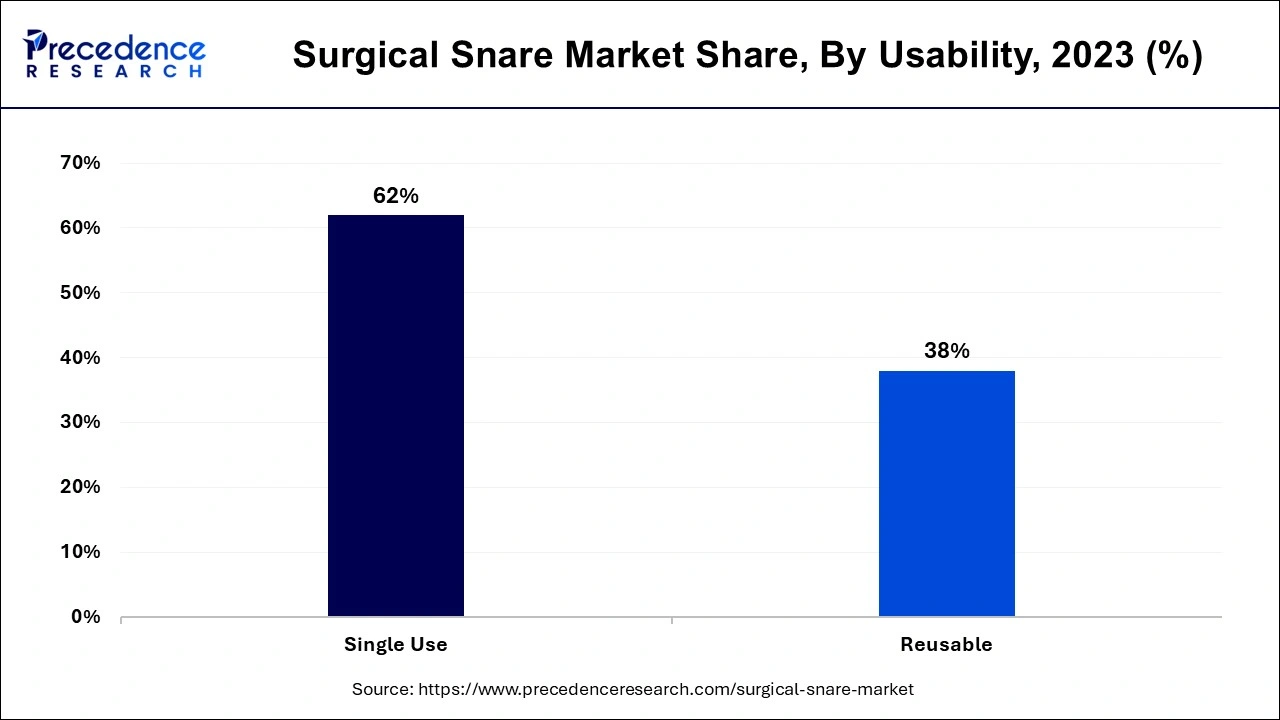

- By usability, the single-use segment contributed the highest market share of 62% in 2024.

- By usability, the reusable segment is expected to witness the fastest CAGR during the forecast period.

- By application, the GI endoscope segment held the largest market share of 32% in 2024.

- By application, the arthroscopy segment is anticipated to grow at the fastest CAGR during the forecast period.

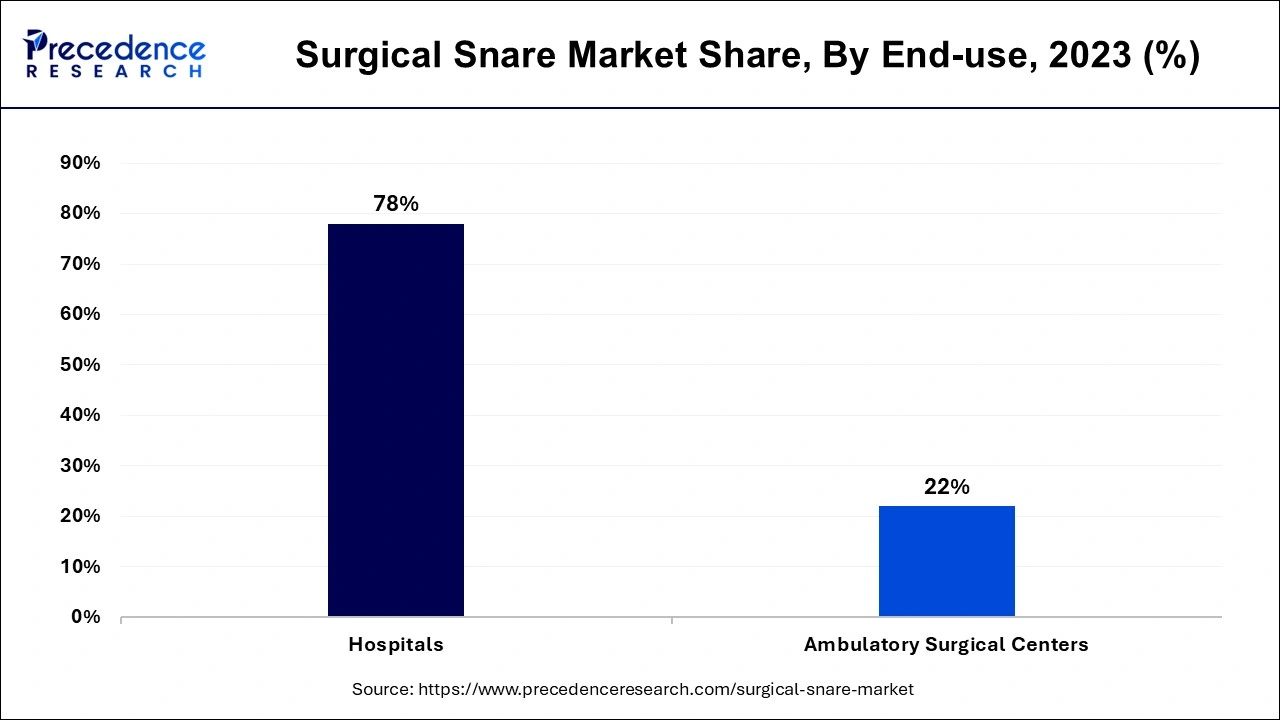

- By end-use, the hospitals segment accounted for the biggest market share of 78% in 2024.

- By end-use, the ambulatory surgical centers segment is observed to grow rapidly during the forecast period.

How is Artificial Intelligence (AI) enhancing the Surgical Snare Market?

More accurate snaring of polyps or lesions is made possible by AI-integrated endoscopic equipment that can differentiate bad tissue from healthy tissue in real time. Adaptive surgical snare market designs can improve procedural success rates by addressing differences in tissue density or architecture. By guaranteeing that the surgery is performed precisely, AI analytics prevent issues, including bleeding, perforation, and partial tissue removal. After the procedure, artificial intelligence also verifies that the snared tissue was accurately and fully removed by evaluating biopsy or follow-up imaging data.

Market Overview

Surgical snares are crucial in minimally invasive procedures like gastrointestinal endoscopy, colonoscopy, and bronchoscopy, which are now the gold standard for identifying and treating diseases like colorectal cancer and gastrointestinal disorders. These procedures are recommended because of their decreased dangers, quicker recovery, and shorter hospital stays. Awareness efforts and government-led screening programs for the early diagnosis of malignancies and other gastrointestinal problems have strengthened the surgical snare market application in diagnostic and therapeutic operations.

- A projected 2,001,140 new instances of cancer will be diagnosed in the U.S. in 2024, according to the American Association for Cancer Research.

- With 262,261 shipments, India is the world's top importer of surgical instruments.

Where Wire Loops Become Instruments of Life-Saving Precision

The surgical snare market is evolving rapidly as minimally invasive procedures gain prominence across gastroenterology, pulmonology, ENT, and gynecology. Surgical snares enable clinicians to excise polyps, lesions, foreign bodies, and abnormal tissues with accuracy, speed, and minimal trauma. As endoscopic and laparoscopic interventions continue to outperform traditional open surgeries, demand for advanced snares grows steadily.

Innovations include rotatable snares, micro-snares, insulated designs, and ultra-fine cutting loops engineered for complex anatomical pathways. Hospitals and ambulatory surgical centers increasingly prefer disposable snares for sterility assurance and ease of use. The market is driven by rising procedure volumes, clinical efficiency demands, and technological enhancements in endoscopy.

Surgical Snare Market Growth Factors

- Snares are frequently employed for tissue removal, tumor excision, or polyp removal in surgical operations. These operations are becoming increasingly popular due to the rising prevalence of chronic conditions like cancer, gastrointestinal issues, and obesity.

- The surgical snare market is predicted to rise as healthcare systems prioritize early detection and treatment.

- The surgical snare market is growing due to ongoing improvements in surgical snare designs and materials, such as the creation of snares with improved safety features, precision, and compatibility with cutting-edge surgical systems (such as robotic-assisted operations). These developments increase surgical efficacy and efficiency, which promotes broader use among medical professionals.

Market Outlook

- Industry Growth Overview: Industry growth stems from rising gastrointestinal procedures, ENT interventions, and demand for precision tissue excision. Innovations include coated wire loops, heat-treated alloys, and low-friction sheaths. Increasing preference for outpatient surgery accelerates snare usage. Growing investment in endoscopic equipment indirectly boosts associated consumables like snares. Higher screening rates for polyps and early cancer detection further strengthen growth. The industry is rapidly evolving toward specialized, high-performance devices.

- Global Expansion: Manufacturers expand globally through partnerships with hospitals, distributors, and GI specialty networks. Emerging markets adopt affordable, standardized snare designs to meet rising procedural demand. Multinational companies localize production to reduce costs and regulatory hurdles. Training initiatives support adoption in new geographies. Endoscopy device companies integrate snares with their broader product portfolios. Global expansion ensures wide accessibility of advanced snare technology.

- Sustainability Trends: Sustainability initiatives include developing recyclable handle components and reducing plastic use in disposable snares. Manufacturers explore bio-friendly polymers and energy-efficient production techniques. Packaging reduction becomes a priority to minimize medical waste. Robust sterilization validation supports more sustainable reusability in select regions. Hospitals adopt greener procurement policies, influencing snare design evolution. Sustainability is slowly integrating into endoscopic consumable manufacturing.

- Startup Ecosystem: Startups focus on advanced snare geometries, coated wire loops, and improved handle mechanics. Some develop AI-integrated visualization tools that optimize snare deployment during endoscopy. Innovations target smoother resection, reduced bleeding, and better tactile feedback. Partnerships with GI surgeons help refine product usability. Startups also explore multifunctional snares that combine cutting, grasping, and coagulation abilities. Their agility drives performance upgrades across the industry.

Market Scope

| Report Coverage | Details |

| Market Size by 2025 | USD 2.36 Billion |

| Market Size in 2026 | USD 2.45 Billion |

| Market Size in 2034 | USD 3.34 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 3.94% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Usability, Application, End-Use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Significant increase in gastrointestinal procedures

The main purpose of surgical snares is to remove aberrant tissue from the GI system, such as polyps or tiny tumors, during endoscopic treatments. The need for these tools has grown as routine colonoscopies and upper gastrointestinal endoscopies have increased. Manufacturers in the surgical snare market are developing advanced surgical snares with increased safety, flexibility, and cutting precision. Bipolar and hybrid snares, for instance, are intended to lower the risk of bleeding during procedures, hence improving patient outcomes.

Increasing prevalence of chronic kidney diseases

Kidney biopsies are frequently used to diagnose chronic kidney disease, assess the degree of damage, and identify underlying causes, such as glomerulonephritis, diabetic nephropathy, or autoimmune disorders. Chronic kidney illnesses are now detected early because of awareness programs and improved diagnostic tools. Surgical snares are necessary for early intervention treatments like biopsies and stone removal.

Restraints

Limited infrastructural facilities

Well-equipped hospitals and diagnostic facilities are scarce in many developing nations. Finding the facilities needed to carry out minimally invasive treatments, such as specialized operating rooms, cutting-edge imaging equipment, and trained staff, is frequently impossible. Compared to other pressing healthcare concerns, investing in such infrastructure may not be financially feasible for healthcare institutions in resource-constrained environments.

High cost of the product

For performance, flexibility, and longevity, surgical snares are constructed using cutting-edge materials and technologies, including coated loops, stainless steel, and tungsten wires. These elements raise the cost of production. Although disposable surgical snares improve safety and hygiene, they are costly and increase ongoing hospital expenses. Reusable snares are more expensive initially, but they must also be maintained and sterilized, which raises operating costs.

Opportunities

Rising incidence of cancer

Early-stage polyps are the precursor to many malignancies, including colorectal cancer. Surgical snares can safely and completely remove polyps during colonoscopies, greatly lowering the chance that they will progress to cancer. Minimally invasive procedures are becoming increasingly popular among patients and healthcare professionals due to their many advantages, such as quicker recovery periods, fewer complications, and cheaper costs. Surgical snares are increasingly used in oncology applications as essential tools for minimally invasive procedures.

- With over 65,000 biopsies performed each year, percutaneous lung biopsy (PLB) is a minimally invasive technique that is becoming increasingly popular for the workup of suspected lung nodules.

Increasing awareness about the benefits of surgical snare

Patients now have easier access to medical information because of the growth of digital health platforms. Many people are taking the initiative to learn about their alternatives for treatment, including how surgical snares function in minimally invasive procedures. The need for less intrusive, outpatient-friendly procedures enables producers to reach a broader range of customers. Healthcare workers are becoming more aware of sophisticated surgical snare designs, such as those with ergonomic handles, improved flexibility, and electrosurgical compatibility. Since these advancements in the surgical snare market have become the go-to option for endoscopic procedures because they enhance procedural results.

Segment Insights

Usability Insights

The single-use segment dominated the surgical snare market in 2024. By being pre-sterilized and disposed of after only one usage, single-use surgical snares reduce the possibility of infection transmission between patients. This is especially important in surgical and endoscopic treatments when sterilizing is crucial. Single-use devices remove the need for extra effort and resources for maintenance, in contrast to reusable snares that require labor-intensive cleaning, disinfection, and re-sterilization procedures.

The reusable segment is observed to grow at the fastest rate in the surgical snare market during the forecast period. Hospitals and surgical facilities can save money by using reusable surgical snares. Reusable snares can be used repeatedly after being properly sterilized, which lowers the total cost per treatment even though their initial cost may be more than that of disposable ones. Reusable snares are appealing because of their long-term cost-saving feature, particularly for healthcare practitioners with limited funding. Reusable solutions are now more effective thanks to ongoing advancements in surgical snare technology, with designs aimed at increasing patient outcomes, lowering the risk of complications, and improving simplicity of usage. Because of these improvements in functionality and design, more medical practitioners are choosing reusable snares over disposable ones.

Application Insights

The GI endoscope segment held the largest share of the surgical snare market in 2024. Using an endoscope, endoscopy is a minimally invasive treatment that enables doctors to inspect the GI system. With GI endoscopes, surgical snares are frequently used for tissue sampling, tumor excision, and polypectomy (removal of polyps). The need for surgical snares has increased dramatically due to the growth of endoscopic applications, such as in the diagnosis and treatment of different GI disorders. Endoscopic treatments have replaced traditional open operations as the least invasive way to do procedures like gastroscopies and colonoscopies.

- In November 2024, Optiscan Imaging and Monash University partnered to develop Optiscan Imaging's next-generation gastrointestinal (GI) flexible endomicroscopy. This partnership will improve Optiscan's cutting-edge Edge-AI-enabled technology, which will improve real-time cancer detection during gastrointestinal procedures.

The arthroscopy segment is observed to expand rapidly in the surgical snare market during the forecast period. Joint issues are becoming more common as the world's population ages, which increases the demand for arthroscopic operations. Arthritis, which frequently necessitates arthroscopic intervention, is more common in older people. A surgical snare is necessary to remove tissue or foreign objects from the joint area during arthroscopy. Advanced snares that provide greater accuracy, effectiveness, and safety have been developed due to the rise in arthroscopy procedures.

- In November 2024, to provide soft tissue treatments for orthopedic sports medicine surgery, Johnson & Johnson and MedTech announced an exclusive commercial distribution arrangement with Responsive Arthroscopy Inc.

End-use Insights

The hospitals segment accounted for the largest share of the surgical snare market in 2024. A considerable number of surgical procedures are performed in hospitals, particularly large medical institutes, every day. Specialized tools, including surgical snares, which are essential in many surgeries, are frequently needed for these procedures. Endoscopic procedures (such as those involving the gastrointestinal, pulmonary, or urinary systems), tumor excisions, biopsy collections, and polyp removals are the main applications for surgical snares. The need for surgical snares is fueled by the large volume of hospital surgeries, encompassing both simple and complicated operations.

The ambulatory surgical centers segment is observed to grow rapidly in the surgical snare market during the forecast period. More diagnostic and treatment operations are being carried out due to the growing prevalence of chronic illnesses such as colorectal cancer, gastrointestinal issues, and respiratory conditions. Surgical snares are frequently employed for polypectomy, tumor resection, and the excision of other malignant growths. The need for surgical snares in ambulatory surgical centers is anticipated to increase dramatically as these facilities offer specialist care in fields including cancer, pulmonology, and gastroenterology.

Regional Insights

U.S. Surgical Snare Market Size and Growth 2025 to 2034

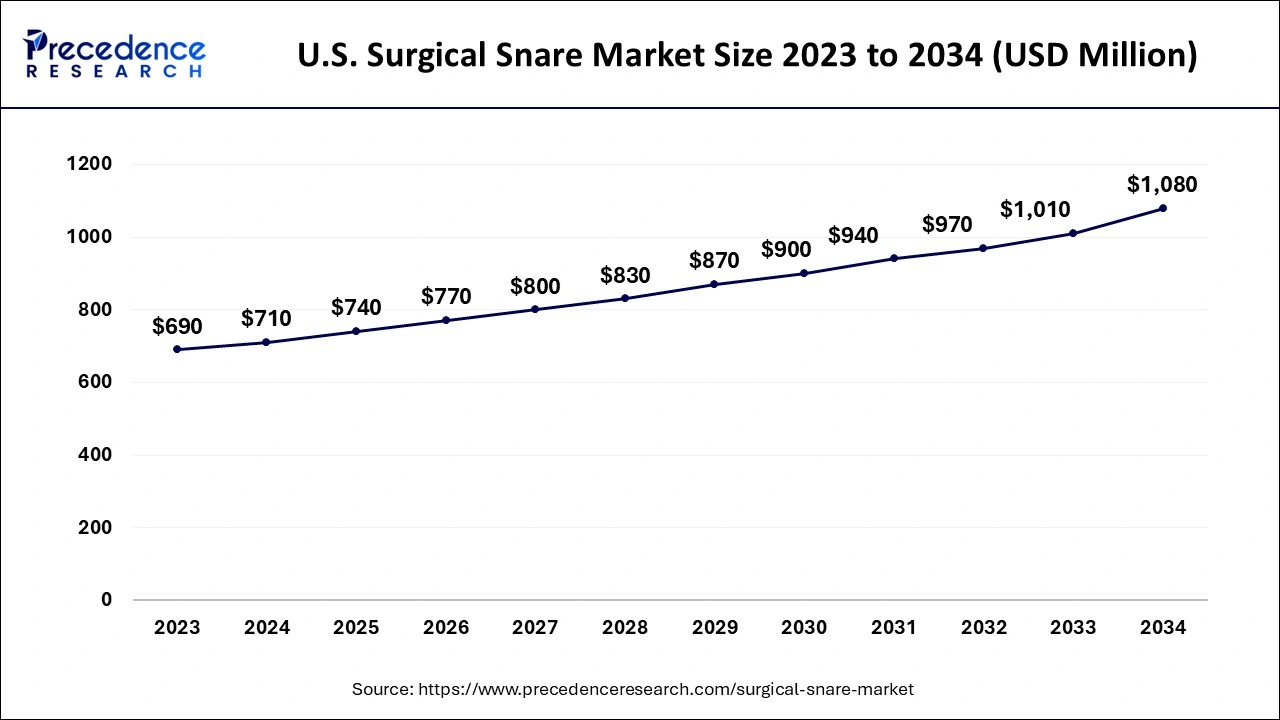

The U.S. surgical snare market size is exhibited at USD 740 million in 2025 and is projected to be worth around USD 1,080 million by 2034, growing at a CAGR of 4.28% from 2025 to 2034.

North America dominated the surgical snare market in 2024. Due to its sophisticated healthcare system, North America has substantial purchasing power. The high expenses of healthcare guarantee that clinics and hospitals can purchase the latest equipment, such as surgical snares, which are essential for carrying out various medical procedures. High accessibility to these medical gadgets results from government spending on healthcare, especially in the United States. The supremacy of the surgical snare market in North America is mostly due to the presence of major medical device manufacturers like Boston Scientific and Medtronic. Due to their extensive local production and distribution networks, these reputable businesses can satisfy the rising demand for surgical snares.

- In August 2022, Medtronic Private Limited introduced the GI Genius intelligent endoscopy module, a cutting-edge computer-aided polyps detection device driven by artificial intelligence (AI). By providing improved visualization during colonoscopy, the module enables doctors to identify and treat colorectal cancer. It is a game-changing technology that relies on deep learning algorithms and real-time data.

Asia Pacific is observed to host the fastest-growing surgical snare market during the forecast period. Oncology and endoscopic operations are receiving more attention because of the rising incidence of cancer, particularly in nations like China. In endoscopy, surgical snares are widely used to remove tumors, polyps, and other aberrant growths. The market for surgical snares expands in tandem with the growing need for cancer treatment and diagnostic operations. The use of minimally invasive surgical procedures has significantly increased in the area. For accuracy and effectiveness, these procedures, which usually entail fewer incisions and quicker recovery periods, frequently call for instruments such as surgical snares. The need for surgical snares in the area increases as these operations become more widespread.

Will Europe Push High-Standards Snare Technologies to the Forefront?

Europe's surgical snare market is shaped by strict clinical standards, strong colorectal cancer screening programs, and rapid adoption of minimally invasive technologies. Healthcare systems favour snares with ergonomic handles, enhanced torque control, and low-risk cutting profiles. Demand from outpatient endoscopy clinics continues to grow. Precision engineering and strict regulatory frameworks elevate product quality across the region. Cross-border clinical research encourages innovation in snare loop materials and coating technologies. Europe remains an influential market in defining performance expectations for surgical snares.

Germany Surgical Snare Market Trends

Germany's market is witnessing steady growth, driven by the country's advanced healthcare infrastructure and a high volume of endoscopic procedures. Increasing implementation of colorectal cancer screening programs is a major factor boosting demand for surgical snares, particularly for polyp removal and other gastrointestinal interventions. There is a growing emphasis on minimally invasive surgeries, prompting hospitals and clinics to adopt more sophisticated snare technologies, including single-use, ergonomically designed, and high-precision models.

Is MEA Preparing for Modern Endoscopic Precision?

The Middle East & Africa are steadily advancing their endoscopy infrastructure, creating new opportunities for surgical snare adoption. Hospitals in the Gulf invest heavily in modern, minimally invasive surgical suites. Growing awareness of early gastrointestinal cancer detection supports rising procedure volumes. African nations focus on expanding access to essential endoscopy tools, including cost-efficient snares. Training programs and cross-regional collaborations improve clinician expertise. Although adoption varies, MEA presents long-term demand for reliable surgical snare solutions.

The UAE Surgical Snare Market Trends

The UAE leads with advanced endoscopy centres and strong demand for premium snares. Saudi Arabia continues expanding GI care capacity, fuelling consistent snare usage. South Africa invests in both public and private endoscopy services, driving the need for versatile snare types. Egypt focuses on scaling affordable, high-volume screening programs. Nigeria strengthens basic GI infrastructure, generating demand for essential snares. Together, these markets define MEA's evolving landscape for minimally invasive excisions.

Can Latin America Scale Up Endoscopic Precision Technologies?

Latin America is expanding its surgical snare market as endoscopic screening becomes more widely accessible. Growing incidence of colorectal cancer and gastrointestinal disorders increases demand for reliable snares. Hospitals embrace disposable snares for standardized performance and infection-control efficiency. Economic variability encourages procurement of mid-range snares balancing cost and performance. Endoscopy clinics are expanding, especially in urban regions. The region is gradually adopting advanced snares as training capabilities improve.

Brazil Surgical Snare Market Trends

Brazil shows high usage of snares across public and private endoscopy units. Mexico adopts advanced snare designs for polypectomy and mucosal resection. Argentina focuses on cost-effective solutions to support expanding GI care access. Chile integrates high-precision snares into well-developed endoscopy systems. Colombia invests in clinician training, boosting the adoption of diverse snare types. These countries collectively strengthen Latin America's surgical snare ecosystem.

Market Value Chain Analysis

- Raw Material: Key raw materials include stainless steel, nitinol, coated wires, PTFE sheaths, and medical-grade plastics. Loop geometry and alloy treatment determine cutting performance. Biocompatible materials ensure patient safety and smooth deployment. High-flexibility polymers allow precise maneuverability within endoscopic channels. Material purity directly influences device reliability. Manufacturers increasingly explore advanced coatings for improved cutting efficiency.

- Technological Shift: Technological advancements include torque-responsive handles, micro-snares for narrow anatomies, and insulated loops to prevent collateral thermal injury. Rotatable snares improve angle precision during challenging resections. Enhanced metal alloys provide superior strength with reduced wire fatigue. Integration with advanced endoscopy platforms supports better visualization and control. Manufacturers are developing hybrid snares for specialized procedures like EMR/ESD. The technological shift is moving toward smarter, more surgeon-friendly devices.

Surgical Snare Market Companies

- Medtronic

- Olympus Corporation

- Merit Medical Systems

- Avalign Technologies

- Hill-Rom Holdings, Inc.

- Sklar Surgical Instruments

- Cook

- CONMED Corporation

- Steris (U.S.)

- Boston Scientific Corporation

- Medline Industries, Inc.

Latest Announcements by Industry Leaders

- In February 2024, recently introduced in the United States by Boston Scientific Corp., the Versavue single-use flexible cystoscope may help lower the risk of infections in patients brought on by incorrect reprocessing of reusable cystoscopes.

- In March 2023, NVIDIA and Medtronic announced their partnership to speed up the advancement of AI in the healthcare sector and introduce innovative AI-based patient care solutions. Medtronic's GI Genius cognitive endoscopy module, created and produced by Cosmo Pharmaceuticals, will use NVIDIA healthcare and edge AI technology. GI Genius is the first FDA-approved AI-assisted colonoscopy tool to assist doctors in identifying polyps that may develop into colorectal cancer.

Recent Developments

- In November 2024, In Shimla, the Indira Gandhi Medical College and Hospital (IGMC) began doing laparoscopic procedures for complicated cancers. The Department of Surgery has recently carried out laparoscopic procedures to treat stomach or its components removal, cancer in the food pipe, and rectal cancer.

- In May 2024, Medtronic plans to start more clinical research on its Hugo robotic-assisted surgery system to broaden its indications to include gynecology and hernias.

Segments Covered in the Report

By Usability

- Single Use

- Reusable

By Application

- GI Endoscope

- Laparoscopy

- Urology Endoscopy

- Gynecology Endoscopy

- Arthroscopy

- Bronchoscopy

- Mediastinoscopy

- Laryngoscopy

- Others

By End-Use

- Hospitals

- Ambulatory Surgical Centers

By Region

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting