Track And Trace Solutions Market Size and Growth 2025 to 2034

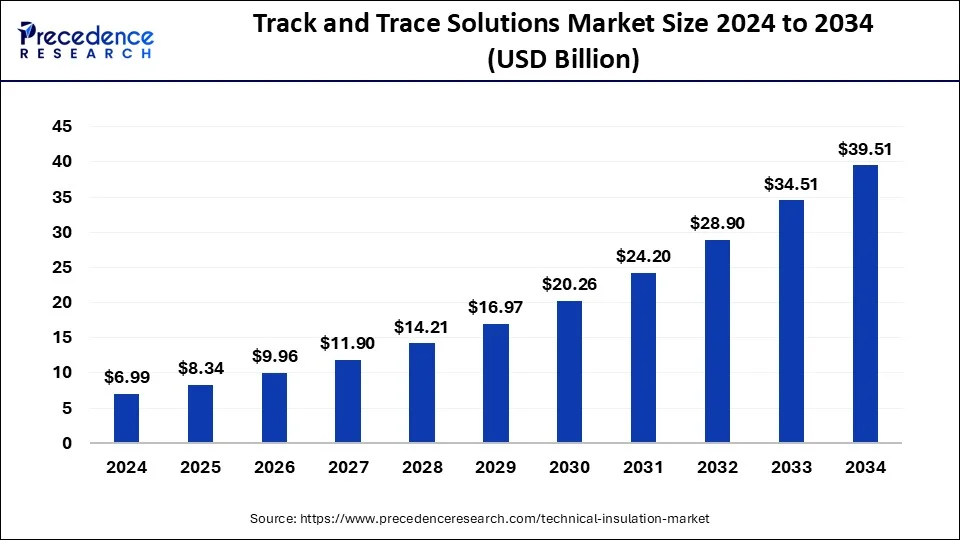

The global track and trace solutions market size was estimated at USD 6.99 billion in 2024 and is predicted to increase from USD 8.34 billion in 2025 to approximately USD 39.51 billion by 2034, expanding at a CAGR of 18.91% from 2025 to 2034.

Track And Trace Solutions Market Key Takeaway

- In terms of revenue, the track and trace solutions market is valued at $8.34 billion in 2025.

- It is projected to reach $39.51 billion by 2034.

- The track and trace solutions market is expected to grow at a CAGR of 18.91% from 2025 to 2034.

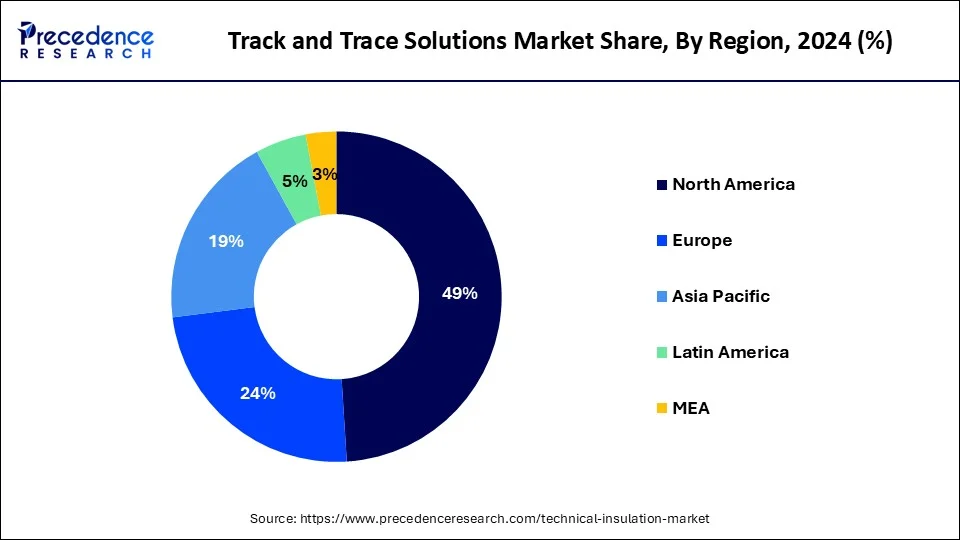

- North America Market has accounted market share of around 37% in 2024.

- By product, software solutions has generated highest market share of 52% in 2024.

- The hardware systems segment has held 48% market share in 2024.

- By application, the serialization solutions segment has garnered market share of 56% in 2024.

- By technology, barcode technology has captured market share of 81% in 2024.

- By end-use, pharmaceutical companies had highest market share of around 27% in 2024.

U.S. Track And Trace Solutions Market Size and Growth 2025 to 2034

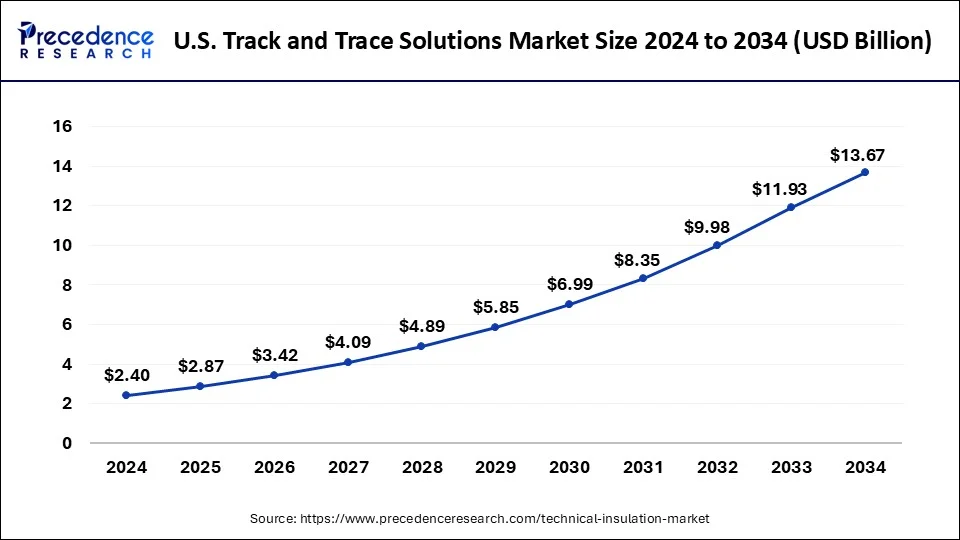

The U.S. track and trace solutions market size was valued at USD 2.40 billion in 2024 and is expected to be worth around USD 13.67 billion by 2034, at a CAGR of 19% from 2025 to 2034.

North America dominated the global track and trace solutions market in 2024 with significant revenue share, trailed by Europe. Causes including the existence of a huge number of biotechnology and pharmaceutical corporations and medical device producers, strict regulations concerning serialization, and the increasing medical devices market, are driving the growth of the track and trace solutions market growth in this region.

The region has a robust presence of highly regulated serialization and aggregation standards and sophisticated healthcare infrastructure. The increasing adoption of advanced identification technologies, such as RFID and barcoding, by pharmaceuticals and other medical device companies is expected to propel the growth of the track and trace solutions market.

Moreover, the rapid expansion of the e-commerce and retail sectors in the region is expected to boost the expansion of the market during the forecast period. For instance, according to the article published by the Census Bureau of the Department of Commerce in May 2025, e-commerce sales in the first quarter of 2025 accounted for 16.2 percent of total sales. Track And Trace Solutions offer real-time providing real-time data about the product's condition, location, and authenticity. The surging demand for effective inventory management and the rising focus on improving product safety and quality control are anticipated to accelerate the market's revenue in the region.

- In October 2024, Multi-Color Corporation (MCC), a global label company, announced the acquisition of Starport Technologies, a provider of smart label solutions based in Kansas City, Missouri. The company's acquisition of Starport Technologies aims to expand its RFID capabilities and intelligent packaging solutions.

Asia Pacific market for track and trace solutions offer great potential and projected to register fastest growth rate throughout the forecast period. The intensifying pharmaceutical market and the enactment of rigorous regulations to improve the consistency and quality of pharmaceutical medicine are the important factors for market growth in this region. Additionally, escalating pressure to limit high occurrence of fake drugs in emerging Asian nations such as China and India further drives the market growth. China's track and trace regulations and laws authorized serialization and tracking during the supply chain and vital compliance reporting to the China Food and Drug Administration for whole pharmaceuticals. These rigorous regulations are anticipated to lift the growth of the market in these nations in the nearby future.

- In July 2023, ID TECH, a prominent player in the RFID segment, announced the launch of its latest innovation, the IDT 87 IN RFID Integrated Reader. This state-of-the-art device represents a remarkable leap forward in RFID technology, designed and manufactured within the country. With its advanced features, sleek design, and unparalleled performance, the IDT 87 IN sets a new benchmark for track and trace solutions.

The Indian region has a strong presence in the pharmaceutical industry. For instance, according to the article published by the Press Information Bureau (PIB) in December 2024, India's pharmaceutical market for FY 2023-24 is valued at USD 50 billion, with domestic consumption valued at USD 23.5 billion and exports valued at USD 26.5 billion. India's pharma industry is considered to be the world's third-largest by volume and 14th in terms of value of production.

With an extremely diversified product base covering generic drugs, bulk drugs, over-the-counter drugs, vaccines, biosimilars, and biologics. According to the article published in May 2025, the Indian pharmaceutical market continued rising in April 2025, achieving a strong annual growth of 7.8%, with total sales reaching a remarkable Rs 19,711 crore. Such factors indicate the need for a track and trace solution in the pharmaceutical industry.

New product and service launches for track and trace solutions:

- In an effort to improve patient safety standards in Nigeria and guarantee product safety, MeCure Industries Plc introduced a track-and-trace system in January 2024. The Nigerian pharmaceutical business faces a twofold challenge in addressing the growing threat of fake and counterfeit drugs in the market while also ensuring medicine accessibility. This approach addresses both of these issues.

- In June 2023, supply chain visibility solutions provider Vizion unveiled Intermodal Rail Tracking, a new service that complements the business's core container tracking offering. In order to prevent access fees, the new function will provide shippers and logistics service providers with information about events, such as the final free dates and the dates that are accessible for pickup.

- December 2023 saw the launch of UniShip, a comprehensive post-order journey solution with shipment tracking and a clever courier partner allocation engine for D2C brands and online merchants. Unicommerce is one of India's top SaaS platforms for e-commerce enablement. Orders en way to buyers, orders returned by buyers and en route to sellers, and management of orders that could not be delivered are all expertly managed by UniShip.

Market Overview

The global track and trace solutions market is estimated to experience momentous growth during the estimate period owing to aspects such as upsurge in adoption of track and trace solutions by pharmaceutical and medical device manufacturers to resolve the problem of drug counterfeit and organized regulatory framework & execution of standards. Though these influences develop the growth of the track and trace solutions market, great installation cost related with aggregation and serialization solutions greatly obstruct the market growth.

Increasing emphasis on the prevention of counterfeit products

According to the Pharmaceutical Security Institute (PSI), law enforcement officials uncovered 6,897 incidents of counterfeiting, illegal diversion, and theft of pharmaceuticals in 142 countries in 2023. The crimes involved more than 2,440 different medicines across every therapeutic category. The PSI documented 4,894 arrests for pharmaceutical crime in 2023; the largest number of arrests achieved in 22 consecutive years of data.

To assist law enforcement agencies in preventing counterfeit Pfizer medicines from reaching patients, Pfizer Global Security has provided product training to authorities from 182 countries.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 39.51 Billion |

| Market Size in 2025 | USD 8.34 Billion |

| Market Size in 2024 | USD 6.99 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 18.91% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Technology, Application, End User, Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Market Driver

Emphasis on counterfeit prevention Counterfeit products can tarnish a company's reputation and erode consumer trust. By implementing track and trace solutions, companies can authenticate their products and assure customers of their authenticity, thereby safeguarding their brand reputation. Many industries, such as pharmaceuticals, food and beverage, and electronics, are subject to stringent regulations mandating the serialization and traceability of products. Failure to comply with these regulations can result in legal penalties and market access restrictions. Track and trace solutions help companies meet these regulatory requirements by providing visibility into product movements and ensuring compliance with serialization standards. Thereby, the rising focus of counterfeit prevention acts as a major driver for the track and trace solutions market.

Market Restraint

Complexity in integration

Different industries have unique processes, systems, and standards. Implementing track and trace solutions across these diverse ecosystems can be complex. Integrating the technology with existing systems and workflows without disrupting operations can be challenging. Track and trace solutions often involve collecting and managing vast amounts of data from various sources. Ensuring compatibility and consistency of data formats across different systems and stakeholders can be difficult. Mismatched data formats or incompatible systems can hinder seamless integration and data sharing.

Market Opportunity

Integration of advanced technologies

Track and trace solutions can integrate with emerging technologies such as artificial intelligence (AI), machine learning (ML), and augmented reality (AR) to further enhance their capabilities. For example, AI and ML algorithms can analyze supply chain data to predict demand, optimize routing, and detect anomalies, while AR technology can provide interactive visualizations of product information and instructions. New technologies enable greater visibility and transparency across the supply chain, allowing companies to track the movement of goods from production facilities to end consumers. This increased visibility helps companies identify inefficiencies, mitigate risks, and respond more effectively to disruptions.

- In March 2023, the airport management platform AeroCloud introduced AeroCloud Optic, a new passenger tracking tool. Airport employees can spot patterns, make inferences, and forecast future events using artificial intelligence and machine learning algorithms developed by UK-based AeroCloud. This helps with long-term planning and decision-making that is more precise.

Application Insights

As of 2024 serialization solutions occupied major share in terms of revenue in the global track and trace solutions marketplace. This is attributed to the growing focus of regulatory bodies and execution of the same. Country governments, federal agencies, and the healthcare sector are taking actions to reduce product diversion and drug forging. Serialization is a major step to obey with new ePedigree regulations that are mandatory for product traceability throughout the supply chain. Furthermore, augmented focus on patient security and brand safety by producers is anticipated to push segment growth throughout the study period.

Product Type Insights

Among different product type, software solutions dominated market with huge share of track and trace solutions market revenue in 2024. This is on account of mounting adoption in healthcare companies, such as biopharmaceuticals, pharmaceuticals, and medical devices corporations. These software solutions are employed for uninterrupted management of product lines, manufacturing facilities, case, and warehousing, bundle tracking, and shipping. Establishments developing this software are capitalizing in R&D for improved product improvement, which is anticipated to thrust market growth during years to come.

Technology Insights

Among technology segmentation of the market, as of 2024, barcodes technology garnered major share of the total revenue in the track and trace solutions market. 2D barcode has appeared as leading sub-segment and is anticipated to uphold its position during the estimate period. Augmented application of 2D barcodes in biopharmaceutical and pharmaceutical product packaging is a main aspect that backed to the great revenue share. Furthermore, plenty data storage capacity of 2D barcodes above linear barcodes plus its greater popularity in the market, lifts the sale of 2D barcode-based track and trace solutions.

End-user Insights

In 2024, out of different end users of the market pharmaceutical companies lead the market with significant revenue share. Guaranteeing safe product track and trace abilities through several entities during the supply chain by employing serialization is a decisive step to meet the issues confronted by pharmaceutical firms. Presently, it is binding for pharmaceutical producers to obey with state and federal regulations for track and trace solutions, which is further flourishing the demand for these solutions.

- In March 2025, Systech, part of Markem-Imaje and Dover, and a provider of digital identification and traceability software solutions, announced the launch of UniSecure artAI, an AI-powered authentication solution designed to safeguard brands, ensure packaging quality, and protect patients.

Track and Trace Solutions Market Companies

- Adents International

- Mettler-Toledo International, Inc

- Axway, TraceLink, Inc

- Optel Vision

- Siemens AG

- SeidenaderMaschinenbau GmbH

- Others

Key Companies & Market Share Insights

Rising numbers of companies are facing frequent issues on account of the increasing diversity and complexity in serialization necessities, mostly in the pharmaceutical business. Disparities in regulations and standards across nations along with the management of accumulated complex data makes it tough for companies to implement serialization in track and trace. Nevertheless, cumulative rate of forging of pharmaceuticals and other healthcare produces pushes the acceptance of serialization in the supply chain.

Recent Developments

- In February 2025, Shadowfax announced the launch of SF Shield, a technology initiative designed for logistics security and operational efficiency. SF Shield serves as a multi-layered security framework that combines two major innovations: Track & Trace Solution and SF Eye to enhance visibility, security, and control across logistics operations.

- In January 2025, Infor Nexus, the single-instance supply chain network platform providing visibility and collaboration, announced NexTrace. This solution is designed to improve customer transparency and offer a competitive advantage. NexTrace provides end-to-end transparency by seamlessly tracking raw materials through to finished products and beyond, ensuring full traceability throughout the entire supply chain journey.

- In November 2024, Dot Ai and Würth Industry North America (WINA), a leading industrial distributor and division of the Würth Group, announced the execution of a Partner Distribution agreement. The collaboration aims to accelerate order processes, enhance performance metrics, and optimize asset intelligence for WINA's manufacturing and industrial clients.

Segments Covered in the Report

This research report includes complete assessment of the market with the help of extensive qualitative and quantitative insights, and projections regarding the track and trace solutions market. This report offers breakdown of market into prospective and niche sectors. Further, this research study calculates market revenue and its growth trend at global, regional, and country from 2025 to 2034. This report includes market segmentation and its revenue estimation by classifying it on the basis of various parameters including product type, application, technology, end user, and region as follows:

By Technology

- RFID

- Barcode

By Product

- Hardware Systems

- Monitoring & Verification Solutions

- Printing & Marking Solutions

- Labeling Solutions

- Others

- Software Solutions

- Bundle Tracking Software

- Plant Manager Software

- Line Controller Software

- Others

By Application

- Aggregation Solutions

- Bundle Aggregation

- Case Aggregation

- Pallet Aggregation

- Serialization Solutions

- Carton Serialization

- Label Serialization

- Bottle Serialization

- Data Matrix Serialization

End-User

- Medical device Companies

- Pharmaceutical Companies

- Food and Beverage

- Healthcare

- Consumer Packaged Goods

- Luxury Goods

- Others

By Region

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting