Clinical Trial Biorepository and Archiving Solutions MarketSize and Forecast 2025 to 2034

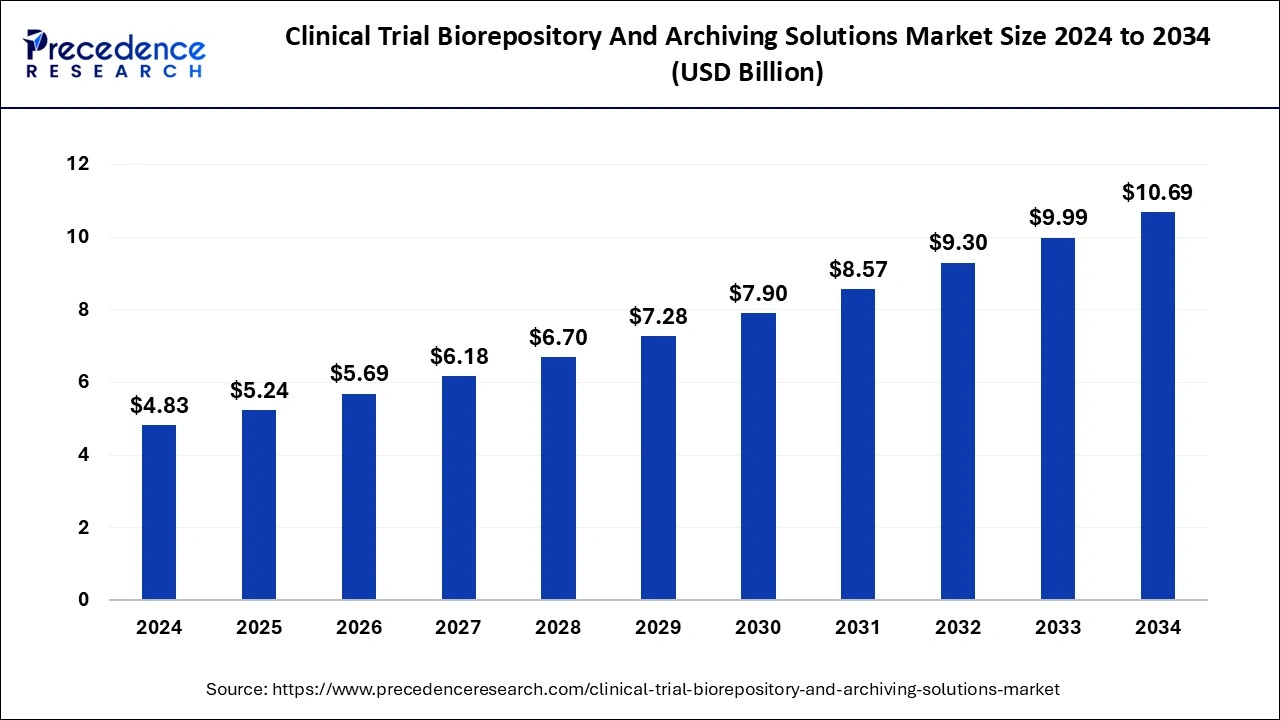

The global clinical trial biorepository and archiving solutions market size accounted for USD 4.83 billion in 2024 and is expected to exceed around USD 10.69 billion by 2034, growing at a CAGR of 8.27% from 2025 to 2034. The rising research and development activities in the global pharmaceutical industry are observed to drive the growth of the clinical trial biorepository and archiving solutions market.

Clinical Trial Biorepository and Archiving Solutions Market Key Takeaways:

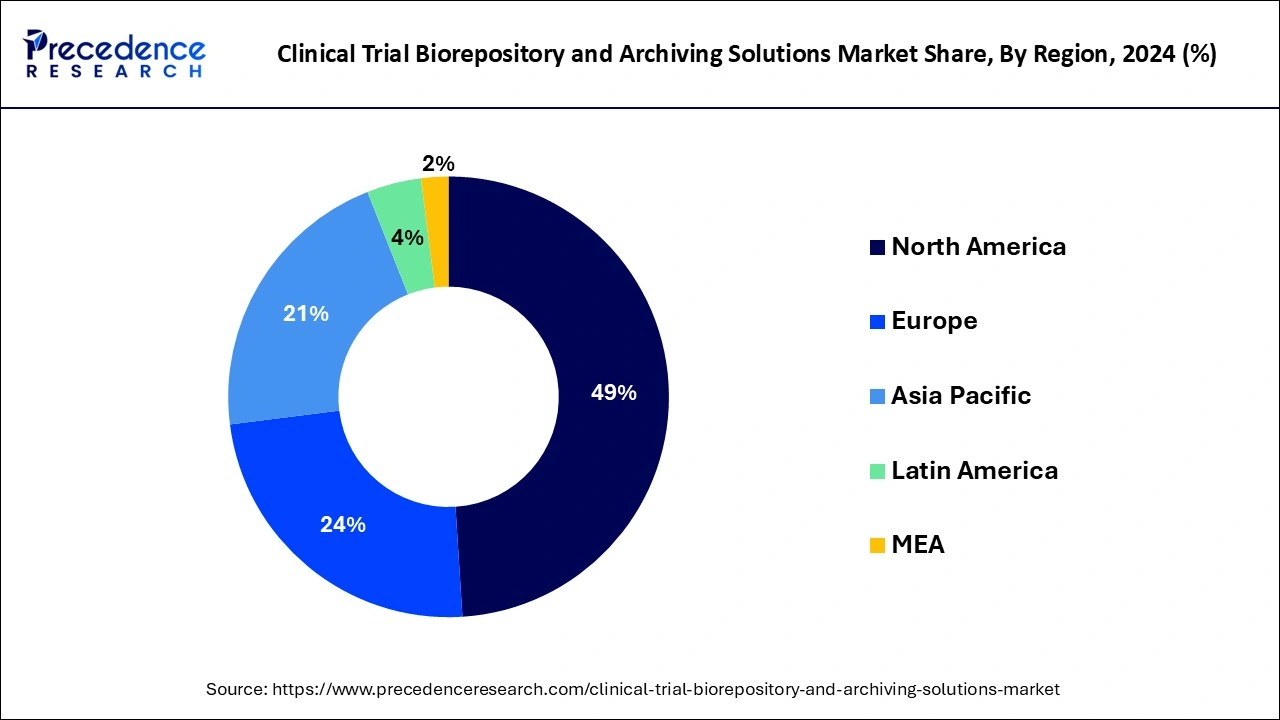

- North American region generated more than 49% of the revenue share in 2024.

- By Product, the clinical segment generated more than 64% of the revenue share in 2024.

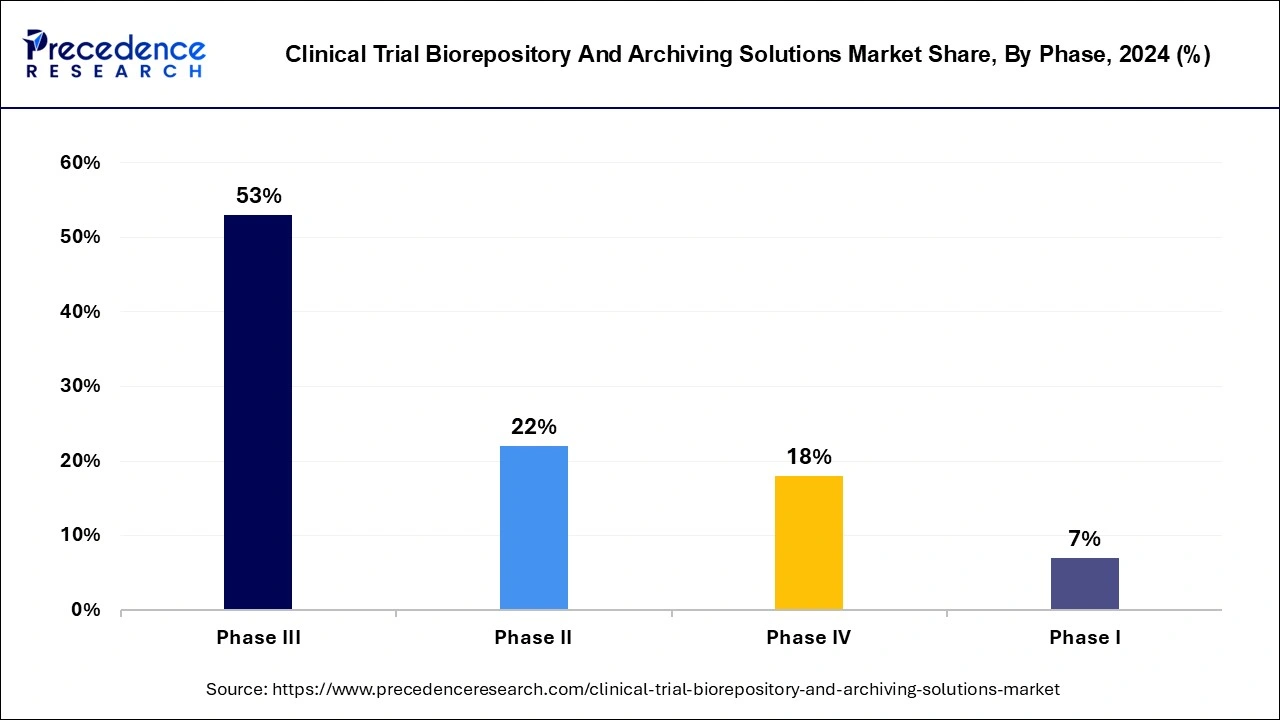

- By Phase, the phase III segment captured the biggest market share of 53% in 2024.

- By Phase, the Phase II segment is expected to expand at the fastest CAGR between 2025 and 2034.

- By Services, the biorepository services segment captured the largest market share of 67% in 2024.

- By Services, the archiving solutions segment is expected to grow at the fastest CAGR between 2025 and 2034.

U.S.Clinical Trial Biorepository and Archiving Solutions Market Size and Growth 2025 to 2034

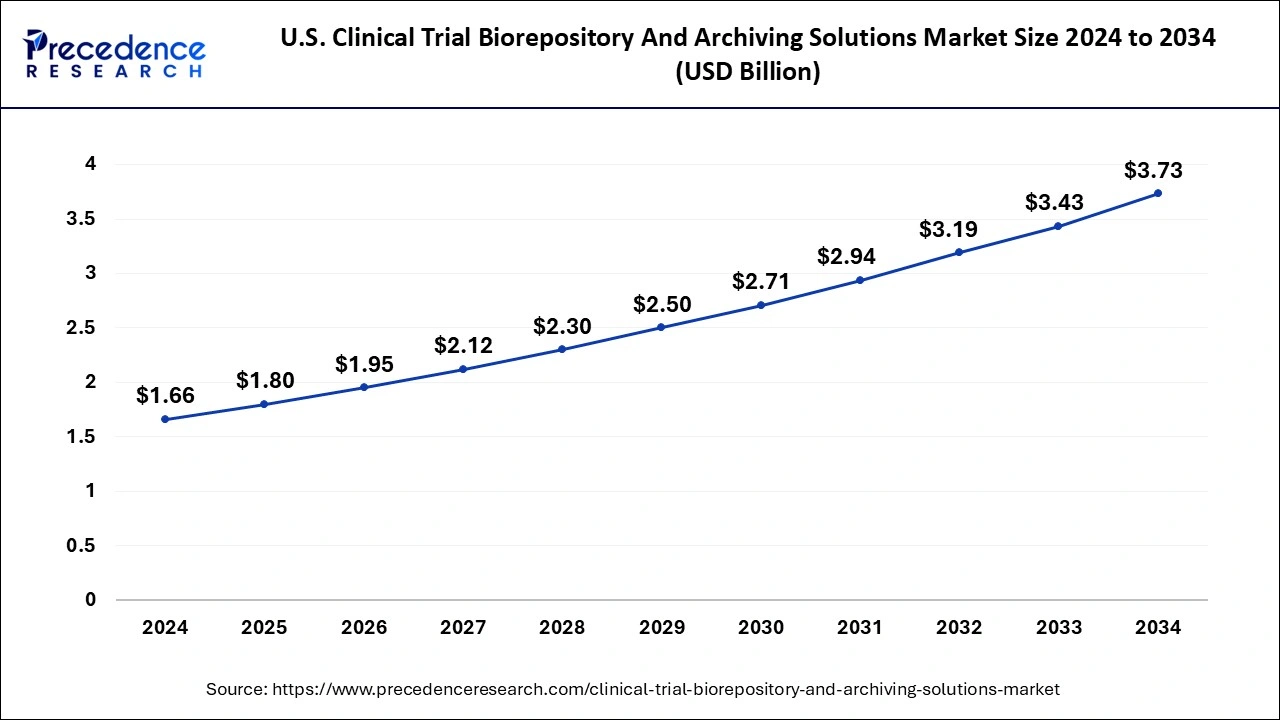

The U.S. clinical trial biorepository and archiving solutions market size was exhibited at USD 1.66 billion in 2024 and is projected to be worth around USD 3.73 billion by 2034, growing at a CAGR of 8.43% from 2025 to 2034.

North America dominated the clinical trial biorepository and archiving solutions market by accounting for over 49% share of the market;the region is expected to grow at a pace during the forecast period.

The market is primarily driven by factors such as the increasing number of clinical trials in the region, the rising demand forcell and gene therapies, and the increasing focus onprecision medicine.

The United States dominates the North American clinical trial biorepository and archiving solutions market due to the presence of a large number of clinical research organizations (CROs) and pharmaceutical companies in the country. Additionally, the U.S. government's focus on precision medicine and the increasing adoption of digital technologies in clinical trials are driving the growth of the market in the country.

Canada also represents a significant market for clinical trial biorepository and archiving solutions, with the country's healthcare system being recognized as one of the best in the world. The Canadian government has also made significant investments in research and development in the healthcare sector, which is driving the growth of the market in the country.

Asia Pacific is the fastest growing region for the global clinical trial biorepository and archiving solutions market;the rising number of clinical research along with improving healthcare infrastructure is considered a significant factor for the market's growth in Asia Pacific. Countries such as China, India, and Japan are the major contributors to the Asia Pacific clinical trial biorepository and archiving solutions market.

China, in particular, is emerging as a significant market due to the country's large population and growing healthcare industry. Additionally, the Chinese government's investments in the healthcare industry and initiatives such as the "Healthy China 2030" plan are driving the growth of the market in the country.

Advancements in the pharmaceutical and biotechnology industries, with an increasing focus on cell andgene therapies, are considered to support the market's growth in Asia Pacific. Several countries are focused on developing new facilities to boost medical research.

For instance, in March 2022, CHA Medical and Bio Group officially announced that they have started the construction of their new Cell Gene Biobank Facility in Pangyo, South Korea. The companies have invested over $250 million in this project that aims to boost cell and gene manufacturing and advanced cell biobanking.

Europe is another significant region for the clinical trial biorepository and archiving solutions market.Countries such as Germany, the United Kingdom, and France are the major contributors to the Europe clinical trial biorepository and archiving solutions market. These countries have a well-developed healthcare infrastructure and a large number of pharmaceutical and biotechnology companies conducting research in the region.

Latin America, the Middle East, and Africa represent a significant market for clinical trial biorepository and archiving solutions,with the region's growing population and increasing prevalence of chronic diseases providing ample opportunities for clinical research. The UAE, in particular, is emerging as a significant market due to the country's investments in the healthcare industry and the growing number of clinical trials being conducted in the country.

In April 2022, Al Jalia Foundation announced the establishment of Dubai's first robotic biobank in partnership with Mohammad Bin Rashid University of Medicine and Health Sciences. The collaboration aims to advance medical science research and development activities, especially for genetic disorders, cancers, and other chronic diseases. The robotic biobank will have the capacity to manage seven million specimens.

Market Overview

Clinical trial biorepositories and archiving solutions are critical components of the clinical trial process. They enable the safe and efficient storage and management of biological samples and clinical trial data, which can be used for further research and development of treatments for a wide range of diseases, including cancer.

The rising demand for storing, managing, and sharing biosamples and collected data, specifically in the oncology sector, is observed to boost the demand for biorepository and archiving solutions in the global healthcare industry.

Oncology research often requires large datasets to identify biomarkers, investigate treatment responses, and develop new therapies. Storing and sharing data enables researchers to collaborate and analyze larger datasets, leading to more robust and meaningful research findings. Along with this, sharing data enables researchers and clinicians to identify trends and patterns in patient data, which can inform clinical decision-making and improve patient outcomes.

In July 2022, Altru Health System stated that it is using Altru Cancer Center to collect specimen samples for medical research and collecting data for breast and colorectal cancer. Altru is conducting a biorepository study using genes, cells, and proteins that can provide information about cancer.

Moreover, to accelerate the drug development process, researchers are focused on boosting the clinical trials along with deploying biorepository facilities; this is another factor to boost the market's growth with the rising number of clinical trials for cancer treatment.

Clinical Trial Biorepository And Archiving Solutions Market Growth Factors

The clinical trial biorepository and archiving solutions market is growing, with the number of healthcare centers significantly focused on chronic disorders. Governments and private bodies across the globe are investing massively in improving the healthcare sector by considering public health concerns.

The Indian government is investing to robust the creation of 1,50,000 government-supported healthcare and wellness centers to improve the nation's healthcare infrastructure. Such rising investments in improving healthcare infrastructure are predicted to support the market's growth during the forecast period.

Rising investment in improving the infrastructure of the life science industry for research and development purposes is observed as a significant driving factor for the growth of the clinical trial biorepository and archiving solutions market. Moreover, increasing collaboration, partnerships, facility launches, and other business activities are supplementing the market's growth. Such business activities highlight the importance of medical research and a broader future opportunity for the market players to grow.

In January 2023, BioBank announced to open UK's second-largest biobank facility in Liverpool with a massive investment of 7.6 million Euros. The new facility will be opening at Wavertree Technology Park. With the new facility, BioBank aims to enhance its capabilities to collect and preserve stem cells for therapeutic purposes.

Furthermore, considering the rising demand for medical research with the help of different biological samples, in October 2022, Tampa General Hospital and the University of South Florida Health Morsani College of Medicine announced their strategic partnership to operate a medical research biorepository; the biorepository intends to collect and store samples for medical research.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 5.24 Billion |

| Market Size by 2034 | USD 10.69 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 8.27% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Phase, Services, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

The rising importance of data storage and management

Clinical trials generate large amounts of data, including patient data, lab results, imaging data, and other types of data. The volume and complexity of this data require robust storage and management solutions to ensure data integrity and accessibility. Biorepositories and archiving solutions offer secure storage and management solutions that ensure data privacy and compliance. Overall, the rising importance of data storage and management is driving the growth of the clinical trial biorepositories and archiving solutions market by addressing the increasing volume and complexity of data, ensuring data security and compliance, facilitating collaborative research, supporting data-driven decision-making, and enabling advanced analytics applications.

Restraint

Data standardization

The lack of standardization in data collection and storage practices can create challenges for data sharing and analysis, limiting the usefulness of biorepository and archiving solutions. Lack of data standardization can lead to additional costs related to data cleaning and harmonization and data migration from one system to another. The lack of standardized data can make it challenging to share data between researchers, institutions, and countries, which can limit collaboration and hinder scientific progress. Overall, the lack of data standardization is a significant restraint for the clinical trial biorepository and archiving solutions market.

Opportunity:

Rising number of biobanking

The growing biobanking industry offers several opportunities to the clinical trial biorepository and archiving solutions market. Biobanks are repositories of biological samples such as blood, tissue, and DNA collected from patients and healthy individuals for research purposes. The samples stored in biobanks can be used for various applications, including drug discovery, clinical research, and personalized medicine. Biobanks require customized solutions that can meet their specific storage and management needs. Clinical trial biorepository and archiving solutions play a critical role in the biobanking industry by providing storage and management solutions for the large volumes of biological samples collected during clinical trials. As the biobanking industry continues to grow, the demand for clinical trial biorepository and archiving solutions is also observed to grow.

Covid-19 Impacts:

The impacts of the Covid-19 pandemic on the clinical trial biorepository and archiving solutions market have been mixed. While there has been a reduced demand for these solutions due to delays and disruptions in clinical trials, the increased demand for COVID-19-related trials and the shift to digital solutions offer new growth opportunities.

Clinical trials have been delayed or disrupted due to the pandemic, which has impacted the need for biorepository and archiving solutions. Many clinical trials have been paused, and some have been canceled altogether. This has resulted in reduced demand for biorepository and archiving solutions.

There has been a significant increase in the number of clinical trials related to COVID-19. This has created a demand for biorepository and archiving solutions specific to COVID-19 research. Companies that provide biorepository and archiving solutions have responded to this demand by offering specialized COVID-19 solutions.

Moreover, the Covid-19 pandemic presented an opportunity for researchers to investigate the causes of such respiratory diseases. Considering the same, in July 2021, Tulane University launched a new ‘Covid-19 Biobank' for blood and cell samples from Covid-19 survivors to investigate the causes of recovery.

With social distancing and travel restrictions in place, remote monitoring of clinical trials has become more prevalent; this has increased the need for electronic data capture and other remote monitoring solutions. The pandemic has accelerated the trend towards digitalization in the healthcare industry, and this has led to increased adoption of digital biorepository and archiving solutions. This trend is expected to continue even after the pandemic ends, as digital solutions offer numerous benefits, such as increased efficiency and reduced costs.

Product Insights

The clinical segment holds the dominating share of the global market; the segment is expected to maintain its dominance during the forecast period owing to the rising investment in clinical trials. Moreover, the increasing prevalence of chronic disease boosts the demand for clinical products, biorepositories, and archiving solutions that offer long-term value to such products. Hence, the innovation and advancement in clinical products will subsequently boost the segment's growth.

Clinical products are subject to strict regulations and guidelines regarding collecting, handling, storing, and disposing of biological samples. Biorepository and archiving solutions help to ensure compliance with these regulations and reduce the risk of legal and ethical issues.

The preclinical segment is also expected to register the fastest growth during the period analyzed. The faster rate of novel drugs/vaccines/medicines getting approved by regulatory bodies is considered to boost the development of the preclinical product segment. Moreover, the increased success rate of preclinical products and reduced production cost are other factors driving the segment's growth.

Preclinical products are often the result of significant investment in research and development, and companies need to protect their intellectual property rights. Biorepository and archiving solutions provide a secure environment for storing and managing confidential information related to preclinical products.

Phase Insights

Phase III segment held over 53% of the total share in 2022; the segment is expected to contribute the largest share during the forecast period. Phase III clinical trials involve testing a new drug or therapy on a large group of patients to assess its safety and effectiveness. Biorepositories are critical to the success of Phase III clinical trials because they provide a secure and controlled environment for the storage and management of biological specimens collected from trial participants.

The phase III segment will continue to grow with the deployment of advanced technologies in the biorepository and archiving solutions facilities to ensure the traceability of specimens and data.

Phase II segment is expected to witness the fastest growth during the projected timeframe. Phase II clinical trials are conducted on a larger group of patients after a treatment has been deemed safe and tolerable in a Phase I trial. Such trials require a specific facility to manage the specimens in a controlled environment, specifically for future analysis. The rising demand for storage and management platform for specimens, including urine, blood, tissue, and other fluids for future clinical references, will boost the demand for biorepository and archiving solutions in phase II clinical trials.

Services Insights

The biorepository segment dominated the market with the largest revenue share in 2022; the segment will continue its dominance during the forecast period. Biorepositories are facilities that store biological samples such as blood, tissue, cells, and DNA from individuals for future use in research and development. Biorepositories are becoming crucial for research and development, as they provide researchers with access to biological samples essential for understanding the underlying mechanisms of diseases and developing new treatments.

These services ensure the integrity and stability of biological samples, providing researchers with access to critical resources for developing new treatments.

On the other hand, the archiving solutions segment will register the fastest growth rate during the forecast period with rising medical research and clinical trials. Archiving solutions provide a means of accessing and retrieving data and documents as needed. Archiving solutions are becoming particularly important for clinical trials and research studies that may require ongoing analysis or follow-up. The rising demand for long-term storage with data integrity is propelling the growth of the archiving solutions segment.

Recent Developments:

- In February 2023, Qatar-based Hamad Medical Corporation (HMC) and Qatar BioBank (QBB) launched Phase I tissue biobank services at the department of laboratory, medicine, and pathology. The newly launched tissue biobank facility aims to enable researchers to study human tissue samples accurately with relevant results.

- In November 2022, Atlanta-based, The Center for Global Health Innovation announced the opening of NexGen Biobanking services in order to bring crucial biospecimen storage infrastructure to Georgia's life science industry.

- In October 2022, one of the world's largest biorepositories, Sampled, announced the expansion of its Sampled Labs facility in Piscataway. The announced facility will be the largest of its kind in the world. The new facility will enhance Sampled's capacity for storing, analyzing, managing, and researching up to 20 million specimens.

Clinical Trial Biorepository and Archiving Solutions Market Companies

The clinical trial biorepository and archiving solutions market is a rapidly growing industry that involves storing and managing biological samples and clinical trial data. Here are some key players in this market:

- Thermo Fisher Scientific Inc.

- Azenta U.S.

- Charles River Laboratories

- LabCorp Drug Development

- Precision for Medicine Inc.

- Medpace

- Labconnect

- Q2 Solutions

Segments Covered in the Report:

By Product

- Preclinical Products

- Clinical Products

By Phase

- Phase I

- Phase II

- Phase III

- Phase IV

By Services

- Biorepository Services

- Archiving Services

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- The Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting