What is the Tractor Implements Market Size?

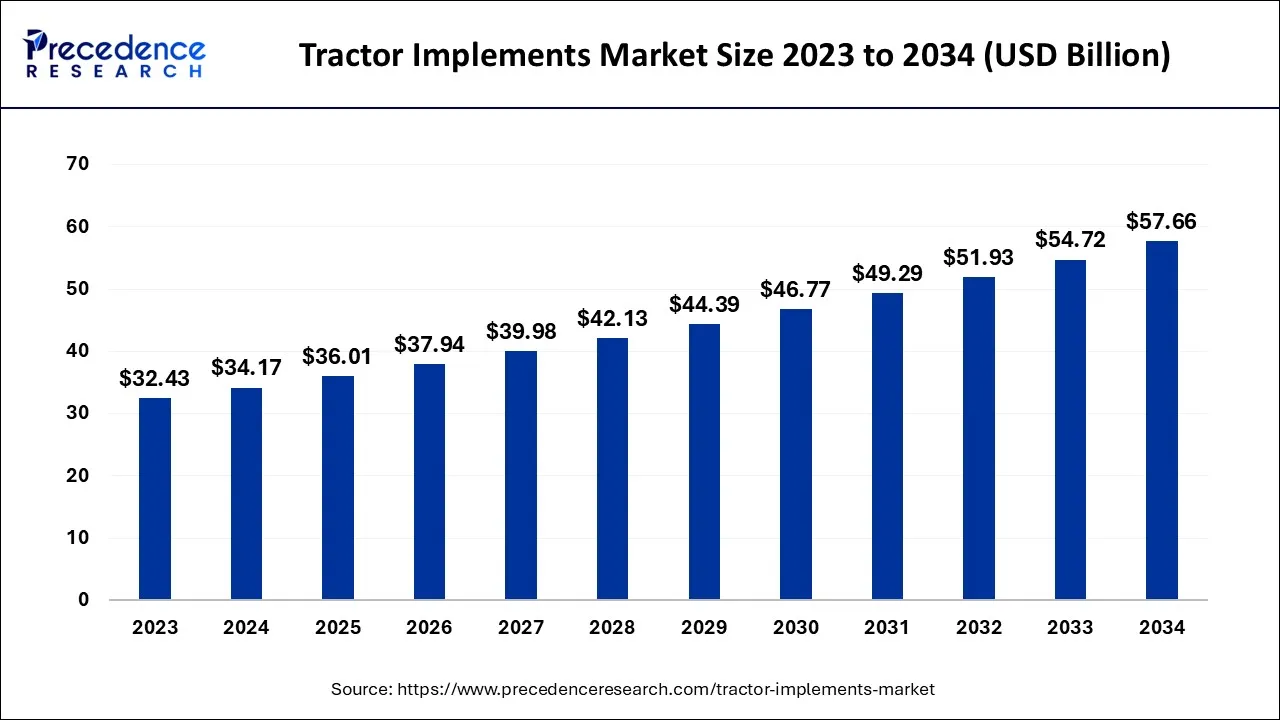

The global tractor implements market size is calculated at USD 36.01 billion in 2025 and is predicted to increase from USD 37.94 billion in 2026 to approximately USD 57.66 billion by 2034, growing at a CAGR of 5.37% from 2025 to 2034.

Tractor Implements Market Key Takeaways

- In terms of revenue, the market is valued at $36.01 billion in 2025.

- It is projected to reach $57.66 billion by 2034.

- The market is expected to grow at a CAGR of 5.37% from 2025 to 2034.

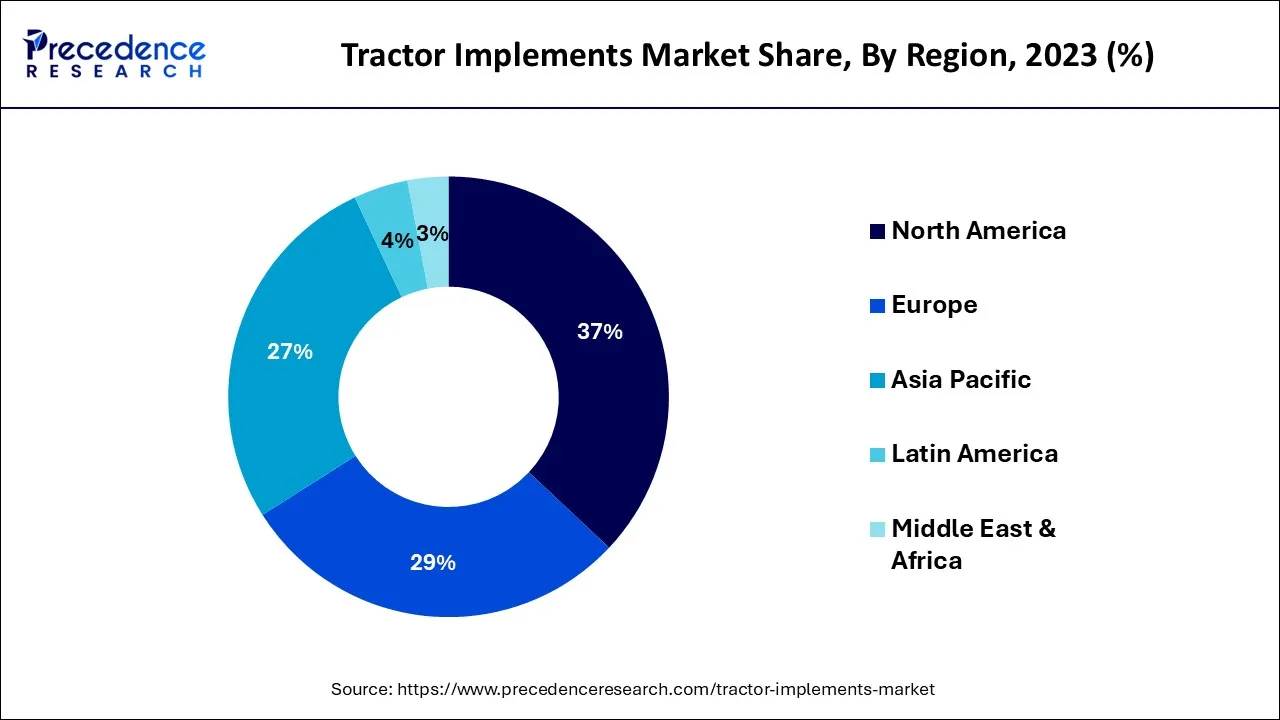

- North America led the global market with the highest market share of 37% in 2024.

- By Phase Type, the irrigation & crop protection segment is predicted to record the maximum market share in 2024.

- By Power Type, the powered distribution segment is expected to generate the largest market share in 2024.

- By Drive, the 4-wheel drive segment is projected to capture the highest market share in 2024.

Market Overview

The tractor implements market refers to the global industry that produces and sells a range of attachments and accessories used to enhance tractors' capabilities and functionality. These implements are designed to perform various tasks, such as plowing, tilling, seeding, harvesting, digging, hauling, and lifting. Tractor implements include front-end loaders, backhoes, mowers, tillers, cultivators, plows, balers, sprayers, and spreaders.

The tractor implements market serves many customers, including farmers, ranchers, landscapers, construction workers, and homeowners. The market is driven by the growing demand for food, increasing mechanization in agriculture, and the need for efficient and cost-effective equipment.

The tractor implements market has been growing steadily, driven by increasing agriculture and construction equipment demand. They are attachments that can be fitted onto tractors to improve their functionality and performance. These implements include plows, tillers, cultivators, harrows, loaders, backhoes, and many others. They are used for extensive tasks, such as planting, harvesting, excavation, and construction.

Furthermore, the global population is expected to grow significantly in the coming years, which is expected to drive the demand for food. Tractor implements are used extensively in agriculture to improve productivity and efficiency, which is expected to drive the demand for these products. Also, various governments worldwide are providing support and subsidies to the agriculture industry, which is expected to drive the demand for tractor implements. For instance, the U.S. government subsidizes farmers for purchasing equipment, including tractor implements.

However, the high cost of tractor implements, dependence on the agriculture industry, low awareness and adoption maintenance and repair costs, and environmental concerns are anticipated to impede the market growth. Tractor implements can be expensive, especially those that are technologically advanced or have multiple functionalities. This can be a major barrier for small and medium-sized farmers who may not have the financial resources to invest in these products. It is highly dependent on the agriculture industry. A downturn in the agriculture sector, such as decreased crop demand, could reduce demand for tractor implements.

The COVID-19 pandemic led to disruptions in global supply chains, which affected the availability of raw materials and components for tractor implement manufacturers. This resulted in production delays and increased costs for some manufacturers. Additionally, the pandemic led to a decline in global trade and economic activity, reducing demand for tractor implements in some regions. However, the pandemic also led to a surge in demand for food, which resulted in increased demand for tractors and tractor implements. The pandemic led to a renewed focus on food security, which led to increased investments in the agriculture industry. Many farmers and agricultural businesses invested in new tractors and tractor implements to improve their productivity and efficiency.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 36.01 Billion |

| Market Size in 2026 | USD 37.94 Billion |

| Market Size by 2034 | USD 57.66 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 5.37% |

| Dominated region | Asia Pacific |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Phase Type, Power Type, Drive, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Government support to brighten the market prospect

Many governments worldwide are providing support and subsidies to the agriculture industry, including support for the purchase of equipment such as tractors and tractor implements. The Indian government introduced various schemes to promote using tractors and tractor implements, including subsidies for purchasing these products. For instance, Pradhan Mantri Fasal Bima Yojana provides insurance coverage and financial support to farmers in case of crop failure. The government also provides subsidies for purchasing tractors and implements under the Rashtriya Krishi Vikas Yojana.

Similarly, the government of China has also provided support for the agriculture industry, including subsidies for the purchase of agricultural machinery such as tractors and implements. For instance, in 2020, the Chinese Ministry of Finance announced that they allotted more than $ 2.8 billion in subsidies for agricultural-related machinery purchases. In the United States, the government provides subsidies and tax incentives to farmers to purchase equipment, including tractors and tractor implements.

These subsidies and incentives can help reduce the cost of purchasing these products, increasing the demand for them. Thus, government support can play a significant role in driving demand for tractor implements by making them more affordable and accessible for farmers and agricultural businesses.

Mechanization in agriculture further drives demand for the market

As agriculture becomes increasingly mechanized, farmers and businesses require more advanced and specialized equipment to improve their productivity and efficiency. Precision farming technologies such as GPS-guided tractors and implements are becoming increasingly popular as farmers look to optimize their crop yields and reduce waste. These technologies require specialized tractor implements such as precision seeders, cultivators, and sprayers. Specialty crops such as fruits, vegetables, and nuts require specialized equipment, such as orchards and vineyard tractors, designed to work in narrow rows and tight spaces. These tractors often require specialized implements such as pruners, hedgers, and cultivators.

Furthermore, Tractor implements are also used extensively in livestock farming for feeding, cleaning, and manure-handling tasks. Feed mixers, hay balers, and manure spreaders are commonly used in livestock operations. Thus, mechanization in agriculture is driving demand for specialized tractor implements designed to improve productivity, efficiency, and sustainability. As farmers and agricultural businesses look to adopt new technologies and practices, the demand for these specialized implements is expected to grow.

Key Market Challenges

High cost of tractor implements causing hindrances to the market

Farmers may not have enough money left over to invest in expensive implements when purchasing a tractor, which can limit their ability to utilize the tractor's capabilities fully. In addition, the high cost of implements may make it difficult for farmers to justify the investment, especially if they do not plan to use the implement frequently. This can lead to a situation where farmers opt to rent or borrow implements as needed rather than purchasing them outright.

Moreover, the high cost of tractor implements can limit the market to larger farms or commercial operations with the financial resources to make such investments. Smaller farms may not be able to afford the high cost of the implements, which can limit their ability to compete with larger farms. To address this issue, manufacturers could consider exploring alternative materials or manufacturing processes that could reduce the cost of tractor implements. Additionally, they could offer financing options or lease programs to make the implements more accessible to farmers who may not have the capital to purchase them outright.

Key Market Opportunities

Growing demand for sustainable agriculture practices

The growing demand for sustainable agriculture practices is a key opportunity for the tractor implements market. The use of modern implements and technologies can significantly enhance the productivity and efficiency of agricultural practices, while also reducing the environmental impact of farming activities. This has led to a growing demand for tractor implements that are designed to support sustainable agriculture practices, such as precision farming, reduced tillage, and crop rotation.

Additionally, the increasing global population has put pressure on the agricultural sector to produce more food with limited resources, leading to a shift toward sustainable agricultural practices. This, in turn, has resulted in increased demand for tractor implements that can help farmers achieve more sustainable farming practices. Furthermore, the government's initiatives and subsidies to promote sustainable agriculture practices have also boosted the adoption of such tractor implements. Moreover, the tractor implements market is expected to witness significant growth in the coming years, as farmers increasingly adopt sustainable agricultural practices to meet the growing demand for food while preserving natural resources.

Advancements in tractor implements

Advancements in tractor implements have created several opportunities for growth in the market. One major driver of this trend is the growing demand for precision agriculture practices. Tractor implements with advanced technology such as GPS and sensors are able to provide more precise and efficient use of resources like water and fertilizer, leading to improved yields and cost savings for farmers.

Another opportunity is the development of autonomous tractor implements, which can operate without the need for human intervention. These implements are able to perform tasks like planting and harvesting crops with greater efficiency and accuracy, leading to improved productivity and cost savings for farmers. Additionally, the use of lighter and more durable materials like composite plastics and carbon fiber in the construction of tractor implements has resulted in reduced weight and improved performance. This allows for more efficient use of energy and increased durability of the implements, leading to longer lifespans and reduced maintenance costs for farmers.

Phase Type Insights

On the basis of phase type, the tractor implements market is divided into tillage, irrigation & crop protection, sowing & planting, harvesting & threshing, and others, with the irrigation & crop protection segment accounting for most of the market. This is due to the increasing demand for efficient and sustainable agricultural practices which require efficient use of water resources and minimal use of chemicals.

As farmers and agricultural businesses look for ways to improve their productivity and profitability, the demand for specialized tractor implements is expected to grow, particularly in segments such as irrigation & crop protection, where precision and efficiency are essential for optimal crop yields. Additionally, the irrigation and crop protection segment is driven by the increasing need for water management and crop protection in agriculture. With the help of advanced implements, farmers can efficiently manage irrigation and crop protection, leading to higher crop yield and quality.

Power Type Insights

On the basis of the power type, the tractor implements market is divided into powered and unpowered, with powered distribution accounting for most of the market. This is because powered equipment is typically more efficient and productive, allowing farmers to accomplish more in less time and with less labor. Powered equipment also allows for more precise and consistent results, which is important for modern farming operations.

The growing trend towards mechanization in agriculture is driving the demand for powered tractor implements as they can help increase efficiency and reduce labor costs. Additionally, the availability of tractors with higher horsepower is enabling farmers to use more powered implements for their farming operations. However, unpowered equipment still has a place in the market, particularly for smaller-scale operations and tasks that do not require the power or efficiency of larger equipment. Some farmers may also prefer unpowered equipment for its simplicity and low cost.

Drive Insights

On the basis of drive, the tractor Implements market is divided into 2-wheel Drive and 4-wheel Drive, with 4-wheel drive accounting for most of the market. This is because 4-wheel Drive tractors are more versatile and can handle various tasks and terrain conditions. They also provide better traction and stability, which is important for heavy-duty tasks such as plowing and hauling. The increasing demand for larger and more powerful tractors for commercial agriculture purposes, particularly in developing countries, is driving the growth of this segment.

Additionally, the adoption of precision farming techniques and the need for high-quality crops are also contributing to the growth of this segment, as 4-wheel drive tractors offer better precision and accuracy in farming operations. However, 2-wheel drive tractors still have a place in the market, particularly for smaller-scale operations and tasks that do not require the power or versatility of 4-wheel drive tractors. Some farmers may also prefer 2-wheel drive tractors for their simplicity and lower cost.

Implement Type Insights

The tillage/soil preparation implement segment accounted for the dominating share of 34.60% in 2024. The segment includes ploughs (moldboard, disc, chisel), harrows (disc, tine), cultivators (field, rotary), rotavators / rotary tillers, and subsoilers. Tillage implements play a vital role in numerous primary tasks such as breaking up soil, preparing a seedbed, controlling weeds, and others. The growth of the segment is mainly driven by the growing demand for efficient and sustainable agricultural practices, which require efficient use of water resources and minimal use of chemicals.

Power Source Insights

The powered segment held a dominant presence in the coronary stents market in 2024, with 61.30%. The powered segment includes PTO-powered and hydraulically powered. Powered equipment is more efficient and productive, which allows farmers to accomplish more in less time and with reduced labor. Powered equipment allows for precise and consistent results, which is crucial for modern farming operations. Moreover, the increasing trend towards mechanization in agriculture is driving the demand for powered tractor implements.

Mounting Type Insights

The three-point hitch-mounted segment held the major market share of 47.90% in 2024. The growth of the segment is attributed to the increasing agricultural mechanization and the global shortage of agricultural labor is making mechanized tools more essential. Additionally, the strong focus on precision agriculture is significantly boosting the adoption of more sophisticated hitch systems. The market is experiencing a shift toward quick-hitch systems, which reduce implement attachment time by nearly 70%.

Application Insights

The land preparation segment registered its dominance with 33.50% over the global tractor implements market in 2024. The land preparation is segmented into plowing, tilling, and harrowing, which are all important for tasks like breaking up soil, preparing seedbeds, leveling, and others. Land preparation is a crucial step for successful crop cultivation. The growth of the segment is driven by the growing need for improved soil health and the increasing demand for precision agriculture techniques.

End-User Sector Insights

The agriculture segment contributed the biggest market share of 89.20% in 2024. The agriculture segment includes farm-level (large, medium, small) and commercial farming. Agriculture is a significant and growing industry. The industry is seeking improved farming productivity, enhanced efficiency, and reduced labor dependency through advanced mechanization and precision farming technologies. In addition, the rising global food demand necessitates more efficient and productive farming equipment, along with the increasing integration of smart and precision farming technologies, leading to improved resource efficiency and higher yields in the agriculture industry. Individual Farmers are increasingly adopting advanced mechanization, owing to the labor shortages and increasing need to boost yield. Large Commercial farming is the early adopter of advanced technology, like GPS-guided machinery, autonomous equipment, and others, to optimize resource utilization and increase productivity.

Regional Insights

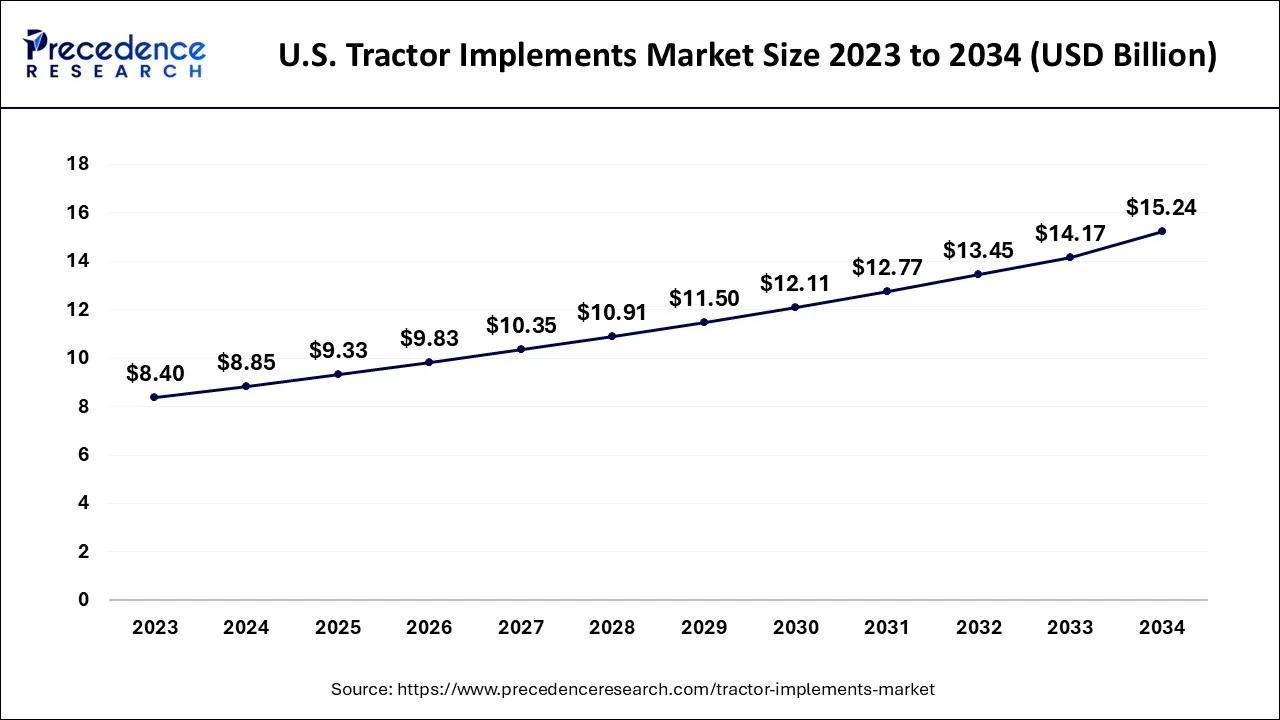

U.S. Tractor Implements Market Size and Growth 2025 to 2034

The U.S. tractor implements market size is exhibited at USD 9.33 billion in 2025 and is projected to be worth around USD 15.24 billion by 2034, growing at a CAGR of 5.59% from 2025 to 2034.

On the basis of geography, Asia-Pacific dominates the market, primarily driven by the increasing demand for food, growing mechanization, and government support for agriculture. The Asia-Pacific region's growing population is expected to reach 4.8 billion by 2050. This presents a significant opportunity for the tractor implements market. Farmers and agricultural businesses will need to invest in new equipment and technologies to increase their productivity and meet the growing demand for food.

Europe is a significant market for Tractor Implements, with Germany, the United Kingdom, and France being the major contributors to the market's growth. High technological innovation and a focus on precision agriculture drive the market. The Europe tractor implements market is focused on precision agriculture, which involves using advanced technologies such as GPS and sensors to improve the efficiency and productivity of agricultural operations. This focus on precision agriculture drives the development of specialized tractor implements such as GPS-guided tractors, precision planters, and variable-rate fertilizers. This trend is expected to continue to drive innovation in Europe's Tractor Implements market.

The region in North America is anticipated to have the greatest CAGR. The North American region has a growing population, and food production needs to be increased to meet the growing demand. This presents a significant opportunity for the tractor implements market, as farmers and agricultural businesses must invest in new equipment and technologies to increase their productivity and efficiency.

The Middle East and Africa are expected to grow significantly in the tractor implements market during the forecast period. To deal with the growing demand for food, various policies as well as investments are being imposed by the government in the Middle East and Africa. This, in turn, is increasing the use of tractor implements to enhance crop and food production. Similarly, the industries are also increasing the development of these tractor implements to promote their use. Thus, all these developments are promoting the market growth.

Tractor Implements Market Companies

- Claas KGaA Mbh

- Deere & Company

- Kubota Corp.

- CNH Industrial N.V.

- Agco Corporation

- Tractors and Farm Equipment Limited (TAFE)

- SDF Group

- Mahindra & Mahindra

- J C Bamford Excavators Ltd. (JCB)

- Actuant

- Kuhn Group

- Alamo Group

Recent Developments

- In June 2025, to develop the Precise Defense program, a collaboration between Netafim USA, which is a subsidiary of Netafim Ltd. (global leader of precision irrigation solutions), and Bayer was announced. To deal with nematodes, which are invisible and a possible threat to the productivity and health of almond trees, solutions will be provided in this program. Additionally, a prevailing one-two punch leveraging precision drip irrigation technology of Netafim will also be delivered along with Velum One Nematicide, and other crop protection products protecting the root zones in this Precise Defense program. Thus, the residual efficacy through uniform application rates will be enhanced, as well as the water used to irrigate almond trees will also be minimized by this delivery method.

(Source: https://www.businesswire.com)

- In May 2025, two completely electric products will be launched by VST Tillers & Tractors, which is a leading manufacturer of agricultural machinery. These 2 electric products include an entirely electric power weeder and an electric power tiller. Thus, with these launches, the company will move into the electric platform space, as well as the industry's move toward electrification will be backed by the company, which is one of its missions.

(Source:https://www.thehindubusinessline.com)

- In May 2021,CLAAS KGaA Mbh acquired a marginal stake in the Dutch startup company AgXeed B.V. The acquisition was anticipated to help commercialize autonomous agriculture-based farming machines.

- In August 2021,Breviglieri launched Breviglieri Mekfarmer 80 Power Harrow with a packer roller for farmers to help decrease the absorption of power and fuel consumption and improve soil crumbling.

- In June 2022,Vaderstad launched a new disc cultivator, the carrier XT 425-625, which permits various machines to optimize their performance and offers improved efficacy with low diesel intake.

Segments Covered in the Report

By Implement Type (Revenue: US$ Bn & Volume: Mn Units)

- Tillage / Soil Preparation Implement:

- Ploughs (Moldboard, Disc, Chisel)

- Harrows (Disc, Tine)

- Cultivators (Field, Rotary)

- Rotavators / Rotary Tillers

- Subsoilers

- Sowing & Planting Implement:

- Seed Drills

- Planters (Precision Planters)

- Transplanters

- Crop Maintenance & Protection Implement:

- Weeders

- Inter-row Cultivators

- Sprayers (Boom, Airblast)

- Fertilizer Spreaders / Applicators

- Harvesting & Post-Harvest Implement:

- Reapers

- Combine Harvesters

- Forage Harvesters

- Potato Diggers

- Balers (Round, Square)

- Material Handling, Transport & Other Implement:

- Front-End Loaders

- Bale Grabbers / Spears

- Pallet Forks

- Tractor Trailers / Trolleys

- Post-Hole Diggers

- Landscaping & Earthmoving (Dozer Blades, Box Scrapers, Land Graders)

By Power Source

- Powered:

- PTO-Powered

- Hydraulically Powered

- Unpowered:

- Ground-Engaging

By Mounting Type

- Three-Point Hitch Mounted

- Drawbar / Trailed

- Front-Mounted

- Semi-Mounted

By Application

- Land Preparation

- Plowing

- Tilling

- Harrowing

- Sowing & Planting

- Crop Protection & Fertilizing

- Harvesting & Threshing

- Post-Harvest & Agro-Processing

By End-User Sector

- Agriculture:

- Farm-level (Large, Medium, Small)

- Commercial Farming

- Non-Agriculture:

- Forestry

- Construction & Landscaping

- Municipal Services (e.g., snow removal, groundskeeping

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content