What is Triceps Implants Market Size in 2026?

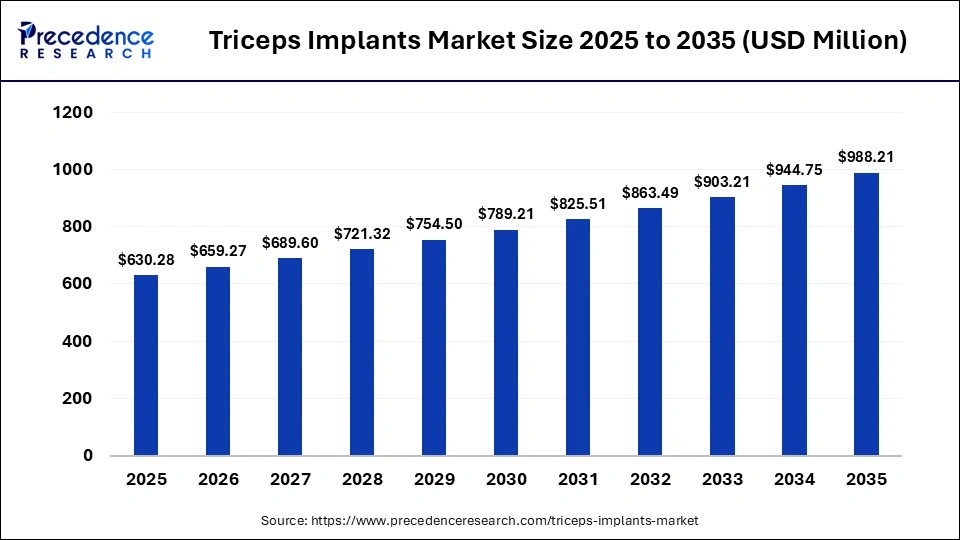

The global triceps implants market size was calculated at USD 630.28 million in 2025 and is predicted to increase from USD 659.27 million in 2026 to approximately USD 988.21 million by 2035, expanding at a CAGR of 4.60% from 2026 to 2035. The market centers on silicone-based and custom anatomical implants designed for upper-arm augmentation and reconstruction. Demand is driven by body-contouring surgeries, post-traumatic repairs, medical tourism growth, surgeon preference for minimally invasive techniques, and durability and safety profiles.

Key Takeaways

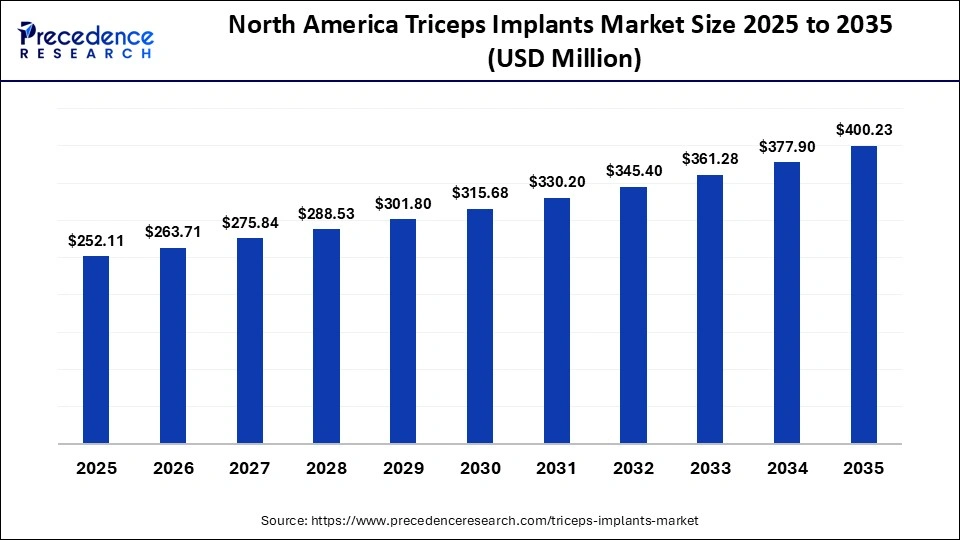

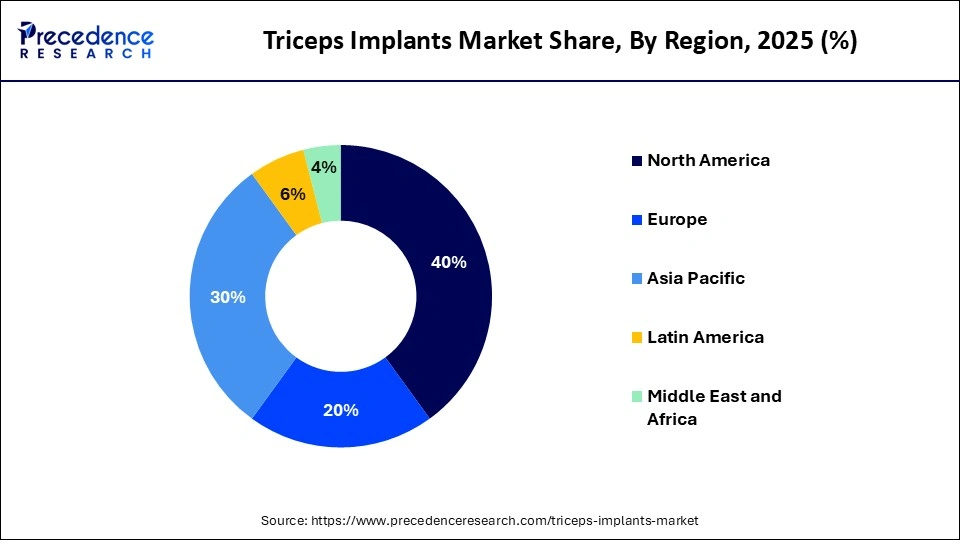

- North America led the triceps implants market with a share of approximately 41.5% in 2025.

- Asia-Pacific is expected to expand at the highest CAGR of 5.0% in the market between 2026 and 2035.

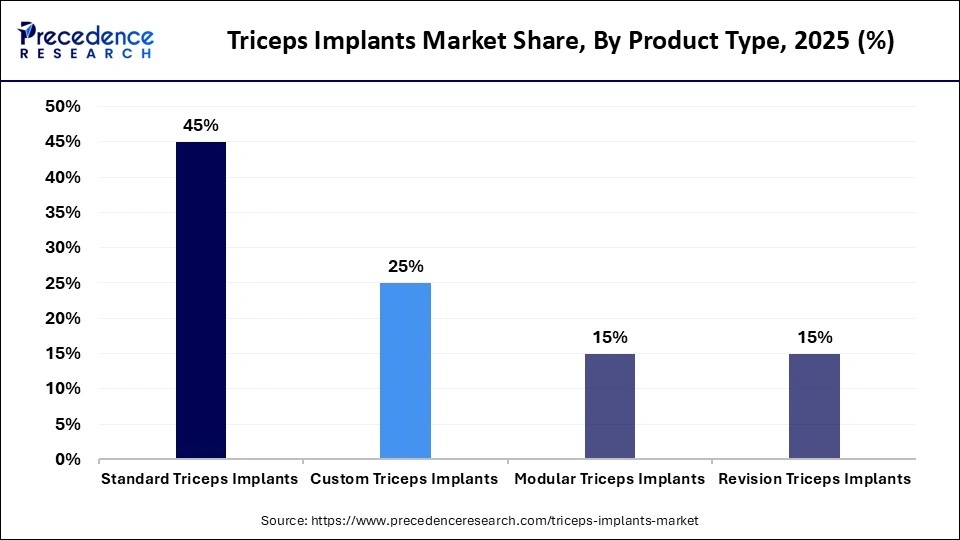

- By product type, the standard triceps implants segment held a dominant revenue share of approximately 45% in the market in 2025.

- By product type, the custom triceps implants segment is expected to grow at the highest CAGR of approximately 4.1% between 2026 and 2035.

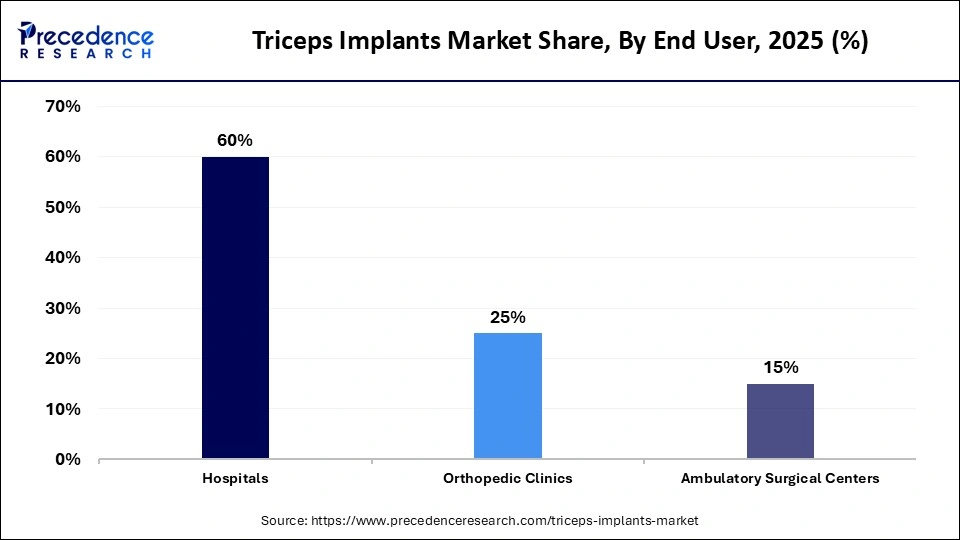

- By end user, the hospitals segment led the market with a share of approximately 60% in 2025.

- By end user, the ambulatory surgical centers segment is expected to expand at the fastest CAGR of approximately 4.3% from 2026 to 2035.

Why is the Triceps Implants Market Gaining Momentum?

Triceps implants are medical-grade prosthetic devices, commonly made from solid or semi-solid silicone, designed to enhance upper-arm definition or restore lost muscle volume after trauma or surgical procedures. The market is gaining traction as clinics expand body-contouring portfolios, patient demand for targeted arm aesthetics increases, and surgeons adopt anatomically shaped, long-lasting implant options that deliver predictable cosmetic outcomes.

Primary Trends Influencing the Triceps Implants Market

- Shift Towards Patient-Specific and Digitally Designed Implants

Manufacturers are investing in digital modeling, advanced imaging, and 3D production methods to deliver anatomically contoured triceps implants. This trend supports premium pricing strategies, improves surgical predictability, and enables companies to target high-value reconstructive and aesthetic segments with customized solutions. - Growing Preference for Minimally Invasive Placement Techniques

Clinics and surgeons are adopting smaller-incision approaches that shorten procedure time and reduce postoperative downtime. This shift improves patient throughput in surgical facilities, enhances clinic profitability, and attracts a broader base of cosmetic patients seeking quicker recovery. - Rising Role of Outpatient and Specialty Aesthetic Centers

The migration of procedures from large hospitals to ambulatory surgical centers and specialized cosmetic clinics is expanding access to the triceps implants market. These facilities offer lower operational costs and faster scheduling, encouraging higher procedural volumes and strengthening partnerships between implant manufacturers and private surgical networks. - Investment in Advanced, Long-Lasting Implant Materials

Companies are focusing on high-cohesive silicone and other biocompatible compounds that deliver better structural stability and reduced complication risks. Improved durability helps brands position their products as premium offerings, lowers revision rates, and builds long-term surgeon loyalty. - Convergence of Aesthetic Enhancement and Reconstructive Demand

Market growth is increasingly supported by patients seeking both cosmetic arm definition and post-trauma or post-surgical muscle restoration. This dual-use demand encourages broader product portfolios, diversified clinical applications, and new revenue streams across both aesthetic and reconstructive procedure segments.

How Is AI Reshaping the Triceps Implants Industry?

Artificial intelligence is reshaping the triceps implants market through highly data-driven, precision-oriented applications. Advanced machine learning tools analyze patient imaging to generate tailored 3D implant geometries and optimize fit, biomechanics, and material use, reducing trial-and-error design cycles and enhancing surgical predictability.

AI also supports predictive modeling for surgical risks and postoperative outcomes, enabling bespoke implant planning and faster turnaround from scan to production. In broader orthopedics, AI-enabled planning and robotics improve placement accuracy and procedural efficiency, laying the groundwork for next-generation personalized implants with better functional performance.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 630.28 Million |

| Market Size in 2026 | USD 659.27 Million |

| Market Size by 2035 | USD 988.21 Million |

| Market Growth Rate from 2026 to 2035 | CAGR of 4.60% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | By Product Type,End User, and region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segmental Insights

Product Type Insights

Why Was the Standard Triceps Implants Segment Dominant in the Market?

The standard triceps implants segment dominated the triceps implants market with a share of approximately 45% in 2025, due to its cost-effectiveness, established clinical track record, and wide availability across hospitals and orthopedic centers. These implants are routinely used in common trauma, reconstructive, and aesthetic procedures, enabling faster surgical planning and inventory management. Their standardized sizing and proven performance reduce customization costs, support higher procedure volumes, and make them the preferred choice for high-throughput surgical settings.

The custom triceps implants segment is expected to expand rapidly in the market with a CAGR of 4.1% in the coming years, as healthcare providers increasingly prefer implants designed to match a patient's exact arm structure. Customized solutions improve surgical precision and aesthetic symmetry, particularly in complex reconstruction cases. With better imaging software and streamlined manufacturing processes, companies can deliver made-to-order implants faster, creating higher-value offerings and stronger differentiation compared to standard, off-the-shelf products.

End User Insights

Which End User Segment Led the Triceps Implants Market?

The hospitals segment led the market with a share of approximately 60% in 2025, due to their advanced surgical infrastructure, availability of specialized orthopedic and plastic surgeons, and capacity to manage complex or high-risk procedures. Hospitals also handle a higher volume of trauma and reconstructive cases, maintain comprehensive implant inventories, and offer integrated postoperative care, making them the primary setting for triceps implant surgeries.

The ambulatory surgical centers segment is expected to be the fastest-growing segment in the market with the highest CAGR of approximately 4.3% in the coming years, due to their lower procedure costs, shorter patient stay, and streamlined scheduling compared to hospitals. These centers are increasingly preferred for elective aesthetic and minor reconstructive procedures. Their operational efficiency, quicker turnaround times, and growing partnerships with implant suppliers are driving higher procedural volumes and faster segment expansion.

Regional Insights

How Big is the North America Triceps Implants Market Size?

The North America triceps implants market size is estimated at USD 252.11 million in 2025 and is projected to reach approximately USD 400.23 million by 2035, with a 4.73% CAGR from 2026 to 2035.

Why North America Dominated the Triceps Implants Market?

North America held a major revenue share of approximately 40% in 2025, due to its strong concentration of specialized orthopedic and aesthetic surgery centers, early adoption of advanced implant design technologies, and structured reimbursement frameworks that support elective procedures. The region shows increasing uptake of customized and high-performance implants, driven by sports injury cases and body-contouring demand. Established distribution networks and close collaboration between surgeons and device manufacturers further strengthen regional market leadership.

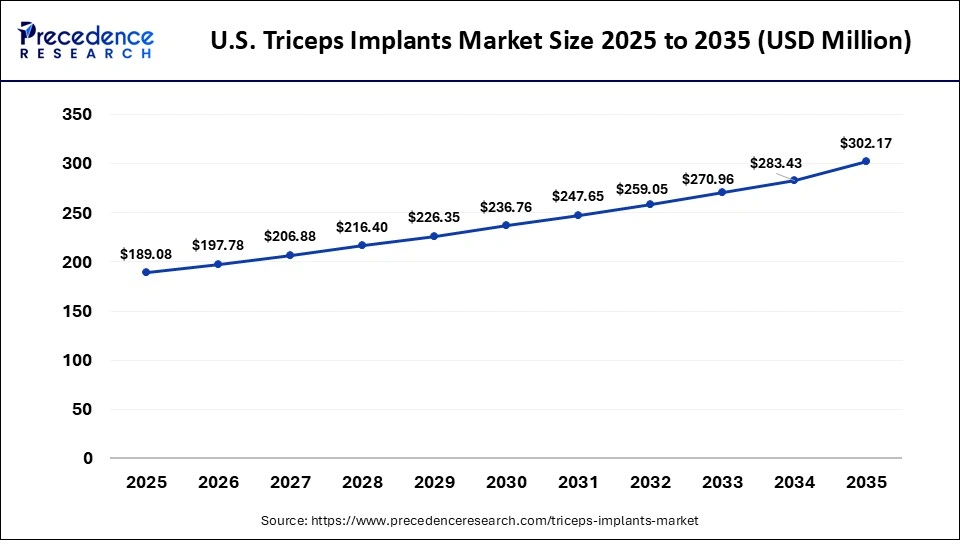

What is the Size of the U.S. Triceps Implants Market?

The U.S. triceps implants market size is calculated at USD 189.08 million in 2025 and is expected to reach nearly USD 302.17 million in 2035, accelerating at a strong CAGR of 4.80% between 2026 to 2035.

U.S. Market Trends

In the U.S., triceps implants benefit from a strong innovation ecosystem where FDA-cleared technologies, advanced imaging-to-implant workflows, and surgeon preference for precision solutions drive product uptake. High rates of sports injuries, an aging population, and growing demand for minimally invasive aesthetic and reconstructive procedures fuel market growth. Robust reimbursement policies and concentrated R&D investment by leading device firms further position the U.S. as North America's dominant and trend-setting market for triceps implants.

Why is Asia-Pacific Experiencing the Fastest Growth in the Triceps Implants Market?

Asia-Pacific is expected to be the fastest-growing region in the market with a CAGR of approximately 5.0% during the predicted timeframe, due to the rapid expansion of private aesthetic clinics, increasing medical tourism, and growing acceptance of elective body-contouring procedures. Local device manufacturers are entering the segment with competitively priced implants, while hospitals are adopting digital planning and customized implant solutions, enabling higher procedure volumes and stronger market penetration across developing urban centers.

China Market Trends

China's market is evolving through the rapid expansion of private orthopedic and aesthetic hospital chains in major urban clusters, where demand for arm-contouring and post-trauma reconstruction is rising. Domestic device companies are scaling production of competitively priced silicone implants, allowing hospitals to reduce procurement costs. At the same time, top-tier hospitals are integrating digital imaging, 3D modeling, and customized implant planning, creating a premium segment focused on precision procedures and faster patient turnover.

Will Europe Grow in the Triceps Implants Market?

Europe is expected to grow at a notable CAGR in the foreseeable future, due to its high procedure volumes in upper-extremity surgeries, supported by mature orthopedic care systems in countries such as Germany, France, and the U.K. Rising elderly populations with degenerative joint disorders and fracture risks are expanding the need for orthopedic surgeries. The region also benefits from strong public healthcare coverage, established arthroplasty programs, and increasing adoption of minimally invasive, bone-preserving, and technologically advanced implant solutions across specialized orthopedic centers.

UK Market Trends

The UK leads the market in Europe because of its high number of upper-limb surgeries performed each year through the public healthcare system. Many large hospitals and specialist orthopedic centers handle complex elbow and trauma cases, creating steady demand for triceps repair implants. Early adoption of new implant designs and structured surgical referral systems also supports consistent procedure volumes across the country.

Which Factors Drive the Triceps Implants Market in Latin America?

Latin America is expected to witness significant growth in the market, mainly because more trauma and sports-related elbow injuries are being treated surgically instead of with conservative methods. Countries like Brazil and Mexico are expanding orthopedic services in private hospitals, where advanced repair implants are increasingly used. The region is also seeing more trained upper-limb surgeons, which is leading to a steady rise in complex elbow repair procedures.

Brazil Market Trends

The market in Brazil is driven by growing awareness of triceps implants procedures, the burgeoning medical tourism sector, and an increasing healthcare expenditure. Brazil is among the top three countries in the world that conduct the highest number of aesthetic procedures. The presence of skilled professionals and a rapidly expanding healthcare infrastructure augments the market.

How Big is the Success of the Middle East and Africa in the Triceps Implants Market?

The Middle East and Africa are expected to grow at a considerable CAGR in the upcoming period, due to the rising number of elbow injuries caused by road accidents, construction work, and sports activities. Several countries are expanding hospital infrastructure and orthopedic departments, which is improving access to surgical treatments. In addition, private healthcare expansion in Gulf countries and a gradual rise in the aging population are increasing the demand for advanced triceps repair implants.

Triceps Implants Market Companies

- Acumed

- Stryker Corporation

- Johnson and Johnson (DePuy Synthes)

- Zimmer Biomet

- Smith and Nephew

- Arthrex, Inc.

- Globus Medical, Inc.

- Orthofix Medical Inc.

- CONMED Corporation

- BioTek Instruments, Inc.

- Braun Melsungen AG

- DJO Global, Inc.

- B. Braun Melsungen AG (additional line)

- Hanson Medical, Inc.

- Wanhe Plastic Materials (cosmetic implants)

Recent Developments

- In September 2025, Shoulder Innovations commercially launched the InSet 70 humeral stem across the U.S., broadening its shoulder and upper-arm implant lineup. The stem is designed to support both anatomic and reverse shoulder arthroplasty procedures. The rollout enhances the company's competitive presence in the upper-extremity market by offering surgeons a streamlined implant system for diverse clinical indications.

(Source: https://www.prnewswire.com) - In June 2025, Johnson and Johnson MedTech introduced the VOLT proximal humerus plating system in the U.S., expanding its upper-extremity fixation portfolio. The system features anatomically contoured plates with variable-angle locking technology, enabling improved stability in upper-arm procedures. The launch strengthens the company's position in trauma and reconstructive segments, supporting surgeons with more precise fixation solutions.

(Source: https://www.jnj.com) - In March 2025, Johnson and Johnson MedTech showcased new digital orthopedics technologies alongside its extremity implant portfolio. The updates included data-driven planning tools and patient-specific instrumentation aimed at improving surgical precision and efficiency. This expansion highlights the company's strategy to combine implant hardware with digital solutions, enhancing clinical outcomes in upper-extremity procedures.

Segments Covered in the Report

By Product Type

- Standard Triceps Implants

- Custom Triceps Implants

- Modular Triceps Implants

- Revision Triceps Implants

By End User

- Hospitals

- Orthopedic Clinics

- Ambulatory Surgical Centers

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting